Overview

The duration for financing commercial property can vary significantly based on factors such as:

- Property type

- Borrower financial health

- Market conditions

- Loan structure

Understanding these factors is crucial for investors, as they directly influence financing terms and the number of years available for repayment. This knowledge supports informed decision-making in property investments. Are you aware of how these elements affect your financing options? By grasping the nuances of commercial property financing, investors can navigate the complexities of the market more effectively.

Introduction

Navigating the world of commercial property financing often feels like traversing a complex maze, filled with unique terms and varying conditions that significantly differ from residential loans. Investors seeking to understand the financing durations available for commercial property will uncover a wealth of strategies and insights that can empower their decision-making process.

However, with factors such as:

- Property type

- Borrower financial health

- Market conditions

influencing financing durations, the question remains: how can investors effectively assess their options and secure the best terms in this rapidly evolving landscape? Furthermore, understanding these dynamics is crucial for making informed investment choices.

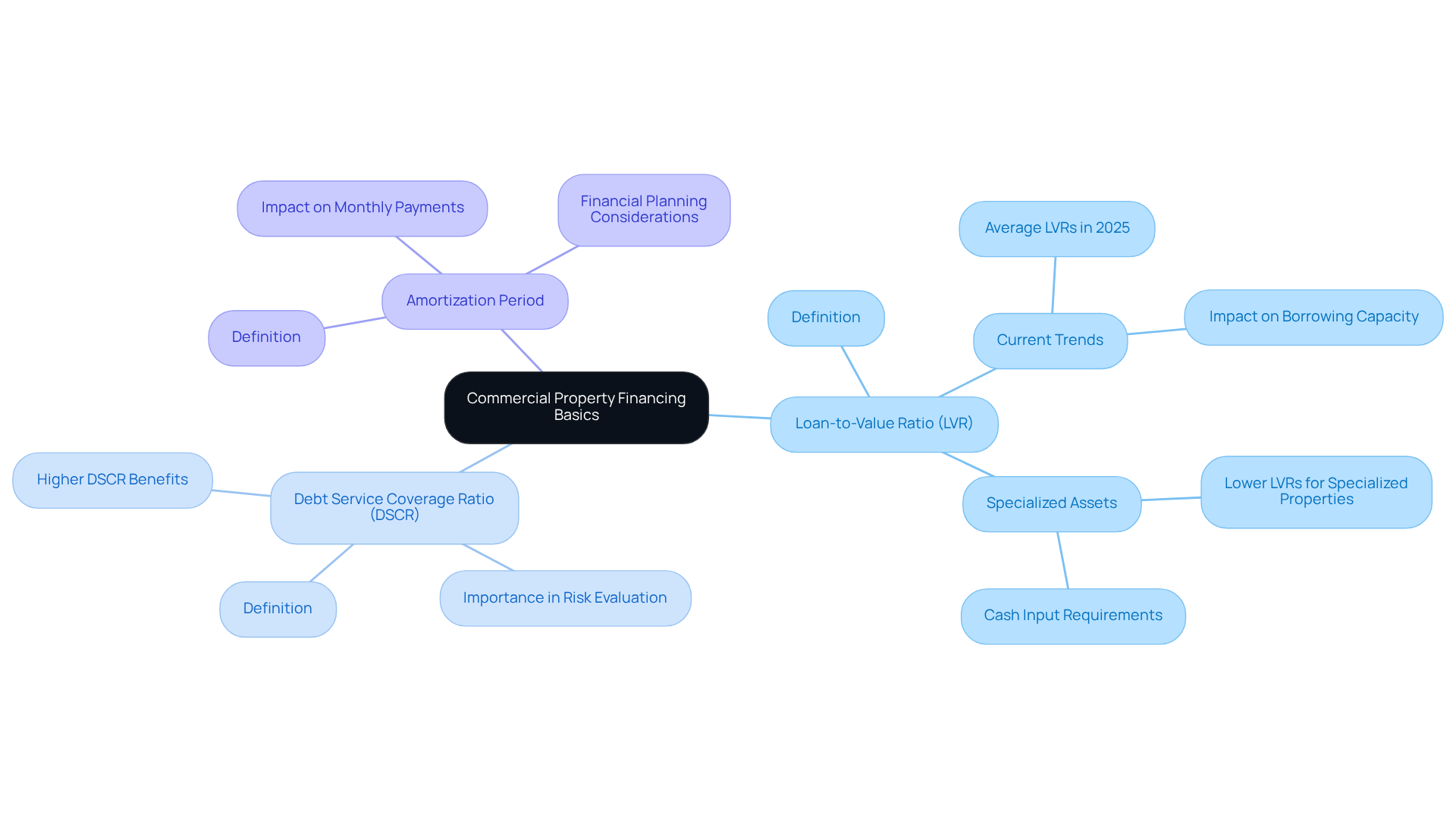

Understand Commercial Property Financing Basics

Property financing is the process of securing funds for the acquisition, development, or refinancing of business properties. Unlike residential financing, business funding is structured differently, often necessitating larger down payments and shorter durations. Key terms to grasp include:

