Overview

Selecting the right business lenders in Australia is crucial for entrepreneurs, as it significantly impacts their financial stability and growth potential. Lenders who specialize in small enterprise financing provide tailored solutions that effectively address the unique challenges businesses face. This specialization ensures more favorable terms and enhances cash flow management, ultimately supporting the growth aspirations of entrepreneurs.

Introduction

In the dynamic landscape of business financing, selecting the right lender transcends mere financial decision-making; it can serve as a pivotal factor in shaping a company's trajectory. Entrepreneurs encounter a diverse array of options, ranging from traditional banks to innovative alternative lending solutions, each presenting unique terms and conditions that can significantly influence cash flow and long-term growth.

Furthermore, with the emergence of specialized lenders like Finance Story, businesses now have access to tailored financial solutions designed to meet their specific needs.

This article delves into the critical importance of choosing the right business lender, explores various loan types available in Australia, and highlights the significant financial challenges faced by small business owners. Ultimately, it aims to guide them toward informed decisions that foster success and sustainability.

The Importance of Choosing the Right Business Lender

Selecting the appropriate business lenders in Australia is crucial for entrepreneurs seeking financing that supports their growth and sustainability. The terms, interest rates, and flexibility provided by these lenders can significantly affect not only immediate cash flow but also the long-term sustainability of an enterprise. A lender specializing in small enterprise financing, such as Finance Story, is often better equipped to understand the unique challenges faced by both startups and established companies, thus providing tailored solutions that align with their specific needs.

For instance, business lenders focusing on small business financing may offer more advantageous terms compared to conventional banks, which might lack insight into the complexities of a startup's cash flow dynamics. In 2025, the average borrowing amount for owner-occupier dwellings in Australia varies significantly by state, with New South Wales leading at $449,000, while Tasmania records the lowest at $231,000. Additionally, the average mortgage size for owner-occupier dwellings in the Australian Capital Territory is $377,000. This disparity underscores the significance of choosing a lender that can accommodate the specific financial environment of an enterprise's location.

Moreover, recent statistics indicate that loan commitments categorized as 'Other' experienced a notable 3.9% increase from the September to December quarter of 2024, with a significant rise of 25.9% compared to the same quarter in the previous year. This trend emphasizes the necessity for small enterprise owners to explore various business lenders in Australia to secure the best possible terms.

Understanding the background, reputation, and specific products of these lenders is crucial for making informed decisions. Expert opinions suggest that 40% of consumers choose brokers for their knowledge and experience, reinforcing the value of working with professionals who can navigate the complexities of the lending landscape. By utilizing innovative lending solutions, such as those offered by Finance Narrative, companies can access a diverse portfolio of private lenders and mainstream funding institutions, ensuring they find the most suitable financing options for their unique circumstances.

Finance specializes in crafting refined and highly tailored cases to present to banks, improving the chances of obtaining the appropriate funding for commercial property investments and refinances. Furthermore, Finance's dedication to nurturing lasting connections with clients guarantees that organizations receive ongoing assistance during their financial journey. As one satisfied client, Natasha B. from VIC, stated, "I will definitely be recommending your services to anyone." This testimonial reflects the trust and satisfaction that Finance Story builds with its clients.

Ultimately, the right business lenders in Australia can be a pivotal factor in a company's success, influencing everything from cash flow management to growth potential. Successful funding narratives often arise from collaborations with lenders who grasp the subtleties of small enterprise operations and are dedicated to aiding their clients' monetary journeys, including refinancing alternatives that adapt to changing organizational needs.

