Overview

Securing a loan for commercial investment property involves navigating several essential steps.

- Borrowers must assess their financial needs.

- Research potential lenders.

- Prepare the necessary documentation.

- Ultimately submit their applications.

Understanding the specific requirements of commercial loans is crucial; these often include higher down payments and a robust credit profile. By grasping these factors, borrowers can significantly enhance their chances of approval and successfully secure financing.

Introduction

Navigating the world of commercial real estate presents a formidable challenge, especially when securing financing for investment properties. With loan amounts commencing at $500,000 and interest rates frequently exceeding those of residential mortgages, grasping the intricacies of commercial loans is essential for aspiring investors. This article explores the critical steps and strategies necessary for obtaining a loan for commercial investment property, providing insights into various loan types and the application process.

What are the pivotal factors that can determine a borrower’s likelihood of approval in this competitive landscape?

Understand Commercial Real Estate Loans

Commercial real estate financing is specifically tailored for the acquisition, refinancing, or development of properties utilized for business purposes. These loans exhibit significant differences from residential mortgages in several key aspects:

- Loan Amounts: Commercial loans typically commence at $500,000, reflecting the larger scale of investment compared to residential loans.

- Interest Rates: Interest rates for business real estate financing in 2025 range from 6.2% to 9.5%, generally higher than those for residential mortgages due to the increased risk associated with business properties.

- Loan Terms: The conditions for business loans typically span from 5 to 20 years, with amortization periods that may extend beyond the loan term, allowing for flexibility in repayment.

- Down Payments: Borrowers should anticipate a larger down payment, usually between 20% to 30% of the property's value, which is a standard requirement owing to the elevated risk profile of investment properties.

Understanding these elements is crucial for anyone considering how to get a loan for commercial investment property, as they directly influence the overall cost and feasibility of the investment. Finance Story specializes in creating polished and highly individualized business cases to present to banks, ensuring that borrowers can navigate the complexities of securing funds effectively. Our extensive network includes a full range of lenders, from high street banks to innovative private lending panels, catering to various property types such as warehouses, retail premises, factories, and hospitality ventures.

Financial specialists observe that the distinctions between business and residential financing can greatly influence a borrower's approach and results. For instance, while residential loans often cater to individual homebuyers with lower down payment requirements, business loans necessitate a more robust financial profile and a clear investment strategy to secure favorable terms.

Successful case studies demonstrate that astute investors who understand how to get a loan for commercial investment property and partner with the appropriate funding sources while presenting detailed financials can navigate the complexities of commercial financing effectively. As the market evolves, staying informed about interest rate trends and lender requirements will be essential for achieving investment goals. It is recommended for borrowers to ensure they possess detailed financials and a robust credit profile to enhance their chances of approval. If you're considering a business property investment, contact Finance Story to discover customized financing options that suit your requirements.

Explore Types of Commercial Loans

When considering financing for commercial investment properties, understanding the various types of loans available is essential, as each is tailored to meet specific needs:

-

Standard Commercial Loans: These traditional loans are utilized for purchasing or refinancing commercial properties. They typically require a solid plan and thorough financial documentation, ensuring lenders can evaluate the feasibility of the investment. Finance Story focuses on crafting refined and highly customized proposals to present to banks, significantly improving the likelihood of obtaining these funds.

-

SBA Financing: Supported by the Small Business Administration, this funding is especially beneficial for small enterprises. Offering favorable terms, including lower down payments and extended repayment periods, it becomes an attractive option for those looking to invest in commercial real estate.

-

Bridge Financing: Created for short-term funding, bridge financing offers immediate resources until a more permanent solution is secured. Commonly used in real estate transactions, it allows investors to act quickly in competitive markets.

-

Hard Money Financing: These asset-based funds, offered by private lenders, usually feature higher interest rates. They are suitable for borrowers who need quick access to funds, often for urgent investment opportunities.

-

Construction Financing: Specifically intended for funding the development of new business properties, these funds are disbursed in stages as construction advances. This structure allows borrowers to manage cash flow effectively while ensuring that funds are available as needed.

By understanding how to get a loan for commercial investment property, you can make informed decisions that align with your financial goals and investment strategies.

