Overview

The primary focus of this article is to delineate the requirements for securing commercial investment property loans. It comprehensively details various loan types, eligibility criteria, and necessary documentation, alongside key financial metrics that investors must grasp to adeptly navigate the complexities of financing commercial real estate. This discussion underscores the critical importance of a robust business plan and sound financial health for successful loan approval.

Introduction

Understanding the intricacies of commercial investment property loans is essential for anyone looking to navigate the dynamic landscape of business real estate. As the demand for commercial properties surges, potential investors are presented with unique opportunities to acquire, develop, or refinance assets that can yield substantial returns. However, the path to securing financing is often fraught with challenges.

What are the critical requirements and metrics that investors must grasp to succeed in this competitive arena? This article delves into the essential elements of commercial investment property loan requirements, equipping readers with the knowledge needed to make informed decisions and secure optimal funding solutions.

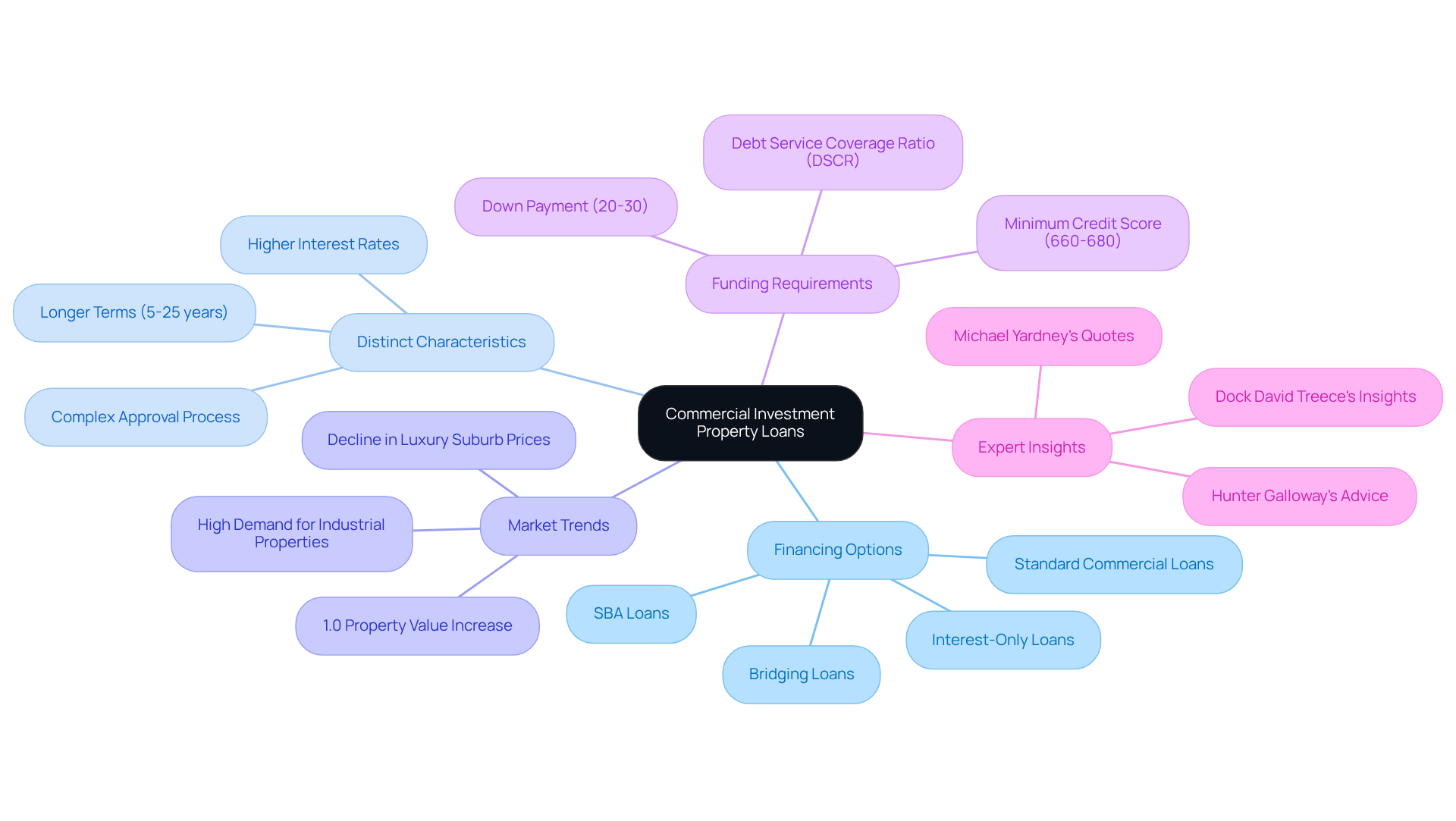

Define Commercial Investment Property Loans

Business investment financing options represent tailored solutions that address the commercial investment property loan requirements for the acquisition, development, or refinancing of business real estate. Unlike residential financing, which is secured by assets for personal use, business financing is backed by assets utilized for commercial purposes, such as office buildings, retail spaces, and industrial structures. These financial agreements typically feature distinct terms, interest rates, and eligibility criteria, which align with the commercial investment property loan requirements due to the heightened risks associated with business investments.

Recent trends reveal a burgeoning interest in business properties, particularly within regional markets, where property values have appreciated by 1.0% over the past three months. Financial experts underscore the importance of understanding these differences; as a leading mortgage broker asserts, "Just as you probably need a mortgage to buy a home, you likely require financing to afford a business property acquisition."

