Overview

To secure a commercial loan for rental property, prospective borrowers must prepare essential documentation, select a suitable lender, and navigate the application process effectively.

- A strong credit rating is crucial.

- Understanding loan terms and comparing lender options are critical steps that enhance the likelihood of securing favorable financing conditions.

Are you ready to take the next step in your investment journey? By following these guidelines, you can position yourself for success in obtaining the financing you need.

Introduction

Navigating the world of commercial loans for rental properties can indeed be a daunting task, particularly as the market evolves and financing options grow increasingly complex. Understanding the nuances of these loans is vital for investors aiming to capitalize on lucrative rental opportunities. This guide presents a comprehensive, step-by-step approach to securing a commercial loan, emphasizing essential documentation, lender evaluation, and negotiation tactics.

With numerous lenders and loan types available, how can investors ensure they are making the most informed choice for their financial future?

Understand Commercial Loans for Rental Properties

Business financing for rental assets is specifically designed to support income-producing investments, which is essential for understanding how to get a commercial loan for rental property through leasing. In contrast to home mortgages, these financing options typically necessitate a larger initial payment, generally ranging from 20% to 30% of the asset's value. By 2025, borrowers can expect to secure financing of up to 75% of the asset's value, with limits reaching up to $2 million, while assets exceeding $5 million may require individual evaluations. These loans can be structured in various formats, including fixed-rate, variable-rate, or interest-only options, thereby offering flexibility tailored to the investor's strategy.

At Finance Story, we specialize in crafting refined, highly customized business cases to present to banks, ensuring you have the best opportunity to secure the appropriate funding for your commercial real estate investment. We collaborate with a diverse range of lenders, including high street banks and innovative private lending panels, to present you with the most advantageous options available. Understanding critical terms such as loan-to-value ratios (LVR) and debt service coverage ratios (DSCR) is essential. Lenders evaluate both the asset's income potential and the borrower's financial stability to determine eligibility. A strong credit rating is crucial for obtaining favorable conditions; thus, enhancing your credit rating and saving for larger deposits can significantly increase your chances of a successful application. Furthermore, refinancing options are available to adapt your financing strategy as your business evolves. Familiarizing yourself with these concepts will prepare you for the subsequent stages of the application process, ultimately improving your likelihood of knowing how to get a commercial loan for rental property investment. Additionally, with the national rental vacancy rate in Australia reported at only 1.3% in July 2024, grasping the competitive rental market landscape is vital for prospective investors.

