Overview

You can loan your Self-Managed Super Fund (SMSF) money, provided you adhere to specific legal requirements and create a compliant loan agreement that aligns with your fund's investment strategy. This article outlines essential steps to navigate this process effectively.

First, it is crucial to understand the different types of loans available. Furthermore, ensuring compliance with the Superannuation Industry (Supervision) Act is vital. In addition, maintaining thorough documentation will help mitigate risks and enhance the effectiveness of your SMSF investments. By following these guidelines, you can make informed decisions that benefit your financial future.

Introduction

Navigating the intricate landscape of Self-Managed Super Funds (SMSFs) presents both rewarding opportunities and formidable challenges, particularly in securing loans for investment purposes. SMSF loans uniquely enable individuals to leverage their superannuation, diversifying investment portfolios through property or other assets.

However, grasping the complexities of SMSF lending—including the various types of loans available, legal requirements, and best management practices—is essential for maximizing benefits while minimizing risks.

This article explores the critical components of SMSF loans, guiding readers through the fundamental aspects of borrowing, compliance, and effective management, empowering them to make informed financial decisions.

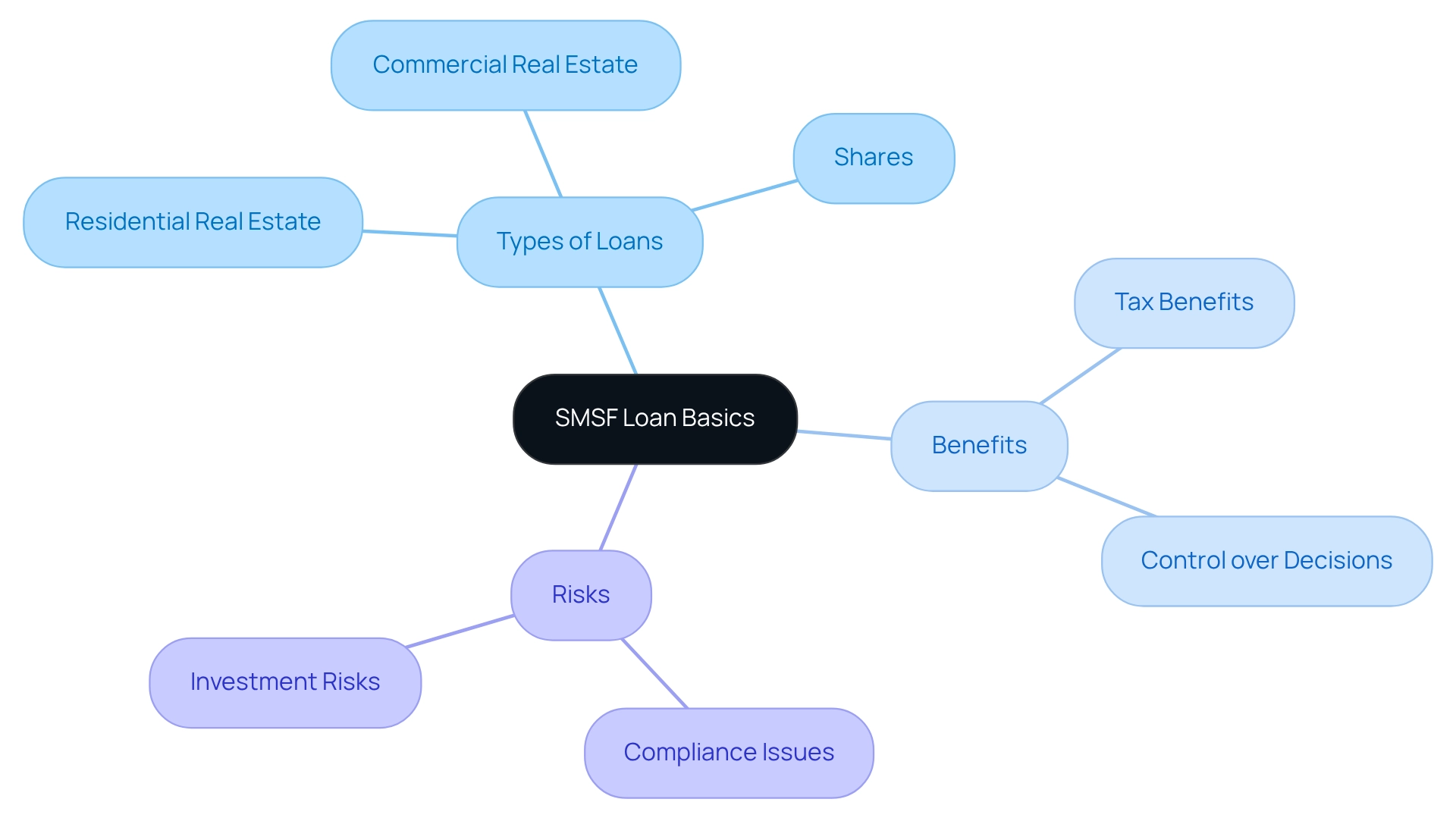

Understand SMSF Loan Basics

A Self-Managed Super Fund borrowing arrangement stands as a tailored financing solution, empowering a Self-Managed Super Fund to secure capital for investing in real estate or other valuable resources. This option is particularly appealing for individuals aiming to broaden their asset portfolios while utilizing their superannuation. Consider the following crucial elements:

- Types of Self-Managed Super Fund Loans: These loans encompass a variety of options, including residential real estate loans, commercial real estate loans, and financing for acquiring shares. This diversity provides a broad spectrum of funding opportunities.

- Benefits: Self-Managed Super Fund loans offer significant advantages, such as potential tax benefits and enhanced control over financial decisions. Typically, a self-managed super fund boasts assets exceeding $1.3 million, underscoring the substantial financial capacity available for investment.

- Risks: However, it is vital to recognize the associated risks, including compliance issues and the possibility of financial loss if investments underperform. A notable case study illustrates this: a self-managed super fund with two members successfully acquired a residential asset, effectively utilizing their investment. The property's value appreciated significantly, and they strategically managed the sale to optimize after-tax returns as they transitioned into retirement.

