Overview

This article delves into the essential techniques and factors that play a crucial role in valuing vacant commercial property. It presents various valuation methods, including the following:

- Sales Comparison Approach

- Cost Approach

- Income Approach

Moreover, it emphasizes critical factors such as:

- Location

- Market conditions

- Zoning regulations

These factors collectively influence a property's worth. Understanding these elements is vital for investors seeking to make informed decisions in the commercial real estate market.

Introduction

Valuing vacant commercial properties presents a nuanced challenge, demanding a keen understanding of various influencing factors and methodologies. Investors and landowners can gain crucial insights into market dynamics, empowering them to make informed decisions that significantly impact their financial outcomes.

However, given the complexity of valuation methods and the ever-evolving landscape of commercial real estate, how can one confidently navigate this intricate process and ensure accurate assessments? The answers lie in a strategic approach that combines knowledge with practical insights.

Understand the Basics of Commercial Property Valuation

Commercial real estate assessment is a crucial procedure that reveals how to value vacant commercial property based on various influencing factors. The primary objective of assessment is to determine a fair value, which is essential for transactions related to purchasing, selling, or financing real estate, and it is also important when learning how to value vacant commercial property. Key concepts in this domain include:

- Market Value: This represents the estimated price at which a property should exchange in the current market, reflecting the consensus between buyers and sellers.

- Investment Worth: This is the significance of a real estate asset to a particular investor, determined by their unique investment criteria and objectives.

- Appraisal: A professional assessment of a real estate asset, typically required by lenders to evaluate risk and ensure appropriate financing.

Understanding how to value vacant commercial property is vital for effectively navigating the valuation process. In 2025, the average worth of unoccupied commercial real estate in Melbourne is expected to reflect the dynamics of supply and demand, with limited availability pushing prices upward. As highlighted by industry specialists, knowing how to value vacant commercial property is influenced by factors such as location, tenant demand, and industry trends, making it essential for investors to remain informed about these aspects.

Furthermore, securing the right financing through tailored business loans can significantly impact your investment strategy. At Finance Story, we specialize in creating polished and highly individualized business cases to present to lenders, ensuring you have access to a comprehensive suite of financing options. This expertise is particularly advantageous when utilizing Self-Managed Super Funds (SMSF) for commercial real estate investments, as it enables you to navigate the intricacies of funding while enhancing your investment potential. Real-world instances of how to value vacant commercial property often emphasize the importance of comprehensive due diligence and understanding local conditions, ensuring that investors can make informed decisions.