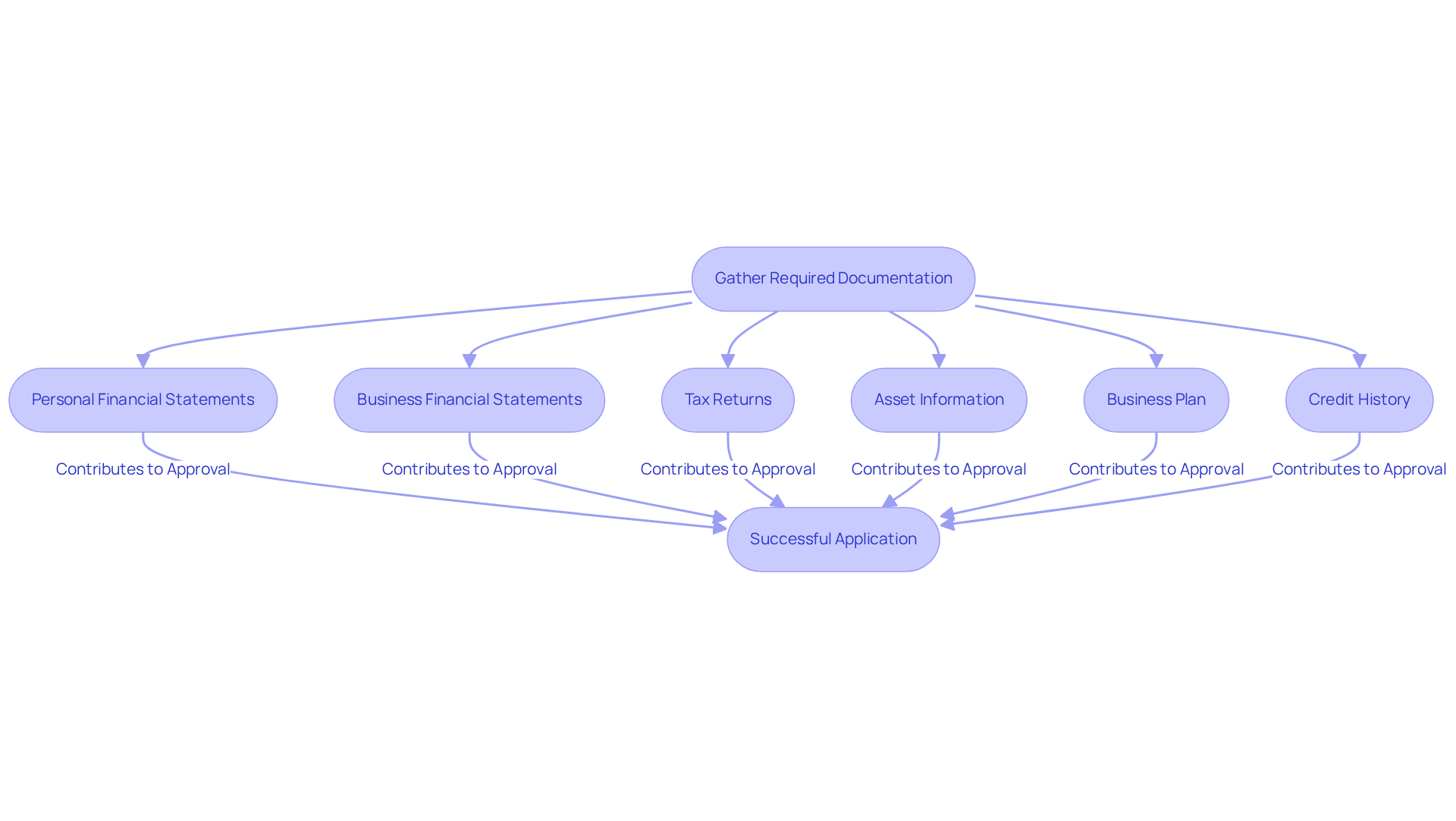

Gather Required Documentation for Your Application

To understand how to get a commercial loan for rental property, one must meticulously prepare several essential documents that play a crucial role in the approval process. Here’s a breakdown of the key documentation needed:

- Personal Financial Statements: These documents should thoroughly outline your assets, liabilities, and net worth, providing creditors with a clear view of your economic status.

- Business Financial Statements: Include profit and loss statements, balance sheets, and cash flow statements for the past two years. These documents illustrate your business's economic health and operational performance.

- Tax Returns: Submit personal and business tax returns for the last two years. This information helps lenders verify your income and assess your financial stability.

- Asset Information: Collect the asset’s purchase agreement, lease agreements, and any existing asset appraisals. This data is vital for evaluating the investment's potential.

- A well-structured business plan that includes how to get a commercial loan for rental property, along with your investment strategy and projected income, is essential. It showcases your vision and preparedness to manage the investment effectively.

- Credit History: Lenders will review your credit report to assess your creditworthiness. A strong credit history can significantly enhance your chances of approval.

Organizing these documents in advance can streamline the application process, reducing delays and unexpected expenses. Based on industry insights, the typical duration to collect these documents can vary from a few days to multiple weeks, depending on the intricacy of your economic situation. For instance, a case analysis concerning a business proprietor in Brisbane emphasized that careful preparation of accounts resulted in a successful funding request, illustrating the significance of having all essential documentation prepared.