By grasping these essential concepts, you will be better equipped to navigate the self-managed super fund lending landscape and make informed choices regarding your financial future.

Identify Legal Requirements for SMSF Lending

Before proceeding with self-managed super fund (SMSF) financing, it is crucial to grasp the legal obligations involved. Key legal considerations include:

- SIS Act Compliance: Ensure strict adherence to the Superannuation Industry (Supervision) Act 1993, which governs SMSFs. Compliance with this act is vital for the legitimacy of the financing.

- Funding Approach: The SMSF must establish a comprehensive funding strategy that encompasses the proposed financing, clearly demonstrating how it aligns with the fund's objectives. This strategy is essential for both compliance and effective fund management.

- Lending Restrictions: Familiarize yourself with the restrictions on lending to related parties. It is imperative that credit conditions are defined on commercial terms to avert conflicts of interest and ensure compliance.

- Documentation: Maintain meticulous records to validate adherence to all legal obligations. This includes borrowing contracts, financial strategies, and any other relevant documents.

Utilizing SMSFs for commercial real estate ventures can be a strategic decision, as there are fewer constraints compared to residential real estate. Finance Story is poised to provide expert guidance on managing self-managed super fund commercial real estate ventures, offering tailored lending options that meet your specific needs.

Recent trends in SMSF loans have introduced innovative features such as offset accounts, which allow borrowers to reduce interest expenses while maintaining liquidity for future opportunities. This advancement enhances financial flexibility and aligns with the SMSF's investment strategy, particularly concerning commercial property investments.

Moreover, SMSFs benefit from lower capital gains tax rates on assets held for over 12 months, making them an attractive option for long-term investments. Nevertheless, due diligence is essential; having a single individual oversee the process can mitigate costly errors and ensure compliance with the SIS Act. By adhering to these legal requirements, you can protect your self-managed super fund and facilitate a seamless lending process. Additionally, it is crucial to recognize that if the borrowing extends to its full term and is settled, the transfer of legal ownership from the bare trustee to the SMSF trustee may occur decades later, underscoring the long-term nature of SMSF borrowings.