Explore Key Valuation Methods for Vacant Commercial Properties

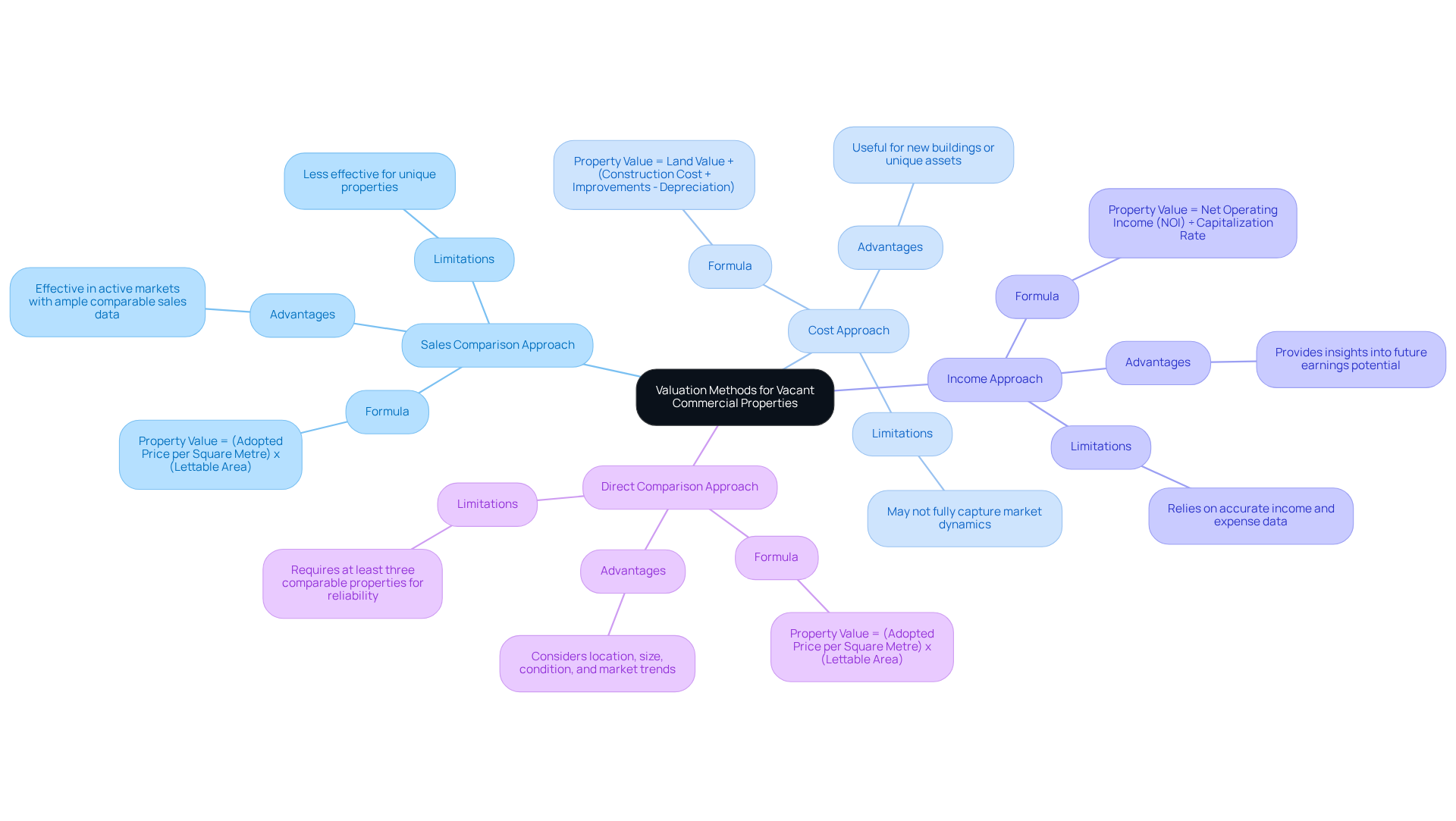

Valuing vacant commercial properties requires a comprehensive understanding of several key methods, each presenting unique advantages and limitations:

-

Sales Comparison Approach: This method evaluates the property by comparing it to similar properties that have recently sold in the vicinity. The formula utilized is Property Value = (Adopted Price per Square Metre) x (Lettable Area). Adjustments are made for variations in size, location, and characteristics, allowing for a refined understanding of economic worth. This approach proves particularly effective in active markets with ample comparable sales data, delivering a reliable estimate grounded in actual transactions.

-

Cost Approach: This method determines worth based on the expense to replace the asset, adjusted for depreciation. The formula for this approach is Property Value = Land Value + (Construction Cost + Improvements - Depreciation). It is especially advantageous for new buildings or unique assets where comparable sales data may be scarce. By calculating the total cost of construction alongside land value, this method offers a clear assessment framework, though it may not fully capture market dynamics.

-

Income Approach: This method assesses value based on the potential income the asset could generate, employing metrics such as capitalization rates. The initial step involves estimating the Net Operating Income (NOI) by subtracting operating expenses from total rental income. This approach is frequently utilized for investment properties, providing insights into future earnings potential. However, its effectiveness relies on precise income and expense data, underscoring the importance of reliable financial projections. Additionally, current industry trends and comparables should be considered alongside this method to ensure accurate asset valuation.

-

Direct Comparison Approach: Also known as the Comparable Transactions Approach, this method establishes a property's value by comparing it to recent sales of similar properties within the same area. It takes into account factors such as location, size, condition, industry trends, and zoning regulations.

