Overview

The primary inquiry addressed in this article is how businesses can determine their borrowing capacity for property acquisition. This article provides a comprehensive step-by-step guide that underscores the significance of evaluating financial factors, including:

- Income stability

- Credit history

- Existing debts

- Specific lender criteria

By accurately assessing these elements, businesses can effectively gauge their borrowing capacity, ultimately empowering them to make informed decisions regarding property investments.

Introduction

In the intricate world of property acquisition, understanding borrowing capacity is essential for both individuals and businesses. It serves as the foundation for determining how much financing one can realistically secure, influenced by a myriad of factors such as income stability, credit history, and existing debts.

As the demand for commercial property investments continues to rise, small business owners must navigate these complexities with strategic insight. This article delves into the nuances of borrowing capacity, offering expert advice and practical steps to enhance financial readiness for property purchases.

By leveraging tailored solutions and comprehensive documentation, businesses can position themselves for success in securing the necessary funding to achieve their growth objectives.

Understanding Borrowing Capacity for Property Acquisition

Borrowing ability is a crucial concept that determines the maximum amount a lender is willing to offer based on an individual’s or entity’s economic profile. This assessment requires a comprehensive evaluation of various factors, including income, expenses, credit history, and existing debts. Understanding how much your business can borrow to acquire property is vital for setting realistic expectations, whether for personal or commercial use.

