Overview

This article serves as a vital resource for small business owners seeking suitable loan lenders in their area to fulfill their financing needs. It delineates various types of small business loans available, guiding readers through the process of identifying potential lenders. Furthermore, it offers comprehensive advice on comparing loan options and navigating the application process. By equipping readers with these essential tools, the article empowers them to secure the appropriate funding necessary for their enterprises.

Introduction

In the dynamic landscape of small business financing, understanding the various loan options available is crucial for entrepreneurs seeking to fuel growth and manage operational costs. From traditional term loans to innovative invoice financing, each type of loan serves distinct purposes and comes with its own set of criteria. As small business owners navigate the intricate world of lenders, evaluating interest rates, repayment terms, and associated fees becomes essential in making informed financial decisions.

This article delves into the multifaceted realm of small business loans, offering valuable insights on identifying potential lenders, comparing loan options, and successfully navigating the application process. By ensuring that businesses are well-equipped to secure the funding they need for success, we aim to empower entrepreneurs to take decisive action in their financial journeys.

Understand Small Business Loans

Funding options from small business loan lenders near you serve as vital financial tools designed to assist companies with operational expenses, invest in expansion, or manage cash flow. Below are the primary categories of small enterprise financing:

- Term Financing: These conventional borrowings allow businesses to secure a lump sum, which is then repaid over a fixed duration with interest. They are particularly suitable for significant investments such as equipment or property.

- Lines of Credit: This flexible option enables businesses to borrow up to a predetermined limit, paying interest only on the amount utilized. It is ideal for navigating cash flow fluctuations.

- SBA Financing: Backed by the Small Business Administration, these funds offer favorable conditions but require a comprehensive application process.

- Equipment Financing: Specifically designed for acquiring equipment, this type of financing uses the equipment itself as collateral.

- Invoice Financing: Businesses can borrow against their outstanding invoices, providing immediate cash flow.

In addition to these alternatives, small business owners looking to invest in commercial properties should consider refinancing existing debts or seeking tailored financing solutions. Understanding loan repayment requirements is crucial, as small business loan lenders often assess the loan-to-value ratio (LVR) when determining borrowing capacity against a property. For example, when purchasing a freehold property, a lender may allow borrowing against the commercial asset but not the business itself unless substantial assets are involved. This highlights that leveraging property equity can be a pivotal strategy for funding acquisitions. By thoroughly understanding these funding options and their frameworks, you can align your choices with your specific needs and financial situation.

