Overview

Securing financing for a business is a critical endeavor that requires a solid understanding of the funding landscape. Business owners must first identify the types of funding available and accurately assess their financial needs. This foundational knowledge sets the stage for preparing a comprehensive application, which must include essential documentation.

A balanced approach between debt and equity funding is vital. Tailored proposals, crafted with care, can significantly enhance the chances of obtaining necessary financial support. Furthermore, maintaining open communication with lenders fosters trust and transparency, which are key to successful financing outcomes.

Are you ready to take the next step in securing your business's financial future? By following these guidelines, you can position yourself for success in the competitive financing landscape.

Introduction

In the dynamic landscape of small business financing, grasping the fundamental differences between debt and equity options is crucial for entrepreneurs aiming to drive their growth.

As trends shift towards traditional funding sources, a notable number of small businesses are increasingly turning to loans to navigate the complexities of today's economy.

This article explores the essential aspects of business financing, detailing various options available—from bank loans to innovative non-bank solutions—while underscoring the significance of a strategic approach in securing the right capital.

By equipping business owners with insights into assessing their financial needs, preparing comprehensive documentation, and adeptly navigating the application process, this guide aspires to empower them to make informed decisions that foster long-term success.

Understand Business Financing Basics

Business funding can be categorized into two primary types: debt and equity. Debt funding involves borrowing money that must be repaid over time, usually with interest. Common forms include bank loans, lines of credit, and bonds.

In contrast, equity funding raises capital by selling shares of the company, which does not require repayment but leads to ownership dilution.

As of 2025, trends suggest a significant change in funding choices among small enterprises. Recent statistics indicate that around 42% of small enterprises chose debt support, reflecting a growing dependence on loans to sustain operations and growth. This marks a notable change from 2022, where only 8% pursued government support, emphasizing a shift towards more conventional funding sources.

Successful examples of debt funding for startups illustrate its effectiveness. Numerous small enterprises have utilized bank credit to broaden their activities, demonstrating that with a strong strategy, borrowing can be a practical choice for expansion. Additionally, collaborating with experts like Finance Story can enhance your chances of securing the right financing.

They focus on developing refined and uniquely tailored business cases to present to banks, ensuring that your financing proposal meets the elevated standards of financial institutions. Finance Story also offers access to a complete variety of financial institutions, including high street banks and innovative private lending panels, customized to your specific circumstances.

However, the landscape is evolving; several non-bank lenders have emerged, offering tailored loans and utilizing technology to assess creditworthiness, thereby expediting access to finance. It is important to note that while these alternatives provide options, the funding obtained through them is still limited compared to traditional bank lending.

Grasping the subtleties of debt versus equity funding is essential for small enterprise owners. Expert opinions highlight that a balanced strategy, considering both forms of funding, can lead to more sustainable growth. The significance of understanding these fundamentals cannot be overstated, as they greatly affect funding strategies and long-term organizational health.

As the financing landscape continues to evolve, staying informed about how to get financing for a business will empower owners to make strategic decisions that align with their goals. As the quote goes, "Successful people ask better questions, and as a result, they get better answers."

Furthermore, small enterprise owners should be aware of how to get financing for a business through resources such as the U.S. Small Enterprise Administration (SBA), which provides a guaranteed loan program to assist in securing funding. Insights from the case study titled "Impact of Economic Conditions on Small Enterprises" reveal that while small enterprises are crucial to the economy, they face challenges such as declining conditions and confidence due to weaker demand, rising costs, and labor shortages. This context underscores the importance of understanding how to get financing for a business while navigating the current economic landscape.

For those managing leasehold enterprises, utilizing property equity and cash savings can also be viable strategies for acquisitions.

