Overview

Commercial property loans provide essential financing specifically for business-related real estate. These loans are uniquely structured, with terms influenced by the property's income-generating potential rather than the borrower's personal income. Understanding this distinction is crucial for securing favorable financing for your business investments.

The application process for commercial property loans involves several key requirements and factors that can affect loan terms. Familiarizing yourself with these elements can significantly enhance your chances of obtaining the best possible financing. Have you considered how your property's income potential aligns with your financing needs?

In addition, it's important to recognize the various factors that lenders evaluate when determining loan terms. These may include:

- The property's location

- The property's condition

- Market demand, among others

By being aware of these considerations, you can better prepare yourself to meet lender expectations and improve your application.

Ultimately, securing the right commercial property loan can empower your business to thrive. Take the time to understand the intricacies of the loan process and position yourself for success in your financial endeavors.

Introduction

Navigating the world of commercial property loans can be a daunting task for business owners eager to invest in real estate. Unlike residential mortgages, these specialized financing options come with unique requirements and considerations that can significantly impact a company's financial health. This guide aims to demystify the commercial property loan process, outlining essential steps and key insights that empower businesses to make informed decisions.

What challenges might arise during the application process?

How can a deeper understanding of these loans lead to better financial outcomes?

Define Commercial Property Loans

Business financing options represent specialized financial instruments designed to assist companies in obtaining, refinancing, or developing assets essential for their operations. Unlike residential financing, which is secured against a home, commercial financing is secured against business assets. These financial agreements cater to various categories of real estate, including:

- office structures

- retail areas

- storage units

- manufacturing sites

Finance Story is committed to developing refined and exceptionally tailored business cases for banks, ensuring that your funding proposal meets the evolving demands of financial institutions.

Typically, business property financing requires a larger deposit, often ranging from 25% to 35% of the property's value; however, certain lenders may demand deposits of up to 50% for high-value or specialized properties. Moreover, business mortgage rates tend to be higher than residential mortgage rates, frequently 1-2.5% greater due to perceived higher risks. The approval process for these loans generally takes 4-6 weeks, and borrowers should be aware that a credit score above 650 is often necessary to secure favorable conditions. A well-presented application can significantly bolster your case to the bank and address any potential concerns.

Additionally, borrowers might consider using residential real estate as extra security for a business loan through a method known as cross-collateralization, which can help in obtaining better terms. For any business owner contemplating a commercial real estate investment, understanding how a commercial property loan works, along with these distinctions and challenges, is crucial. Collaborating with Finance Story can provide the expertise needed to navigate this complex environment. Furthermore, Finance Story offers access to a comprehensive suite of lenders, including high street banks and innovative private lending panels, ensuring a wide range of financing options tailored to your needs.