Follow Steps to Apply for a Commercial Loan

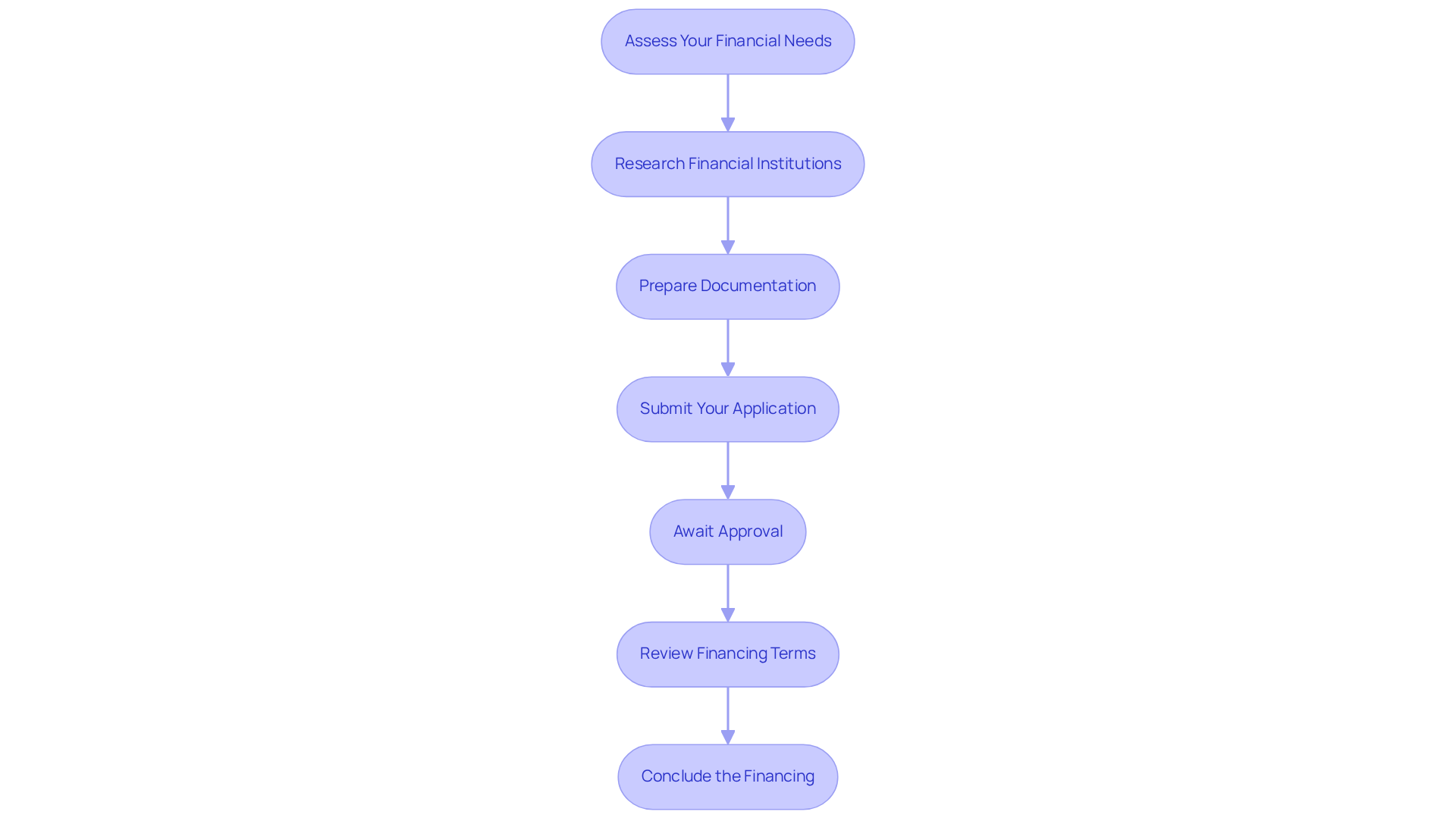

Applying for a commercial loan entails several critical steps that can greatly influence your approval chances.

-

Assess Your Financial Needs: Begin by clearly defining the amount of funding you require and its intended purpose. This evaluation not only aids in selecting the right financing but also helps articulate your needs to potential financiers.