Assess Your Financial Needs and Goals

Begin by calculating your total funding requirements, encompassing both start-up costs (one-time expenses) and operational costs (recurring expenses). In 2025, the anticipated average start-up expenses for small enterprises in Australia are substantial, necessitating a comprehensive budget that details these costs and highlights any funding shortfalls. Setting clear financial goals, such as revenue targets or expansion plans, is crucial for guiding your financing strategy.

For instance, did you know that 54% of companies in the Electricity, Gas, Water, and Waste Services sector expect price hikes? Such increases may affect operational expenses and should be included in your financial planning. Furthermore, 47% of enterprises in the Accommodation and Food Services sector anticipate raising their prices over the next three months, underscoring the necessity for thorough financial evaluation.

This evaluation not only clarifies the amount of funding required but also assists in identifying how to secure financing through the most appropriate funding alternatives available. At Finance Story, we specialize in developing refined and tailored business cases to present to financiers, ensuring you obtain the appropriate funding for your commercial property investments. We offer a full range of lenders to suit any circumstance, whether you are purchasing a warehouse, retail premise, factory, or hospitality venture.

The typical amount for day-to-day capital is $75,552, while the typical amount for other purposes is $112,047. As Phil Collard, a lending specialist, notes, "The right loan facility can be a very powerful tool to accelerate growth, so be sure to have your plans clearly mapped out, including expected ROI." By understanding your financial environment and establishing strategic objectives, you can position your venture for success in securing financing.

Moreover, the trend towards AI and cloud adoption is noteworthy, with 36% of organizations currently utilizing AI. This underscores the significance of integrating advanced technologies to improve operational efficiency, which can also impact your financial planning.

Explore Different Financing Options

Businesses have access to a variety of financing options, each with unique characteristics that cater to different needs and circumstances:

- Bank Loans: These traditional loans typically require collateral and a strong credit history. While they can provide substantial funding, the approval process can be lengthy, and the requirements may be stringent. Current statistics indicate that the approval rates for bank loans have varied, with many small enterprises still encountering difficulties in obtaining traditional financing. At Finance Story, we specialize in creating refined and highly personalized proposals to present to banks, significantly enhancing your chances of approval.

- Lines of Credit: Providing flexibility, lines of credit enable companies to withdraw funds as required, making them ideal for managing cash flow variations. This option can be especially advantageous for small enterprises facing urgent working capital needs. As industry specialist Tom Sullivan emphasizes, "small enterprises, particularly those with working capital requirements, don’t always have 90 days to wait for a loan to arrive."

- Grants: Non-repayable funds from governments or organizations can provide significant support, though they often come with specific eligibility criteria and application processes. Obtaining a grant can be competitive, but it offers a valuable resource for companies that qualify.

- Crowdfunding: This method involves raising small amounts of money from a large number of people, typically through online platforms. It serves as an effective way to gauge market interest and build a customer base while securing funding.

- Angel Investors and Venture Capital: These options involve equity financing, where individuals or firms invest in exchange for ownership stakes. While they can offer substantial funding, they also require relinquishing a portion of authority over the enterprise.

When assessing these options, consider your enterprise model, financial situation, and growth plans. For instance, while bank loans may offer lower interest rates, they can also come with longer approval times and stricter requirements. In contrast, lines of credit provide immediate access to funds but may carry higher interest rates.

The pandemic has shifted the funding requirements of small enterprises towards survival instead of expansion, making it crucial for owners to learn how to secure financing amidst evolving funding alternatives. Nearly half of small and medium-sized enterprises still rely on outdated record-keeping techniques, which can obstruct their ability to present a strong case for funding.

At Finance Story, we recognize the significance of customized loan proposals and insights into loan repayment criteria, which can enable enterprises to learn how to secure financing strategically. We collaborate with a full range of lenders, including high street banks and innovative private lending panels, to assist you in purchasing various types of commercial properties, such as warehouses, retail premises, factories, and hospitality ventures. Case studies reveal that access to commercial credit is essential for survival and growth; however, many small enterprises hesitate to utilize credit due to perceived high costs.

