Overview

To finance a business property successfully, understanding the types of properties, financing options, and the step-by-step application process is essential. This article outlines key aspects, including:

- The differences between conventional loans and SBA loans

- The importance of thorough documentation

- Strategies to overcome common financing challenges

By equipping readers with this knowledge, they will be better prepared to secure appropriate funding for their business investments.

Introduction

Understanding the intricacies of financing a business property is essential for entrepreneurs aiming to expand their commercial footprint. As the demand for commercial real estate rises, navigating this complex landscape presents significant opportunities for growth and investment. However, the journey to securing the right financing can be fraught with challenges.

Many business owners find themselves asking: what steps are necessary to successfully finance a business property and avoid common pitfalls? This article will guide you through the essential processes, providing insights that can help you make informed decisions.

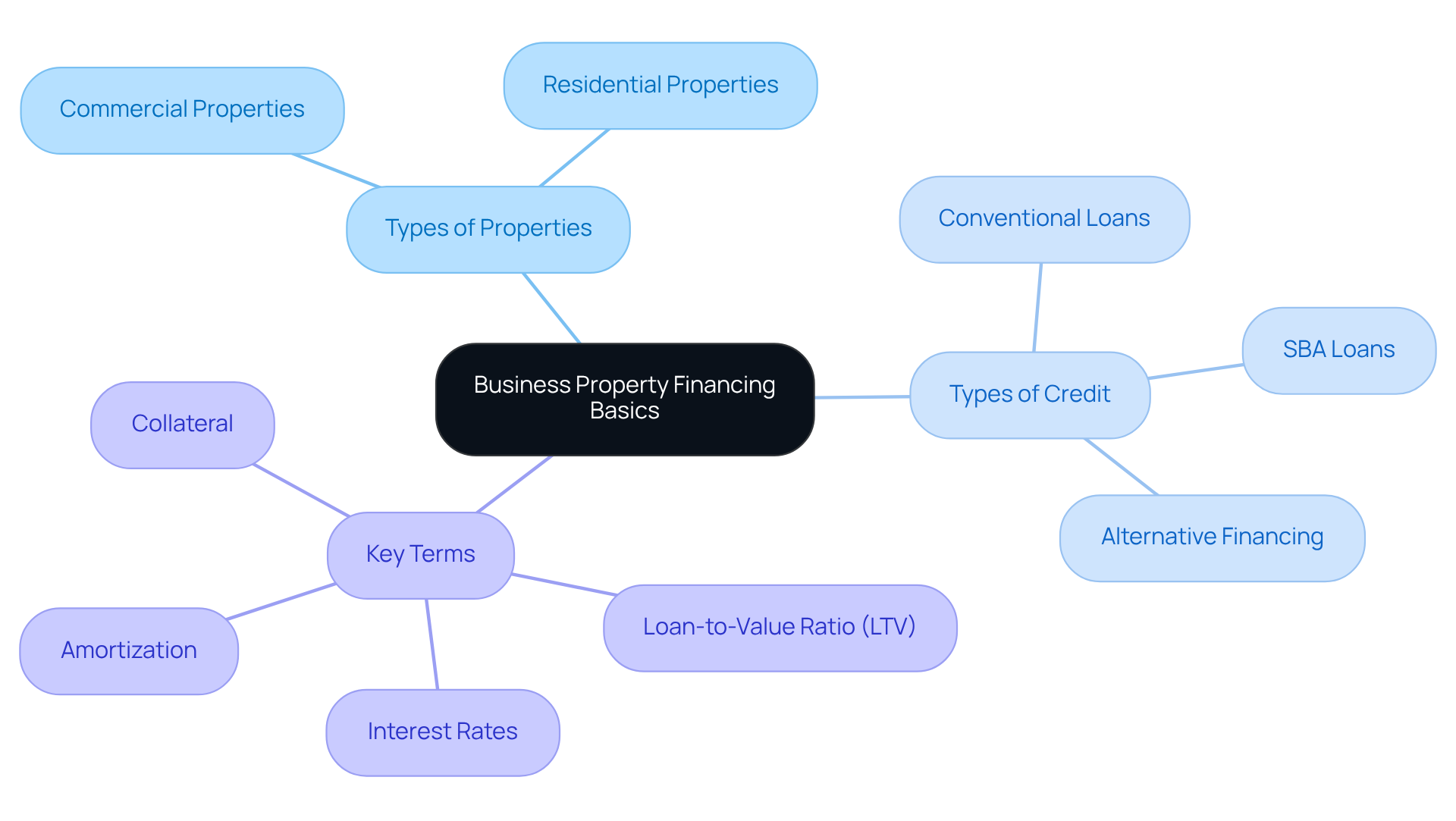

Understand Business Property Financing Basics

Understanding how to finance a business property is a critical process that involves securing resources to acquire or refinance real estate for commercial purposes. Grasping the intricacies of this process is essential for making informed financial decisions.

-

Types of Properties: It is vital to distinguish between commercial properties—such as office buildings, retail spaces, and warehouses—and residential properties. In 2025, approximately 23.3% of commercial property mortgages have risen compared to the previous year, showcasing a growing interest in commercial investments.

-

Types of Credit: Familiarize yourself with the various credit options available for commercial funding. While conventional loans are widely used, Small Business Administration (SBA) loans and alternative financing options also present viable avenues. Each type carries its own requirements and benefits tailored to different business needs.

-