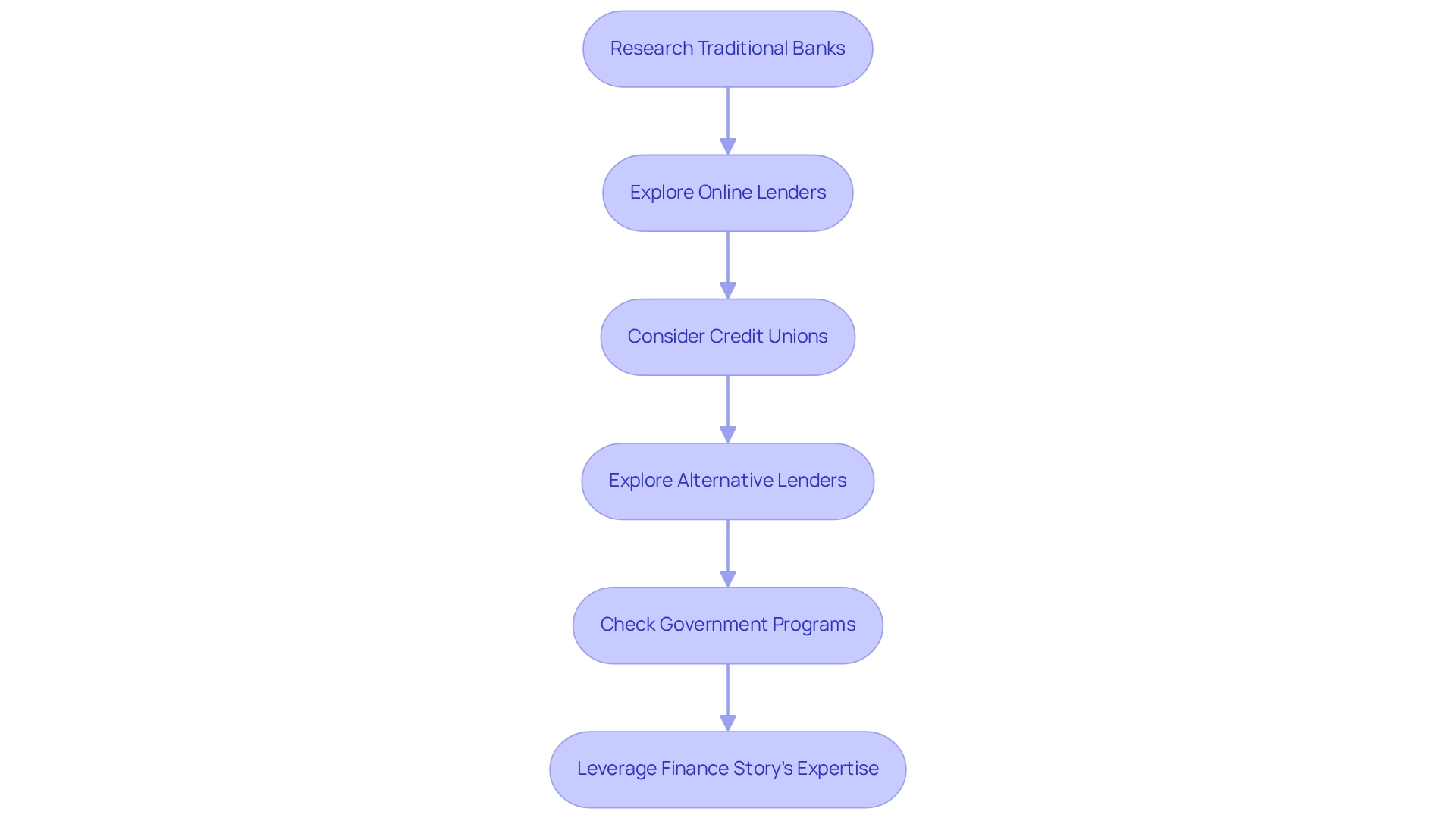

Identify Potential Lenders

To secure suitable lenders for your small enterprise financing, follow these essential steps:

- Research Traditional Banks: Start with reputable financial institutions known for providing funding to small enterprises. Seek those with a strong reputation and favorable terms.

- Explore Online Lenders: Online platforms offer rapid access to funds, often with less stringent requirements compared to traditional banks.

- Consider Credit Unions: These member-owned institutions frequently provide competitive rates and personalized service.

- Explore Alternative Lenders: Certain firms specialize in small enterprise financing, potentially offering more flexible terms.

- Check Government Programs: Investigate government-backed funding or grants that can provide financial support with lower interest rates.

- Leverage Finance Story's Expertise: With access to a diverse network of financiers, including specialized institutions and private investors, Finance Story can assist in crafting tailored business cases for your funding proposals. Their expertise in securing funding for commercial property investments and refinancing options ensures you have the right support to navigate the financing process effectively.

By expanding your search across these categories and utilizing the resources available through Finance Story, you can identify small business loan lenders near you that align with your specific funding needs.

