Overview

This article provides a comprehensive comparison of commercial lenders in Australia and their international counterparts, underscoring the strengths and weaknesses inherent in each.

Australian lenders are recognized for their personalized service and profound understanding of the local market. In contrast, international lenders often offer larger funding amounts and a broader array of financial products.

Consequently, the choice between these options hinges on a business's specific needs and growth ambitions. As you consider your financial strategy, reflect on which lender aligns best with your objectives.

Introduction

The landscape of commercial lending is undergoing rapid transformation, offering businesses an array of options both locally and internationally. As Australian lenders respond to evolving market demands, they are providing tailored financial products designed for a diverse spectrum of enterprises, from emerging startups to established corporations.

However, with the enticing promise of global financiers offering greater capital and innovative solutions, companies face a critical decision: should they prioritize the personalized service and market expertise of Australian lenders, or should they venture into the expansive opportunities presented by international options?

This article explores the intricacies of commercial lending, comparing the strengths and challenges faced by lenders in Australia and abroad, ultimately guiding businesses toward informed financing choices.

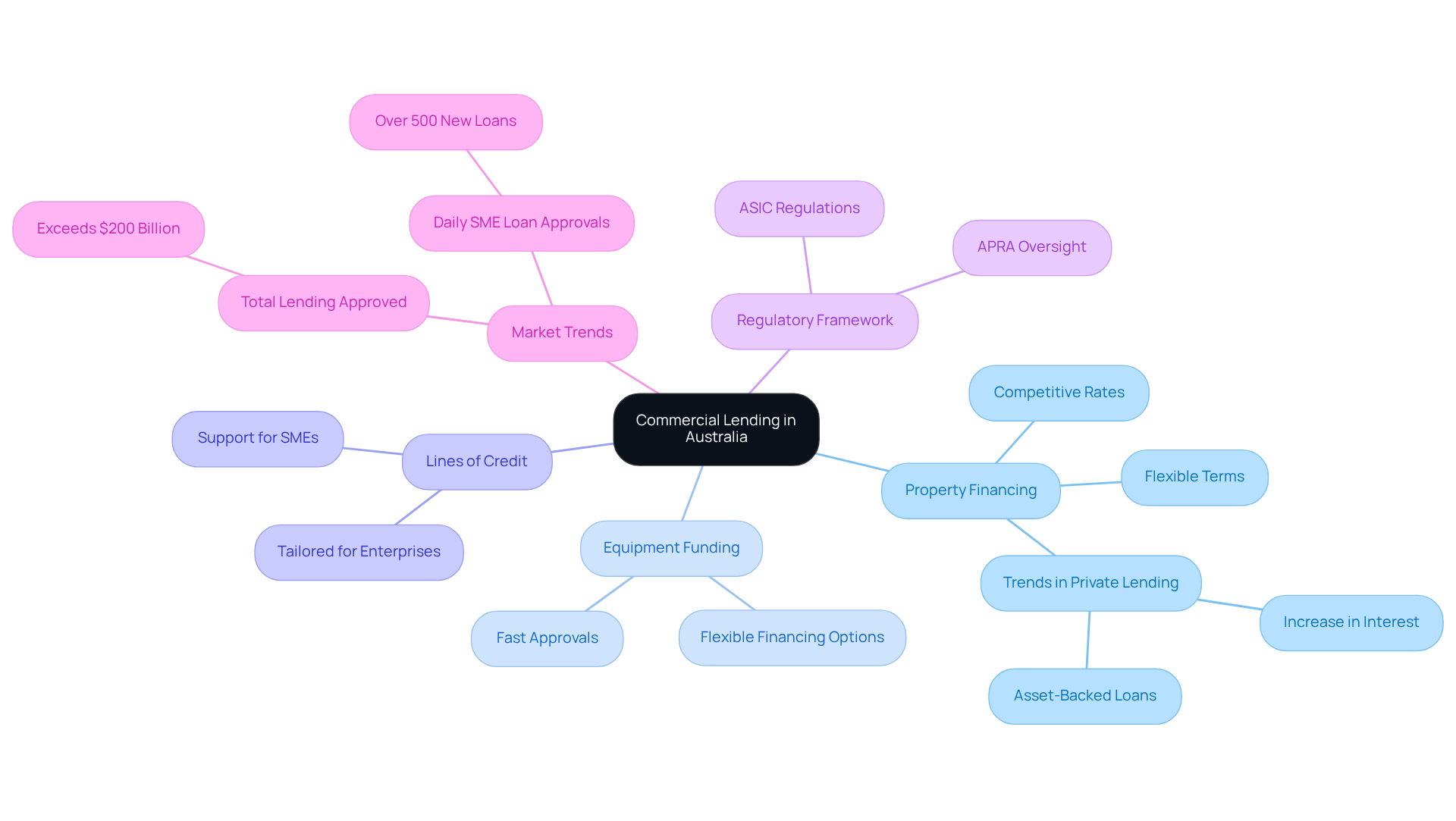

Understanding Commercial Lending in Australia

In Australia, commercial lenders provide a diverse array of financial products designed to cater to the varying needs of businesses, ranging from small startups to large corporations. The primary categories of commercial financing include:

