Overview

This article serves as a comprehensive guide for securing business bank loans in Australia. It outlines the essential steps, the various types of loans available, and addresses common application challenges. Understanding loan fundamentals is crucial, as is the meticulous preparation of financial documents. Effectively navigating the application process can significantly enhance the chances of approval. Insights and statistics pertinent to small enterprises in Australia further support this guidance.

Introduction

In the competitive landscape of small business, securing the right financing is crucial—it can be the defining factor between success and stagnation. With a myriad of loan options at their disposal, entrepreneurs must grasp the nuances of business loans to effectively fuel growth and navigate operational challenges. Understanding essential terms such as principal and interest rates is vital, alongside exploring various loan types like term loans and lines of credit.

This article delves into the critical elements of business financing, highlighting the necessity of meticulous financial documentation. Furthermore, it guides readers through the loan application process, addressing common pitfalls that may arise. By equipping small business owners with the knowledge to tackle these financial hurdles, this comprehensive guide empowers them to make informed decisions that align with their unique business goals.

Understand Business Loan Basics

Commercial credit, including business bank loans in Australia, serves as an essential financial tool for supporting diverse enterprise needs, such as growth, equipment procurement, and operational costs. To effectively navigate the landscape of business financing, it is crucial to understand several key terms:

- Principal: This refers to the total amount borrowed from the lender.

- Interest Rate: The cost associated with borrowing, typically expressed as a percentage of the principal. Starting in 2025, average interest rates for business bank loans in Australia will vary, reflecting market conditions and financial institution policies.

- Term: The specified duration over which the borrowed amount must be repaid, significantly impacting monthly payments and overall financial planning.

- Secured vs. Unsecured Financing: Secured financing requires collateral, such as property or equipment, which the lender can seize if the borrower defaults. In contrast, unsecured loans do not necessitate collateral, making them accessible but often accompanied by higher interest rates.

Understanding these fundamentals is vital for assessing your options regarding business bank loans in Australia. Finance Story focuses on developing refined and highly customized cases to present to banks, ensuring that small entrepreneurs can secure business bank loans that meet their specific requirements. We offer a comprehensive range of lenders, including high street banks and innovative private lending panels, to suit various circumstances—whether you are purchasing a warehouse, retail premise, factory, or hospitality venture. For instance, the survival rates of new enterprises in Australia underscore the significance of obtaining suitable funding; industries like agriculture, forestry, and fishing showcase a survival rate of 62.6% beyond three years, whereas sectors such as transport and warehousing encounter a lower rate of 38.8%. Notably, SMEs account for approximately two-thirds of Australia’s workforce, highlighting the essential role of small enterprises in the economy and the need for customized business bank loans to enhance their viability. Furthermore, agriculture, forestry, and fishing support services boast a profit margin of 20.2%, further emphasizing the importance of understanding financial options in these sectors.

As Shaun McGowan, creator of Money.com.au, observes, comprehending the conditions of business bank loans in Australia is crucial for making informed financial choices that can significantly affect a company's success. By familiarizing yourself with these terms and concepts, you can make decisions that align with your objectives and financial situation. Additionally, refinancing options can provide further flexibility and support as your enterprise evolves.

Explore Types of Business Loans

In Australia, enterprises have access to a diverse array of business bank loans tailored to meet their specific monetary requirements. Understanding these categories can significantly enhance your ability to secure funding for expansion and operations.

- Term Financing: This financial resource provides a lump sum for a fixed duration, typically used for substantial investments such as property or equipment. With fixed interest rates, it simplifies budgeting for companies.

- Lines of Credit: Offering flexibility, lines of credit allow enterprises to withdraw funds as needed, making them ideal for managing cash flow variations. This funding type is particularly beneficial for seasonal businesses or those facing unexpected expenses.

- Equipment Financing: Specifically designed for acquiring equipment, these funds use the equipment itself as collateral, enabling businesses to obtain necessary tools without straining their cash flow.