Key Terms: A solid understanding of essential terms is crucial for navigating discussions with lenders. Key concepts include the loan-to-value ratio (LTV), reflecting the proportion of financing to the property's value; interest rates, which can fluctuate significantly based on market conditions; amortization, the process of repaying an obligation over time; and collateral, the asset pledged against the financing.

By grasping these fundamentals, you will be better equipped to explore how to finance a business property and seek capital that aligns with your business objectives.

Explore Financing Options for Business Properties

When financing a business property, it's essential to consider the following options:

- Conventional Loans: Typically offered by banks and credit unions, these loans require a solid credit history and a down payment of around 20%. Interest rates generally range from 5% to 7%, making them a practical choice for established enterprises.

- SBA Loans: Backed by the Small Business Administration, these loans provide favorable terms, including lower down payments and interest rates between 5.5% and 6.75%. They are particularly advantageous for small enterprises, as they necessitate at least 51% of the property to be utilized for commercial purposes, ensuring that the financing aligns with operational needs.

- Alternative Financing: Explore options such as peer-to-peer lending, crowdfunding, or private investors. These avenues can offer more flexible terms and quicker access to capital, which may be crucial for businesses looking to seize immediate opportunities.

- Commercial Mortgages: Specifically designed for acquiring commercial properties, these mortgages often have different criteria compared to residential financing. Borrowers typically need to demonstrate a greater capacity to repay, as commercial loans usually have shorter terms of 15 to 20 years and a loan-to-value ratio capped at 70%.

Investigating and evaluating how to finance a business property is crucial for discovering the optimal funding solution tailored to your company's requirements. This ensures that you can effectively navigate the complexities of the financial landscape.