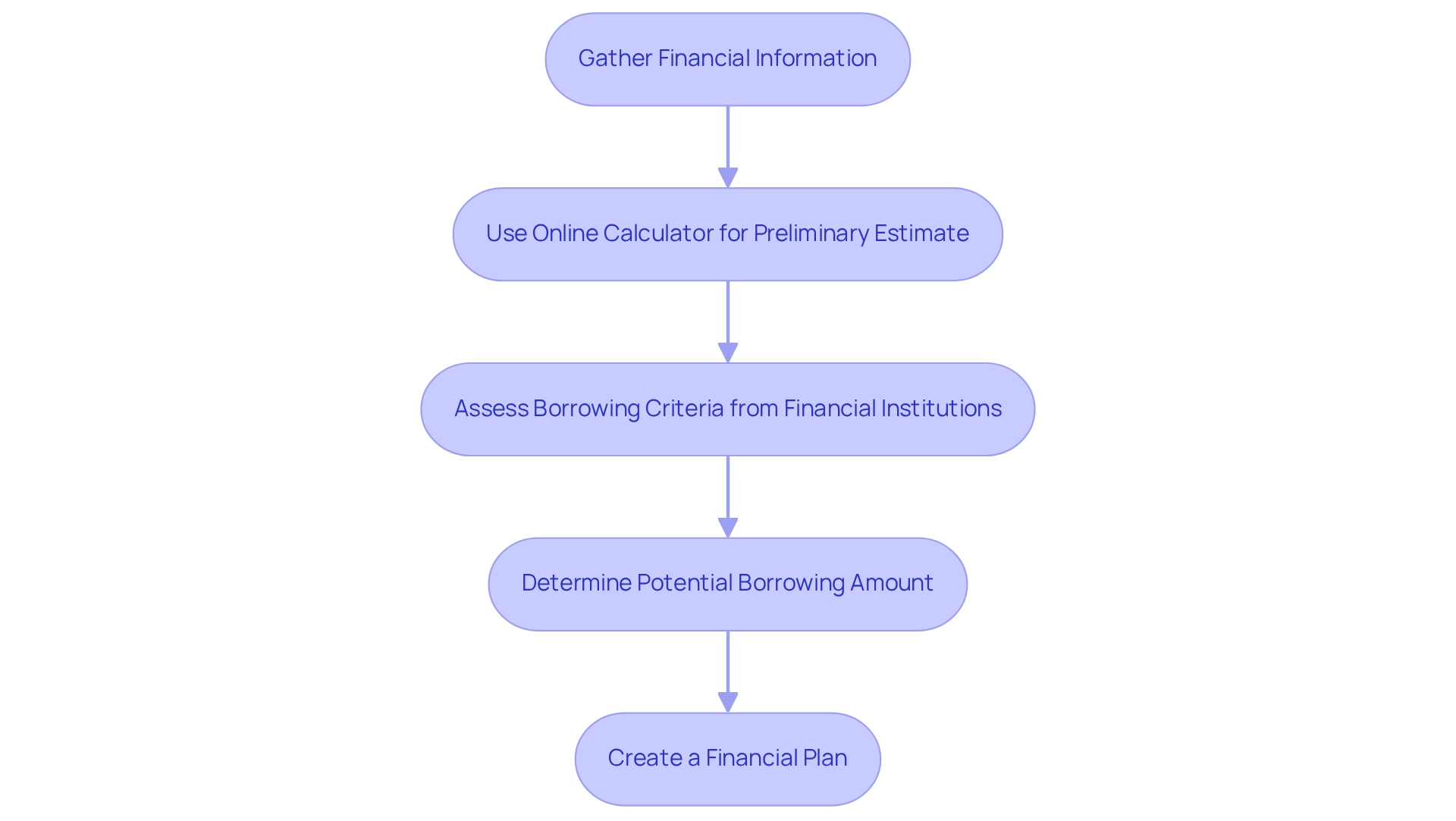

At Finance Story, we excel in crafting polished and highly individualized business cases for presentation to banks, ensuring you secure the appropriate financing for your commercial property investments, which may include warehouses, retail spaces, factories, and hospitality ventures. To accurately determine how much your business can borrow to buy property in 2025, begin by gathering your financial information, including total income, regular expenses, and any outstanding debts.

Many banks and financial institutions provide online calculators that can offer a preliminary estimate of how much your business can borrow to buy property based on these details, simplifying the process of gauging your potential borrowing limits.

Current statistics reveal that the average borrowing ability for small enterprises in Australia has seen fluctuations, with recent data indicating new personal fixed-term loan commitments reaching $3.0 billion in the December quarter of 2023. This figure highlights the ongoing demand for financing among small enterprises, despite the challenges posed by economic conditions. It is essential for small business owners to understand how this demand can affect their borrowing capacity and the terms they may encounter.

Expert opinions underscore the necessity of having a clear financial plan when considering borrowing. As industry experts emphasize, "The appropriate financing option can be a highly effective instrument to boost growth, so ensure your plans are distinctly outlined, including anticipated ROI." This strategic approach not only aids in assessing how much your business can borrow to buy property but also guarantees that the funds are utilized efficiently to foster growth.

When evaluating borrowing potential for commercial financing, consider the specific criteria of financial institutions, which may vary based on the type of property and its intended use. For example, commercial real estate financing often has different criteria compared to residential mortgages, influencing overall borrowing limits. Finance Story provides access to a comprehensive range of financial institutions, including major banks and innovative private funding panels, to meet your specific financing needs, including refinancing options to adapt to your evolving operational requirements.

Real-world examples illustrate the calculation process effectively. For instance, a small business owner seeking to purchase a commercial property should assess their annual income, operational expenses, and any existing loans to determine how much their business can borrow to buy property. By applying these figures to a lender’s borrowing capacity formula, they can arrive at a more accurate estimate of how much their business can borrow to buy property.

Additionally, case studies on borrowing capacity assessments indicate that regulators, including the Reserve Bank of Australia, are closely monitoring housing-related vulnerabilities. This scrutiny is particularly relevant given historical trends where periods of low interest rates have led to riskier borrowing practices. Upholding robust lending criteria is vital to avoid excessive debt accumulation among households and enterprises, especially considering the recent decline in earnings in the rental, hiring, and real estate services sector, which decreased by 0.7%.

In summary, understanding and calculating your borrowing capacity is a critical step in the property acquisition process. By utilizing available tools and expert insights from Finance Story, small business owners can navigate the complexities of financing and make informed decisions that align with their growth objectives. Moreover, recent modifications to the publication outputs of lending indicators may enhance the usability and interpretability of borrowing capacity data, offering small business owners clearer insights into their financing options.

Key Factors Influencing Your Business's Borrowing Power

Several key factors significantly influence your business's borrowing power when seeking financing for property acquisition:

- Income Stability: Lenders prioritize enterprises with consistent and reliable income streams. A steady income not only demonstrates your capacity to repay borrowed funds but also enhances your overall creditworthiness. In 2025, statistics suggest that companies with consistent revenue are more inclined to obtain advantageous financing conditions, as creditors increasingly depend on income stability as a key factor for approval. Furthermore, adaptable financing servicing can boost repayment rates by an average of 30%, assisting customers in managing temporary setbacks.

- Credit History: Your credit score serves as a crucial indicator of your reliability as a borrower. Lenders meticulously review your credit report to assess your past borrowing behavior, including payment history and outstanding debts. A strong credit history can significantly improve your chances of obtaining a loan, while a poor credit score may limit your options. As Val Srinivas, a senior research leader in banking and capital markets, emphasizes, understanding your borrowing power is essential in navigating the lending landscape.

- Existing Debts: The amount of existing debt you carry plays a vital role in determining your borrowing capacity. Lenders evaluate your debt-to-income ratio, which reflects your financial health and ability to manage additional debt. A lower ratio signifies a stronger stance for borrowing, whereas a higher ratio may raise concerns for those providing loans.