Addressing these barriers can enhance their chances of success in a competitive market. The failure rate for firms operating for ten years is 65.7%, underscoring the importance of obtaining sufficient funding to mitigate risks and promote long-term viability.

Prepare Required Documentation for Application

When learning how to secure financing for a business, it is crucial to prepare a thorough collection of documents to improve your likelihood of approval. The following items are generally necessary:

- Plan: A well-organized plan is essential. It should encompass a comprehensive outline of your enterprise model, market analysis, and financial projections. A solid plan not only clarifies your vision but also demonstrates to financiers that you have a clear strategy for success. At Finance Story, we focus on developing refined and uniquely tailored cases that can greatly enhance your likelihood of obtaining funding.

- Financial Statements: Recent financial reports, including profit and loss statements, balance sheets, and cash flow statements, offer financiers insight into your organization's financial health. These documents should reflect your current operations and profitability, showcasing your ability to meet repayment criteria.

- Cash Flow Projections: Understanding your cash flow is vital. Lenders want to see projections that demonstrate your ability to manage expenses and revenues effectively, especially during slower months. This insight helps them evaluate your ability to make repayments reliably.

- Tax Returns: Both personal and corporate tax returns for the past two years are generally required. These documents assist creditors in evaluating your financial history and stability.

- Identification: Personal identification documents for all owners are necessary to verify identities and ownership.

- Collateral Documentation: If relevant, include documents that demonstrate ownership of assets intended to be used as collateral. This can strengthen your application by providing security for the loan, which is crucial for understanding how to get financing for a business.

Organizing these documents in advance not only streamlines the application process but also showcases your preparedness to potential lenders. Statistics show that companies with well-prepared documentation understand how to get financing for a business and have a significantly higher success rate in obtaining loans. For instance, a comprehensive strategy can be the determining factor in acquiring support, as illustrated by a situation where a café proprietor secured funding by showcasing a strong plan that encompassed sound financial forecasts and market analysis. This preparation is essential in today's competitive lending environment, where lenders seek clear evidence of an enterprise's potential for success. Moreover, verifying your eligibility for funding can be completed in merely 60 seconds, offering a swift evaluation of your choices. Remember, if you aren’t approved for a loan, you are more than your credit score, as noted by Samantha Novick, senior editor at Funding Circle. This perspective can assist small enterprise owners in managing the emotional challenges of the funding process. With Finance Story's reputation for professionalism and a deep understanding of the finance sector, you can trust that you are receiving guidance tailored to your unique needs.

