Overview

This article serves as a comprehensive guide for small business owners seeking to navigate the complexities of borrowing a business loan. Understanding the various types of loans available is crucial for making informed decisions. Assessing your borrowing capacity is equally important, as it lays the groundwork for what you can realistically secure. Preparing the necessary documentation is a vital step in the process, and being aware of common application mistakes can greatly enhance your chances of obtaining financing. By following these guidelines, businesses can position themselves for growth and operational success.

Introduction

In the dynamic landscape of small business financing, understanding the intricacies of business loans is essential for entrepreneurs eager to fuel growth and navigate challenges. Business loans are critical lifelines, enabling companies to invest in essential resources, manage cash flow, and expand operations. With various types of loans available—from traditional term loans to innovative financing options like invoice financing and crowdfunding—business owners must make informed decisions that align with their unique needs and objectives.

As the lending landscape evolves, grasping the nuances of each loan type, assessing borrowing capacity, and preparing a compelling application can significantly enhance the likelihood of securing necessary funds. Have you considered how well you understand your financing options? This article delves into the essential aspects of business loans, offering insights into the application process, common pitfalls to avoid, and alternative financing solutions that can empower small businesses to thrive in today's competitive market.

Understanding Business Loans: What You Need to Know

Business credits serve as essential monetary tools that empower companies to support operations, stimulate expansion, and pursue specific initiatives. These financial aids can be utilized for a variety of purposes, including acquiring essential equipment, managing cash flow, or enhancing operational capabilities. Understanding how to borrow a business loan and the various kinds of financial assistance available is crucial for making informed financial decisions.

Key types of business loans include:

- Term Loans: Traditional loans with a fixed repayment schedule, typically used for significant investments like equipment or real estate.

- Lines of Credit: A flexible borrowing option that allows companies to withdraw funds as needed, making it ideal for managing cash flow fluctuations.

- Invoice Financing: This form of credit enables companies to borrow against unpaid invoices, providing instant cash flow assistance.

Each type of credit has its own conditions, interest rates, and repayment arrangements, which can greatly influence your company's financial health. Recent statistics indicate that the average amount requested for minor enterprise financing is approximately $94,845, with many companies seeking funds for vehicle and equipment acquisitions. This trend underscores the increasing readiness of small and medium-sized enterprises (SMEs) to leverage financing for growth, even amid economic challenges.

According to a case study titled 'Small Loan Statistics,' this trend reflects a positive outlook for enterprise growth and investment in Australia.

Before delving into how to borrow a business loan, it is essential to thoroughly assess your organization's requirements. Determine the amount of funding needed and outline a clear plan for its utilization. As Phil Collard, a finance lending specialist, emphasizes, "The appropriate funding option can be a highly effective instrument to boost growth, so ensure your strategies are well outlined, including anticipated ROI."

This strategic approach not only enhances your chances of securing a loan but also positions your enterprise for sustainable growth and success in a competitive landscape.

At Finance Story, we specialize in crafting refined and highly customized cases to present to banks, ensuring you obtain the right financing for your commercial property investments or refinances, whether it be a warehouse, retail establishment, factory, or hospitality venture. With access to a comprehensive range of lenders, including high street banks and innovative private lending panels, we can assist you in navigating the complexities of enterprise financing. Furthermore, it is noteworthy that nearly half of medium and minor-sized enterprises still rely on paper documentation, which can complicate their monetary processes and borrowing requirements.

Additionally, there are approximately 842,800 commercial credit card accounts in Australia, with an average monthly balance of $15,166, emphasizing the diverse monetary resources available to enterprises.

Exploring Different Types of Business Loans

Small businesses have access to a variety of loan types, each designed to meet specific financial needs:

- Term Loans: These traditional loans come with a fixed repayment schedule and are typically utilized for substantial investments, such as purchasing equipment or real estate. In 2025, term financing remains a favored option among small enterprises, especially for long-term projects. Finance Story focuses on crafting refined and highly personalized case studies to present to lenders, ensuring that your term loan proposal meets the elevated standards of financial institutions.

