Overview

Securing a commercial real estate loan with no money down is not just a dream; it can be a reality through various options. Consider alternatives like:

- Seller financing

- Lease options

- Government-backed financing

- Partnerships

- Creative financing strategies

These avenues empower borrowers to enter the commercial property market without the burden of upfront capital. By leveraging innovative financial arrangements, you can enhance your chances of success.

However, it's crucial to emphasize the importance of a strong financial profile. A well-prepared financial background significantly boosts the likelihood of loan approval. Are you ready to explore these financing options and take the next step in your commercial real estate journey? With the right strategies in place, you can navigate the complexities of financing and unlock new opportunities in the market.

Introduction

Navigating the world of commercial real estate can be daunting, particularly when the prospect of securing a loan without a down payment appears out of reach. As we look ahead to the evolving market of 2025, innovative financing options are emerging, presenting new pathways for aspiring investors.

This article explores the strategies and opportunities available for obtaining a commercial real estate loan with no money down, challenging the traditional notion that significant upfront capital is a necessity.

What if the key to entering the commercial property market lies in creative financing solutions rather than conventional methods? By embracing these alternatives, you may find that the barriers to entry are not as insurmountable as they seem.

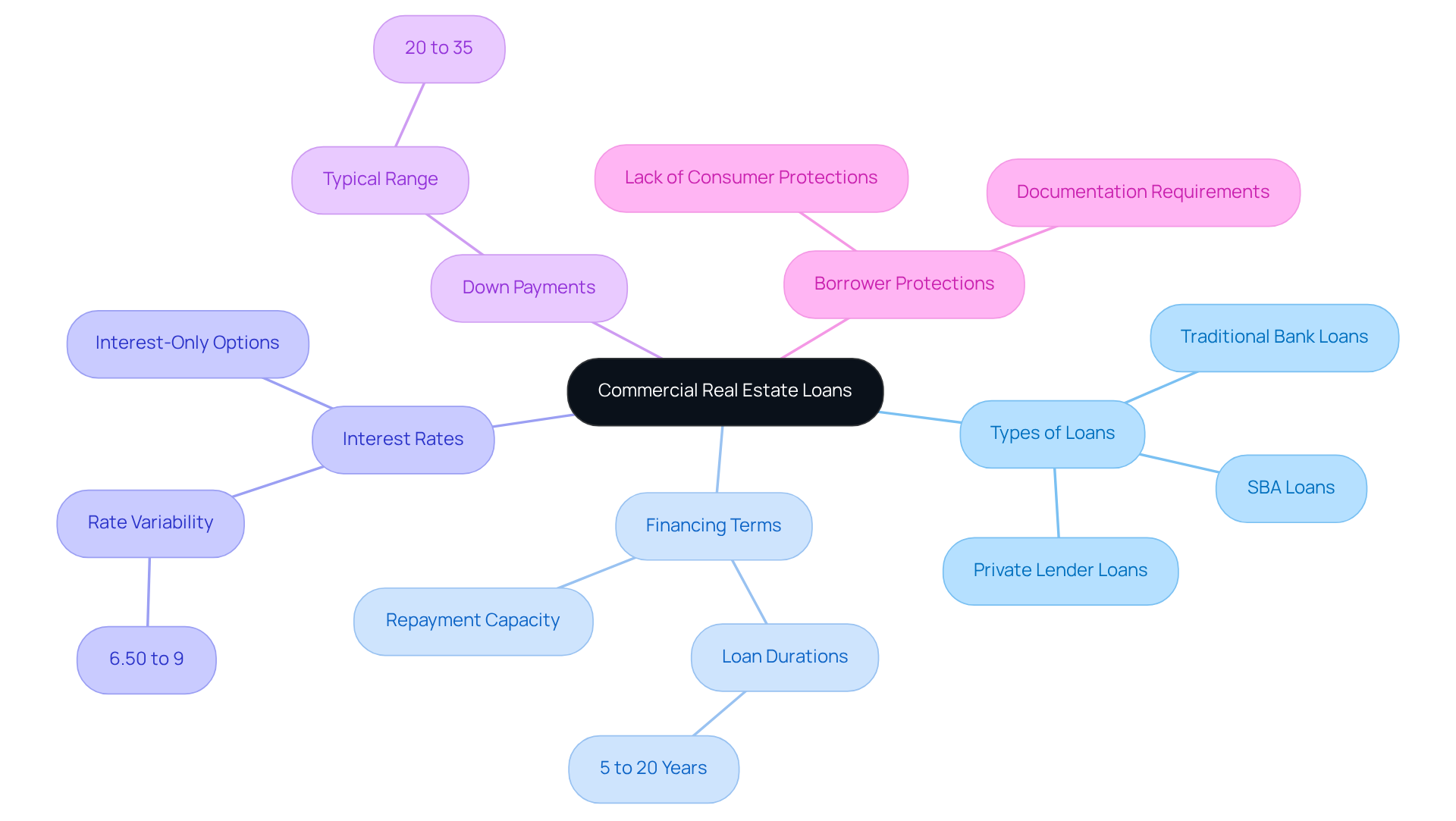

Understand Commercial Real Estate Loans

Commercial real estate financing options serve as specialized resources for acquiring or refinancing properties designated for commercial purposes. As we step into 2025, the landscape of these loans reflects evolving market trends and borrower needs, underscoring several key distinctions from residential mortgages.

