Overview

This article delves into the essential process of obtaining a commercial investment property mortgage. It underscores the significance of understanding various mortgage options, the necessary documentation, and the application process. By detailing the specific types of commercial mortgages available, it provides a comprehensive overview of the critical documents required for a successful application. Furthermore, it highlights the strategic role of mortgage brokers in navigating the complexities of financing, ultimately enhancing the likelihood of securing favorable loan terms. Are you ready to explore how these insights can empower your financial decisions?

Introduction

Navigating the world of commercial investment property mortgages can indeed be a daunting task. The unique complexities that differentiate them from residential financing demand attention. Investors encounter a myriad of options, from traditional mortgages to bridge loans, each presenting its own terms, interest rates, and down payment requirements. As the demand for specialized financing continues to surge, understanding how to secure the right mortgage becomes essential.

What key steps and strategies can help investors tackle common challenges in this process? By doing so, they not only secure financing but also optimize their investment potential.

Understand Commercial Investment Property Mortgages

Commercial investment property mortgage options represent customized solutions for purchasing or refinancing commercial real estate. These options differ significantly from residential financing due to their specific underwriting criteria, interest rates, and terms. At Finance Story, we excel in crafting polished and highly individualized business cases to present to banks, ensuring you secure the right financing tailored to your needs.

Types of Commercial Mortgages: These encompass traditional mortgages, bridge loans, and hard money loans, each designed to cater to specific borrower needs and scenarios. Our expertise empowers us to assist you in selecting the most appropriate option from our comprehensive array of financial institutions, including high street banks and innovative private financing panels.

Mortgage Terms: Typically, commercial mortgages feature shorter durations than residential financing, often ranging from 5 to 20 years, with amortization periods that may extend beyond the mortgage term. Grasping these terms is crucial for effective financial planning.

Interest Rates: Rates can vary considerably based on the financial institution, the borrower's credit profile, and the property's type and location. As of 2025, conventional financial institutions offer variable interest rates for business financing ranging from 5.89% to 10.74%, while private entities provide fixed rates between 8.35% and 11.15%. We offer insights into how to navigate these variables to secure favorable rates.

Down Payments: Higher down payment requirements are standard, generally between 20% to 30% of the property's purchase price, reflecting the increased risk associated with commercial lending. Our team is here to assist you in preparing for these financial commitments.

Understanding these elements is vital for investors aiming to navigate the complexities of securing a commercial investment property mortgage effectively. For instance, Finance Story has successfully aided clients in obtaining advantageous loan conditions by leveraging its extensive network of financial institutions, ensuring customized funding solutions that meet specific organizational requirements. This adaptability and commitment to client relationships are essential in a landscape where total commercial property exposure limits have risen by 3.6% over the past year, underscoring the growing demand for specialized financing options.

Gather Required Documentation and Information

When applying for a commercial investment property mortgage, compiling several critical documents is essential to streamline the process and enhance your chances of approval:

- Business Financial Statements: Prepare profit and loss statements, balance sheets, and cash flow statements covering the past 2-3 years. These documents provide creditors with a clear view of your company's financial condition and performance.

- Personal Financial Statements: Many creditors request personal financial details from entrepreneurs, including tax returns and net worth statements. Approximately 70% of lenders assess personal financial statements to gauge the overall financial stability of the applicant.

- Enterprise Strategy: A well-organized enterprise strategy is vital. It should outline your investment approach, market assessment, and financial forecasts, showcasing your understanding of the market and your enterprise's potential. Engaging a skilled broker, such as those at Finance Story, can assist you in developing a refined and highly personalized proposal to present to financiers.

- Property Information: Include comprehensive details about the property, such as its location, type, and current income (if applicable). This information aids lenders in evaluating the investment's viability.

- Credit Reports: Both personal and commercial credit reports are often required to assess creditworthiness. A higher business credit score can significantly improve your chances of securing favorable loan terms.

- Legal Documents: Collect any pertinent legal documents, including leases, purchase agreements, or partnership agreements, as these may be required for review by the financial institution.

Arranging these documents beforehand not only enables a smoother application process for a commercial investment property mortgage but also demonstrates your readiness and professionalism to prospective financiers. By providing a thorough financial summary, you can effectively showcase your capability to handle the property loan and repay the debt. Furthermore, approval rates for business loan applications are estimated to be approximately 60%-70%, and financial institutions generally demand a minimum deposit of 20-30% of the property's worth. The usual timeline for obtaining a commercial loan can vary from 8 to 10 weeks, so preparing in advance is essential. With Finance Story's expertise in refinancing and obtaining customized business loans, including access to a variety of financial institutions, you can navigate the market more effectively and secure competitive terms.