Successful funding instances illustrate the potential of business credit. Generally, the commercial investment property loan requirements necessitate a down payment of 20% to 30% of the asset's value, allowing investors to deploy their capital efficiently. Additionally, interest-only financing can provide initial cash flow advantages, enabling borrowers to focus on asset management and growth during the early stages of ownership.

Understanding the commercial investment property loan requirements, along with refinancing options, is crucial for investors aiming to navigate the complexities of the business real estate sector and secure optimal funding solutions. With Finance Story's expertise, you can confidently pursue your next business investment, assured that you have the necessary support to address the evolving needs of your enterprise.

Explore Types of Commercial Loans

A variety of commercial loans are available, each designed to meet specific investment needs:

-

Standard Commercial Loans: These traditional loans are primarily used for purchasing commercial properties. They typically require a substantial down payment and offer either fixed or variable interest rates. A credit score of at least 660 is often necessary to meet the commercial investment property loan requirements, along with a 20% down payment.

-

Construction Financing: Designed for funding the construction of new commercial properties, these options typically have short terms and elevated interest rates. Upon finishing the project, they transform into standard financing options, enabling long-term funding.

-

Bridge Financing: These short-term resources provide immediate funding while awaiting a more permanent solution, such as a long-term mortgage. They are particularly useful for investors needing quick access to capital.

-

Low-Doc Financing: Requiring minimal documentation, these options cater to borrowers with unconventional financial situations, making them an attractive choice for those who may struggle with traditional requirements.

-

SBA Financing: Supported by the Small Business Administration, these funds provide advantageous conditions for small enterprises seeking to acquire business property. They are designed to support business growth and expansion, making them a popular choice among entrepreneurs.

Understanding these credit types is essential for investors to choose the most appropriate financing alternatives that meet their commercial investment property loan requirements. As the real estate market evolves, remaining knowledgeable about the latest advancements and trends in financing options can greatly influence investment success.

