Overview

Business financing operates through two primary methods:

- Debt financing, which involves borrowing funds that must be repaid with interest.

- Equity financing, which entails raising capital by selling shares of the company.

Understanding these financing options is crucial for entrepreneurs. Furthermore, effective cash flow management and a solid business plan are essential for securing appropriate funding. Navigating the complexities of the financial landscape requires not only knowledge but also strategic planning. Are you prepared to explore these avenues and enhance your financial acumen?

Introduction

In the intricate realm of business financing, comprehending the available options is pivotal for unlocking growth and achieving operational success. Entrepreneurs encounter a multitude of choices, ranging from debt and equity financing to various loan types tailored to specific needs.

As this landscape evolves, grasping essential concepts such as cash flow management, the loan application process, and repayment terms becomes increasingly vital. Statistics reveal that a significant portion of small businesses grapple with financing challenges; thus, equipping oneself with financial literacy and strategic insights can be transformative.

This article explores the fundamentals of business financing, examining the diverse avenues for securing funds, the complexities of the application process, and best practices to enhance the likelihood of approval. By navigating these critical aspects, business owners can strategically position themselves for success in a continuously shifting economic environment.

Understanding the Basics of Business Financing

Corporate funding encompasses the various techniques and procedures through which enterprises acquire capital to sustain operations, expand, and progress, thereby elucidating the mechanics of business financing. It primarily involves two main types: debt financing and equity financing. Understanding these concepts is crucial for any entrepreneur aiming to navigate the economic landscape effectively.

-

Debt Financing: This entails borrowing money from banks or lending institutions, which must be repaid over time, typically with interest. Notably, approximately 70% of small enterprises in the United States carry outstanding debt, with 62% owing over $100,000. While many business owners fear that acquiring new credit may exacerbate their financial burdens, strategic debt management—such as consolidating multiple obligations into a single payment—can facilitate quicker repayment and alleviate financial strain. At Finance Story, we specialize in developing refined, customized proposals for lenders, ensuring our clients secure appropriate funding solutions tailored to their unique situations. We collaborate with a diverse range of lenders, including high street banks and private lending panels, to provide flexible loan options. As our team emphasizes, 'we work hard to support as many small enterprises as possible,' highlighting the importance of accessible financing solutions.

-

Equity Financing: This method raises capital by selling shares of the company to investors. It allows companies to obtain funds without incurring debt, although it involves relinquishing a portion of ownership and control. Successful instances of equity financing are evident in startups that have effectively attracted venture capital, enabling them to scale operations without the immediate pressure of repayment.

-

Cash Flow Management: Effective cash flow management is vital for any enterprise. It involves overseeing and enhancing the inflow and outflow of cash to ensure the company can meet its obligations and invest in growth opportunities. A well-managed cash flow can significantly improve an enterprise's grasp of business financing, as lenders often assess cash flow stability when reviewing loan applications. Given Finance Story's reputation for professionalism and a deep understanding of the finance sector, we provide valuable insights into managing cash flow effectively, ensuring our clients are well-prepared when pursuing funding.

By comprehending the mechanics of business financing, entrepreneurs can make informed decisions about which funding options best align with their strategic objectives. As the landscape of commerce funding evolves, staying informed about recent trends and statistics—such as ongoing statistical revisions in GFS—will further empower entrepreneurs to navigate their financial journeys successfully. Moreover, with investor financing commitments reaching 48,876, the funding environment for small enterprises remains dynamic and full of opportunities.

Furthermore, we assist clients in refinancing their commercial properties, including warehouses, retail premises, factories, and hospitality ventures, to meet the needs of their evolving businesses.

