Overview

Understanding commercial real estate funding is essential for securing the necessary capital for investment. Various financing options, key terms, and the application process play critical roles in this journey. This article outlines essential steps to navigate this complex landscape, including:

- Preparation of documentation

- Selection of the right lender

- Management of challenges such as creditworthiness and market conditions

Thorough preparation is paramount. By familiarizing yourself with lender requirements, you can significantly enhance your chances of success in obtaining funding. Have you considered how your financial situation aligns with these requirements? Remember, knowledge is power in this arena.

Furthermore, addressing potential challenges head-on will empower you to make informed decisions. The right approach can turn obstacles into opportunities. As you explore your options, keep in mind that understanding the intricacies of the funding process is not just beneficial; it is crucial for achieving your investment goals.

Introduction

Navigating the world of commercial real estate funding can be a daunting task, filled with complex terminology and a multitude of financing options. For businesses looking to acquire or develop properties, understanding the foundational elements of commercial real estate financing is not just beneficial—it is essential for success. However, with so many choices and potential pitfalls, how can investors ensure they secure the right funding while avoiding common challenges? This article delves into the critical steps and strategies necessary to effectively fund commercial real estate, providing valuable insights that can empower investors to make informed decisions in a competitive market.

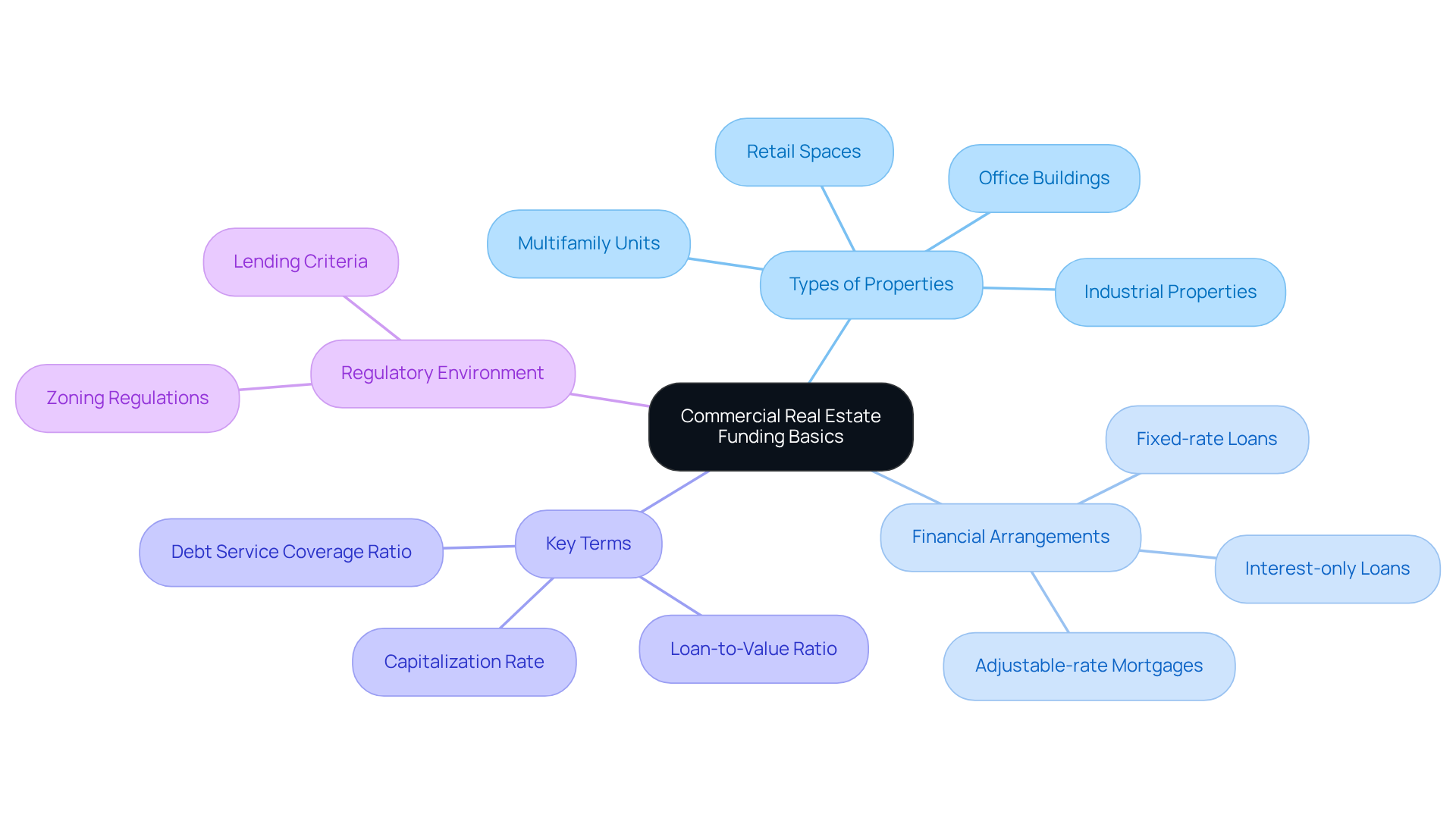

Understand Commercial Real Estate Funding Basics

Commercial real estate financing encompasses a variety of financial tools and strategies tailored to meet the specific needs of companies looking to acquire, develop, or refinance assets. Understanding these key concepts is essential for success in this field:

-

