Overview

To calculate commercial property yield, investors should divide the annual rental income by the property's acquisition cost or market value. This calculation yields a percentage that reflects the asset's profitability. Understanding this metric is crucial for making informed financial decisions. Furthermore, it is essential to distinguish between gross and net yield calculations. By comprehending both metrics, investors can effectively account for operating expenses and market dynamics, leading to more strategic investment choices.

Introduction

Understanding the intricacies of commercial property yield is essential for investors navigating the complex landscape of real estate. This critical metric gauges the income generated by a property relative to its value and serves as a vital tool for making informed investment decisions. However, calculating yield presents challenges, from distinguishing between gross and net returns to avoiding common pitfalls that can distort profitability.

How can investors effectively harness this knowledge to maximize their returns and mitigate risks in an ever-evolving market?

Define Commercial Property Yield

Commercial real estate return is a critical metric that evaluates the income generated by an asset in relation to its value, expressed as a percentage. To learn how to calculate commercial property yield, you simply divide the annual rental income by the asset's acquisition cost or market value. For example, if a commercial property produces $30,000 in annual rent and was purchased for $500,000, the yield calculation is as follows:

Yield = (Annual Rental Income / Property Value) × 100

Yield = ($30,000 / $500,000) × 100 = 6%

This return percentage is vital for investors, providing insight into potential profits and facilitating comparisons among various assets. Understanding commercial asset returns is essential for making informed financial decisions, particularly in a market where average return rates in Melbourne for 2025 are expected to reflect current economic conditions and trends. Moreover, challenges such as tenant turnover and maintaining standards can impact returns, emphasizing the need for investors to conduct thorough due diligence and comprehend local market dynamics.

In addition, leveraging tailored business loans and refinancing options through Finance Story can significantly enhance your investment strategy. Our expertise in crafting refined business cases for banks ensures you have the financial support necessary to optimize your commercial asset yield, whether you are pursuing a standard loan or exploring innovative financing options.

