Overview

Commercial property valuation is primarily conducted through methods such as the Income Capitalisation Method and the Comparable Sales Method. These approaches assess a property's worth based on its income potential and comparable market data, respectively. Understanding these valuation techniques is crucial for making informed investment decisions in the commercial real estate market.

The Income Capitalisation Method involves calculating the Net Operating Income (NOI) of a property, which reflects the income generated after operating expenses. This method emphasizes the property's ability to generate revenue, making it a vital consideration for investors. On the other hand, the Comparable Sales Method analyzes sale prices of similar properties in the market, providing a benchmark for valuation based on recent transactions.

By mastering these techniques, investors can navigate the complexities of the commercial real estate landscape with confidence. Are you ready to enhance your investment strategy? Understanding these methods not only empowers you but also positions you for success in the competitive market.

Introduction

Understanding the valuation of commercial property is essential for investors navigating the complex real estate landscape. Various methods, including the Income Capitalisation Method and Comparable Sales Method, are available, and grasping these concepts can significantly impact investment decisions and financial outcomes.

However, as market dynamics shift and economic factors come into play, how can investors ensure they are accurately assessing property value while avoiding common pitfalls? This exploration delves into key valuation techniques and their implications, empowering investors to make informed choices in an ever-evolving market.

Understand the Basics of Commercial Property Valuation

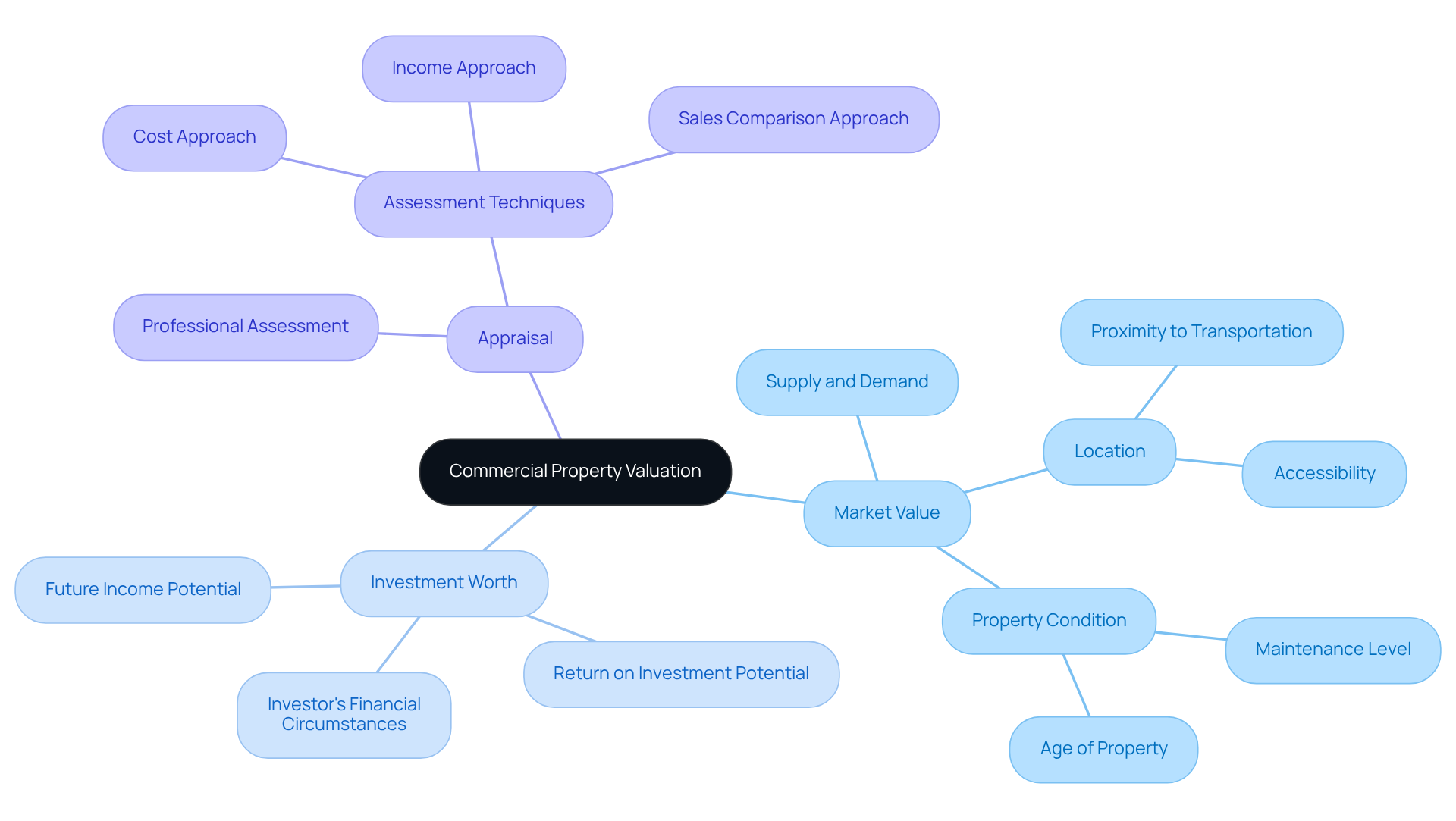

The process of how commercial property is valued is critical, involving the assessment of an asset's worth based on essential factors such as location, condition, and income potential. To navigate this complex landscape, it is vital to understand the following key concepts:

-

Market Value: This figure represents the estimated price a property would command in the current market. It is influenced by factors such as supply and demand, location, and property condition. Properties situated in prime locations or those serving significant community purposes typically command higher market prices.

-

Investment Worth: This concept pertains to the asset's value from the perspective of a particular investor, taking into account their unique financial circumstances and investment objectives. It may vary significantly from market worth, as it reflects the potential return on investment based on the investor's criteria.

-

Appraisal: A professional appraisal delivers an objective assessment of a property's value, often required by lenders during financing processes. This evaluation typically employs various assessment techniques, including the income approach, cost approach, and sales comparison approach.

Grasping these fundamental concepts will not only enhance your understanding of the assessment techniques used but also their implications for securing financing options. As the commercial real estate market in Melbourne is projected to expand, remaining knowledgeable about these valuation principles is imperative for making informed investment choices.

