Overview

The primary focus of this article is to guide readers in effectively navigating the process of securing commercial investment loan rates. Understanding loan types, evaluating interest rates and fees, and preparing a robust application are emphasized as crucial elements for obtaining favorable financing terms in the competitive real estate market. By grasping these concepts, readers can enhance their chances of success in securing the best possible loan rates.

Introduction

Navigating the world of commercial investment loans can indeed be a daunting task, particularly due to the complexities involved in securing favorable rates. These loans are crucial for acquiring, developing, or refinancing income-generating properties; however, they often require higher deposits and come with stricter qualifications compared to residential mortgages. This article explores the intricacies of the commercial investment loan rate process, providing valuable insights into how investors can effectively research, compare, and manage their loan options.

What strategies can potential borrowers employ to not only secure the best rates but also ensure their financing aligns with their long-term investment goals?

Understand Commercial Investment Loans

The commercial investment loan rate is pivotal for those looking to acquire, develop, or refinance income-generating properties, including office buildings, retail spaces, and warehouses. These financial agreements typically necessitate a larger deposit, often between 20% and 30% of the property's value, reflecting the increased risk associated with commercial real estate. Key features of this financing include:

- Loan Types: Borrowers have the flexibility to select from a variety of options, such as fixed-rate, variable-rate, and interest-only loans, each tailored to different financial strategies.

- Loan-to-Value Ratio (LVR): This ratio indicates the percentage of the property's value that can be financed. In commercial financing, LVRs generally range from 60% to 80%, implying that a deposit of 20% to 40% is usually required.

- Repayment Terms: Commercial loans typically feature shorter repayment periods, ranging from 5 to 15 years, in contrast to residential mortgages, which may extend up to 30 years.

Understanding these components is crucial for navigating the commercial financing landscape effectively. As emphasized by financial experts at Finance Story, the differences between commercial and residential financing are significant, with commercial financing often requiring stricter qualifications and larger deposits. Successful applications for a commercial investment loan rate, particularly for office buildings and retail spaces, hinge on presenting a robust business strategy, a solid credit history, and the ability to generate sufficient cash flow for repayment. Additionally, Finance Story offers access to a comprehensive range of financiers, including high street banks and innovative private funding sources, empowering potential investors to make informed decisions in the competitive real estate market.

