Overview

This article delves into SMSF loan offset strategies, underlining their pivotal role in boosting financial success through optimized real estate investments within self-managed superannuation funds.

How can these strategies significantly reduce interest expenses and enhance investment returns? By examining effective fund management examples, we reveal the crucial importance of compliance with regulatory requirements.

Furthermore, understanding these strategies equips you with the knowledge to make informed decisions about your financial future.

Introduction

In the evolving landscape of retirement planning, Self-Managed Super Fund (SMSF) loans have emerged as a powerful tool for savvy investors aiming to enhance their financial futures. These specialized financial products not only facilitate the acquisition of investment properties but also offer unique advantages that traditional superannuation funds may lack.

As the trend toward commercial property investment gains momentum, understanding the intricacies of SMSF loans—including:

- Eligibility criteria

- The strategic use of offset accounts

- The balance of risks and rewards

becomes paramount. Furthermore, with expert guidance available, investors can navigate the complexities of SMSF borrowing to unlock the full potential of their retirement savings while ensuring compliance with regulatory standards.

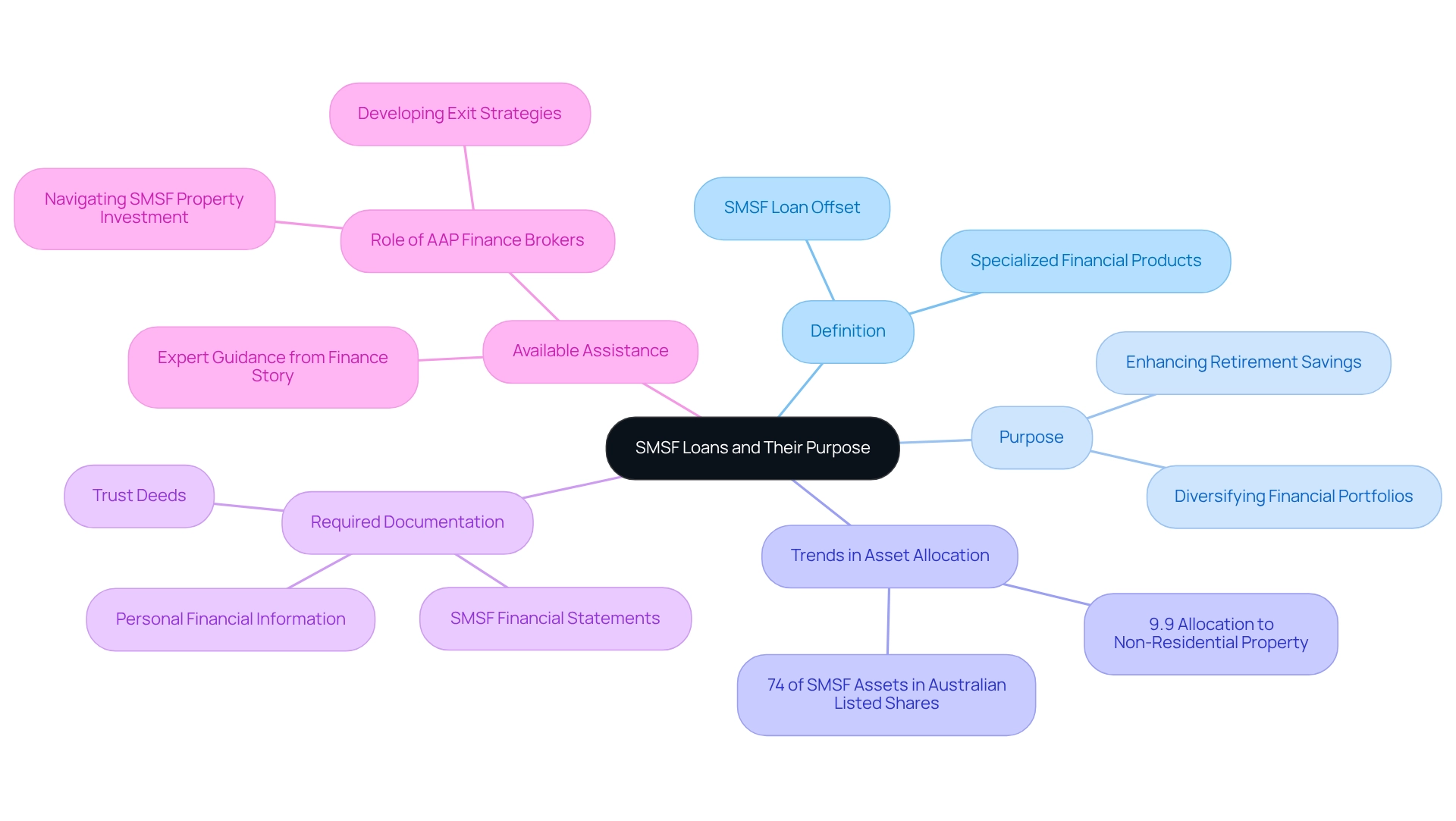

Define SMSF Loans and Their Purpose

