Overview

This article delves into the commercial property loan deposit process, highlighting its critical role for businesses aiming to secure financing for real estate investments. Lenders typically require a deposit ranging from 20% to 35% of the property's value. This requirement is influenced by various factors, including:

- Property type

- Loan-to-value ratio

- The borrower's financial profile

Thus, the article underscores the necessity of preparation and a thorough understanding of market dynamics to enhance the likelihood of loan approval. Are you ready to navigate this complex landscape and improve your chances of securing funding?

Introduction

The landscape of commercial property financing is rapidly evolving, with projections indicating a significant increase in market value in the coming years. As businesses aim to capitalize on this growth, understanding the intricacies of the commercial property loan deposit process is paramount.

What challenges do prospective investors face when navigating deposit requirements? How can they effectively prepare to secure the necessary funding?

This article delves into the essential steps and factors influencing commercial property loan deposits, equipping readers with the knowledge to master this critical aspect of business financing.

Define Commercial Property Loans and Their Importance

Business asset financing options represent tailored solutions specifically designed for the purchase, refinancing, or development of real estate, including a commercial property loan deposit. Unlike residential mortgages, which are secured against individual homes, these financing types are backed by assets utilized for business purposes, including office buildings, retail spaces, and warehouses. For small enterprises, securing a business financing option is crucial for growth, investing in revenue-generating assets, or establishing a dedicated operational site.