In 2025, financial institutions are increasingly emphasizing the need for detailed personal and business financial statements, as they provide a comprehensive view of the applicant's financial capabilities. Ensuring that these documents are precise and current is essential for a successful application for credit. At Finance Story, we provide access to a complete variety of financial institutions, including high street banks and creative private lending panels, to assist you in understanding how to get a commercial loan for rental property or refinancing choices.

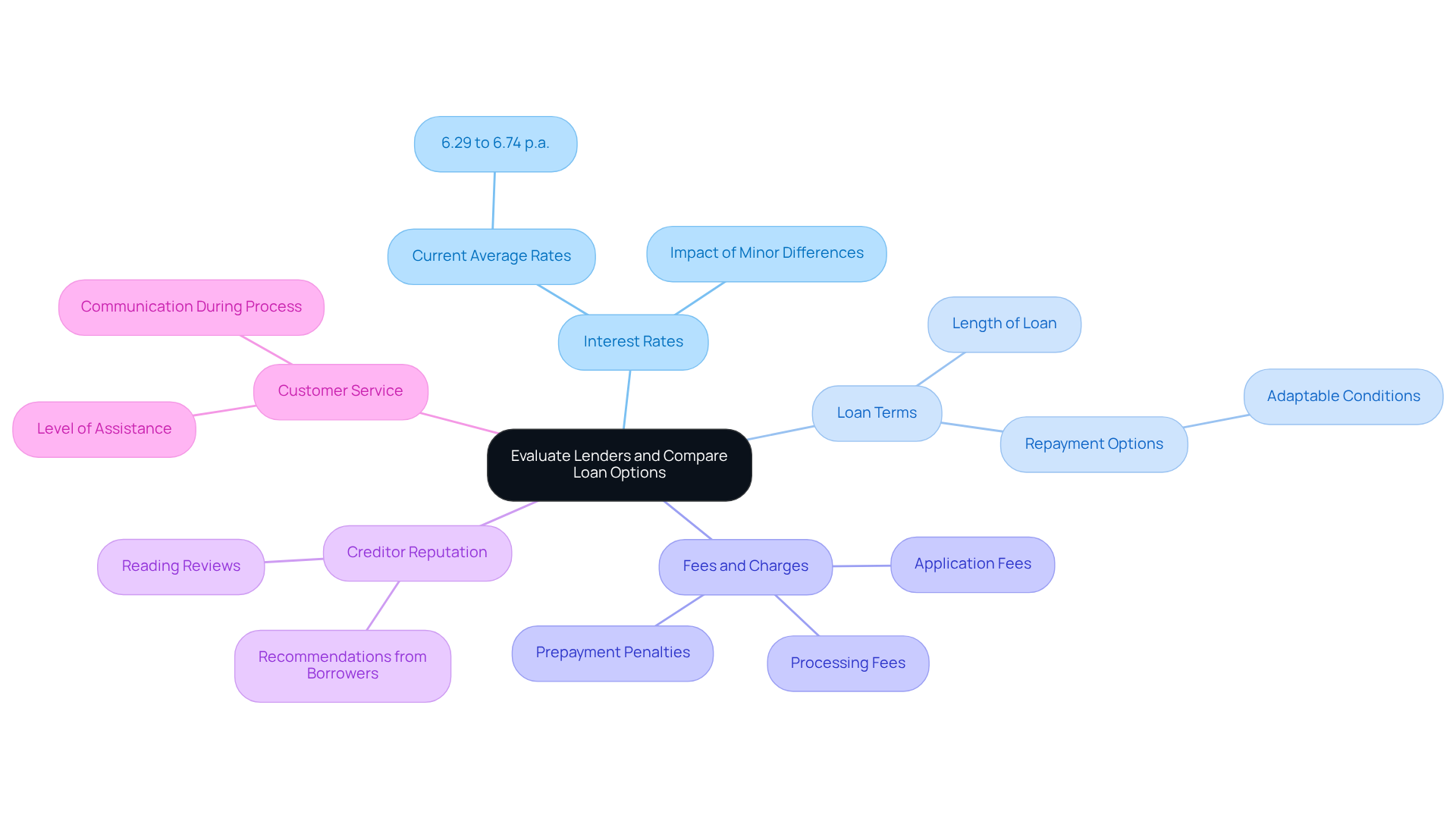

Evaluate Lenders and Compare Loan Options

When evaluating lenders for your commercial loan, it is essential to consider several key factors that can significantly impact your financial outcomes.