Complete the Mortgage Application Process

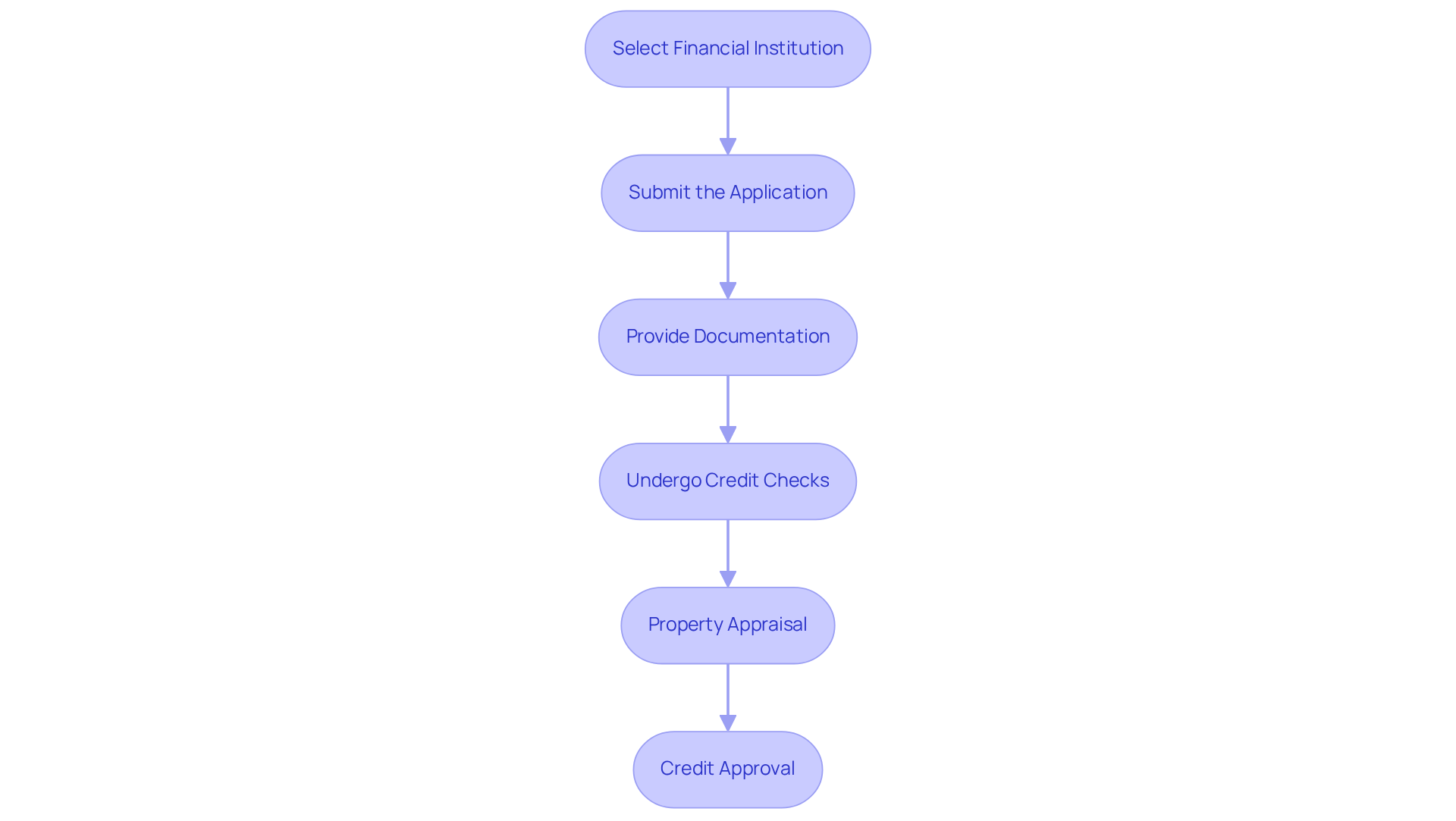

Completing the mortgage application process involves several key steps that can significantly impact your success:

-

Select a financial institution that specializes in commercial investment property mortgage options. Look for competitive interest rates, transparent fees, and strong customer service. Importantly, financial institutions may offer different terms, so evaluating your options is essential.

-

Submit the Application: Complete the mortgage application form provided by your chosen financial institution, ensuring that all information is accurate and comprehensive. A well-prepared application can expedite the review process.

-

Provide Documentation: Gather and submit the necessary documentation alongside your application. This typically includes a financial overview, personal bank statements, and trading accounts. Ensure all documents are current and clearly labeled to facilitate a smooth evaluation.