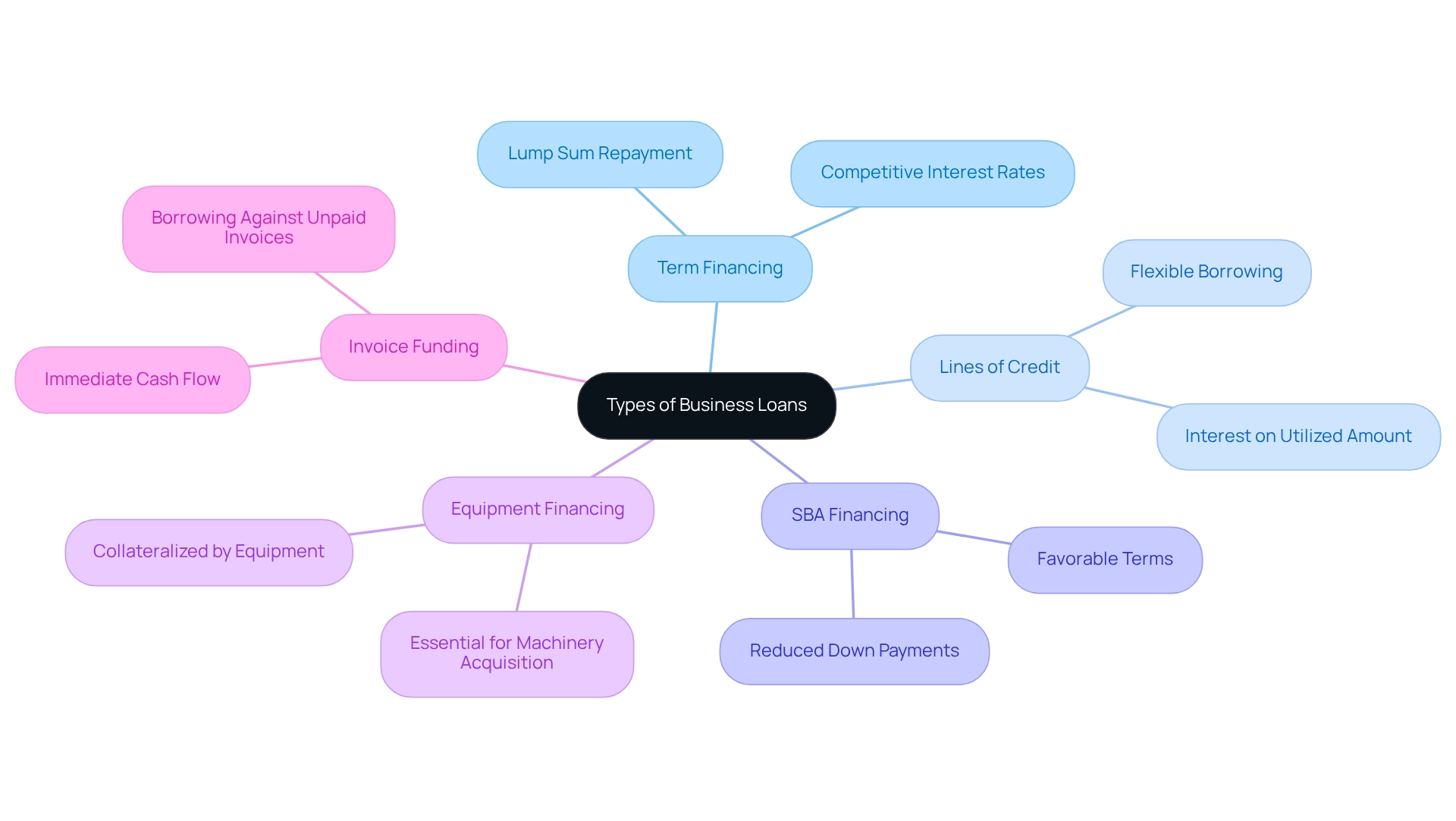

Exploring Different Types of Business Loans

Business owners often wonder how business financing works, given the variety of financing options tailored to meet specific financial needs and operational goals. Understanding how business financing operates is crucial for selecting the most suitable financing method. Here are the main categories of financial assistance available in 2025:

-

Term Financing: These funds provide a lump sum that is repaid over a set period, making them ideal for substantial investments or major acquisitions. This year, competitive interest rates for term financing reflect the evolving lending environment.

-

Lines of Credit: Offering flexibility, lines of credit allow companies to borrow up to a predetermined limit, paying interest only on the amount utilized. This option is particularly advantageous for managing cash flow variations and unforeseen costs.

-

SBA Financing: Backed by the Small Business Administration, this funding offers favorable terms and reduced down payments, making it an appealing choice for small enterprises. Updates in 2025 show that SBA loans continue to support entrepreneurs with accessible funding options.

-

Equipment Financing: Specifically designed for purchasing equipment, these loans use the equipment itself as collateral. This funding is essential for companies looking to enhance or acquire new machinery without straining cash flow.

-

Invoice Funding: This approach allows companies to borrow against unpaid invoices, providing immediate cash flow to manage operational expenses. It is particularly beneficial for firms with extended payment cycles.

At Finance Story, we specialize in developing refined and highly tailored cases to present to banks, ensuring you secure the appropriate funding for your commercial property investments. Statistics reveal that in the December quarter of 2023, the value of new loan commitments for property purchases reached $24.4 billion, indicating a robust demand for funding options. As the economic landscape shifts, small enterprises are increasingly focusing on growth rather than mere survival, with many entrepreneurs seeking to leverage these funding tools to expand their operations.

This shift in focus is vital, as the pandemic has prompted many to transition from borrowing primarily for survival or debt repayment to pursuing funds for growth initiatives.

Furthermore, IBISWorld predicts that lending to private non-financial corporations (PNFCs) will reach £496 billion in 2023, signaling a substantial increase in the lending market. Additionally, numerous small enterprises maintain debt as a financing strategy, with the average SBA credit in 2022 reported at $538,903. By the end of 2022, 70% of small firms had some level of debt, amounting to $18 trillion. By understanding how business financing works, entrepreneurs can make informed decisions that align with their financial strategies and growth objectives.