- Invoice Financing: This option permits companies to borrow against outstanding invoices, providing quick access to cash. It serves as a practical solution for businesses experiencing delays in customer payments, ensuring uninterrupted operations.

- Small Enterprise Administration (SBA) Financing: These government-backed funds often feature favorable terms, including lower interest rates and extended repayment periods, making them an attractive choice for small enterprises aiming to expand or stabilize.

As we look towards 2025, the Australian lending landscape continues to evolve. Business bank loans are influenced by the cash rate, which is at its highest level in over a decade, affecting borrowing costs and availability. Businesses are encouraged to stay informed about current trends and market dynamics to make strategic financing decisions that align with their growth objectives. At Finance Story, we specialize in developing refined and highly customized cases for lenders, ensuring you secure the appropriate funding for your commercial property investments or refinances. By understanding the nuances of each credit category, small business owners can navigate the complexities of obtaining funding more effectively, ultimately enhancing their economic stability.

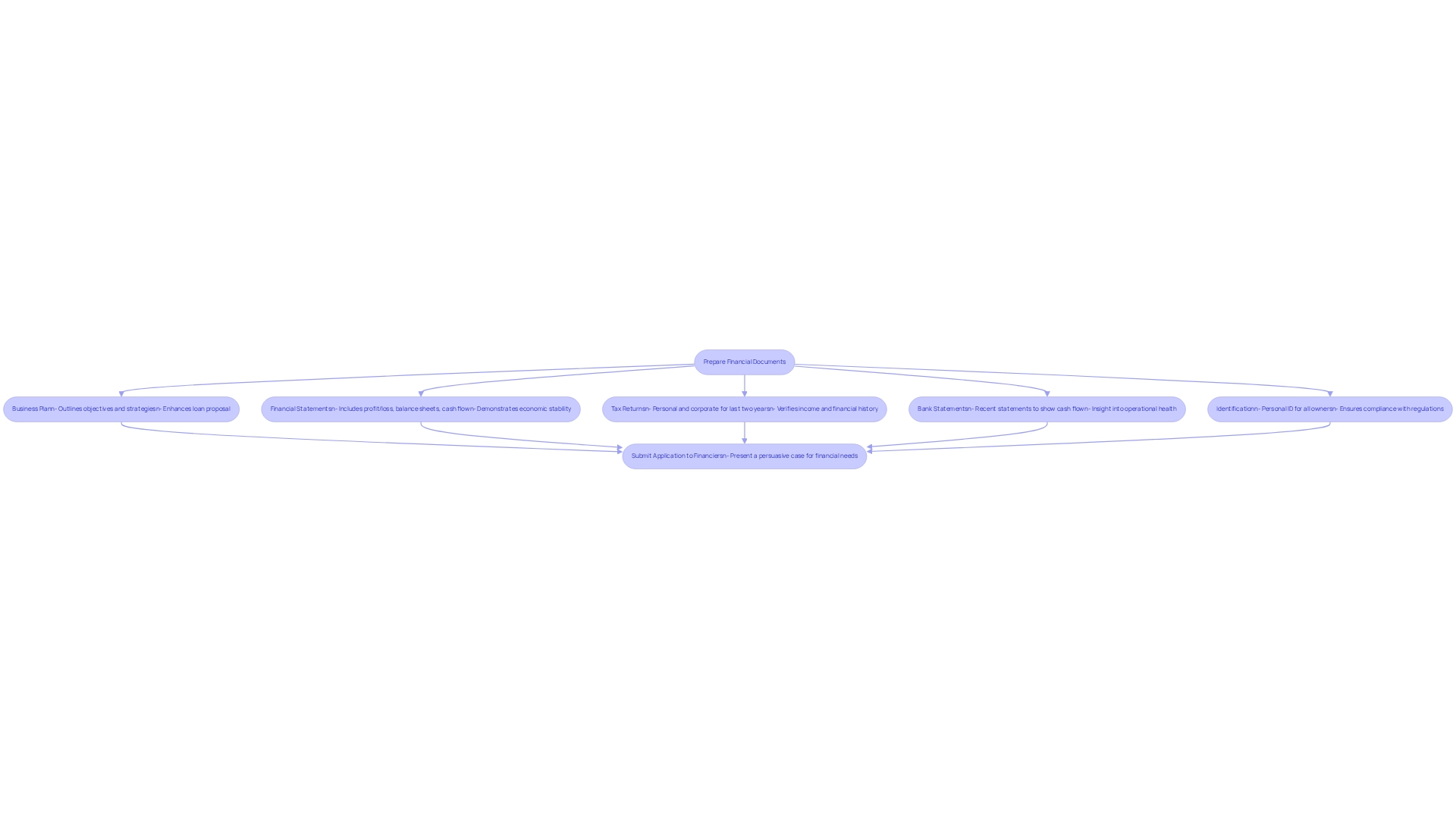

Prepare Your Financial Documents

To effectively seek business bank loans in Australia, gathering multiple essential financial documents that showcase your enterprise's viability and financial well-being is crucial. The following documents are generally necessary:

- Plan: This document should clearly outline your objectives, strategies for achieving them, and how the loan will facilitate growth. A polished and tailored case can significantly enhance your proposal for business bank loans in Australia, especially when presented to lenders.

