Overview

This article underscores the critical role of the Loan-to-Value Ratio (LVR) in commercial property financing. It meticulously details the calculation of LVR, its significance for both borrowers and lenders, and effective strategies for its optimization. A lower LVR is particularly beneficial; it not only secures better loan terms but also mitigates perceived risk. Current market trends indicate that lenders favor an LVR of 65% to 70% for optimal financing conditions. Understanding these dynamics is essential for making informed financial decisions.

Introduction

In the competitive landscape of commercial property financing, grasping the Loan-to-Value Ratio (LVR) is essential for both borrowers and lenders. This pivotal financial metric not only illustrates the relationship between the loan amount and the property’s appraised value but also plays a significant role in shaping the terms and conditions of financing.

As market conditions shift, many individuals may find themselves asking: how can they leverage a lower LVR to secure more favorable loan terms while minimizing risks? This article explores the critical importance of LVR, provides insights on its calculation, and presents strategic approaches to optimize it for successful commercial property investments.

Define Loan-to-Value Ratio (LVR) in Commercial Property Financing

The Loan-to-Value Ratio (LVR) serves as a vital financial metric, illustrating the relationship between the borrowed amount and the appraised value of the asset being financed. It is determined using the formula:

LVR = (Loan Amount ÷ Property Value) × 100.

For instance, if an individual seeks financing of $600,000 for an asset valued at $1,000,000, the LVR would stand at 60%. The LVR on commercial property holds particular significance in financing, as it enables lenders to assess the associated risk of the loan. A lower LVR signifies that the borrower possesses a greater equity stake in the asset, typically resulting in a reduced perceived risk for the lender.