-

Research Financial Institutions: Investigate various financial entities and their loan offerings, focusing particularly on those that specialize in commercial loans. A comprehensive understanding of the market landscape will enable you to identify the best fit for your financial situation.

-

Prepare Documentation: Gather all necessary documents, including financial statements, tax returns, and a detailed project plan. Statistics indicate that thorough documentation can expedite the approval process, as lenders typically seek detailed insights into your financial health and business strategy.

-

Submit Your Application: Diligently complete the financing application form and submit it along with your documentation. Ensure that all information is accurate and current to prevent any delays.

-

Await Approval: Following your submission, the lender will review your application. Be ready for potential follow-up questions or requests for additional information, as this is a standard part of the evaluation process.

-

Review Financing Terms: If your application receives approval, carefully scrutinize the terms and conditions of the financing. Understanding the implications of interest rates, repayment schedules, and any associated fees is vital before making a commitment.

-

Conclude the Financing: Once you agree to the terms, finalize the arrangement by signing the necessary documents and obtaining your funds. This step signifies the commencement of your financial journey with the new capital.

By adhering to these steps, you can streamline your application process and enhance your likelihood of securing the funding necessary for your investment property.

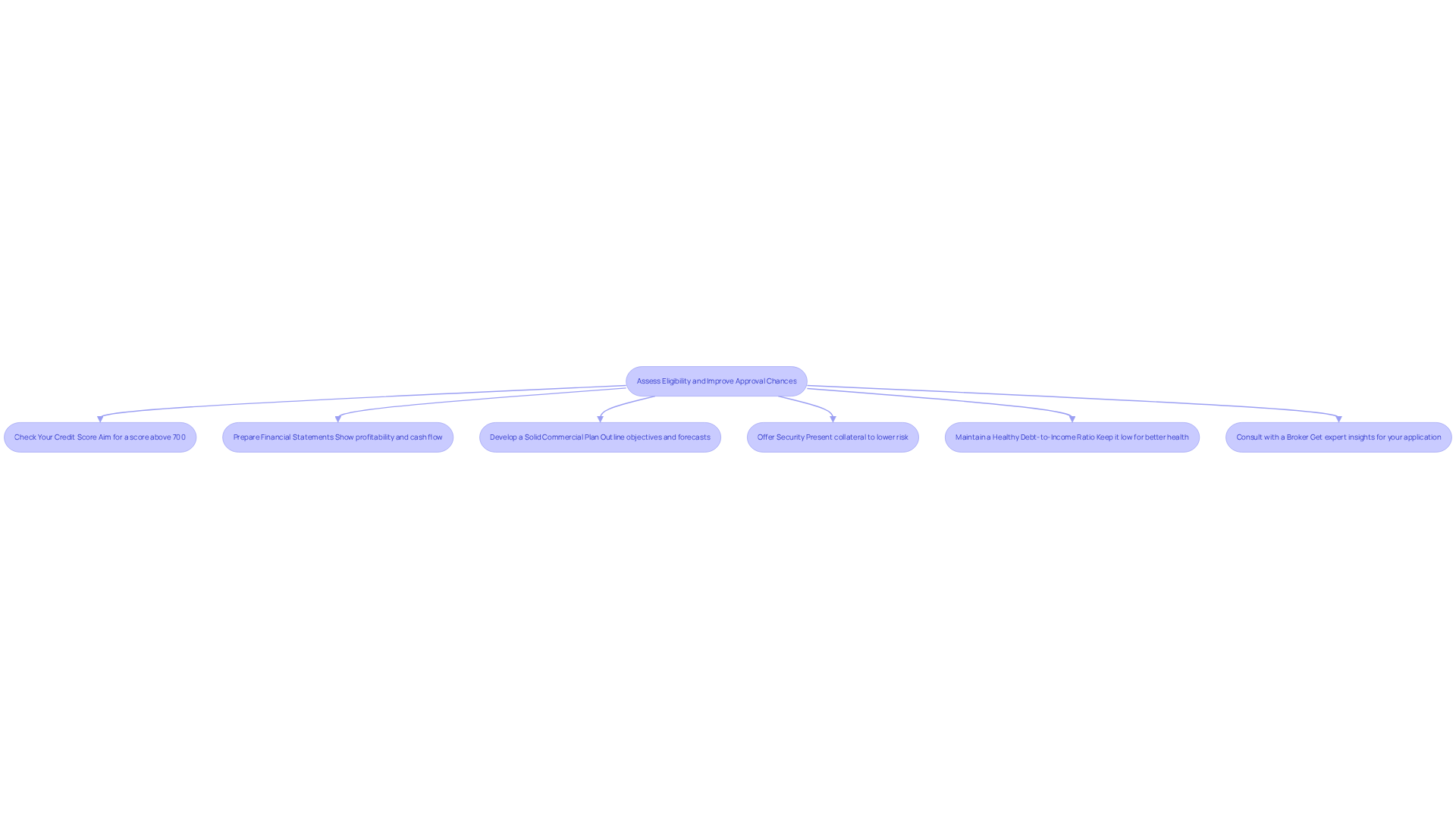

Assess Eligibility and Improve Approval Chances

To enhance your chances of securing a commercial loan, consider the following strategies:

- Check Your Credit Score: A strong credit score is essential for loan approval. Aim for a score above 700, as this significantly improves your chances. Notably, the average credit score in Australia is currently 855, categorizing it as 'excellent', which reflects the importance of maintaining good credit habits. Financial advisors emphasize that a higher credit score not only increases your chances of approval but can also lead to better loan terms.

- Prepare Financial Statements: Ensure your financial statements are accurate and up-to-date. These documents should distinctly demonstrate your company's profitability and cash flow, as creditors often examine them to evaluate financial health. In today's financial environment, having well-prepared financial statements is more essential than ever, as they provide lenders with a clear view of your enterprise's viability.