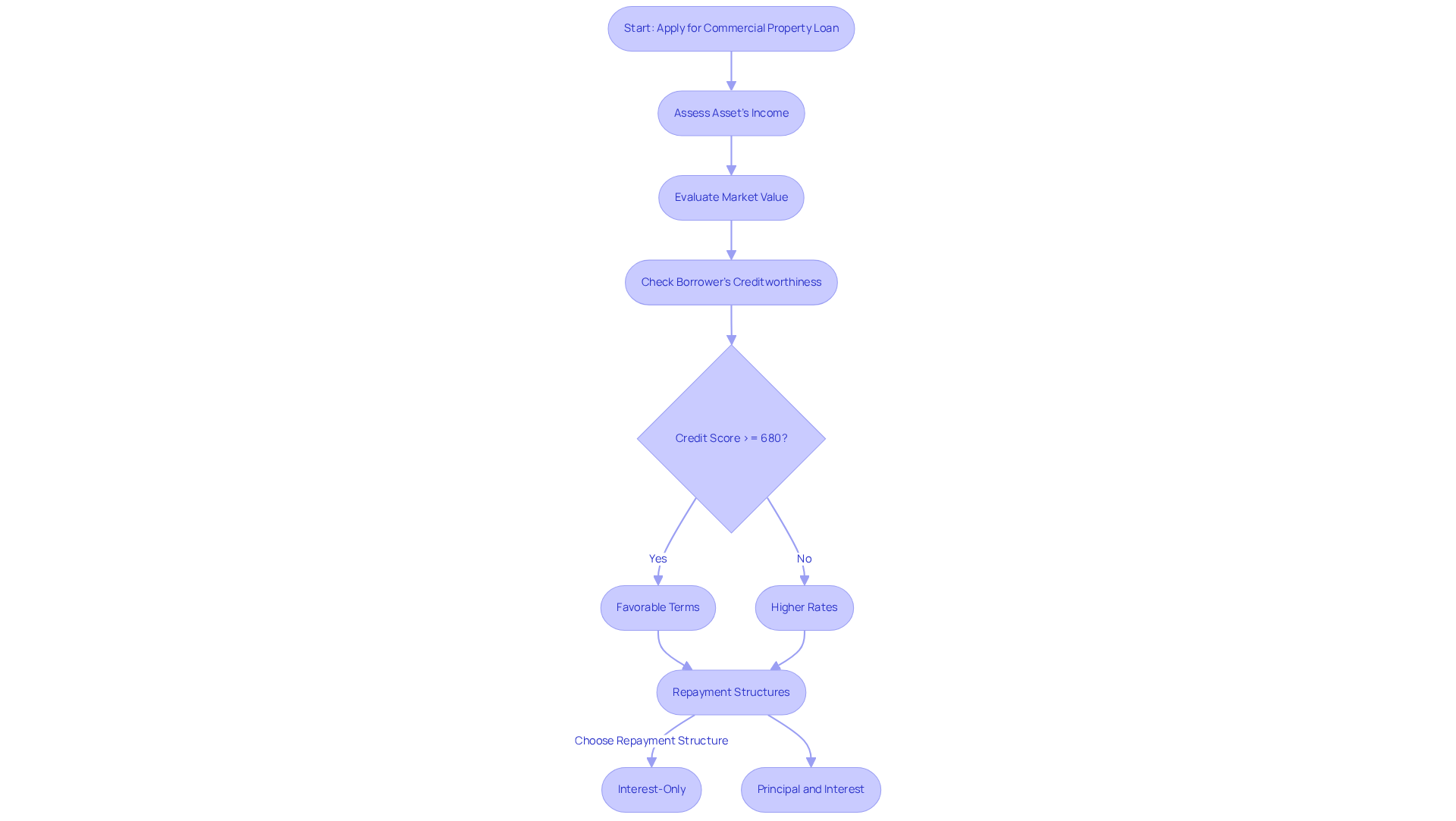

Explain How Commercial Property Loans Work

Commercial financing shares similarities with residential mortgages but possesses distinct features that set them apart. The borrowing sum is primarily influenced by the asset's income-producing capability rather than the borrower's individual earnings. Lenders conduct a comprehensive evaluation of the asset's cash flow, market value, and the borrower's creditworthiness, typically requiring a minimum credit score of around 680. In 2025, average financing terms for business real estate financing in Australia range from 5 to 20 years, with interest rates fluctuating between 6.2% and 9.5%. These rates are affected by factors such as the federal funds rate and the borrower's profile.

Borrowers may encounter various repayment structures, including:

- Interest-only periods that can ease cash flow in the short term

- Traditional principal and interest repayments

Understanding how a commercial property loan works is crucial for companies aiming to navigate the intricacies of funding their business investments effectively. For instance, a borrower with a strong credit history and a low loan-to-value ratio may secure more favorable terms, while those with less favorable profiles might face higher rates and stricter conditions. By grasping these nuances, businesses can make informed decisions that align with their financial goals.