Navigating the Business Loan Application Process

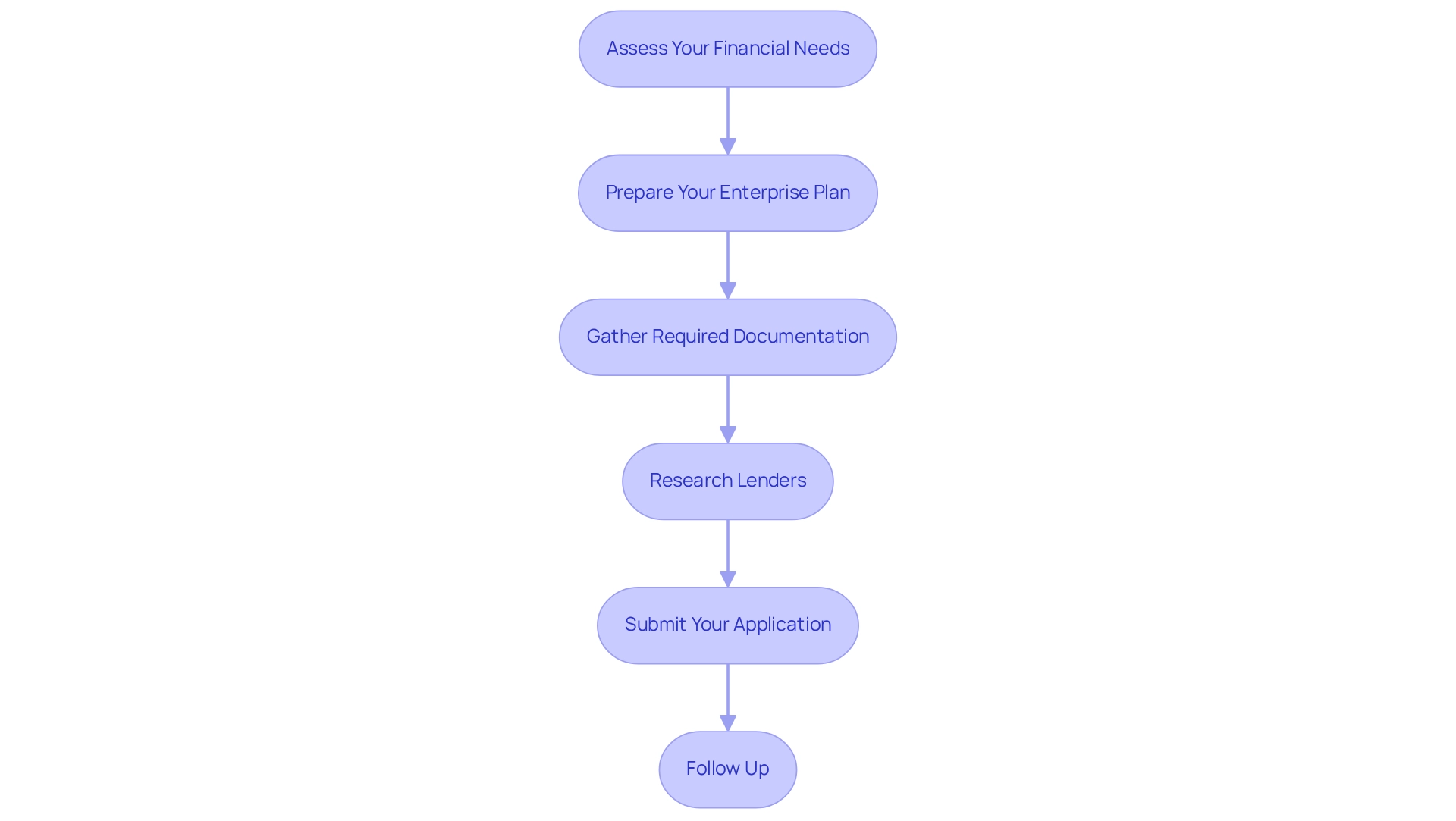

Applying for a commercial loan involves several essential steps that can significantly impact your chances of success:

- Assess Your Financial Needs: Start by determining the exact amount of funding required and the specific purpose for which it will be used. This clarity will guide your entire application process.

- Prepare Your Enterprise Plan: A comprehensive enterprise plan is crucial. It should outline your enterprise model, market analysis, and financial projections. In 2025, lenders increasingly prioritize well-structured project plans, as they provide insight into your strategic vision and operational viability. Successful entrepreneurs often emphasize that a solid business plan is not just a requirement but a roadmap for your business's future.

- Gather Required Documentation: Compile all necessary documentation, which typically includes financial statements, tax returns, and proof of income. Ensuring that these documents are accurate and up-to-date can prevent delays in the application process.

- Research Lenders: Take the time to identify potential lenders and understand their specific requirements and loan products. The lending environment is changing, with new offerings like Canopy arising to fulfill various organizational needs. Familiarizing yourself with various options can help you find the best fit for your situation. As observed in recent trends, over half of small enterprises with revenues surpassing $1 million are now utilizing funding strategically rather than just as a survival resource, emphasizing the significance of comprehending these changing options. At Finance Story, we focus on crafting refined and highly tailored case studies to present to banks, ensuring you obtain the appropriate funding for your commercial property investments. We have access to a full range of lenders, including high street banks and innovative private lending panels, to suit your circumstances whether you are buying a warehouse, retail premise, factory, or hospitality venture.

- Submit Your Application: Complete the application form meticulously, ensuring that all required documents are included. A well-prepared application can significantly enhance your chances of approval.

- Follow Up: After submission, maintain communication with the lender. This proactive approach allows you to address any questions or provide additional information promptly, demonstrating your commitment and professionalism. Tom Sullivan, a FinTech author, highlights that the primary reason small enterprises steer clear of credit is because of elevated fees and interest rates, which emphasizes the significance of being thoroughly prepared.

By following these steps, owners can simplify their application process and enhance their chances of obtaining the required funding. Significantly, as the landscape transitions towards strategic funding, understanding the nuances of the application process becomes increasingly essential. The pandemic has shifted small enterprise funding purposes towards survival and debt repayment, but the current trend indicates a move towards growth-oriented capital, making a thoughtful approach to funding essential.

To further enhance your chances of success, consider booking a free personalized 30-minute consultation with Finance Story's Head of Funding Solutions, Shane Duffy. Discuss your needs and goals, and let us assist you in creating customized financial strategies that align with your objectives.