- Property financing

- Equipment funding

- Lines of credit tailored for enterprises

Commercial lenders in Australia, along with major banks and non-bank institutions, provide competitive rates and flexible terms, often influenced by the monetary policy set forth by the Reserve Bank of Australia. Furthermore, the regulatory framework, overseen by the Australian Prudential Regulation Authority (APRA) and the Australian Securities and Investments Commission (ASIC), guarantees that lending practices remain transparent and responsible.

Recent trends reveal a notable increase in interest for private lending options, serving as alternative financing solutions for enterprises encountering difficulties in securing conventional funding. This shift is particularly significant, as total lending approved to businesses since February has surpassed $200 billion, indicating robust support for the sector. In addition, banks are approving over 500 new SME credits daily for more than 250 days, illustrating the rapidly evolving lending landscape.

Understanding these dynamics is essential for evaluating commercial lenders in Australia in comparison to their global counterparts, especially regarding risk assessment and financing structuring. As enterprises navigate these complexities, the role of specialized financing brokers becomes increasingly vital, offering access to a broader range of lending options and tailored financial strategies.

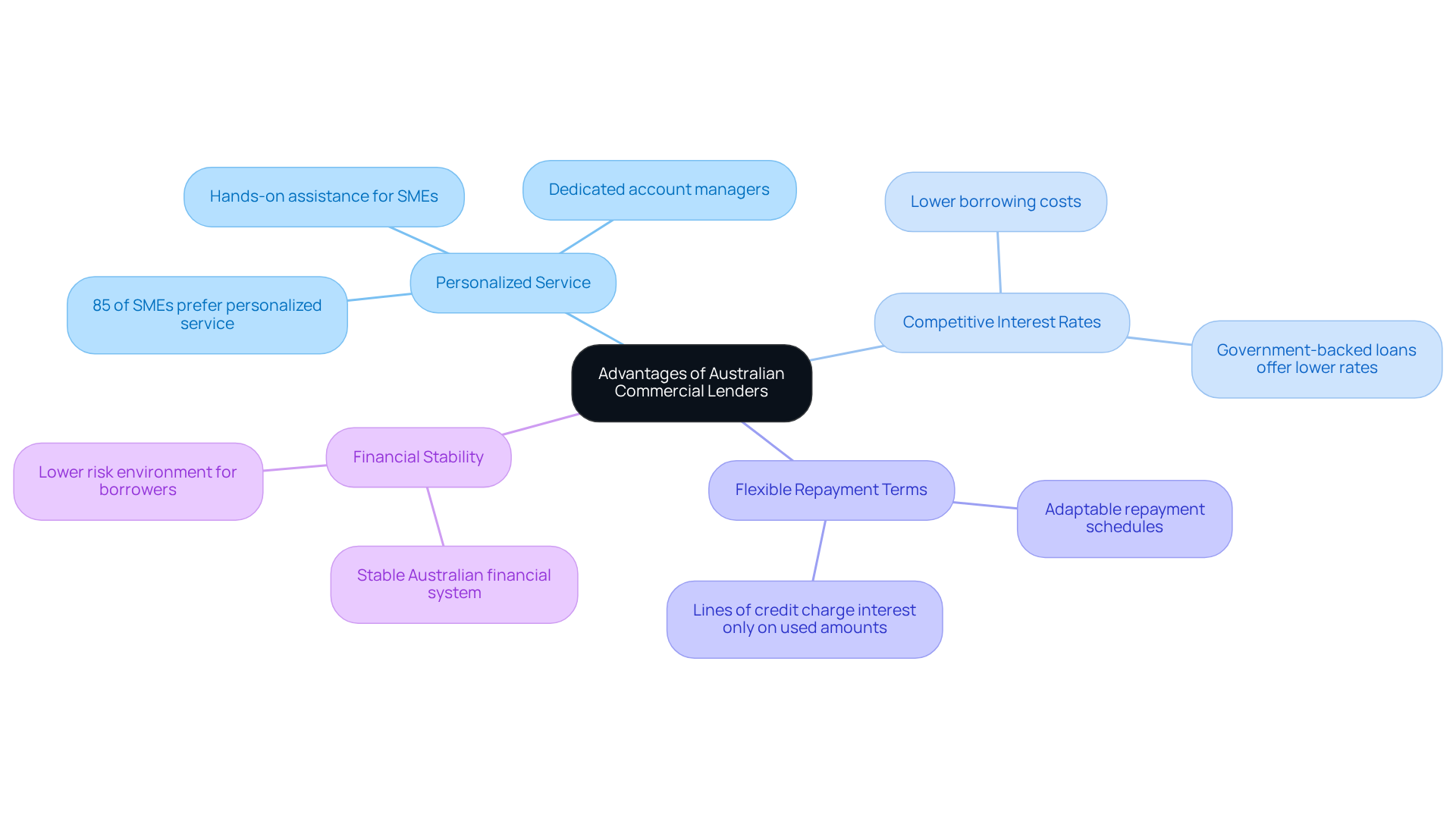

Advantages of Australian Commercial Lenders

Australian commercial banks present a wealth of benefits for enterprises in search of funding. Their deep understanding of the local market empowers them to tailor loan products that meet specific business needs. For instance, many financial institutions assign dedicated account managers to provide personalized service, guiding clients through the lending process. This customized support proves especially advantageous for small to medium-sized enterprises (SMEs), which often thrive with hands-on assistance. In 2025, statistics revealed that 85% of SMEs preferred financial institutions offering personalized service, underscoring its importance in the borrowing landscape.

Furthermore, Australian financial institutions are lauded for their competitive interest rates and flexible repayment terms, rendering financing more accessible. The stability of the Australian financial system, as highlighted in recent reports from the Reserve Bank of Australia, cultivates a lower risk environment for borrowers. This combination of tailored service, market flexibility, and financial stability positions commercial lenders in Australia as an attractive option for enterprises seeking funding in a supportive and familiar setting. Expert insights suggest that institutions prioritizing personalized service not only enhance client satisfaction but also boost loan approval rates, further solidifying their role as trusted partners in the financial journey of SMEs.