Self-Managed Superannuation Fund (SMSF) financing options, such as the SMSF loan offset, represent specialized financial products designed to empower these funds in acquiring capital for asset purchases, particularly in the commercial sector, such as office buildings and warehouses. These financial aids primarily aim to bolster real estate endeavors, potentially enhancing retirement savings for fund members. Unlike residential property purchases, the SMSF loan offset offers fewer restrictions, rendering it an attractive choice for investors. Regulated by stringent rules, these loans ensure that borrowed funds are exclusively utilized for purposes that enhance members' retirement. This borrowing avenue, the SMSF loan offset, is particularly advantageous for individuals seeking to diversify their financial portfolios while adhering to superannuation regulations.

As of 2025, a notable 9.9% of self-managed superannuation fund assets are allocated to non-residential real property, illustrating a burgeoning trend in commercial investments. According to AAP Finance Brokers:

- "We understand precisely what lenders need for self-managed superannuation fund financing, such as trust deeds, financial statements of the SMSF, and personal financial information."

This insight underscores the importance of understanding the documentation required for securing self-managed superannuation fund loans.

Furthermore, Finance Story provides expert guidance to navigate the complexities of utilizing SMSFs for property purchases, including assistance in crafting compliance cases to meet regulatory requirements. With access to a diverse range of boutique lenders, private investors, and traditional banks, Finance Story is well-equipped to assist small business owners in leveraging borrowing calculators for informed investment decisions.

