Overview

This article delves into the essential process of comparing the best commercial mortgage companies to effectively meet specific financial needs. It underscores the significance of evaluating key criteria such as:

- Interest rates

- Fees

- Customer service

- Lender reputation

These factors are crucial for making informed decisions that align seamlessly with borrowers' financial goals. By understanding these elements, readers can navigate the complexities of commercial mortgages with confidence.

Introduction

Understanding the landscape of commercial mortgages is essential for businesses seeking financing for their property needs. With a multitude of lenders providing diverse products, identifying the best commercial mortgage companies can greatly influence financial success. However, with so many options, how can borrowers ensure they are making the right choice that aligns with their unique requirements and financial goals? This article explores the key concepts of commercial mortgages, evaluates leading lenders, and outlines vital criteria to guide informed decision-making in the intricate world of commercial financing.

Understanding Commercial Mortgages: Key Concepts and Definitions

Commercial mortgages represent specialized financial products tailored for the acquisition, refinancing, or development of commercial assets, including income-generating structures such as office buildings, retail spaces, and industrial facilities. Understanding the following key concepts is essential:

- Loan-to-Value Ratio (LTV): This critical metric compares the loan amount to the appraised value of the property. A lower LTV generally indicates decreased risk for financial institutions, potentially resulting in more advantageous borrowing conditions. Typically, financial institutions require a minimum deposit of 20 to 30 percent for commercial financing, which is crucial for grasping the financial commitment involved.

- Debt Service Coverage Ratio (DSCR): This ratio assesses a borrower's ability to repay the loan based on the income generated by the asset. A DSCR exceeding 1 signifies that the asset produces sufficient income to meet its debt responsibilities, which is favorable for financiers. Understanding these metrics is vital for enhancing your chances of securing favorable financing.

- Interest Rates: Rates for business mortgages can vary significantly, influenced by factors such as the lender's policies, the borrower's credit profile, and the specific type and location of the asset. In 2025, average business real estate interest rates in Australia range from 6.2% to 9.5%, reflecting the perceived risk associated with various assets. Notably, business mortgages typically offer lower interest rates compared to conventional financing, as they are secured by the property. However, high-risk business mortgage applications may incur interest rates 3-5% above the base rate.

- Term Length: Commercial mortgages usually have shorter durations than residential mortgages, typically ranging from 5 to 20 years, with amortization periods that may extend beyond the borrowing term. Additionally, business loans often involve increased vacancy risks and upfront expenses, including elevated application fees and valuation costs.

Grasping these concepts is essential for evaluating the best commercial mortgage companies and determining their alignment with specific financial objectives. For instance, understanding the implications of a high LTV ratio can aid borrowers in negotiating improved terms, as financial institutions often view lower LTVs as less risky. Furthermore, the DSCR serves as a crucial measure of financial well-being, with most financial institutions requiring a minimum DSCR of 1.25x to ensure adequate income coverage for debt service. By familiarizing themselves with these key metrics, borrowers can make informed decisions that enhance their chances of securing favorable financing from the best commercial mortgage companies. At Finance Story, we focus on developing refined and uniquely tailored business cases to present to financial institutions, ensuring you have access to a complete array of funding sources and the best opportunity to secure the appropriate financing for your requirements.

Criteria for Comparing Commercial Mortgage Companies: What to Consider

When evaluating the best commercial mortgage companies, several key criteria merit your attention to ensure an informed decision.

-

Interest Rates: Comparing the interest rates offered by various lenders is essential. Even a minor difference in rates can lead to substantial variations in overall borrowing costs, significantly impacting your financial commitments over time.

-

Fees and Closing Costs: It is crucial to assess the total expenses associated with obtaining a mortgage, which typically include origination fees, appraisal fees, and other closing costs. In Australia, average closing expenses for commercial mortgages in 2025 are projected to be higher than those for residential mortgages, often ranging from $800 to $1,500 for properties under $1 million.

-

Financing Terms: Examine the flexibility of financing conditions, including repayment schedules, prepayment penalties, and amortization periods. Understanding these terms can empower you to manage your cash flow effectively.

