Overview

Understanding SMSF loan rules is crucial for making informed investment decisions, especially when it comes to acquiring assets like commercial real estate. These rules, including Limited Recourse Borrowing Arrangements and compliance with the Superannuation Industry (Supervision) Act, play a vital role in safeguarding assets. By adhering to these regulations, investors can ensure successful property acquisitions, leveraging their superannuation for financial growth while effectively managing associated risks. Are you ready to take control of your investment strategy?

Introduction

In the realm of investment strategies, Self-Managed Super Fund (SMSF) loans have emerged as a powerful tool for savvy investors seeking to leverage their superannuation savings. These specialized financial products not only facilitate the acquisition of lucrative commercial properties but also come with a set of stringent regulations that require careful navigation. As the landscape of SMSF loans evolves, understanding the rules, application processes, and inherent risks becomes paramount for investors aiming to maximize their financial potential.

From unlocking diverse investment opportunities to ensuring compliance with the Australian Taxation Office, this comprehensive guide delves into the intricacies of SMSF loans, equipping investors with the knowledge they need to thrive in the competitive property market.

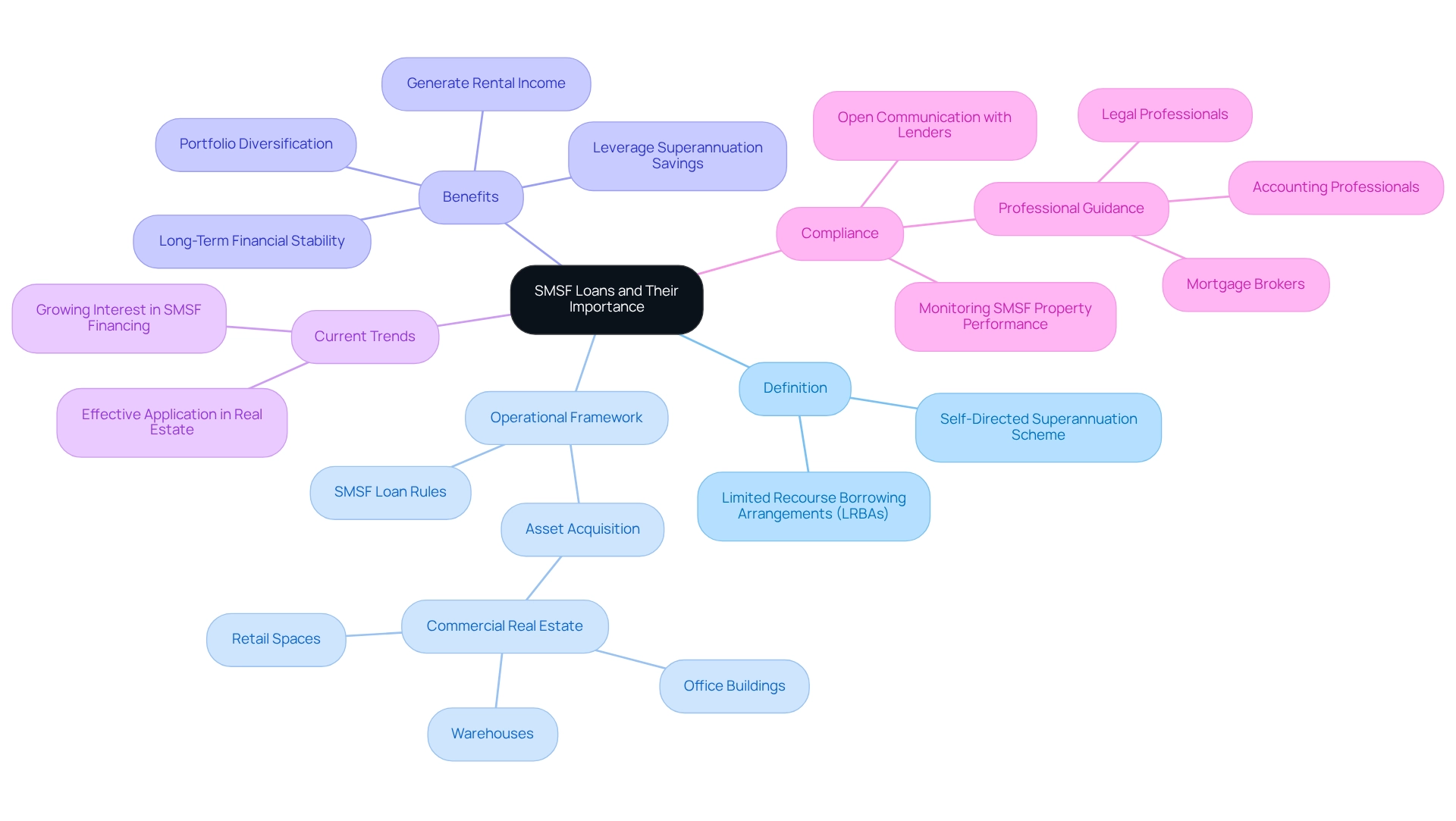

Define SMSF Loans and Their Importance for Investors

A self-directed superannuation scheme borrowing option operates under smsf loan rules and is a specialized financial product designed for trustees to acquire funds for purchasing assets, including commercial real estate such as office buildings, warehouses, and retail spaces. Typically organized as Limited Recourse Borrowing Arrangements (LRBAs), these financial products follow smsf loan rules by limiting the lender's recourse to the asset obtained, thereby safeguarding the fund's other assets in the event of default.

In the 2023-24 period, the guideline interest rate for real estate LRBAs stood at approximately 8.85% p.a., reflecting the current landscape of self-managed superannuation fund financing in Australia, governed by smsf loan rules, which are crucial for investors as they open up significant funding opportunities. This enables individuals to leverage their superannuation savings to acquire assets that generate rental income and appreciate in value. Such a strategy not only bolsters retirement savings but also aligns with broader financial objectives.

Current trends indicate a growing interest in self-managed superannuation fund financing, particularly in relation to the smsf loan rules, with many investors recognizing its potential to diversify portfolios and secure long-term financial stability. Case studies illustrate the effective application of self-managed superannuation fund financing in real estate acquisition, showcasing how Finance Story provides expert assistance to streamline the process and ensure compliance with legal and financial obligations.

By supporting clients in establishing a robust compliance case and selecting appropriate lenders, Finance Story mitigates risks and facilitates a smoother application process, ultimately leading to successful property acquisitions. As the market evolves, maintaining open communication with lenders or brokers is essential for navigating the complexities of self-managed super funds and understanding the smsf loan rules to maximize financial potential.