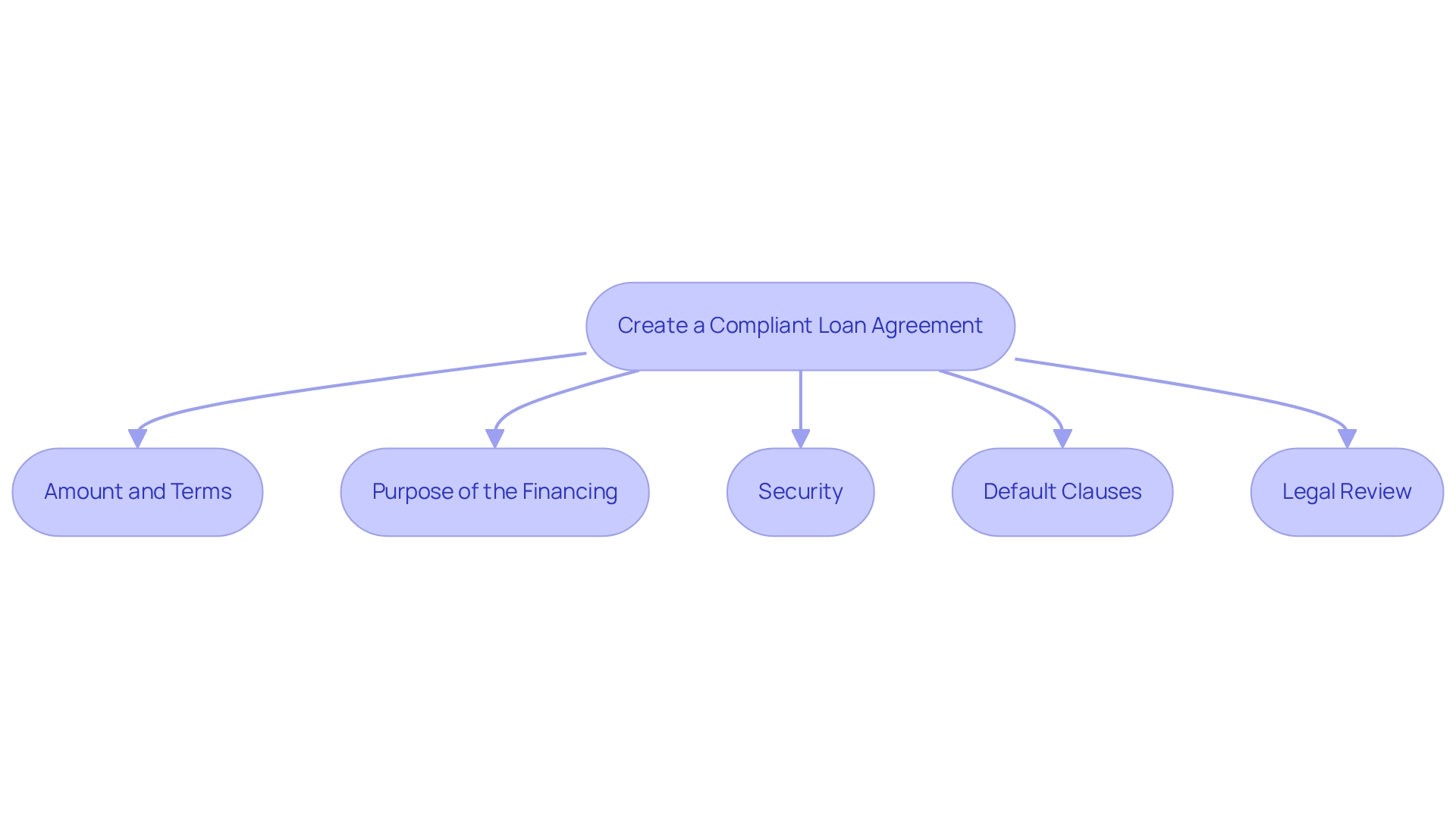

Create a Compliant Loan Agreement

Drafting a compliant financing agreement for a Self-Managed Superannuation Fund involves several essential elements that you must consider:

- Amount and Terms: Clearly specify the sum being borrowed, the interest rate, and the repayment schedule. In 2025, self-managed super fund borrowing interest rates generally vary from 6.5% to 8%, indicating the additional cost borrowers incur compared to standard home financing.