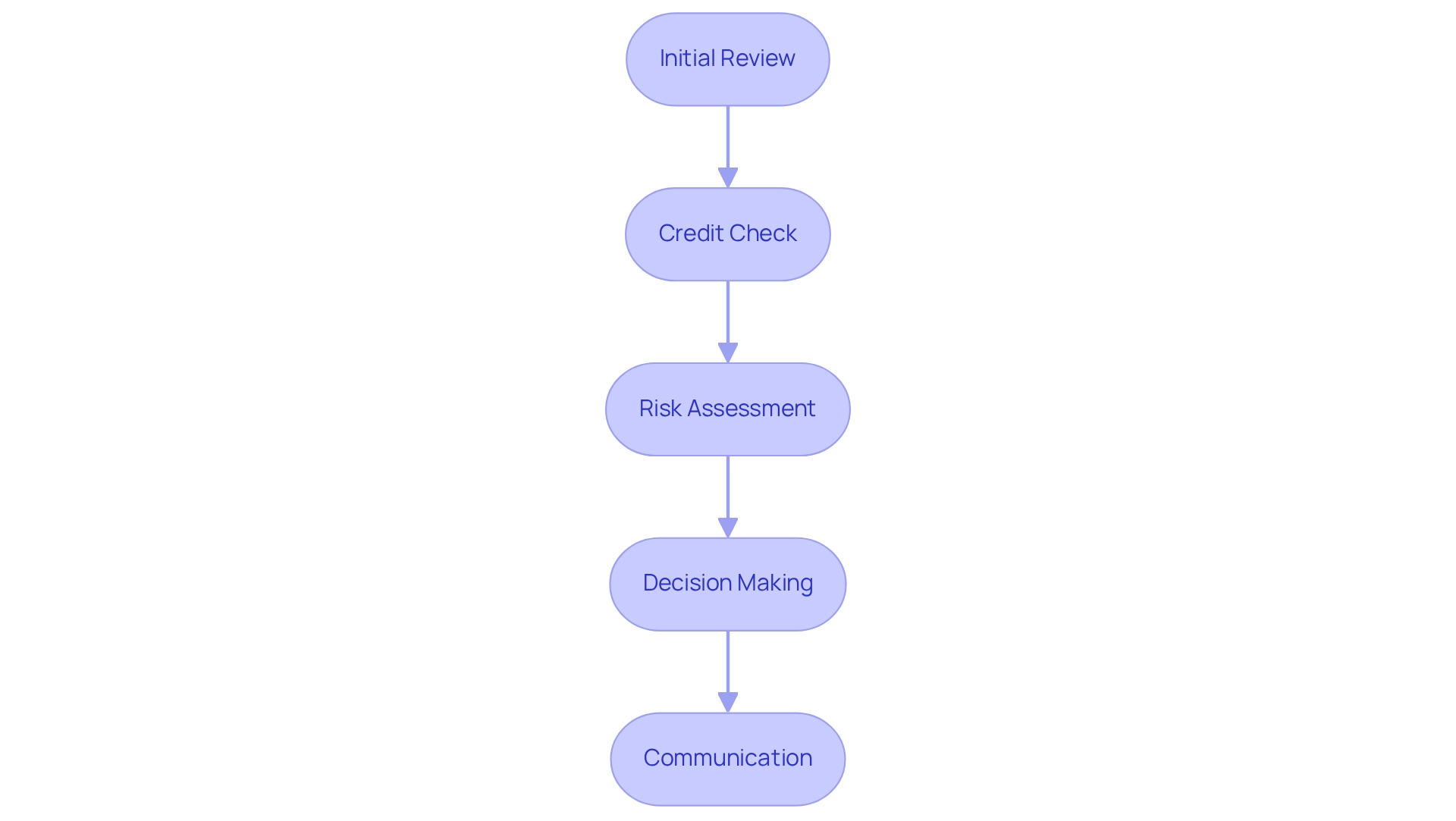

Understanding the Loan Approval Process

The loan approval process serves as a critical pathway for small business owners seeking financing, typically unfolding in several key stages:

-

Initial Review: Lenders commence by assessing the application for completeness and basic eligibility, ensuring that all necessary documentation is provided. This step is particularly crucial when developing a refined and personalized case to present to banks, as it establishes the foundation for a successful application.

-

Credit Check: This stage entails a thorough evaluation of the creditworthiness of both the company and its owners. Lenders scrutinize credit scores and financial records, as these elements significantly impact the chances of approval. As Allison Martin states, "Obtaining financing with a 500 credit score can be difficult, but you’re not entirely out of luck." In 2025, the average credit score required for loan approval is projected to be approximately 680, highlighting the increasing emphasis on creditworthiness in lending decisions. Understanding these criteria is essential for small business owners to effectively navigate the business financing landscape.

-

Risk Assessment: Lenders conduct a comprehensive evaluation of the organization’s financial condition, focusing on cash flow, revenue, and existing debts. This assessment aids lenders in evaluating the potential risks associated with the financing. Industry experts note that lenders regard credit scores as indicators of repayment likelihood; higher scores generally correlate with lower perceived credit risk, whereas lower scores may result in higher borrowing costs. Moreover, businesses that may not meet conventional borrowing criteria can explore unsecured funding, which provides flexible financing solutions for various objectives, such as property acquisitions and working capital expansions. For those managing leasehold enterprises, leveraging property equity and cash savings can also be effective strategies for securing necessary funds.

-

Decision Making: Upon completing the evaluations, lenders arrive at a decision regarding the application. This choice is based on a comprehensive assessment of the company’s financial situation and creditworthiness, along with the tailored proposals presented by Finance Story.

-

Communication: Finally, lenders convey their decision to the applicant. If approved, they provide detailed information regarding the terms and conditions, enabling entrepreneurs to understand their responsibilities and options. This clarity is vital for small business owners aiming to refinance or secure new loans for commercial property investments.

Understanding how business financing works is crucial for entrepreneurs, as it empowers them to enhance their applications and anticipate potential issues from lenders. By familiarizing themselves with these stages and leveraging the expertise of Finance Story, which offers a comprehensive range of lenders to suit various circumstances, owners can significantly improve their chances of obtaining the financing necessary for growth and success.

How Funds Are Disbursed After Approval

Once a loan is approved, the disbursement of funds typically follows a structured process that is crucial for business owners to understand:

-

Financing Agreement Signing: The initial step involves the borrower signing the financing agreement, which clearly outlines the terms and conditions of the financing. This document serves as a legal contract between the borrower and the lender. As Bankrate mentions, "We’re open about how we provide quality content, competitive rates, and helpful tools to you by clarifying how we generate revenue," highlighting the significance of comprehending financing agreements.

-

Verification: Following the signing, the lender may conduct a final verification of the borrower's information and documentation. This step is vital to ensure that all details are accurate and that the borrower meets the necessary criteria for the loan. At Finance Story, we specialize in ensuring that our clients present polished and customized cases to meet these verification standards, enhancing their chances of approval.

-

Fund Transfer: Once verification is complete, funds are typically transferred electronically to the borrower's business bank account. The pace of this transfer can differ; while some lenders may handle the transfer within a few days, others can enable same-day transfers, depending on their policies and the type of financing. Recent statistics indicate that in the December quarter of 2024, the number of refinanced investor credits reached 18,274, reflecting a 4.4% increase from the previous quarter. This trend emphasizes the significance of refinancing alternatives offered by Finance Story, which can assist entrepreneurs in adjusting to their changing economic requirements.

