Overview

This article provides a comprehensive guide on effectively navigating the approval process for commercial loans in Sydney. It details the various types of loans available and outlines the essential steps for successful applications. Understanding the different loan types is crucial. Additionally, preparing comprehensive documentation is key to enhancing your chances of approval. Leveraging available resources and tools can significantly improve your application process. Insights from industry experts and relevant statistics on financing trends further support these points. Are you ready to take control of your financing journey?

Introduction

Navigating the world of commercial loans can be a daunting endeavor for many business owners. With various types of financing available—from secured and unsecured loans to specialized options like SBA loans and commercial mortgages—understanding the nuances is crucial for making informed decisions.

As businesses strive to secure funding for operations, acquisitions, or expansions, a comprehensive grasp of these financial products becomes essential. This article delves into key concepts, application processes, and strategies to enhance approval chances.

By equipping entrepreneurs with the knowledge needed to effectively pursue the right financing solutions, we aim to address the unique needs of each business.

Understand Commercial Loans: Key Concepts and Types

Commercial financing options are essential financial products designed to support business operations, acquisitions, or investments. Unlike residential mortgages, they are organized differently regarding purpose, terms, and approval procedures. The primary types of commercial loans include:

- Secured Financing: These financial products require collateral, such as property or equipment, which the provider can claim if the borrower defaults. They generally offer lower interest rates due to the reduced risk for lenders. In 2025, around 70% of enterprises are choosing secured financing, indicating a preference for lower rates amid economic uncertainties.

- Unsecured Financing: These types of credit do not require collateral but typically carry higher interest rates. They are evaluated based on the borrower's creditworthiness and operational performance. As of 2025, approximately 30% of enterprises are employing unsecured financing, indicating a rising dependence on creditworthiness over collateral. Companies must consider their choices thoughtfully, as unsecured financing may carry elevated interest rates.

- Term Loans: Providing a lump sum that is repaid over a fixed period, term loans are often used for significant investments, such as purchasing property or equipment. They remain a popular option for companies seeking to make substantial capital expenditures.

- Lines of Credit: This flexible borrowing option allows enterprises to draw funds as needed, up to a predetermined limit, making it ideal for managing cash flow fluctuations. Lines of credit are increasingly favored among small enterprises for their flexibility.

- SBA Financing: Supported by the Small Business Administration, these funds provide advantageous conditions for small enterprises but entail an extensive application procedure. They are particularly beneficial for startups and businesses seeking lower interest rates.

- Commercial Mortgages: Specifically designed for acquiring commercial real estate, these financial products are secured by the property itself. The commercial mortgage sector remains robust, driven by strong demand in the industrial sector, despite some pressures on overseas property portfolios. A recent case study on commercial property lending growth indicates that confidence in specific market segments continues to support this sector.

Understanding these types of commercial loans in Sydney is crucial for determining which option aligns best with your objectives and financial situation. Finance Story specializes in creating refined and highly personalized cases to present to lenders, ensuring that small enterprise owners can secure the appropriate commercial loans tailored to their needs. As Anna Bligh, ABA CEO, pointed out, "These small enterprises will guide Australia through the crisis, and after it has passed, employ millions of Australians as the economy recovers." As the landscape evolves in 2025, staying informed about trends and statistics will empower companies to make strategic financing decisions. Furthermore, with APRA closely observing non-performing exposures in the commercial property sector, it is vital for business owners to remain aware of the current economic landscape impacting commercial financing. Finance Story is well-equipped to assist clients in achieving their financial goals efficiently and effectively.