- Loan-to-Value Ratio (LVR): This ratio compares the loan amount to the property's value, significantly influencing borrowing capacity. As we look ahead to 2025, average LVRs for commercial property financing are becoming increasingly favorable, with many lenders offering up to 80% LVRs, particularly in the Self-Managed Super Fund (SMSF) sector.

- Debt Service Coverage Ratio (DSCR): This metric assesses the cash flow available to meet current debt obligations, playing a crucial role in lenders' risk evaluations. A greater DSCR indicates a stronger capacity to manage debt, which can lead to improved financing terms.

- Amortization Period: This refers to the duration over which the loan is repaid, impacting monthly payments and total interest costs. Understanding how many years can you finance commercial property is essential for effective financial planning.

As industry specialists emphasize, successful business property investment requires meticulous planning and thorough deal packaging. Investors should be cognizant of the unique requirements for different asset types, as specialized properties may impose stricter LVRs, often ranging from 50% to 65%. This reality necessitates larger cash inputs, making it crucial for investors to prepare adequately.

In summary, grasping these essential concepts, including how many years can you finance commercial property, will empower you to navigate the business funding landscape more effectively, ensuring informed decisions throughout your investment journey.

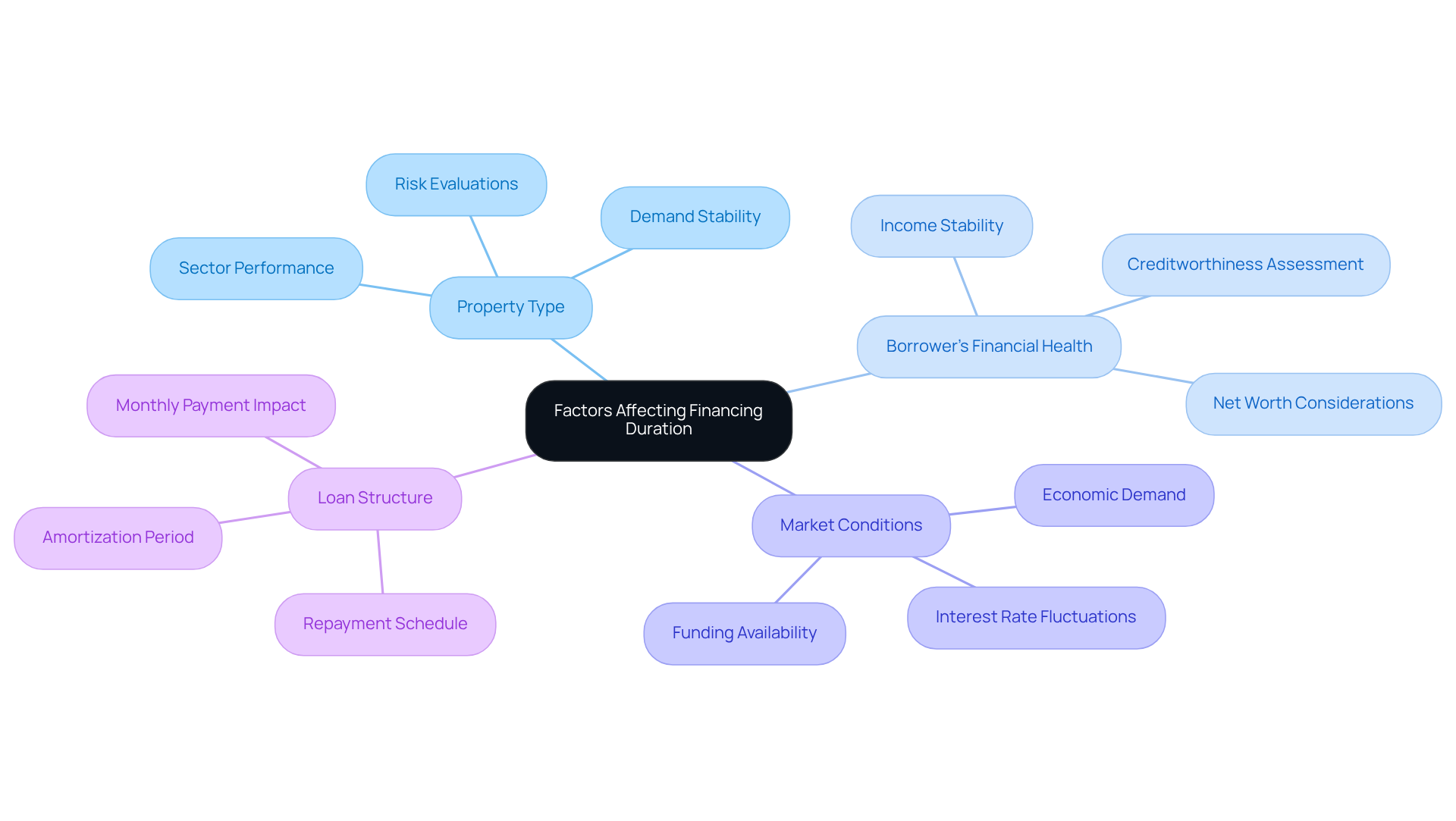

Identify Key Factors Affecting Financing Duration

Several key factors significantly influence the duration of financing for commercial properties:

-

Property Type: Financing terms can vary widely depending on the type of commercial property. For example, retail and industrial properties frequently draw varying risk evaluations from lenders, resulting in distinct financing conditions. Properties demonstrating robust demand and stability, such as industrial spaces, often secure more advantageous terms compared to those in declining sectors like traditional office spaces.

-

Borrower’s Financial Health: Lenders meticulously assess the creditworthiness of borrowers, considering factors such as credit scores, income stability, and existing debt levels. In 2025, statistics suggest that borrowers with a net worth exceeding $1 million, excluding their primary residence, are more likely to secure favorable borrowing conditions. This underscores the growing scrutiny of borrower financial health.

-

Market Conditions: Economic elements, including fluctuating interest rates and the overall demand for commercial properties, significantly impact the availability and terms of funding. As interest rates rise, lenders may impose stricter criteria, affecting approval rates and the associated terms of funding.

-

Loan Structure: The specific terms of the agreement, including the amortization period and repayment schedule, directly influence the length of funding. For instance, loans structured with longer amortization periods may offer lower monthly payments, making them appealing to borrowers aiming to manage cash flow effectively.

Understanding these factors empowers prospective investors to more accurately predict how many years they can finance commercial property, facilitating informed decision-making in a rapidly evolving market.