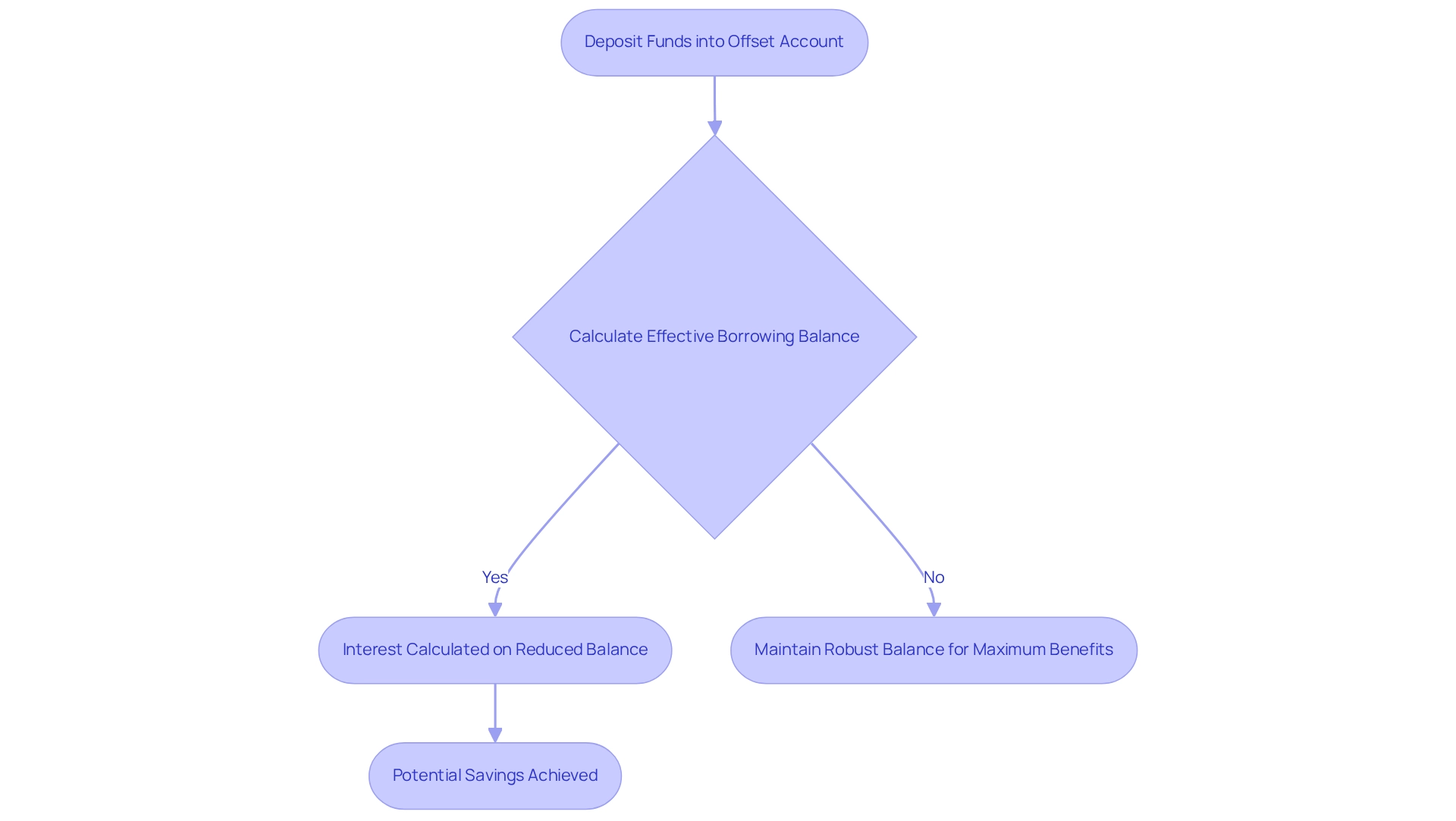

Explain How SMSF Loan Offsets Work

An SMSF loan offset account serves as a strategic financial tool linked to SMSF loan offset, aimed at minimizing interest expenses. By depositing funds into this account, the effective borrowing balance for interest calculations is reduced. For instance, with a credit of $300,000 and $50,000 in the offset account, interest is calculated on only $250,000. This approach can lead to substantial savings over the financing term, ultimately enhancing the fund's investment returns.

Maintaining a robust balance in the offset account is crucial to fully leverage these benefits, particularly with an SMSF loan offset. Recent statistics reveal that self-managed superannuation fund offset accounts can yield average interest savings of up to 30% by 2025, highlighting their effectiveness in lowering overall borrowing costs.

Experts stress the importance of regularly reviewing self-managed superannuation fund financing structures, particularly when incorporating an SMSF loan offset, to avoid non-compliance penalties and preserve tax benefits.

A compelling case study exemplifies the potential of using an SMSF loan offset: a self-managed superannuation fund with two members successfully acquired a residential asset, leveraging their capital while effectively managing the financing. As property values appreciated, they capitalized on their assets, eventually selling at a profit and diversifying their retirement portfolio. This success story demonstrates how the strategic use of offset accounts can enhance financial outcomes and support long-term investment goals.