Each of these methods possesses its strengths and weaknesses, and the selection of a valuation technique can significantly influence the final outcome. Understanding how to value vacant commercial property empowers landowners and investors to make informed decisions in the commercial real estate market.

Identify Factors Affecting the Value of Vacant Commercial Properties

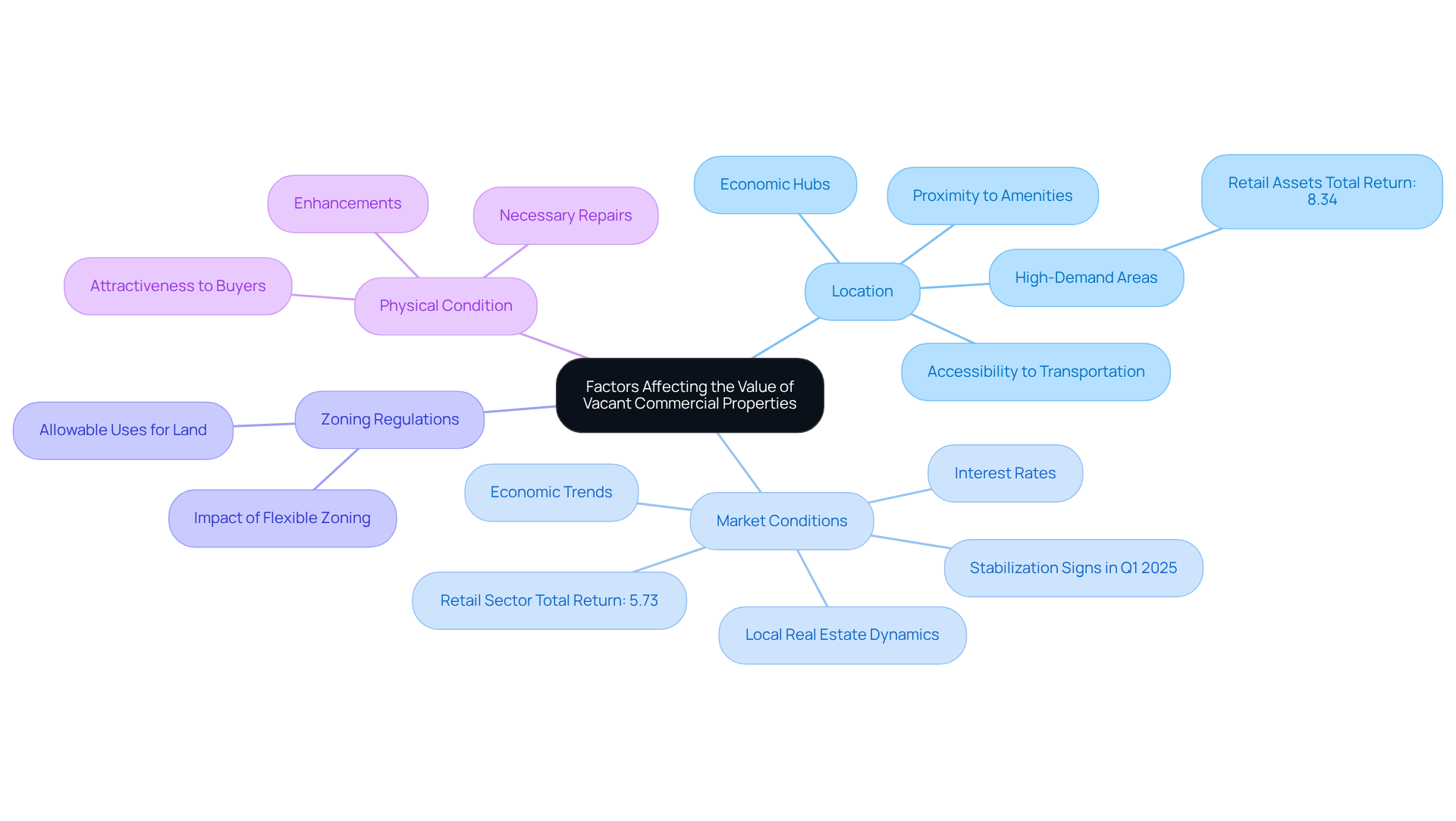

Several key factors significantly influence the value of vacant commercial properties:

-

Location: The proximity to amenities, transportation, and economic hubs is paramount. Properties situated in high-demand areas often command higher prices due to increased accessibility and desirability. For instance, retail assets in sub-regional centers have recently attained remarkable total returns of 8.34%, underscoring the influence of location on investment performance.