- Financial Statements: Include comprehensive profit and loss statements, balance sheets, and cash flow statements for the past two years. High-quality documentation, including a statement of cash flow, greatly enhances your likelihood of approval for business bank loans in Australia, as creditors frequently evaluate the economic stability of your enterprise based on these records. Understanding the repayment criteria for business bank loans in Australia is crucial, and having precise monetary statements can help demonstrate your capability to fulfill these obligations.

- Tax Returns: Provide personal and corporate tax returns for the last two years. These documents assist lenders in verifying your income and financial history for business bank loans in Australia.

- Bank Statements: Recent bank statements are essential to demonstrate your cash flow and financial activity, offering insight into the operational health of your enterprise.

- Identification: Personal identification for all owners is necessary to verify identities and ensure compliance with lending regulations. Ensuring that these documents are accurate and up-to-date will facilitate a smoother application process for business bank loans in Australia.

For example, organizations that utilize secure platforms for document submission can enhance their application experience by prioritizing data security and efficiency. This method allows for quick assessments of loan eligibility without the need for a credit check, often resulting in same-day funding after loan acceptance. By preparing these documents carefully, you position your enterprise favorably for prospective financiers considering business bank loans in Australia.

After collecting these documents, the next step is to contact financiers, including the complete variety available through Finance Story, and submit your application for business bank loans in Australia, ensuring that you present a persuasive case for your company's financial requirements.