Research and Compare Loan Rates

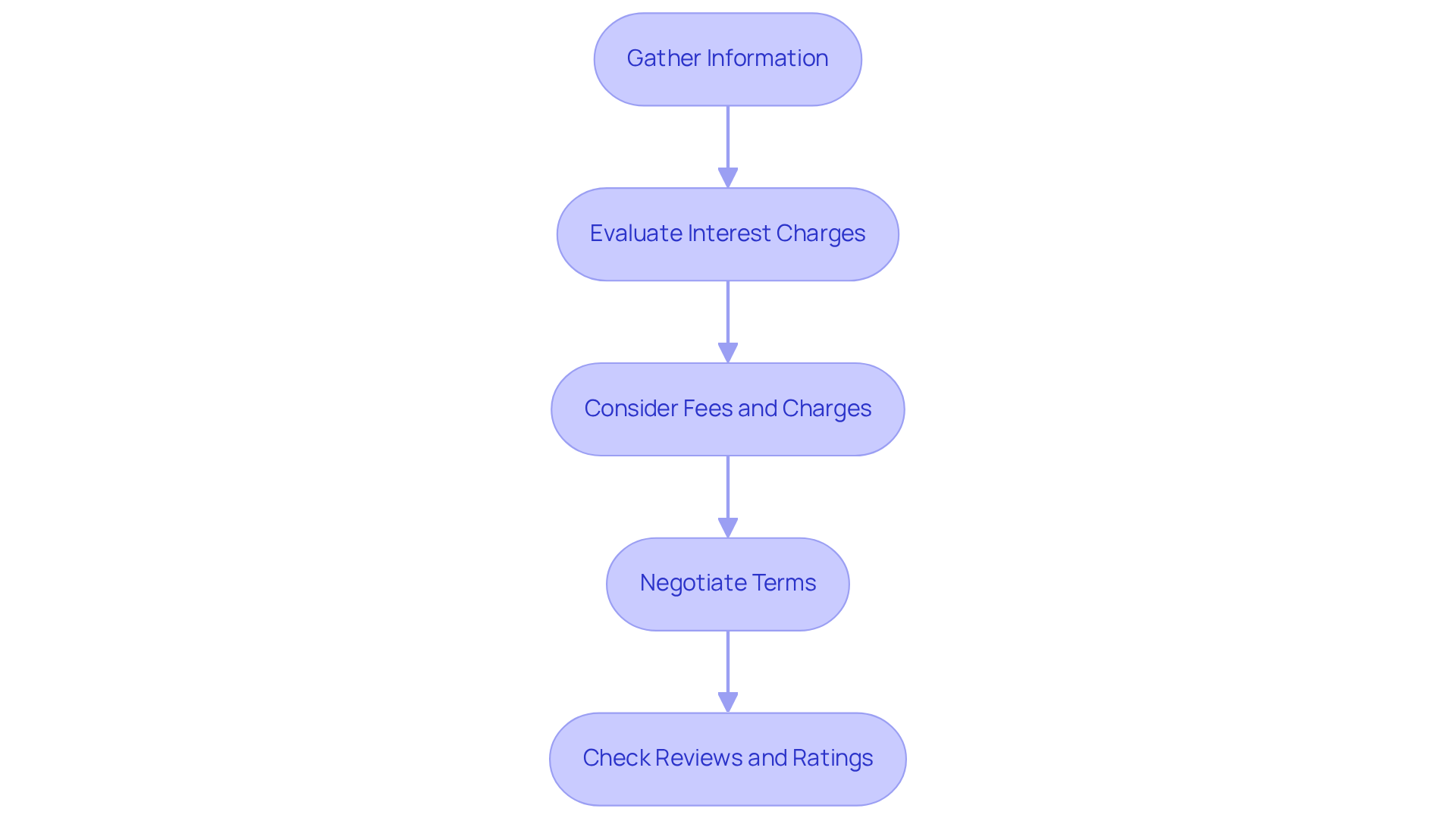

To secure the most favorable commercial investment loan rates, follow these essential steps:

-

Gather Information: Begin by collecting data on a variety of lenders, including banks, credit unions, and private lenders. Utilize online comparison tools to simplify this process and ensure a comprehensive overview. At Finance Story, we focus on developing refined and highly customized business proposals to present to banks, improving your chances of obtaining the most favorable terms.

-

Evaluate Interest Charges: Assess both fixed and variable values. Fixed prices provide stability, simplifying budgeting, whereas variable options may begin lower but can vary, possibly raising expenses over time. Average borrowing costs for commercial properties in Australia generally vary from 6.2% to 9.5%, which reflects the commercial investment loan rate standard for your assessments. Comprehending these figures is essential for making informed choices regarding your financing alternatives.

-

Consider Fees and Charges: Beyond interest rates, evaluate any associated fees such as application fees, valuation fees, and ongoing service fees. These costs can significantly influence the total expenditure of the financing, so it's essential to consider them in your decision-making process. Be aware that financial institutions prefer loan-to-value (LTV) ratios below 70% for commercial properties, which can also affect your loan terms. Our expertise at Finance Story ensures you are well-informed about these criteria.

-

Negotiate Terms: Engage in discussions with financial institutions. Submit competing proposals to obtain improved conditions, as numerous financial institutions are prepared to modify charges or fees to win your business. Keep in mind that the competitive environment among financial institutions can result in more advantageous rates when they compete for your business. Our team can assist you in crafting compelling proposals that highlight your strengths as a borrower.

-

Check Reviews and Ratings: Investigate borrowing entity reputations through customer reviews and ratings. This research will help ensure you select a trustworthy financial institution recognized for quality service. Real-world examples of successful negotiations can provide additional insights into effective strategies. At Finance Story, we have access to a full suite of lenders, including high street banks and innovative private lending panels, ensuring you find the right fit for your needs.

By carefully evaluating the commercial investment loan rate along with rates and terms, and considering the existing fees and charges linked to business financing, you can obtain funding that aligns with your financial goals, ultimately improving your investment strategy.