- Develop a Solid Commercial Plan: A well-structured commercial plan is crucial. It should outline your commercial objectives, market analysis, and financial forecasts. Statistics suggest that companies with comprehensive plans have a greater chance of obtaining loans, as they show readiness and strategic thinking. A robust enterprise plan that includes comprehensive market analysis and financial projections can greatly enhance your application. At Finance Story, we focus on developing refined and highly personalized business cases to present to financial institutions, improving your chances of approval.

- Offer Security: Presenting collateral can greatly lower the risk for creditors and enhance your borrowing conditions. This not only enhances your application but also shows lenders that you are committed to the investment.

- Maintain a Healthy Debt-to-Income Ratio: Lenders prefer borrowers with a lower debt-to-income ratio, which indicates better financial health. Maintaining this ratio under control can create a significant impact on your application for credit.

- Consult with a Broker: Engaging with a mortgage advisor who specializes in business financing can provide valuable insights and streamline the application process. Their expertise can help you navigate complex requirements and improve your chances of approval. At Finance Story, we have a full range of lenders to suit your circumstances, ensuring you find the right financing solution for your needs, including options for refinancing your existing loans.

By implementing these strategies, you can position yourself as a strong candidate for commercial financing, ultimately increasing your likelihood of securing the necessary funds for your investment property.

Conclusion

Navigating the world of commercial investment property financing necessitates a clear understanding of the distinct characteristics of commercial real estate loans. Unlike residential mortgages, these loans vary significantly in amounts, interest rates, down payment requirements, and loan terms. Recognizing these differences is crucial for any investor aiming to secure funding for their business property, as they directly influence the investment's feasibility and overall cost.

This article has highlighted key strategies for obtaining a commercial loan, including:

- Assessing financial needs

- Researching financial institutions

- Preparing thorough documentation

- Understanding eligibility requirements

Furthermore, the importance of maintaining a strong credit score, developing a solid commercial plan, and engaging with financial experts cannot be overstated. These elements collectively enhance the likelihood of securing favorable loan terms and achieving successful financing outcomes.

Ultimately, approaching the commercial loan process with informed strategies and a well-prepared application can significantly improve the chances of approval. For those considering an investment in commercial real estate, leveraging these insights and seeking tailored financing options can pave the way to achieving investment goals. Embracing this knowledge not only empowers investors but also positions them for success in a competitive market.