Overview

Owner financing a commercial property represents a strategic opportunity where the seller directly provides funds to the buyer. This arrangement can lead to quicker transactions and more flexible terms, particularly advantageous for buyers who may have less-than-perfect credit.

It is crucial to establish clearly defined agreements and ensure legal compliance. Effective communication between both parties is essential for a successful transaction. However, it is also important to address potential risks, including buyer default and market fluctuations.

By understanding these dynamics, both buyers and sellers can navigate the complexities of owner financing effectively.

Introduction

Navigating the world of commercial real estate can be daunting, particularly for those unfamiliar with traditional financing methods. Owner financing presents a compelling alternative, enabling sellers to directly fund the purchase. This approach opens doors for buyers who may face challenges in securing loans.

This article explores the essential steps and considerations for successfully structuring owner financing agreements. Additionally, it addresses potential challenges that both buyers and sellers may encounter.

What strategies can be employed to mitigate risks and ensure a smooth transaction in this evolving landscape of property funding?

Understand Owner Financing for Commercial Properties

Owner assistance, or seller support, represents a strategic method of how to owner finance a commercial property, wherein the seller directly provides funds to the purchaser, circumventing traditional lenders. This arrangement yields significant benefits for both parties involved. Sellers can attract a larger pool of purchasers and expedite the selling process, while buyers may find it easier to secure funding, especially if they possess less-than-perfect credit.

Key aspects to consider include:

- Terms of the Agreement: Owner financing agreements must clearly delineate the purchase price, down payment, interest rate, repayment schedule, and any penalties for late payments. A well-organized contract is crucial for ensuring a smooth transaction.

- Legal Considerations: Adherence to local laws and regulations is imperative. Engaging a legal professional can assist in navigating the complexities of these agreements, ensuring all terms are enforceable and transparent.

- Advantages: This funding approach can lead to reduced closing costs and more flexible terms, making it an attractive option for purchasers. Moreover, it can facilitate quicker transactions, which is especially advantageous in a competitive market. Real estate specialists underscore that seller assistance can be mutually beneficial, especially when considering how to owner finance a commercial property, allowing vendors to maintain control over the transaction while providing purchasers with accessible funding alternatives. Notably, with the expertise of Finance Story, you can access a comprehensive range of lenders, including high street banks and private lending panels, thereby enhancing your chances of securing favorable terms.

- Risks: While seller funding presents opportunities, it also entails risks. Sellers face the possibility of customer default, while purchasers may encounter higher interest rates compared to traditional loans. Understanding these risks is essential for both parties to make informed decisions.

In 2025, the landscape of property funding continues to evolve, with many professionals advocating its advantages. As industry leaders highlight, seller assistance can enhance liquidity in the market and provide a pathway for buyers who may struggle with conventional lending methods. Successful seller-backed arrangements in commercial real estate often hinge on clear communication and a mutual understanding of the terms, ensuring that both parties feel secure in their investment. Specific categories of commercial properties that can benefit from propertyholder support include warehouses, retail spaces, factories, and hospitality enterprises. As Andrew Carnegie famously stated, "Ninety percent of all millionaires become so through owning real estate," underscoring the long-term value of real estate investment.