-

Confirmation: After the funds have been transferred, the lender will provide confirmation of the disbursement. This confirmation contains information such as the amount distributed and any conditions linked to the credit, ensuring that the borrower is fully informed.

Comprehending this process is crucial for entrepreneurs, as it equips them for the financial consequences of obtaining their funding. For example, the typical duration for fund distribution following approval can differ, but numerous lenders are embracing advanced technologies to accelerate the process. Furthermore, expert insights indicate that timely fund disbursement can significantly influence an organization's operational capabilities, enabling prompt investment in growth opportunities.

It is also recommended for entrepreneurs to compare personal financing rates to select a lender that suits their budget and to be wary of payday advances because of their high fees and APRs. By being aware of these steps and their significance, entrepreneurs can navigate the financing landscape more effectively, leveraging the expertise of Finance Story to secure the appropriate funding for their needs.

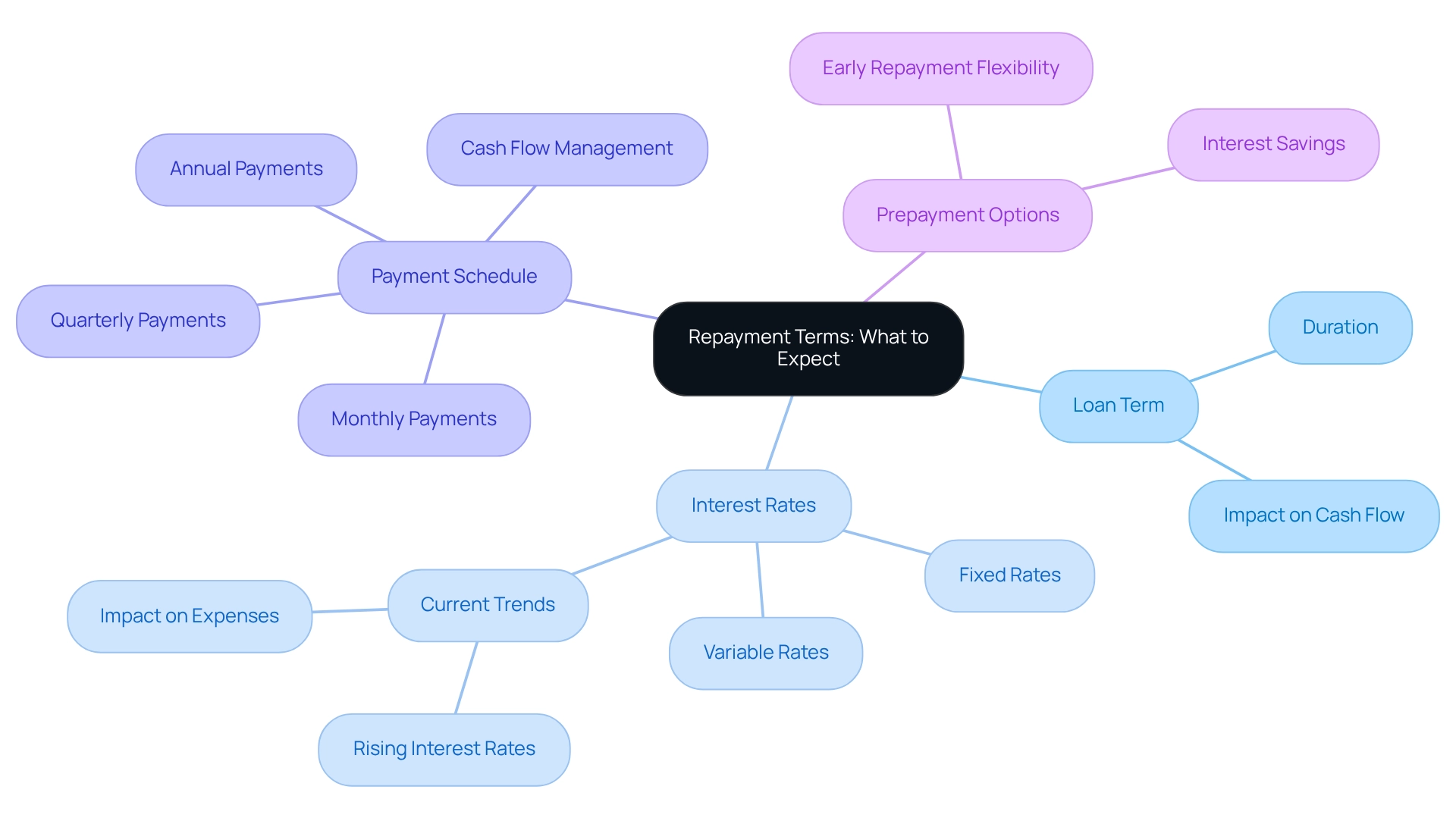

Repayment Terms: What to Expect

Repayment terms for business loans can vary widely depending on the type of loan and the lender, but they generally encompass several key components:

-

Loan Term: This refers to the duration over which the loan must be repaid, typically ranging from a few months to several years. For small enterprises, comprehending the credit duration is crucial, as it directly influences cash flow and financial strategy.

-

Interest Rates: The cost of borrowing can be either fixed or variable. Current trends suggest that interest rates for commercial financing are affected by wider economic circumstances, with variations influencing the overall repayment sum. As of early 2025, companies should recognize that rising interest rates can result in higher expenses throughout the duration of the borrowing, making it essential to obtain favorable rates from the beginning. In December 2023, property financing commitments reached $12.87 billion, reflecting the current lending landscape.

-

Payment Schedule: Payments may be structured on a monthly, quarterly, or annual basis, depending on the loan agreement. This timetable is crucial for enterprises to manage their cash flow effectively. For example, a monthly payment plan may correspond more effectively with consistent revenue cycles, while quarterly payments might fit enterprises with seasonal income.