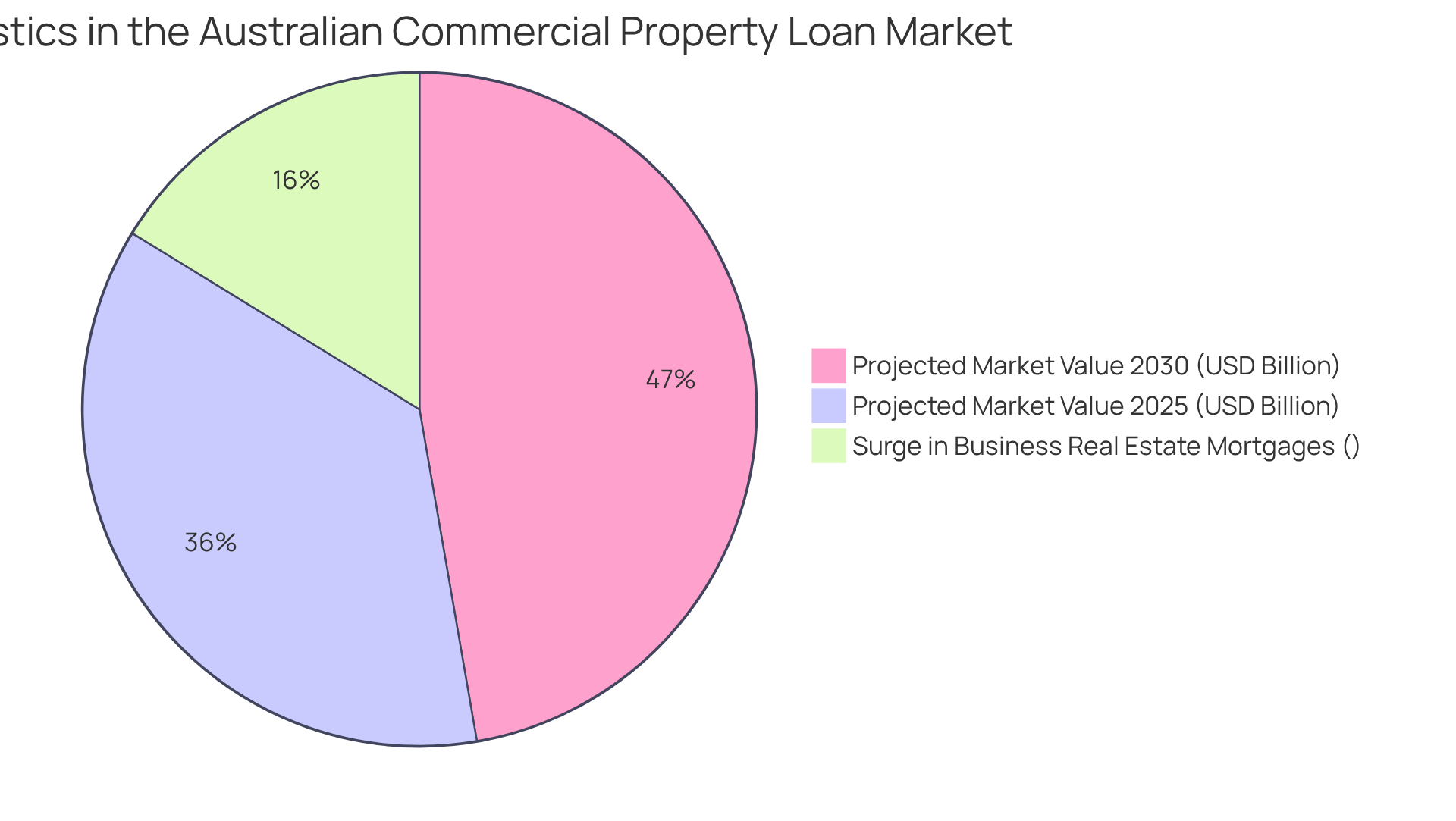

The significance of commercial property loan deposits cannot be overstated; they provide the essential funds necessary for companies to develop and thrive in a competitive landscape. In 2025, Australia’s business real estate market is projected to be valued at approximately USD 52.33 billion, with forecasts indicating growth to USD 67.81 billion by 2030. This upward trend highlights the increasing importance of business real estate as a strategic asset for entrepreneurs.

Furthermore, recent statistics reveal that business real estate mortgages have surged by 23.3% compared to the previous year, indicating a strong demand for financing, which often includes a commercial property loan deposit. As companies navigate the complexities of securing funding, understanding the advantages of business loans—such as favorable terms and the potential for long-term financial stability—becomes essential. By effectively utilizing these funds, business owners can position themselves for sustained growth and success in their respective industries.