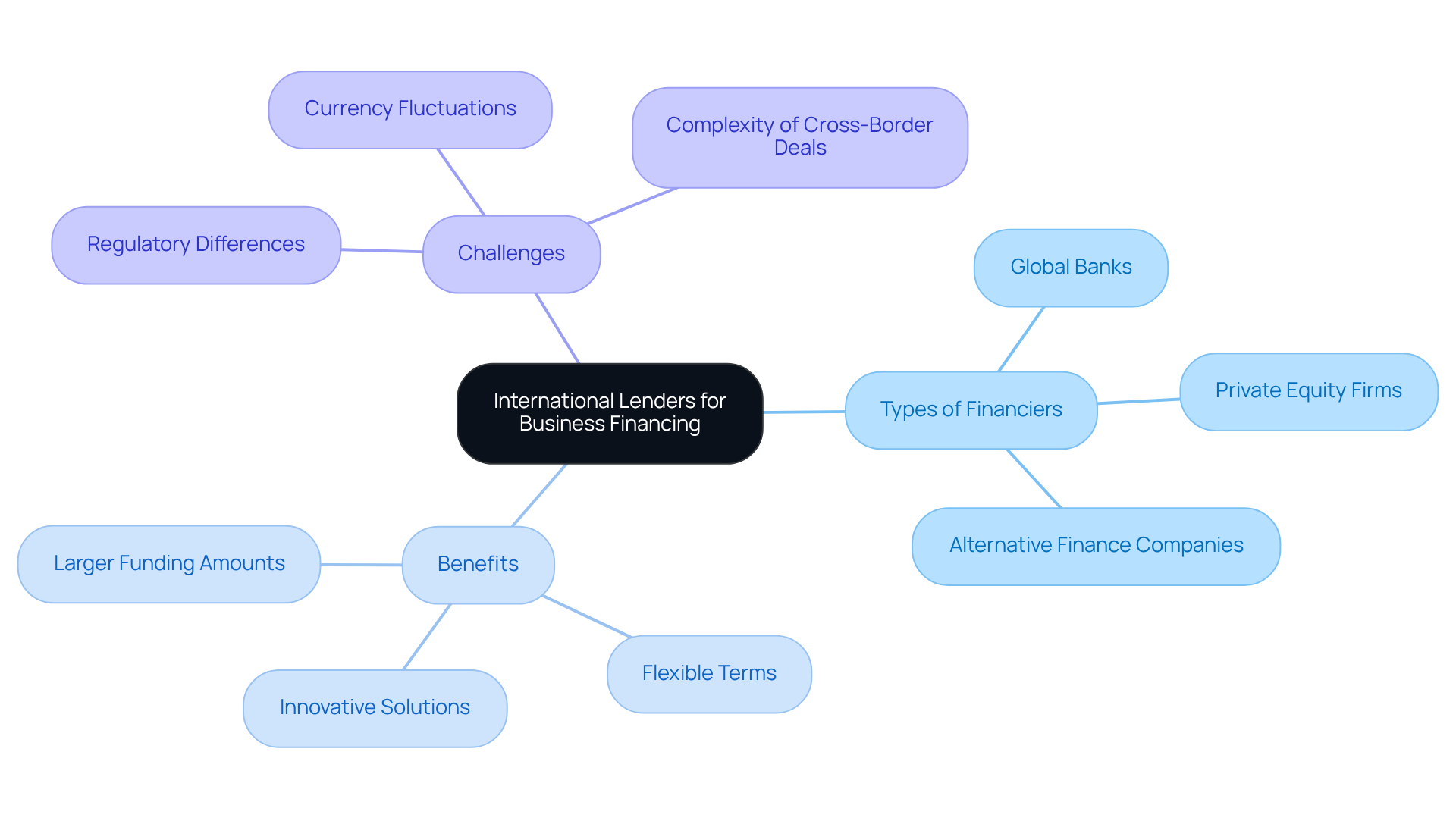

Exploring International Lenders for Business Financing

Global financiers present a diverse array of funding alternatives that can be highly appealing to enterprises in search of capital. These financiers encompass global banks, private equity firms, and alternative finance companies operating on an international scale. A significant advantage of partnering with global financiers lies in their capacity to provide larger funding amounts and a broader spectrum of financial services, particularly advantageous for companies with substantial capital requirements or those aiming to penetrate new markets. For instance, the typical loan amount from overseas financiers can surpass $1 million, catering to various commercial needs.

Furthermore, global financiers often offer more flexible terms and innovative funding solutions, such as asset-based loans and trade finance, facilitating smoother cross-border transactions. However, businesses must navigate potential challenges, including differing regulatory landscapes, currency fluctuations, and the complexities inherent in cross-border dealings. For example, obtaining authorization for overseas financing typically requires between 30 to 90 days, depending on the provider's evaluation process.

Understanding these dynamics is crucial for companies contemplating global financing options, as they significantly influence the overall cost and feasibility of securing loans. With the global lending market projected to grow from $11.3 trillion in 2024 to $12.2 trillion in 2025, opportunities for leveraging global financiers are expanding, making it essential for companies to stay informed about the evolving landscape of global finance. At Finance Story, we specialize in crafting tailored and highly personalized proposals to present to banks, ensuring that small business owners can adeptly navigate these global financing avenues. Additionally, we provide access to a comprehensive range of financial institutions, including high street banks and innovative private funding panels, to address various scenarios, whether you seek to finance a warehouse, retail space, factory, or hospitality project.