-

Prepayment Options: Some loans provide the flexibility of early repayment without penalties, enabling companies to save on interest expenses if they have the capacity to settle their loans earlier. This option can be particularly advantageous in a fluctuating interest rate environment.

Understanding how business financing works and the associated repayment terms is crucial for effective financial management. Lenders will evaluate the strength of your company's profits and cash flow to ensure that you can comfortably meet repayment obligations. For example, if your enterprise is seasonal, it's important to demonstrate that you can manage repayments during quieter months or maintain cash reserves for slower sales periods.

Furthermore, presenting a detailed proposal and cash flow forecasts for a minimum of the next 12 months can greatly improve your likelihood of obtaining advantageous financing conditions.

Data indicates that only 13.8% of small enterprise funding is sanctioned by large banks, while non-bank financing provides nearly a 25% approval rate. This highlights the importance of choosing the right lender, as it can significantly impact the terms offered. Furthermore, with approximately 20% of loan applications denied due to credit issues, maintaining a strong credit profile is essential for securing favorable repayment terms.

As Anna Bligh, CEO of the Australian Banking Association, noted, "This Budget provides extra support to Australians in the short-term whilst at the same time helping to address some of our longer-term challenges."

As companies explore how business financing works, they should also consider expert views on repayment conditions. Economic analysts highlight that a well-organized repayment strategy can improve an enterprise's monetary stability and growth potential. By grasping the average repayment terms for small enterprise financing in 2025, which usually span from three to five years, owners can more effectively prepare for their financial responsibilities and ensure they fulfill their repayment duties.

For more insights and assistance, consider contacting Finance Story, a finance brokerage committed to supporting companies in their growth.

Overcoming Challenges in Business Financing

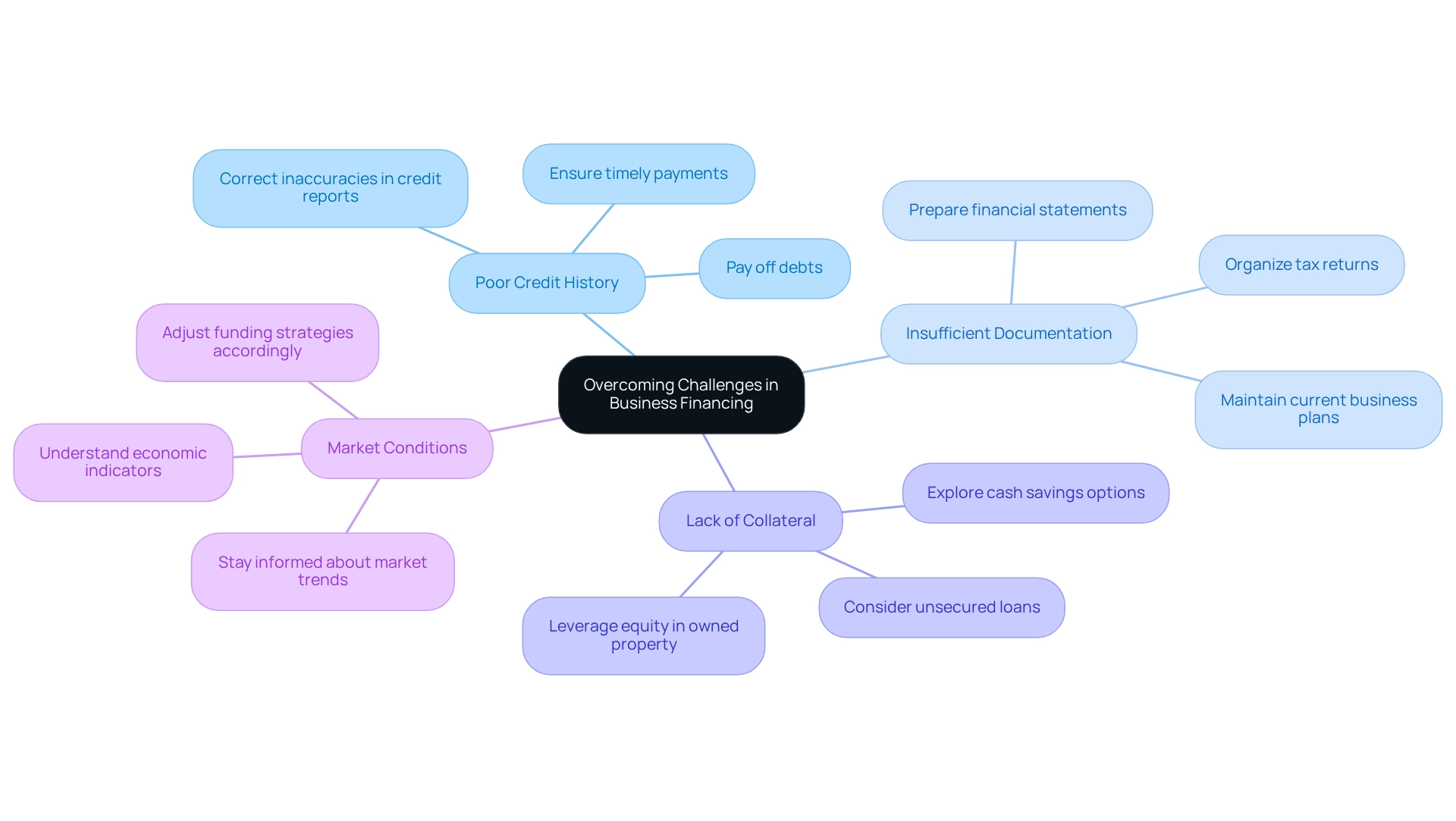

Securing business financing presents several challenges that small business owners must navigate effectively:

- Poor Credit History: A low credit score significantly impacts loan approval rates. In 2025, companies with credit scores below 600 confront a stark reality, as many lenders are becoming increasingly stringent in their evaluations. Business owners should prioritize improving their credit history by paying off debts, ensuring timely payments, and correcting any inaccuracies in their credit reports.