-

Customer Service: Evaluate the quality of assistance provided by the lender. Key aspects to consider include responsiveness, transparency, and the availability of resources to support borrowers throughout the loan process.

-

Creditor Reputation: Investigating the creditor's history by examining customer feedback and industry evaluations is vital. A strong reputation often correlates with reliability and trustworthiness, which are essential in financial partnerships.

-

Specialization: Some financiers focus on specific types of business real estate or funding options. Identifying a lender with expertise in your desired property type can significantly enhance your chances of securing favorable terms.

By concentrating on these criteria, borrowers can navigate the complexities of business lending more effectively, especially when choosing among the best commercial mortgage companies to align their choices with their financial goals and unique situations.

Comparative Analysis of Leading Commercial Mortgage Companies: Features, Pros, and Cons

Company A

- Features: This company offers competitive interest rates, flexible loan terms, and a comprehensive range of financing options tailored to meet various business needs.

- Pros: It is renowned for exceptional customer service, a swift approval process, and specialized programs designed specifically for small businesses, making it a preferred choice for many.

- Cons: However, it has higher closing costs compared to some competitors, which may impact overall affordability for certain borrowers.

Company B

- Features: Company B specializes in large commercial properties, supported by extensive underwriting resources that facilitate complex financing arrangements.

- Pros: It is capable of managing intricate financing needs, with strong industry connections that often lead to favorable terms for established businesses.

- Cons: Conversely, it offers limited flexibility for startups and smaller financial support, which may deter new businesses seeking initial funding.

Company C

- Features: This company provides a diverse portfolio of loan products, including SBA loans and bridge financing, catering to a wide array of borrower requirements.

- Pros: It is particularly beneficial for borrowers with unique financing needs, complemented by robust online resources for education and support.

- Cons: Nevertheless, processing times can be slower, and the level of personalized service may not match that of smaller lenders, potentially leading to a less tailored experience.

This analysis underscores the unique strengths and weaknesses of the best commercial mortgage companies, allowing borrowers to make informed decisions based on their specific financing needs.

Choosing the Right Commercial Mortgage Company: Tailoring Your Decision to Your Needs