- Type of Enterprise and Industry: The character of your venture and the sector in which you operate can influence your borrowing capacity. Certain industries are perceived as higher risk, which may lead to stricter lending criteria. Understanding the dynamics of your industry can help you prepare better and present a compelling case to lenders. The evolving landscape of small business financing, as highlighted in the case study "Small Business Lending Trends: Opportunities in 2025," shows that over half of small businesses with revenues exceeding $1 million are now using financing strategically rather than merely as a necessity.

- Assets and Collateral: Possessing valuable assets can enhance your borrowing capacity. Lenders often require collateral to secure the financing, and having substantial assets can provide them with the assurance needed to approve your application. This is particularly important in a competitive lending environment where collateral can make a significant difference in loan terms.

In light of proposed changes to capital requirements, small enterprise owners should stay informed about how these regulatory shifts may affect their borrowing capacity. By concentrating on these factors, small enterprise owners can strategically position themselves to determine how much they can borrow to buy property and obtain the financing required for property investments. Furthermore, understanding the loan-to-value ratio (LVR) is essential; for example, if you are seeking to finance a freehold property venture, knowing how much your business can borrow to buy property, given that lenders generally permit a maximum LVR of 70%, can assist you in calculating the required equity and cash for your investment.

Furthermore, Finance Story offers tailored funding solutions for building homes and residential property investments, ensuring that both first-time buyers and seasoned investors can find the right financing options to meet their needs.

Essential Financial Metrics to Assess Before Borrowing

Prior to seeking financing, companies should conduct a comprehensive evaluation of the following financial metrics to enhance their likelihood of securing advantageous conditions:

- Cash Flow: A thorough analysis of cash flow statements is essential. Positive cash flow not only signifies a robust enterprise but also demonstrates the capacity to fulfill loan repayments. In 2025, nearly 80% of small to medium enterprises reported cash flow impacts due to declining revenue and low reserves, underscoring the importance of maintaining liquidity. A real-world example of effective cash flow management can be seen in the collaboration between CommBank and AGSM, which provides resources to assist organizations in overcoming these challenges. Finance Story specializes in crafting refined and personalized cases that can help present your cash flow situation effectively to lenders.

- Profitability Ratios: Key metrics such as net profit margin and return on equity are crucial for assessing your organization's profitability and operational efficiency. Understanding these ratios can provide insights into how well your company is performing relative to its peers, particularly in a challenging economic environment where rental and real estate services have experienced a 0.7% drop in earnings compared to the previous year. By leveraging Finance Story's expertise, you can enhance your project case to effectively highlight these metrics.

- Debt-to-Equity Ratio: This ratio evaluates your company's financial leverage. A lower debt-to-equity ratio indicates reduced risk to lenders, making your enterprise a more appealing borrowing candidate. In the current environment, where 46% of companies have reported increased operating expenses, maintaining a balanced ratio is essential. As Jeeva Sanjeevan, Director at Light & Glo, noted, having a solid strategy is crucial for navigating ongoing challenges. Finance Story can assist in developing a strategy that showcases your financial stability.

- Credit Score: Regularly monitoring your credit score is vital. Addressing any discrepancies can significantly affect your borrowing capacity. A higher credit score often leads to improved financing conditions, which is particularly important as businesses face ongoing challenges in the labor market, with 31% struggling to find suitable staff. Finance Story can guide you in enhancing your credit profile before applying for a loan.

- Mortgage-to-Value Ratio (MVR): This ratio compares the mortgage amount to the property value. A lower LVR not only increases your chances of approval but also represents a more secure investment for financiers. Given the present economic circumstances, where numerous enterprises are encountering supply chain disruptions, a favorable LVR can be a crucial element in obtaining financing. With access to a comprehensive range of lenders, Finance Story can assist you in discovering the optimal financing options that align with your LVR.

By focusing on these essential financial metrics and leveraging the expertise of Finance Story, enterprises can significantly enhance their chances for successful funding applications, ensuring they are well-equipped to navigate the complexities of property financing.

Exploring Loan Options for Property Purchases

When contemplating property purchases, businesses often ask, "How much can my business borrow to buy property?" They have access to a variety of financing options tailored to their specific needs. Commercial Property Financing is specifically designed for acquiring commercial real estate. These funds usually present different terms and conditions compared to residential financing, highlighting the unique risks and opportunities linked to commercial properties.

Finance Story focuses on developing refined and highly personalized cases to present to banks, ensuring that your funding proposal meets the elevated expectations of lenders. General financing options can also be utilized for property acquisitions. However, these credits may carry elevated interest rates and more rigorous repayment conditions, making it crucial for companies to assess how much they can borrow before proceeding.