Types of Properties: Distinguishing between various commercial property types is crucial. These include office buildings, retail spaces, industrial properties, and multifamily units. Each type presents unique opportunities and challenges regarding financing and investment potential.

-

Financial Arrangements: Familiarity with common financial arrangements is vital. Fixed-rate loans offer stability through consistent payments, while adjustable-rate mortgages provide lower initial rates that may fluctuate over time. Interest-only loans allow borrowers to pay only the interest for a specified period, maximizing initial cash flow. Finance Story focuses on developing refined, highly personalized business cases for lenders, ensuring you secure the appropriate funding for your investment. Additionally, you will have access to a comprehensive range of lenders, enhancing your funding options.

-

Key Terms: Grasping essential terminology is imperative for navigating business real estate financing. The loan-to-value (LTV) ratio assesses the loan amount in relation to the asset's value, typically ranging from 65% to 80% for commercial loans. The debt service coverage ratio (DSCR) compares a real estate's net operating income to its annual mortgage debt service, with a ratio above 1 indicating positive cash flow. The capitalization rate (cap rate) reflects the anticipated return on investment, aiding investors in evaluating asset value.

-

Regulatory Environment: Awareness of the regulations governing commercial real estate funding is critical. This includes understanding zoning regulations, which dictate how real estate can be utilized, and lending criteria that affect loan eligibility and conditions.

By mastering these fundamentals, you will be better positioned to explore how to fund commercial real estate and navigate the application process effectively. For instance, the average cost per square foot for business property in Britain is projected to reach £60.19 in 2024, underscoring the importance of market trend awareness when assessing investment opportunities. Furthermore, with approximately $600 billion in credits maturing each year until 2028, it is more essential than ever to understand how to fund commercial real estate.