- Lines of Credit: Providing flexibility, lines of credit enable companies to borrow up to a predetermined limit and only incur interest on the amount utilized. This choice is especially advantageous for handling cash flow variations, allowing companies to react swiftly to unforeseen costs or chances. With Finance Story's expertise, you can navigate the complexities of securing a line of credit customized to your company needs.

- Invoice Financing: This innovative solution allows businesses to borrow against their outstanding invoices, providing immediate cash flow without the need to wait for customer payments. As Michael McCareins, a Content Marketing Associate, notes, "The best part? You don’t accrue debt at any point throughout the process since the company is purchasing your receivables." Invoice factoring is especially advantageous as it does not add debt to the balance sheet, making it a strategic choice for many small enterprises. Finance Story can help you craft a compelling case for invoice financing that aligns with your cash flow requirements.

- Equipment Financing: Designed for the acquisition of equipment, this type of financing utilizes the purchased equipment as collateral. This method not only safeguards the funding but also aligns the financing with the asset's worth. Finance Story's expertise ensures that your equipment financing proposal is robust and meets lender expectations.

- SBA Financing: Supported by the Small Business Administration, these financial products often include favorable terms, such as lower interest rates and extended repayment periods. However, they usually necessitate extensive documentation, which can be an obstacle for some small enterprise owners. Finance Story can assist in preparing the necessary documentation to enhance your chances of approval.

In 2022, a notable gap was observed in funding approvals, with male-owned enterprises obtaining 71.6% of total amounts compared to 28.4% for female-owned enterprises. This highlights the ongoing challenges faced by women entrepreneurs in accessing funding. The case study titled "Women Are at a Disadvantage as Male-Owned Businesses Have a Higher Chance of Approval" illustrates these disparities, emphasizing the need for women entrepreneurs to explore grants specifically designed for them to bridge this gap.

As of 2025, understanding how to borrow business loan options is crucial for entrepreneurs seeking to make informed decisions that align with their growth strategies. By assessing the advantages and criteria of each financing option, small enterprise owners can choose the most appropriate funding solution to support their distinct goals. Additionally, the recent December quarter 2024 release of lending indicators marks an evolution in the lending landscape, providing further context for current financing options.

Furthermore, Finance Story offers access to a full suite of lenders, including high street banks and innovative private lending panels, ensuring that you can find the right financing solution for your commercial property needs, whether it be a warehouse, retail premise, factory, or hospitality venture. Refinancing options are also available to meet the evolving needs of your business.

Determining Your Borrowing Capacity: Key Factors to Consider

To effectively assess your borrowing capacity, it is essential to consider several key factors:

- Credit Score: Your credit score plays a pivotal role in the approval process. A better credit score not only boosts your odds of approval but also allows access to larger borrowing amounts and more advantageous interest rates. Lenders rely on this score to evaluate your creditworthiness, making it a critical component of your financial profile. As of 2025, the average credit score of small enterprise owners seeking financing has become increasingly significant, with many lenders emphasizing its influence on funding eligibility.

- Revenue: Consistent and robust income is essential for securing financing. Lenders will examine your income to ensure that you have the resources to repay the debt. In 2025, companies with consistent revenue sources are more likely to obtain favorable credit conditions, as lenders seek assurance of repayment capability.

- Existing Debt: The amount of current debt significantly impacts your ability to secure additional financing. Lenders assess your debt-to-income ratio, which reflects how much of your income is allocated to servicing existing debt. A lower ratio indicates a healthier economic position, enhancing your borrowing capacity. Significantly, remarkable liabilities to small enterprises fell from 80% in 2020 to 74% in 2021, demonstrating how enterprises are adjusting to handle their debts efficiently.

- Enterprise Strategy: A well-organized strategy is essential when pursuing financing. This document should outline your monetary projections and express how you plan to use the funds. An engaging financial plan can not only clarify your monetary strategy but also instill confidence in lenders regarding your capability to manage the funding effectively. At Finance Story, we specialize in creating polished and highly individualized cases to present to banks, ensuring that your proposal meets the heightened expectations of lenders. We assist with various types of commercial properties, including warehouses, retail premises, factories, and hospitality ventures, as well as refinancing options to meet the evolving needs of your business, which is crucial for understanding how to borrow a business loan. By addressing each element thoughtfully, you can significantly enhance your chances of understanding how to borrow a business loan for the desired amount. Furthermore, it is significant that as of 2020, 11.8% of enterprises identified 'other' as the reason for seeking funding, underscoring the varied motivations behind loan requests. Additionally, typical reasons for pursuing financing involve franchising, commercial real estate acquisitions, and cash flow for operations. Lastly, as McKinsey indicates, embedded lending is already linked to higher profit margins, highlighting the significance of comprehending monetary products and their implications for entrepreneurs.

