Overview

Unlocking the potential of Self-Managed Super Fund (SMSF) loans can be a game-changer for property investment. By leveraging your superannuation, you can strategically acquire both residential and commercial properties. But what exactly makes SMSF loans so appealing?

First, consider the tax advantages they offer. These loans not only provide asset protection but also enable you to diversify your investment portfolio. This multifaceted approach can significantly enhance your financial growth. However, it’s crucial to navigate the complex regulations surrounding SMSF loans and manage the associated risks effectively.

Are you ready to take control of your financial future? Understanding the intricacies of SMSF loans is essential for ensuring successful investment outcomes. By being informed and proactive, you can harness the power of your superannuation to build a robust property portfolio.

Introduction

In the dynamic realm of property investment, Self-Managed Super Fund (SMSF) loans have become an essential tool for discerning investors aiming to enhance their retirement portfolios. These specialized financial instruments empower individuals to borrow funds through their SMSF for property acquisitions, while also providing a distinctive combination of tax benefits, investment autonomy, and asset protection.

As the SMSF sector expands, with forecasts suggesting a notable increase in members possessing substantial balances, grasping the advantages and intricacies of SMSF loans is crucial for anyone eager to explore this lucrative pathway. However, with potential rewards come inherent risks and regulatory hurdles that require meticulous consideration and strategic oversight.

This article investigates the complexities of SMSF loans, examining their significance in property investment, the advantages they present, the pitfalls to be mindful of, and effective management strategies to secure long-term success.

Define SMSF Loans and Their Role in Property Investment

Self-Managed Super Funds (SMSFs) serve as specialized financial tools, empowering individuals to use an SMSF loan property to borrow capital for acquiring investment properties. Typically structured as Limited Recourse Borrowing Arrangements (LRBAs), these agreements ensure that a lender's recourse in the event of default is confined solely to the asset purchased with the funds. This protective measure effectively safeguards the other assets within the fund from potential borrowing-related risks. SMSF financing can facilitate the acquisition of both residential and commercial properties, offering investors a flexible avenue to expand their portfolios and bolster their retirement savings.

As we look toward 2025, the landscape of self-managed superannuation funds is witnessing significant growth. Forecasts indicate that by June 30, 2024, over 80,000 members will hold balances exceeding $3 million. This trend underscores a growing reliance on SMSF loan property for financing real estate investments, particularly as investors strive to enhance their retirement earnings. However, navigating the legal framework and compliance requirements surrounding SMSFs is crucial for ensuring successful real estate ventures. Recent reports have highlighted a concerning rise in unauthorized lending, drawing scrutiny from regulatory bodies such as the ATO, while expert opinions emphasize the vital role of SMSF loan property in real estate strategies, with financial consultants advocating for SMSF loan property as a means to improve retirement portfolios. Case studies, including insights from Simon Conolly, a senior manager in business services, showcase effective strategies for maximizing retirement income through SMSFs. Understanding these dynamics is essential for investors aiming to leverage SMSF loan property financing effectively in their real estate endeavors.