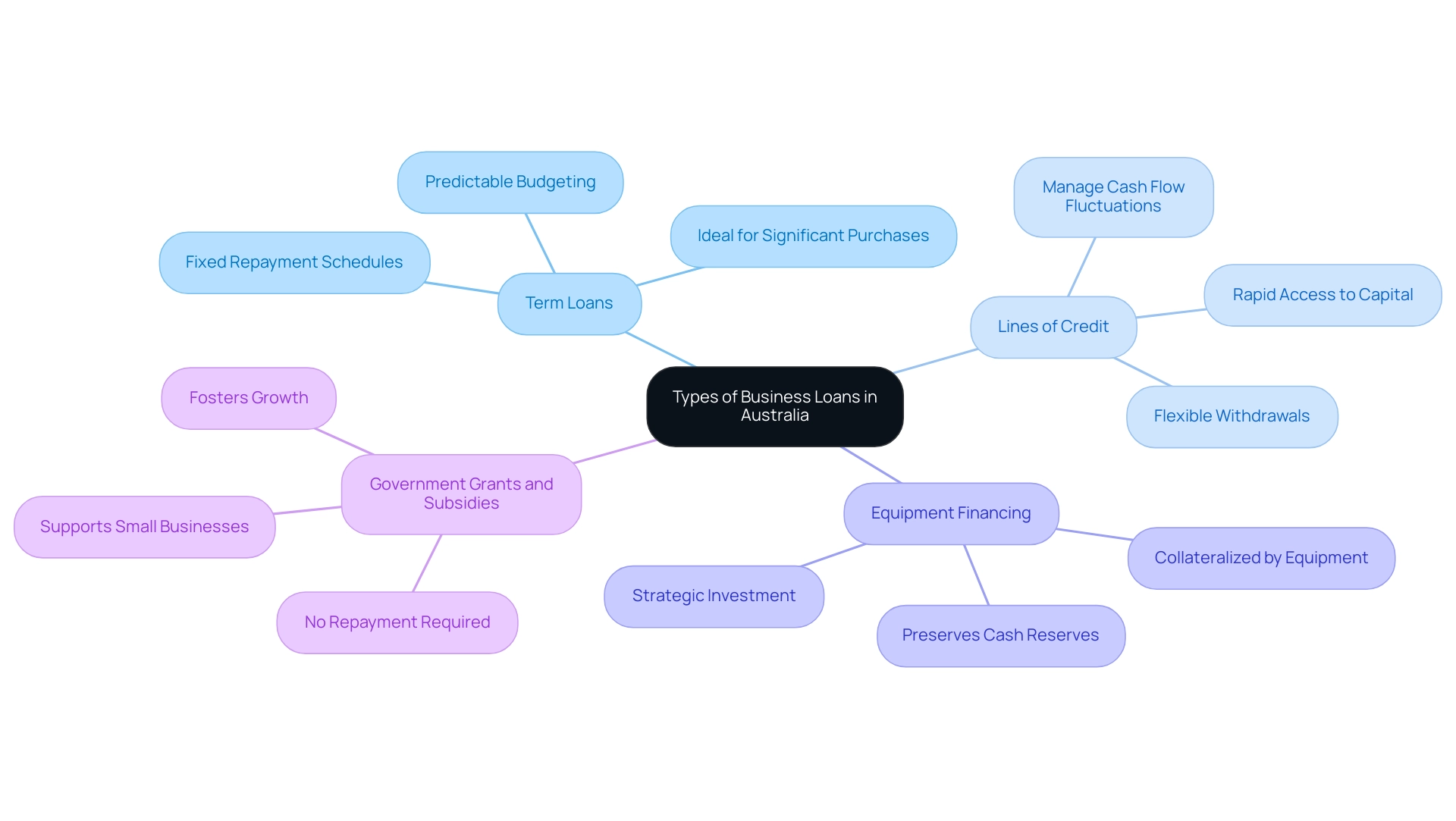

Exploring Different Types of Business Loans in Australia

In Australia, entrepreneurs can access a diverse range of financing options through business lenders designed to meet specific financial needs. The primary types of business loans include:

- Term Loans: These traditional loans feature fixed repayment schedules, making them ideal for businesses aiming to finance significant purchases or expansions. They provide a structured approach to borrowing, allowing for predictable budgeting.

- Lines of Credit: Offering unparalleled flexibility, lines of credit enable businesses to withdraw funds as needed, making them particularly useful for managing cash flow fluctuations. This option allows rapid access to capital without the need for a formal application each time funds are required.

- Equipment Financing: Specifically designed for the acquisition of equipment, this type of loan often uses the purchased equipment as collateral. This can be a strategic choice for organizations looking to invest in essential tools without depleting their cash reserves.

