Overview

The fundamental distinctions between commercial finance brokers in Perth and traditional banks are rooted in their flexibility and client-centric approaches. Brokers provide tailored solutions alongside a broader spectrum of lending options that cater to individual financial needs. Notably, brokers possess the agility to swiftly adapt to unique financial circumstances, facilitating quicker access to funds. In contrast, traditional banks are synonymous with stability and predictability, yet they may fall short in addressing complex financing requirements. This difference is crucial for clients seeking personalized financial solutions.

Introduction

In the intricate world of business financing, the choice between commercial finance brokers and traditional banks can significantly influence a company's growth trajectory. As businesses navigate the complexities of securing loans, understanding the distinct advantages each option offers is crucial. Commercial finance brokers, such as those at Finance Story, are increasingly recognized for their ability to provide tailored financial solutions that cater to unique business needs. They often outperform the more rigid frameworks of traditional banks.

With the rise of brokers in Australia, businesses are discovering the benefits of personalized service and diverse lending options. This shift can lead to quicker approvals and better terms, essential for maintaining a competitive edge. This article delves into the evolving roles of these financial intermediaries and banks, offering insights that help businesses make informed financing decisions. Ultimately, aligning these decisions with their goals is vital in an ever-changing economic landscape.

Understanding Commercial Finance Brokers and Traditional Banks

Commercial finance brokers Perth serve as vital intermediaries between businesses seeking loans and a variety of lenders, including banks and private financial institutions. At Finance Story, we fully comprehend organizational needs, collaborating closely with clients to craft tailored financial solutions that address their unique circumstances. Our expertise lies in developing refined and highly personalized cases, ensuring our clients can access a diverse array of lending options tailored to their specific requirements, including refinancing and securing customized loans for commercial property investments.

This flexibility offers a significant advantage over traditional banks, which typically operate within a more rigid framework and adhere to standardized lending criteria. Such limitations can restrict the choices available to borrowers, complicating the process for companies to obtain the necessary funding, highlighting the growing significance of commercial finance brokers in Perth, as evidenced by a notable rise in demand for their services.

Recent statistics indicate that more companies are seeking assistance from intermediaries to navigate the complexities of financing. For instance, commercial borrowers often pursue financing opportunities to capitalize on prospects such as discounted stock, underscoring the importance of intermediaries in identifying and securing prompt funding options. This trend is further supported by insights from industry experts, who stress the crucial role of commercial finance brokers Perth in diversifying their offerings to satisfy a broader range of customer needs.

Anja Pannek, CEO of the MFAA, noted the positive trend of intermediaries embracing commercial finance brokers Perth lending opportunities, enhancing their ability to assist clients efficiently. The distinctions between commercial finance brokers Perth and traditional banks become particularly evident in their approach to handling loan procedures. Brokers like Finance Story leverage established relationships with self-employed clients to pinpoint potential financing needs, posing targeted questions that commercial finance brokers Perth can use to uncover opportunities for commercial loans.

This proactive strategy not only diversifies the services agents can provide but also strengthens their relationships with clients by offering customized financial solutions. Our expertise in refinancing and securing tailored financial loans for commercial property investments ensures we meet the evolving needs of our clients.

Moreover, educational initiatives within the sector, such as those offered by Pepper Money, emphasize the importance of equipping professionals with the skills necessary to engage effectively with clients. These training programs enable agents to assist clients not only with home loan applications but also in exploring alternative funding options, including commercial property loans through commercial finance brokers Perth.

As John Mohnacheff, group sales manager at Liberty, points out, non-banks have been pioneers in third-party commercial lending for over 15 years, highlighting the evolving role of agents in corporate funding. As the landscape of commercial funding continues to evolve, the function of finance intermediaries is becoming increasingly essential. Their ability to adapt and deliver tailored solutions positions them as crucial allies for businesses navigating the financial landscape in 2025 and beyond.

Advantages of Commercial Finance Brokers for Perth Businesses

Commercial finance brokers Perth provide significant advantages for enterprises by granting access to a diverse array of lenders, often resulting in more competitive rates and favorable terms. At Finance Story, we understand organizational needs like no other, working closely with clients to develop robust cases that align with their specific financial situations and objectives. Our customized strategy ensures tailored solutions that address varied lending requirements, whether for acquiring commercial properties or refinancing existing loans.

Furthermore, our expertise in managing complex lending scenarios is particularly beneficial for enterprises facing unique challenges or credit concerns, establishing us as essential allies in the financing process. Our established connections with a wide-ranging group of lenders, including boutique lenders, private investors, and mainstream banks, enhance our ability to facilitate quicker approvals and negotiate more favorable terms for our clients.