- Purpose of the Financing: Clearly outline the aim of the financing and how it aligns with the self-managed super fund's strategy, ensuring it supports the fund's long-term objectives.

- Security: Specify any collateral offered for the financing, such as real estate or other assets, which is essential for safeguarding the interests of the self-managed super fund.

- Default Clauses: Include provisions that describe the steps to be taken in case of a default, providing clarity on the repercussions and processes.

- Legal Review: It is recommended to have the agreement examined by a legal expert to ensure adherence to relevant laws and regulations. This step is crucial due to the complexities related to self-managed super funds and possible alterations in tax laws, such as the forthcoming 15% tax on super balances surpassing $3 million beginning in 2025-26.

By following these guidelines and utilizing the expertise of Finance Story, which assists in building a strong case and ensuring adherence to regulations, you can identify the appropriate lender for your commercial property. To stay informed about self-managed superannuation fund developments, consider checking the self-managed superannuation fund newsroom and signing up for the monthly self-managed superannuation fund newsletter.

By adhering to these recommendations, you can establish a robust borrowing agreement that not only safeguards your interests but also meets legal obligations, ultimately aiding in the efficient management of your self-managed superannuation fund.

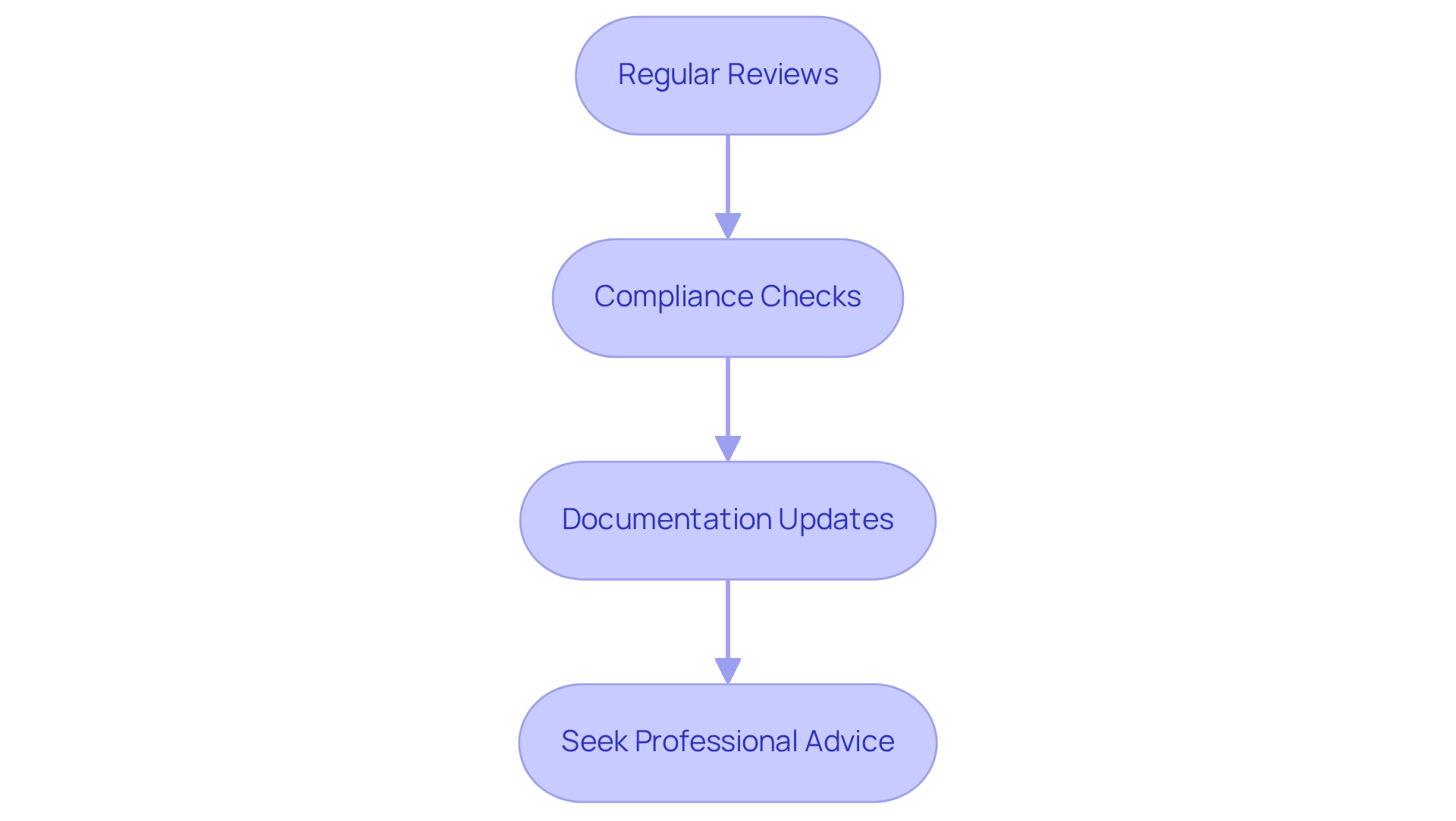

Manage and Monitor the SMSF Loan

Efficient administration and oversight of self-managed superannuation fund borrowing are crucial for answering the question, can I loan my SMSF money, to enhance their worth within your financial strategy. Consider these essential best practices:

- Regular Reviews: Schedule consistent assessments of both financial performance and the underlying assets. This guarantees that they correspond with your financial expectations and goals.

- Compliance Checks: Perform regular evaluations to verify that the funding complies with the Superannuation Industry (Supervision) Act (SIS) regulations and aligns with your fund's strategy. The Australian Taxation Office (ATO) has intensified its data collection efforts to identify non-compliance, making these checks increasingly important. Significantly, there are fewer limitations on commercial real estate investments compared to residential assets, offering greater flexibility in your investment approach.