Navigating the Business Loan Application Process

Navigating the financial application process is essential for small enterprise owners striving to understand how to borrow a business loan efficiently. Here are the essential steps to follow:

- Assess Your Needs: Begin by clearly defining the amount of money required and the specific purposes for which it will be used. Comprehending your financial requirements is crucial, as 23% of enterprises pursue funding to replace capital assets or conduct repairs, while 13.5% intend to refinance or reduce current debt. This understanding will help you articulate how to borrow a business loan to potential lenders.

- Research Lenders: Take the time to compare various lenders and their financing products. Minor banks, which supply 70% of local enterprise financing, frequently deliver more personalized service and adaptability, rendering them a valuable choice for new ventures that may face challenges with larger organizations. As emphasized in a recent case study, these banks play an essential role in assisting small enterprises, especially those that struggle to qualify for loans from larger banks. At Finance Story, we focus on crafting refined and highly personalized proposals to present to lenders, emphasizing how to borrow a business loan effectively and ensuring you have the best opportunity to secure the funds you require. We also provide access to a full range of lenders, including high street banks and innovative private lending panels, to suit your specific circumstances.

- Prepare Your Documentation: Collect all required papers, including accounting statements, tax returns, and a detailed plan for your enterprise. Proper documentation is essential for a seamless application process when you learn how to borrow a business loan, as it shows your enterprise's economic stability and future potential. Our team at Finance Story can assist you in preparing these documents to meet the heightened expectations of lenders.

- Submit Your Application: Complete the application form with accuracy and submit it alongside your documentation. Ensure that all information is clear and concise to avoid delays in processing.

- Follow Up: After submission, proactively follow up with the lender to check on the status of your application. This step is crucial, as it shows your commitment and allows you to provide any additional information they may require.

Additionally, flexible loan servicing options are gaining traction, which can improve repayment rates by an average of 30%. This flexibility can be especially helpful for independent enterprise owners as they manage their financial responsibilities. Remember, preparation is key, and expert opinions suggest that understanding how to borrow a business loan through a well-prepared application can make all the difference in securing the funding you need.

As Anna Bligh, CEO of the Australian Banking Association, stated, "These small enterprises will drive Australia through the crisis, and after it has passed, employ millions of Australians as the economy rebuilds."

Lastly, consider exploring options such as invoice factoring, which enables companies to receive up to 90% of the value of each invoice. This can offer prompt cash flow assistance and support the economic well-being of your enterprise. For personalized guidance, schedule your free consultation with Finance Story's Head of Funding Solutions, Shane Duffy, to discuss tailored financial strategies that meet your unique needs.