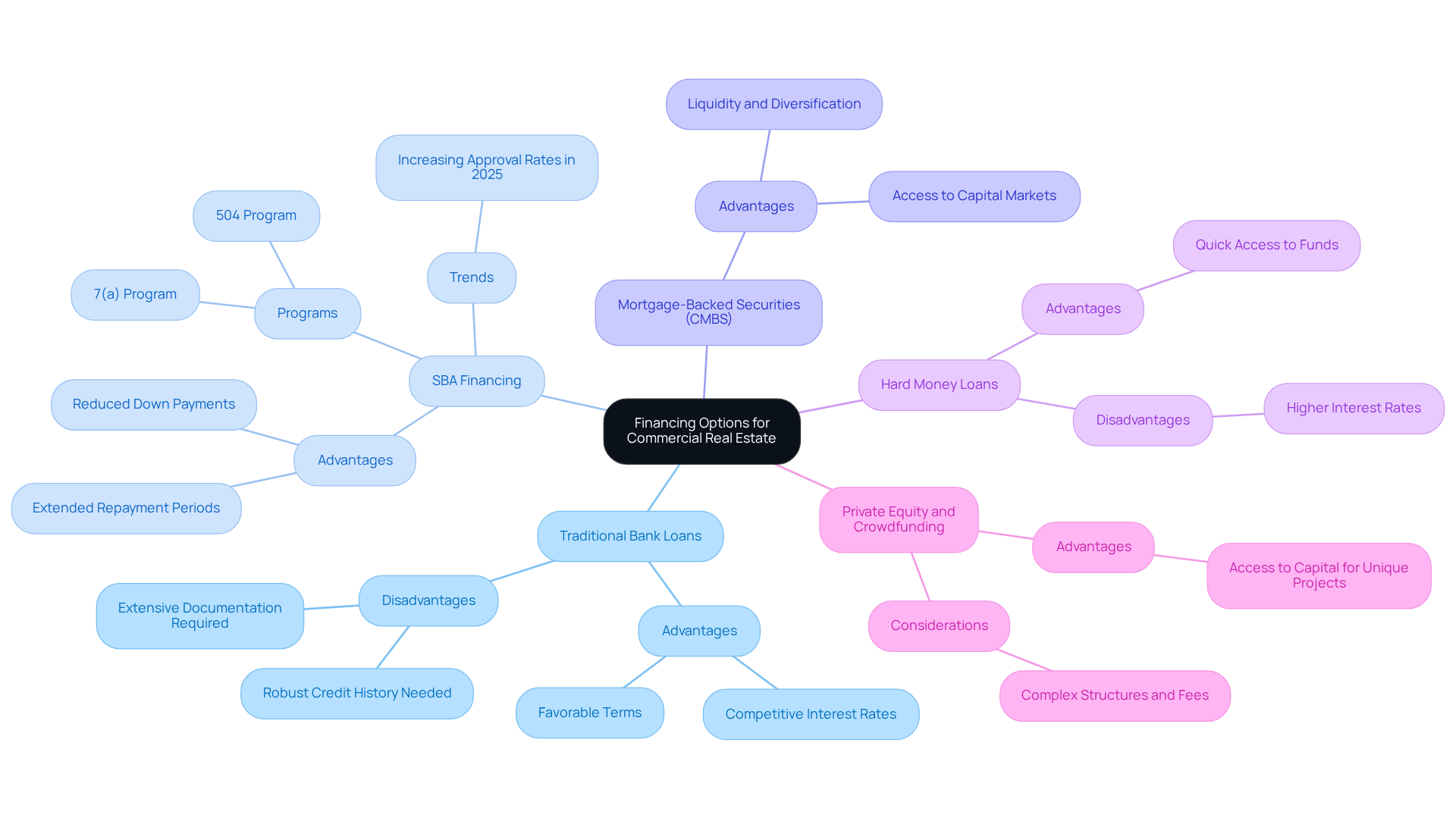

Explore Financing Options for Commercial Real Estate

When financing commercial real estate, a variety of options are available, each with distinct advantages and considerations:

- Traditional Bank Loans: These loans often feature competitive interest rates and favorable terms. However, they typically require extensive documentation and a robust credit history, which can be a barrier for some borrowers.

- SBA Financing: The Small Business Administration (SBA) offers funding programs designed for small enterprises, such as the 7(a) and 504 financing programs. These credits can be especially advantageous for acquiring business real estate, providing reduced down payments and extended repayment periods. In 2025, SBA approval rates for business establishments have displayed a favorable trend, indicating the increasing backing for small enterprise funding.

- Mortgage-Backed Securities (CMBS): These securities are supported by loans on business properties, allowing investors to access capital markets. They can provide liquidity and diversification for investors looking to finance larger projects.

- Hard Money Loans: These short-term loans are backed by real estate and are frequently used for urgent funding needs. While they offer quick access to funds, they come with higher interest rates, making them a more expensive option in the long run.

- Private Equity and Crowdfunding: These creative funding techniques allow numerous investors to combine resources for real estate ventures. They can offer access to capital for projects that may not meet the criteria for conventional funding, although they may involve more complex structures and fees.

At Finance Story, we focus on crafting refined and highly personalized business cases for banks, ensuring you obtain the appropriate funding for your commercial property investments. We work with a full range of lenders, including high street banks and innovative private lending panels, to meet your specific needs. Each funding option presents unique benefits and drawbacks, making it essential to evaluate how to fund commercial real estate based on your specific circumstances and financial goals. Furthermore, refinancing choices are accessible to assist in adjusting your financial arrangements to the changing requirements of your business. Understanding the current market trends can further inform your financing decisions.