Types of Loans: Common options encompass traditional bank loans, SBA loans, and private lender loans. Each type presents distinct terms and conditions tailored to various commercial requirements. At Finance Story, we excel in crafting polished and highly individualized business cases to present to lenders, ensuring you secure the right financing for your commercial investment.

Financing Terms: Typically, commercial financing options feature shorter durations, spanning from 5 to 20 years, in contrast to residential financing, which can extend up to 30 years. This shorter duration often necessitates a greater capacity for repayment, and our team is here to assist you in navigating these terms effectively.

Interest Rates: Interest rates for business financing can vary widely, influenced by factors such as the lender's risk evaluation, the borrower's creditworthiness, and the property's type and location. As of 2025, average rates in Melbourne range from approximately 6.50% to over 9%, contingent on the specifics of the financing. Furthermore, interest-only financing options may be available, which can carry higher rates and require a stronger financial position or lower value-to-equity ratios (LVR) to mitigate risk.

Down Payments: Unlike residential financing, commercial financing generally necessitates larger down payments, typically ranging from 20% to 35% of the property's value. This requirement emphasizes the importance of financial preparedness when pursuing commercial financing, and our expertise can guide you in structuring your finances to meet these demands.

It's crucial to recognize that commercial property borrowers do not enjoy the same consumer protections as home lending, as commercial lending is not regulated by the NCCP. Understanding these factors is essential for anyone seeking to secure a commercial real estate financing option, particularly when considering how to get a commercial real estate loan with no money down. Successful applications often hinge on presenting a robust financial profile and a well-organized plan, which includes providing personal details, tax returns, and property-related documents. This comprehensive approach can significantly enhance the likelihood of approval and favorable terms, and at Finance Story, we are dedicated to supporting you throughout this process.