Statistics reveal that firms utilizing intermediaries experience faster loan approval times compared to those approaching traditional banks. Notably, agents have achieved an 18% increase in market share since 2018, underscoring their growing efficiency in the finance industry. David Bailey, CEO of AFG, highlighted the productivity and value agents provide to clients, further emphasizing the importance of working with experienced commercial finance brokers in Perth. Real-world examples demonstrate how companies have successfully leveraged the services of commercial finance brokers in Perth, such as Finance Story, to secure funding that supports growth and operational needs. Our tailored mortgage brokerage solutions are designed to assist clients in challenging circumstances, showcasing the tangible benefits of this approach and illustrating how brokers can expand their client base and create additional revenue streams.

Benefits of Traditional Banks for Business Financing

Conventional financial institutions present numerous advantages for enterprises, particularly those with robust credit profiles. Their inherent stability and reliability arise from stringent regulatory oversight, fostering trust among borrowers. Banks typically offer a diverse array of financial products, including long-term loans, lines of credit, and treasury services, making them an attractive choice for enterprises in search of comprehensive financial solutions. Established relationships with these institutions can yield favorable conditions for loyal clients, enhancing the overall funding experience.

For enterprises prioritizing security and predictability in their funding, conventional financial institutions are a dependable option, especially for those with straightforward funding needs. In 2025, approval rates for small enterprise loans from conventional institutions are significantly higher than those from alternative providers, reinforcing their reliability in the funding landscape. Furthermore, financial analysts emphasize that the stability offered by conventional institutions is crucial for enterprises aiming to navigate economic uncertainties effectively.

Notably, 83% of lenders in the consumer sector provide embedded services, compared to only 45% of SMB lenders, underscoring the competitive landscape. As Dave Ramsey aptly states, "Financial peace isn't the acquisition of stuff. It's learning to live on less than you make, so you can give money back and have money to invest." This statement underscores the importance of effective financial management, aligning with the theme of traditional banks as dependable funding alternatives.

Additionally, modern fintech providers are harnessing automation and AI to expedite the underwriting process, enabling approvals in under 30 seconds, a stark contrast to traditional methods that can take weeks. In this evolving environment, Finance Story sets itself apart by offering tailored loan solutions and funding alternatives that cater to the specific needs of small enterprise owners. Our expertise in crafting refined loan proposals ensures that clients secure the appropriate funding for their commercial property investments and refinances, ultimately enhancing their growth potential.