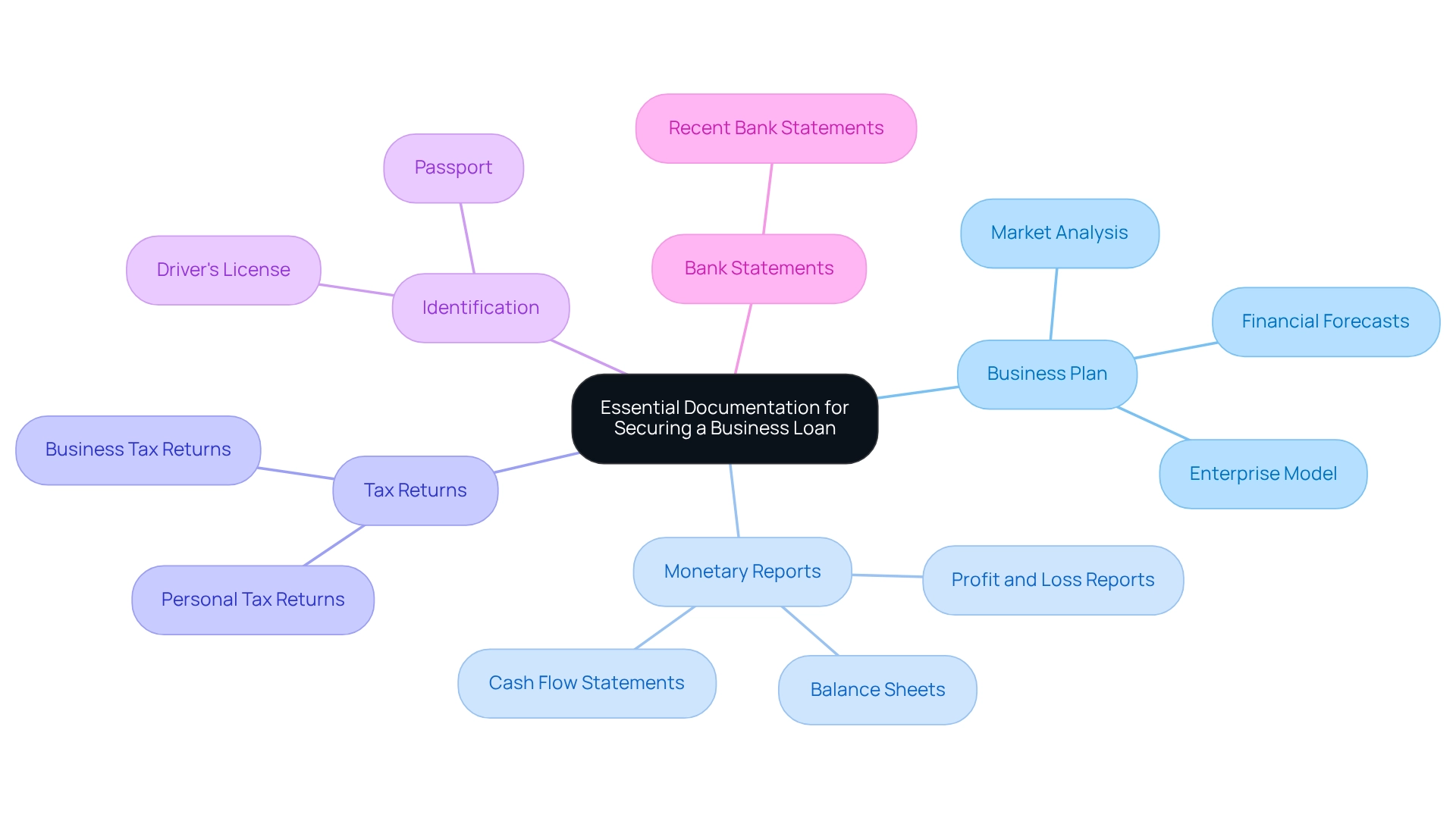

Essential Documentation for Securing a Business Loan

When learning how to borrow a business loan, preparing a comprehensive set of documentation is essential to facilitate a smooth application process. The following key documents are typically required:

-

Business Plan: A well-structured business plan is crucial. It should outline your enterprise model, market analysis, and financial forecasts. A solid plan significantly increases the likelihood of loan approval, as lenders often rely on it to assess the viability of your venture. At Finance Story, we specialize in developing refined and highly personalized proposals to present to banks, ensuring you meet the elevated expectations around securing funds. For instance, a case study involving a show bag enterprise illustrates this point; despite facing challenges during the global pandemic, the venture thrived with the right monetary support, showcasing how a robust strategy can attract lenders even in tough times.

-

Monetary Reports: Recent monetary statements, including profit and loss reports, balance sheets, and cash flow statements, are essential. These documents provide lenders with a clear view of your company's economic status and operational performance. Research shows that a lower debt-to-income ratio, often illustrated through these monetary documents, correlates with a healthier economic position and enhances the chances of loan approval.

-

Tax Returns: Both personal and business tax returns for the past two years are necessary. These documents assist in confirming your income and economic stability, which are essential factors in the lending decision.