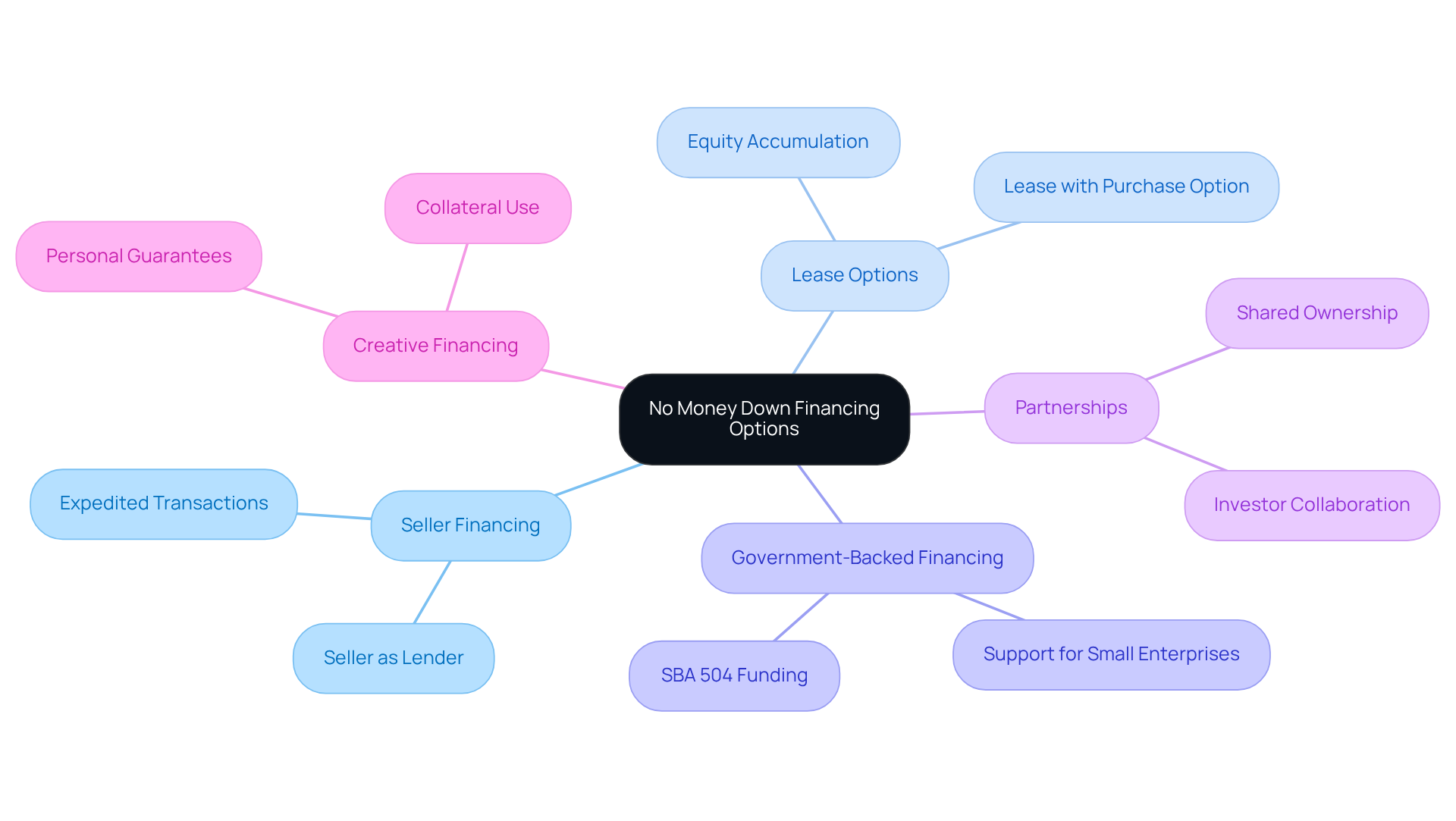

Explore No Money Down Financing Options

Securing a commercial real estate loan without a traditional down payment is achievable through several innovative financing options:

-

Seller Financing: Here, the seller assumes the role of the lender, allowing the buyer to make payments directly to them rather than a bank. This option is particularly advantageous if the seller is motivated to sell quickly, as it can expedite the transaction process.

-

Lease Options: This strategy involves leasing the property with an option to purchase it later. A portion of the lease payments may be credited toward the purchase price, effectively enabling the buyer to accumulate equity over time without an initial cash outlay.

-

Government-Backed Financing: Programs such as the SBA 504 funding can provide capital with little to no down payment, particularly for qualified small enterprises. These financial aids aim to promote business expansion, serving as a lifeline for startups and growing companies.

-

Partnerships: Forming a partnership with an investor who can provide the down payment is another viable option. This approach allows you to leverage their capital while sharing ownership of the property, facilitating entry into the commercial real estate market.

-

Creative Financing: Additional methods include utilizing personal guarantees, collateral, or cash substitutes to secure funding without a cash down payment. These strategies can assist you in navigating the intricacies of financing while minimizing initial expenses.

By exploring these options, you can effectively understand how to get a commercial real estate loan with no money down, even if you lack upfront capital. Notably, recent trends indicate that approximately 14% of commercial real estate agreements are linked to seller financing, highlighting its growing appeal as a viable financing approach.