Guide to Applying for a Commercial Property Loan

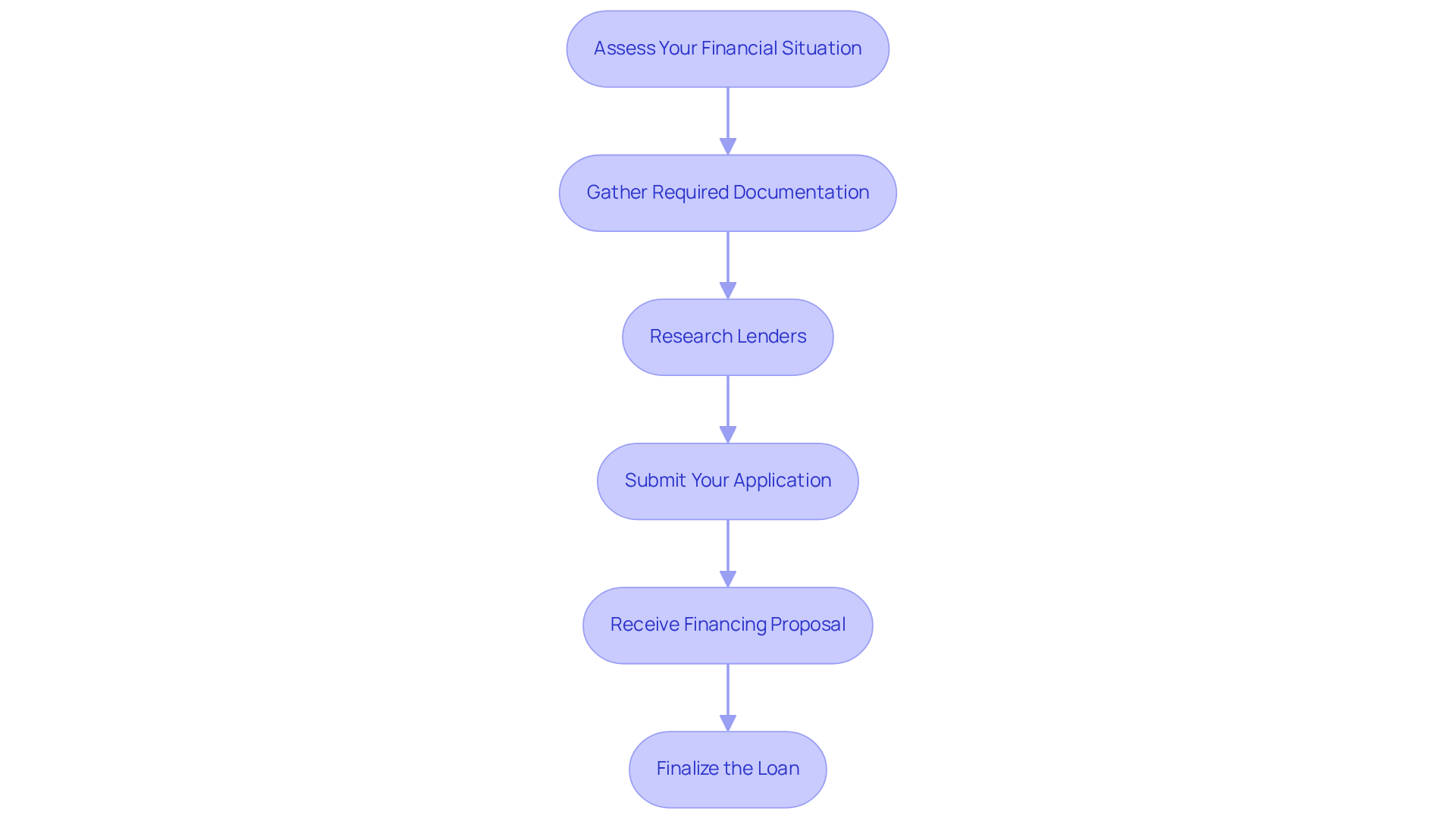

Applying for a commercial property loan involves understanding how a commercial property loan works, as several key steps can significantly impact your success.

-

Assess Your Financial Situation: Begin by evaluating your business's financial health, including cash flow, credit score, and existing debts. This assessment will help you determine how much you can afford to borrow and understand how a commercial property loan works, as well as identify any potential challenges.