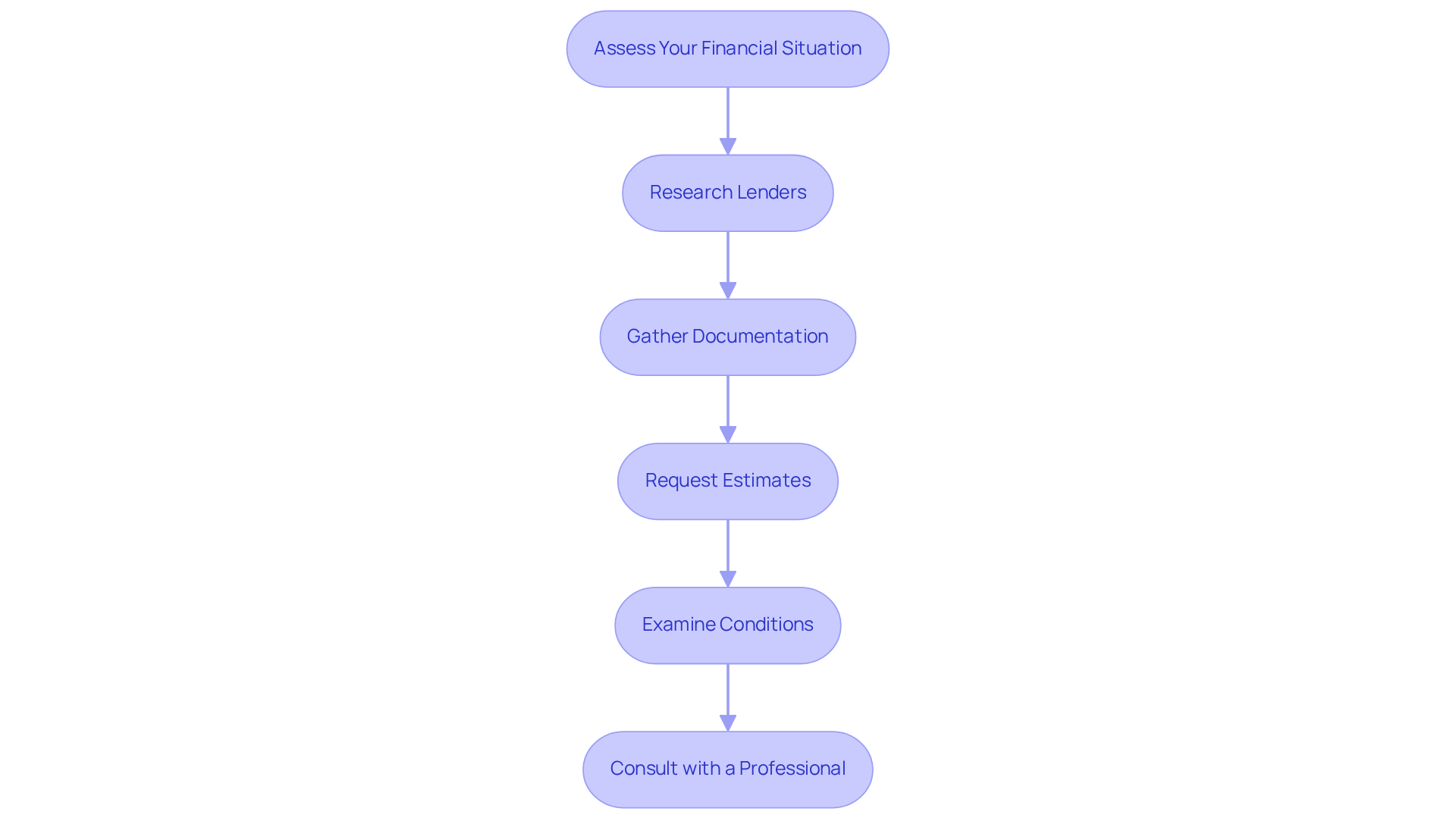

Evaluate Your Financing Options Step-by-Step

To effectively evaluate your financing options for commercial property, consider the following steps:

-

Assess Your Financial Situation: Begin by reviewing your credit score, income, and existing debts. Understanding these factors will help you gauge your borrowing capacity. In 2025, average credit score criteria for business financing are usually approximately 680, but this may differ by provider.

-

Research Lenders: Identify potential lenders, including banks, credit unions, and private lenders. Each may provide various conditions and stipulations, so it's essential to compare their proposals.

-

Gather Documentation: Prepare essential documents such as tax returns, financial statements, and a comprehensive business plan. These will be necessary to present to lenders and demonstrate your financial stability.

-

Request Estimates: Contact various lenders to acquire quotes on financing conditions, interest rates, and related charges. This will provide a clearer picture of your options.

-

Examine Conditions: Thoroughly evaluate the conditions of each borrowing. Focus on interest rates, repayment schedules, and any additional costs that may arise during the loan period.

-

Consult with a Professional: Engaging with a finance consultant can be invaluable. They can help interpret offers, assess your financial situation, and negotiate terms on your behalf, ensuring you secure the best possible deal.

By systematically following these steps, you can make informed choices about your funding options, including understanding how many years you can finance commercial property, ultimately selecting the best fit for your needs.