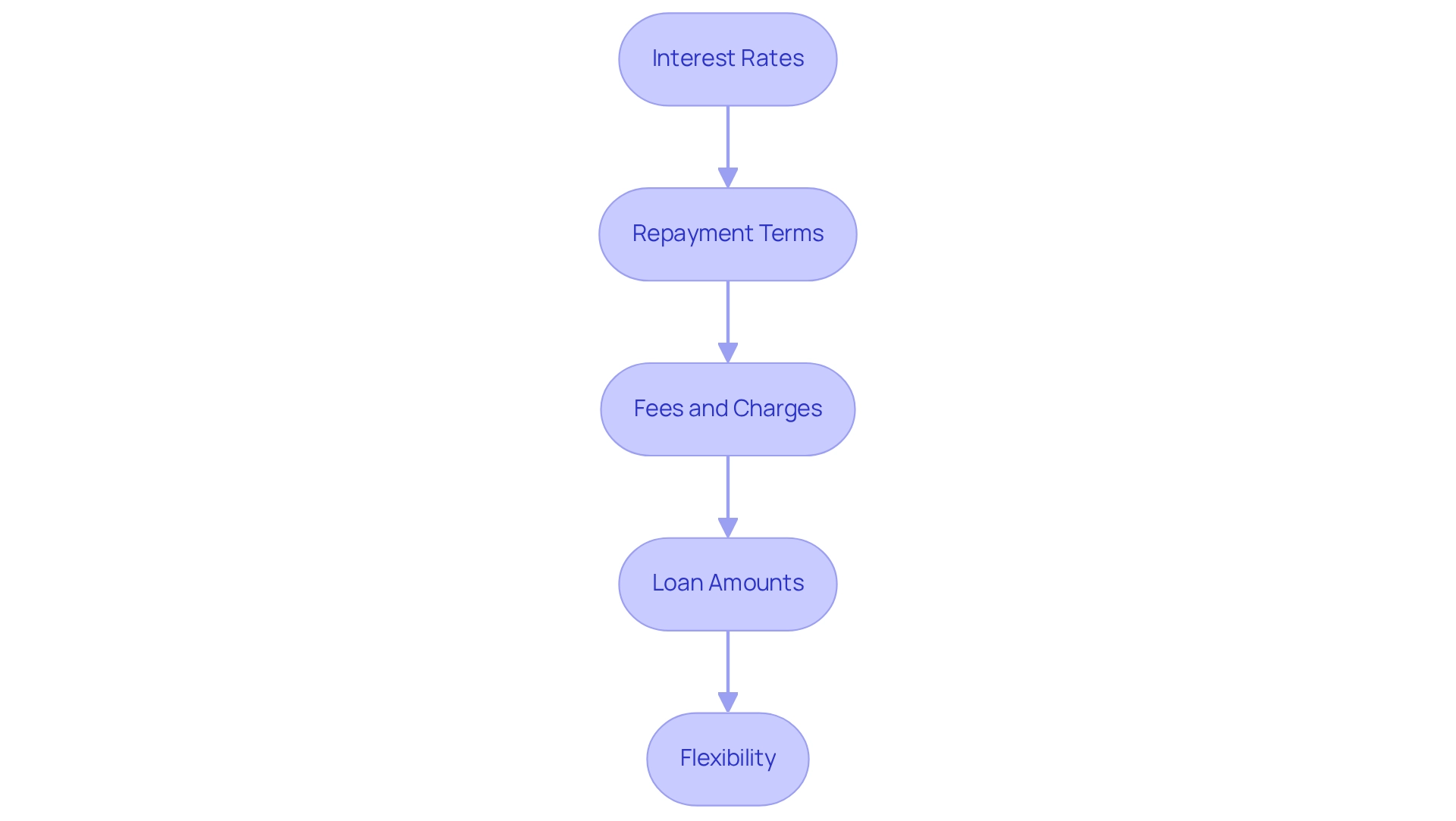

Compare Loan Options

Once you have identified potential small business loan lenders nearby, it’s essential to compare their credit options effectively. Here’s how to evaluate them:

-

Interest Rates: Seek competitive rates. Fixed rates offer stability, while variable rates can fluctuate over time. Understanding the interest rates from small business loan lenders near you will help you assess the overall cost of borrowing.

-

Repayment Terms: Examine the duration of financing and the repayment timetable. Longer terms may reduce monthly payments but can increase the total interest paid. Aligning repayment terms with your business's cash flow is crucial for sustainability when working with small business loan lenders in your area.

-

Fees and Charges: Be vigilant about origination fees, prepayment penalties, or any hidden costs that may impact the total expense of financing. A thorough review of these fees can prevent unexpected financial burdens in the future for those seeking small business loan lenders nearby.

-

Loan Amounts: Ensure the provider can meet your funding needs. Some financial institutions specialize in smaller loans, while others handle larger amounts. Finance Story can help you identify small business loan lenders that cater to your specific financing requirements, whether for a warehouse, retail space, or office.

-

Flexibility: Consider if the lender offers adaptable repayment options or the ability to modify terms if your circumstances change. This flexibility can be vital as your business grows and requires different financial strategies.

By thoroughly assessing these elements, you can select a financing option from small business loan lenders near you that aligns with your business's financial strategy. For tailored support in navigating the complexities of commercial financing and to leverage Finance Story's expertise in crafting refined, customized cases, contact us today.