-

Market Conditions: Economic trends, interest rates, and local real estate dynamics are crucial. The Australian commercial real estate market is currently showing signs of stabilization, with the retail sector delivering a robust total return of 5.73% for the quarter. Understanding these trends assists investors in assessing potential changes in worth.

-

Zoning Regulations: Local zoning laws determine allowable uses for the land, directly impacting its value. Properties with flexible zoning may attract a broader range of potential buyers or tenants, enhancing their marketability.

-

Physical Condition: The condition of the asset, including necessary repairs or enhancements, plays a vital role in its valuation. A well-maintained asset is more attractive to buyers and can command a premium price.

By thoroughly understanding how to value vacant commercial property, landowners and investors can make informed choices that correspond with current market conditions and enhance their investment potential.

Apply Valuation Techniques to Your Commercial Property

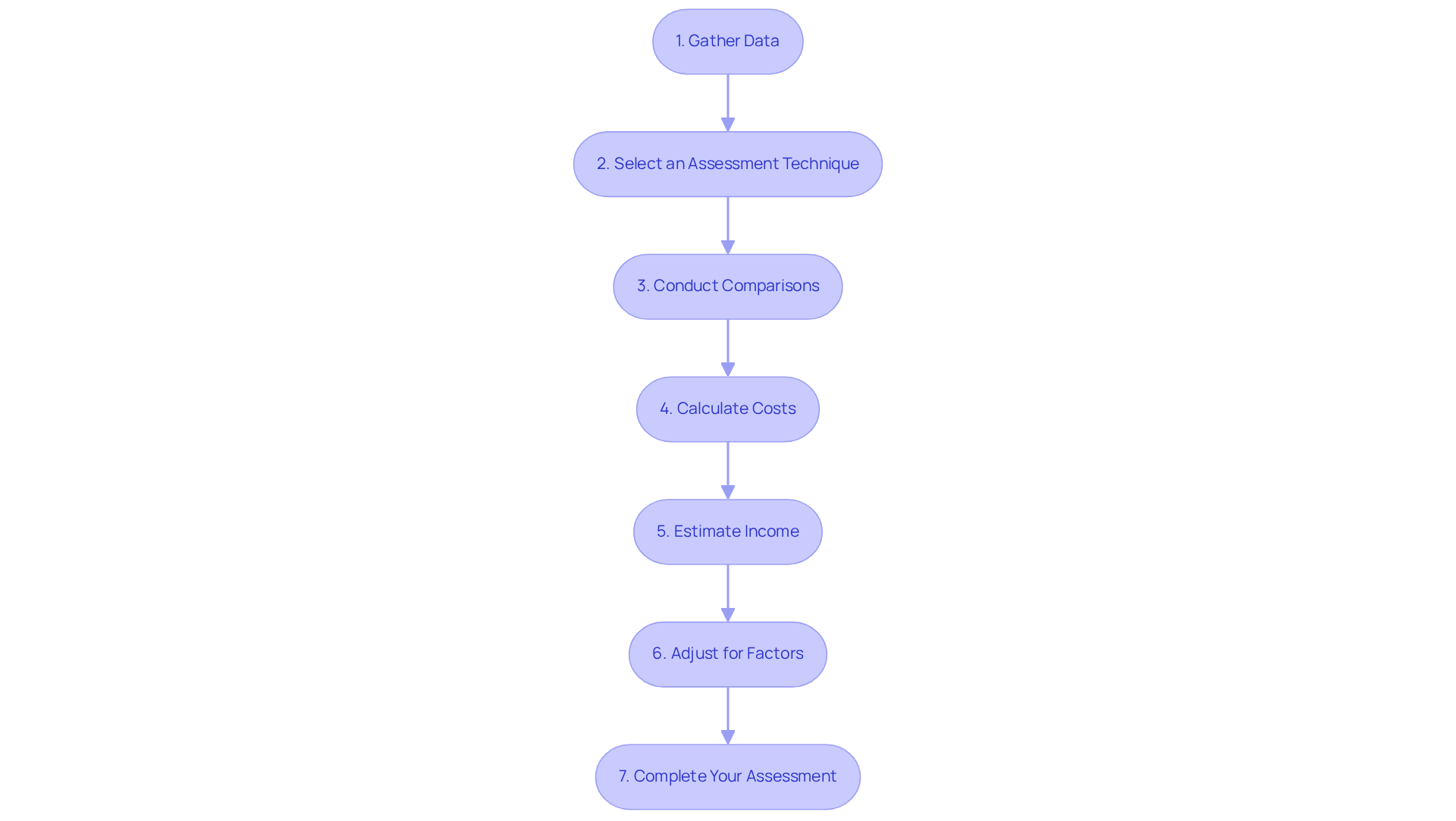

To effectively apply valuation techniques to your vacant commercial property, follow these essential steps:

- Gather Data: Collect comprehensive information about your asset, including its size, location, and any distinctive features that may influence its value.

- Select an Assessment Technique: Choose the most appropriate assessment technique based on your asset type and current market circumstances. Common methods include the Sales Comparison Approach, Cost Approach, and Income Approach.

- Conduct Comparisons: If you opt for the Sales Comparison Approach, identify recently sold similar assets and analyze their sale prices to establish a benchmark for your valuation. This method proves particularly effective when there are enough recent transactions of comparable assets.

- Calculate Costs: For the Cost Approach, estimate the replacement cost of the asset and deduct depreciation to arrive at a net amount. Understanding replacement expenses is crucial, especially in rapidly expanding markets where older structures may be surpassed by newer developments.

- Estimate Income: When employing the Income Approach, evaluate potential rental income and apply a suitable capitalization rate to assess the asset's value. The income capitalization method is most effective for assets with predictable rental income streams.

