Overview

This article outlines essential steps for determining your borrowing capacity for commercial property. It emphasizes the importance of:

- Understanding your financial position

- Calculating borrowing capacity

- Identifying loan eligibility criteria

To support this, it details processes such as:

- Gathering financial documents

- Calculating net worth

- Evaluating various financing options

These steps collectively empower potential borrowers to make informed decisions when securing loans for commercial investments.

Introduction

Understanding the financial landscape of commercial property investment is essential for aspiring buyers. With the right knowledge, investors can adeptly navigate the complexities of borrowing and secure favorable loan terms. However, many encounter obstacles in assessing their financial position and determining their borrowing capacity.

What key steps must be taken to unlock the potential for financing commercial real estate?

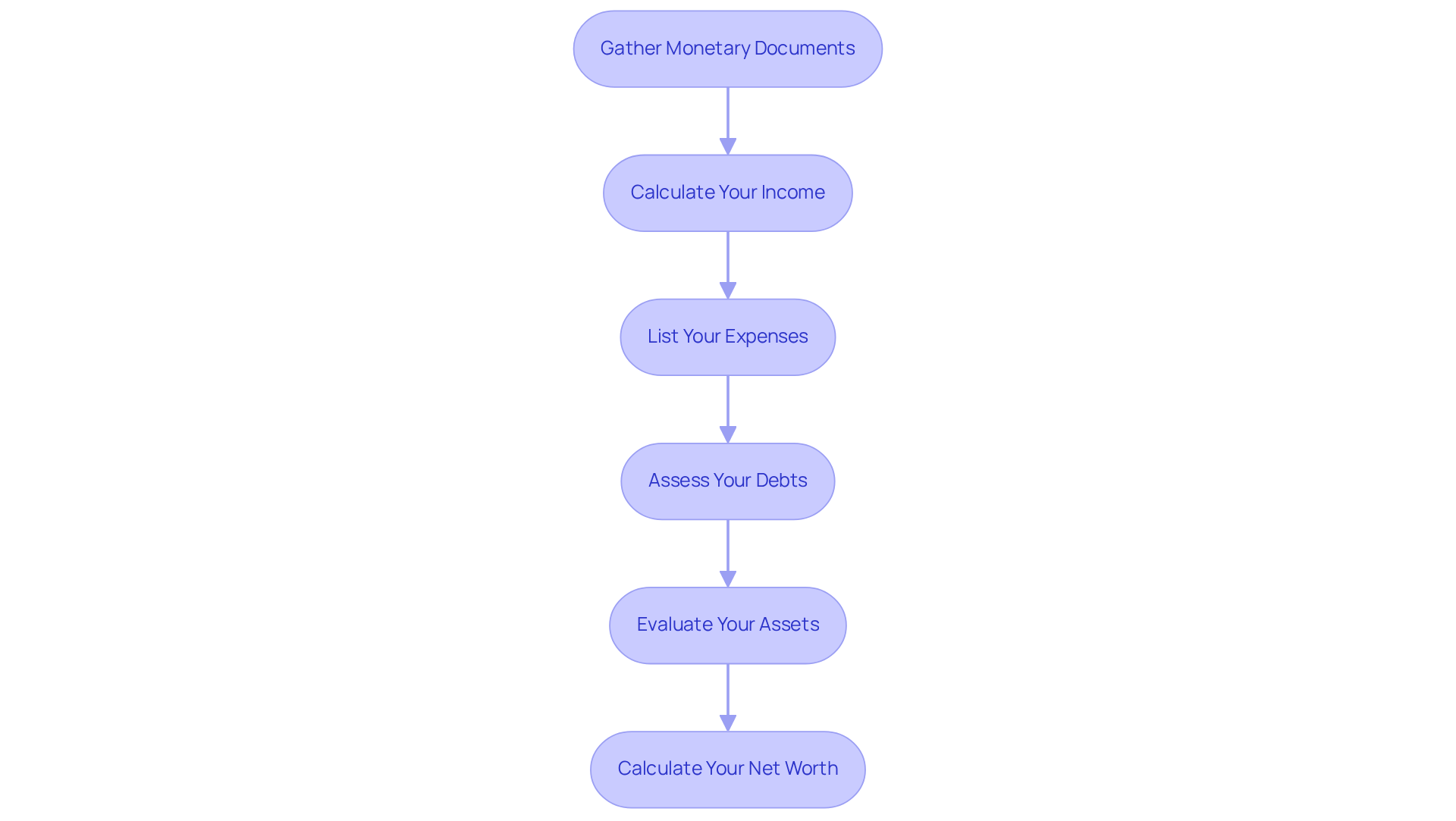

Understand Your Financial Position

To effectively understand your financial position, it is imperative to follow these essential steps:

- Gather Monetary Documents: Begin by collecting recent bank statements, tax returns, and any other pertinent monetary documents. These documents are crucial for showcasing your economic stability to lenders.

- Calculate Your Income: Include all sources of income, such as salary, bonuses, rental income, and any side businesses. This comprehensive view is vital for assessing your borrowing capacity.

- List Your Expenses: Document all monthly expenses, distinguishing between fixed costs (like rent or mortgage payments) and variable costs (like groceries and entertainment). Understanding your spending habits is fundamental for effective financial planning.

- Assess Your Debts: Compile a list of all outstanding debts, including credit cards, personal loans, and other liabilities. This information is essential for lenders to evaluate your debt-to-income ratio.

- Evaluate Your Assets: Identify your assets, such as savings accounts, investments, and property ownership. A clear picture of your assets significantly enhances your economic profile.

- Calculate Your Net Worth: Subtract your total liabilities from your total assets to determine your net worth. This figure is crucial for lenders to assess how much you can borrow for commercial property and your monetary stability.

Understanding these elements not only equips you for the mortgage application process but also empowers you to make informed economic choices. With the average net worth of Australian households reported at $1,021,900, having a solid grasp of your economic situation is more important than ever for securing favorable loan terms.