- Insufficient Documentation: Incomplete or poorly organized documentation can lead to frustrating delays or outright denials of application requests. To reduce this risk, owners should prepare all necessary documents meticulously, including financial statements, tax returns, and plans, ensuring they are accurate and current.

- Lack of Collateral: Many lenders require collateral to secure loans, which can be a hurdle for enterprises without substantial assets. For leasehold enterprises or those lacking a physical property, choices may be restricted to cash savings or leveraging the equity in any owned property. For instance, if an entrepreneur has a home valued at $1.3M with $300k owed, they could potentially access $740k in equity to support their acquisition, supplemented by any cash savings. Business owners should understand how business financing works by exploring various options for providing collateral, such as inventory or equipment, or by considering unsecured loans, which, while often carrying higher interest rates, can be a viable alternative.

- Market Conditions: Economic downturns can tighten lending criteria, making it more challenging for enterprises to obtain funds. Staying informed about current market trends and economic indicators is crucial. For example, recent conversations among financial specialists emphasize that many small enterprises are struggling with elevated input costs and cash flow pressures, which can further complicate their financing efforts. According to a case study, numerous enterprises have faced challenges in establishing prices in a high-inflation environment, resulting in margin compression and cash flow problems. Additionally, profit margins for the majority of small enterprises are approximately at pre-pandemic levels, yet some have experienced reduced capacity to transfer cost hikes to clients lately. Comprehending how business financing works enables entrepreneurs to adjust their funding strategies accordingly. Furthermore, aggregate enterprise leverage has declined over the past decade, indicating that many small enterprises are entering this tightening cycle with low gearing.

By proactively tackling these challenges, small enterprise owners can significantly improve their chances of understanding how business financing works to obtain the funds they require to expand and maintain their operations. Collaborating with financial advisors, like those at Finance Story, can offer personalized guidance on enhancing credit history and navigating the intricacies of commercial funding, particularly in difficult situations. As Anna Bligh, CEO of the Australian Banking Association, stated, "This Budget provides extra support to Australians in the short-term whilst at the same time helping to address some of our longer-term challenges."

Furthermore, clients such as Natasha B. from VIC have conveyed their contentment, declaring, "I will certainly be recommending your services to anyone. We are finished with the constant worry. Once again, thank you so much for being a part of our journey."

Finance Story provides an extensive range of funding choices, guaranteeing that small enterprise owners have access to the finest solutions customized to their requirements.

Best Practices for Securing Business Financing

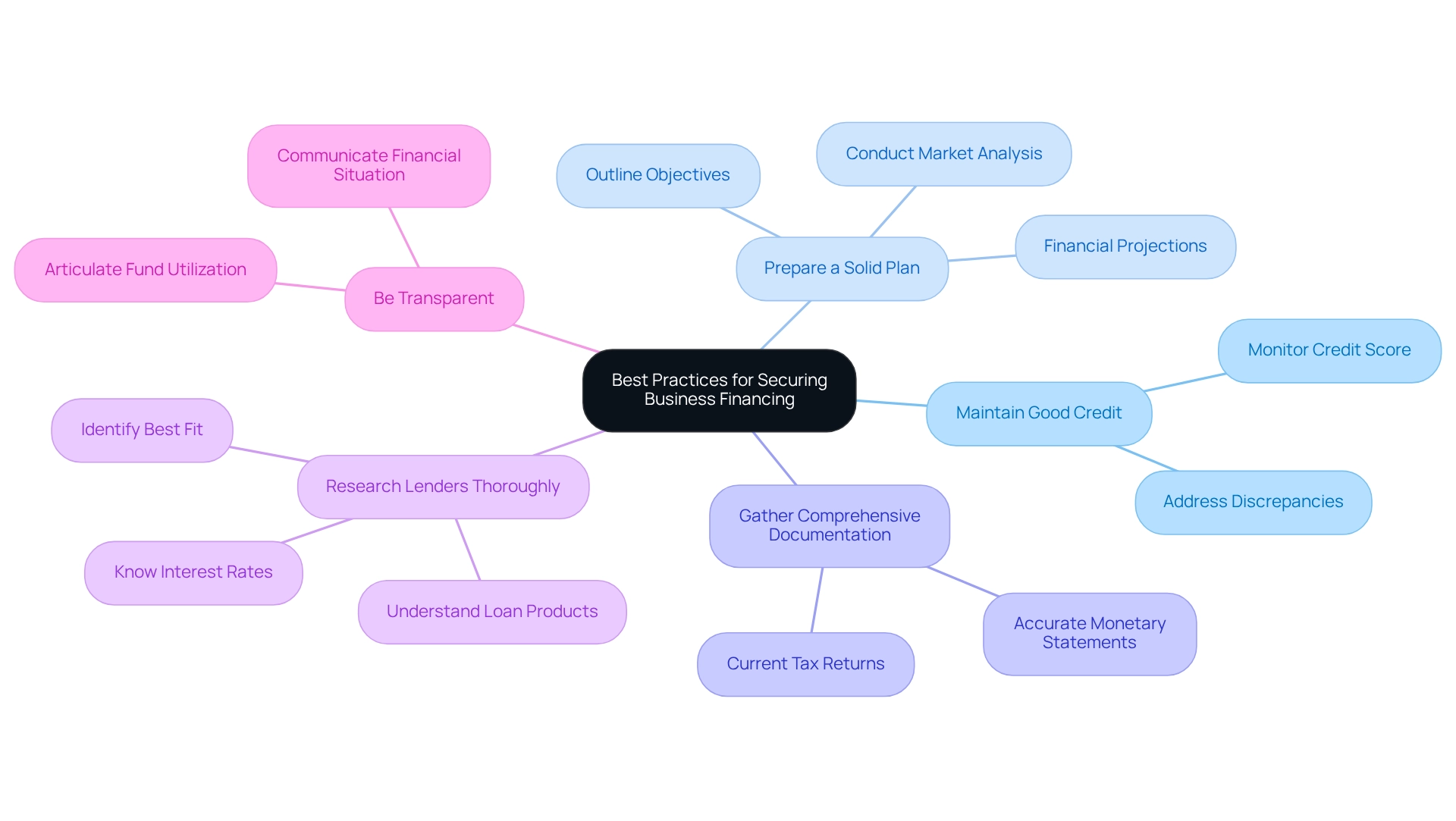

To enhance your likelihood of securing business financing, consider implementing the following best practices:

