Overview

Low doc loans provide financing options with minimal documentation requirements, primarily benefiting self-employed individuals and freelancers who often face challenges with traditional loan processes. These loans allow for alternative income verification methods and expedited approvals, making them an accessible choice for those in need of financial support.

However, it is crucial to be aware of potential risks, such as higher interest rates and the possibility of overborrowing. Are you considering a low doc loan? Understanding both the advantages and the risks can empower you to make informed financial decisions.

Introduction

Understanding the intricacies of low doc loans is essential in a financial landscape where traditional documentation requirements can be a barrier for many. These loans offer a lifeline to self-employed individuals and freelancers, enabling them to secure funding without the exhaustive paperwork typically demanded by conventional lenders.

However, as the popularity of low doc loans rises, so does the complexity surrounding their eligibility and application processes. What challenges might borrowers face in navigating this seemingly accessible option? Furthermore, how can they maximize the benefits while mitigating risks?

Define Low Doc Loans and Their Purpose

To understand how do low doc loans work, it's important to know that they specifically cater to individuals who may lack the conventional paperwork typically required by traditional lenders. These financial products are particularly beneficial for self-employed individuals, freelancers, and those with varying income sources. By minimizing paperwork, low doc options show how do low doc loans work to create a more accessible route to financing, allowing borrowers to obtain funds without the extensive documentation usually linked to conventional options. This flexibility is crucial for business owners aiming to expand operations or individuals seeking to purchase property without the burden of excessive paperwork.

In 2025, the trend of self-employed individuals utilizing low documentation financing continues to rise, with a significant percentage of this demographic opting for these financial solutions. For instance, a nearby barista named Sam successfully navigated the low documentation financing process to buy a home valued at $325,000, leveraging his strong credit history and a deposit of $65,000. By providing the required documentation, including 12 months of Business Activity Statements (BAS) confirmed by the ATO, he secured a low doc mortgage with an 80% loan-to-value ratio (LVR).

Understanding how do low doc loans work reveals advantages that extend beyond mere convenience, as they also offer support for individuals facing challenges in securing conventional funding. With lenders often requiring only a 40% deposit for financing at a 60% LVR, self-employed borrowers can access funds more readily. This is particularly significant as many lenders evaluate applications based on the current business situation, asset position, and liabilities, rather than solely on traditional income verification methods. Consequently, self-employed individuals can achieve their financial goals with greater ease and confidence by understanding how do low doc loans work.

At Finance Story, we provide tailored refinancing solutions designed to help clients access equity and lower rates, facilitating the process for self-employed individuals and small business owners seeking financing. If you're considering a low documentation option, consult with us today to explore your choices and receive personalized assistance to navigate the process efficiently.