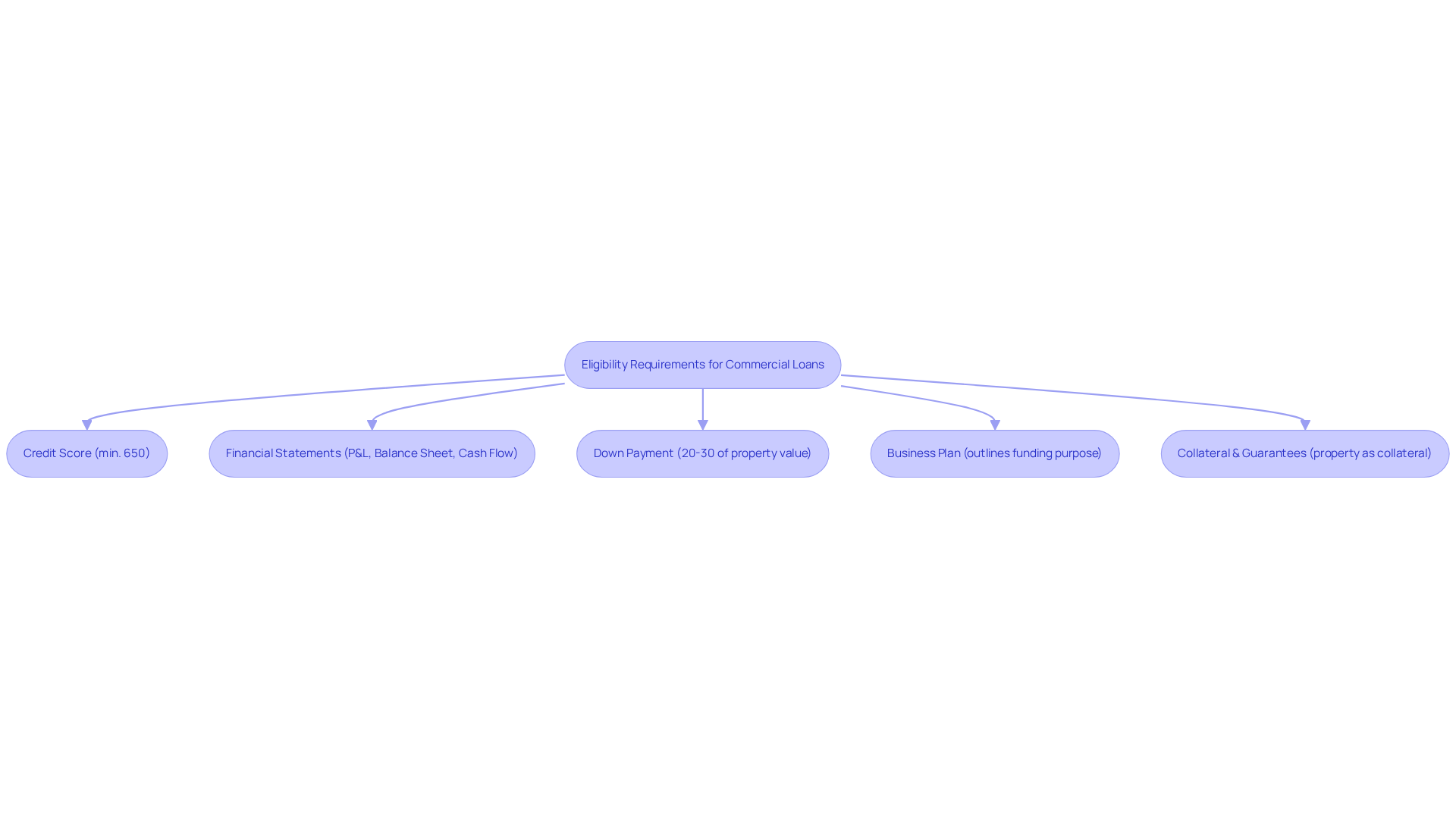

Identify Eligibility Requirements for Commercial Loans

Eligibility criteria for business financing, including commercial investment property loan requirements, can vary significantly depending on the financial institution and the specific type of funding sought. However, several common criteria are typically assessed:

- Credit Score: Most lenders require a minimum credit score, generally above 650, to qualify for a commercial loan. This threshold reflects the financial institution's assessment of the borrower's creditworthiness and capacity to repay.

- Lenders usually request comprehensive financial statements, including profit and loss statements, balance sheets, and cash flow statements, to meet commercial investment property loan requirements. These documents are crucial for evaluating the business's financial health and operational viability.

- A substantial down payment is often required as part of the commercial investment property loan requirements, typically ranging from 20% to 30% of the property's value. This upfront investment demonstrates the borrower's commitment and reduces the creditor's risk.

- A well-organized business plan that outlines the purpose of the funding and the intended use of resources can significantly enhance an application in relation to commercial investment property loan requirements. It provides financiers with insight into the borrower's strategic vision and operational plans.

- The property being financed generally serves as collateral to meet the commercial investment property loan requirements. Additionally, creditors may require personal guarantees from the borrower, further securing the credit against potential defaults.

Understanding these criteria is essential for crafting a successful financing application, especially in a market where business credit requests have seen a 1.6% annual increase, despite ongoing economic fluctuations. As of Q1 2025, the average credit score required for business financing remains a pivotal factor influencing eligibility, with numerous financial institutions emphasizing the importance of a robust economic foundation. With Finance Story's expertise in developing refined and personalized business cases, small business owners can effectively navigate these eligibility requirements, ensuring they present a compelling case to a diverse array of financiers.