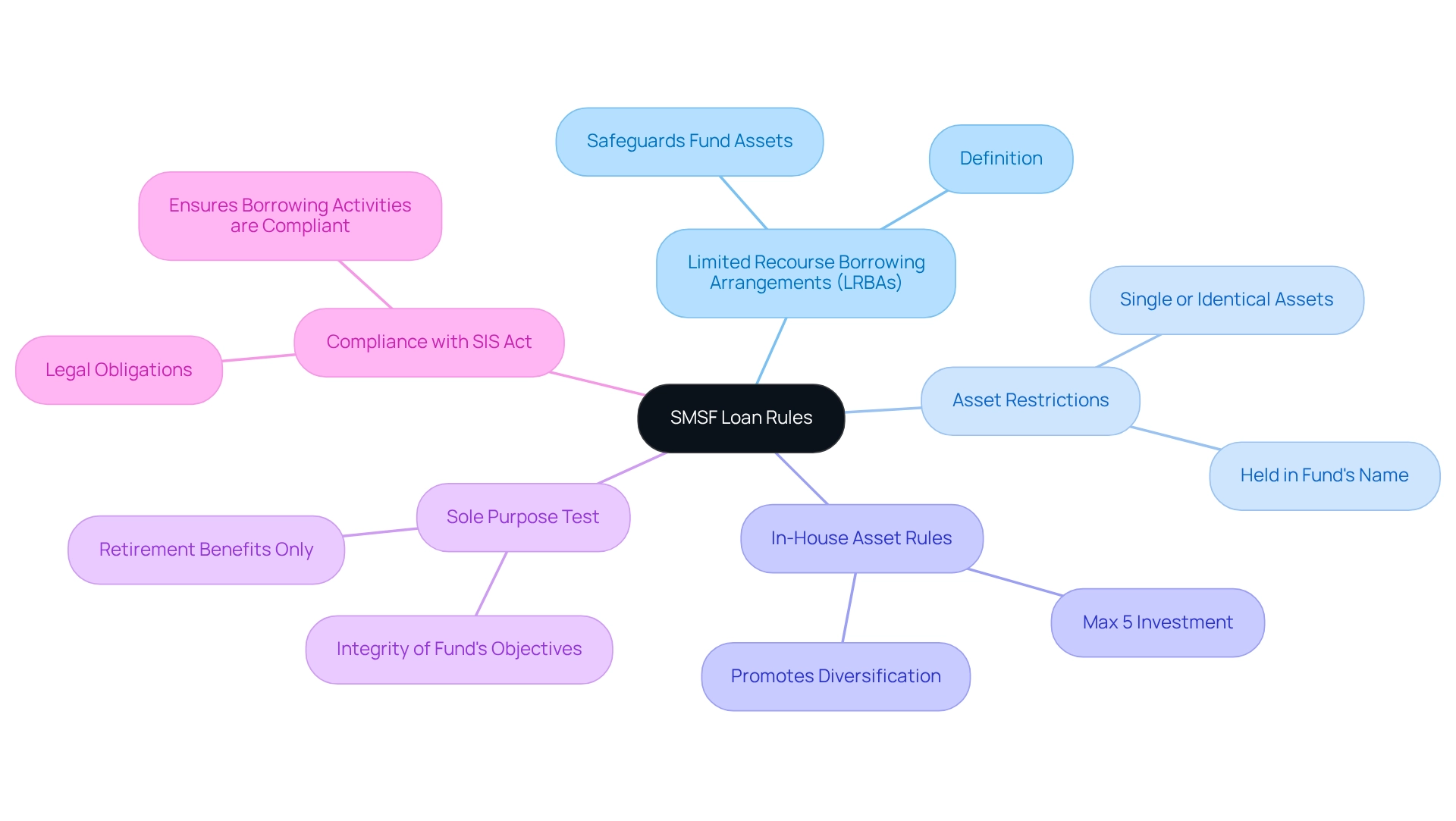

Outline SMSF Loan Rules and Compliance Requirements

Self-managed superannuation fund financing is governed by stringent smsf loan rules established by the Australian Taxation Office (ATO), which are crucial for ensuring compliance and achieving optimal financial outcomes. The primary regulations, often referred to as the smsf loan rules, include:

- Limited Recourse Borrowing Arrangements (LRBAs): Self-managed superannuation funds are allowed to borrow solely under LRBAs, limiting the lender's recourse to the asset acquired, thereby safeguarding the fund's other assets.

- Asset Restrictions: Funds must be allocated to purchase either a single asset or a collection of identical assets, with the asset held in the name of the self-managed superannuation fund.

- In-House Asset Rules: Self-managed superannuation funds cannot invest more than 5% of their total assets in in-house assets, which include financing to members or related parties, thereby promoting diversification and effective risk management.

- Sole Purpose Test: The self-managed superannuation fund must operate exclusively for the purpose of providing retirement benefits to its members, thereby reinforcing the integrity of the fund's objectives.

- Compliance with the SIS Act: All borrowing activities must comply with the Superannuation Industry (Supervision) Act 1993, ensuring that the self-managed superannuation fund meets all legal obligations.

As we approach 2025, adherence to these smsf loan rules is paramount for self-managed superannuation fund investments, especially considering the 297 fund windups reported, with more expected in the June quarter. Engaging expert support can significantly streamline the self-managed super fund loan process, assisting investors in navigating the complexities of the smsf loan rules. Successful case studies, particularly those highlighting long-term holding strategies for self-managed superannuation fund properties, underscore the benefits of adhering to these regulations, including reduced capital gains tax and potentially tax-exempt rental income during retirement. Expert insights stress the necessity of comprehending the smsf loan rules to avoid pitfalls and maximize investment potential.