-

Undergo Credit Checks: Be prepared for the financial institution to conduct credit checks on both your business and personal credit histories. A strong financial profile can enhance your chances of approval, especially in a competitive lending environment.

-

Property Appraisal: The financial institution will generally require an evaluation of the property to ascertain its market value. This step is crucial for assessing the risk associated with the financial agreement.

-

Credit Approval: After reviewing your application and documentation, the lender will either approve or deny your request. If approved, you will receive a loan commitment letter outlining the terms, including interest rates and repayment schedules.

Adhering to these steps carefully will improve your likelihood of a successful application for a commercial investment property mortgage, particularly in the current market where commercial loans are increasingly scrutinized due to rising interest rates and economic conditions.

Engage a Mortgage Broker for Expert Guidance

Involving a loan broker can be a strategic decision when navigating the commercial investment property mortgage landscape, especially with a specialist like Finance Story, recognized for its customized brokerage solutions. Here’s how to effectively collaborate with a broker:

- Research Brokers: Seek brokers who specialize in commercial real estate and possess a strong reputation within the industry. Finance Story stands out as one of Australia’s most innovative commercial and personal funding specialist brokerages, which can significantly influence your financing options.

- Discuss Your Needs: Clearly articulate your financial goals, the type of property you are interested in, and any specific challenges you may encounter. This information is crucial for the broker to tailor their services to your situation, ensuring you receive bespoke services that align with your financing journey, particularly regarding a commercial investment property mortgage.

- Review Options: A skilled broker will present a range of financing choices from various lenders, allowing you to compare terms, conditions, and potential costs efficiently. Finance Story provides access to a comprehensive portfolio of private, boutique commercial investors alongside standard financing providers, ensuring you have all available choices.

- Negotiate Terms: Brokers have the expertise to negotiate on your behalf, aiming to secure more favorable financing terms, including lower interest rates and reduced fees, which can lead to substantial savings over the life of the agreement. By identifying the most suitable loan options, brokers can potentially save clients significant money, especially when crafting polished and highly individualized business cases for banks, including a commercial investment property mortgage.

- Stay Involved: While brokers handle much of the legwork, it’s essential to remain engaged in the process. This ensures that your needs are being met and allows you to address any questions or concerns that may arise. Remember, clients do not pay brokers directly; the lender covers the broker's fees, alleviating concerns about costs.

Leveraging a broker's knowledge not only conserves your valuable time but can also result in considerable financial advantages, enhancing the financing process to be more effective and aligned with your investment objectives. Brokers like Finance Story can also assist clients in planning for the future by discussing options for refinancing or accessing equity as financial situations evolve.