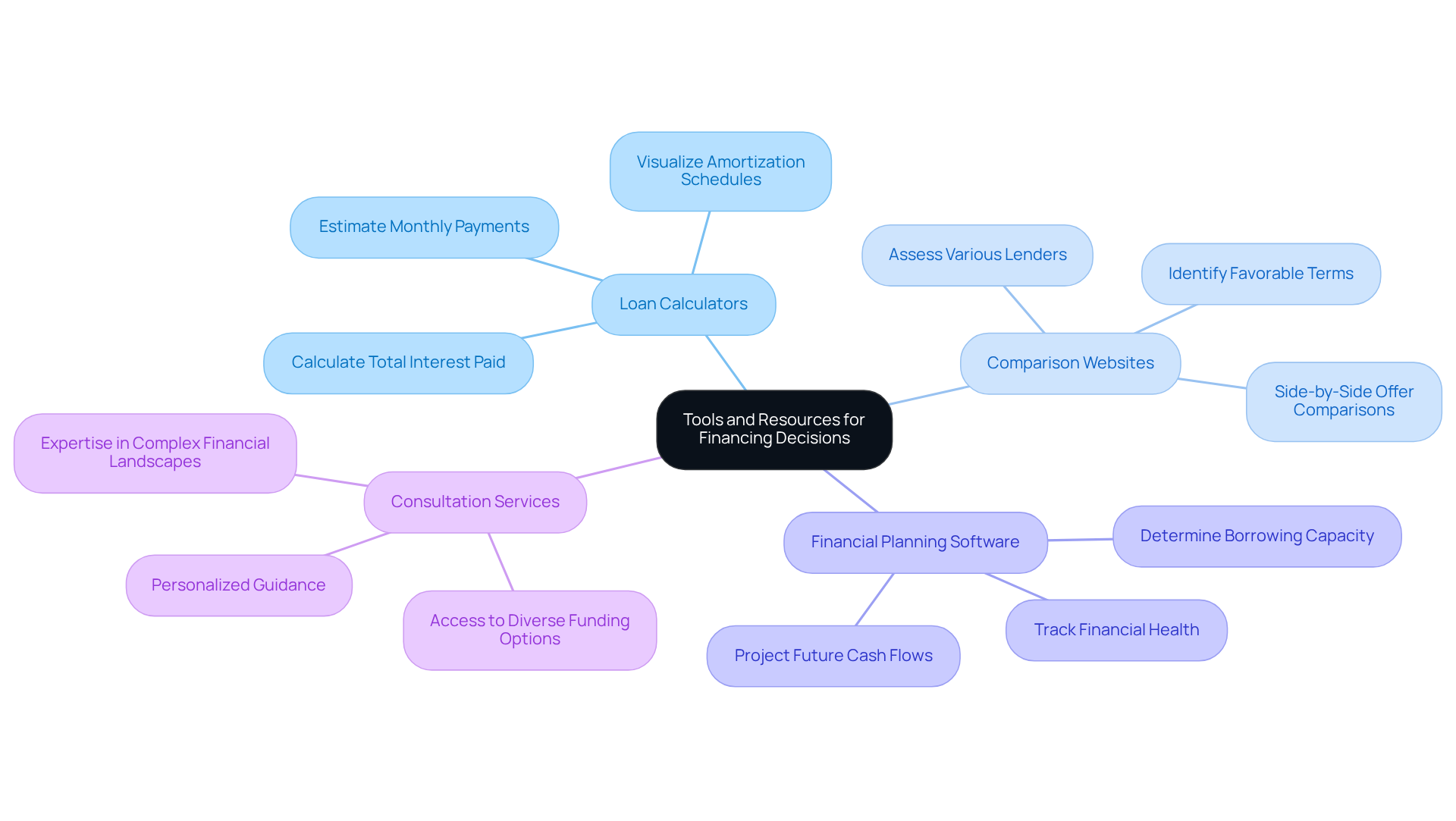

Utilize Tools and Resources for Financing Decisions

To enhance your financing decisions, consider leveraging the following tools and resources:

- Loan Calculators: Online calculators are invaluable for estimating monthly payments, total interest paid, and amortization schedules based on varying loan amounts and interest rates. These tools help you visualize the financial implications of different borrowing scenarios.

- Comparison Websites: Utilize financial comparison websites to assess various lenders and their offerings side-by-side. This approach allows you to identify the most favorable terms and conditions available in the market.

- Financial Planning Software: Implement software designed to track your financial health and project future cash flows. This can be crucial in determining your borrowing capacity and ensuring that you make sound financial decisions.

- Consultation Services: Collaborate with financial advisors or brokers who can offer personalized guidance and access to a wider variety of funding options. Their expertise can guide you through complex financial landscapes, ensuring you find the best solutions for your needs.

By effectively utilizing these tools and resources, you can navigate the complexities of commercial property financing with greater confidence. This enables you to make informed decisions that align with your financial goals.

Conclusion

Understanding the intricacies of financing commercial property is essential for making informed investment decisions. The ability to navigate the complexities of commercial loans—including the duration of financing and the factors influencing it—can significantly impact an investor's success. By grasping the fundamental aspects of commercial property financing, investors position themselves for favorable terms and long-term profitability.

Key factors such as property type, borrower financial health, market conditions, and loan structure play a crucial role in determining how many years one can finance a commercial property. The insights provided in this guide highlight the importance of assessing these elements to predict financing duration accurately. Furthermore, utilizing tools like loan calculators and comparison websites empowers investors to evaluate their options and secure the best possible financing arrangements.

Ultimately, the journey into commercial property financing transcends merely securing funds; it encompasses strategic planning and informed decision-making. By applying the knowledge gained from this article, investors can enhance their financial acumen and approach the commercial real estate market with confidence. Embracing these insights facilitates smarter investments and paves the way for future success in the dynamic world of commercial property.