Navigate the Financing Application Process

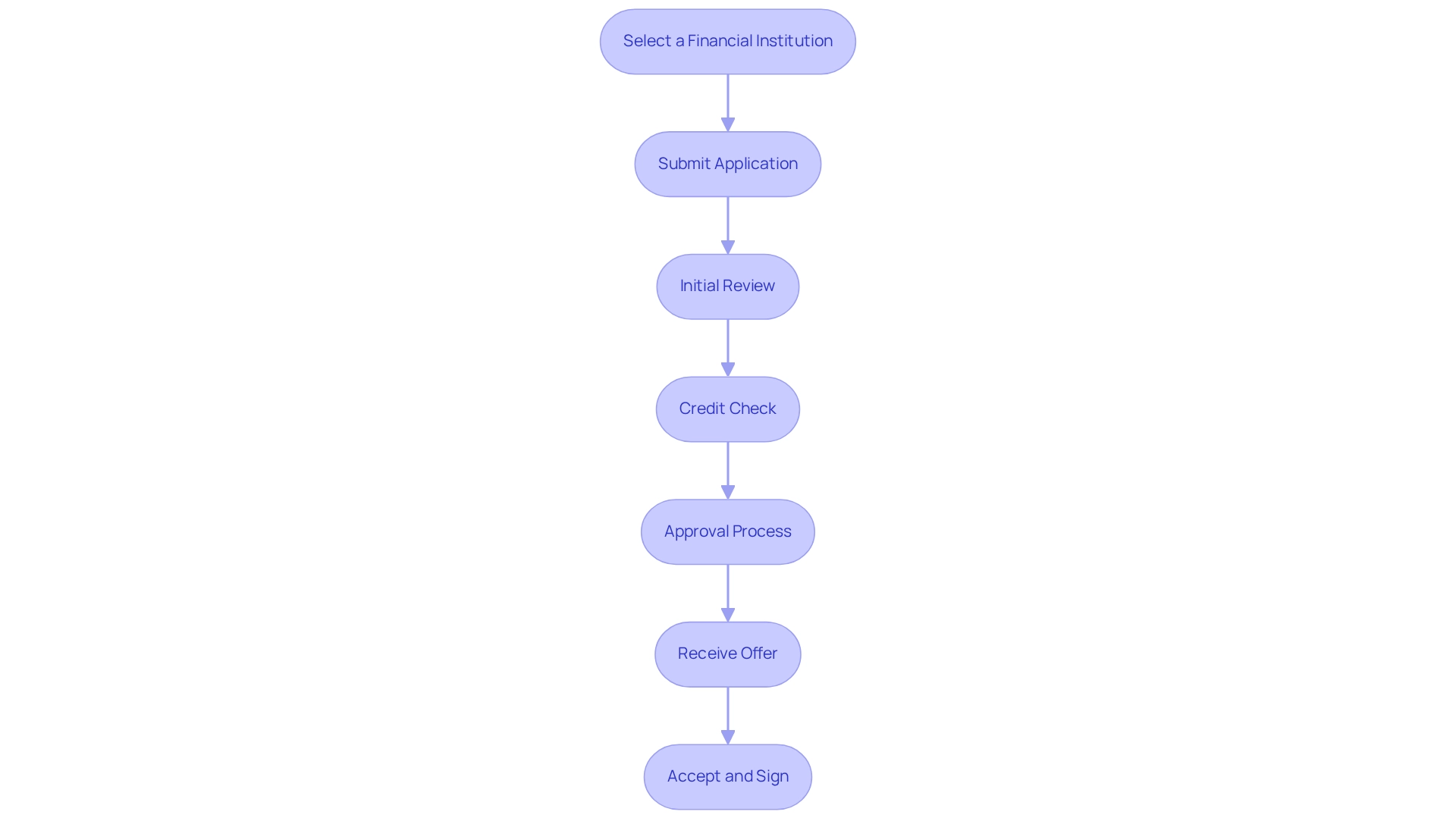

The funding application process typically involves several key steps that can streamline your path to securing support:

- Select a Financial Institution: Conduct thorough research to identify an entity that aligns with your business needs and financing objectives. Consider factors such as interest rates, financing terms, and customer service. It's essential to understand that financial institutions may have different criteria for commercial property loans, especially regarding loan-to-value ratios (LVR) and equity utilization. For instance, the maximum LVR for borrowing against commercial property is typically 70%.

- Submit Application: Fill out the application form correctly and send it with the required documentation, including financial statements and project plans. Be ready to showcase a refined business case that emphasizes your business's strengths and potential, as this can greatly affect the creditor's decision. Initial Review: The financial institution will conduct a preliminary assessment of your application and supporting documents to ensure completeness. This stage is crucial for identifying any potential issues early on.

- Credit Check: Be prepared for a credit check, which assesses your creditworthiness and financial history. A strong credit profile can enhance your chances of securing favorable loan terms.

- Approval Process: If your application passes the initial review, it will enter the underwriting stage, where the financial institution assesses the associated risks. Understanding the lender's repayment criteria and risk assessment methods can help you prepare better.

- Receive Offer: Upon approval, you will obtain a proposal that details the terms and conditions of the funding. Pay close attention to the details, especially regarding repayment schedules and any fees involved. Remember to consider additional costs such as valuation, legal, and stamp duty fees, which are important for a complete understanding of the financing process.