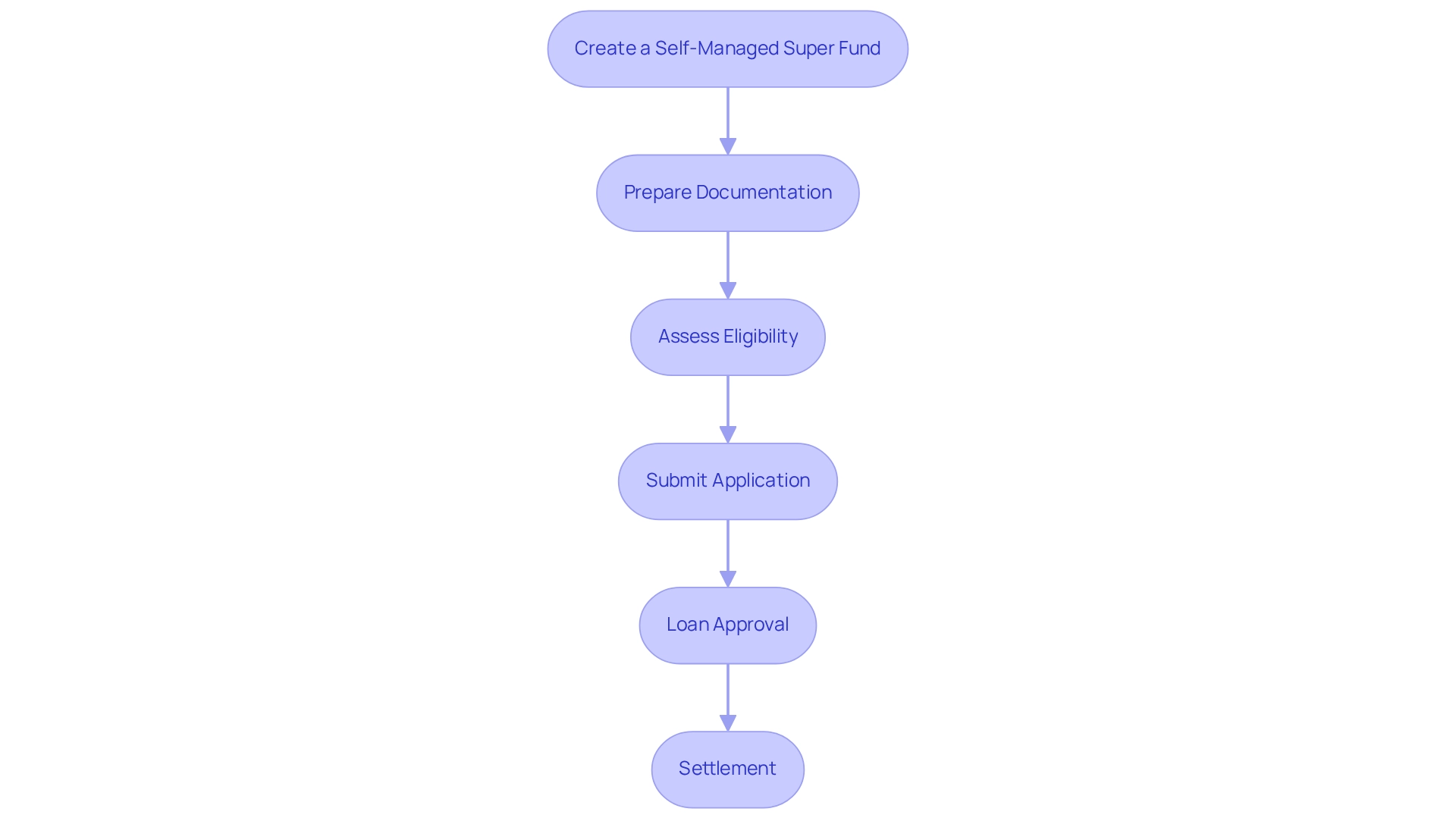

Explain the Application Process and Eligibility for SMSF Loans

Applying for a self-managed superannuation fund loan requires a systematic approach that follows the SMSF loan rules to ensure compliance and secure funding. Here’s a detailed breakdown of the process:

- Create a self-managed super fund: Ensure the self-managed super fund complies with regulations and has a corporate trustee in place.