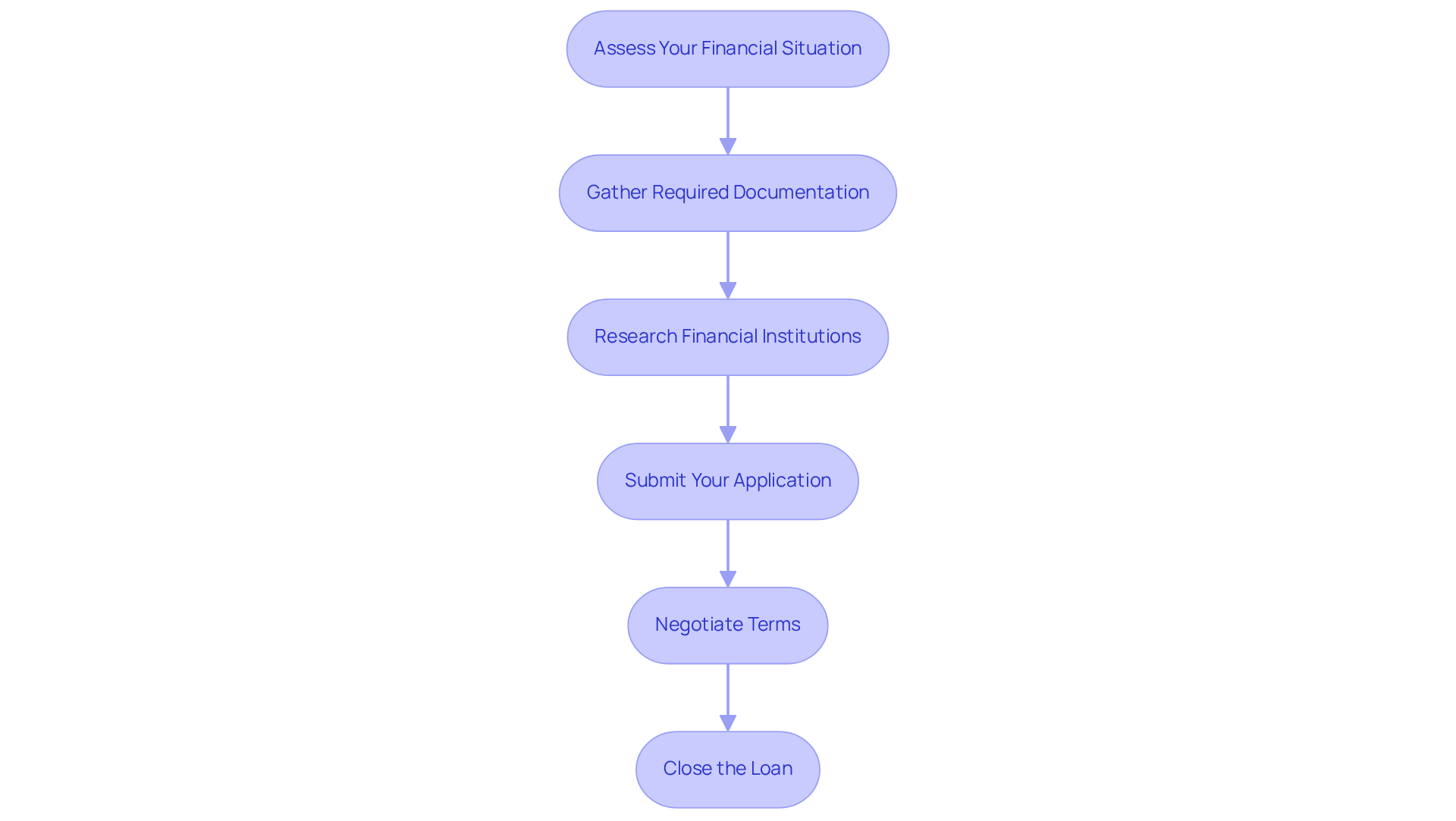

Apply for Financing: Step-by-Step Process

To successfully apply for financing, follow these essential steps:

-

Assess Your Financial Situation: Begin by reviewing your credit score, financial statements, and business plan. This initial assessment will empower you to understand your borrowing capacity and pinpoint areas that may require improvement.

-

Gather Required Documentation: Compile necessary documents such as tax returns, bank statements, and proof of income. Lenders typically require these to evaluate your application. For instance, PAYG employees must provide two recent payslips and three months of bank statements, while self-employed individuals need two years of financial documentation.

-

Research Financial Institutions: Identify potential financing sources and compare their offerings, interest rates, and terms. This step encompasses both conventional banks and alternative financing sources, as each may present different requirements and flexibility in their borrowing processes.

-

Submit Your Application: Complete the application form and submit it along with your documentation. Ensure that all information is accurate and comprehensive to avoid delays in processing.

