Overview

This article presents a comprehensive comparative analysis of commercial property lenders in Australia, focusing on the strengths and weaknesses of key institutions such as:

- Commonwealth Bank

- ANZ

- NAB

- Judo Bank

- Liberty Financial

It meticulously details essential criteria for evaluating these lenders, including:

- Interest rates

- Loan-to-value ratios

- Fees

- Repayment terms

- Customer service

- Specialization

By doing so, it ultimately guides borrowers in selecting the most suitable financing options tailored to their specific needs.

Introduction

In Australia’s dynamic lending landscape, businesses encounter a multitude of choices when securing financing for commercial properties. As the demand for tailored financial solutions continues to rise, understanding the distinct offerings of leading lenders becomes essential for making informed decisions.

How do borrowers effectively navigate this complex environment to identify the best fit for their unique needs, especially when the stakes are high and the options are vast?

This article provides a comparative analysis of commercial property lenders in Australia, highlighting key criteria and insights that empower business owners to select the most suitable financing partner.

Overview of Leading Commercial Property Lenders in Australia

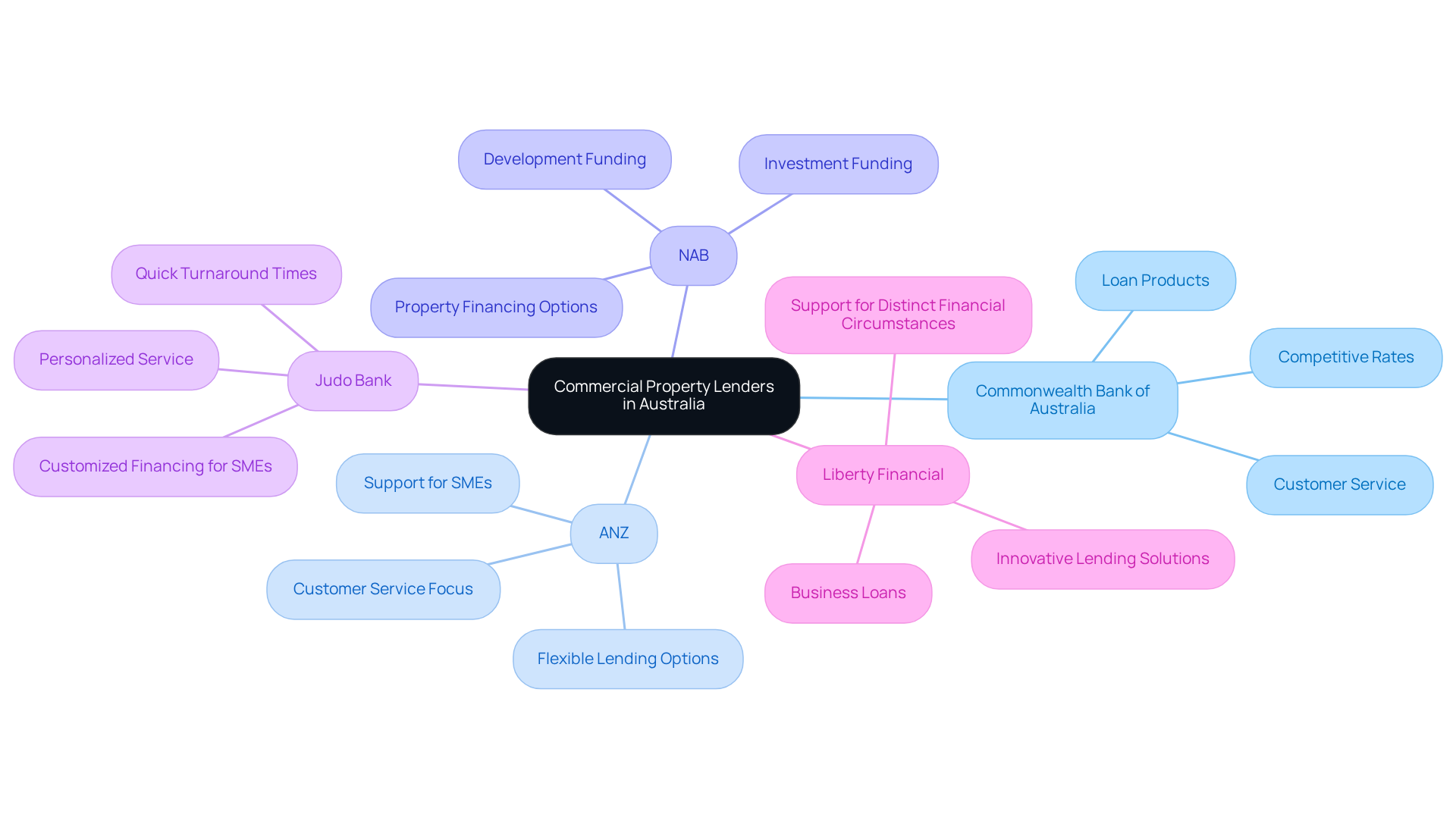

In Australia, the lending landscape for businesses is shaped by several key players, including commercial property lenders Australia, major banks, and innovative non-bank lenders. Notable institutions include:

- Commonwealth Bank of Australia (CBA): Renowned for its extensive reach and competitive rates, CBA provides a diverse range of commercial loan products tailored to meet various business needs.

- ANZ: With a strong emphasis on customer service, ANZ offers flexible lending options and is well-regarded for its support of small to medium enterprises.