-

Identification: Personal identification documents, such as a driver's license or passport, are required to confirm your identity and ensure compliance with regulatory standards.

-

Bank Statements: Recent bank statements offer insights into your cash flow and spending habits, allowing lenders to evaluate your financial management.

Preparing these documents beforehand not only simplifies the application process but also enhances your understanding of how to borrow a business loan. Moreover, adaptable financing servicing has been shown to increase repayment rates by an average of 30%, highlighting the importance of presenting a well-rounded application that addresses lenders' concerns. By ensuring that all essential documents are meticulously prepared, entrepreneurs can significantly improve their prospects of learning how to borrow the business loan needed to grow and sustain their ventures.

Additionally, Finance Story provides access to a full range of lenders, including high street banks and innovative private lending panels, to suit various circumstances, whether you are purchasing a warehouse, retail premise, factory, or hospitality venture. Furthermore, we can assist with restructuring your commercial financing to accommodate the changing requirements of your enterprise. As Jess Rise noted, "Thriday feels like a product built in the future. I never want to go back to my old way of doing things." This viewpoint highlights the significance of innovative financial solutions that connect with small enterprise owners seeking contemporary methods of financing.

The Role of Credit Scores in Business Loan Approval

Credit scores play a pivotal role in determining financing approvals. Here’s how they influence the process:

- Impact on Approval: Lenders heavily depend on credit scores to assess the risk of lending to a business. A higher credit score significantly boosts the chances of approval, signaling to lenders that the entity is a reliable borrower. At Finance Story, we specialize in crafting tailored financing proposals, complete with comprehensive cases to present to banks, thereby enhancing your prospects of securing funding.

- Influence on Terms: Beyond mere approval, a robust credit score can lead to more favorable financing conditions. Companies with strong credit profiles often enjoy lower interest rates and higher borrowing limits, essential for growth and expansion. Directors with elevated credit scores may also benefit from advantageous repayment terms, such as extended repayment periods and more flexible payment schedules. Our expertise in refinancing can assist you in navigating these terms effectively.

- Improving Your Score: Business owners can take deliberate steps to boost their credit scores. Key strategies include making timely payments on existing debts, keeping credit utilization below 30%, and regularly checking credit reports for inaccuracies. These measures not only improve credit ratings but also enhance the overall financial health of the business. Additionally, separating personal and business finances by opening accounts under the entity's name can help establish a solid credit profile.

Understanding how to secure business loans and the importance of credit scores empowers entrepreneurs to effectively manage their financial futures, positioning them favorably when seeking financing. As of 2025, the average credit score required for small businesses remains around 680, underscoring the necessity of maintaining a strong credit profile. By focusing on credit management and leveraging our expertise at Finance Story, entrepreneurs can navigate the lending landscape more efficiently and obtain the financing essential for their ventures.

We provide a comprehensive range of lenders tailored to your needs, whether you are acquiring a warehouse, retail space, factory, or hospitality business. The fluctuations in personal credit balances also highlight the market's volatility, which can influence financial decisions for businesses. Don’t hesitate to contact Finance Story for support with your financing requirements.