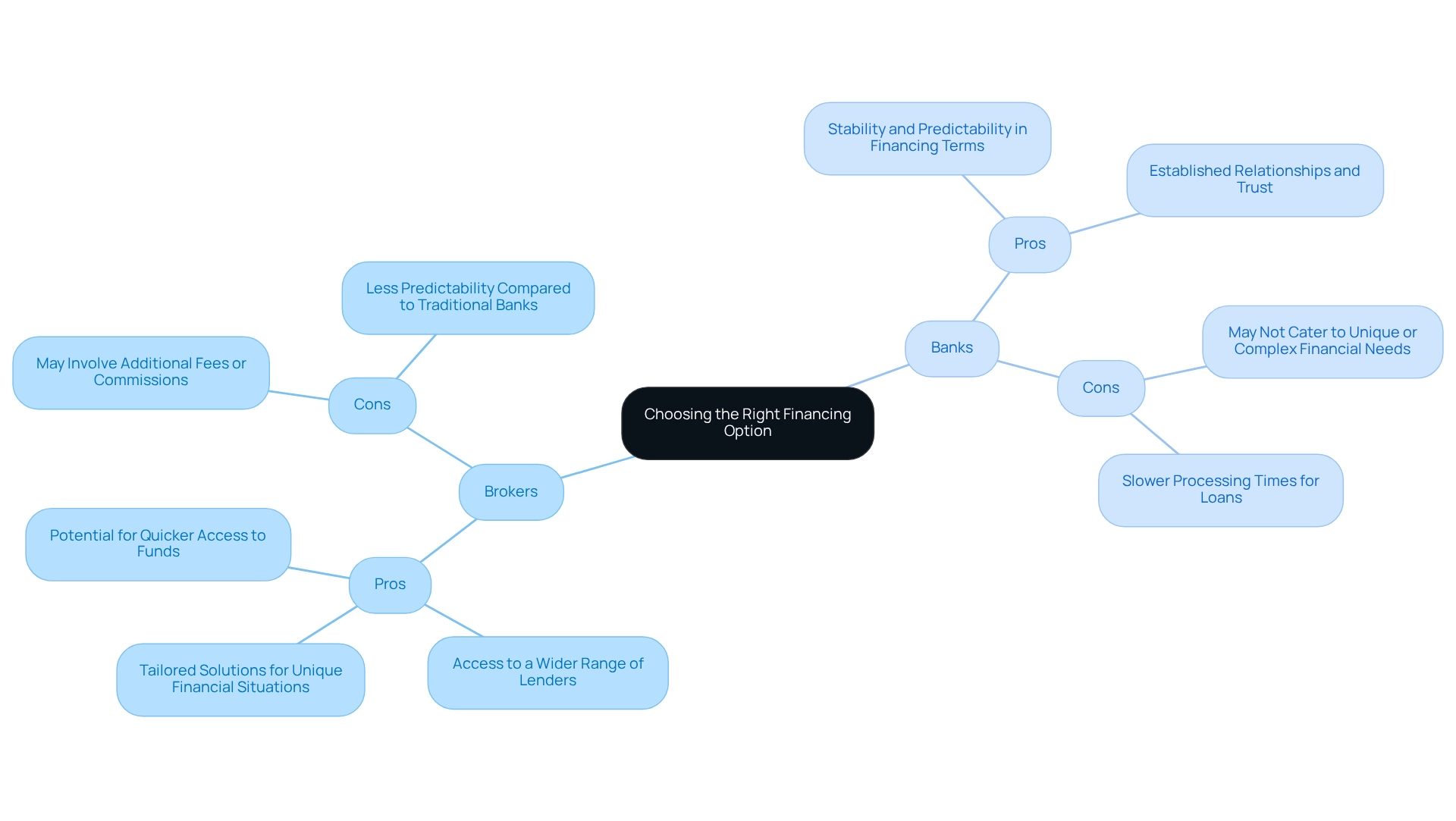

Choosing the Right Financing Option: Brokers vs. Banks for Your Business Needs

When choosing between commercial finance brokers Perth and conventional banks, companies must evaluate several essential factors, including their specific monetary needs, credit history, and the complexity of their funding requirements. Companies facing distinctive or complex financial circumstances often benefit from the customized solutions that commercial finance brokers Perth, like Finance Story, provide, leading to faster access to funds. Our expertise in crafting refined and highly tailored business cases ensures that you secure the appropriate funding for your commercial property investments, whether it be a warehouse, retail space, factory, or hospitality venture. Furthermore, we offer a comprehensive array of lenders to accommodate various situations, thereby enhancing your funding options. Conversely, companies with strong credit histories and straightforward funding needs may find traditional banks to be a more stable and predictable choice.

Recent statistics indicate that approximately 60% of small and medium enterprises (SMEs) in Australia expressed a need for additional funding in late 2024. This underscores the importance of understanding available options. As SMEs continue to demonstrate resilience and optimism despite economic challenges, assessing the urgency of funding requirements and aligning them with long-term financial objectives becomes crucial.

For instance, a case study on SME resilience amid economic pressures illustrates how enterprises that opted for brokers navigated financing options more effectively than those relying solely on banks. These enterprises reported quicker financing and more adaptable conditions, which were vital for their growth and success in a competitive environment. Anna Bligh, CEO of the Australian Bankers' Association, emphasized, "These small enterprises will lead Australia through the crisis, and after it has passed, employ millions of Australians as the economy recovers."

Ultimately, business owners should carefully assess their unique circumstances to determine which funding option from commercial finance brokers Perth will best support their objectives. A systematic approach to evaluating the advantages and disadvantages of commercial finance brokers Perth in comparison to financial institutions can aid in making a well-informed decision, ensuring that the chosen monetary route aligns with their specific needs and goals.

Pros of Using Brokers:

- Tailored solutions for unique financial situations.

- Access to a wider range of lenders, including private lending panels.

- Potential for quicker access to funds.

Cons of Using Brokers:

- May involve additional fees or commissions.

- Less predictability compared to traditional banks.

Pros of Using Traditional Banks:

- Stability and predictability in financing terms.

- Established relationships and trust.

Cons of Using Traditional Banks:

- May not cater to unique or complex financial needs.

- Slower processing times for loans.

To explore tailored financial strategies, schedule your free personalized consultation with Finance Story's Head of Funding Solutions today.

Conclusion

Navigating the landscape of business financing demands a nuanced understanding of the available options, particularly the distinctions between commercial finance brokers and traditional banks.

Commercial finance brokers, such as those at Finance Story, deliver personalized solutions tailored to the unique needs of businesses. They provide access to a diverse range of lenders and facilitate quicker approvals. This flexibility is crucial for companies facing complex financial situations or seeking competitive terms that align with their growth objectives.

Conversely, traditional banks offer stability and reliability, appealing to businesses with strong credit profiles and straightforward financing needs. Their capacity to provide long-term loans and comprehensive financial products is reinforced by regulatory oversight, fostering trust among borrowers. However, as the financial landscape evolves, the role of brokers is becoming increasingly significant, especially for businesses that require customized services and swift access to funds.

Ultimately, the choice between utilizing a commercial finance broker or a traditional bank rests on the specific circumstances of each business. By understanding the advantages and limitations of both options, business owners are empowered to make informed financing decisions that align with their goals. In an ever-changing economic environment, leveraging the strengths of either brokers or banks can profoundly influence a company’s growth trajectory and overall financial health.