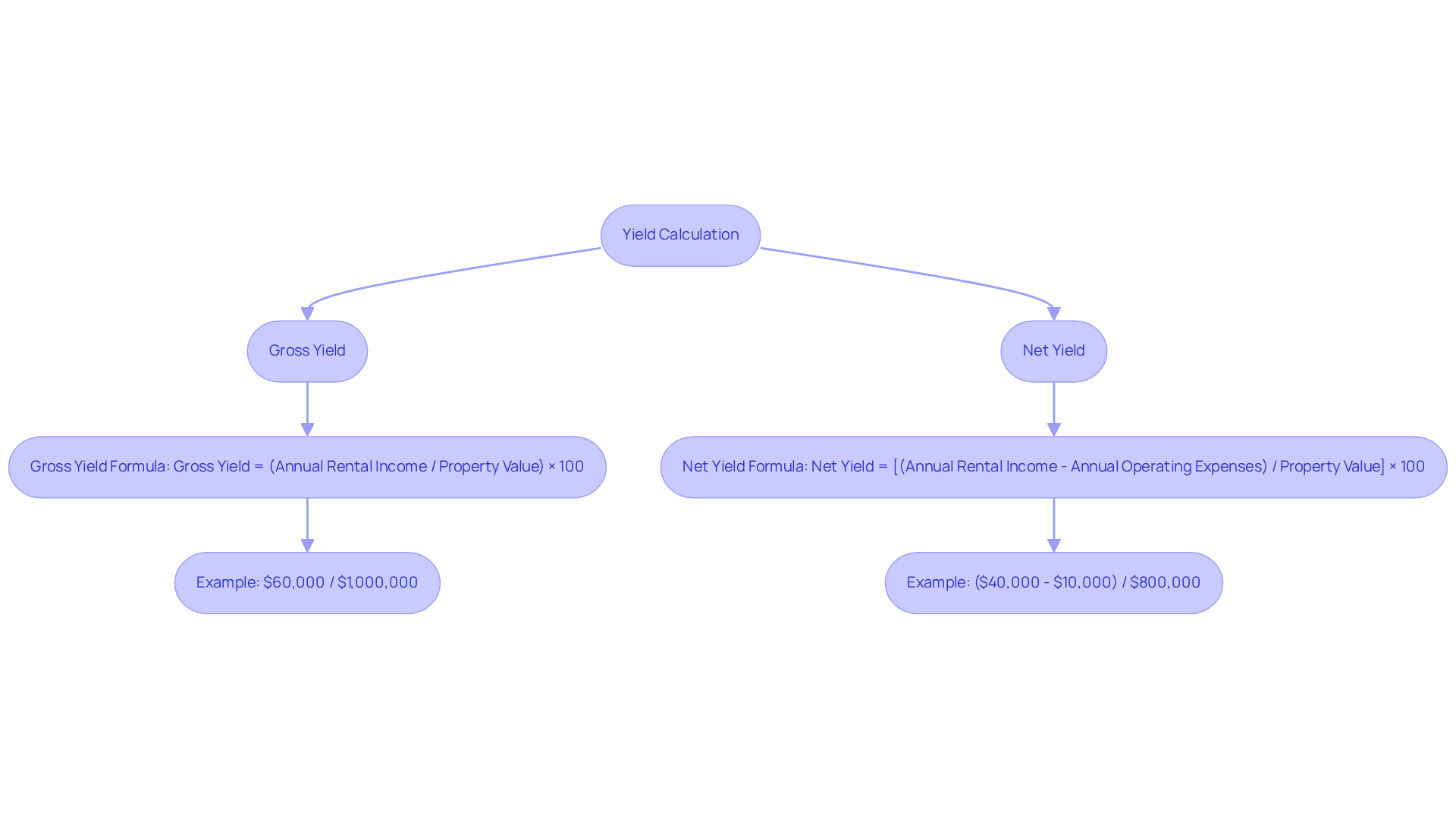

Understand Yield Calculation Formulas

Two primary formulas are essential for calculating commercial property yield:

-

Gross Return: This metric indicates the total yearly revenue produced by the asset divided by its acquisition cost. The formula is:

Gross Yield = (Annual Rental Income / Property Value) × 100

In Australia, gross rental yields for commercial properties typically range from 5% to 6%, with variations based on location and property type. For example, an asset generating $60,000 in yearly rent with a purchase cost of $1,000,000 would produce a gross return of 6%.

-

Net Return: This calculation considers the operating costs linked to the asset, offering a more precise representation of profitability. The formula is:

Net Yield = [(Annual Rental Income - Annual Operating Expenses) / Property Value] × 100

For instance, if a property has an annual rental income of $40,000 and annual operating expenses of $10,000, with a property value of $800,000, the net yield would be:

Net Yield = [(40,000 - 10,000) / 800,000] × 100 = 3.75%

Understanding both gross and net yield is crucial for investors, as it allows for a comprehensive evaluation of investment profitability. While gross return provides a straightforward measure of income, net return offers insights into the actual cash flow after expenses, making it a crucial metric for informed financial choices. Furthermore, securing financing through a diverse range of lenders available at Finance Story can enhance investment opportunities. Being aware of tenant liabilities and potential vacancy risks is essential, as these factors can significantly impact true returns and financing options.