- NAB: Acknowledged for its extensive range of property financing options, NAB serves both investment and development funding needs.

- Judo Bank: As a newer entrant, Judo Bank specializes in offering customized financing for SMEs, focusing on personalized service and quick turnaround times.

- Liberty Financial: Recognized for its innovative lending solutions, Liberty provides a range of business loans, especially serving borrowers with distinct financial circumstances.

These commercial property lenders in Australia embody a mix of traditional banking entities and agile non-bank financiers, catering to a broad spectrum of business asset financing requirements across the country. In the business real estate sector, commercial property lenders Australia have contributed to a significant rise in lending activity, with real estate mortgages increasing by 23.3% compared to the previous year, indicating a robust demand for financing solutions in this evolving market.

In this competitive environment, Finance Story distinguishes itself by offering specialized expertise in crafting refined and personalized business cases for funding proposals. This ensures that clients receive tailored solutions that effectively address their specific needs. Testimonials from satisfied clients, such as Natasha B from VIC, underscore the effectiveness of Finance Story's approach, stating, "I will definitely be recommending your business to anyone. We are finished with the constant worry. Once again, thank you so much for being a part of our journey." This context is crucial for small business owners exploring their financing options, as Finance Story's understanding of loan repayment standards and its capability to support various types of business assets further solidify its status as a dependable partner in this dynamic environment.

