Overview

To successfully fund a commercial property, investors must grasp the various types of properties, financing options, and essential documentation while preparing for potential challenges. This article outlines crucial steps, such as:

- Assessing financial situations

- Gathering required documents

- Selecting the right lender

These elements collectively empower investors to navigate the complexities of commercial property financing with confidence and effectiveness.

Introduction

Navigating the world of commercial property financing presents both excitement and challenges as investors strive to unlock the potential of lucrative business assets. It is essential to understand the intricacies of funding options, ranging from traditional bank loans to innovative financing solutions, for successful investments.

However, with stricter lending criteria and higher interest rates on the horizon, how can investors secure the best possible terms for their commercial ventures?

This article explores critical steps and strategies designed to help navigate the complexities of funding commercial properties, empowering investors to make informed decisions and achieve their financial goals.

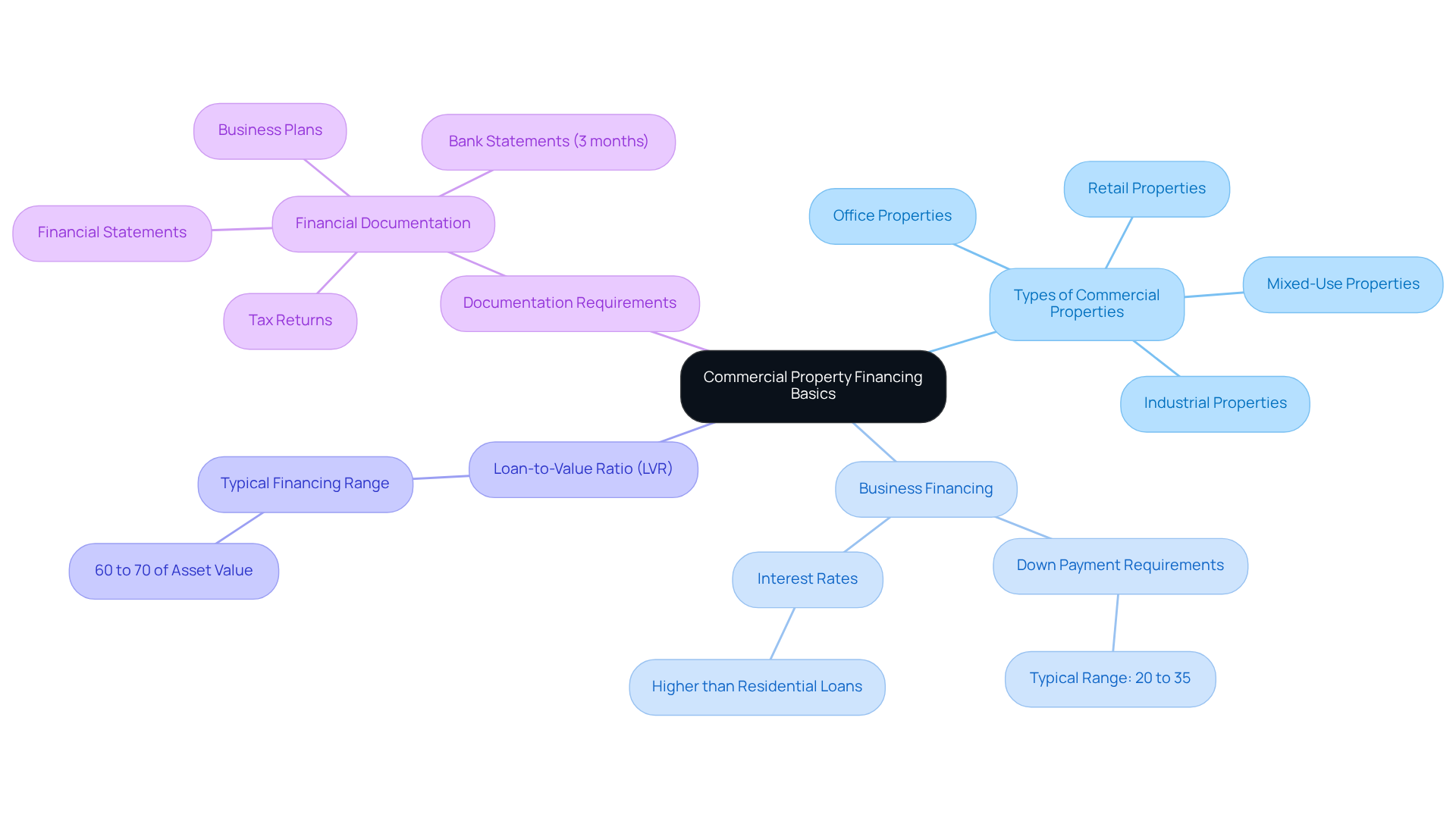

Understand Commercial Property Financing Basics

Commercial real estate funding is essential for acquiring or developing assets designated for business use, including office buildings, retail spaces, and storage facilities. Understanding the following key aspects will empower you to navigate this intricate landscape:

- Types of Commercial Properties: Familiarize yourself with various categories, such as retail, industrial, office, and mixed-use properties. Each category presents distinct financing needs and market dynamics that are crucial for informed decision-making.