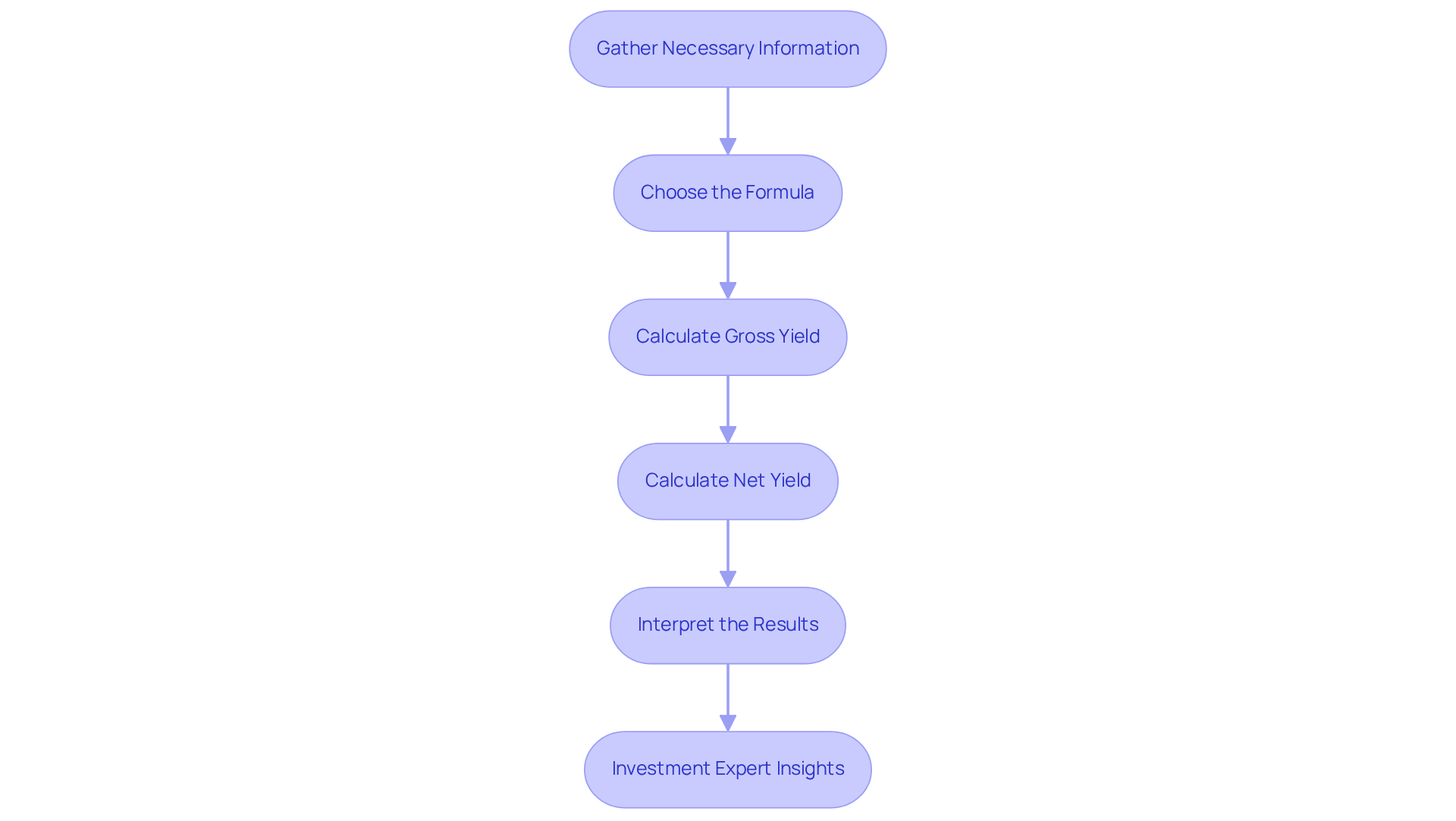

Calculate Yield Step-by-Step

To calculate the commercial property yield, follow these essential steps:

-

Gather Necessary Information: Begin by collecting data on the annual rental income and the purchase price of the property. For example, if the annual rental income is $50,000 and the purchase price is $800,000, you have the crucial figures needed for your calculations.

-

Choose the Formula: Decide whether to calculate the gross yield or the net yield. This guide will address how to calculate commercial property yield through both methods to ensure comprehensive understanding.

-

Calculate Gross Yield:

- Utilize the formula: Gross Yield = (Annual Rental Income / Property Value) × 100.

- In our example: Gross Return = ($50,000 / $800,000) × 100 = 6.25%.

-

Calculate Net Yield (if applicable):

- Assume annual operating expenses are $10,000.

- Apply the formula: Net Return = [(Annual Rental Income - Annual Operating Expenses) / Property Value] × 100.

- In this scenario: Net Yield = [($50,000 - $10,000) / $800,000] × 100 = 5%.

-

Interpret the Results: Analyze the return percentages to assess whether the allocation aligns with your financial objectives. A higher return typically indicates a more lucrative asset. Understanding how to calculate commercial property yield by examining the nuances of gross versus net return can significantly assist in your decision-making process.

As investment expert Godfrey Dinh states, "Master cap rates in commercial real estate investment: Learn what they are, how to calculate them, and what factors influence them." With the average yearly rental earnings for commercial assets in Melbourne projected to be competitive in 2025, comprehending return calculations will be vital for maximizing gains.