Apply for a Commercial Investment Loan

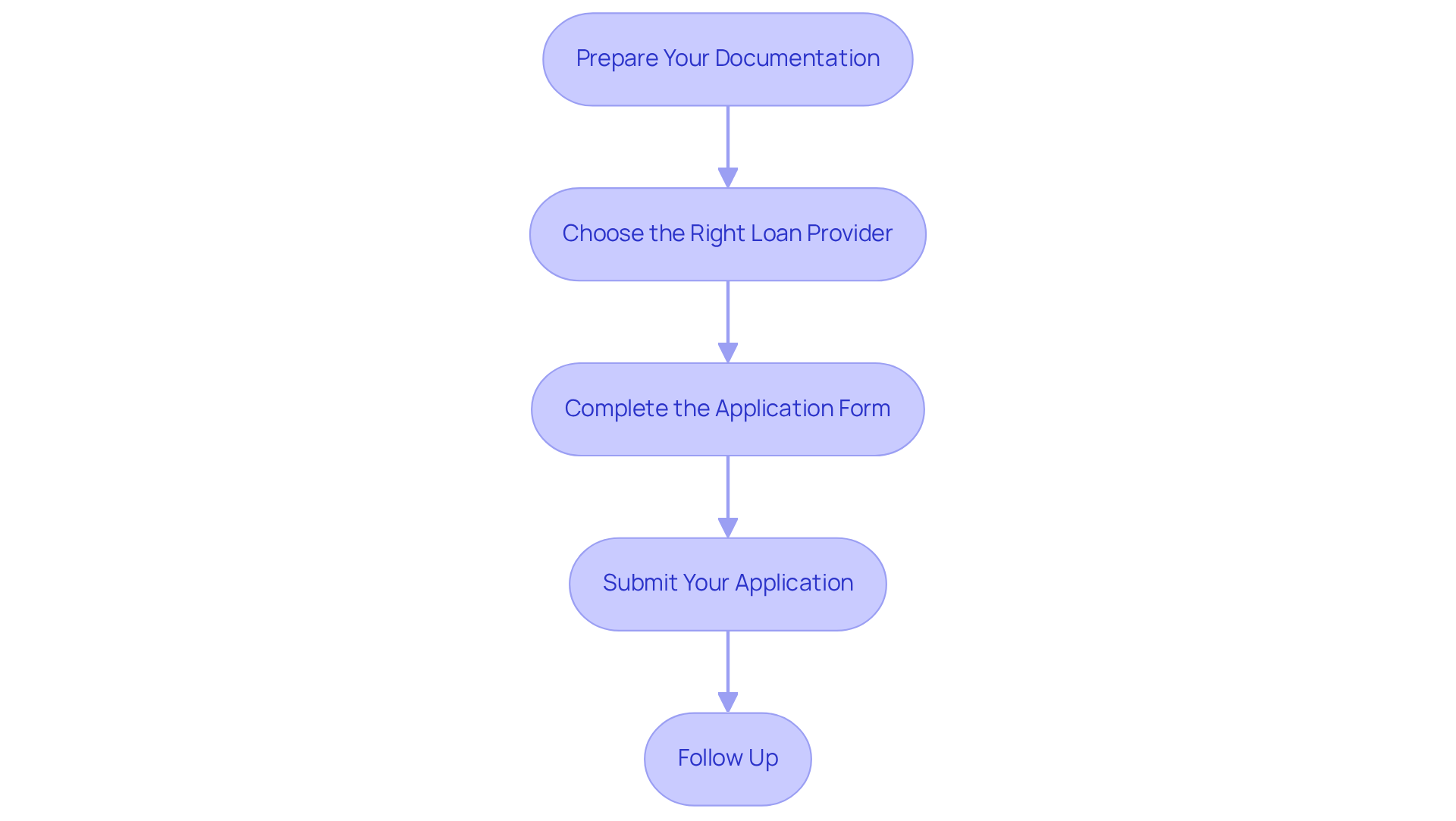

Applying for a commercial investment loan involves several essential steps that can significantly impact your chances of approval:

-

Prepare Your Documentation: Gather the necessary documents, which typically include:

- Financial statements for the last three years

- A comprehensive business plan outlining your investment strategy

- Recent tax returns and Notices of Assessment covering the most recent 12-month period