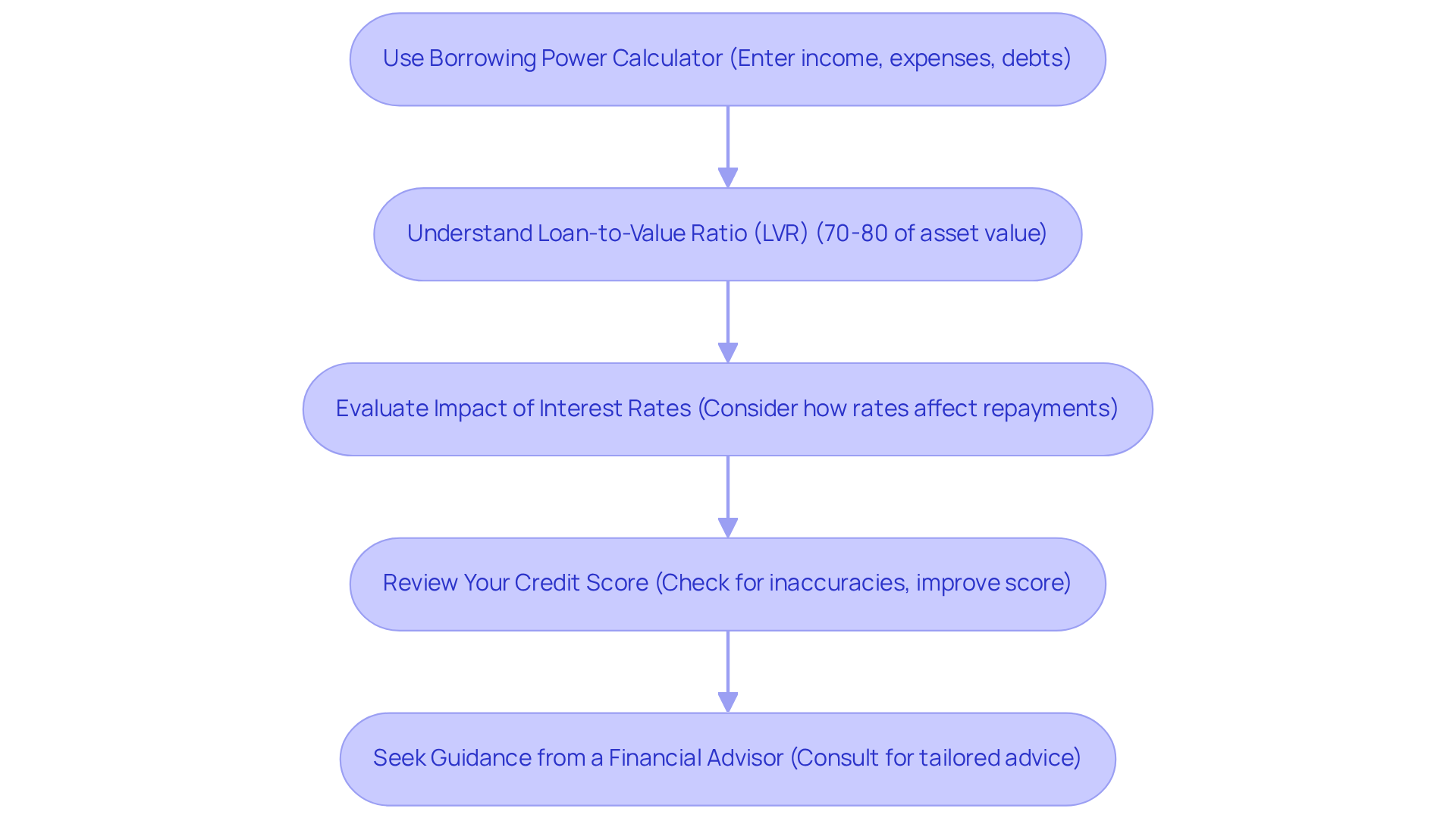

Calculate Your Borrowing Capacity

To accurately determine your borrowing capacity for commercial property, follow these essential steps:

-

Utilize a Borrowing Power Calculator: Many banks and financial institutions provide online calculators. By entering your income, expenses, and existing debts, you can obtain a preliminary estimate of how much you can borrow. Finance Story focuses on crafting refined and highly customized business cases to showcase to lenders, thereby improving your loan potential.

-

Understand Your Loan-to-Value Ratio (LVR): Lenders typically allow financing up to 70-80% of the asset's value. For instance, if you are looking to acquire a property valued at $1 million, your potential loan range would be between $700,000 and $800,000. Current statistics indicate that the share of new loans with an LVR of 80% or higher has risen to 32%, reflecting a growing acceptance of higher leverage in the market.

-

Evaluate the Impact of Interest Rates: It's crucial to consider how prevailing interest rates influence your repayments. As rates rise, your capacity to take on debt may diminish, which makes it essential to understand how much you can borrow for commercial property and stay informed about market trends. Recent studies indicate that a cash rate reduction could rekindle market interest, potentially resulting in higher property values and lending activity. As analyst Alexandra Koster pointed out, "One cash rate reduction alone doesn't significantly affect your loan capacity, but it can positively influence the confidence of buyers in the market."

-

Review Your Credit Score: A strong credit score can significantly enhance your lending capacity. Regularly check your credit report for inaccuracies and take steps to improve your score if needed. Financial analysts emphasize that a better credit profile opens up more favorable lending options, which is crucial when working with a diverse range of lenders, including high street banks and private lending panels.

-

Seek Guidance from a Financial Advisor: If you find the calculations daunting or need tailored advice, consulting with a financial advisor or mortgage broker can provide valuable insights. Their expertise can assist you in navigating the complexities of loans and ensure you make informed choices. With the average new credit size for owner-occupants in Australia reaching a record high of $666,000, professional guidance is increasingly important in managing larger amounts.

By adhering to these steps and utilizing the expertise of Finance Story, including refinancing options, you can gain a clearer understanding of your borrowing potential and make strategic decisions in your commercial real estate investments.

Identify Loan Eligibility Criteria

To assess your eligibility for a commercial property loan, it is crucial to consider several key criteria:

-

Income Verification: Lenders require evidence of income, which may include pay slips, tax returns, or business accounting statements. For example, a business owner typically needs to present their last two years of tax returns along with current financial statements to demonstrate income stability.