- Interest Rates: Comparing the interest rates offered by various lenders is crucial. Even a minor difference can lead to substantial variations in your total repayment costs. For instance, current average interest rates for commercial financing in Australia for 2025 range from 6.29% to 6.74% per annum, depending on the amount and terms.

- Loan Terms: Examine the length of the loan and the repayment options available. Some financiers may offer adaptable conditions that better suit your cash flow requirements, which can be especially advantageous for managing rental property costs.

- Fees and Charges: Be vigilant about any additional fees, including application fees, processing fees, and potential prepayment penalties. Understanding these costs upfront can prevent unexpected financial burdens later.

- Creditor Reputation: Investigate the creditor's standing by reading reviews and seeking recommendations from other borrowers. A creditor's track record can provide valuable insights into their reliability and service quality.

- Customer Service: Evaluate the level of assistance and communication you can expect during the financing process. An institution that prioritizes customer service can significantly enhance your borrowing experience.

By carefully analyzing these elements, you can select a provider that aligns with your financial goals and increases your chances of understanding how to get a commercial loan for rental property with favorable financing conditions.

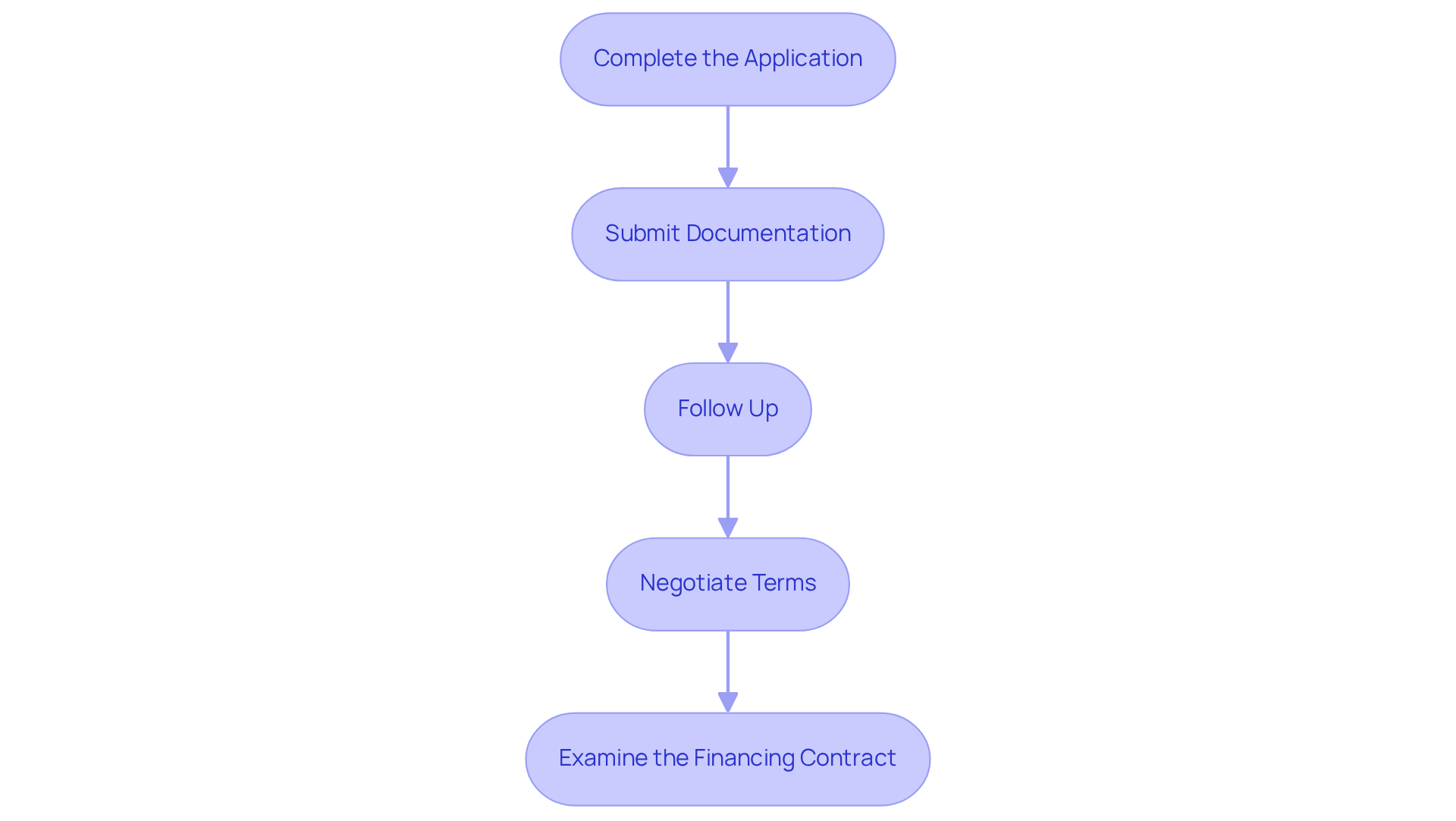

Submit Your Application and Negotiate Terms

To successfully secure a commercial loan, follow these essential steps after selecting a lender and preparing your application:

- Complete the Application: Accurately fill out the financial institution's application form, ensuring all required information is included to avoid unnecessary delays.

- Submit Documentation: Attach all necessary documentation to your application. Thoroughly check for completeness to facilitate a smooth review process.

- Follow Up: After submission, promptly follow up with the lender to confirm receipt of your application and inquire about the expected timeline for processing.