-

Negotiate Terms: Once your application is approved, carefully review the conditions of the financing. Don’t hesitate to negotiate for better rates or terms that align with your requirements; lenders may be open to adjustments based on your financial profile.

-

Close the Loan: After agreeing on the terms, finalize the paperwork and close the loan. It’s crucial to fully understand all obligations before signing, as this will impact your financial commitments moving forward.

By following these steps, you can simplify the application procedure and significantly enhance your chances of securing the funding needed for your property investments.

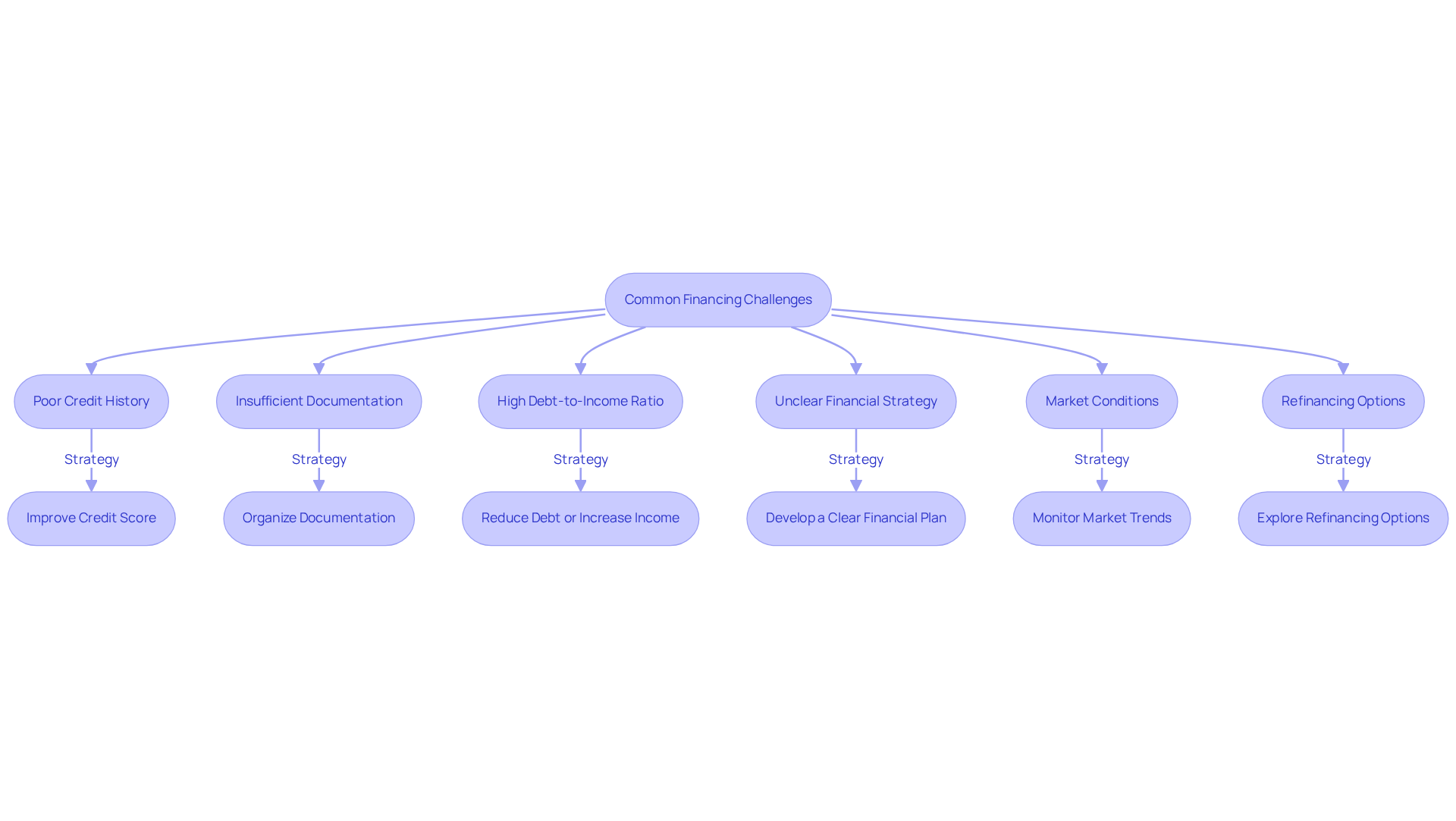

Troubleshoot Common Financing Challenges

Navigating how to finance a business property can present numerous challenges. Here are some common hurdles and strategies to overcome them:

- Poor Credit History: A low credit score can significantly hinder your financing options. To improve your credit, focus on paying down existing debts and making timely payments. This proactive approach can enhance your creditworthiness, making you a more attractive candidate for lenders. As Marco Carbajo states, "With strong commercial credit, you create a safety net for your enterprise."

- Insufficient Documentation: Lenders require thorough documentation to assess your financial health. Ensure that all financial statements, including profit and loss statements, balance sheets, and tax returns, are current and accurately reflect the performance of your enterprise. Incomplete or outdated documents can lead to delays or denials. Many small business owners face challenges here, as highlighted by a case study showing that 73% of owners use personal credit cards for funding, indicating a reliance on personal finances due to documentation issues.

- High Debt-to-Income Ratio: A high debt-to-income ratio can indicate financial pressure to creditors. To improve this ratio, consider reducing existing debts or increasing your income through additional revenue streams. This adjustment can enhance your appeal to potential lenders. Significantly, 79% of small enterprises found it challenging to obtain affordable capital, highlighting the necessity of managing debt efficiently.

- Unclear Financial Strategy: A well-organized plan is essential for understanding how to finance a business property effectively. Your strategy should clearly delineate your organizational model, market analysis, and financial projections. A thorough plan shows financiers that you possess a clear vision and strategy for your enterprise's future. Finance Story focuses on developing refined and tailored business cases that can assist you in presenting a persuasive proposal to financiers.