-

Gather Required Documentation: Prepare essential documents such as financial statements, tax returns, business plans, and property details. Lenders typically require this information to assess your application thoroughly. In 2025, businesses should be ready to provide profit and loss statements, balance sheets, and cash flow statements for the last 2-3 years.

-

Research Lenders: Explore various lenders, including banks and specialized commercial lenders. Compare their financing products, interest rates, and terms to find the best fit for your needs. To understand how a commercial property loan works, it's important to note that commercial mortgage rates in Canada generally range from 3.95% to 7.95%, influenced by factors such as economic conditions and borrower profiles.

-

Submit Your Application: Complete the loan application form and submit it along with your documentation. Be ready for extra questions or requests for information from the financial institution, as this can help speed up the process.

In the loan approval process, once submitted, the lender will review your application, conduct a property valuation, and assess how a commercial property loan works. The approval procedure can take anywhere from 6 to 12 weeks, depending on the intricacy of the financing and the speed of document submission.

-

Receive Financing Proposal: If accepted, you will obtain a financing proposal outlining the terms and conditions. Review this carefully before accepting, as it will outline your repayment obligations and any fees associated with the loan.

-

Finalize the Loan: Upon acceptance, sign the necessary documents, and the funds will be released for your asset purchase or development. Successful applicants often share stories of how tailored support from their lenders made the process straightforward and stress-free, emphasizing the importance of choosing the right financial partner.

By adhering to these guidelines and preparing thoroughly, you can improve your likelihood of obtaining a business financing option that aligns with your needs.

Address Frequently Asked Questions About Commercial Property Loans

Address Frequently Asked Questions About Commercial Property Loans

-

What is the typical loan-to-value ratio (LVR) for commercial property loans?

The typical LVR for commercial property loans generally falls between 50% and 70%. Most financial institutions favor LVRs under 70% to mitigate risk, while certain financing options for land banks and pre-development sites may vary from 50% to 65%. -

Can I utilize a business financing option for real estate development?

Yes, commercial loans are suitable for purchasing land and financing construction projects, provided the lender approves the development plan. This flexibility allows investors to leverage their financing for various real estate development opportunities. -

What factors influence the interest rate on business real estate financing?

Interest rates for commercial property loans can vary significantly based on several factors, including the borrower's credit profile, the property's location and type, and the overall economic climate. As of mid-2025, interest rates for these credits range from 6.2% to 9.5%, influenced by the lender's evaluation of risk and market conditions. -

Are there any charges related to business real estate financing?

Yes, borrowers should be aware of various fees that may apply, such as application fees, valuation fees, and legal costs. Understanding these charges is essential for evaluating the overall expense of borrowing before proceeding with an application. -

How does a commercial property loan work in relation to the time required to receive approval for business real estate financing?

The approval timeline for a commercial property loan can vary widely, typically ranging from a few weeks to several months. This duration depends on the financial institution's processes and the complexity of the application, including the thoroughness of the financial documentation provided. At Finance Story, we collaborate with a diverse range of lenders, including high street banks and private lending panels, to streamline this process for you.

Conclusion

Understanding commercial property loans is essential for business owners seeking to invest in real estate. These specialized financial instruments are tailored to support various types of commercial properties, from office buildings to retail spaces, and require a strategic approach to navigate their complexities effectively.

Throughout this guide, we have explored key aspects of commercial property loans, including:

- Their distinct characteristics compared to residential financing

- The importance of cash flow and creditworthiness in securing favorable terms

- The step-by-step process of applying for these loans

Additionally, we have highlighted crucial factors such as:

- Deposit requirements

- Interest rates

- The significance of thorough documentation to enhance the chances of approval

In the broader context, the insights provided reinforce the importance of being well-informed before embarking on the journey of obtaining a commercial property loan. By understanding how these loans work and preparing adequately, business owners can position themselves for success in their real estate ventures. Engaging with experienced financial partners, like Finance Story, can further streamline the process and open doors to a diverse array of financing options tailored to meet specific business needs.