Follow the Steps to Structure an Owner Financing Agreement

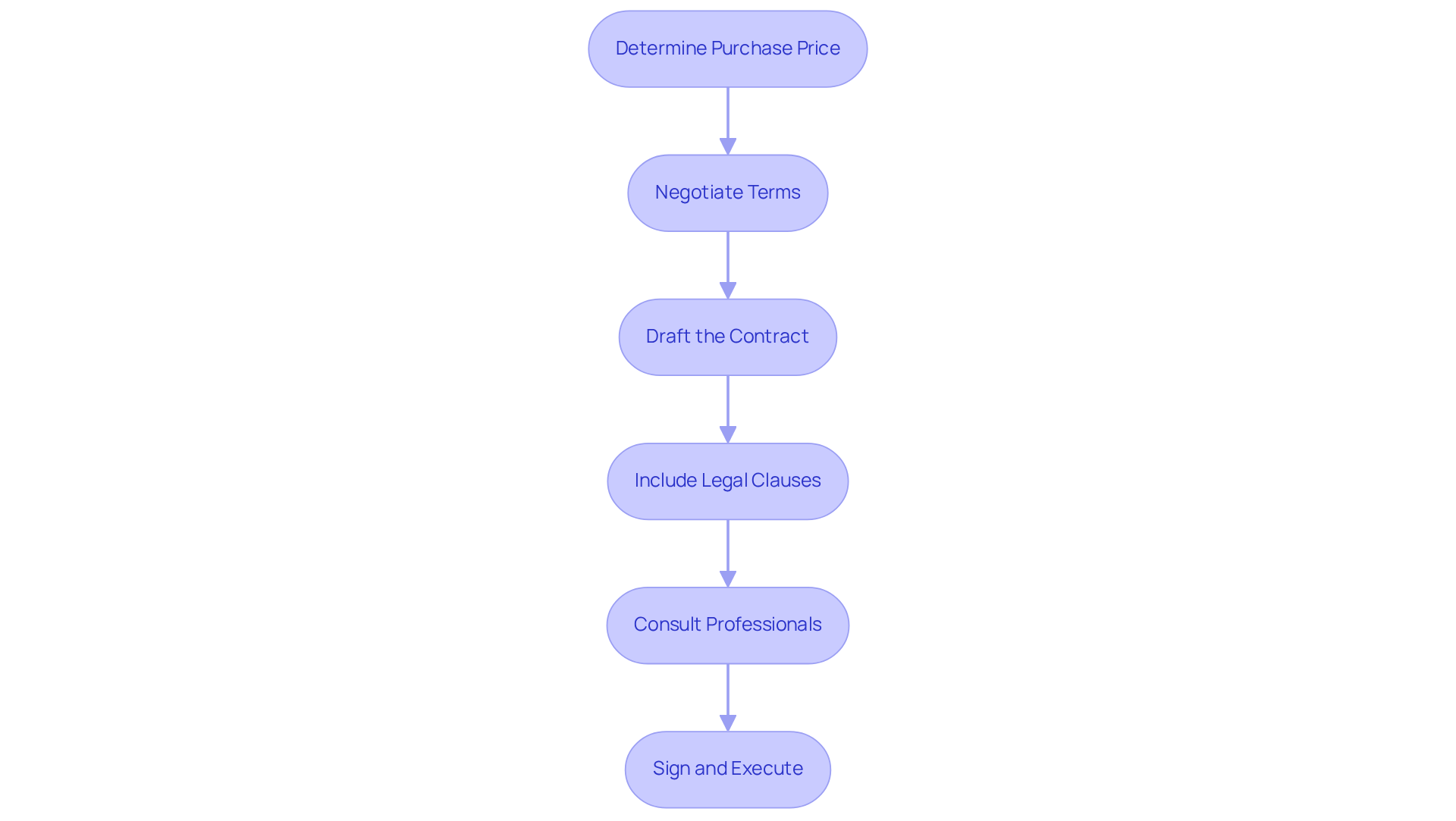

To effectively structure an owner financing agreement, consider the following steps:

-

Determine the Purchase Price: Establish a fair market value for the property by researching comparable properties to ensure the price is competitive. Typically, a substantial down payment of approximately $25,000 is anticipated in owner transactions.

-

Negotiate Terms: Engage in discussions to agree on key terms such as the down payment, interest rate, repayment schedule, and loan duration. Owner financing terms often range from 3 to 5 years with amortization periods of 15 to 20 years. Both parties should feel comfortable with the negotiated terms to foster a positive transaction.

-

Draft the Contract: Create a comprehensive written document that encapsulates all negotiated terms. This document should clearly outline the responsibilities and obligations of both the purchaser and seller. As mentioned by Bill Hutchins, a key role of a real estate attorney in an owner financing arrangement is the drafting of the loan documents.

-

Include Legal Clauses: Incorporate essential legal clauses, including default terms, late payment penalties, and any applicable contingencies. These clauses protect both parties and clarify expectations. It is crucial to highlight that the seller retains legal title to the property until the buyer fully pays off the loan balance.

-

Consult Professionals: Before concluding the contract, it is essential to have it examined by a real estate lawyer. Their expertise ensures compliance with local laws and regulations, safeguarding the interests of both parties. As emphasized by industry experts, professional guidance is essential to navigate the complexities of owner financing.

-

Sign and Execute: Once both parties are satisfied with the contract, proceed to sign the document and carry out the transaction. Ensure that all necessary paperwork is filed appropriately to formalize the contract. Be aware that if purchasers fail to make payments, they risk losing the property and any payments contributed towards it.

By following these steps, purchasers and vendors can effectively learn how to owner finance a commercial property, navigating the complexities of owner funding agreements and leading to successful transactions that meet their financial needs.

Identify and Overcome Common Challenges in Owner Financing

Owner financing presents several challenges that can be daunting for sellers. Understanding these common issues and how to owner finance a commercial property to effectively overcome them is crucial for a successful transaction.

Buyer Qualification: One of the primary concerns for sellers is the buyer's ability to repay the loan. To mitigate this risk, understanding how to owner finance a commercial property is essential to conduct thorough due diligence. This includes performing credit checks and comprehensive financial assessments to ensure that the buyer is capable of fulfilling their obligations.

Legal Compliance: Navigating the complexities of ensuring that the contract adheres to local laws can be overwhelming. Engaging a real estate lawyer to examine the contract and provide guidance on legal obligations is a prudent step that can safeguard you when learning how to owner finance a commercial property against potential pitfalls.

Default Risks: Sellers must also consider the risk of client default. To protect against this, requiring a larger down payment can be beneficial. Additionally, including a clause that allows for property repossession in the event of default can provide an extra layer of security.

Market Fluctuations: The real estate market is subject to changes that can impact property values. To address this concern, it is wise to include terms in the agreement that allow for adjustments based on prevailing market conditions. This flexibility can help both parties navigate uncertainties.

Communication: Effective communication is vital in any transaction. Misunderstandings can easily arise between buyers and sellers, so maintaining open lines of communication throughout the process is crucial. This ensures that both parties remain aligned and informed, ultimately fostering a smoother transaction.

Conclusion

Owner financing for commercial properties emerges as a compelling alternative to traditional lending methods, offering distinct advantages for both sellers and buyers. This approach not only streamlines the transaction process but also creates opportunities for those who may encounter difficulties in securing conventional financing. By grasping the intricacies of owner financing, parties can forge a mutually beneficial arrangement that enhances the overall experience of buying and selling commercial real estate.

The article explores essential components of owner financing, emphasizing the significance of:

- Clearly defined agreements

- Legal compliance

- Potential risks involved

Key steps to successfully structure an owner financing agreement are underscored, highlighting the necessity of:

- Thorough negotiations

- Professional guidance

- Effective communication

Furthermore, common challenges such as buyer qualification and market fluctuations are addressed, providing insights on navigating these obstacles for a successful transaction.

Ultimately, embracing owner financing can foster greater flexibility and accessibility within the commercial real estate market. As trends continue to evolve in 2025, stakeholders are urged to consider this financing method as a strategic option. By staying informed and proactive in addressing potential challenges, both sellers and buyers can unlock the full potential of owner financing, paving the way for successful investments in the dynamic landscape of commercial property.