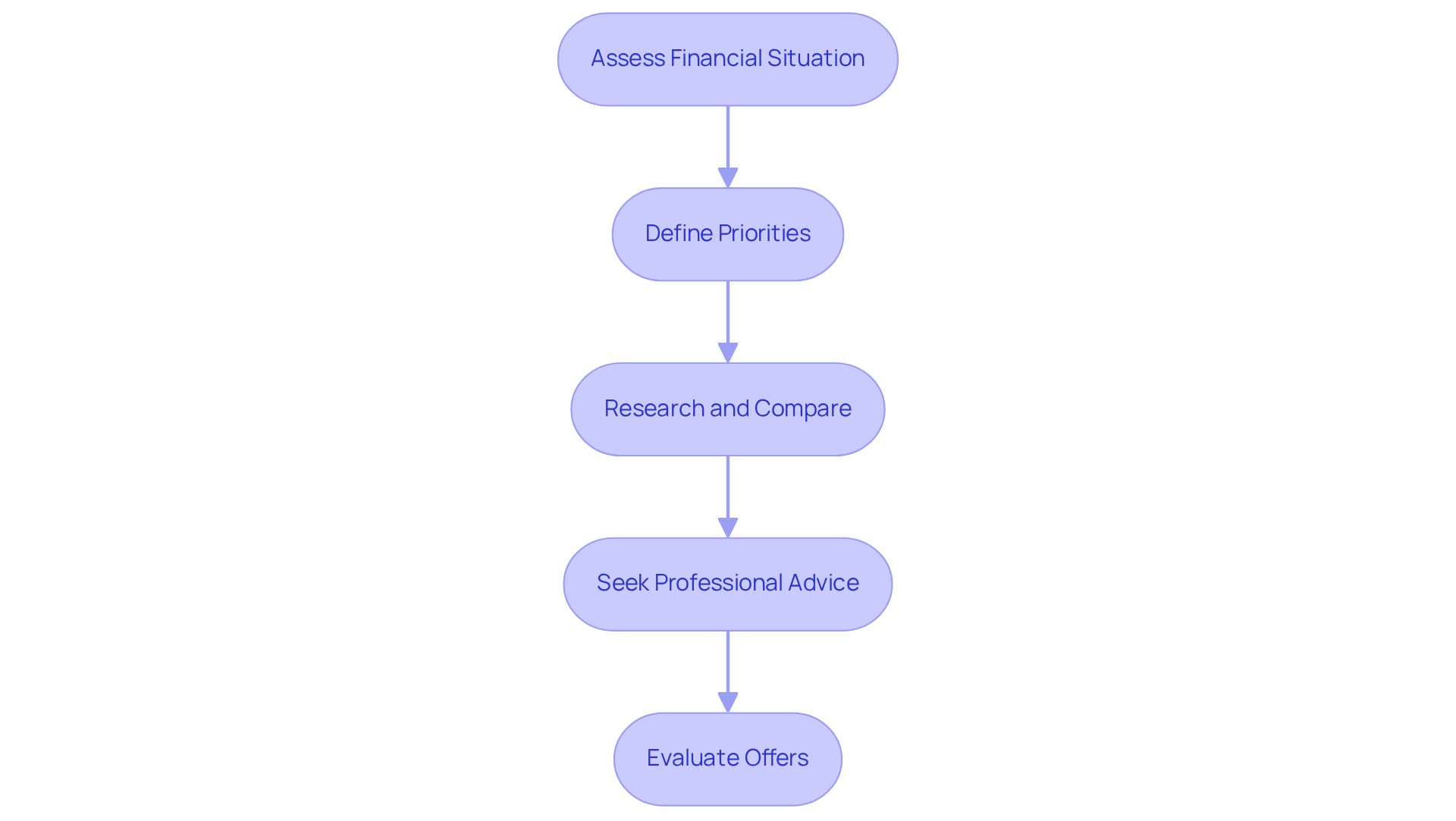

Selecting the best commercial mortgage companies is essential for achieving your financial goals. To navigate this process effectively, consider the following steps:

- Assess Your Financial Situation: Begin by evaluating your creditworthiness and financial objectives, along with the type of property you plan to finance. This foundational knowledge is crucial, particularly in 2025, where creditworthiness significantly impacts mortgage approvals.

- Define Your Priorities: Identify the key factors that matter most to you—be it competitive interest rates, exceptional customer service, or specialized loan products tailored to your needs.

- Research and Compare: Utilize the criteria you've established to evaluate various lenders. Focus on the best commercial mortgage companies that align with your priorities and have a reputation for professionalism and a deep understanding of the finance sector.

- Seek Professional Advice: Consulting with a finance expert or mortgage broker can provide personalized insights and recommendations, assisting you in navigating the complexities of the lending landscape.

- Evaluate Offers: After narrowing down your options, meticulously review the terms and conditions of each offer. Pay close attention to fees, repayment terms, and any potential penalties to ensure you make an informed choice.

By following these steps, borrowers can make well-informed decisions that align with their financial objectives, ultimately leading to a successful mortgage experience.

Conclusion

Understanding the intricacies of commercial mortgages is crucial for making informed financial decisions. This article underscores the significance of key concepts such as:

- Loan-to-value ratios

- Debt service coverage ratios

- Interest rates

All of these play a pivotal role in the mortgage landscape. By familiarizing oneself with these terms, borrowers can adeptly navigate the complexities of securing financing from the best commercial mortgage companies.

The analysis of leading lenders reveals the necessity of evaluating various criteria, including:

- Interest rates

- Fees

- Customer service

- Specialization

Each company's unique features, pros, and cons offer valuable insights that can guide borrowers in selecting the right lender for their specific needs. By assessing financial situations, defining priorities, and conducting thorough research, individuals can significantly enhance their chances of finding the most suitable commercial mortgage options.

Ultimately, the journey to securing a commercial mortgage demands diligence and a strategic approach. Borrowers are encouraged to leverage the information provided to make well-informed decisions that align with their financial goals. Engaging with financial experts and meticulously reviewing offers can further empower borrowers, ensuring they choose the best commercial mortgage company for their unique circumstances.