Identify Eligibility Criteria for Low Doc Loans

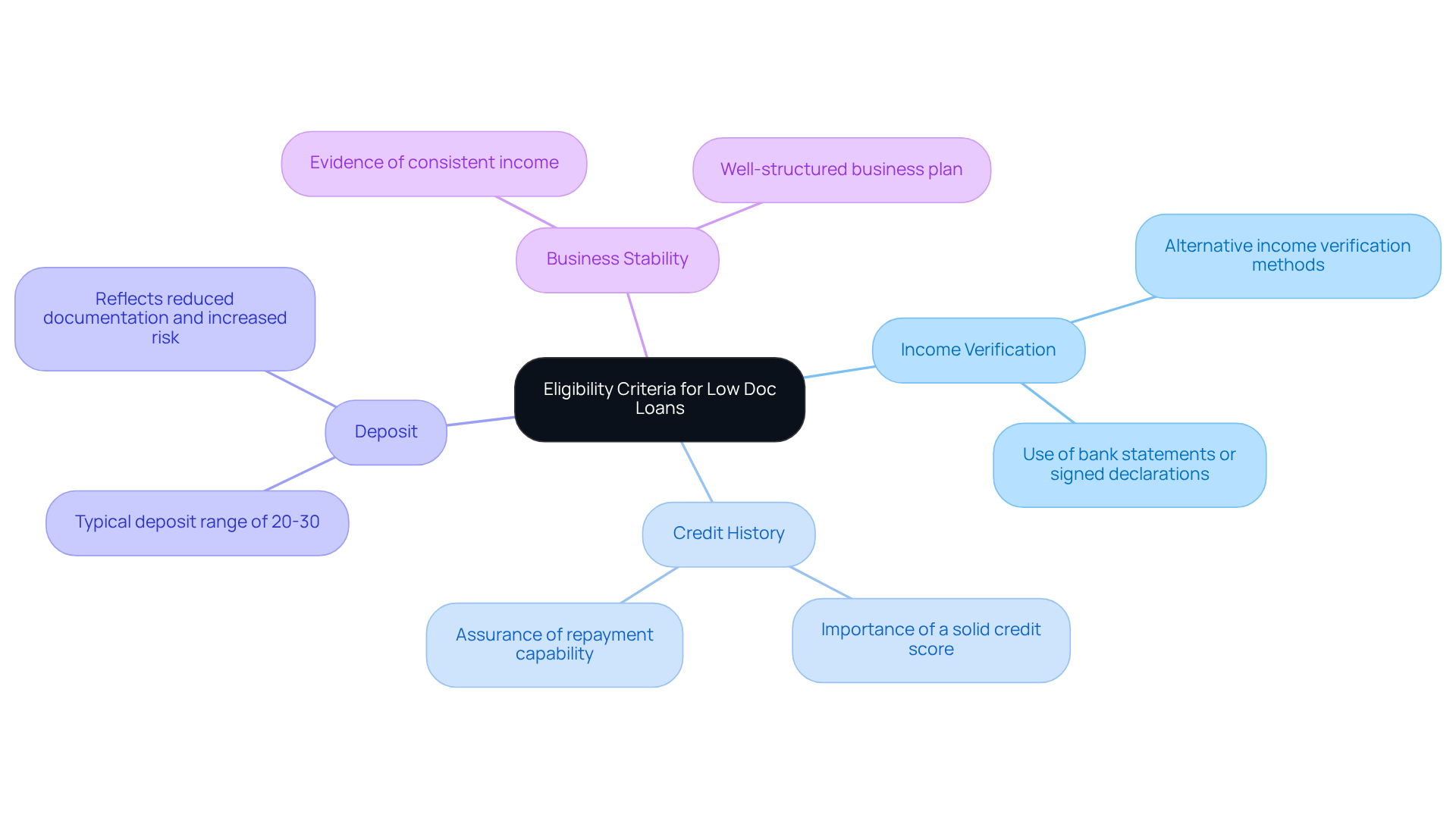

To qualify for a low documentation financing option, applicants must generally fulfill certain requirements that can differ by provider. Key eligibility requirements include:

- Income Verification: Unlike traditional loans that demand extensive documentation, low doc loans allow for alternative income verification methods. Borrowers can use bank statements or a signed declaration of income, streamlining the approval process and enabling faster access to funds.

- Credit History: A solid credit score is essential, as lenders seek assurance of the borrower's repayment capability. This requirement underscores the importance of maintaining a good credit profile.

- Deposit: Typically, a larger deposit is required for low documentation financing, often ranging from 20% to 30% of the property's value. This higher deposit reflects the reduced documentation and increased risk associated with these loans.

- Business Stability: Lenders typically look for evidence of business stability, which may include a history of consistent income or a well-structured business plan. Demonstrating stability can significantly enhance an applicant's chances of approval.

Understanding these criteria is crucial for borrowers, particularly small business owners, as it helps them assess their eligibility and prepare effectively for the application process. Furthermore, for individuals exploring refinancing alternatives or obtaining leasehold properties, it's crucial to understand how low doc loans work, as they can lead to faster approvals and increased acceptance rates, acting as a beneficial funding option for urgent financial requirements. As Ben Younan, co-founder of Finance Story, emphasizes, 'My ongoing commitment to client education is crucial for helping clients understand their financial management and investment strategies,' which includes explaining how low doc loans work and their advantages.