- Identification documents

- Current credit report

- Property-related documents such as an Environmental Site Assessment conducted within the past 12 months and an Appraisal report completed within the past six months if required

-

Choose the Right Loan Provider: Research potential financial institutions to find one that offers favorable terms and has a solid reputation in the market. Successful financial institutions are those adapting to the evolving landscape, utilizing data analytics and AI for underwriting, which enhances the efficiency of the loan process. Furthermore, consider institutions incorporating ESG factors into their lending decisions, as this is becoming progressively significant in the regulatory landscape. At Finance Story, we specialize in linking you with a complete array of financial institutions, including high street banks and innovative private lending panels, ensuring you find the right fit for your circumstances.

-

Complete the Application Form: Accurately fill out the financial institution's application form, ensuring that all information is complete and truthful. This step is vital as financial institutions increasingly scrutinize applications for accuracy and completeness. Our expertise at Finance Story can help you create polished and highly individualized business cases that stand out.

-

Submit Your Application: Submit your application along with all required documentation. Keeping copies for your records is essential for tracking your application.

-

Follow Up: After submission, maintain open communication with the financial institution to monitor the progress of your application. Be prepared to provide any additional information they may request, as timely responses can expedite the approval process.

By carefully organizing your paperwork and thoughtfully choosing a lender, you can simplify the application procedure and improve your chances of obtaining a commercial investment loan rate for business funding. With Finance Story's expertise in refinancing and obtaining customized business funding, you can navigate the complexities of business financing with assurance.