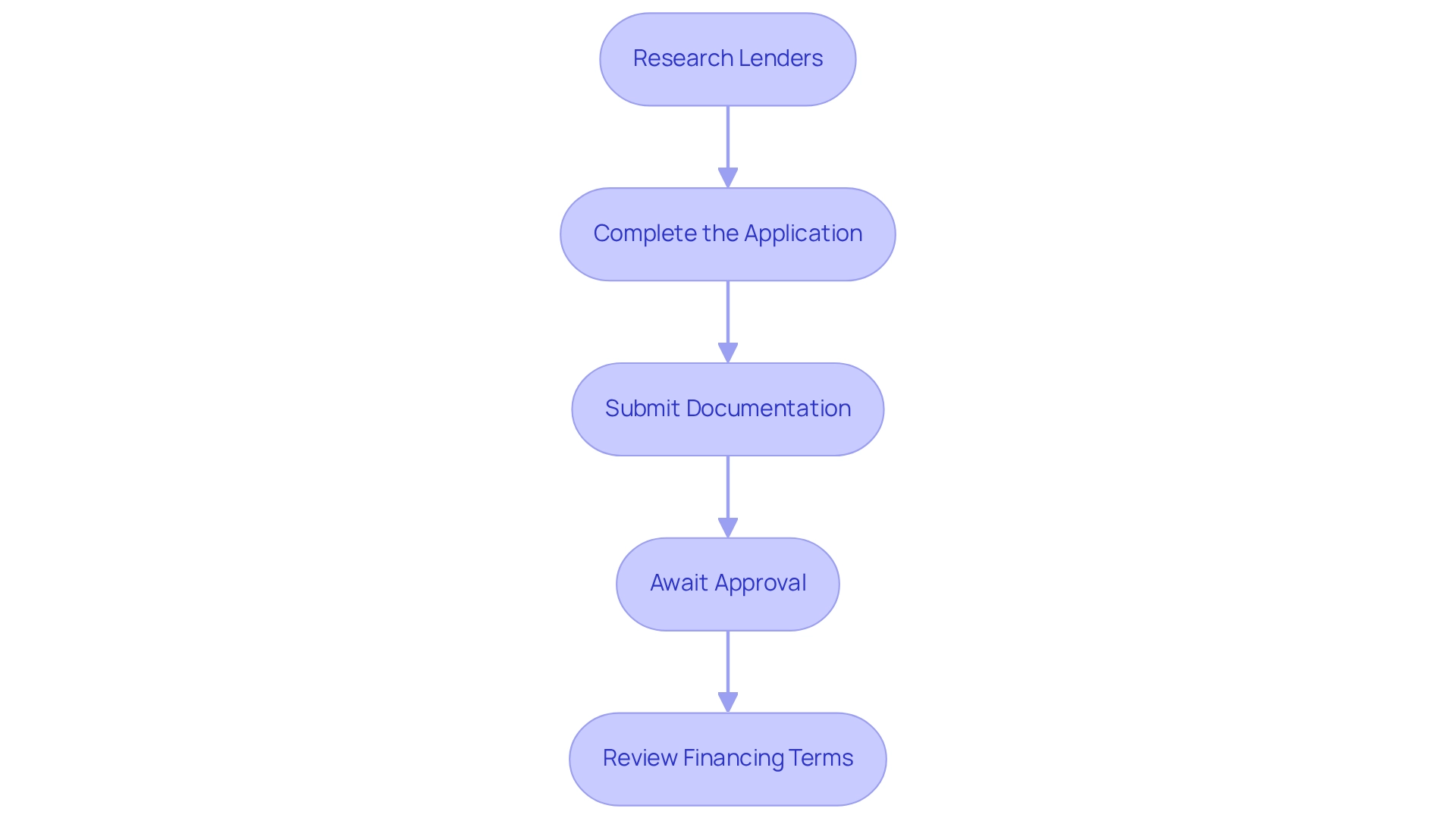

Navigate the Loan Application Process

To successfully navigate the loan application process for small businesses in Australia, it is essential to follow these key steps:

- Research Lenders: Begin by evaluating various lenders and their financing options. Seek out choices that align with your specific business needs and financial situation. Understanding that average interest rates for small-business financing range from 6.42% to 12.41% as of Q2 2024 can significantly aid you in making informed decisions.

- Complete the Application: Carefully fill out the application form, ensuring that all requested information is included. Paying attention to detail at this stage can streamline the process and minimize the risk of delays.

- Submit Documentation: Provide all necessary financial documents, such as tax returns, profit and loss statements, and any additional information that may be requested. Comprehensive documentation can expedite the review process. Lenders will assess your business's profitability and cash flow to determine its ability to support loan repayments, particularly during slower months.

- Await Approval: Once your application is submitted, the lender will review it. Be prepared for potential follow-up requests for further information, as this is a standard part of the process. They may also require a strategy outline and cash flow forecasts to evaluate your understanding of the business and its growth potential.

- Review Financing Terms: If your application is approved, take the time to thoroughly examine the financing terms. Understand the repayment schedule, interest rates, and any associated fees before signing. This step is crucial to ensure that the funding aligns with your business's financial strategy. Collaborating with a finance brokerage like Finance Story can provide access to a comprehensive range of lenders and tailored solutions for your business bank loans in Australia, particularly for commercial property investments.