-

Maintain Good Credit: Regularly monitor your credit score and proactively address any discrepancies. Understanding how business financing works is crucial, as a strong credit score significantly influences loan approval rates. Companies with higher credit scores are often regarded more favorably by lenders, enhancing their chances of obtaining advantageous terms. With over 25 years of experience in enhancement and technology implementation, Finance Story emphasizes that maintaining good credit is a foundational step in the financing process.

-

Prepare a Solid Plan: Crafting a comprehensive strategy is essential. This document should clearly outline your company's objectives, market analysis, and financial projections. A well-organized plan not only demonstrates your enterprise's viability but also instills confidence in potential lenders regarding your ability to repay the loan. As the statistic indicates, only about a third of small businesses survive to their tenth anniversary, underscoring the importance of securing a solid plan for success.

-

Gather Comprehensive Documentation: Ensure that all monetary statements, tax returns, and other necessary documents are accurate and current. Providing lenders with detailed documentation that assesses your financial health is essential for understanding how business financing works, as being organized can streamline the approval process.

-

Research Lenders Thoroughly: Take the time to understand the specific requirements and loan products offered by various lenders. This knowledge helps you identify the best fit for your funding needs. Finance Story provides access to a full suite of lenders, including high street banks and innovative private lending panels, ensuring you can find the right financing solution for your circumstances. For example, the Small Business Administration (SBA) states that average interest rates for loans can differ greatly, ranging from 2.54% to 7.01%. Knowing these details can help you make informed decisions, especially considering the varying interest rates can heavily impact your repayment strategy.

-

Be Transparent: Clearly communicate your organization's financial situation and articulate how you plan to utilize the funds. Transparency fosters trust and can lead to more favorable lending terms.

By following these best practices, owners can gain insight into how business financing works, positioning themselves as trustworthy borrowers and enhancing their opportunities to secure the necessary funding to expand and maintain their enterprises. As Helen Jackson, a prominent financial author, highlights, "By remaining aware of these insights, we can enhance the development and resilience of enterprises in the years ahead." Staying informed about evolving trends in finance is crucial for fostering growth and resilience in the coming years.

The Importance of Understanding Business Financing

Understanding how business financing works is crucial for entrepreneurs, as it lays the foundation for obtaining necessary funds and making strategic choices that promote growth. At Finance Story, we recognize the importance of a solid and ongoing relationship to fully understand your needs, allowing us to create highly tailored and comprehensive funding solutions. Monetary knowledge empowers entrepreneurs to make informed choices regarding growth and investment prospects, ensuring that resources are allocated effectively. Additionally, it enables efficient cash flow management, which is crucial for avoiding economic pitfalls that can jeopardize operations. Furthermore, it helps build strong relationships with lenders and investors, fostering trust and facilitating smoother negotiations for funding. Lastly, it allows entrepreneurs to adapt to changing market conditions and economic landscapes, enabling agile responses to challenges and opportunities.

Statistics reveal that monetary knowledge significantly influences performance, particularly among micro, small, and medium enterprises (MSMEs). Studies suggest that improving monetary habits through focused training can result in better performance metrics for these enterprises. For instance, a logistic regression analysis demonstrated a clear correlation between economic literacy indices and the performance of MSMEs, highlighting that monetary behavior is a critical determinant of success. The Average VIF (AVIF) value in this study is 2.668, further supporting the argument that economic literacy is crucial for effective management of enterprises.

Moreover, expert opinions underscore the significance of economic literacy for entrepreneurs. Financial trainers stress that understanding how business financing works, including funding alternatives like those provided by Finance Story, not only assists in obtaining loans but also improves overall commercial insight, which is essential for long-term viability. As we progress through 2025, the significance of monetary literacy continues to rise, with entrepreneurs increasingly acknowledging that informed funding choices can result in enhanced cash flow and operational efficiency.

Numerous instances exist of enterprises that have effectively utilized economic knowledge to boost their cash flow. By prioritizing monetary literacy and utilizing personalized lending solutions from Finance Story, entrepreneurs can significantly enhance their chances of success in a competitive environment by understanding how business financing works to navigate the complexities of business funding. Additionally, insights for policymakers suggest that tailored entrepreneurship policies should consider financial literacy and its varying effects across different demographics, emphasizing the need for targeted financial education to enhance the performance of MSMEs.

Conclusion

Navigating the landscape of business financing is essential for entrepreneurs seeking to secure the necessary funds for growth and sustainability. This article outlines key elements, including:

- The distinctions between debt and equity financing

- The variety of loan types available

- The critical steps involved in the loan application process

Understanding cash flow management and the intricacies of the loan approval process empowers business owners to make informed decisions that align with their financial goals.

Moreover, recognizing the challenges in securing financing—such as poor credit history and insufficient documentation—is crucial for overcoming barriers that may hinder access to funds. By implementing best practices like:

- Maintaining good credit

- Preparing comprehensive business plans

- Conducting thorough research on lenders

business owners can significantly enhance their chances of obtaining favorable financing options.

Ultimately, financial literacy emerges as a vital component for entrepreneurs. It not only facilitates informed decision-making but also fosters strong relationships with lenders and investors. As the economic landscape continues to evolve, staying knowledgeable about financing options and trends will empower business owners to adapt and thrive in a competitive marketplace. By prioritizing financial understanding and leveraging tailored funding solutions, entrepreneurs can position their businesses for long-term success and resilience.