Understanding the nuances of how much your business can borrow to buy property is essential for making informed choices that align with your objectives.

SMSF Loans: For enterprises functioning under a self-managed super fund (SMSF), utilizing this structure to acquire property can be a highly tax-efficient approach. This method not only aids in asset accumulation but also offers potential tax benefits that can enhance overall financial performance.

Finance Story provides expert guidance on navigating SMSF commercial property investments, ensuring tailored lending solutions that fit your needs.

Bridging Loans: These short-term financing solutions are ideal for enterprises that need immediate funding while awaiting long-term financing or the sale of another property. Bridging financing can offer the essential liquidity to capitalize on opportunities promptly, enabling enterprises to respond quickly in a competitive market.

Fixed vs. Variable Rate Financing: When choosing a credit option, companies must evaluate whether a fixed or variable interest rate fits better with their financial strategy. Fixed-rate financing offers stability in repayments, while variable-rate financing can provide flexibility, albeit with potential fluctuations in interest costs.

Current trends indicate a growing interest in sustainable practices within the commercial property sector, with many enterprises planning to undertake deep energy retrofits in the coming months. This shift not only addresses climate change concerns but also aligns with emerging regulatory standards, making it a pivotal consideration for property investments. A recent case study emphasizes that a notable percentage of global participants intend to pursue extensive energy retrofits in the coming 12 to 18 months, signifying a transition towards more sustainable practices in the sector.

By 2025, average interest rates for commercial financing in Australia are anticipated to remain competitive, mirroring the changing environment of financial lending. Financial consultants highlight the significance of grasping the subtleties of each credit type to make knowledgeable choices that align with organizational objectives and economic well-being. Additionally, the Australian Prudential Regulation Authority (APRA) plans to modernize its formal data collections for commercial real estate lending, which may impact financing options and regulatory compliance in the sector.

According to Tim Coy, a senior research leader in commercial real estate, understanding these dynamics is vital for organizations maneuvering through the current market.

Necessary Documentation for Securing a Property Loan

To effectively obtain a property mortgage, companies must prepare and submit a thorough collection of documents that demonstrates how much your business can borrow to buy property. This collection showcases economic stability and the feasibility of the investment. At Finance Story, we focus on developing refined and highly customized case presentations for creditors, ensuring that your loan submission aligns with the increasingly elevated standards of lending institutions. We have access to a complete array of financial institutions, including high street banks and creative private financing groups, to fit any situation.