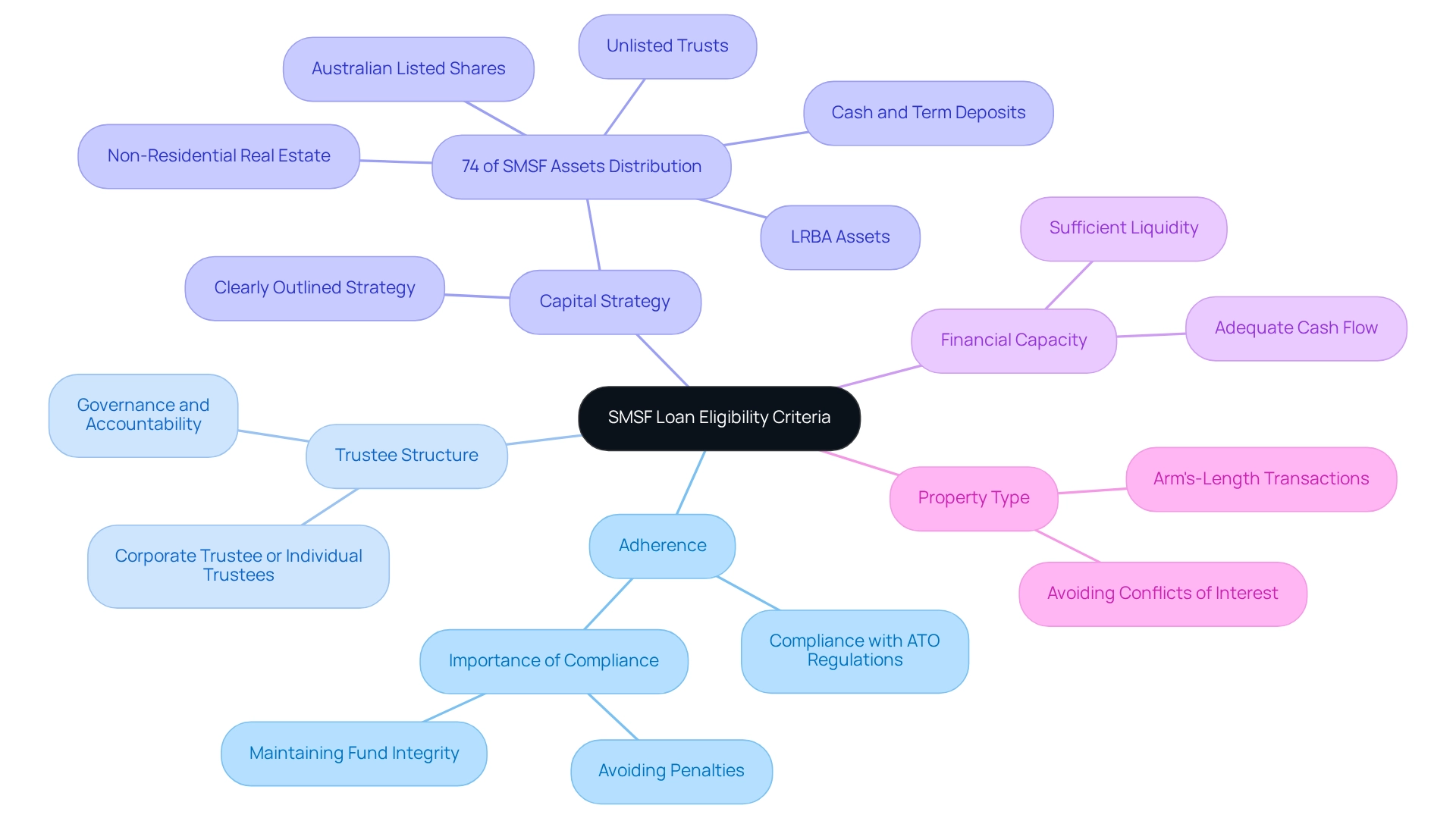

Outline Eligibility Criteria for SMSF Loans

To qualify for an SMSF loan, several key criteria must be met:

-

Adherence: The self-managed superannuation fund must comply with Australian Taxation Office (ATO) regulations, with a significant percentage of such funds maintaining adherence in 2025. As one specialist pointed out, "A self-managed super fund with real estate is akin to managing a small enterprise – you must pay attention to the accounts and rules." Finance Story can help ensure that your self-managed super fund meets these compliance requirements, especially when allocating resources to commercial properties like office buildings, warehouses, and retail locations, which have fewer restrictions compared to residential assets.