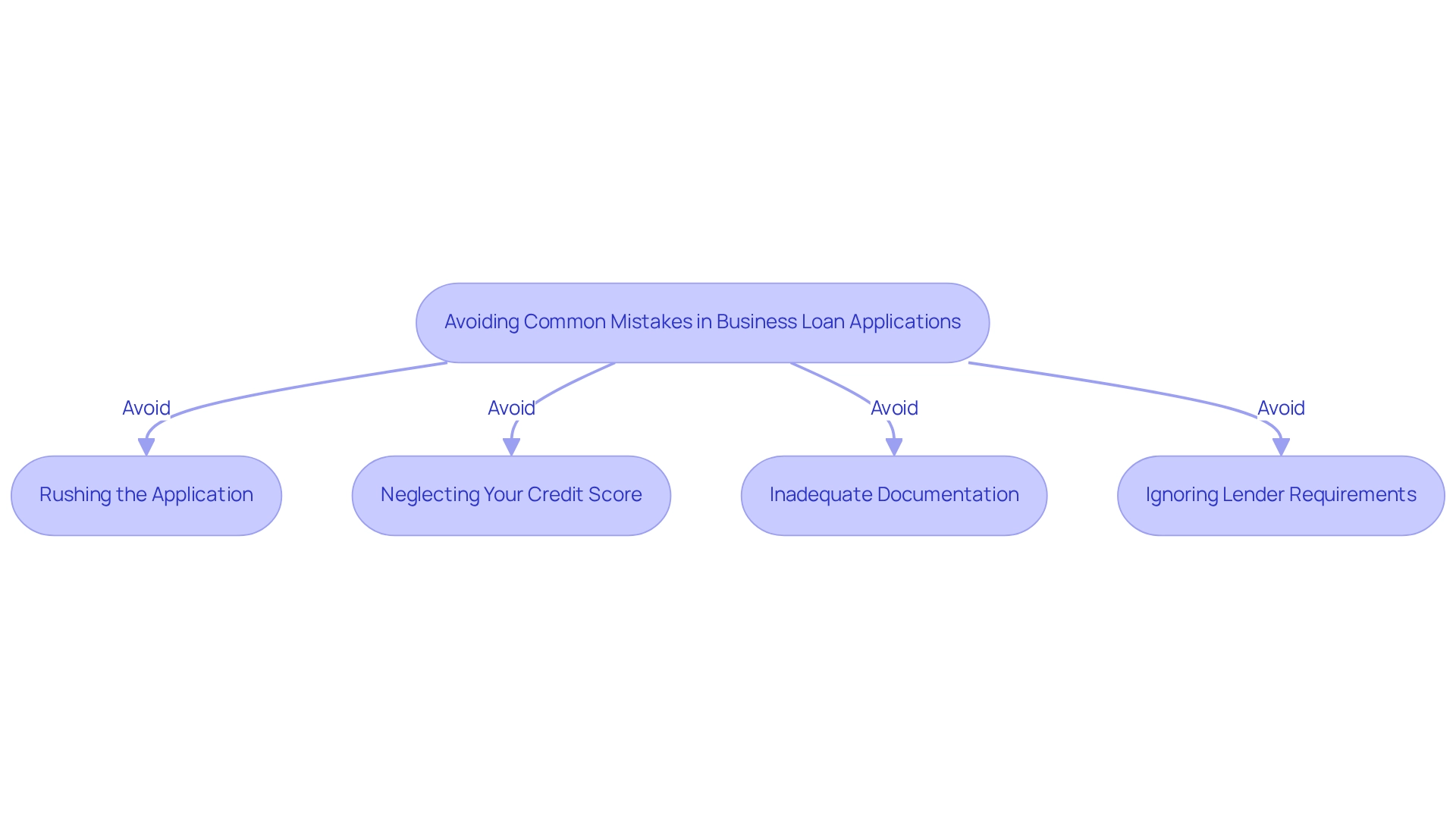

Avoiding Common Mistakes in Business Loan Applications

To significantly improve your chances of securing a business loan, it is crucial to avoid these common pitfalls:

- Rushing the Application: Taking the time to meticulously complete your application is essential. Inaccuracies or incomplete information can lead to delays or outright denials.

- Neglecting Your Credit Score: A surprising number of applicants overlook their credit scores, which can have a substantial impact on loan approval. Understanding your credit standing before applying can help you address any issues proactively.

- Inadequate Documentation: Insufficient documentation is a frequent cause of application setbacks. Ensure you provide all necessary financial statements, tax returns, and operational plans to support your request.

- Ignoring Lender Requirements: Each lender has specific criteria that must be met. Familiarize yourself with these requirements to avoid unnecessary complications in the approval process.

By steering clear of these mistakes, you can present a more compelling application that showcases your ability to secure a business loan, thereby enhancing your likelihood of obtaining the funding you need. Statistics reveal that 70% of minor enterprises hold some level of debt, totaling $18 trillion owed by the end of 2022. This underscores the importance of a well-prepared application in navigating the competitive financing landscape.

Furthermore, alternative lenders boast approval rates of 71% for small business funding requests, compared to only 58% for conventional banks.