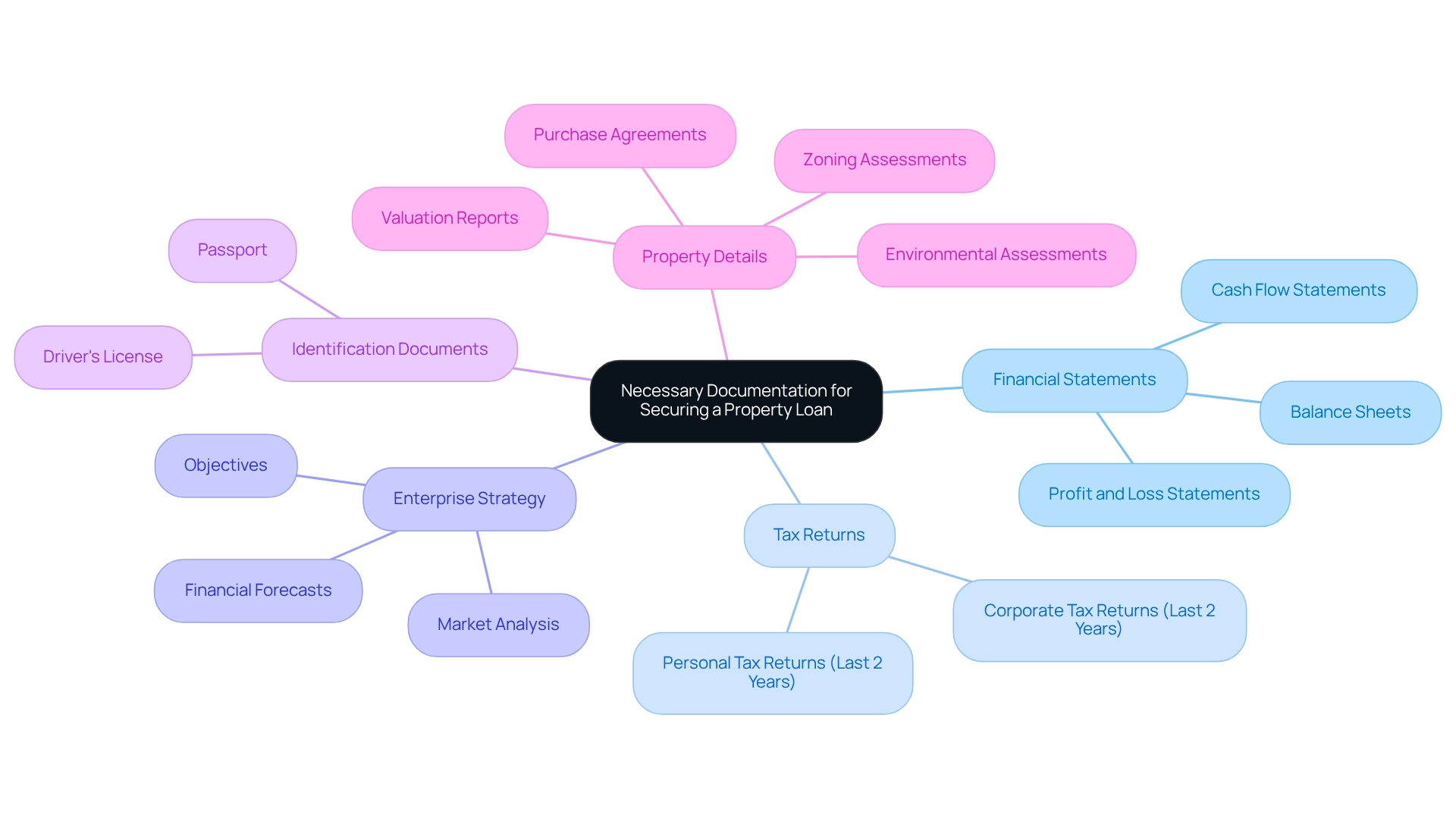

The following key documents are typically required:

- Financial Statements: Recent profit and loss statements, balance sheets, and cash flow statements are essential to illustrate the organization's financial health. These documents provide lenders with insights into revenue trends, expenses, and overall profitability, which are critical for assessing loan eligibility.

- Tax Returns: Both personal and corporate tax returns for the past two years are necessary to verify income. Lenders utilize this information to confirm that the reported income corresponds with the statements, ensuring transparency and precision in the application process.

- Enterprise Strategy: A well-organized enterprise strategy is essential, outlining your objectives, market analysis, and financial forecasts. This document not only outlines the purpose of the financing but also demonstrates to lenders that the enterprise has a clear strategy for growth and repayment.

- Identification Documents: Personal identification, such as a driver's license or passport, is required for all business owners. This step is crucial for confirming the identities of those participating in the application and ensuring adherence to regulatory requirements.

- Property Details: Comprehensive information about the property being purchased is essential. This includes valuation reports, purchase agreements, and any relevant zoning or environmental assessments. Such details assist creditors in assessing the property's value and its potential as security for the financing.

In 2025, companies must also be aware of the latest requirements for credit applications, which may include additional documentation or revised financial statement formats. For example, numerous lenders now highlight the significance of cash flow statements, as they offer a clearer view of an entity's capacity to manage its finances and fulfill financial obligations.

Eligibility for commercial property financing involves factors such as income stability, deposit requirements, detailed documentation, property registration, and credit history. Comprehending these factors can significantly improve a company's chances of understanding how much your business can borrow to buy property.

Specific types of commercial properties that can be financed include warehouses, retail premises, factories, and hospitality ventures. Case studies illustrate the significance of thorough documentation. For instance, companies that carefully organize their statements often encounter a more seamless approval process.

Engaging with financial advisors, like those at Finance Story, can further enhance this preparation, as they can provide insights into the specific financial statements required for different types of loans. Furthermore, collaborating with specialist lenders can assist enterprises in recognizing opportunities and reducing risks, ultimately improving their capability to obtain the required funding.

Statistics indicate that companies that adhere to these documentation standards have a higher likelihood of securing financing. In fact, Finance Story boasts a remarkable 99% loan success rate, underscoring the importance of proper documentation in the loan application process. As Belinda Wright, head of partnerships and distribution at non-bank lender Thinktank, states, "We recognize that educating and upskilling mortgage brokers is crucial for the brokers’ work, our operations, and the industry as a whole; this is why broker education is woven into the fabric of how we operate."

By comprehending and preparing the necessary documentation, enterprises can significantly enhance their chances of securing the funding required to understand how much your business can borrow to buy property, including refinancing options to meet the evolving demands of their operations.