Identify Common Calculation Mistakes

When calculating commercial property yield, it is crucial to avoid these common pitfalls:

-

Neglecting Operating Expenses: Failing to account for operating expenses can significantly distort profit perceptions. To determine how to calculate commercial property yield, always deduct these costs to arrive at a true net yield.

-

Using incorrect values can lead to mistakes, so ensure that the rental income and property value used in how to calculate commercial property yield are both accurate and current. Misjudging these figures can result in distorted outcomes and unfavorable financial choices.

-

It is essential to understand how to calculate commercial property yield by distinguishing between gross and net returns. Applying the incorrect formula can distort the asset's profitability, resulting in misguided investment strategies.

-

Disregarding Market Trends: Market conditions play a vital role in output expectations. Always assess the broader market context, as fluctuations can influence rental income and real estate values. For instance, understanding how economic shifts affect demand can provide insights into potential yield changes.

-

Overlooking long-term implications, knowing how to calculate commercial property yield is just one aspect of property ownership. Consider other factors such as capital growth and market stability to develop a comprehensive investment strategy that aligns with your financial goals. Furthermore, including sensible provisions for vacancies and maintenance expenses in return calculations is crucial for precise evaluations.

-

Consulting Professionals: Collaborating with financial consultants or management specialists can offer customized insights and assist in reducing mistakes in return calculations. Their expertise can guide you in making informed decisions based on real-time market conditions.

By being mindful of these errors, investors can make more informed decisions and enhance their potential for success in the commercial real estate market.

Explore Tools and Resources for Yield Calculation

To effectively calculate commercial property yield, a variety of tools and resources are available to assist investors in making informed decisions:

-

Online Return Calculators: User-friendly calculators, such as those available on Rethink Investing and Crew Commercial, enable fast calculations of gross and net returns based on user inputs. These tools simplify the process, making it accessible for both novice and experienced investors. Financial advisors recommend these calculators for their ease of use and accuracy, particularly for those learning how to calculate commercial property yield during initial investment assessments.

-

Spreadsheet Software: Utilizing programs like Microsoft Excel or Google Sheets allows for the creation of custom output calculation templates. This method facilitates more thorough examinations, accommodating different situations and assumptions that may influence results. Statistics suggest that around 70% of real estate investors employ spreadsheet software for profit calculations, highlighting its efficiency in the industry.

-

Financial Apps: Mobile applications designed for real estate investors frequently include integrated return calculation tools. These applications enable on-the-go evaluations, simplifying the process of assessing potential opportunities in real-time.

-

Professional Consultation: Collaborating with finance consultants or real estate advisors can provide personalized insights into yield calculations, particularly for complex properties. Their expertise assists in navigating the complexities of commercial ventures, ensuring precise evaluations. As pointed out by industry specialists, having a professional assess your calculations can significantly improve financial outcomes.

-

Educational Resources: Engaging with literature and web-based courses centered on commercial real estate enhances comprehension of return calculations and broader financial strategies. This knowledge is crucial for making sound financial decisions.

By leveraging these tools and resources, investors can understand how to calculate commercial property yield, which helps them gain a clearer picture of potential returns and ultimately guides their investment choices. For example, using an online yield calculator, an investor might find that a property costing $500,000 with a rental income of $400 per week results in a rental yield of 4.16%. This illustrates the practical application of these resources.

Conclusion

Understanding how to calculate commercial property yield is crucial for investors seeking to evaluate the profitability of their real estate investments. This guide outlines the importance of yield as a key metric, detailing the step-by-step process for calculating both gross and net yields. By mastering these calculations, investors can make informed decisions that align with their financial goals and market conditions.

The article delves into the formulas required for yield calculation, emphasizing the significance of considering operating expenses and market trends. It highlights common mistakes that can lead to inaccurate assessments, such as neglecting operating costs and using outdated values. Furthermore, the importance of leveraging various tools and resources—like online calculators and professional consultations—has been underscored to assist investors in making accurate evaluations.

Ultimately, the ability to calculate commercial property yield effectively empowers investors to navigate the complexities of the real estate market with confidence. By applying the insights and strategies discussed, individuals can enhance their investment decisions, capitalize on opportunities, and mitigate risks in a dynamic economic landscape. Embracing this knowledge is not just beneficial; it is essential for achieving long-term success in commercial real estate.