-

Trustee Structure: A corporate trustee or individual trustees must manage the self-managed super fund, ensuring proper governance and accountability.

-

Capital Strategy: The self-managed superannuation fund should have a clearly outlined capital strategy that corresponds with the loan's objective, demonstrating a proactive method to financial management. Significantly, 74% of self-managed superannuation fund assets are held in Australian listed shares, cash and term deposits, unlisted trusts, non-residential real estate, and LRBA assets, highlighting the importance of a structured investment strategy. Investing in commercial real estate through your SMSF loan offset can be a strategic decision, and Finance Story provides customized support to help you navigate this process efficiently.

-

Financial Capacity: The fund must demonstrate adequate cash flow to service loan repayments, along with sufficient liquidity to cover ongoing costs.

-

Property Type: The property being acquired must meet specific criteria, including being an arm's-length transaction, which is crucial to avoid conflicts of interest. Finance Story is here to assist you in forming a strong argument for lender selection, ensuring that your funding aligns with compliance standards.

Comprehending these standards is essential for a successful loan application, particularly in relation to changing economic policies that may influence self-managed superannuation fund strategies. As the self-managed superannuation fund lending market continues to evolve in 2025, marked by a robust network of specialized lenders, prospective borrowers are urged to remain aware of compliance obligations and seek advice on their choices. Moreover, wider economic policies, like housing affordability initiatives and tax reforms, could indirectly influence self-managed superannuation fund strategies and property market dynamics. For tailored guidance, book a chat with Finance Story today.