Apply the Income Capitalisation Method

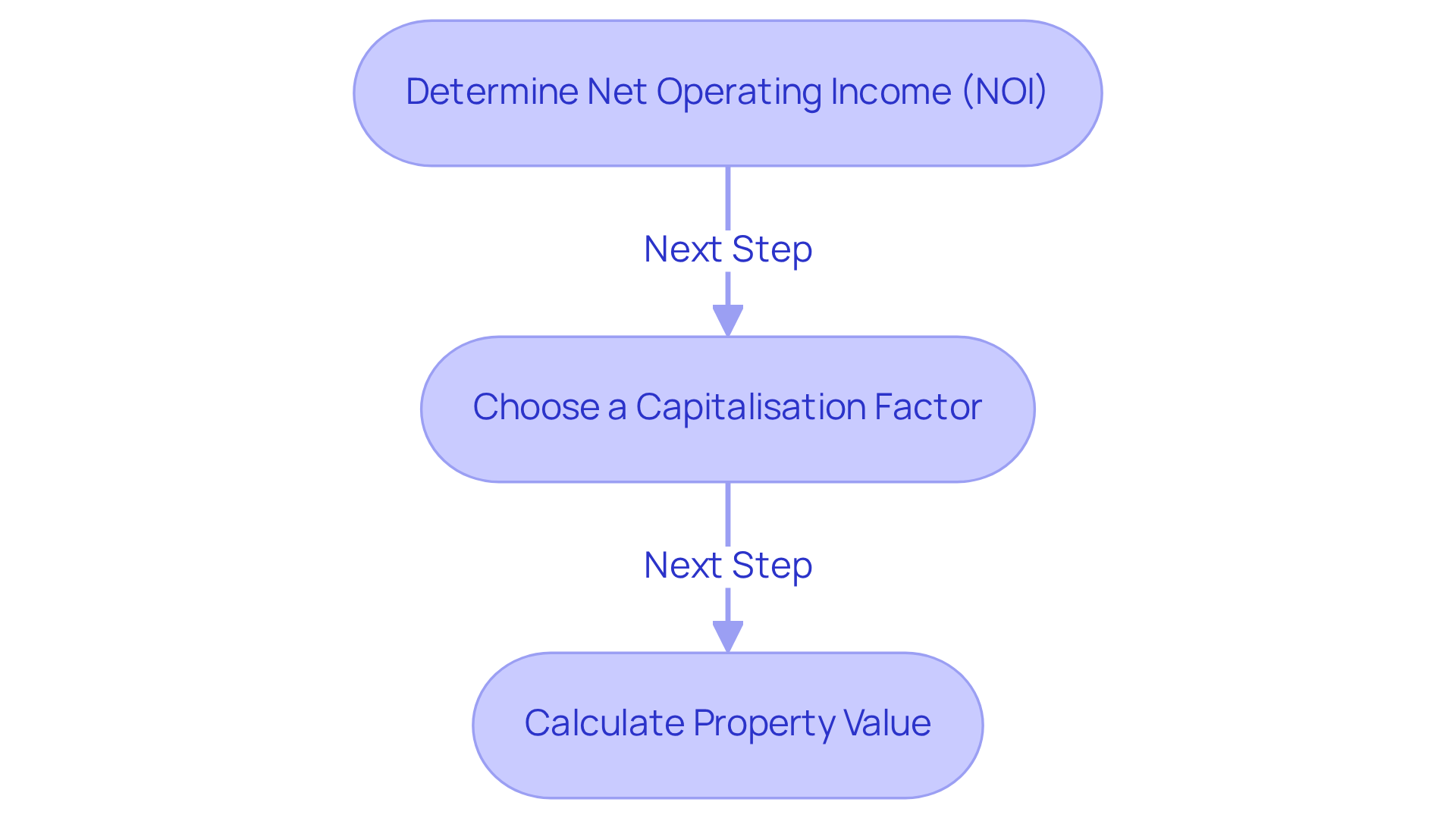

To effectively apply the Income Capitalisation Method, follow these essential steps:

-

Determine Net Operating Income (NOI): Begin by calculating the total income generated by the asset, such as rent, and subtract operating expenses, including maintenance and management costs.

- Example: If an asset generates $100,000 in rent and incurs $30,000 in expenses, the NOI is $70,000.

-

Choose a Capitalisation Factor: This factor signifies the anticipated return on investment and varies depending on the type of real estate and market conditions. Examine similar assets to determine a suitable price.

- Example: If comparable assets have a cap percentage of 7%, use this for your calculations. According to NT Valuers, understanding cap rates is essential for commercial real estate investors.

-

Calculate Property Value: Use the formula: Property Value = NOI / Capitalisation Rate.

- Example: $70,000 / 0.07 = $1,000,000. This figure illustrates how commercial property is valued based on its income potential.

Understanding how commercial property is valued is crucial for commercial real estate investors. Precise assessments guide investment choices and asset management strategies. Present capitalization percentages for commercial real estate in Melbourne typically range from 4.75% to 5.75% for prime office spaces, depending on the asset type and location. This variability underscores the importance of selecting the appropriate percentage for your specific investment. Furthermore, broader economic factors, including interest rates and market trends, significantly influence real estate assessments, making it essential to stay informed. Engaging with professional appraisal services can provide valuable insights and help avoid common pitfalls in cap rate calculations.

Utilize the Comparable Sales Method

To effectively utilize the Comparable Sales Method for commercial property valuation, it is crucial to follow these essential steps:

-

Research Comparable Listings: Begin by identifying listings that are similar in size, location, and type, which have recently sold. Leverage real estate databases or consult with a knowledgeable real estate agent. Collecting information from several similar assets is essential to guarantee a dependable valuation.

- Example: Look for listings that sold within the last six months in the same neighborhood to ensure relevance.