- Business Financing: Unlike residential financing, business financing typically necessitates a larger down payment, often ranging from 20% to 35%. Interest rates for these loans are generally higher, reflecting the elevated risk associated with commercial investments.

- Loan-to-Value Ratio (LVR): This critical metric indicates the percentage of the asset's value that can be financed through credit. Lenders typically offer funding between 60% and 70% of the asset's appraised value, underscoring the significant equity investment required from the borrower.

- Documentation Requirements: To secure business financing, be prepared to provide comprehensive financial documentation, including business plans, tax returns, and financial statements. Lenders often seek proof of profitability, usually demonstrated through at least three months of bank statements.

By mastering these fundamentals, you will be well-equipped to explore various funding options and effectively navigate the application process on how to fund a commercial property.

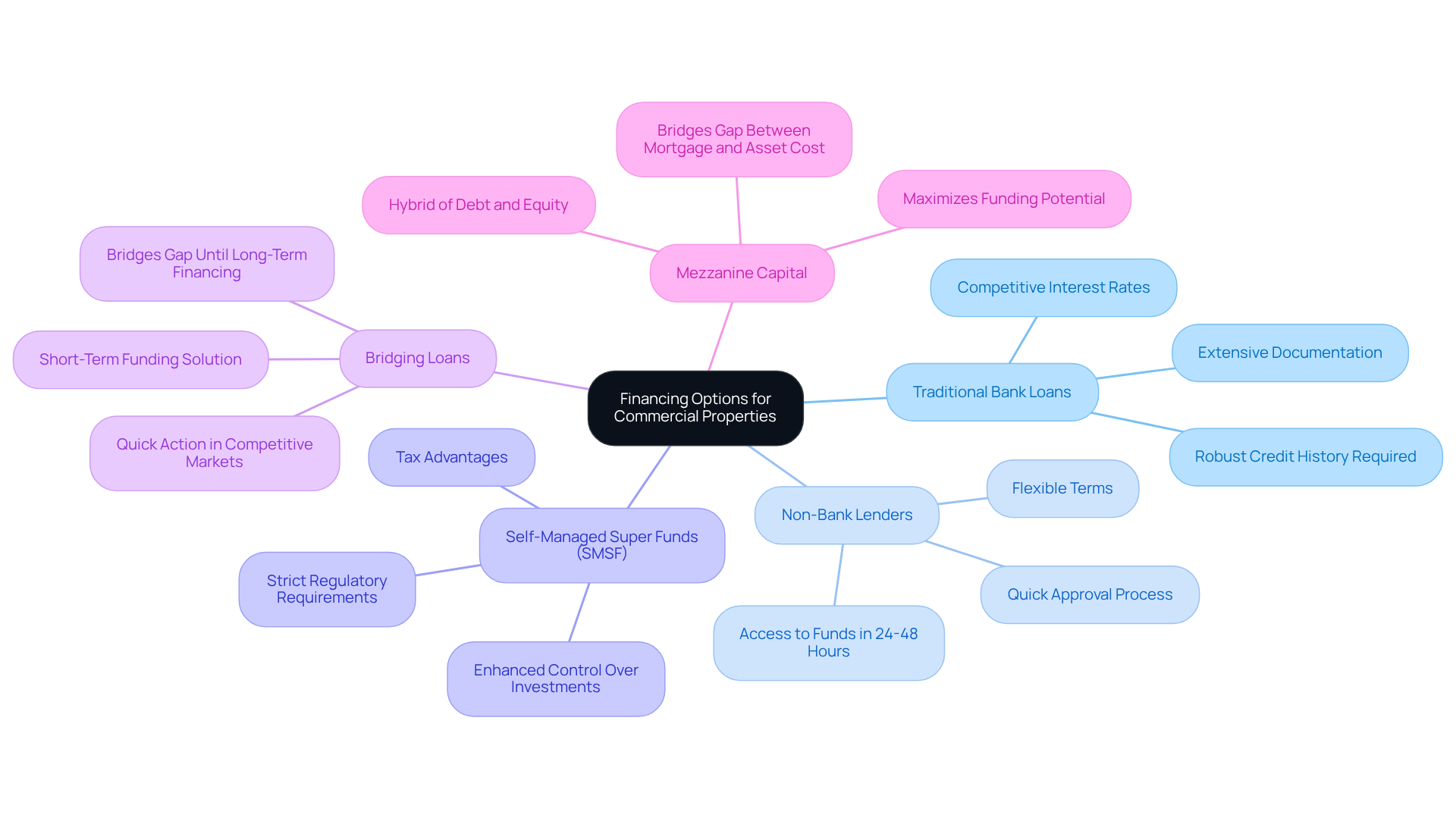

Explore Financing Options for Commercial Properties

When financing commercial properties, various options cater to different needs and circumstances:

- Traditional Bank Loans: These loans are prevalent in the market, known for their competitive interest rates and favorable terms. However, they typically demand extensive documentation and a robust credit history, which can be a barrier for some borrowers.

- Non-Bank Lenders: Offering greater flexibility, non-bank lenders often provide quicker approval processes, making them an attractive choice for those with unique financial situations. Their capacity to sanction credit in days, in contrast to the prolonged timelines of conventional banks, enables borrowers to capitalize on lucrative opportunities quickly.

- Self-Managed Super Funds (SMSF): Investing through an SMSF can yield tax advantages and enhanced control over investments. However, it necessitates adherence to strict regulatory requirements, which can complicate the process for some investors.

- Bridging Loans: These short-term funding solutions are designed to bridge the gap until long-term support is secured. They are particularly beneficial for investors needing to act quickly in competitive markets.

- Mezzanine Capital: This hybrid funding option merges aspects of debt and equity, effectively bridging the gap between the primary mortgage and the total asset cost. It can be a strategic choice for investors looking to maximize their funding potential.

Grasping these funding alternatives enables investors to choose the most appropriate approach for their business investments, in line with their financial objectives and situations.