- Market Conditions: Stay informed about current market conditions that may impact lending. If interest rates are high, it might be wise to delay your application until the market becomes more favorable. Understanding these dynamics can help you make informed decisions about how to finance a business property and the timing of your financing efforts. With access to a full suite of lenders, including high street banks and innovative private lending panels, Finance Story can assist you in navigating these conditions effectively.

- Refinancing Options: If you already possess a commercial loan, contemplate refinancing to better align with your changing operational requirements. Finance Story can help you explore various refinancing options that may offer more favorable terms or lower interest rates.

By proactively addressing these challenges and preparing the necessary documentation, you can navigate the financing process with greater confidence and success. As one satisfied client, Natasha B. from VIC, stated, "I will definitely be recommending your business to anyone. We are finished with the constant worry. Once again, thank you so much for being a part of our journey.

Conclusion

Financing a business property is a multifaceted endeavor that demands careful consideration of various elements, including the types of properties, available credit options, and the essential terms governing any financing agreement. Mastering these components equips business owners with the knowledge necessary to make informed decisions, empowering them to navigate the complexities of acquiring or refinancing commercial real estate effectively.

This article explores critical financing options, such as:

- Conventional loans

- SBA loans

- Alternative financing methods

Each option is tailored to meet specific business needs. It outlines a step-by-step application process that underscores the importance of:

- Assessing financial situations

- Gathering documentation

- Negotiating terms

Furthermore, it addresses common challenges, including:

- Poor credit history

- Insufficient documentation

It provides strategic insights to overcome these hurdles.

Ultimately, the successful financing of business properties hinges on preparation, understanding, and adaptability. By actively engaging with the financing process and staying informed about market conditions, business owners can secure the funding necessary to achieve their property investment goals. Taking these steps not only facilitates immediate financial success but also lays a robust foundation for long-term growth and stability in the competitive commercial landscape.