-

Analyze Sale Prices: Gather the sale prices of these comparable assets and calculate the average price per square foot. Keep in mind that a CMA is not an official appraisal; rather, it serves as a guide than a definitive value.

- Example: If three similar assets sold for $1,000,000, $1,200,000, and $1,100,000, the average sale price would be $1,100,000, leading to an average price per square foot based on their respective sizes.

-

Adjust for Differences: Make necessary adjustments based on differences between your asset and the comparables, such as condition, amenities, or unique features. Exercise caution, as poor comparisons can lead to inaccurate valuations.

- Example: If your asset features a new roof worth $20,000, increase the comparable price by this amount to represent its improved worth. Additionally, consider other features like the number of bathrooms or specific amenities that may require adjustments.

-

Estimate Worth: Utilize the modified average price per square foot to assess your asset's worth. The CMA process is typically performed free of charge by real estate agents, making it accessible for small business owners seeking professional assistance.

- Example: If the adjusted average price per square foot is $200 and your real estate measures 5,000 square feet, the estimated value would be $1,000,000.

By following these steps, you can arrive at a well-informed valuation that demonstrates how commercial property is valued in relation to current market conditions and comparable sales data.

Choose Suitable Financing Options for Your Valued Property

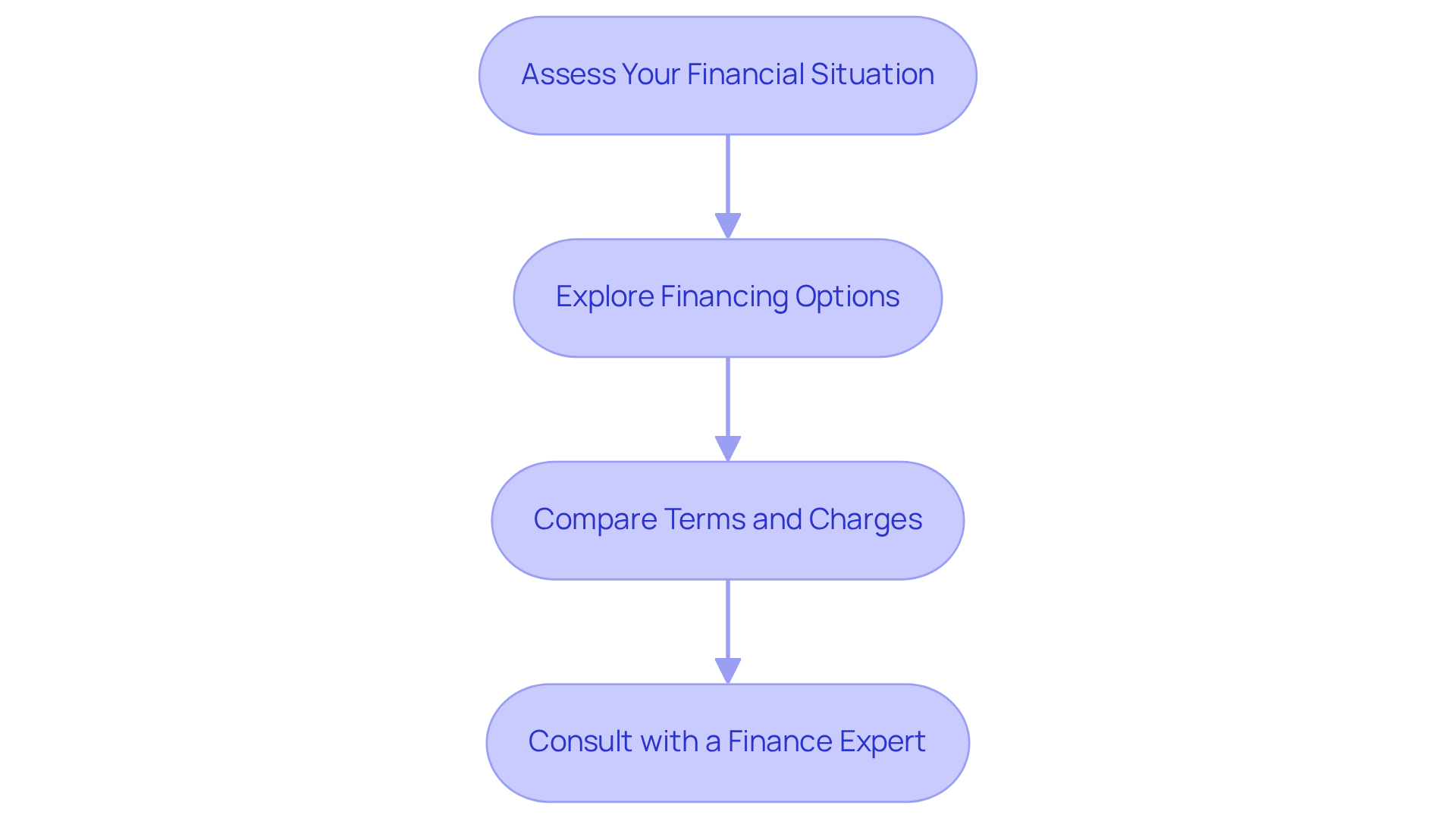

Selecting the right financing options for your commercial property involves several key steps:

- Assess Your Financial Situation: Begin by evaluating your credit score, income, and existing debts to determine your borrowing capacity. A strong credit score can greatly improve your likelihood of obtaining reduced interest levels, making it a vital element in your financial evaluation. Understanding the 5Cs of Credit—character, capacity, capital, collateral, and conditions—will also help you navigate loan strategies effectively.

- Explore Financing Options: Investigate the various types of loans available for commercial properties. Options include traditional bank loans, private lenders, and government-backed loans. For instance, a Small Business Administration (SBA) loan can provide favorable terms for qualifying businesses, making it a viable choice for many. Finance Story specializes in creating polished and highly individualized business cases to present to banks, ensuring you have the best chance of securing the necessary funds for your commercial investment. As one satisfied client, Natasha B. from VIC, stated, "I will definitely be recommending your business to anyone. We are finished with the constant worry."