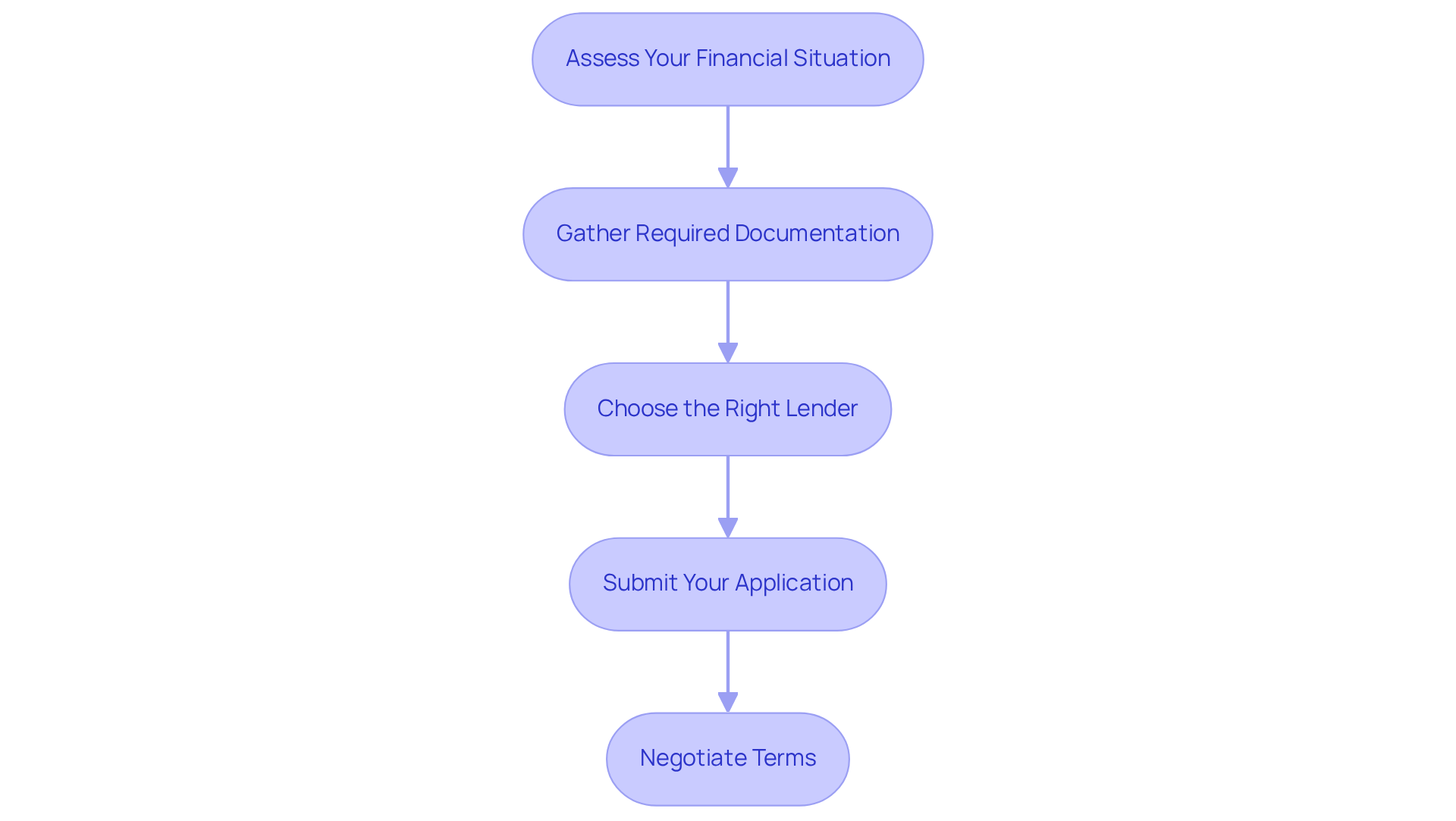

Prepare and Apply for Your Commercial Property Loan

To effectively prepare and apply for a commercial property loan, consider the following steps:

-

Assess Your Financial Situation: Begin by reviewing your credit score, income, and existing debts to gauge your borrowing capacity. A credit score of 75 or higher is generally viewed as favorable by lenders, while a score below 640 may complicate your application.

-

Gather Required Documentation: Compile essential documents, including:

- Financial statements (profit and loss, balance sheets)

- Tax returns for the past two years

- A comprehensive business plan outlining your investment strategy

- Property details, such as valuation and lease agreements.

-

Choose the Right Lender: Research various lenders to identify one that meets your specific needs. Consider factors such as interest rates, fees, and customer service. Some lenders may offer more flexible terms, especially for those with less-than-perfect credit.

-

Submit Your Application: Complete the lender's application form and submit your documentation. Be prepared to discuss your financial history and investment plans, as lenders will evaluate your overall financial position, including the 5 Cs of credit: credit history, capacity, capital, collateral, and character.

-

Negotiate Terms: After receiving approval, carefully review the loan terms. Don’t hesitate to bargain for better rates or terms, as this can significantly affect your overall expenses.

By adhering to these steps, you can simplify the application procedure and improve your likelihood of obtaining the required funding for your business real estate investment while learning how to fund a commercial property.