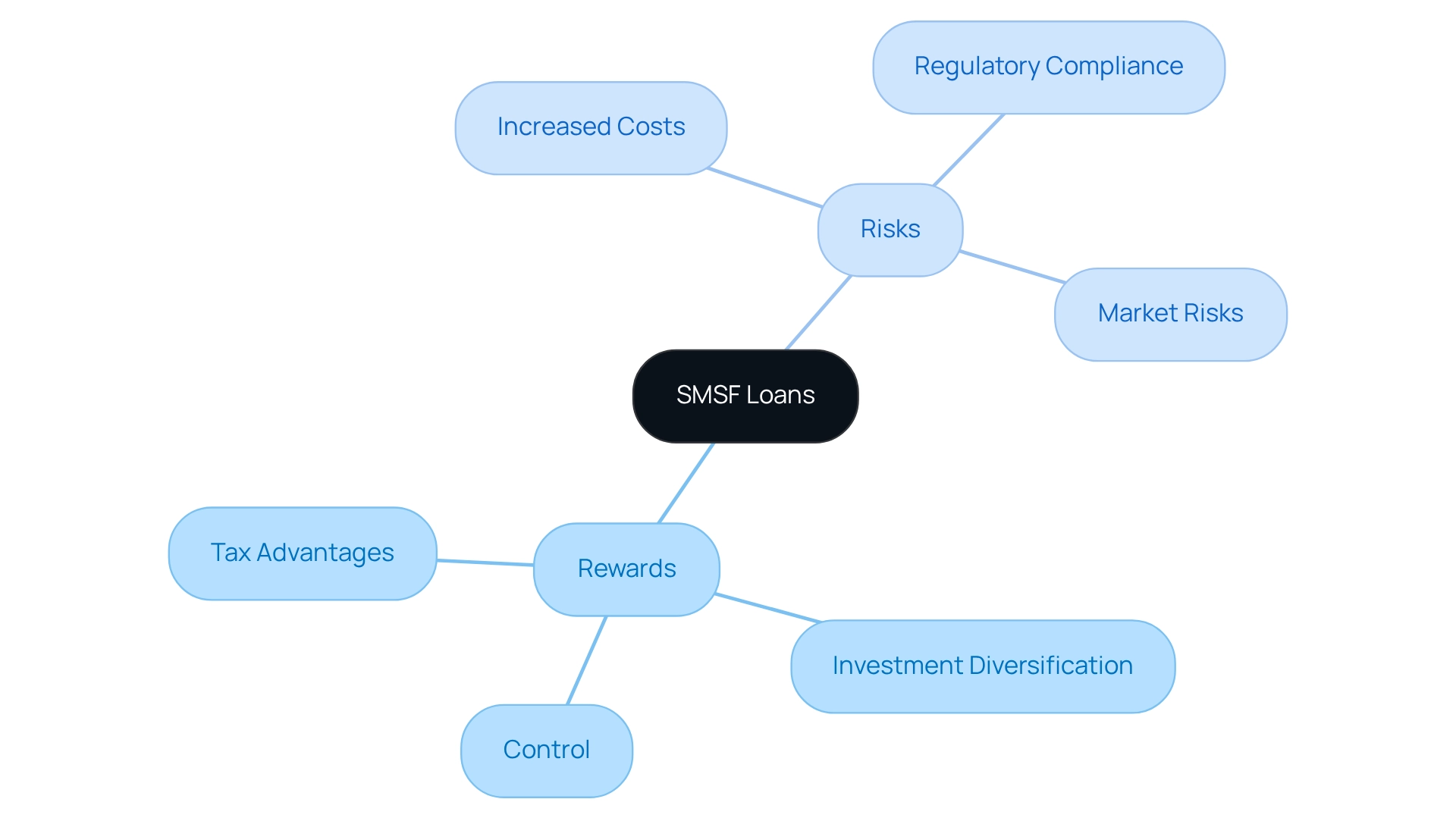

Assess Risks and Rewards of SMSF Loans

When assessing self-managed superannuation fund financing, it is essential to weigh the risks and benefits associated with an SMSF loan offset. The rewards include:

- Tax Advantages: SMSFs benefit from concessional tax rates on revenue, significantly enhancing overall returns. In 2025, these tax advantages remain a compelling reason for many investors.

- Investment Diversification: Self-managed superannuation fund financing enables access to real estate, providing opportunities for steady rental income and potential capital growth.

- Control: Members of a self-managed super fund exercise greater authority over their asset selections compared to conventional superannuation funds, allowing for customized strategies that align with personal financial goals.

Conversely, the risks encompass:

- Increased Costs: Self-managed superannuation fund loans generally involve higher interest rates and fees than conventional loans, affecting overall profitability.

- Regulatory Compliance: Adherence to stringent regulations is mandatory for SMSFs; failure to comply can lead to significant penalties.

- Market Risks: Property values are influenced by market changes, and a decrease can lead to negative equity, presenting a threat to the asset's viability.

Comprehending these dynamics is crucial for making informed investment choices within a self-managed super fund framework. A structured approach, as outlined in case studies on setting up an SMSF loan offset, emphasizes the importance of planning and collaboration with experienced professionals to navigate these complexities effectively.

Conclusion

Self-Managed Super Fund (SMSF) loans are increasingly recognized as essential tools for retirement planning, particularly for investors targeting commercial properties. By leveraging these loans, individuals can significantly enhance their retirement savings through strategic real estate investments. This shift towards non-residential assets highlights the evolving landscape of investment opportunities.

Moreover, offset accounts linked to SMSF loans present a unique opportunity to reduce interest payments and improve overall investment returns. Effectively managing these accounts can lead to substantial savings, as evidenced by successful real-world applications. This underscores the importance of a well-structured financial strategy in maximizing investment potential.

To qualify for SMSF loans, investors must meet specific eligibility criteria, including:

- Regulatory compliance

- A robust trustee structure

- A clear investment strategy

Understanding the associated risks and rewards is crucial; while SMSF loans offer tax benefits and greater investment control, they also entail higher costs and strict compliance requirements.

In summary, SMSF loans provide a powerful avenue for maximizing retirement savings through strategic property investments. With the right knowledge and expert support, investors can navigate the complexities of SMSF borrowing, ensuring compliance and unlocking the full potential of their retirement funds. Staying informed in this evolving landscape is key to achieving financial success.