- Prepare Documentation: Gather essential documents, including the Trust Deed for the fund, financial statements, and a clearly defined investment strategy.

- Assess Eligibility: Lenders typically require the SMSF to maintain a minimum balance, generally around $200,000, along with sufficient cash flow to manage repayments and other expenses.

- Submit Application: Complete the financing application form and submit it with the necessary documentation to the lender.

- Loan Approval: The lender evaluates the application based on compliance, serviceability, and the funding strategy. This assessment can take between 4 to 8 weeks.

- Settlement: Once approved, the financing is finalized, enabling the self-managed super fund to proceed with the property acquisition.

Understanding these steps is crucial, especially as self-managed super fund assets are primarily allocated to Australian listed shares (27.5%) and cash or term deposits (17.9%). This organized approach not only facilitates a smoother application process but also ensures compliance with regulatory requirements, ultimately leading to successful real estate investments under SMSF loan rules.

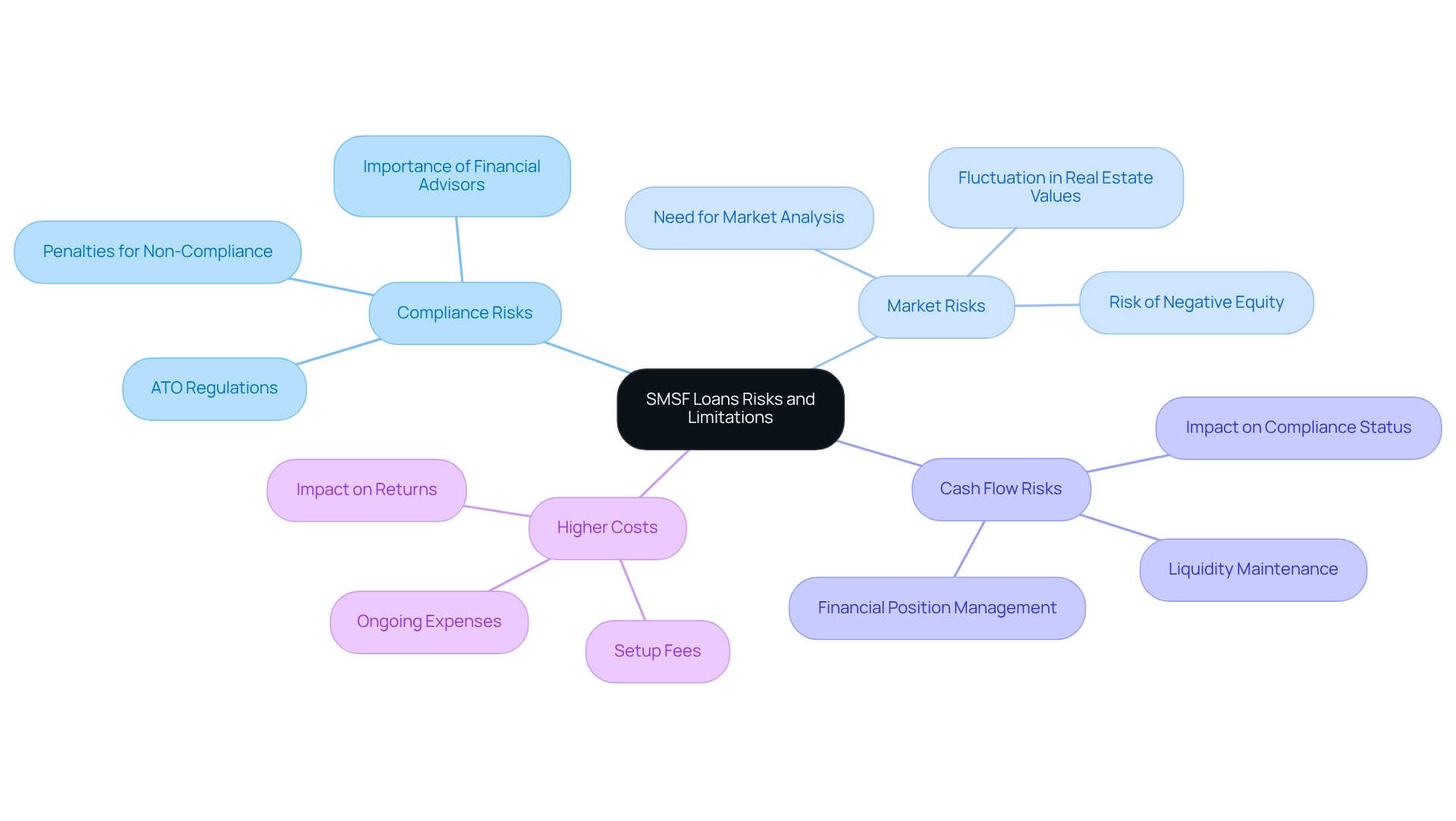

Identify Risks and Limitations of SMSF Loans

Self-managed superannuation fund financing provides substantial benefits for investing in commercial real estate, but it also carries inherent risks and restrictions that must be understood, particularly the smsf loan rules:

- Compliance Risks: Failure to adhere to ATO regulations can result in severe penalties, including the classification of the self-managed superannuation fund as non-compliant. Engaging with financial advisors and accountants, such as those at Finance Story, is crucial for navigating these complexities efficiently and ensuring compliance when investing in commercial real estate.

- Market Risks: Real estate values are subject to fluctuation, and there exists a risk of negative equity if property values decrease. Notably, 74% of self-managed superannuation fund assets are allocated to Australian listed shares, cash and term deposits, unlisted trusts, non-residential real estate, and LRBA assets. This statistic underscores the necessity of conducting comprehensive market analysis before making financial decisions in commercial real estate.

- Cash Flow Risks: It is essential for self-managed superannuation funds to maintain adequate liquidity to cover repayments, insurance, and other associated costs. A lack of cash flow can jeopardize the fund's compliance status, making it imperative for trustees to uphold a robust financial position, especially when investing in commercial properties.