Moreover, expert insights indicate that having a clear plan, including anticipated return on investment (ROI), can transform a financing option into a powerful growth tool. As Phil aptly stated, "The right financial arrangement can be a very powerful tool to accelerate growth, so be sure to have your plans clearly mapped out, including expected ROI." As you prepare your application, remember that accuracy and thoroughness are your best allies in achieving your financial goals.

Significantly, the typical small enterprise funding amount sought is $94,845, and SMEs are increasingly aiming to utilize financing for expansion, particularly for acquiring established companies and purchasing equipment. This trend highlights the importance of understanding how to borrow a business loan to secure potential benefits while avoiding common pitfalls.

To further enhance your financing strategy, consider booking a free personalized consultation with Finance Story's Head of Funding Solutions, Shane Duffy. This meeting will enable you to discuss your specific needs and goals, ensuring a customized approach to your financing journey. We focus on developing refined and highly personalized case studies to present to lenders, including a full range of options for commercial investment properties such as warehouses, retail spaces, factories, and hospitality ventures.

By working with us, you will gain access to a comprehensive suite of lenders, from high street banks to innovative private lending panels.

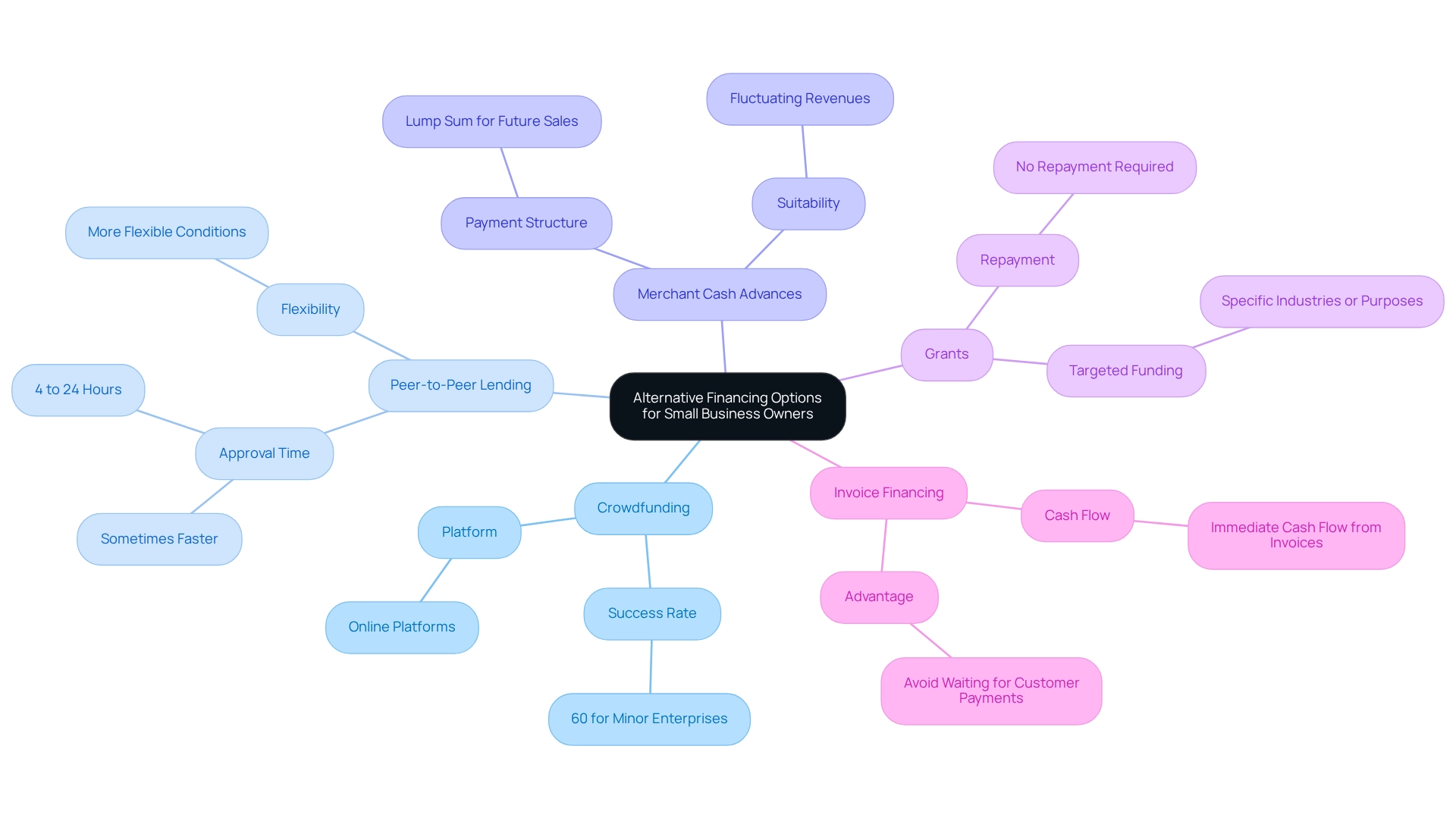

Alternative Financing Options for Small Business Owners

When traditional business loans are not viable, small business owners can explore several alternative financing solutions tailored to their unique needs:

- Crowdfunding: This method allows businesses to raise small amounts of money from a large number of people, typically through online platforms. In 2025, crowdfunding has experienced a notable increase, with success rates for minor enterprises reaching around 60%, demonstrating its efficiency as a feasible funding avenue.

- Peer-to-Peer Lending: This option enables enterprises to obtain loans directly from individuals via online platforms, often providing more flexible conditions than traditional banks. The peer-to-peer lending market has grown swiftly, with numerous small enterprises reporting faster approval times, frequently within 4 to 24 hours. Most clients see approvals in this timeframe, sometimes even faster, making it an attractive option for urgent funding needs.

- Merchant Cash Advances: This financing option offers a lump sum in exchange for a portion of future sales, making it especially suitable for enterprises with fluctuating revenues. This option allows for immediate access to cash, which can be crucial for managing operational costs during lean periods.