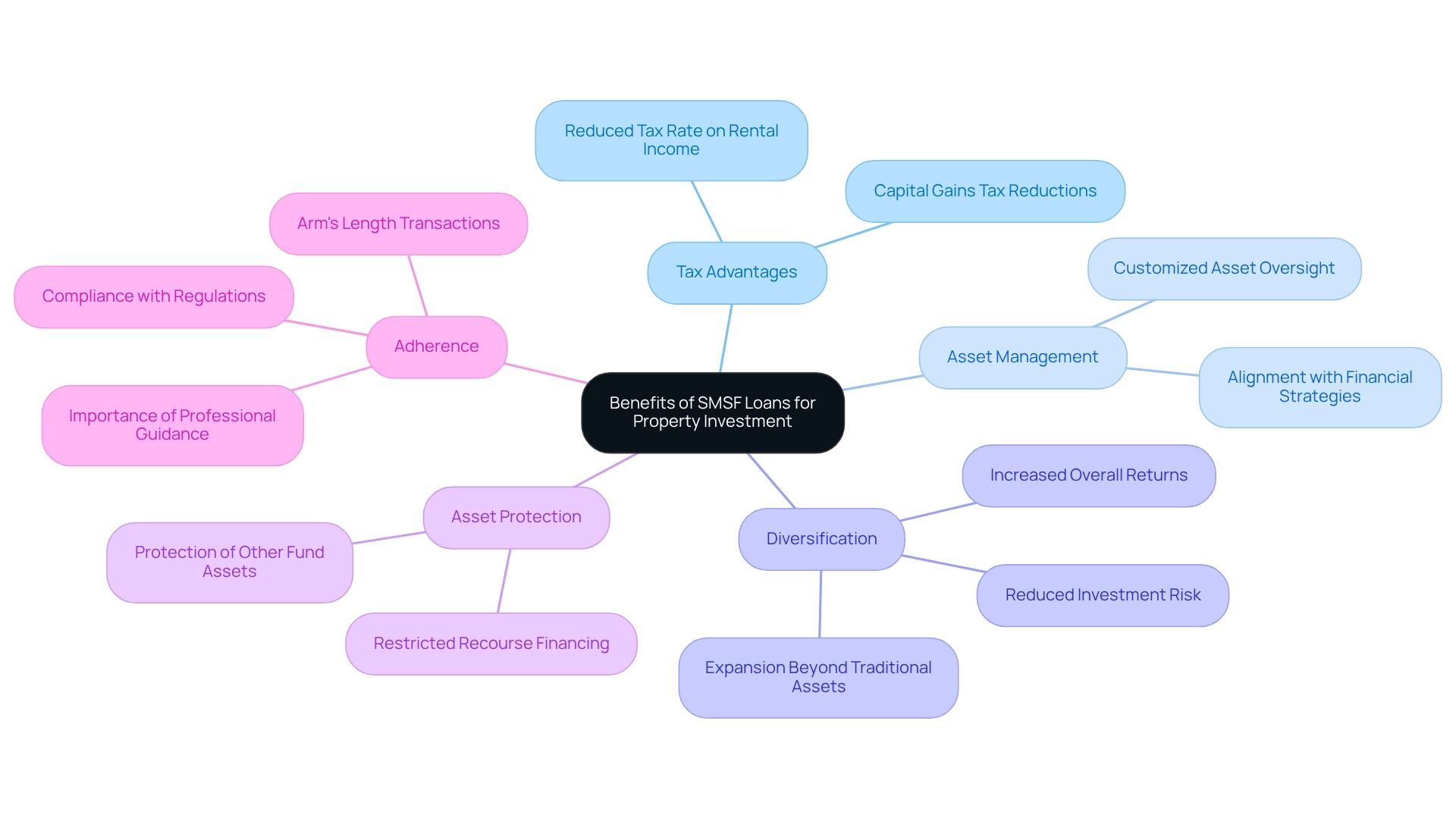

Explore the Benefits of SMSF Loans for Property Investment

Investing in real estate through an SMSF loan property presents several significant advantages that can greatly enhance your financial strategy.

- Tax Advantages: SMSFs benefit from a favorable tax regime, with rental income typically taxed at a reduced rate of 15%. Furthermore, assets retained for over 12 months may be eligible for capital gains tax reductions, improving overall returns.

- Asset Management: Trustees of SMSFs have the freedom to choose real estate that aligns with their financial strategies and retirement goals, allowing for a customized approach to asset oversight.

- Diversification: Utilizing SMSF loan property financing enables investors to expand their portfolios beyond traditional assets. This can potentially lead to increased overall returns and reduced risk through diversification. Utilization of an SMSF loan property allows investors to harness their superannuation resources for real estate acquisitions, greatly enhancing investment returns and positioning this strategy as a tactical financial decision.

- Asset Protection: The restricted recourse characteristic of self-managed superannuation fund financing safeguards other assets within the fund, ensuring that they remain protected in the event of a default.

- Adherence: Self-managed superannuation fund trustees must follow strict compliance rules, including ensuring that all transactions are conducted at arm's length and solely for the benefit of the fund. This regulatory framework is essential for preserving the integrity of the self-managed super fund, and the procedure for establishing an SMSF loan property for real estate acquisition includes several important steps, such as evaluating borrowing capacity, choosing the suitable asset, and ensuring adherence to legal obligations. Engaging with experienced professionals is advisable to navigate these complexities effectively.