Outline the Application Process for Low Doc Loans

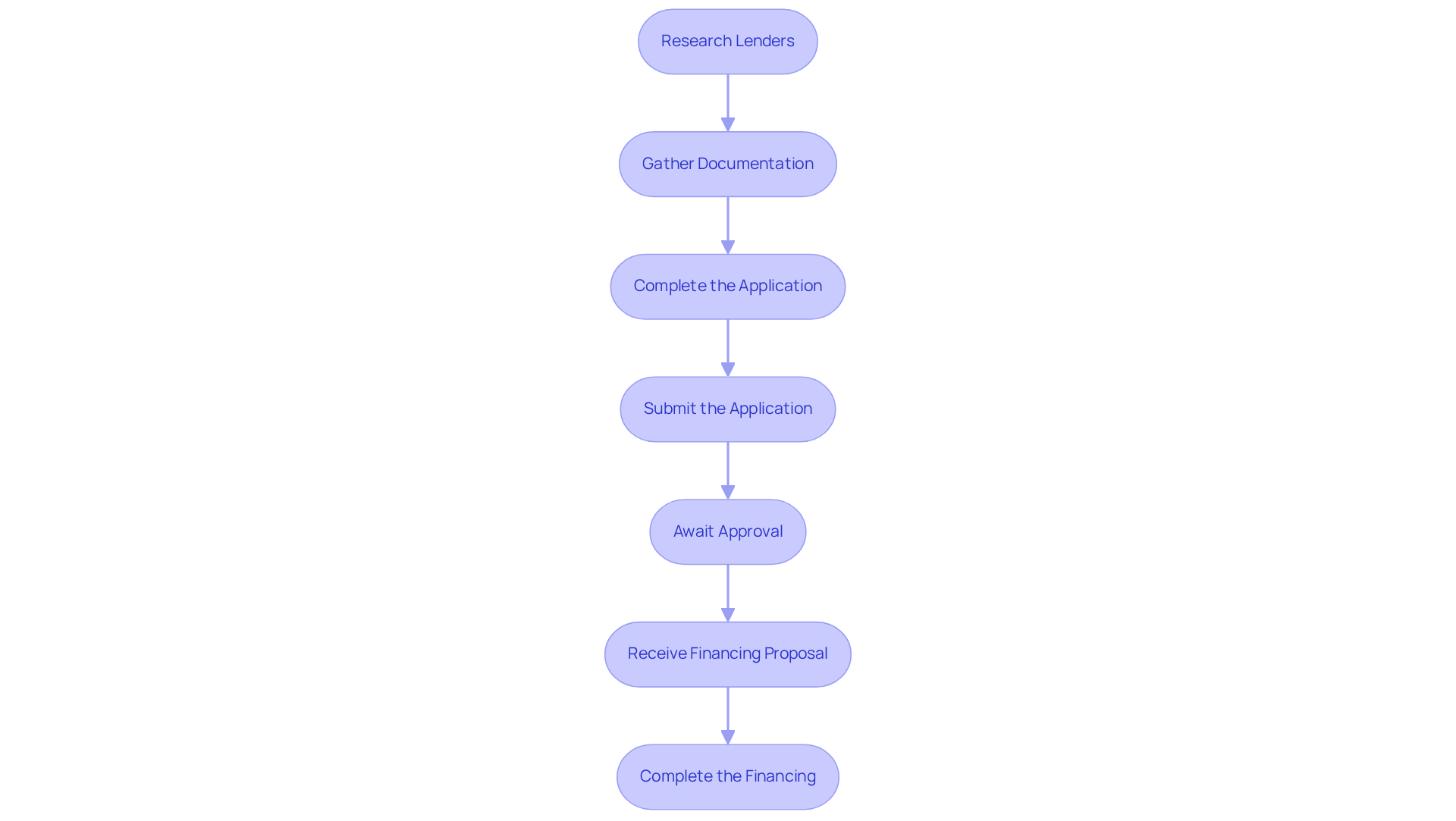

The application process for low doc loans typically unfolds through several key steps:

- Research Lenders: Start by exploring lenders that offer low documentation financing. Compare their terms, interest rates, and eligibility criteria to identify the best fit for your needs.