- Adjust for Factors: Consider external elements such as prevailing economic conditions, zoning regulations, and asset utility, which can significantly impact your valuation. For instance, restricted supply and robust demand in a sector suggest the potential for increasing rental rates and declining cap rates.

- Complete Your Assessment: Compile all findings and calculations to ascertain the estimated worth of your asset. Ensure that your assessment reflects current economic conditions, as factors like Melbourne’s office vacancy hovering near 20% can influence real estate values.

By systematically following these steps and considering the broader market context, you can learn how to value vacant commercial property accurately and well-informed.

Conclusion

Valuing vacant commercial property is a multifaceted process that necessitates a comprehensive understanding of various techniques and influencing factors. The central message underscores that a thorough grasp of valuation methods—such as the Sales Comparison Approach, Cost Approach, and Income Approach—is essential for making informed investment decisions. When applied correctly, these methods provide a framework for determining a fair market value, which is crucial for transactions in the commercial real estate sector.

Key arguments presented throughout the article highlight the importance of:

- Location

- Market conditions

- Zoning regulations

- Physical condition of properties

as significant determinants of value. Each of these factors plays a critical role in shaping the market landscape, influencing both potential buyers and investors. By recognizing these elements, stakeholders can better navigate the complexities of commercial property valuation and position themselves for success in a competitive market.

Ultimately, understanding how to value vacant commercial property transcends mere academic exercise; it is a vital skill that empowers investors to maximize returns and minimize risks. As market dynamics evolve, staying informed about current trends and best practices will enhance decision-making capabilities. Engaging with industry experts and utilizing comprehensive valuation techniques can significantly improve investment outcomes, ensuring that stakeholders are well-equipped to capitalize on opportunities in the commercial real estate arena.