Navigating the Loan Application Process

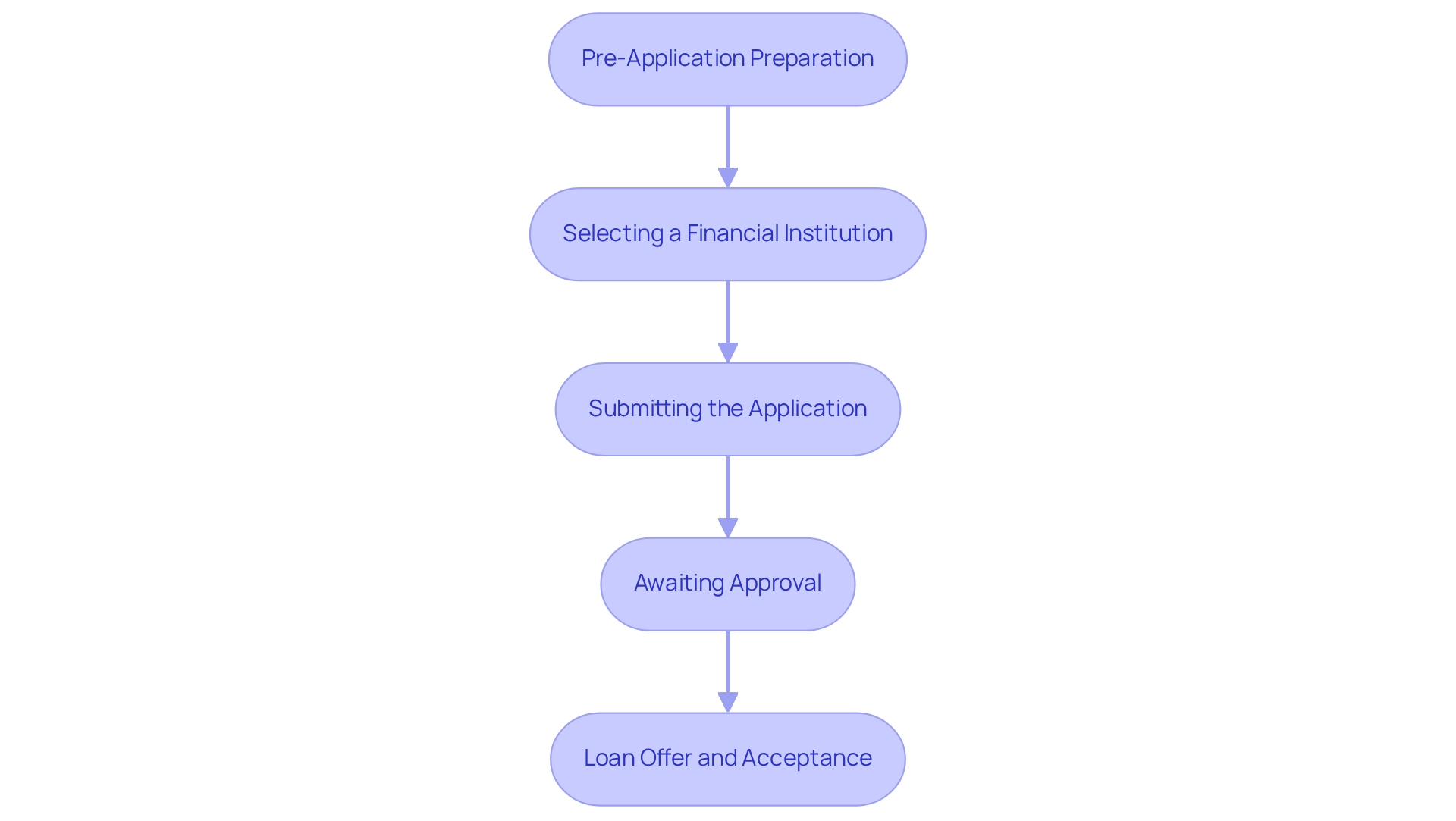

Navigating the loan application process is crucial for small enterprise owners seeking funding for property acquisitions. Follow these essential steps to enhance your chances of success:

-

Pre-Application Preparation: Start by gathering all necessary documentation, including monetary statements, tax returns, and business plans. Assess your financial metrics, such as cash flow and credit history, to confirm you meet borrowing requirements. This preparation is vital, as it lays the groundwork for a successful application.

-

Selecting a Financial Institution: Conduct thorough research to compare various providers. Seek those that offer favorable terms and conditions tailored to your needs. Consider factors like interest rates, fees, and the provider's reputation for customer service. In 2025, small enterprise funding approval rates are expected to be competitive, making it essential to choose a lender that aligns with your financial objectives. Notably, No-Doc commercial loans are available up to $5 million, presenting an option for those who may not meet traditional documentation requirements. Finance Story specializes in crafting polished and highly individualized business cases to present to banks, ensuring you have the best chance of securing the right financing. We collaborate with a comprehensive array of financial institutions, including high street banks and innovative private financing panels, to accommodate your unique situation, whether you are purchasing a warehouse, retail space, factory, or hospitality project.