- Higher Costs: Financing through self-managed superannuation funds often entails higher setup fees and ongoing expenses compared to traditional financing options, potentially affecting overall returns. Understanding these financial implications is vital for effective fund management, particularly concerning commercial real estate acquisitions, and must be aligned with the smsf loan rules that restrict asset options in a self-managed super fund. Regular assessments of financial standings and asset performance, along with avoiding excessive borrowing, are optimal strategies for successfully managing self-managed superannuation fund financing.

By comprehending these risks, trustees can make informed decisions that align with their financial objectives. Consulting with Finance Story's financial advisors can facilitate navigation through the complexities of SMSF loan rules and ensure compliance with legal requirements while pursuing commercial property investments.

Conclusion

Navigating the world of Self-Managed Super Fund (SMSF) loans presents both opportunities and challenges for investors. By leveraging superannuation savings, SMSF loans enable the acquisition of lucrative commercial properties, fostering potential for rental income and capital growth. However, understanding the stringent regulations governing these loans is essential to ensure compliance with the Australian Taxation Office (ATO) and to protect the fund's integrity.

The application process for SMSF loans requires careful preparation and adherence to specific eligibility criteria, emphasizing the need for a systematic approach to secure funding successfully. Investors must also remain vigilant about the risks associated with SMSF loans, including:

- Compliance pitfalls

- Market fluctuations

- Cash flow management

By acknowledging these risks and seeking professional guidance, investors can mitigate challenges and enhance their investment strategies.

Ultimately, SMSF loans can be a powerful tool for those looking to maximize their financial potential in the property market. With the right knowledge and support, investors can navigate the complexities of SMSF loans, ensuring not only compliance but also the successful realization of their investment goals. As the landscape continues to evolve, staying informed and proactive will be key to thriving in this competitive arena.