- Grants: Small enterprises should consider exploring government or private funding that does not require repayment. These grants are often targeted at specific industries or purposes, providing a valuable funding avenue without the burden of debt.

- Invoice Financing: This method permits companies to utilize outstanding invoices to obtain immediate cash flow, allowing them to avoid waiting for customer payments. This can be particularly advantageous for companies that encounter delays in receivables.

These alternative financing choices are becoming increasingly favored among entrepreneurs, particularly in 2025, as they provide vital funding solutions for those learning how to navigate business loans while facing challenges in obtaining conventional loans. As Jon Sutton, CEO of ScotPac, noted, "That is great news for our broader economy as SMEs are the biggest employers in the country." The expansion of these choices indicates a wider trend towards innovative monetary solutions that address the varied requirements of enterprises today.

Furthermore, the Finance Cloud Global Market Report 2025 highlights the increasing use of cloud-based solutions in financial operations, further supporting the relevance of these alternative financing methods. Finance Story's dedicated lending partner in the UK for expat loans also enhances its capabilities in providing diverse financing solutions tailored to small business owners.

Conclusion

Securing the right business loan is a multifaceted process that demands a thorough understanding of various loan types, careful assessment of borrowing capacity, and meticulous preparation of documentation. Entrepreneurs must navigate a diverse landscape of financing options, including:

- Term loans

- Lines of credit

- Invoice financing

- Alternative solutions like crowdfunding and peer-to-peer lending

Each option presents unique benefits and considerations, making it essential for business owners to align their financing choices with their specific operational needs and growth strategies.

Furthermore, the significance of maintaining a strong credit score cannot be overstated, as it significantly impacts loan eligibility and terms. By proactively managing credit and preparing a solid business plan, entrepreneurs can enhance their chances of securing favorable financing. Avoiding common pitfalls in the application process, such as incomplete documentation and rushing submissions, can further improve the likelihood of success.

In addition, as the financing landscape continues to evolve, staying informed about current trends and innovative funding solutions is crucial for small business owners. By leveraging expert guidance and exploring a variety of financing options, entrepreneurs can position their businesses for sustainable growth and navigate the challenges of today's competitive market effectively. Embracing these strategies not only empowers businesses to secure necessary funds but also fosters resilience and adaptability in an ever-changing economic environment.