- Government Grants and Subsidies: Various programs are available to support small businesses, providing funds that do not require repayment. These grants can significantly alleviate financial burdens and foster growth.

Statistics indicate that the value of new financial commitments for property purchases reached $20.53 billion in December 2024, reflecting a robust demand for financing solutions. Furthermore, with 78% of founders planning to expand their businesses globally within the next year, understanding these financing options becomes crucial for tapping into international markets.

Expert opinions emphasize the importance of choosing the appropriate financing facility. As one expert noted, "The right loan facility can be a very powerful tool to accelerate growth, so be sure to have your plans clearly mapped out, including expected ROI." This underscores the necessity for owners to align their financing choices with their operational needs and growth strategies, especially when selecting business lenders in Australia.

Finance distinguishes itself from competitors through its commitment to innovation and adaptability in the lending process. By developing refined and highly personalized cases, Finance ensures that clients can effectively present their proposals to banks and secure the appropriate loans. With access to a diverse portfolio of private lenders and mainstream funding organizations, Finance can present clients with a variety of options tailored to their unique circumstances, including financing for warehouses, retail premises, factories, and hospitality ventures.

Additionally, Finance provides refinancing services to assist companies in addressing the changing requirements of their operations. This innovative approach improves the brokerage's service offerings and reputation for professionalism, ensuring that clients can navigate the complexities of the economic landscape effectively.

By comprehensively understanding these financing types and leveraging the expertise of business lenders like Finance, business owners can make informed decisions that support their financial objectives and enhance their potential for success. Furthermore, it is important to consider the current lending environment, as new credit commitments can exhibit volatile month-to-month movements due to the influence of small numbers of high-value credits. This context further emphasizes the importance of choosing the right loan facility.

Understanding the Financial Needs of Small Business Owners

Small enterprise owners in Australia encounter numerous economic challenges that significantly impact their operations and growth potential. Key issues include managing cash flow, addressing unexpected expenses, and securing capital for expansion through business lenders Australia. A crucial aspect of these challenges is the seasonal variations in revenue that many companies face, necessitating access to flexible financing options that can adapt to fluctuating cash flow situations.

The importance of effective cash flow management cannot be overstated; it is essential for maintaining operational stability and ensuring that organizations meet their financial obligations. Statistics reveal that a considerable number of small enterprises grapple with cash flow issues, with many indicating a need for working capital to cover operational costs while awaiting customer payments. This predicament can strain resources, making it imperative for entrepreneurs to pursue tailored financial solutions from business lenders Australia that cater to their specific circumstances.

Expert opinions emphasize that understanding these financial needs is vital for both business lenders Australia and consultants. Shane, the Founder and Funding Specialist Director at Finance Story, highlights the value of leveraging his extensive experience in growth and customized financial solutions to assist small enterprise owners. His insights into the particular challenges faced by small enterprises enable business lenders Australia to craft personalized financing options that not only address immediate cash flow concerns but also foster the long-term sustainability of the venture.

For instance, innovative lending solutions can provide essential support during challenging periods, allowing companies to navigate financial obstacles more effectively.

Moreover, case studies illustrate that enterprises across various regions in Australia encounter differing levels of economic challenges. For example, while the Australian Capital Territory has shown a growth rate of 3.5%, other regions like Victoria have seen declines in enterprise numbers, underscoring the necessity for region-specific economic strategies. As of mid-2024, nearly 2.7 million actively trading enterprises existed in Australia, reflecting a 2.8% increase in the number of firms, which highlights the growing demand for effective management solutions.

Additionally, the average loan amount for other purposes is reported to be $112,047, providing further context to the financial landscape that small enterprises navigate.

In summary, addressing the financial challenges faced by small enterprise owners in Australia necessitates a nuanced understanding of their needs and the provision of tailored financial solutions from business lenders Australia that enhance cash flow management and support sustainable growth. With the expertise of professionals like Shane at Finance Story, small enterprise owners can access the guidance and resources required to secure the appropriate financing options for their unique situations. Testimonials from satisfied clients further illustrate the effectiveness of Finance's services, showcasing how customized solutions have positively impacted their enterprises.