Prepare Necessary Documentation for Loan Applications

When applying for a commercial loan, borrowers must meticulously prepare the following documentation to enhance their chances of approval:

- Personal Identification: A government-issued ID, such as a driver's license or passport, is essential for verifying identity.

- Business Financial Statements: Recent profit and loss statements, balance sheets, and cash flow statements for the last two years offer creditors a snapshot of the business's financial health.

- Tax Returns: Both personal and business tax returns for the previous two years are crucial for demonstrating income stability and compliance.

- Business Plan: A comprehensive business plan detailing the intended use of the loan and projected financial performance is vital. This document not only outlines the business strategy but also highlights the borrower’s foresight and planning abilities, which are crucial when presenting refined and tailored business cases to financial institutions.

- Property Documents: If purchasing a property, include the property title, appraisal report, and lease agreements if applicable. These documents validate the investment and its potential returns.

- Credit History: A summary of personal and business credit history offers lenders insight into financial reliability and past borrowing behavior.

Ensuring that all documents are accurate and complete according to the commercial investment property loan requirements can significantly enhance the likelihood of approval for credit. Statistics indicate that applications with comprehensive documentation see higher approval rates, underscoring the importance of thorough preparation. For instance, Finance Story specializes in creating tailored loan proposals that meet the evolving needs of businesses, leading to higher success rates in securing financing. Furthermore, borrowers should be aware of the complete variety of financial institutions accessible through Finance Story, including high street banks and innovative private lending panels, which can offer diverse financing options. Financial advisors suggest that borrowers remain flexible and responsive to further documentation requests from financial institutions, as this adaptability can streamline the application process. As Juanita Heidebrecht, a reliable mortgage specialist, highlights, being adaptable with extra documents is crucial, as financial institutions may ask for more information to guarantee a comprehensive assessment.