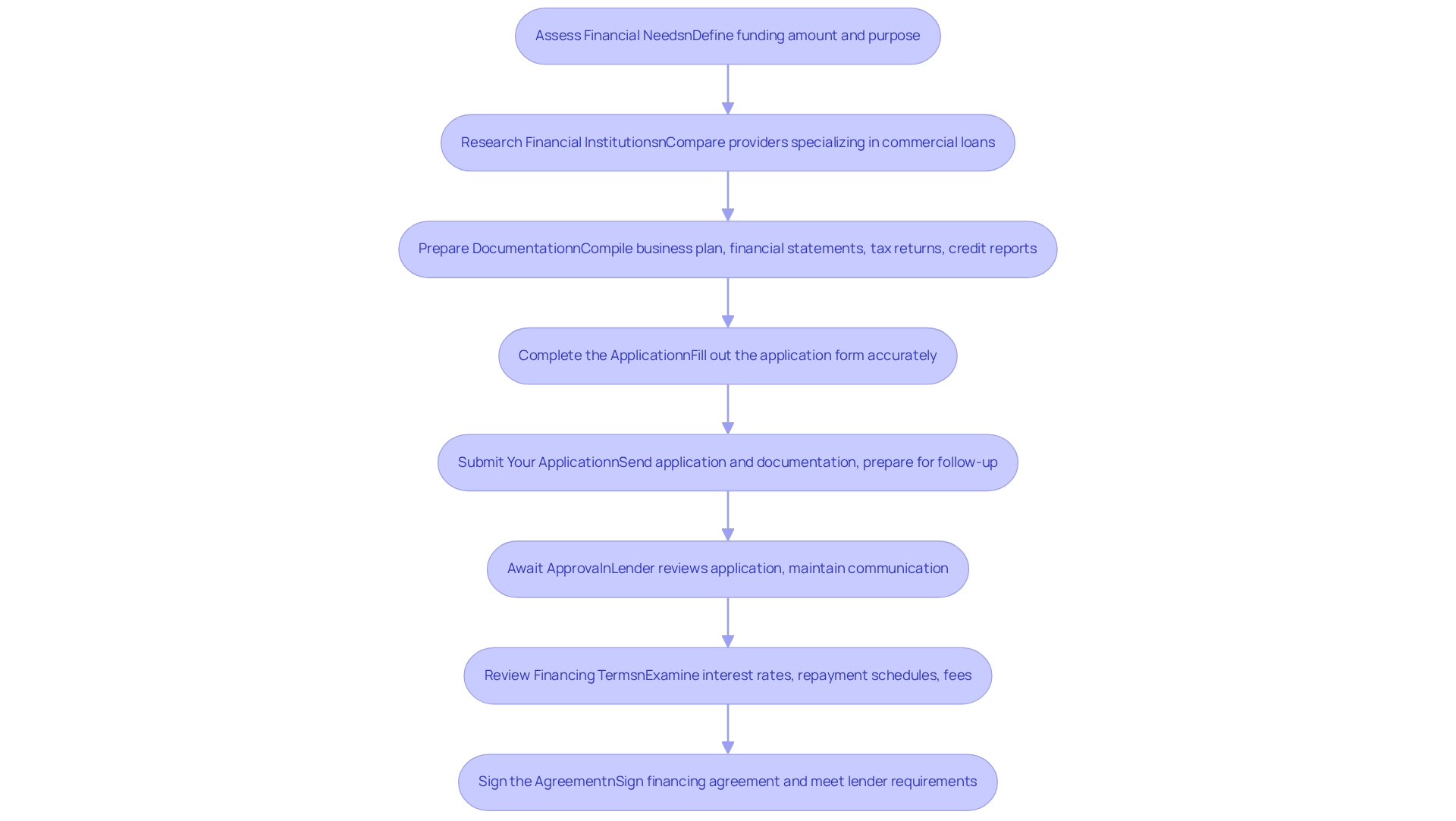

Navigate the Application Process: Step-by-Step Instructions

To successfully apply for a commercial loan, follow these essential steps:

- Assess Your Financial Needs: Clearly define the amount of funding required and its intended use. This clarity will assist your financing selection process.

- Research Financial Institutions: Compare different providers and their offerings, focusing on those that specialize in commercial loans tailored to your industry type. At Finance Story, we provide access to a complete range of financial institutions, including high street banks and innovative private lending panels, ensuring you discover the right match for your situation.

- Prepare Documentation: Compile the necessary documents, including:

- Business plan

- Financial statements (profit and loss, balance sheet)

- Tax returns

- Personal and business credit reports

Preparing these documents in advance streamlines the application process, making it easier to present your case to lenders. Comprehensive and accurate documentation is crucial for demonstrating your business's financial health.

- Complete the Application: Accurately fill out the financial institution's application form, ensuring all information is current and comprehensive.

- Submit Your Application: Send your application along with the required documentation. Be prepared for follow-up questions from the financial institution.

- Await Approval: The lender will review your application, which may take several days to weeks. Maintain communication for updates.

- Review Financing Terms: If approved, carefully examine the financing terms, including interest rates, repayment schedules, and any associated fees. Typically, a deposit is required for a commercial property mortgage, usually a percentage of the property's value, which is an important financial commitment to consider. As Tim Ricardo, Director, mentions, "Credit history, along with the collateral, will be taken into account by the bank when discussing this rate."

- Sign the Agreement: Once satisfied with the terms, sign the financing agreement and meet any requirements established by the lender prior to disbursement.

By following these steps and considering these insights, you can streamline your application process and significantly enhance your chances of obtaining the necessary funding for your venture. Furthermore, for individuals seeking expert financial guidance, Finance Story provides assistance in reducing financial risks linked to business financing, including refinancing options tailored for different commercial properties.

Enhance Your Approval Chances: Key Factors to Consider

To enhance your prospects for securing a commercial financing option, consider the following key factors:

- Credit Score: A robust credit score is essential, ideally targeting 700 or higher to significantly improve your approval odds. Be mindful that some lenders may require even higher credit scores than 680 for SBA financing. If your score is currently low, prioritize steps to enhance it before submitting your application.

- A comprehensive plan is crucial; it showcases your market understanding and strategic vision. Include thorough monetary forecasts and elucidate how the loan will support your objectives. At Finance Story, we specialize in crafting polished and highly individualized business cases for commercial loans in Sydney, which can markedly improve your chances of approval.