Key Comparison Criteria for Commercial Property Lenders

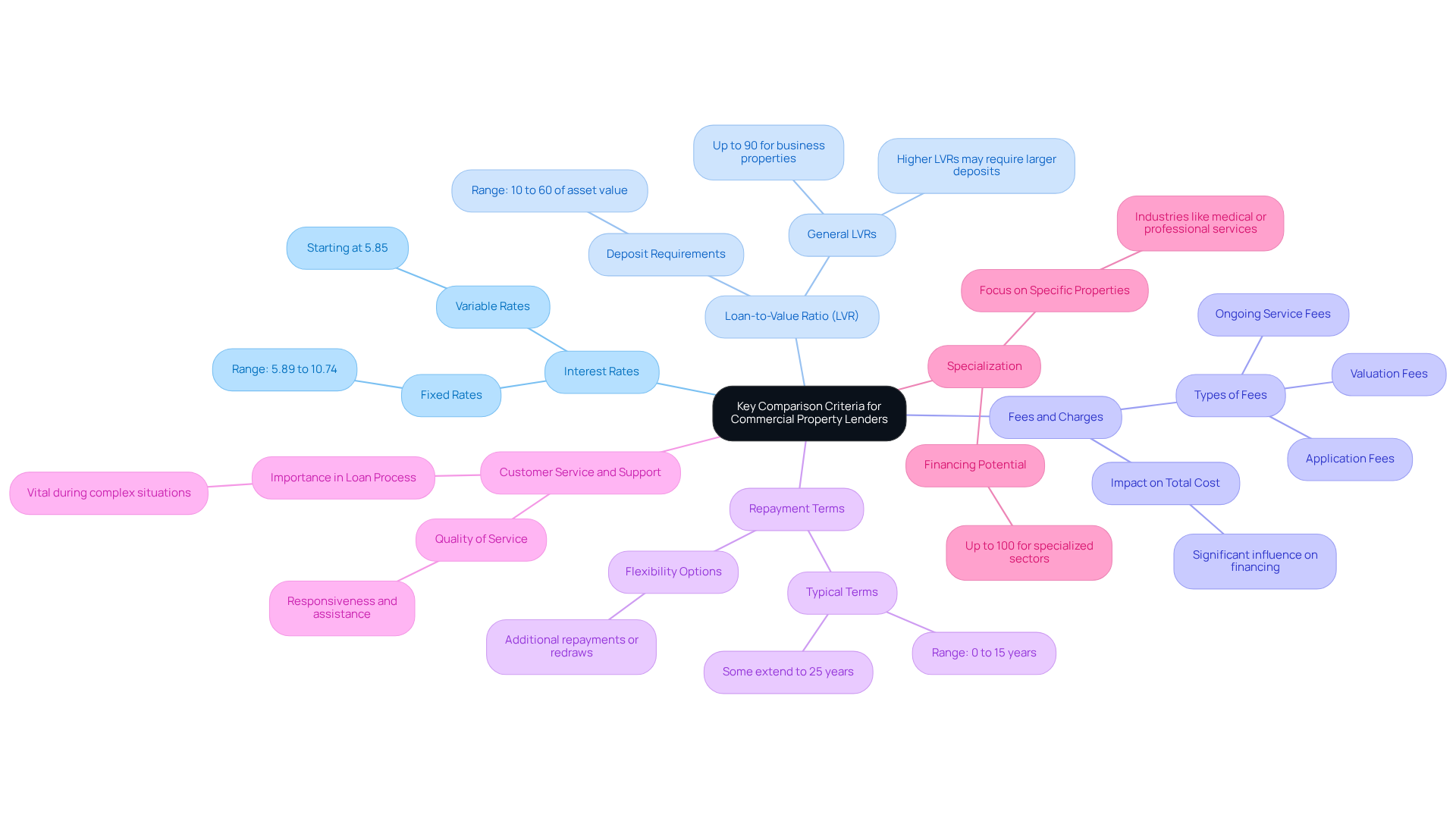

When evaluating commercial property lenders, several essential criteria warrant consideration:

- Interest Rates: The cost of borrowing stands as a primary concern. Traditional lenders typically offer fixed rates ranging from 5.89% to 10.74%, with variable rates starting at 5.85%. Grasping the implications of each type is vital for financial planning, particularly when collaborating with experts like Finance Story, who specialize in crafting polished, individualized business cases for presentation to banks.

- Loan-to-Value Ratio (LVR): This ratio signifies the percentage of the asset's value that can be financed. In 2025, financiers generally permit LVRs up to 90% for business properties. However, reduced LVRs often lead to more favorable terms and require larger deposits. The deposit necessary for commercial financing can range from 10% to 60% of the asset value, providing crucial context regarding LVR implications. Finance Story aids in navigating these requirements to secure optimal financing options.

- Fees and Charges: Beyond interest rates, lenders may impose various fees, including application, valuation, and ongoing service fees. These can significantly influence the total cost of financing, making it essential to evaluate all potential expenses. Specific examples of fees include application fees, valuation fees, and ongoing service fees, which should be carefully examined. Finance Story's expertise ensures that clients fully understand all expenses associated with their proposals.

- Repayment Terms: Flexibility in repayment options is essential. Most commercial financing options typically have terms ranging from 0 to 15 years, with some allowing additional repayments or redraws to assist in effective cash flow management. Certain credits may extend to 25 years, providing a clearer picture of common practices. Understanding these terms is crucial for small business owners aiming to align their financing with operational needs.

- Customer Service and Support: The quality of service provided by the financial institution can greatly influence the borrowing experience, particularly in complex situations. A financial institution's responsiveness and assistance can be vital during the loan process, underscoring the importance of such responsiveness in addressing client needs. Finance Story prides itself on delivering exceptional support throughout the financing journey.