A well-organized self-managed superannuation fund financing option can enable the acquisition of high-value assets, but careful consideration is crucial to prevent expensive errors. As the housing market in Australia continues to flourish, with values hitting unprecedented levels, the tactical application of self-managed superannuation fund financing can place investors favorably in this competitive environment.

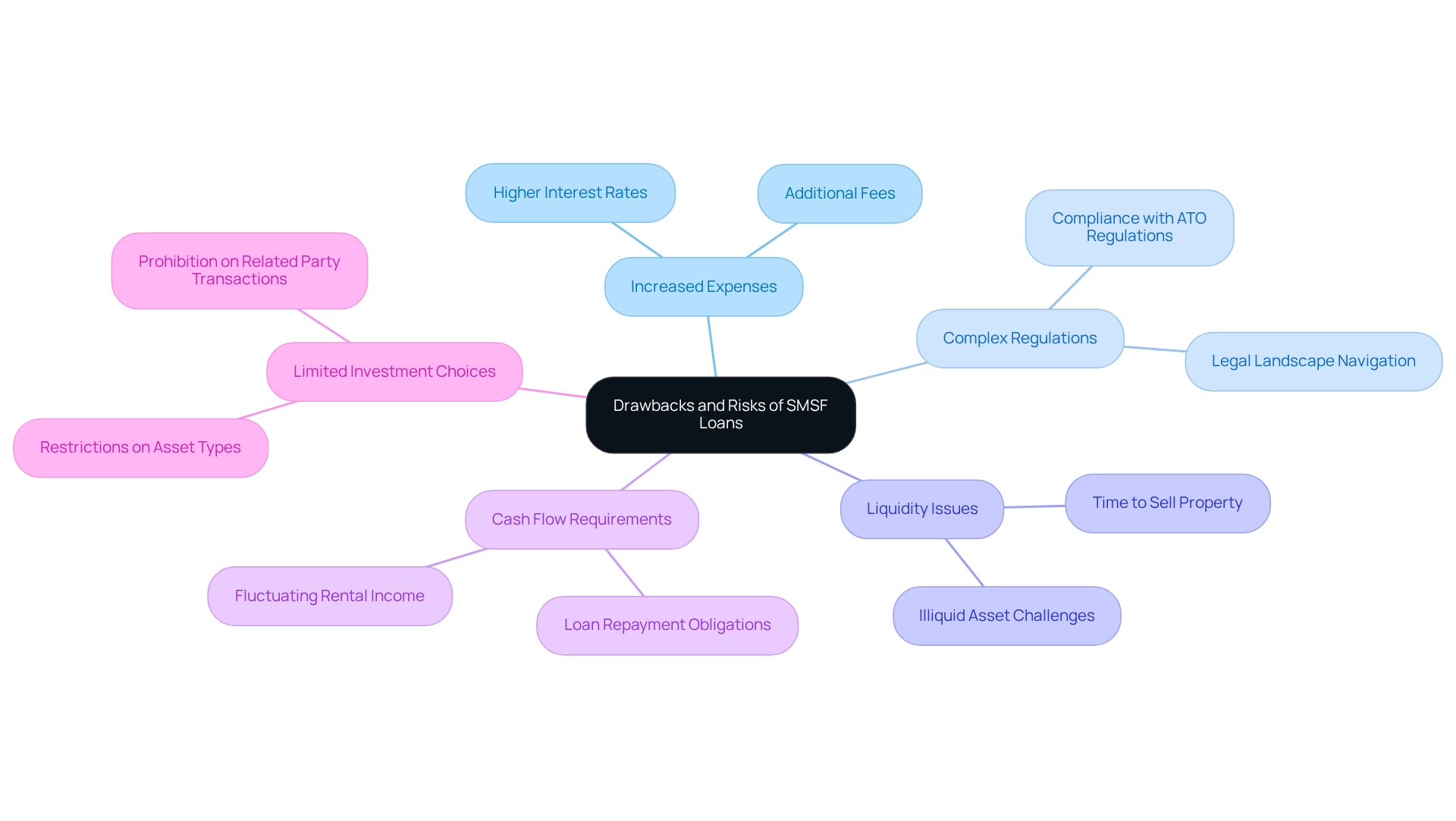

Analyze the Drawbacks and Risks of SMSF Loans

While self-managed superannuation fund financing presents numerous advantages, it also comes with specific disadvantages and risks that require careful consideration:

- Increased Expenses: Self-managed superannuation fund loans often carry higher interest rates and fees compared to traditional loans, which can impact overall profitability. This factor is particularly significant for small business owners contemplating commercial property investments using an SMSF loan property.