- Compare Terms and Charges: Gather quotes from multiple lenders to compare interest amounts, repayment terms, and associated fees. For example, a lender offering a 4% interest rate with a 25-year term may present a more advantageous option than one with a 5% rate and a shorter 15-year term, impacting your long-term financial obligations. With access to a comprehensive portfolio of private and boutique commercial investors, Finance Story can provide you with a range of choices tailored to your specific needs, ensuring you find the best fit for your financing requirements.

- Consult with a Finance Expert: Engaging a finance consultant can be invaluable in navigating the complexities of financing options. They can offer insights into which lenders are more likely to approve your loan based on your specific property type and financial profile, ensuring you secure the best possible deal for your investment. Additionally, working with a mortgage broker like Finance Story can simplify the loan process, as they bring expertise in the mortgage market and can assist you in securing favorable terms, alleviating the constant worry associated with financing decisions.

Conclusion

Understanding how commercial property is valued stands as a cornerstone of successful investing in the real estate market. By familiarizing oneself with key valuation methods, such as the Income Capitalisation Method and the Comparable Sales Method, investors can adeptly navigate the complexities of property assessment. This knowledge not only aids in making informed investment decisions but also enhances the potential for achieving favorable financial outcomes.

Throughout this article, we explored critical concepts such as market value, investment worth, and professional appraisals. The Income Capitalisation Method underscores the importance of calculating Net Operating Income and selecting appropriate capitalisation factors. Meanwhile, the Comparable Sales Method highlights the necessity for thorough research and adjustments based on comparable listings. Furthermore, selecting suitable financing options emerges as an essential step for investors aiming to maximize their investments.

Ultimately, the ability to accurately assess commercial property value is vital in a market characterized by constant change. By applying these valuation techniques and remaining informed about market trends, investors can position themselves for success. Engaging with finance experts and leveraging professional appraisal services can further enhance the investment process, ensuring that decisions are backed by solid data and insights. Taking these steps not only mitigates risks but also paves the way for prosperous ventures in the dynamic realm of commercial real estate.