Furthermore, Finance Story offers a comprehensive range of lenders, ensuring that small enterprise owners have access to the most suitable financing options available, including refinancing opportunities that can alleviate financial pressures.

Alternative Lending Solutions: Expanding Your Financing Options

Alternative lending solutions provided by business lenders in Australia have increasingly become a vital resource for enterprises, offering diverse options that extend beyond traditional banking avenues. Key alternatives include:

- Peer-to-Peer Lending: This innovative approach connects borrowers directly with investors, often resulting in lower interest rates and more flexible repayment terms. The growth of peer-to-peer lending in Australia has been notable, with significant increases in both participation and funding volumes. This reflects a shift towards more accessible financing options for small enterprises.

- Invoice Financing: This solution enables companies to leverage their outstanding invoices as collateral for immediate cash flow relief. By borrowing against invoices, companies can address short-term financial needs without waiting for customer payments, thus maintaining operational stability.

- Crowdfunding: Crowdfunding platforms allow enterprises to raise capital from a large pool of individuals, often in exchange for equity or rewards. As of early 2025, the volume raised through reward-based crowdfunding worldwide reached an impressive $1.03 billion, showcasing its effectiveness as a funding mechanism for startups and small enterprises.

These alternative financing options provided by business lenders in Australia are particularly advantageous for startups or enterprises with less established credit histories. They offer opportunities to secure funding tailored to specific needs. The flexibility and accessibility of these solutions empower entrepreneurs to pursue their business goals with greater confidence and support.

In the context of the broader lending landscape, the average new owner occupier lending amount, including refinancing, stands at $665,978 as of February 2025. The national average amount for owner occupier dwellings is $384,000, with the highest in NSW at $449,000. This illustrates the varying loan sizes across Australia and the importance of tailored financing solutions.

Peter Marshall, a Financial Services Specialist with over 20 years of experience in the Australian banking and finance industry, emphasizes the need for innovative lending solutions offered by business lenders in Australia in today's market. He states, "Understanding the unique needs of each client is crucial in providing effective financial solutions."

Finance Story exemplifies this commitment to innovation and adaptability in the lending process. Specializing in creating polished and highly individualized cases for various commercial properties, including warehouses, retail premises, factories, and hospitality ventures, they present clients with tailored options that enhance their service offerings. This is especially crucial in navigating difficult monetary situations and offering specialized knowledge for expatriate funding.

With access to a varied range of private lenders and mainstream funding organizations, Finance Story guarantees that clients can obtain the appropriate capital for their commercial property investments and refinances.

The Value of Tailored Financial Solutions in Business Lending

Tailored financial solutions offered by business lenders in Australia play a crucial role in lending, as they cater to the distinct needs and circumstances of each borrower. For instance, a company aiming for expansion may require a different financial structure compared to one focused on managing cash flow. Lenders that prioritize personalized services, such as Finance Story, can thoroughly evaluate a company's unique situation, recommending products that align with their specific goals.

This tailored approach not only increases the chances of loan approval from business lenders in Australia but also fosters a stronger connection between the lender and the borrower, ultimately resulting in better economic outcomes.

Statistics reveal that enterprises utilizing tailored financial solutions experience significantly higher approval rates. In fact, personalized lending services offered by business lenders in Australia can enhance the likelihood of obtaining funding by addressing the specific needs of each enterprise. Companies such as Finance Story illustrate this dedication to customized lending solutions, ensuring clients secure the most appropriate funding alternatives from business lenders in Australia for their distinct circumstances, whether they are acquiring a commercial property or refinancing a current obligation.

Moreover, case studies illustrate the tangible benefits of personalized lending. For example, small enterprises that engaged with tailored financial services reported enhanced cash flow management and successful expansion efforts, demonstrating the value of customized solutions in achieving organizational objectives. Significantly, Goldman Sachs suggests that 70% of small enterprise loans are given by banks with under $250 billion in assets, emphasizing the competitive landscape of lending.

Despite the emergence of new lenders and products, obtaining finance through traditional lenders remains challenging for small enterprises. This context underscores the relevance of tailored solutions in navigating these hurdles. As the environment of lending evolves, the significance of customized monetary solutions from business lenders in Australia remains vital, particularly in 2025, where adaptability and comprehension of client needs are essential for success in obtaining funding.