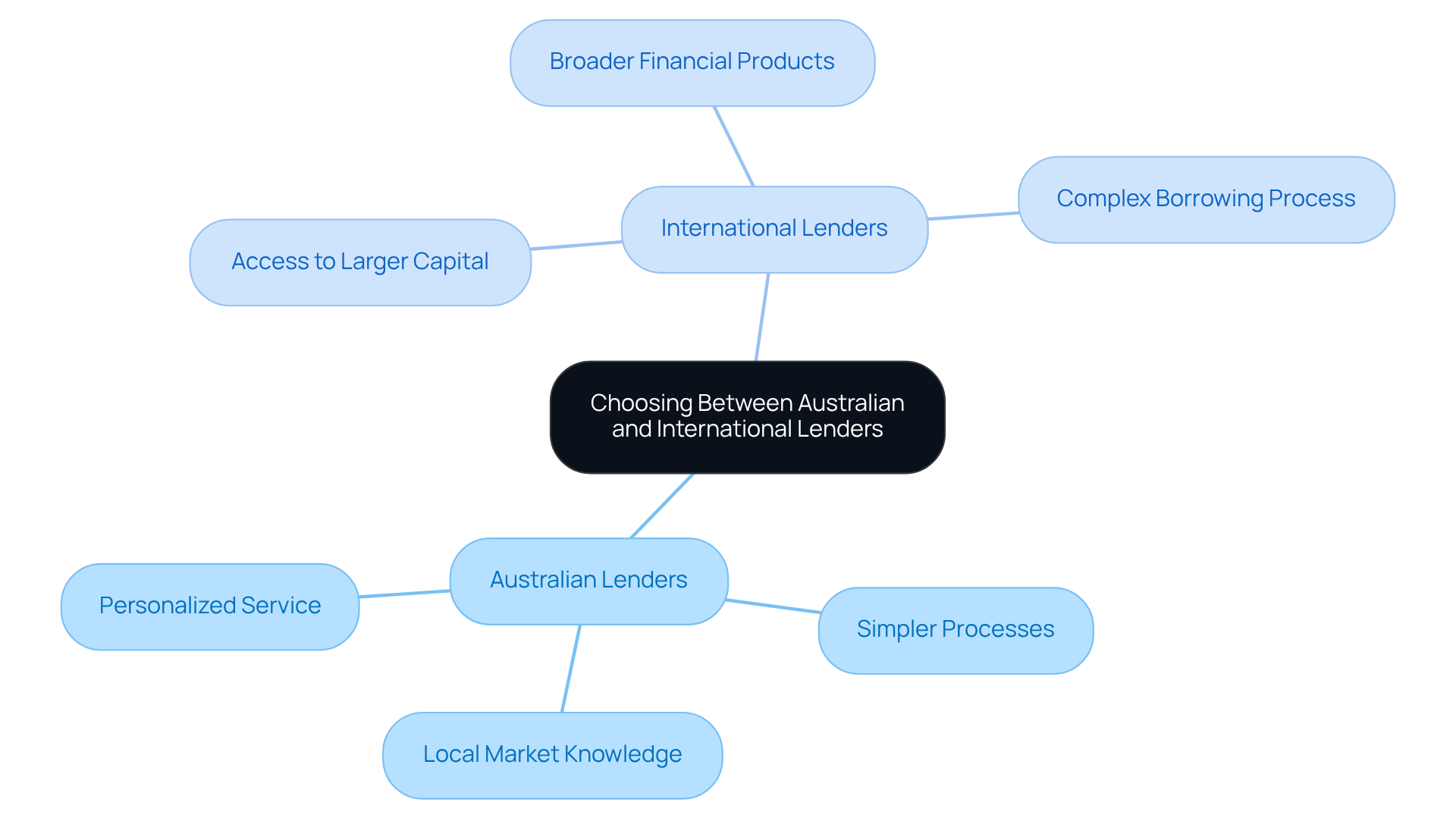

Comparative Analysis: Choosing Between Australian and International Lenders

When choosing between Australian and overseas financiers, businesses must consider several essential factors. Commercial lenders in Australia are renowned for their personalized service and in-depth understanding of local market conditions, often resulting in more tailored financing solutions. Their application processes tend to be more straightforward, with less bureaucratic red tape compared to many global financial institutions.

On the other hand, global financiers may offer access to larger amounts of capital and a broader range of financial products, which can be advantageous for companies with ambitious growth plans. However, navigating the complexities of foreign lenders can complicate the borrowing process, with potential language barriers and differing regulatory requirements to consider.

Ultimately, the decision hinges on the specific needs of the organization, including its size, growth aspirations, and the type of funding required from commercial lenders in Australia. A thorough evaluation of both options, informed by these insights, will empower businesses to make well-informed financing decisions.

Conclusion

The landscape of commercial lending offers a compelling choice for businesses, with Australian lenders providing a unique blend of personalized service and market insight that aligns closely with local needs. This tailored approach, coupled with competitive rates and a stable financial environment, positions Australian commercial lenders as a formidable option for enterprises seeking funding. On the other hand, international lenders present a broader spectrum of financial products and potentially larger capital amounts, appealing to businesses with expansive growth ambitions.

Key arguments throughout this article underscore the advantages of Australian lenders, such as their deep understanding of the local market and streamlined application processes, which often lead to quicker approvals. Conversely, global financiers grant access to diverse funding options but introduce complexities related to regulatory navigation and potential language barriers. Ultimately, the choice between these two avenues should be guided by the specific requirements and aspirations of the business in question.

In conclusion, grasping the nuances of commercial lending—both locally and internationally—is essential for businesses aiming to make informed financing decisions. As the lending landscape continues to evolve, staying informed about current trends and regulations will empower enterprises to leverage the best options available, whether through Australian or international lenders. Businesses are encouraged to engage with financial experts to explore tailored solutions that align with their growth objectives, ensuring they harness the full potential of the financing avenues at their disposal.