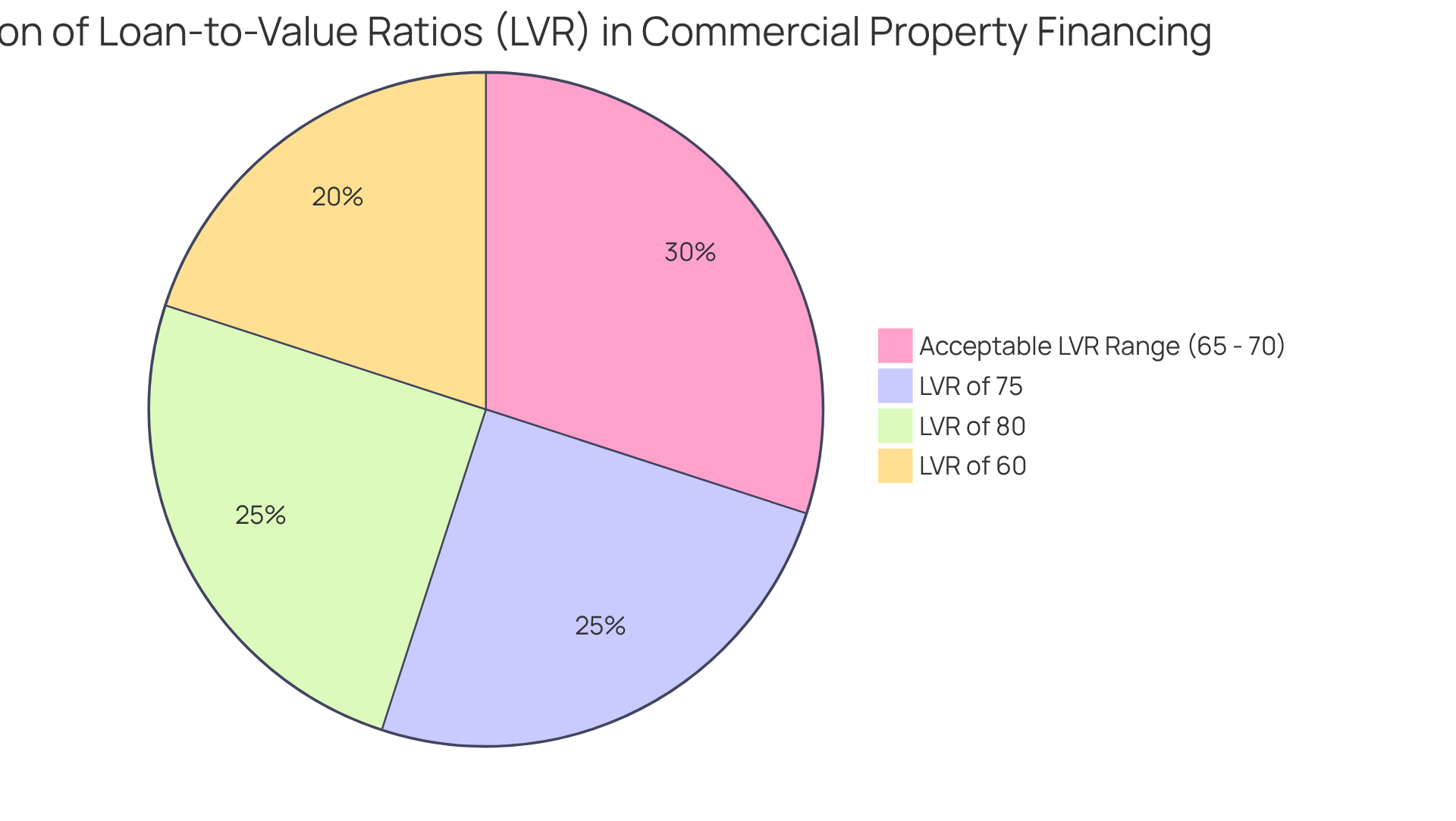

Recent trends reveal that the acceptable LVR on commercial property in Australia generally ranges from 65% to 70%, reflecting a cautious stance by lenders in response to prevailing market conditions. By 2025, the average LVR on commercial property is anticipated to align with these standards, underscoring the importance of maintaining a lower LVR on commercial property to enhance approval chances and secure more favorable interest rates.

Understanding LVR is essential for individuals pursuing loans, as it directly influences their borrowing capacity and the overall cost of financing. For example, if an individual seeks financing of $800,000 for an asset appraised at $1,000,000, the LVR would be 80%. This elevated LVR may result in higher interest rates due to the increased risk perceived by lenders. Conversely, a borrower with a $200,000 deposit on the same asset would have an LVR of 75%, potentially qualifying for more advantageous loan terms.

At Finance Story, we prioritize crafting refined and highly tailored business cases that highlight the significance of LVR on commercial property and present the complete range of lenders available to you, including options for refinancing your commercial property. This comprehensive strategy enhances your likelihood of securing the right financing for your commercial real estate investments. In summary, the LVR on commercial property is a critical element of financing, aiding both lenders and clients in making informed financial decisions.

Explain the Importance of LVR for Borrowers and Lenders

The LVR on commercial property serves as a pivotal metric for individuals seeking funds and lenders navigating the financing landscape. For those pursuing credit, maintaining a lower LVR on commercial property is advantageous, as it typically results in more favorable financing conditions, including reduced interest rates and lower insurance costs. An LVR on commercial property of 80% or lower is generally deemed 'good,' allowing individuals to avoid Lenders Mortgage Insurance (LMI), which can significantly inflate the total cost of financing.

However, it is crucial to recognize that LMI may also apply to LVRs below 80% under certain conditions, contingent on the asset's location or type. On the other hand, a higher LVR on commercial property signals increased risk for lenders, often resulting in stricter lending criteria and elevated interest rates. For instance, financing with an LVR exceeding 80% may necessitate LMI, further escalating the borrower's expenses.

To illustrate, if an individual secures financing of $450,000 for a property valued at $600,000, the LVR would be calculated at 75%. Therefore, a thorough understanding of LVR on commercial property is vital for individuals aiming to negotiate favorable financing terms while allowing lenders to effectively manage their risk exposure.