Additionally, consumer preferences indicate that a significant portion of financial services consumers prefer to make purchases by calling a live agent, with 66% of banking consumers opting for phone calls when finalizing purchases. This trend emphasizes the importance of timely communication in the lending process, especially during peak times like 12 p.m., to maximize revenue and ensure a frictionless experience for clients.

Testimonials from pleased clients further emphasize Finance's commitment to personalized service: 'I will certainly be recommending your company to anyone. We are finished with the constant worry. Once again, thank you so much for being a part of our journey,' says Natasha B, VIC.

With access to a comprehensive panel of lenders, including mainstream banks and private investors, Finance Story is well-equipped to meet diverse financing needs, whether for a warehouse, retail premise, factory, or hospitality venture.

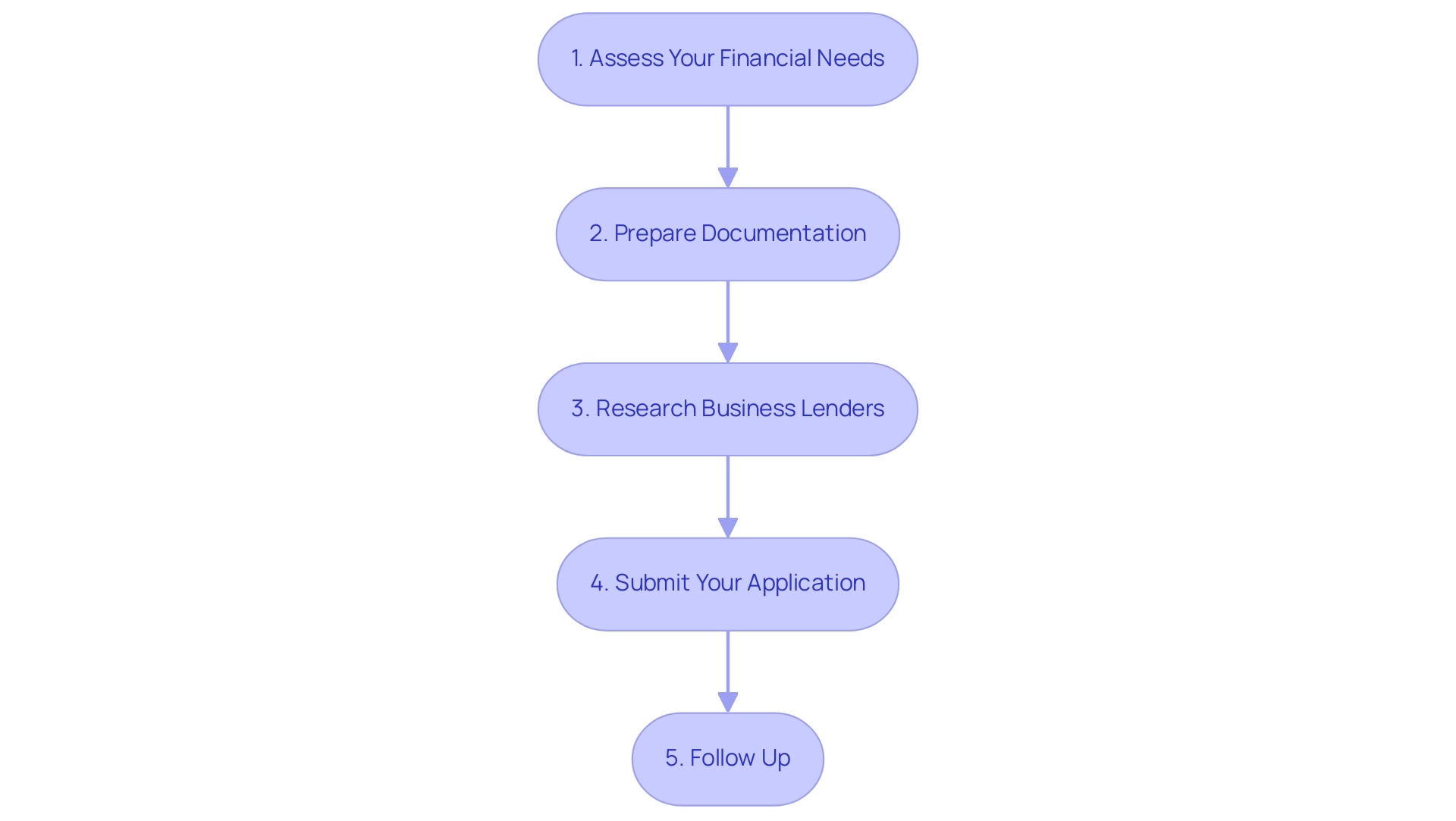

Navigating the Business Loan Application Process

Navigating the financial application process can be a complex endeavor; however, understanding the essential steps can significantly ease the experience. Here’s a comprehensive guide to help you through the process:

- Assess Your Financial Needs: Begin by determining the exact amount of funding required and the specific purpose for which it will be used. This clarity will guide your application and help lenders understand your needs. In 2025, the average loan amounts for owner-occupier homes in Australia reached $811,000, indicating the rising need for assistance among small enterprises.

- Prepare Documentation: Compile all necessary documents, including financial statements, tax returns, and a well-structured project plan. Having these documents ready will streamline the application process and demonstrate your preparedness to lenders.

- Research Business Lenders in Australia: Investigate potential lenders that align with your organizational requirements. Compare their offerings, interest rates, and terms to find the best fit for your situation. This step is crucial, as selecting the right business lenders in Australia can make a significant difference in your financing experience. Finance specializes in providing access to a diverse portfolio of business lenders in Australia, including high street banks and innovative private lending panels, ensuring tailored options for your unique circumstances, whether you are looking to finance a warehouse, retail premise, factory, or hospitality venture.

- Submit Your Application: Fill out the application form accurately, ensuring that all requested information is provided. Incomplete applications can lead to delays or rejections, so attention to detail is vital. Finance Story's expertise in creating polished and individualized cases can enhance your application, increasing your chances of approval. Our team understands the heightened expectations around securing funds and is equipped to meet them.