Outline Deposit Requirements for Commercial Property Loans

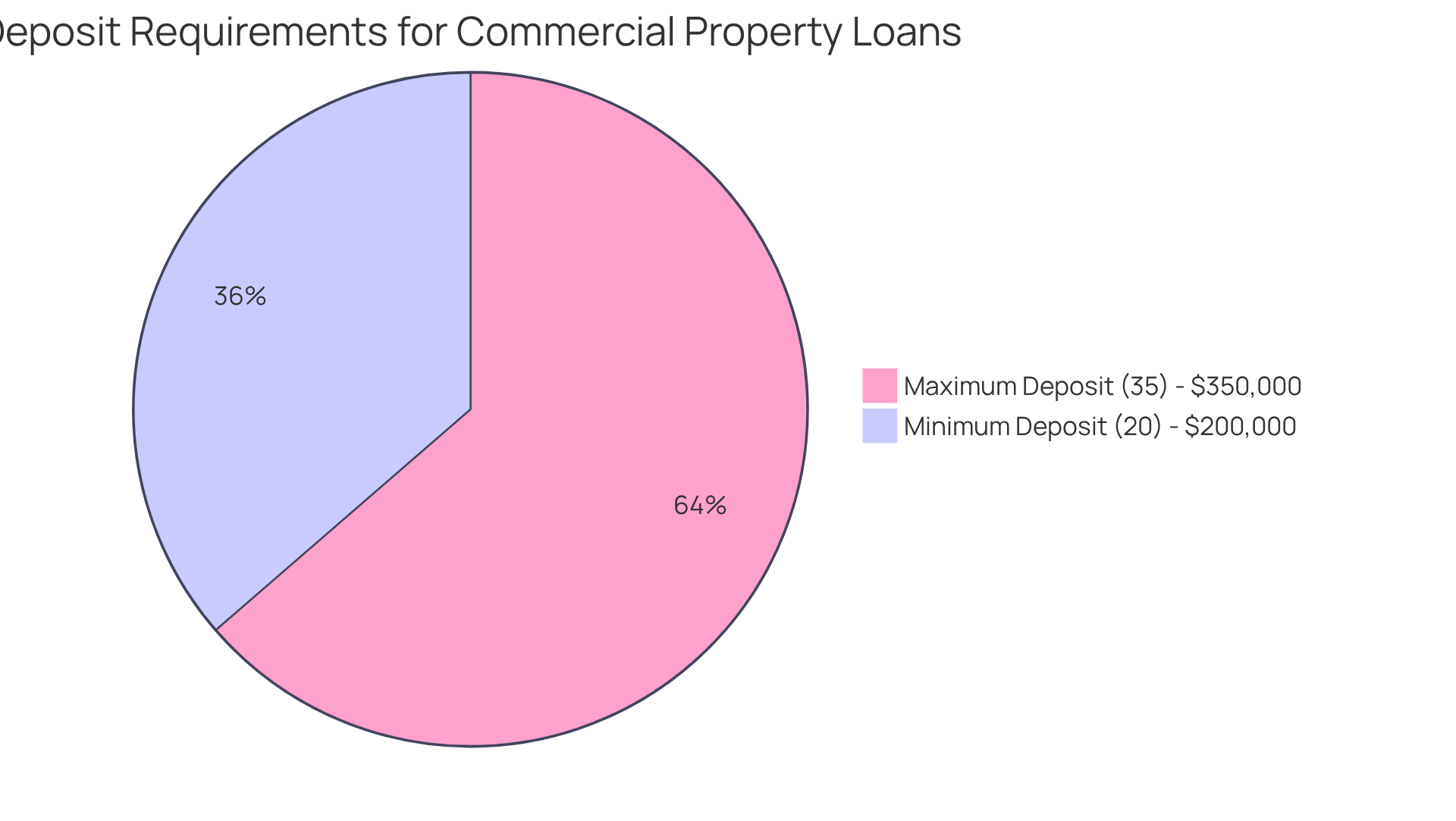

In the realm of business real estate financing, lenders typically require a commercial property loan deposit that ranges from 20% to 35% of the asset's purchase price. For instance, if a business asset is valued at $1 million, this translates to a necessary commercial property loan deposit payment of $200,000 to $350,000. This larger initial investment as a commercial property loan deposit not only enhances the likelihood of loan approval but can also yield more favorable loan terms, including lower interest rates. As Scott Kuru aptly states, "As a general guideline, commercial real estate usually demands a significantly larger capital investment than their residential equivalents." At Finance Story, we excel in crafting polished and highly personalized business cases, designed to help you navigate these financing requirements effectively.

The specific funding requirements for a commercial property loan deposit can fluctuate based on various factors, including the type of property, the lender's policies, and the borrower's financial profile. For example, companies with strong financial backgrounds may successfully negotiate lower upfront percentages, while higher-risk borrowers might face demands for contributions exceeding 40%. Understanding these dynamics is crucial for prospective investors aiming to secure the best financing options. Our expertise in refinancing and acquiring tailored business funding can guide you throughout this process.

Examine Factors Influencing Commercial Property Loan Deposits

The deposit required for a commercial property loan is influenced by several key factors:

-

Property Type: Specialized properties, such as those needing extensive renovations or located in less desirable areas, often necessitate a higher deposit. For instance, properties in prime locations or with distinctive benefits may require a commercial property loan deposit that exceeds the usual range of 20% to 30%.

-

Loan-to-Value Ratio (LVR): Lenders generally prefer a lower LVR for business loans, which typically ranges from 60% to 75%. This indicates that a larger upfront payment is necessary to meet lender requirements, reflecting the heightened risk associated with commercial investments.

-

Borrower's Financial Profile: A strong credit history and stable income can lead to more favorable savings terms. Conversely, borrowers with less robust financial profiles may encounter increased collateral requirements, as lenders aim to mitigate perceived risks.

-

Market Conditions: Economic factors and trends in the real estate market significantly influence lender policies regarding funds. In unstable markets, for example, lenders may raise savings requirements to safeguard against potential losses.

Understanding these factors is crucial for potential investors, as they can significantly affect the overall financing strategy and investment returns.