- Gather Documentation: Although less documentation is required, it is crucial to know how do low doc loans work by preparing alternative forms of income verification, such as bank statements or a letter from an accountant. This will streamline your application process.

- Complete the Application: Carefully fill out the funding application form provided by the lender. Ensure all information is accurate and complete to prevent any delays in processing.

- Submit the Application: Submit your application along with the necessary documentation. Many lenders facilitate online submissions for added convenience.

- Await Approval: After submission, the lender will review your application. This evaluation process can take anywhere from a few days to a few weeks, so patience is essential.

- Receive Financing Proposal: If approved, you will receive a financing proposal detailing the terms and conditions. Take the time to review this document thoroughly before making a decision.

- Complete the Financing: Once you accept the offer, finalize the financing by signing the required documents and meeting any remaining conditions set by the lender. This step is crucial to secure your funding.

Evaluate the Benefits and Risks of Low Doc Loans

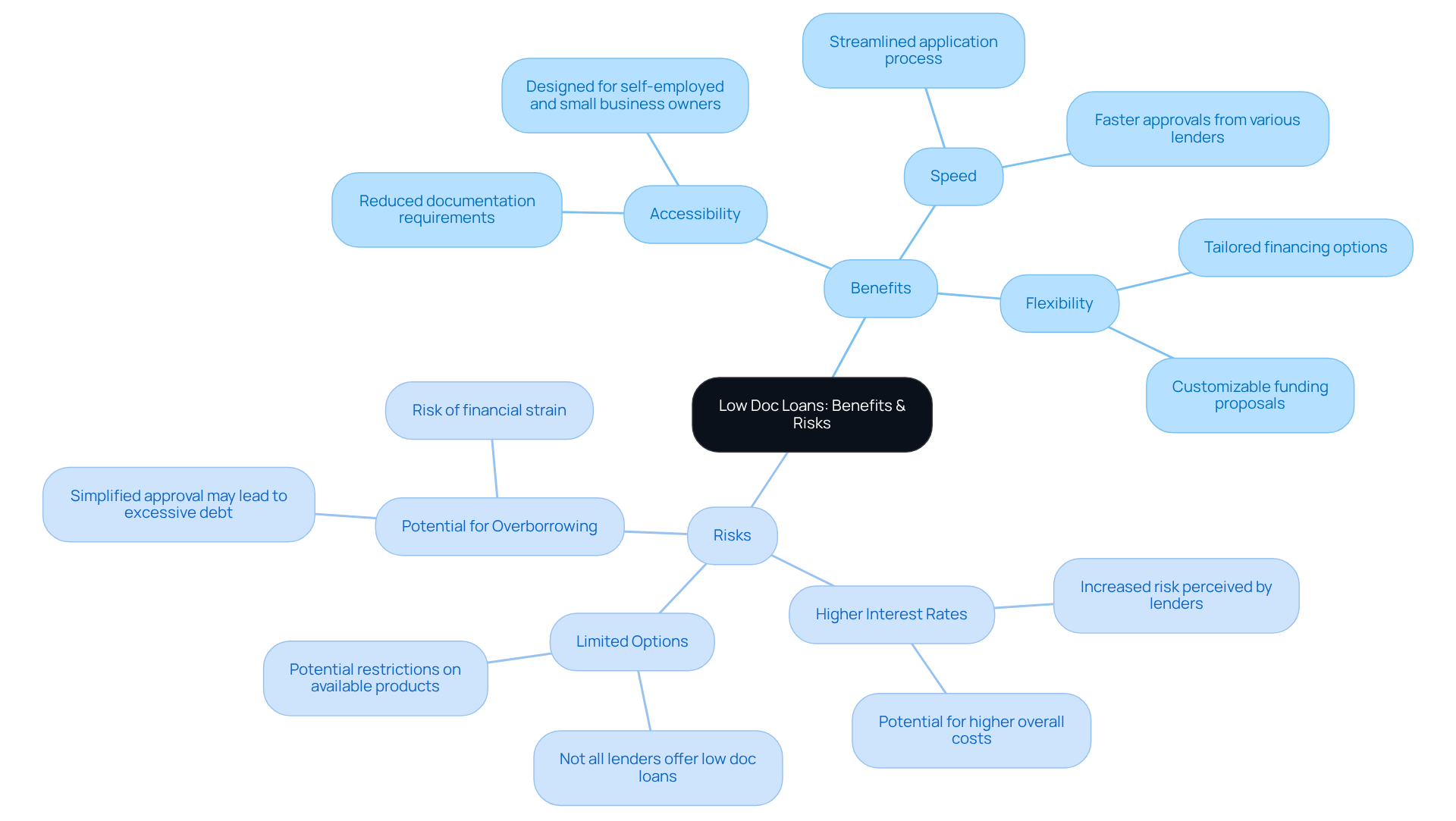

Low doc loans present a blend of advantages and risks that borrowers must carefully consider:

Benefits:

- Accessibility: These loans are crafted to offer financing options for individuals who may struggle to meet traditional documentation requirements, such as self-employed individuals and small business owners. Finance Story excels in creating polished and highly individualized business cases, ensuring that clients can effectively present their needs to lenders.

- Speed: The streamlined application process allows individuals to secure funds more swiftly, which is particularly beneficial for those in need of immediate financial assistance. With access to a comprehensive range of lenders, including high street banks and innovative private lending panels, Finance Story can facilitate faster approvals.

- Flexibility: Low documentation financing options can be tailored to accommodate the distinct financial circumstances of borrowers, making them a versatile choice for various business requirements. Finance Story's expertise in customized funding proposals ensures that clients receive financing solutions that align with their specific situations.

Risks:

- Higher Interest Rates: Given the increased risk perceived by lenders, low doc loans generally come with higher interest rates compared to conventional loans. Finance Story assists clients in understanding these costs and exploring options to mitigate them.