- Specialization: Some financial institutions focus on specific types of commercial properties or industries, which can be advantageous for borrowers with unique needs. For instance, businesses in sectors like medical or professional services may secure financing as high as 100%, showcasing the potential benefits of specialization. Finance Story's access to a comprehensive range of financial institutions, including high street banks and innovative private borrowing panels, empowers clients to discover the best match for their particular situations.

These criteria provide a robust framework for evaluating commercial property lenders in Australia and determining which aligns best with a borrower’s financial objectives.

Comparative Analysis of Lender Offerings and Services

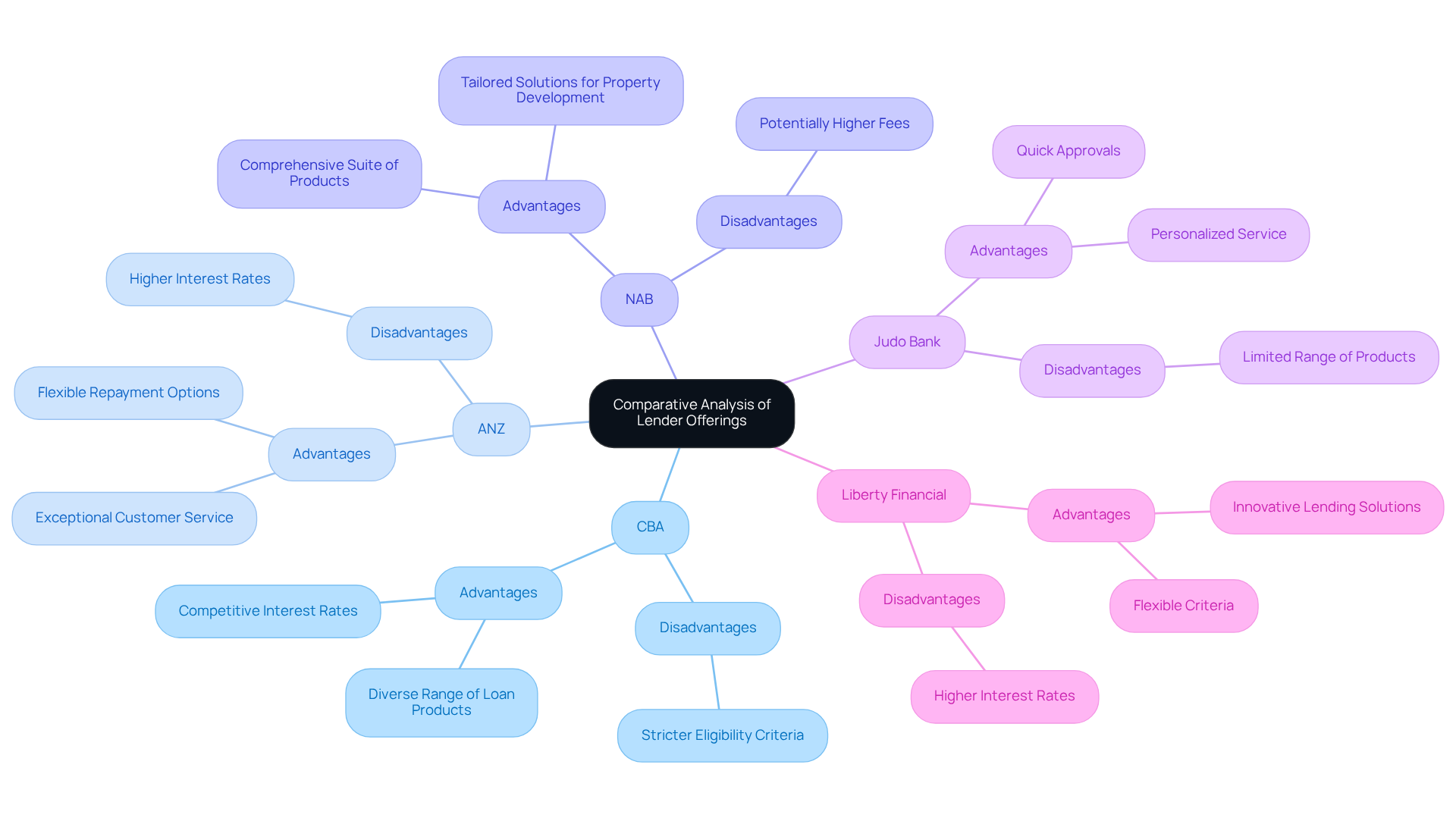

A comparative analysis of the offerings from leading commercial property lenders reveals distinct advantages and disadvantages that are crucial for borrowers to consider:

- Commonwealth Bank of Australia (CBA): This lender offers competitive interest rates and a diverse range of loan products. However, it may impose stricter eligibility criteria that could limit access for some borrowers.

- ANZ: Renowned for its exceptional customer service, ANZ provides flexible repayment options. Nevertheless, its interest rates may be slightly higher than those of some competitors. Financial experts note that ANZ's adaptability in lending practices significantly enhances client satisfaction.

- NAB: This institution features a comprehensive suite of products, including tailored solutions for property development. However, borrowers should be aware of potentially higher fees associated with its services, which could impact overall loan costs.

- Judo Bank: Known for quick approvals and personalized service, Judo Bank is particularly well-suited for small to medium enterprises (SMEs). Nonetheless, it may offer a more limited range of products compared to larger banks, which could restrict options for some borrowers.

- Liberty Financial: Recognized for its innovative lending solutions, Liberty is flexible with its criteria, catering to a variety of borrower needs. However, this flexibility often comes with higher interest rates, reflecting the increased risk involved.

This analysis highlights the necessity of aligning the offerings of commercial property lenders in Australia with specific borrower needs—be it competitive rates, flexibility, or specialized services—to ensure optimal financing outcomes.

Choosing the Right Lender: Tailoring Options to Your Needs

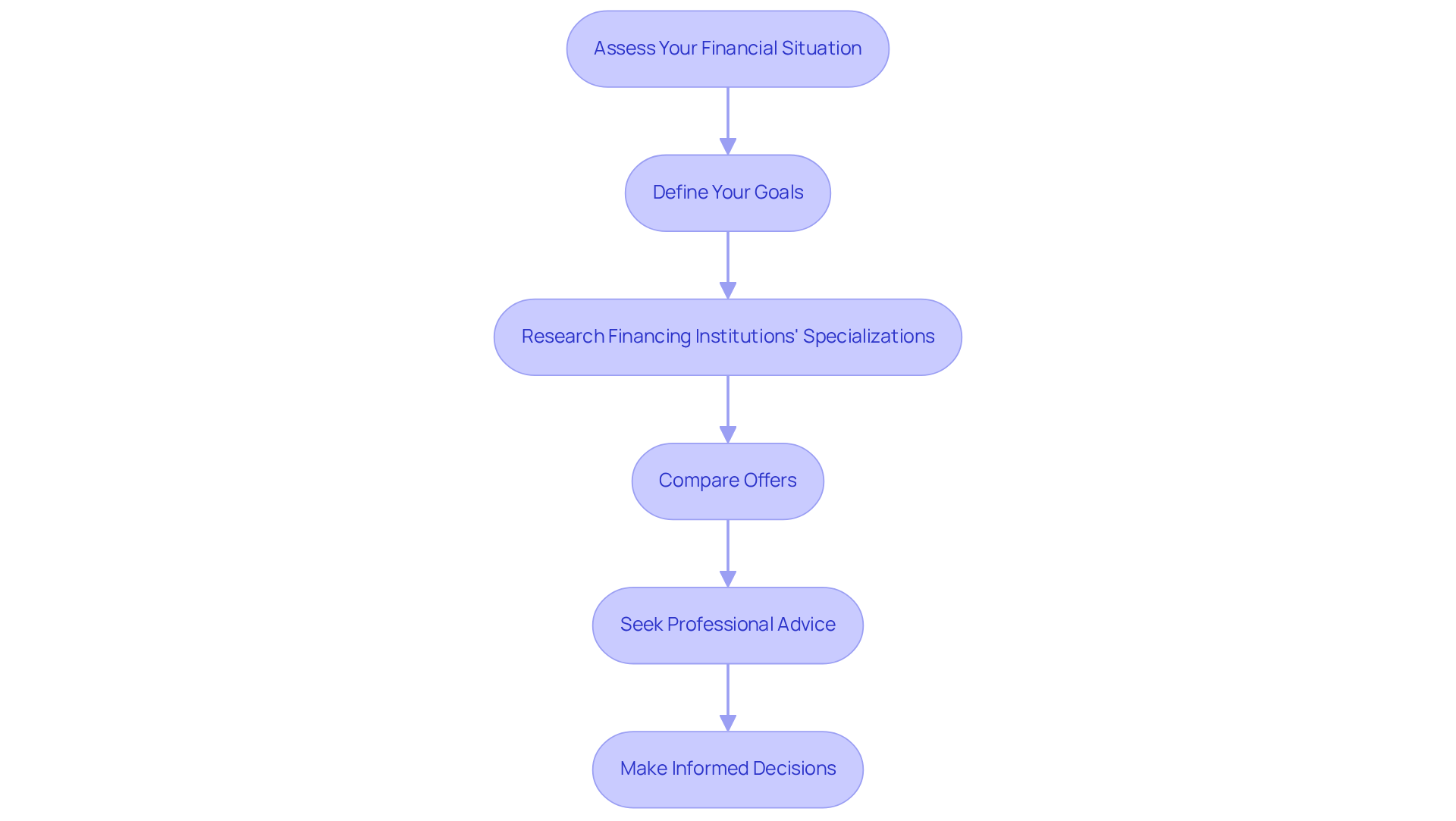

Selecting the right commercial property lenders Australia requires a strategic approach that aligns with your unique business needs.

- Assess Your Financial Situation: Begin by evaluating your creditworthiness and financial history. Comprehending these elements will assist you in recognizing financial institutions that are most appropriate for your particular needs.

- Define Your Goals: Clearly articulate what you seek from a loan. Consider whether you need a lower interest rate, flexible repayment terms, or specific features that support your business strategy.

- Research Financing Institutions' Specializations: Various financing institutions may have expertise in different sectors or property types, such as warehouses, retail spaces, factories, and hospitality ventures. Aligning your business with commercial property lenders Australia can provide significant advantages.