-

Credit History: A robust credit history plays a vital role in securing financing. Lenders will scrutinize your credit report for any defaults or late payments, as a clean record significantly boosts your chances of approval.

-

Deposit Requirements: Most lenders expect a deposit ranging from 20-30% of the asset's value. A larger deposit not only reduces the borrowed amount but also signals financial stability, thereby enhancing your approval prospects.

-

Property Valuation: The property in question must undergo an appraisal to determine its market value, which directly influences the financing amount you can secure. Accurate valuations are essential for both the lender and the borrower.

-

Debt-to-Income Ratio: Lenders evaluate your debt-to-income ratio, which compares your monthly debt obligations to your gross monthly income. A lower ratio is preferred, indicating sufficient income to manage additional debt.

-

Business Stability: For commercial financing, lenders often require proof of business stability. This may involve presenting a comprehensive business plan and financial projections, showcasing your business's potential for growth and profitability.

Understanding these criteria can significantly enhance your chances of securing a commercial financing agreement, which is essential in determining how much you can borrow for commercial property and navigating the lending landscape more effectively.

Explore Financing Options for Commercial Properties

When considering financing options for commercial properties, it is essential to evaluate the following avenues:

-

Traditional Bank Loans: These loans are recognized for their competitive interest rates, typically ranging from 5.89% to 10.74% for commercial real estate. However, they often come with stringent eligibility criteria, making them suitable for borrowers with strong credit profiles and stable financials.

-

Private Lenders: For those who may not meet the strict requirements of traditional banks, private lenders offer more flexible terms. While interest rates can exceed 10%, they provide quicker approvals and less stringent documentation requirements, making them an attractive option for many businesses.

-

SMSF Loans: Utilizing a Self-Managed Super Fund (SMSF) to acquire commercial real estate can yield substantial tax advantages. This approach allows investors to leverage their superannuation savings while enjoying potential capital growth. Finance Story specializes in guiding clients through the complexities of SMSF commercial real estate investments, ensuring tailored lending solutions that meet individual needs.

-

Bridging Loans: These short-term financing solutions are ideal for securing a property while awaiting long-term financing approval. They can be particularly useful in competitive markets where timing is crucial.

-

Low-Doc Financing: For borrowers who find it challenging to supply extensive documentation, low-doc financing offers a practical alternative. Although they typically carry higher interest rates, they provide a pathway to financing for those with unique circumstances.

-

Consult a Mortgage Broker: Engaging a mortgage broker can streamline the process of navigating various financing options. Brokers have access to a wide range of lenders and can help identify the best solutions tailored to your specific needs, ensuring you secure the most favorable terms available. As analyst Matthew Board suggests, businesses should apply for loans when their accounts are healthy to secure better terms from banks and lenders.

By understanding these options and leveraging the expertise of Finance Story, including our ability to create polished and individualized business cases for banks, you can make informed decisions regarding how much you can borrow for commercial property that align with your financial goals and the unique demands of your investment. Additionally, we offer a full suite of lenders to meet your refinancing needs, ensuring you have access to the best financing solutions available.

Conclusion

Understanding the intricacies of borrowing for commercial property is essential for making informed investment decisions. By grasping your financial position, calculating your borrowing capacity, and identifying loan eligibility criteria, potential borrowers can navigate the complex lending landscape with confidence. Each step outlined in this guide serves as a building block towards securing favorable financing terms, ultimately empowering investors to achieve their commercial real estate goals.

Key insights include:

- The importance of thorough financial documentation

- The impact of credit scores on loan eligibility

- The variety of financing options available—from traditional bank loans to private lenders and SMSF loans

Furthermore, recognizing the significance of interest rates and the loan-to-value ratio can help borrowers better understand their potential borrowing limits and the overall market dynamics.

In conclusion, the path to securing a commercial property loan involves careful evaluation and strategic planning. By leveraging the resources available, including calculators and professional advice, investors can not only determine how much they can borrow but also position themselves advantageously in a competitive market. Taking proactive steps to assess financial health and explore diverse financing options will ultimately lead to more successful and sustainable investments in the realm of commercial real estate.