- Negotiate Terms: Upon receiving a financial offer, engage in negotiations. Discuss interest rates, repayment terms, and any associated fees. Leverage competing offers to strengthen your position and secure more favorable terms. If you're uncertain about the negotiation process, consider reaching out to Finance Story for valuable insights and customized monetary strategies.

- Examine the Financing Contract: Before signing, thoroughly examine the financing contract to ensure all terms correspond with your discussions. Pay attention to any restrictive covenants that may limit your business operations and seek clarification on any unclear points to avoid future misunderstandings.

By following these steps, you can effectively navigate the commercial financing application process and understand how to get a commercial loan for rental property that aligns with your financial objectives. Remember, 68% of small business owners say access to financing is the most important factor in the growth of their businesses, making it crucial to secure favorable loan terms. Additionally, to explore a full range of lenders and refinancing options tailored to your needs, book your free personalized consultation with Shane Duffy, Head of Funding Solutions at Finance Story.

Conclusion

Understanding the intricacies of obtaining a commercial loan for rental property is crucial for any investor aiming to excel in this competitive market. This guide offers a comprehensive roadmap, emphasizing the significance of preparation, thorough documentation, and strategic lender evaluation to secure the most advantageous financing options available.

Key insights include:

- The necessity of compiling detailed financial documentation.

- Assessing lenders based on interest rates, loan terms, and customer service.

- Navigating the essential steps of submitting a loan application and negotiating terms.

Each of these components is vital in enhancing the likelihood of approval and ensuring that the loan aligns with the investor's financial objectives.

Ultimately, securing a commercial loan transcends mere access to funds; it involves making informed decisions that will influence long-term investment success. Investors are urged to take proactive measures in understanding their financing options, preparing meticulously, and utilizing available resources to adeptly navigate the complexities of commercial loans. By doing so, they position themselves for success in the lucrative arena of rental property investment.