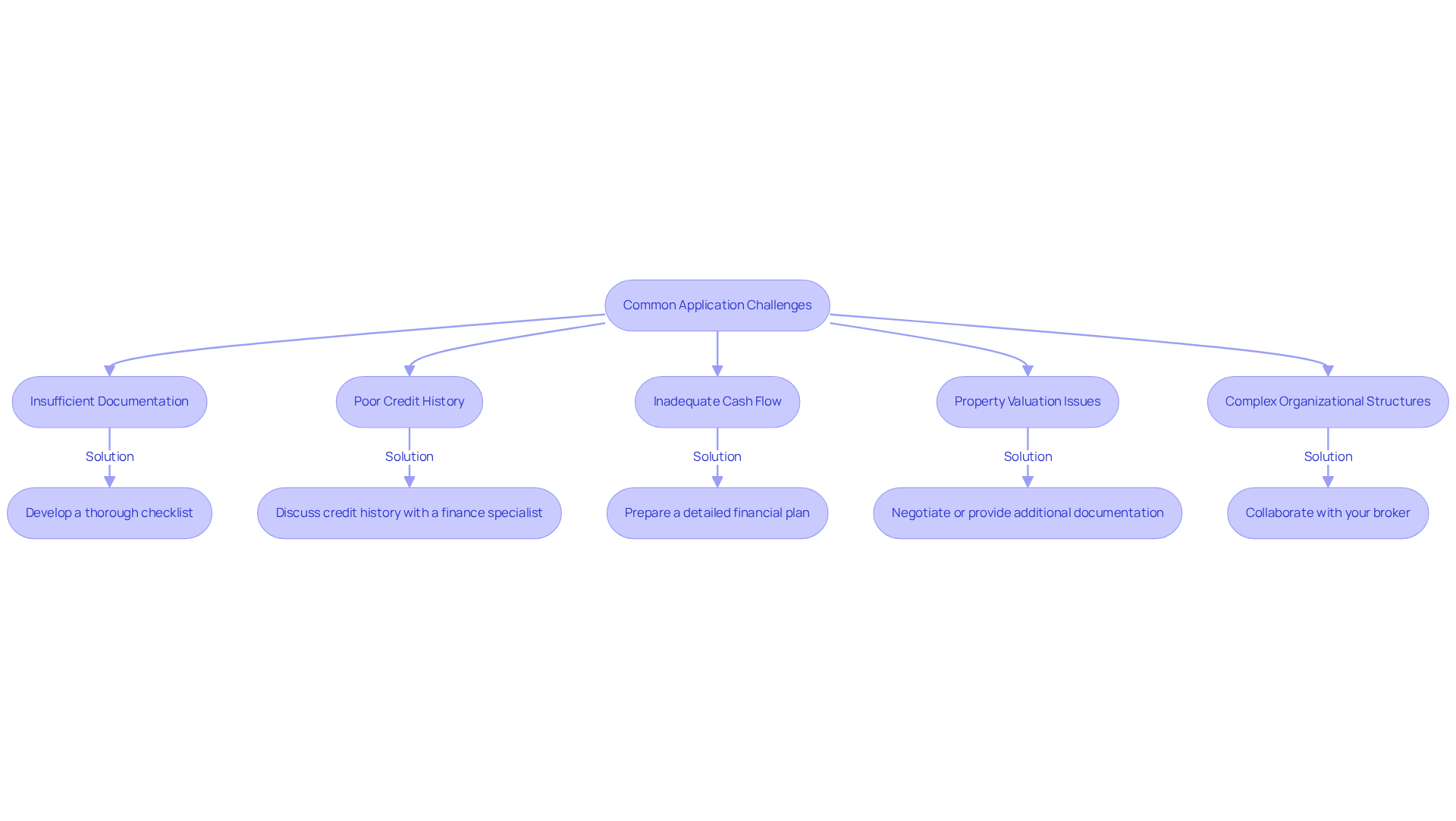

Identify and Overcome Common Application Challenges

Navigating the commercial investment property mortgage application process can present several challenges. Understanding these common issues and employing effective strategies to overcome them is crucial for achieving success in commercial investment property mortgage.

-

Insufficient Documentation: Ensure you have all required documents ready. Develop a thorough checklist to prevent overlooking any important items, such as tax returns, financial statements, and strategic plans. Have you considered discussing your credit history with a finance specialist? This can enhance your chances of approval for a commercial investment property mortgage, as they concentrate on developing refined and tailored business cases for banks.

-

Poor Credit History: A low credit score can significantly affect your chances of receiving approval for financing. To improve your credit before applying, focus on paying down existing debts, correcting any errors on your credit report, and maintaining timely payments. Remember, a good credit rating reflects responsible financial management and decreases the chances of defaulting on credit, as pointed out by financial specialists.

-

Inadequate Cash Flow: Lenders typically seek evidence of strong cash flow. Prepare a detailed financial plan that outlines your income, expenses, and projected cash flow to demonstrate your ability to manage loan repayments effectively. Understanding the repayment criteria for a commercial investment property mortgage is crucial; finance experts can provide insights tailored to your specific needs.

-

Property Valuation Issues: If the appraisal comes in lower than expected, be ready to negotiate or provide additional documentation to support your property's value. This could include recent comparable sales or improvements made to the property. Having a strong case can assist in these negotiations.

-

Complex Organizational Structures: If your enterprise has a complicated structure, collaborate with your broker to simplify the presentation of your financials. Clear and concise documentation can help lenders comprehend your operations better and facilitate the approval process. The expertise in refinancing and securing tailored business loans can be invaluable in these situations.

By anticipating these challenges and preparing accordingly, you can significantly enhance your chances of a successful application for a commercial investment property mortgage.

Conclusion

Mastering the commercial investment property mortgage process is crucial for investors aiming to navigate the complexities of financing commercial real estate. By understanding the unique features of commercial mortgages—such as types, terms, interest rates, and documentation requirements—investors can position themselves to secure favorable financing tailored to their needs.

Key strategies discussed include:

- Gathering essential documentation

- Engaging a knowledgeable mortgage broker

- Addressing common application challenges

The significance of preparing a comprehensive financial overview and grasping the specific requirements of lenders cannot be overstated. By leveraging expert guidance and proactively approaching the application process, investors can significantly enhance their chances of approval and favorable terms.

Ultimately, the commercial investment property mortgage landscape is rife with opportunities for those who are well-prepared. Investors are encouraged to take action by:

- Educating themselves on the mortgage process

- Seeking professional assistance when needed

- Remaining vigilant to overcome potential hurdles

Embracing these strategies will not only lead to successful financing but also empower investors to optimize their investment potential in a competitive market.