The Australian Banking Association has highlighted the vital role of government assistance in facilitating small business financing, with over $200 billion in funds approved since February 2020. As Anna Bligh, CEO of the Australian Banking Association, stated, "These small enterprises will propel Australia through the crisis, and after it has passed, employ millions of Australians as the economy recovers." This context underscores the importance of being well-prepared and knowledgeable when seeking financial assistance in the current environment.

Troubleshoot Common Application Issues

Frequent problems in financial applications can significantly obstruct your opportunities for securing business bank loans in Australia. Here’s how to troubleshoot these challenges effectively:

- Incomplete Documentation: One of the most common pitfalls is submitting incomplete documentation. For instance, a small enterprise owner might overlook including recent tax returns, leading to delays or rejections. To avoid this, create a checklist of all required documents and double-check for any missing items before submission. Collaborating with experts like Finance Story can help ensure your proposal is polished and comprehensive, thereby increasing your chances of approval.

- Low Credit Score: A low credit score can be a major barrier to loan approval. To improve your score, concentrate on paying down existing debts and ensuring that all bills are paid on time. This proactive approach can enhance your creditworthiness before applying for business bank loans in Australia. Remember, 63% of small enterprises would contemplate funding that liberated cash from receivables, underscoring the significance of cash management in your fiscal strategy. Consulting with Finance Story can provide insights into how to effectively present your monetary situation to lenders.

- Unclear Strategy: A vague or poorly articulated plan can lead to rejection. Ensure your plan is comprehensive, detailing your strategy, market analysis, and financial projections. A well-structured plan demonstrates your preparedness and vision to lenders. Finance Story specializes in creating personalized case studies that can help clarify your objectives and strengthen your application.

- Inconsistent Monetary Statements: Precision in your monetary statements is crucial. Ensure that they accurately represent your business's current economic condition without discrepancies, as inconsistencies can raise concerns for creditors. Engaging with experts can assist you in preparing precise and consistent monetary documentation.

- Lack of Cash Flow: If cash flow is a concern, explore alternative financing options or enhance your cash management practices before applying. Demonstrating a solid cash flow can reassure lenders of your ability to repay the loan. As Joann Farley wisely advises, "Know you want it, then wait for wholesale!" This emphasizes the importance of being strategic in your financial decisions. Finance Story can assist in identifying the right financing solutions tailored to your cash flow needs, including refinancing options that may better suit your evolving business requirements.

Addressing these common issues can significantly enhance your chances of a successful application for business bank loans in Australia. By being thorough and proactive, and leveraging the expertise of Finance Story, you can navigate the complexities of the financing landscape more effectively. Furthermore, with access to a full range of lenders, including high street banks and innovative private lending panels, Finance Story can help you secure the best financing options for your commercial property investments.

Conclusion

Securing the right financing is pivotal for small businesses aiming for growth and sustainability. Understanding the fundamentals of business loans, including key terms like principal and interest rates, sets the foundation for making informed decisions. The variety of loan types available—from term loans and lines of credit to specialized financing options—provides entrepreneurs with the flexibility to choose solutions that align with their operational needs and financial goals.

Preparation plays a crucial role in the loan application process. Compiling accurate financial documentation, including business plans and financial statements, enhances credibility and demonstrates a business's viability to potential lenders. Navigating the application process requires diligence; from researching lenders to meticulously reviewing loan terms post-approval, ensuring that the financing aligns with the business’s strategic objectives.

Common pitfalls, such as incomplete documentation or unclear business plans, can hinder the application process. By addressing these challenges proactively and seeking expert guidance, small business owners can significantly improve their chances of securing the necessary funding. In this dynamic financial landscape, leveraging the expertise of firms like Finance Story can provide invaluable support, facilitating access to tailored loan options that foster business growth and sustainability.

Ultimately, the knowledge gained from this guide empowers small business owners to approach financing with confidence, ensuring they are well-equipped to make strategic financial decisions that contribute to their long-term success.