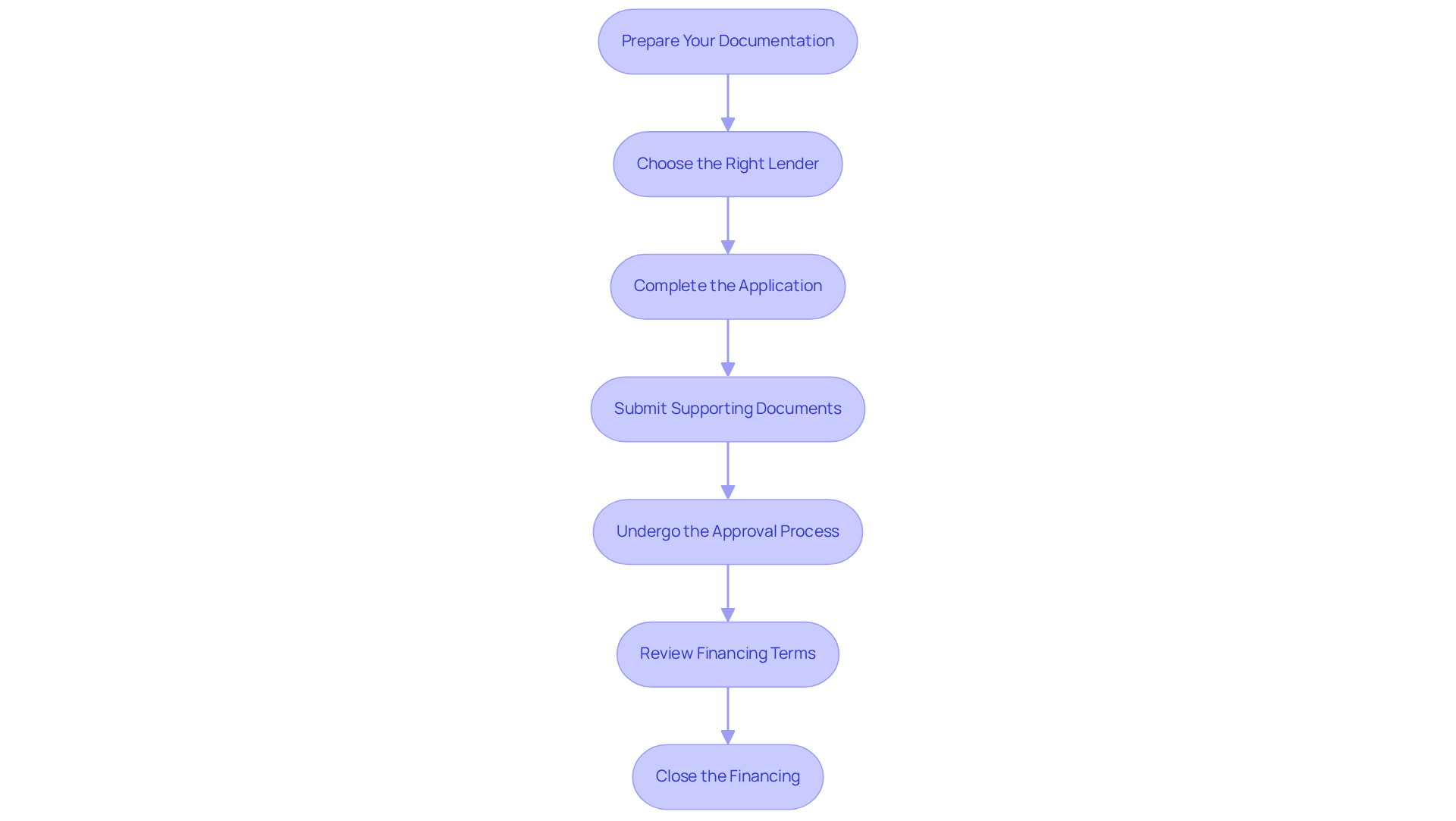

Apply for Commercial Real Estate Loans: A Step-by-Step Process

Applying for a commercial real estate loan involves several critical steps that can significantly impact your chances of approval:

-

Prepare Your Documentation: Assemble essential documents such as financial statements, tax returns, business plans, and detailed property information. A well-organized documentation set is crucial, as lenders often require proof of income through various means, including BAS statements or signed accountant letters. Be aware that traditional banks typically require a credit score of at least 660 and a loan-to-value ratio (LVR) that usually ranges up to 80%. At Finance Story, we specialize in creating polished and highly individualized business cases to present to banks, enhancing your chances of securing the necessary funds.