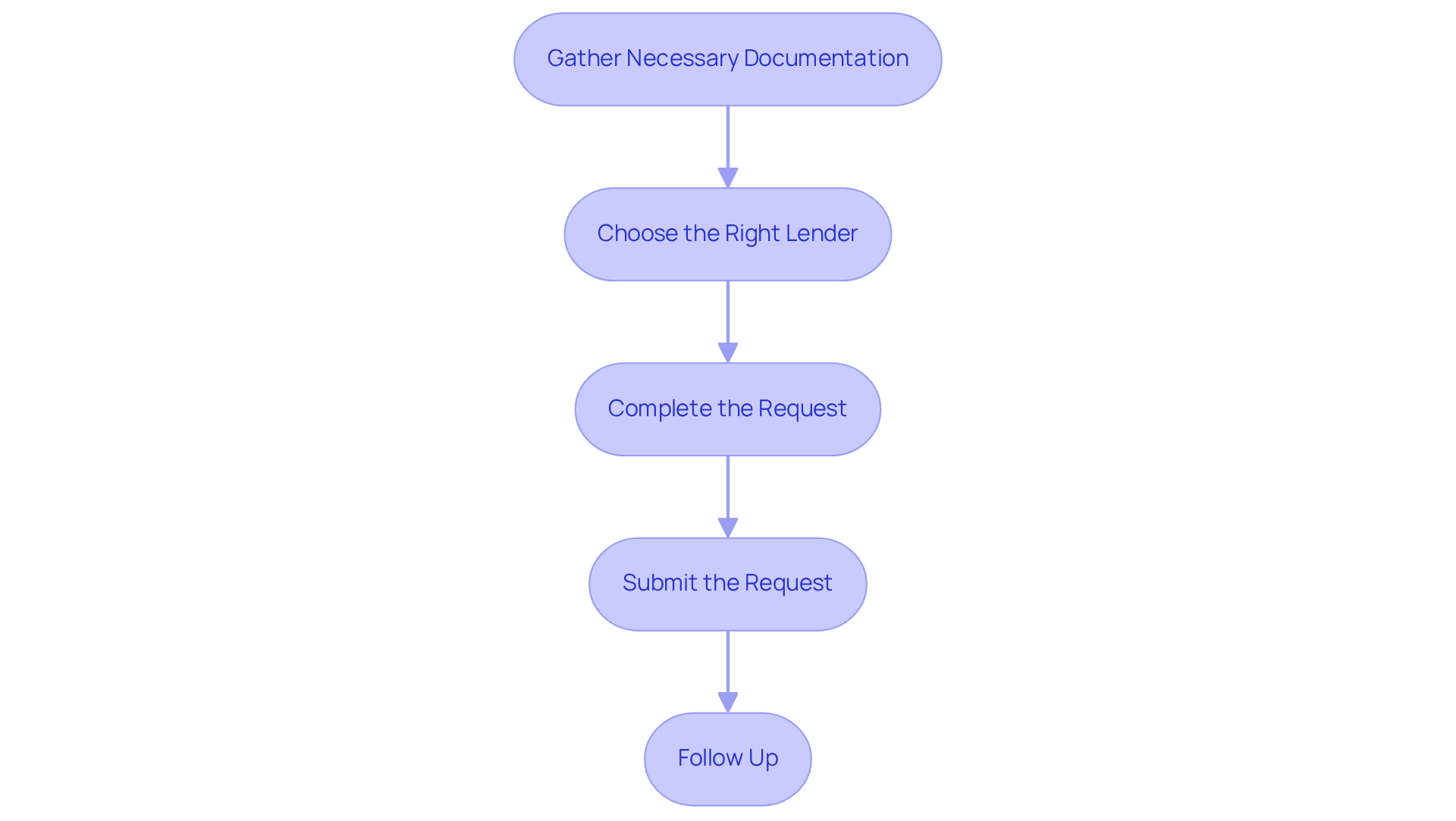

Prepare and Submit Your Loan Application

To successfully prepare and submit your loan application, follow these essential steps:

-

Gather Necessary Documentation: Collect all required documents, including business financial statements (profit and loss, balance sheets), personal financial statements, tax returns for the past two years, and a comprehensive business plan outlining your goals and how the property fits into them.

-

Choose the Right Lender: Research various lenders to find one that offers favorable terms for your situation. Consider factors such as interest rates, fees, and customer service, as these can significantly impact your financing experience.