- Accept and Sign: Carefully review the offer, and if it meets your expectations, sign the agreement to complete the financing. Ensure that you comprehend all facets of the agreement, including any implications for your company's cash flow. Being proactive and responsive throughout this process can greatly accelerate approval. In 2025, the average duration required for small enterprise financing approval in Australia is roughly 2 to 4 weeks, influenced by the financial institution and complexity of the application. Moreover, understanding how to get financing for a business includes comprehending lender selection criteria, as statistics show that small enterprises emphasize aspects like interest rates, loan terms, and the lender's reputation when choosing a funding partner. Successful case studies emphasize that enterprises that uphold clear communication and offer thorough documentation often manage the funding application process more effectively, resulting in positive outcomes. Utilizing property equity and cash savings can also play a vital role in securing the necessary funds for your enterprise acquisition.

Understand Post-Application Expectations

After submitting your application, several important steps in the financing process await your attention:

- Waiting Period: The review process typically spans from a few days to several weeks, influenced by the financial institution's policies and the complexity of your application. In 2025, many creditors are streamlining their procedures, with some offering approvals within 24 to 48 hours, significantly reducing the waiting time for small enterprise loans.

- Communication: Maintaining open lines of dialogue with your creditor is essential. Expect to receive updates and possibly requests for additional information or clarification during the review. Statistics reveal that regular communication between lenders and small businesses can enhance the overall experience and expedite the process. Consider scheduling regular check-ins or promptly responding to inquiries to foster a productive dialogue.

- Approval Notification: Upon approval, you will receive a formal notification detailing the financing terms. This document is vital for understanding your obligations and the specifics of your financing. It is crucial to carefully review the financing proposal before proceeding to ensure you fully grasp the terms.

- Funding Timeline: After accepting the financing offer, funds are generally disbursed within a few days to a few weeks, depending on the lender's procedures. Patience and responsiveness during this phase are vital for a smooth funding experience. For example, Dark Horse Financial reported that an unsecured 5-year term loan was approved within 48 hours, illustrating the potential for rapid funding.

If your business operates within a lease or lacks a physical building, consider leveraging any equity in properties you own or utilizing cash savings for acquisitions. Understanding these post-application expectations can empower you to navigate the financing process more effectively, ensuring you are prepared for each stage. Additionally, if you have concerns about your credit score, be aware that some lenders offer specialized products for borrowers with less-than-perfect credit histories, which can broaden your financing options.

Conclusion

Understanding the intricacies of business financing is essential for small business owners seeking to navigate a complex economic landscape. This article has explored the two primary types of financing: debt and equity, emphasizing the growing trend towards debt financing as small businesses increasingly rely on loans for growth and operational support. With a significant percentage of businesses now opting for traditional funding sources, the importance of a strategic approach in securing the right capital cannot be overstated.

Assessing financial needs and goals plays a pivotal role in determining the most suitable financing options. By accurately calculating total funding requirements and setting clear financial objectives, entrepreneurs can effectively position themselves to secure the necessary resources for success. The variety of financing options available—ranging from bank loans and lines of credit to grants and crowdfunding—offers diverse paths for business owners, each with its own advantages and challenges.

Preparation is key when navigating the financing application process. A well-structured business plan, comprehensive financial statements, and organized documentation can significantly enhance approval chances. Understanding the expectations post-application, including communication with lenders and the funding timeline, is equally crucial in ensuring a smooth financing experience.

Ultimately, the landscape of small business financing is evolving, and staying informed about the latest trends and financing options is vital. By equipping themselves with knowledge and tailored strategies, entrepreneurs can make informed decisions that not only meet their immediate funding needs but also support their long-term growth and sustainability. Embracing a balanced approach to financing will empower small business owners to thrive in a competitive market.