-

Choose the Right Lender: Conduct thorough research to identify a lender that aligns with your financing needs and offers competitive terms. Local lenders may provide insights into specific lending criteria and preferences, enhancing your application’s success. With access to a full suite of lenders, including high street banks and innovative private lending panels, Finance Story can help you find the right fit for your circumstances.

-

Complete the Application: Accurately fill out the loan application form, ensuring all information is complete and truthful. A strong credit profile is essential, as lenders assess credit history to determine borrower risk.

-

Submit Supporting Documents: Provide all necessary documentation to the lender, including proof of income and asset valuation. This may encompass directors' payslips, business bank statements, and a rent roll for investment assets.

-

Undergo the Approval Process: Be prepared for the lender to conduct due diligence, which may involve credit checks and asset appraisals. Understanding the unique aspects of the property market can aid in making informed investment decisions. Finance Story's expertise in refinancing and obtaining customized business funding can guide you through this process.

-

Review Financing Terms: Once approved, carefully examine the financing terms, including interest rates, repayment schedules, and any associated fees. Negotiating with lenders can help secure better interest rates and terms.

-

Close the Financing: Finalize the financing by signing the necessary documents and securing the funds. This step is crucial for ensuring that all terms are understood and agreed upon before proceeding.

By adhering to these steps and utilizing the knowledge of Finance Story, you can simplify the application procedure and improve your likelihood of understanding how to fund commercial real estate investments. As Bill Robb, a finance industry expert with over 26 years of experience, emphasizes, "Thorough preparation and understanding of lender requirements are key to successful loan applications.

Navigate Challenges in Securing Funding

Securing funding for commercial real estate can present various challenges in learning how to fund commercial real estate. Understanding these obstacles and employing effective strategies is crucial for success.

-

Creditworthiness Issues: A lower credit score can hinder your financing options. To enhance your creditworthiness, focus on paying down existing debts, ensuring timely payments, and correcting any inaccuracies on your credit report. Furthermore, engaging with lenders who specialize in accommodating borrowers with less-than-perfect credit can also be beneficial.

-

Insufficient Documentation: Having all necessary documentation prepared is vital to avoid delays in the loan process. Common documents include financial statements, tax returns, and property appraisals. Consider hiring a financial consultant to help organize your paperwork and ensure completeness.

-

Market Conditions: Economic downturns can significantly impact lending availability. Staying informed about current market trends, such as interest rate fluctuations and lender sentiment, can help you adapt your financing strategy. For instance, with over 56% of lenders expressing a desire to grow their commercial real estate exposures, there may be opportunities even in challenging times.

-

Property Valuation Discrepancies: If a lender's appraisal comes in lower than expected, be prepared to negotiate. Providing additional evidence of the property's value, such as recent comparable sales or improvements made, can strengthen your case.

-

Regulatory Hurdles: Familiarizing yourself with local regulations and zoning laws is essential, as these can affect your funding options. Consulting with a real estate attorney can provide clarity on compliance requirements and help navigate any legal complexities.

By anticipating these challenges and preparing accordingly, you can significantly enhance your chances of successfully learning how to fund commercial real estate endeavors. At Finance Story, we specialize in creating polished and highly individualized business cases to present to banks, ensuring you have access to a comprehensive portfolio of lenders tailored to your unique circumstances. Our bespoke mortgage services and expertise in refinancing position us as a trusted partner in your financing journey.

Conclusion

Mastering the complexities of commercial real estate funding is essential for anyone aiming to invest in this lucrative sector. By grasping the various financing options, key terms, and the step-by-step application process, investors can strategically position themselves for success. Furthermore, knowledge of the regulatory environment and market trends empowers investors to make informed decisions, ensuring they secure the necessary funding for their ventures.

This article underscores vital strategies, including:

- The preparation of comprehensive documentation

- The selection of the right lender

- The navigation of potential challenges such as creditworthiness and market conditions

Each financing option, ranging from traditional bank loans to innovative crowdfunding methods, presents its own set of advantages and considerations, highlighting the necessity for tailored approaches based on individual circumstances.

Ultimately, the journey to successfully funding commercial real estate demands diligence, preparation, and a proactive mindset. By leveraging the insights provided, investors can effectively overcome obstacles and seize opportunities within the commercial real estate landscape. Embracing these essential steps not only facilitates securing funding but also paves the way for long-term success in real estate investments.