- Compare Offers: Utilize set evaluation standards to assess various financial institutions and their products. This side-by-side analysis will help you identify the most favorable terms. With access to a comprehensive array of financial institutions, including mainstream banks and innovative private financing options, Finance Story can assist you in navigating this process effectively.

- Seek Professional Advice: Engaging with a finance broker or advisor can offer valuable insights and assist in navigating the complexities of lending options. Their expertise can help you overcome common challenges, such as high fees and lengthy approval times.

By following these steps, borrowers can make informed decisions that align with their financial objectives, ensuring they choose a lender that meets their specific needs. Real-world examples from Finance Story clients illustrate how tailored lending options can lead to successful outcomes.

Conclusion

In the competitive landscape of commercial property lending in Australia, it is crucial for businesses seeking financing to understand the diverse offerings and unique strengths of various lenders. Analyzing leading institutions—from established banks like Commonwealth Bank of Australia and NAB to innovative entrants like Judo Bank and Liberty Financial—reveals a rich tapestry of options tailored to meet varying business needs. Each lender presents distinct advantages, whether it be competitive interest rates, exceptional customer service, or specialized financing solutions.

Key factors such as:

- interest rates

- loan-to-value ratios

- fees

- repayment terms

- customer support

- lender specialization

play a pivotal role in determining the best fit for borrowers. By carefully evaluating these criteria, businesses can align their financial strategies with lenders that support their unique operational goals. The insights provided here serve as a valuable guide for navigating the complexities of commercial property lending, empowering borrowers to make informed decisions.

Ultimately, the choice of a commercial property lender should be driven by a clear understanding of individual financial needs and objectives. Engaging with expert brokers like Finance Story can streamline this process, ensuring that businesses secure the most favorable terms and support for their financing endeavors. As the commercial property market continues to evolve, leveraging the right lending partnerships will be critical to achieving long-term success and growth.