Prepare for Your Commercial Property Loan Deposit

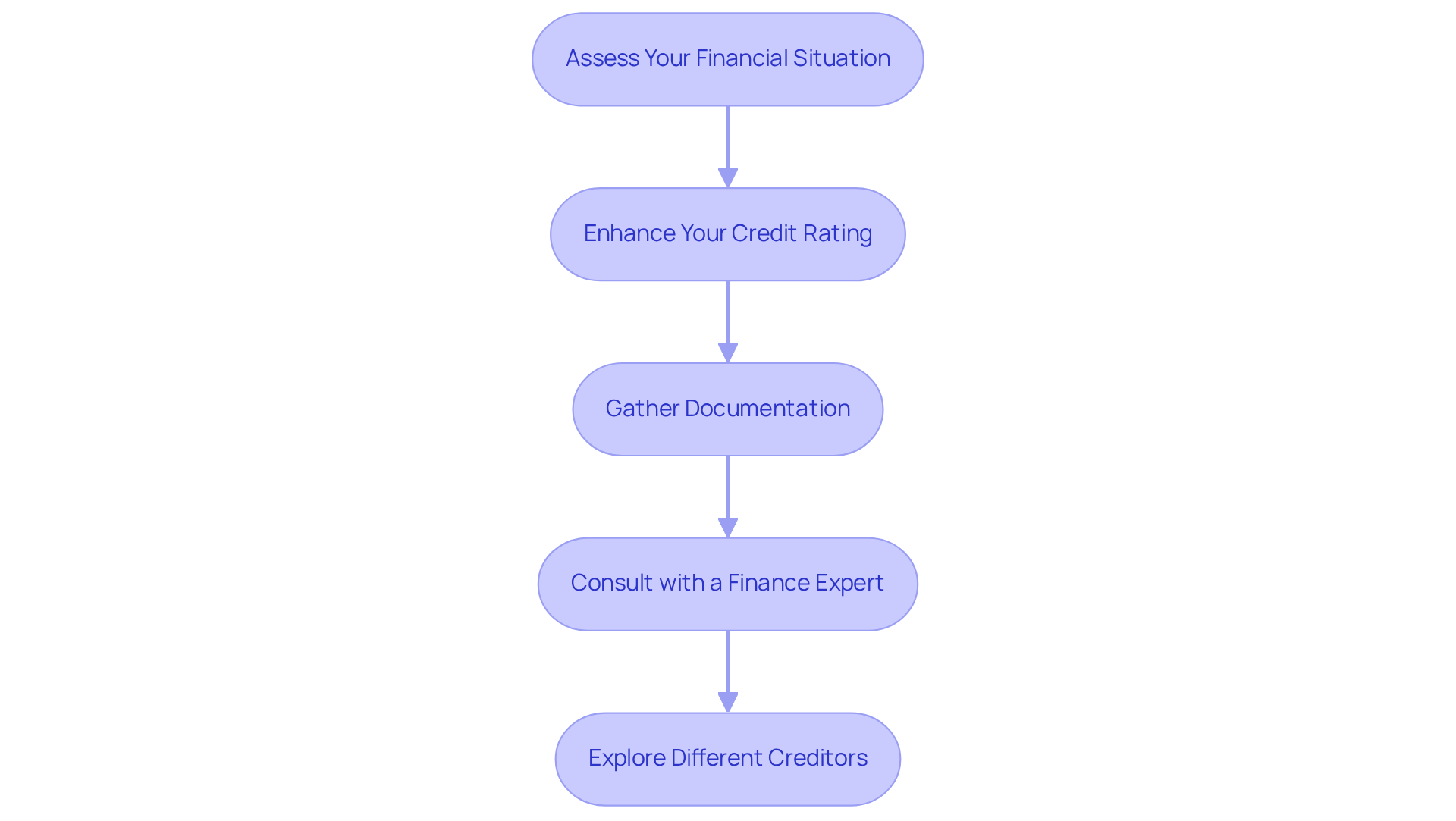

To effectively prepare for your commercial property loan deposit, follow these essential steps:

-

Assess Your Financial Situation: Begin by reviewing your savings, income, and expenses to determine how much you can realistically allocate for a deposit. Aim to have at least 30% of the property's value available upfront, as this is often a requirement for lenders.

-

Enhance Your Credit Rating: A solid credit score is essential for obtaining advantageous financing conditions. Concentrate on settling outstanding debts and ensuring prompt payments on all credits. Most lenders favor a credit score of 650 or above for commercial property financing, so take proactive measures to improve your creditworthiness.

-

Gather Documentation: Compile necessary financial documents, including tax returns, bank statements, and business financials. Lenders typically require at least two years of financial statements to assess your financial health, so having these ready can strengthen your application.

-

Consult with a Finance Expert: Engaging with a finance consultant can provide you with tailored advice and insights into the lending landscape. Their knowledge can assist you in navigating the intricacies of obtaining financing and enhance your likelihood of approval.

-

Explore Different Creditors: Investigate various creditors to comprehend their specific funding prerequisites and borrowing conditions. This knowledge will empower you to choose the best financing option that aligns with your financial situation and investment goals.

By following these steps, you can improve your readiness for a commercial property loan deposit and boost your chances of securing the financing you require.

Conclusion

Mastering the commercial property loan deposit process is essential for business owners aiming to invest in real estate. Grasping the intricacies of securing a commercial property loan deposit can significantly influence a company’s growth trajectory and long-term success. This article outlines the critical components involved in navigating this process, emphasizing the importance of preparation and strategic planning.

Key points discussed include the necessity of a substantial deposit, typically ranging from 20% to 35% of the property’s purchase price. Various factors influence these requirements, such as property type, loan-to-value ratio, and the borrower’s financial profile. Furthermore, actionable steps for preparing for a commercial property loan deposit are provided, highlighting the importance of:

- Assessing financial situations

- Enhancing credit ratings

- Consulting with finance experts to optimize chances of approval

In conclusion, as the commercial real estate market continues to grow, understanding the commercial property loan deposit process becomes increasingly vital for aspiring investors. By implementing the strategies outlined, business owners can position themselves for success in securing financing. Taking proactive steps today not only prepares individuals for their immediate investment needs but also lays the foundation for sustainable growth and financial stability in the competitive landscape of commercial real estate.