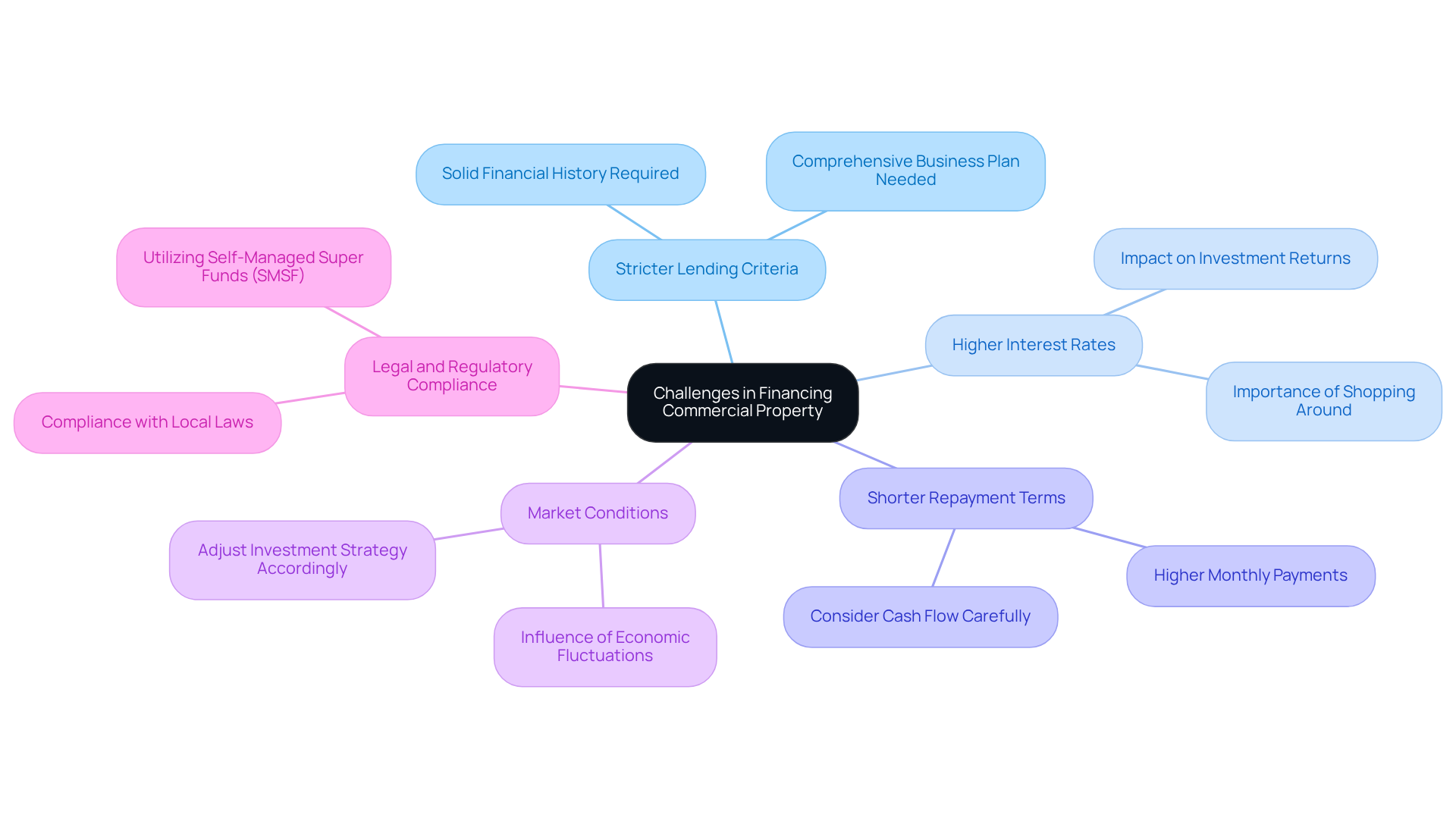

Navigate Challenges and Considerations in Financing

Navigating the challenges of how to fund a commercial property necessitates both awareness and preparation. Here are key considerations to keep in mind:

- Stricter Lending Criteria: Lenders often impose more stringent requirements for commercial loans compared to residential loans. Be prepared to demonstrate a solid financial history and a comprehensive business plan. Finance Story specializes in crafting polished and highly individualized business cases to present to banks.

- Higher Interest Rates: Commercial financing frequently comes with elevated interest rates, which can significantly impact your overall investment returns. It is advisable to shop around for the best rates, leveraging Finance Story's access to a wide range of lenders, including high street banks and innovative private lending panels.

- Shorter Repayment Terms: Many commercial credits feature shorter repayment periods, resulting in higher monthly payments. Carefully consider your cash flow and repayment capacity; consult with Finance Story for valuable insights on loan repayment criteria.

- Market Conditions: Economic fluctuations can greatly influence real estate values and rental income. Staying informed about market trends and adjusting your investment strategy accordingly is crucial.

- Legal and Regulatory Compliance: Ensure that your investment complies with local laws and regulations, particularly if utilizing a Self-Managed Super Fund (SMSF) for funding. Finance Story can assist you in leveraging SMSFs for your business investments, whether you are acquiring a warehouse, retail location, factory, or hospitality endeavor.

By being cognizant of these challenges and preparing accordingly, you can significantly enhance your chances of understanding how to fund a commercial property investment successfully.

Conclusion

Understanding how to fund a commercial property is crucial for anyone looking to invest in real estate designated for business use. This process involves navigating a complex landscape of financing options, each with its unique requirements and implications. By grasping the fundamentals of commercial property financing, investors can make informed decisions that align with their financial goals.

Key arguments presented in this guide highlight the importance of understanding various financing types, such as:

- Traditional bank loans

- Non-bank lenders

- Alternative options like SMSFs and bridging loans

Furthermore, the article emphasizes the necessity of thorough preparation in the loan application process, including:

- Assessing financial situations

- Gathering documentation

- Negotiating terms

Awareness of challenges such as stricter lending criteria and market conditions further equips investors to tackle potential obstacles effectively.

Ultimately, successful commercial property funding is not merely about securing a loan; it is about strategic planning and informed decision-making. By leveraging the insights provided, investors can enhance their chances of achieving their real estate aspirations. Engaging with financial experts can also provide invaluable guidance, ensuring that each step taken is aligned with both current market conditions and long-term investment strategies.