- Documentation Updates: Keep up-to-date records, reflecting any changes to financing terms or investment strategies. This practice not only aids in compliance but also supports informed decision-making.

- Seek Professional Advice: Engage with a financial advisor or accountant who specializes in SMSFs. Their knowledge can greatly simplify the intricacies of self-managed super fund financing and real estate acquisition, ensuring you make informed choices. Finance Story provides expert advice to assist you in managing the complexities of self-managed superannuation fund commercial real estate investments.

Ongoing oversight of superannuation fund financing performance is essential, as it enables prompt modifications and strategic planning. Investing in self-managed superannuation fund properties is generally a medium to long-term approach, and comprehending the related expenses of purchasing and selling is crucial. By implementing these best practices, you may wonder, can I loan my SMSF money to enhance the effectiveness of your overall financial success. BOOK A CHAT.

Conclusion

Navigating the complexities of Self-Managed Super Funds (SMSFs) and their associated loans presents both opportunities and challenges. Understanding the fundamentals of SMSF loans—encompassing the various types available, the benefits they offer, and the inherent risks—is essential for any investor aiming to leverage their superannuation for property or other asset investments. Legal compliance, particularly with the Superannuation Industry (Supervision) Act, stands as a critical element that must not be overlooked.

Equally important is the creation of a compliant loan agreement, which lays the groundwork for successful borrowing and investment. Clarity in terms, purposes, and security provisions within the agreement safeguards the interests of the SMSF. Furthermore, the regular management and monitoring of the SMSF loan, coupled with ongoing compliance checks, are vital practices that ensure alignment with investment strategies and regulatory requirements.

Ultimately, a well-informed approach to SMSF loans can unlock significant financial benefits while mitigating risks. By staying updated on legal requirements and best practices, investors can navigate the SMSF landscape effectively, making informed decisions that bolster their long-term financial goals. Embracing this knowledge empowers individuals to take control of their superannuation and invest wisely for a secure financial future.