- Economic Health: Lenders will scrutinize your monetary statements. Ensure they reflect strong cash flow and profitability, proactively addressing any discrepancies or weaknesses. Our expertise in refinancing can help you present your financial health in the best possible light.

- Collateral: Offering collateral can significantly enhance your approval chances, particularly for unsecured credit. Secured financing typically features lower rates since the collateral helps mitigate risk for creditors. Be prepared to provide collateral that can guarantee the financing, as this reduces the risk for the creditor.

- Debt-to-Income Ratio: Maintain a low debt-to-income ratio, as creditors prefer borrowers who can comfortably manage existing debts alongside new loan payments. The average successful applicant in Australia typically maintains a ratio below 30%.

- Industry Experience: Demonstrating relevant industry experience can foster trust among financial institutions. Highlight your background and any notable successes to strengthen your application. Expert opinions suggest that showcasing your experience can significantly enhance your credibility.

- Relationship with Financial Institution: Cultivating a connection with your financial institution can be advantageous. Establishing rapport prior to applying can enhance trust and understanding, making your case more compelling. Collaborating with Finance Story provides you access to a comprehensive range of financial institutions, including high street banks and innovative private financing panels, which can further assist your application.

- Types of properties: Finance Story can assist with a variety of commercial properties in Sydney, which can be financed through commercial loans in Sydney, including warehouses, retail premises, factories, and hospitality ventures. This extensive variety of choices enables you to discover the appropriate financing solution tailored to your unique requirements.

By considering these elements, you can present a convincing argument to financial institutions, thereby enhancing your chances of securing business funding. Additionally, maintaining a strong credit score yields long-term benefits, as it builds trust with lenders and facilitates easier access to financing, ultimately reducing borrowing costs.

Utilize Resources and Tools: Maximize Your Loan Search

To maximize your loan search, leverage the following resources and tools:

- Online Financing Calculators: These essential tools allow you to estimate monthly payments and total interest costs based on varying amounts and terms. Major banks, such as NAB and CommBank, provide user-friendly calculators that can assist you in evaluating your commitments efficiently. Particularly, the enterprise funding calculator serves as a valuable resource for companies aiming to make informed economic choices.

- Comparison Websites: Platforms like Finder and Canstar facilitate side-by-side evaluations of various credit products, enabling you to pinpoint the most competitive rates and terms accessible in the market.

- Wealth Consultants: Collaborating with a wealth consultant can yield customized insights and tailored suggestions that align with your specific enterprise requirements, enhancing your overall loan strategy. At Finance Story, we specialize in creating refined and highly personalized cases to present to lenders, ensuring you secure the best financing options.

- Industry Reports: Staying updated on market trends and interest rates is crucial. Regularly review reports from the Australian Bureau of Statistics and reputable financial news outlets to inform your decisions.

- Networking: Participate in local business groups or online forums to connect with fellow business owners. Sharing experiences can offer valuable perspectives on financial institutions and loan products that have proven effective for others in your industry.

- Lender Reviews: Investigate lender reputations through customer reviews and testimonials. Websites like Trustpilot provide insights into customer satisfaction and service quality, helping you make informed choices.

- Government Resources: Explore government websites for information on grants and funding options available for businesses. These resources can enhance your application and provide additional financial assistance.

- Case Studies: Understanding repayment alternatives is essential for effective debt management. For example, the case study titled 'Personal Repayment Strategies' underscores the significance of calculating estimated repayments to ensure borrowers can manage their debts effectively. At Finance Story, we comprehend the intricacies of repayment criteria, assisting you in navigating these aspects with ease.

By utilizing these resources, you can deepen your understanding of the lending landscape and make informed choices that align with your goals. In December 2024, total financial commitments for dwellings reached $87.23 billion, underscoring the importance of strategic financial planning in today’s competitive environment. One satisfied client, Sarah J., noted, "Finance Story helped me secure a loan for my retail business, making the process seamless and stress-free," highlighting the value of leveraging these tools and resources.

Conclusion

Understanding the intricacies of commercial loans is vital for business owners seeking to secure financing for their operations, acquisitions, or expansions. This article has explored various types of commercial loans, from secured and unsecured loans to specialized options like SBA loans and commercial mortgages. Each type comes with its own set of benefits and considerations, making it essential for businesses to align their financial needs with the appropriate loan product.

Navigating the application process can be complex. However, following a structured approach can significantly enhance the chances of approval. By assessing financial needs, researching lenders, preparing comprehensive documentation, and understanding the loan terms, business owners can present a compelling case to potential lenders. Key factors such as credit score, business plan, and financial health play a crucial role in the approval process and should be prioritized to strengthen applications.

Furthermore, leveraging resources and tools such as online calculators, comparison websites, and financial advisors can further empower business owners in their search for the right loan. Staying informed about market trends and engaging with industry peers can provide valuable insights that inform strategic financial decisions.

In conclusion, equipping oneself with the right knowledge and resources is essential for successfully navigating the commercial loan landscape. By taking the time to understand the available options and preparing diligently for the application process, businesses can position themselves for success in securing the funding necessary to thrive in today’s competitive environment.