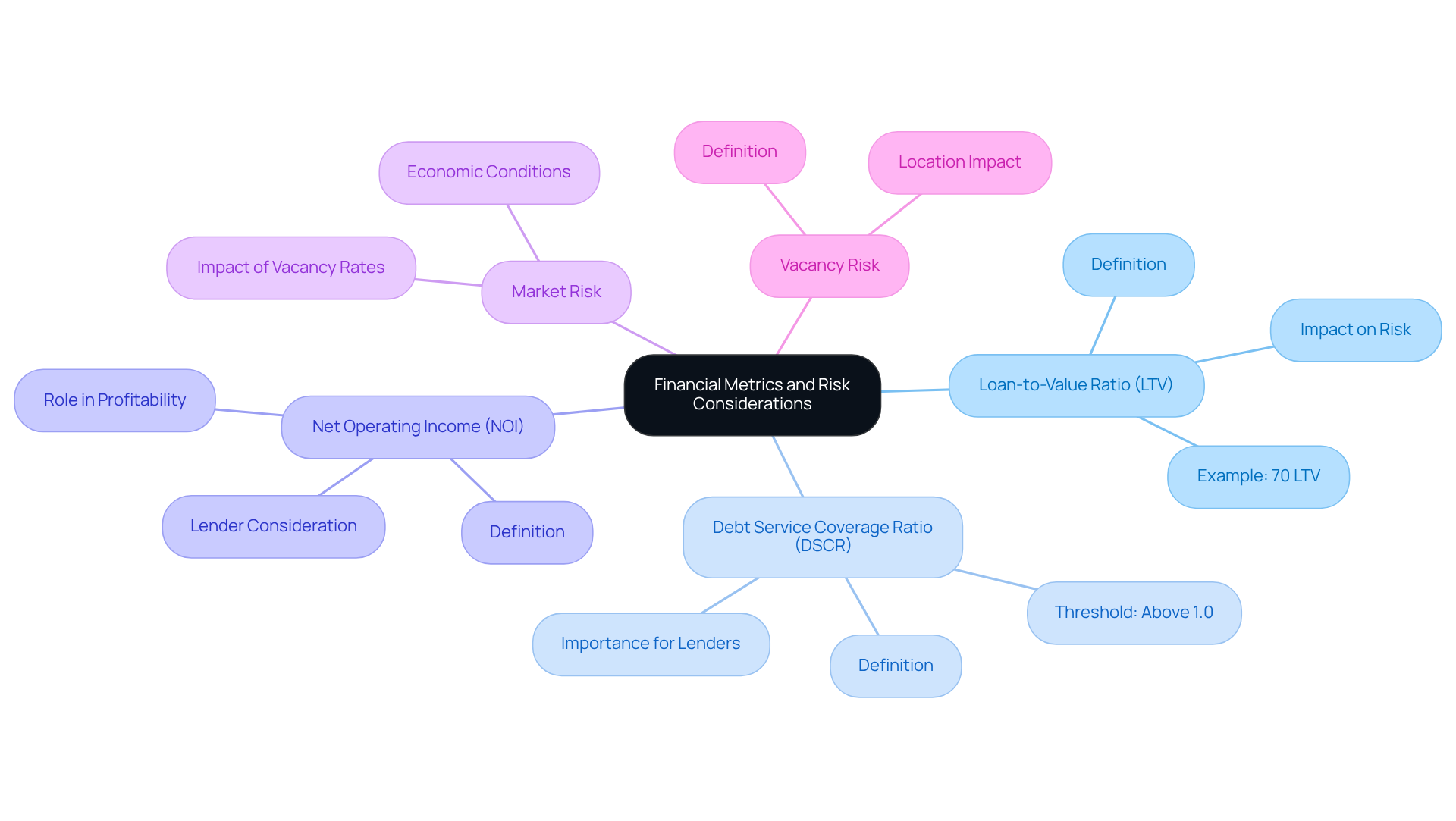

Understand Financial Metrics and Risk Considerations

Investors must grasp several critical financial metrics and risk considerations when they consider the commercial investment property loan requirements.

-

Loan-to-Value Ratio (LTV): This ratio is pivotal as it compares the loan amount to the appraised value of the property. A lower LTV signifies decreased risk for lenders, facilitating it for borrowers to obtain favorable financing terms. For instance, an asset valued at $1 million with a mortgage of $700,000 results in a 70% LTV, which is typically regarded as acceptable.

-

Debt Service Coverage Ratio (DSCR): This metric evaluates a real estate's ability to fulfill its debt obligations. A DSCR above 1.0 indicates that the asset generates sufficient income to cover loan payments, which is essential for lenders when assessing risk. In 2025, average DSCRs for commercial assets are anticipated to remain above this threshold, suggesting a stable income generation environment.

-

Net Operating Income (NOI): NOI signifies the income generated by the asset after subtracting operating expenses. This figure is crucial for assessing profitability and is closely observed by lenders to ensure that the asset can meet its financial obligations.

-

Market Risk: Investors should be aware of economic conditions and market trends that could influence property values and rental income. For example, the current economic landscape shows increasing vacancy rates in major cities, which could impact future cash flows.

-

Vacancy Risk: The likelihood of having periods without tenants can significantly affect cash flow. Properties in high-demand locations typically experience lower vacancy rates, making location a critical factor in investment decisions.

By understanding these metrics and associated risks, investors can make more informed decisions regarding the commercial investment property loan requirements, ultimately enhancing their chances of success in the competitive real estate market.

Conclusion

Navigating the landscape of commercial investment property loans requires a comprehensive understanding of the unique criteria and requirements that differentiate them from traditional residential financing. These loans are tailored to support the acquisition, development, or refinancing of commercial real estate, necessitating a strategic approach to meet the specific demands of lenders and investors alike.

Key insights into commercial loan types, eligibility requirements, and necessary documentation have been outlined, emphasizing the importance of a solid financial foundation and meticulous preparation. Investors must be aware of the various financing options available, such as:

- Standard commercial loans

- Construction financing

- SBA-backed loans

Each serving distinct purposes. Furthermore, understanding financial metrics like Loan-to-Value Ratio (LTV) and Debt Service Coverage Ratio (DSCR) is essential for assessing risk and making informed investment decisions.

In conclusion, the commercial investment property loan requirements are not merely a checklist but a roadmap for success in the competitive real estate market. By arming oneself with knowledge and leveraging expert guidance, investors can confidently navigate the complexities of financing, ensuring they are well-prepared to seize opportunities as they arise. Embracing these insights can lead to more strategic investments and ultimately foster growth in the dynamic realm of commercial real estate.