- Complex Regulations: Investors must navigate a complex legal landscape, including compliance with Australian Taxation Office (ATO) regulations. This complexity can be intimidating; however, Finance Story is equipped to assist you in building a robust case and ensuring compliance, thereby streamlining the process.

- Liquidity Issues: Property is typically an illiquid asset, meaning it can take time to sell. This characteristic may pose challenges if the SMSF needs to access cash quickly. Recognizing these liquidity constraints is essential for effective financial planning.

- Cash Flow Requirements: SMSFs must maintain adequate cash flow to cover loan repayments and other expenses, which can be challenging if rental income fluctuates. Finance Story can offer tailored guidance to help you effectively manage these cash flow requirements.

- Limited Investment Choices: SMSFs face restrictions regarding the types of assets they can invest in, and purchasing residential real estate from related parties is prohibited. However, there are fewer limitations on commercial real estate ventures, which can provide significant opportunities for small business owners looking to diversify their portfolios through an SMSF loan property.

Implement Effective Management Strategies for SMSF Loans

To efficiently manage SMSF loan property and the associated loans and assets within self-managed super funds (SMSFs), particularly in commercial real estate, consider implementing the following strategies:

- Regular Review of Financial Strategy: Periodically assess your SMSF's financial approach to ensure it aligns with your financial goals and adapts to evolving market conditions. Regular reviews are essential, especially as over 65% of SMSFs have been established for more than a decade, reflecting a trend of long-term commitment among fund members. Furthermore, with more than 80,000 members projected to have balances exceeding $3 million by 30 June 2024, the significance of effective management strategies is heightened. Given the fewer restrictions on commercial real estate investments compared to residential properties, now is an opportune moment to evaluate your strategy.

- Maintain Accurate Records: Keep meticulous records of all transactions, including loan agreements and asset management documents. This practice is vital for compliance with ATO regulations and promotes transparency in your fund's activities, particularly when investing in commercial assets through an SMSF loan property.

- Cash Flow Management: Implement strategies to effectively manage cash flow. Setting aside reserves for unforeseen costs or fluctuations in rental income can safeguard your assets and ensure liquidity. This is especially crucial in the commercial property sector, where income can vary significantly.

- Seek Professional Advice: Engage with financial advisors or accountants who specialize in SMSFs. Their expertise can help navigate complex regulations and optimize your financial strategy, ensuring that your fund remains compliant and effective. Finance Story can assist you in building a solid case for compliance and identifying the right lender for your commercial real estate.

- Diversify Investments: Consider broadening your fund's portfolio by investing in various types of real estate or other asset categories. This approach can mitigate risks and enhance returns, fortifying your financial strategy. With the right guidance, you can explore diverse commercial property options that align with your financial objectives.

By adopting these effective management strategies, SMSF members can significantly improve their prospects for long-term success and satisfaction with their financial outcomes. As illustrated in the case study on the longevity of SMSFs, many members express contentment with their investment strategies and are inclined to continue managing their funds into retirement.

Conclusion

Investing through Self-Managed Super Fund (SMSF) loans presents a unique opportunity for individuals to enhance their retirement portfolios while navigating the complexities of property investment. By leveraging these specialized financial instruments, investors can access significant tax advantages, enjoy greater control over their investments, and diversify their assets to mitigate risks. However, it is essential to acknowledge the regulatory landscape and the potential drawbacks, including higher costs and liquidity issues, that accompany SMSF loans.

Effective management strategies are paramount for maximizing the benefits of SMSF loans. Regularly reviewing investment strategies, maintaining accurate records, and managing cash flow are critical components that contribute to long-term success. Furthermore, seeking professional advice can provide invaluable insights into compliance and the optimization of investment strategies, ensuring that SMSF members remain on track to achieve their financial goals.

As the SMSF sector continues to grow and evolve, understanding the intricacies of SMSF loans becomes increasingly important. Investors who approach this pathway with diligence and strategic foresight can harness the power of SMSF loans to secure a prosperous retirement future. Embracing these opportunities while being mindful of the associated risks will empower individuals to make informed decisions that align with their investment aspirations.