- Follow Up: Maintain communication with the lender throughout the process. Being proactive in addressing any questions or additional requirements can help expedite your application and demonstrate your commitment.

By following these steps, owners can greatly enhance their prospects of a successful financing application, obtaining the required funds for growth. Furthermore, the total value of new loan commitments for personal fixed-term loans peaked at $8.43 billion in June 2024, underscoring the robust lending landscape. As Anna Bligh, CEO of the ABA, stated, "These small enterprises will drive Australia through the crisis, and after it has passed, employ millions of Australians as the economy rebuilds."

To further enhance your financing journey, consider scheduling a free personalized consultation with Finance's Head of Funding Solutions, Shane Duffy. Discuss your needs and goals, and let Finance collaborate with you to create customized financial strategies that align with your objectives. This innovative approach not only strengthens your application but also positions Finance Story as a trusted partner for small businesses navigating the complexities of securing financing.

Conclusion

Choosing the right business lender is essential for entrepreneurs seeking immediate cash flow and sustainable growth. The diverse lending landscape in Australia, which includes traditional banks and innovative lenders like Finance Story, presents various options that can significantly influence a business's financial health. Understanding loan types—such as term loans and lines of credit—empowers business owners to make informed decisions aligned with their objectives.

Small businesses frequently encounter financial challenges, including cash flow management and unexpected expenses. Tailored financial solutions from specialized lenders effectively address these needs. Finance Story distinguishes itself by offering personalized services that enhance the likelihood of loan approval and cultivate strong relationships between lenders and borrowers.

As alternative financing options like peer-to-peer lending and crowdfunding gain traction, they provide accessible funding avenues for small enterprises. By focusing on customized financial solutions and collaborating with knowledgeable brokers, business owners can significantly improve their chances of success and secure suitable financing.

In conclusion, the journey to securing business financing involves forging partnerships with lenders who comprehend the unique challenges faced by small businesses. By making informed choices and pursuing tailored lending options, entrepreneurs can strategically position their businesses for sustainable growth and success within a competitive marketplace.