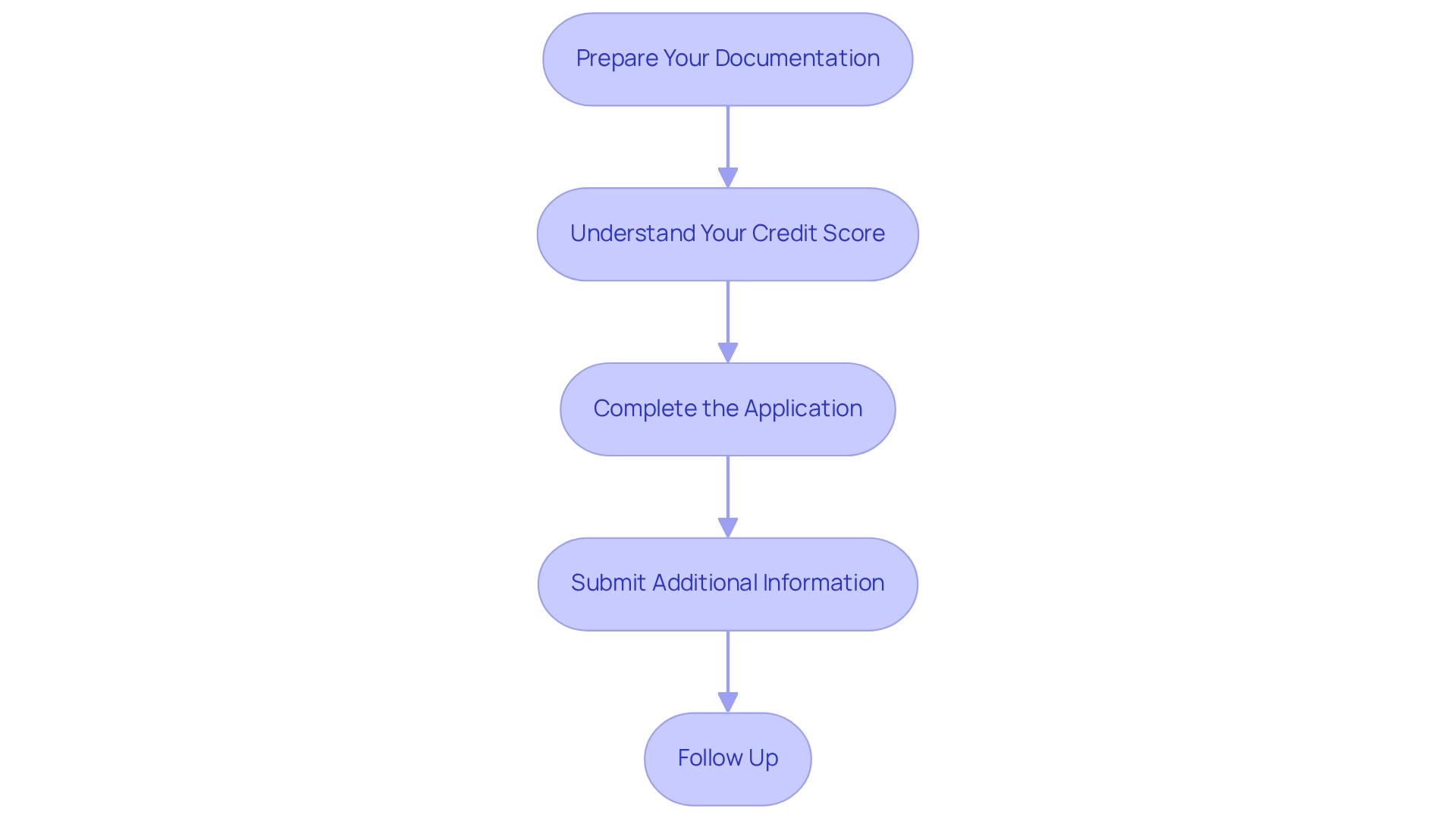

Navigate the Application Process

To successfully navigate the loan application process, follow these steps:

-

Prepare Your Documentation: Gather necessary documents such as financial statements, tax returns, and a comprehensive business plan. When approaching small business loan lenders, they will require proof of income and the viability of your venture. A well-prepared case can significantly enhance your proposal.

-

Understand Your Credit Score: Check both your personal and commercial credit scores. A higher score can improve your chances of approval and secure better terms, particularly when working with small business loan lenders.

-

Complete the Application: Fill out the financial institution's application form accurately. Be ready to provide comprehensive information regarding your enterprise and its financial background, along with any collateral specifics or personal assurances that might be necessary.

-

Submit Additional Information: Be prepared to supply any extra details the financial institution requests. This may include insights into your repayment strategy, which is crucial for securing financing tailored to your business needs.

-

Follow Up: After submitting your application, proactively follow up with the lender to check on the status and address any concerns they may have. This proactive approach can help you navigate the complexities of securing funding for your commercial property investments by connecting with small business loan lenders, ultimately streamlining the application process and increasing your chances of securing the funding you need.

Conclusion

Navigating the world of small business loans can indeed be a daunting task for entrepreneurs. However, understanding the various options available is essential for making informed decisions. This article highlights key types of loans:

- Term loans

- Lines of credit

- SBA loans

- Equipment financing

- Invoice financing

Each serving distinct purposes tailored to a business's unique financial needs. Equally crucial is identifying the right lender; entrepreneurs can select from:

- Traditional banks

- Online lenders

- Credit unions

- Alternative financing options

Ensuring they find the best match for their requirements.

Furthermore, comparing loan options is vital to securing favorable terms. Entrepreneurs must evaluate:

- Interest rates

- Repayment schedules

- Fees

- Flexibility

To choose a loan that aligns with their financial strategies. The importance of thorough preparation in navigating the application process cannot be overstated. Having the right documentation and understanding credit scores can significantly impact approval chances.

Ultimately, empowering small business owners with knowledge about loan types, lender options, and application strategies equips them to take decisive action in their financial journeys. By leveraging the insights provided, entrepreneurs can confidently pursue the funding necessary to fuel growth and secure their business's future. The road to financial success begins with informed choices and strategic planning, making it imperative for small business owners to engage with the financing landscape proactively.