- Limited Options: The availability of low documentation financing is not universal; not all lenders offer these products, potentially restricting options for individuals seeking assistance. Engaging with Finance Story can help navigate these limitations and identify the best available options for various commercial properties, including warehouses, retail spaces, and hospitality ventures.

- Potential for Overborrowing: The simplified approval process may lead some individuals to take on more debt than they can manage, resulting in financial strain. Finance Story provides valuable insights to help clients evaluate their financial capabilities and avoid overleveraging.

Understanding these factors is essential for individuals to determine how low doc loans work and if this option aligns with their financial goals and abilities. Engaging with accredited mortgage brokers like Finance Story can offer valuable insights and help navigate the complexities of these loans, ensuring that borrowers secure the best possible terms.

Conclusion

Low doc loans serve as a crucial financial solution for individuals who may find it challenging to meet the stringent documentation requirements of traditional lending. By streamlining the application process, these loans empower self-employed individuals and small business owners to access the necessary funds for growth and investment, sidestepping the usual bureaucratic obstacles. Understanding how low doc loans operate is essential for anyone looking to leverage this financing option effectively.

This article highlights key aspects of low doc loans, including:

- Eligibility criteria such as alternative income verification methods

- The significance of credit history

- The necessity for a substantial deposit

It outlines the application process, which involves:

- Researching lenders

- Preparing necessary documents

- Submitting applications for approval

Furthermore, the benefits—such as increased accessibility, speed, and flexibility—are weighed against risks like higher interest rates and the potential for overborrowing.

Ultimately, low doc loans represent a significant opportunity for those seeking more adaptable financing options. Engaging with knowledgeable professionals, such as those at Finance Story, can enhance understanding and facilitate a smoother application process. As the landscape of self-employment continues to evolve, exploring low doc loans could be a strategic move for individuals aiming to achieve their financial aspirations while navigating the complexities of modern lending.