Manage and Review Your Loan Terms

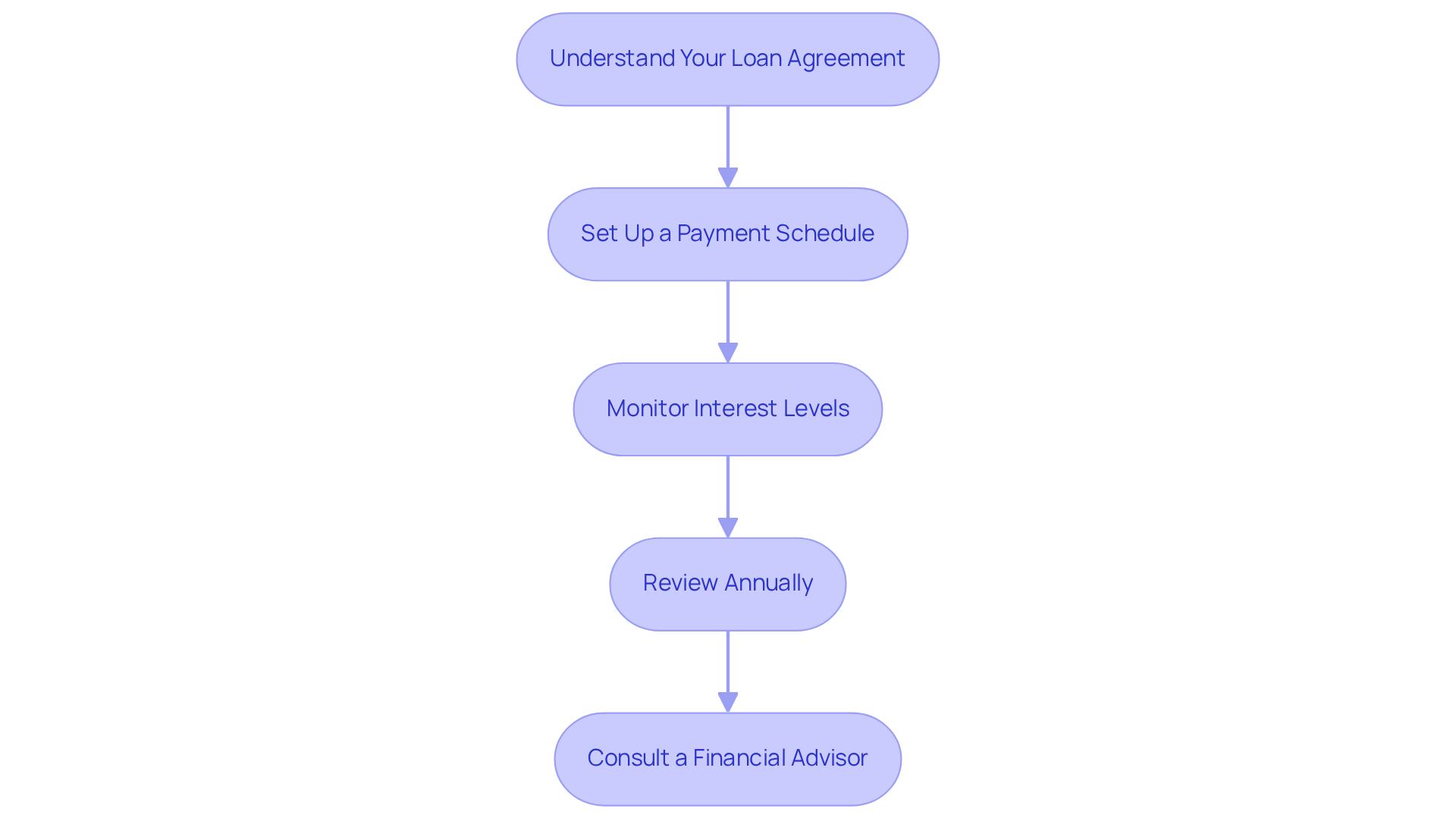

Once your commercial investment loan rate is approved, effective management becomes essential.

-

Understand Your Loan Agreement: Familiarize yourself with all terms, including interest percentages, repayment schedules, and any penalties for late payments. A clear understanding can prevent costly mistakes and ensure compliance with the agreement.

-

Set Up a Payment Schedule: Create a calendar for your repayments to ensure you never miss a payment. Remember, missed payments can negatively impact your credit score and future borrowing capacity.

-

Monitor Interest Levels: Keep an eye on market interest levels. With overall business and multifamily mortgage borrowing anticipated to increase to $583 billion in 2025, refinancing your debt when interest levels decline significantly can lead to substantial savings. For instance, the average commercial investment loan rate for refinancing is expected to be around 5.5% in 2025. This presents a favorable opportunity to consider refinancing if your existing rate is higher. Finance Story specializes in crafting polished and individualized business cases to present to lenders, ensuring you secure the best refinancing options available from a wide range of lenders.

-

Review Annually: At least once a year, assess your borrowing terms and financial situation. Evaluate if your existing financing still meets your needs or if modifications are necessary, especially in a changing market where the commercial investment loan rate is expected to fluctuate. Partnering with Finance Story grants you access to a comprehensive suite of lenders, enhancing your ability to adapt to evolving financial circumstances.

-

Consult a Financial Advisor: Regularly meet with a financial advisor or your mortgage broker to discuss your financing performance and explore options for improvement. Financial specialists emphasize that understanding credit agreements is vital for making informed decisions that align with your business objectives.

By proactively overseeing your financing, you can ensure it remains aligned with your financial goals, particularly in an environment where numerous companies are restructuring business debts to reduce interest costs and enhance cash flow. For example, a local manufacturing company recently refinanced its commercial loan, reducing its interest rate from 6% to 4.5%, resulting in significant savings that were redirected towards business expansion.

Conclusion

Mastering the commercial investment loan rate process is essential for anyone looking to invest in income-generating properties. By grasping the intricacies of commercial loans—including types, repayment terms, and the significance of a robust business strategy—investors can position themselves for success in a competitive market. This knowledge not only aids in securing favorable loan rates but also ensures a smoother application process.

Key insights covered in this guide emphasize:

- The necessity of thorough research when comparing loan rates

- The significance of loan-to-value ratios

- The importance of preparation in the application process

Furthermore, effective management of loan terms post-approval is crucial for maintaining financial health and capitalizing on refinancing opportunities when market conditions are favorable. Partnering with experienced financial institutions provides invaluable support throughout this journey.

Ultimately, navigating the commercial investment loan landscape requires diligence and strategic planning. Investors are encouraged to take proactive steps in managing their loans, regularly reviewing their terms, and consulting with financial advisors to ensure alignment with their long-term objectives. By doing so, they can enhance their investment strategies and optimize their financial outcomes in an ever-evolving market.