In Australia, the average LVR stands at approximately 68%, providing a benchmark for individuals to assess their financial standing. This dynamic emphasizes the significance of the LVR on commercial property in shaping the financial landscape for both parties. By collaborating with Finance Story, borrowers can access personalized support to navigate the complexities of LVR, ensuring they secure the most advantageous loan terms tailored to their specific financial circumstances.

Guide to Calculating LVR for Commercial Properties

Calculating the LVR on commercial property is vital for comprehending your financing position. Here’s how to determine your LVR:

- Determine the Loan Amount: Identify the total amount you plan to borrow.

- Evaluate the Asset Value: Acquire an appraisal or market assessment of the asset to ensure accuracy.

- Apply the Formula: Use the formula LVR = (Loan Amount ÷ Property Value) × 100.

Example: If you are borrowing $800,000 for a property valued at $1,200,000, the calculation would be:

LVR = ($800,000 ÷ $1,200,000) × 100 = 66.67%.

This indicates that 66.67% of the asset's worth is being financed. Understanding your LVR on commercial property is crucial; a lower LVR on commercial property typically results in better loan terms and lower interest rates, whereas a higher LVR on commercial property may lead to increased costs and risks. For instance, lenders often prefer an LVR on commercial property of 65% to 70%, reflecting their risk assessment criteria. Regularly reassessing your LVR as property values fluctuate can enhance your negotiating power and financial strategy.

Strategies to Optimize LVR and Enhance Loan Applications

To optimize your LVR and enhance your loan application, consider the following strategies:

- Increase Your Deposit: A larger deposit reduces the loan amount, thereby lowering the LVR. Aim for at least 20% of the asset's value to avoid additional costs like Lenders Mortgage Insurance (LMI). Most lenders prefer an LVR of 80% or less, making a substantial deposit crucial.

- Select Assets Carefully: Invest in assets with strong growth potential. Properties in high-demand areas are generally viewed as more stable investments, which can lead to increased property values over time, thereby improving your LVR.

- Enhance Your Credit Score: A higher credit score increases your appeal as a borrower, potentially resulting in improved terms and reduced interest rates. This can significantly impact your overall borrowing costs and LVR.

- Consider Additional Security: Offering additional collateral can provide lenders with more assurance, which may lead to a more favorable LVR. This strategy can be especially effective for commercial financing, particularly regarding LVR on commercial property, where perceived risk is higher.

- Refinance Current Debts: If you have current debts, refinancing them through Finance Story to secure lower interest rates can enhance your overall financial position. This can positively influence your LVR by decreasing the total debt in relation to your asset value.

By implementing these strategies, you can effectively manage your LVR, making your loan application more appealing to lenders and potentially securing better financing terms. Finance Story specializes in creating polished and highly individualized business cases to present to lenders, ensuring you have the best chance of success. With access to a full range of lenders, including high street banks and innovative private lending panels, we can help you navigate the complexities of financing. For instance, a case study on "Valuation Surprises And Solutions" illustrates how maintaining property condition can lead to better valuations, ultimately improving LVR.

Conclusion

Understanding the Loan-to-Value Ratio (LVR) is essential for anyone engaged in commercial property financing, as it acts as a pivotal indicator of financial health and risk management. A precisely calculated LVR not only illustrates the relationship between the loan amount and the property value but also significantly influences financing terms, affecting both borrowers and lenders.

The article emphasizes the necessity of maintaining a lower LVR, which can result in more favorable loan conditions, including reduced interest rates and the potential to sidestep costly Lenders Mortgage Insurance (LMI). It details the calculation process for LVR, outlines strategies for optimizing it, and underscores the advantages of a robust financial position for negotiating better terms. Furthermore, insights into current market trends and acceptable LVR ranges provide invaluable context for borrowers navigating the financing landscape.

Ultimately, mastering the intricacies of LVR is crucial for achieving success in commercial property investments. By implementing the discussed strategies—such as increasing deposits, selecting high-potential assets, and enhancing credit scores—borrowers can improve their LVR and strengthen their loan applications. This proactive approach not only mitigates risks but also opens avenues to better financing opportunities, reinforcing the significance of LVR in the domain of commercial property financing.