-

Complete the Request: Fill out the loan request form accurately. Be prepared to provide detailed information about your business operations, financial health, and the property you wish to purchase. Lenders often look for a clear understanding of your business model.

-

Submit the Request: Once your request is complete, submit it along with all supporting documents. Ensure that everything is organized and clearly labeled to facilitate the review process. A well-prepared submission can expedite approval.

-

Follow Up: After submission, proactively follow up with the lender to confirm receipt of your request and inquire about the timeline for approval. This method not only demonstrates your dedication but also helps keep your submission on course.

By carefully crafting your submission, you significantly improve your likelihood of understanding how to get a commercial real estate loan with no money down, particularly in an environment where 59% of small enterprises indicate being in fair or poor economic condition. Understanding what lenders seek can further enhance your proposal, making it vital to present a persuasive case for your financing requirements.

Troubleshoot Common Loan Application Issues

Even with meticulous preparation, challenges can arise during the loan submission process. Understanding these prevalent issues and implementing effective strategies to troubleshoot them is essential:

-

Incomplete Documentation: It is crucial to ensure that all required documents are submitted. Examine your submission carefully for any missing information. If a lender requests additional documents, respond promptly to avoid processing delays. Finance Story can assist you in gathering and organizing your documentation to streamline this process.

-

Low Credit Score: A lower-than-expected credit score can obstruct your request. In Australia, credit scores range from 0 to 1,200. To enhance your score before applying, focus on paying off outstanding debts, correcting inaccuracies on your credit report, and refraining from new credit inquiries. Maintaining a credit utilization ratio below 30% is advisable, and consistently paying bills on time is crucial. Finance Story offers insights and strategies to help you improve your credit profile prior to application.

-

Insufficient Cash Flow: Lenders require evidence that your business generates sufficient income to cover loan payments. If cash flow is limited, consider providing additional financial forecasts or obtaining a co-signer with a stronger financial background to bolster your request. Our team at Finance Story can help you prepare compelling financial documentation to support your case.

-

Property Appraisal Issues: Should the property appraise for less than anticipated, you may need to renegotiate the purchase price or offer additional collateral. Be prepared to discuss the property's potential value and any improvements that could enhance its worth with the lender. Finance Story's market expertise can provide you with valuable insights on how to approach these discussions effectively.

-

Lender Communication: Maintain open lines of communication with your lender throughout the process. If issues arise, reach out for guidance. Lenders can offer valuable perspectives on potential delays or issues, assisting you in managing the process more effectively. With Finance Story, you have a dedicated partner who will advocate for you and ensure that your concerns are addressed promptly.

By understanding these common challenges and knowing how to address them, you can significantly enhance your chances of a successful loan application. Remember that improving your credit score typically requires several months of consistent effort, so start early to position yourself optimally.

"I will certainly be suggesting your services to anyone. We are finished with the constant worry. Once again, thank you so much for being a part of our journey." - Natasha B, VIC

Finance Story understands business like no other. We are becoming synonymous with finding solutions even in challenging circumstances. With access to a comprehensive portfolio of private, boutique commercial investors, in addition to standard financing providers, we have all the choices available to discuss with you.

Conclusion

Securing a commercial real estate loan without an upfront cash payment is not only achievable but can also serve as a strategic advantage for aspiring investors. By understanding the diverse financing options available—such as seller financing, lease options, and government-backed programs—individuals can effectively navigate the complexities of commercial loans, positioning themselves for success in the competitive real estate market.

Key insights from this discussion emphasize the importance of thorough preparation when applying for a loan:

- Gathering necessary documentation

- Selecting the right lender

- Addressing common application issues

These are critical steps that can significantly influence the approval process. Furthermore, exploring creative financing methods and understanding lender expectations can enhance the likelihood of securing favorable terms.

Ultimately, the journey to acquiring a commercial real estate loan with no money down demands a proactive approach and a willingness to explore various financing avenues. By leveraging available resources and seeking expert assistance, potential borrowers can overcome financial barriers and confidently embark on their commercial real estate ventures. Embracing these strategies not only opens doors to investment opportunities but also empowers individuals to take control of their financial future in the realm of commercial real estate.