-

Submitting the Application: Fill out the application form accurately and in detail. Ensure that all required documentation is included to prevent delays. A well-prepared application can significantly enhance your chances of approval.

-

Awaiting Approval: After submission, be prepared for the financial institution to conduct a thorough review of your application. This may involve additional requests for information or clarification. On average, application processing times for small enterprises in Australia in 2025 are anticipated to range from a few days to several weeks, depending on the lender's workload and the complexity of your application. It's important to note that during the pandemic, many small businesses accumulated significant cash buffers, which have aided them in navigating recent economic challenges. However, these buffers have diminished, returning to pre-pandemic levels, which may impact future credit requests.

-

Loan Offer and Acceptance: Once your application is approved, review the loan offer carefully. Pay close attention to interest rates, fees, and repayment terms. Understanding these specifics is crucial before accepting the offer, as they will influence your company's financial health in the long run. As Anna Bligh, CEO of the Australian Banking Association, stated, "This Budget provides extra support to Australians in the short-term whilst at the same time helping to address some of our longer-term challenges," highlighting the importance of the current economic climate for small enterprise owners.

By following these steps and preparing thoroughly, small enterprise owners can navigate the funding application process more efficiently, increasing their likelihood of obtaining the necessary financing to achieve their property investment goals. Additionally, consider scheduling a complimentary personalized consultation with Finance Story's Head of Funding Solutions, Shane Duffy, to discuss tailored financial strategies that align with your objectives.

Overcoming Challenges in Securing Business Loans

Acquiring funding can present numerous obstacles, particularly for small enterprises navigating the financial landscape in 2025. Understanding these challenges is crucial for success. Here are some common obstacles and strategies to overcome them, informed by insights from Finance Story, a leader in tailored financing solutions:

- Insufficient Credit History: New businesses frequently encounter difficulties stemming from a lack of established credit history. To mitigate this, consider applying for smaller amounts initially or leveraging personal credit as a backup option. Gradually establishing a robust credit profile can significantly enhance your chances of securing larger financing in the future. Finance Story specializes in crafting refined and tailored business cases that can assist you in presenting a compelling proposal to potential financiers.

- High Debt-to-Income Ratio: A high debt-to-income ratio can severely restrict your borrowing capacity. Prioritize reducing existing debts before applying for a new loan. This not only strengthens your financial position but also makes you a more attractive candidate to lending institutions. Finance Story can guide you in effectively presenting your financials to meet lender requirements.

- Insufficient Documentation: Many credit requests are delayed or denied due to incomplete or erroneous documentation. It is essential to ensure that all required documents are meticulously prepared and organized. Consulting with a financial advisor, like those at Finance Story, can provide invaluable guidance and streamline the application process, ensuring you have everything in order to secure the funding you need.

- Market Conditions: Economic downturns can introduce uncertainty in lending practices. Staying informed about current market trends is imperative. Flexibility in your loan options can also help you adapt to changing conditions, thereby increasing your chances of approval. Notably, recent data indicates that enterprise lending in Australia has shown promising growth, with a 0.9% increase reported in February. This suggests a potential easing of cash flow pressures for many enterprises, indicating that as demand rises and borrowing costs decrease, small enterprises may find it easier to secure necessary funding.

- Creditor Requirements: Each creditor has distinct criteria for loan approval. Conduct thorough research to identify institutions whose criteria align with your company's economic profile. Finance Story offers access to a comprehensive portfolio of lenders, including high street banks and innovative private lending panels, ensuring you have the best options available to meet your needs.

In addition to obtaining new financing, restructuring your current commercial debts can be a strategic approach to better align your financial responsibilities with evolving operational needs. Finance Story provides tailored refinancing solutions that can help you optimize your loan terms and enhance cash flow.

In light of the Prime Minister's statement that "small enterprises are the backbone of our economy," it is imperative to ensure they have access to fair and sustainable financing options. Small entrepreneurs must proactively address these common challenges. Furthermore, 56% of owners report that digitalization is perceived as too expensive for SMEs, complicating the process of securing loans.

By addressing these challenges and staying informed about the lending environment, you can position yourself for success in determining how much your business can borrow to acquire property. As Natasha B. from VIC stated, 'I will certainly be suggesting your services to anyone. We are finished with the constant worry.'

Once again, thank you for being a part of our journey.

The Role of Mortgage Brokers in Business Financing

Mortgage brokers are vital players in business financing, offering a range of services that significantly aid small business owners in securing funding for property acquisitions. Their contributions encompass:

-

Accessing a Wide Range of Financial Institutions: Brokers cultivate relationships with numerous providers, which allows them to pinpoint the most suitable financing options tailored to your specific needs. This access is essential, particularly in a competitive lending market where choices can differ significantly. At Finance Story, we deliver customized funding solutions for home building and residential property investments, ensuring you find the right fit for your circumstances. We collaborate with a comprehensive array of lenders, including high street banks and innovative private lending panels, to fulfill your financing requirements.

-

Negotiating Terms: Brokers leverage their expertise to negotiate favorable terms and interest rates on your behalf. This capability can lead to substantial savings over the course of the agreement, significantly impacting your overall financial health. Our team excels in crafting polished and highly individualized business cases for banks, enhancing your prospects of securing the best possible terms.

-

Streamlining the Application Process: The financing application process can be overwhelming, but brokers simplify it by gathering and organizing the necessary documentation. This efficiency not only saves time but also mitigates the risk of errors that could delay approval. At Finance Story, we ensure that your loan proposal is comprehensive and meets the heightened standards of financial institutions.

-

Providing Expert Advice: Brokers provide invaluable insights into the lending landscape, assisting you in navigating your options. Their grasp of current market trends and lender requirements empowers you to make informed decisions that align with your objectives. Our expertise extends to refinancing options, enabling you to adjust your financing strategy as your business evolves. We can assist with various commercial properties, including warehouses, retail premises, factories, and hospitality ventures.

-

Ongoing Support: A reputable broker continues to offer support even after securing your loan. This ongoing relationship is beneficial for addressing future financing needs or adjustments, ensuring that your organization remains agile in a fluctuating economic environment. Finance Story is dedicated to being your partner in navigating the complexities of commercial property investments and refinancing.

Statistics underscore the increasing importance of mortgage brokers in today’s financial landscape. For instance, by 2025, mortgage brokers are recognized for helping small enterprises achieve average savings of approximately 15% on loans compared to those who handle the lending process independently. Additionally, data reveals that 70% of small enterprises carry some form of debt, totaling $18 trillion, highlighting the necessity of effective financing strategies.

As finance author Janet Gershen-Siegel notes, '70% of small enterprises hold some level of debt with a total of $18 trillion owed by the end of 2022.'

Case studies further illustrate the tangible benefits of engaging mortgage brokers. For example, a small business owner aiming to expand operations found that partnering with a broker not only expedited the financing approval process but also secured a lower interest rate, ultimately saving thousands over the financing period. The average SBA loan was reported at $538,903, and many small businesses carry debt, with a significant number unlikely to fully repay their obligations, particularly as many do not survive beyond their tenth year.

Such examples accentuate the essential role brokers play in facilitating access to financing and enhancing the financial viability of small enterprises.

In summary, mortgage brokers are indispensable partners in the financing process. Their ability to access multiple lenders, negotiate favorable terms, and provide ongoing support positions them as key players in helping small businesses thrive within a competitive market. Furthermore, data from the MFAA underscores the crucial role of mortgage brokers in driving access, competition, and personalized solutions in the lending market, further solidifying their significance in the current financial landscape.

Recent statistics reveal that loan commitments categorized as 'Other' experienced a 3.9% increase from the September quarter to the December quarter of 2024, with a remarkable rise of 25.9% compared to the same quarter in 2023, indicating a dynamic lending environment that brokers can adeptly navigate.

Conclusion

Understanding borrowing capacity is paramount for small business owners aiming to secure financing for property acquisition. This article has delved into the multifaceted nature of borrowing capacity, highlighting critical factors that influence it, such as:

- Income stability

- Credit history

- Existing debts

- The nature of the business itself

By meticulously assessing these elements, businesses can better position themselves for favorable loan terms and successful funding outcomes.

Furthermore, the importance of thorough documentation and a strategic approach to loan applications cannot be overstated. Businesses that prepare comprehensive financial statements, tax returns, and well-structured business plans significantly enhance their chances of approval. Engaging with experts like Finance Story provides valuable insights and tailored solutions that streamline the borrowing process and improve overall financial readiness.

In a competitive lending environment, leveraging the expertise of mortgage brokers can also provide substantial advantages. Their ability to access a wide range of lenders, negotiate terms, and simplify the application process can make a significant difference in securing the necessary funding. As the demand for commercial property investments continues to rise, small businesses must embrace these strategies to navigate the complexities of financing and achieve their growth objectives.

Ultimately, understanding and enhancing borrowing capacity is not just about securing a loan; it is about laying the groundwork for future success and sustainability in the ever-evolving landscape of property acquisition. Small business owners are encouraged to take proactive steps, utilize available resources, and seek expert guidance to unlock their financing potential and drive their businesses forward.