Overview

Financing a commercial property requires a comprehensive understanding of various options available in the market. These include:

- Traditional bank loans

- Non-bank lenders

- SBA loans

- Mezzanine funding

- Bridge loans

- Crowdfunding

Each option comes with its own set of benefits and challenges. As small business owners, it is crucial to navigate these complexities effectively. Have you considered how your financial profile aligns with these diverse financing avenues? Presenting a strong financial profile and tailored proposals is essential to secure funding, especially in a landscape where lending criteria are tightening and down payment requirements are on the rise. Understanding these elements can empower you to make informed decisions and enhance your chances of success.

Introduction

Navigating the complex world of commercial property financing poses a significant challenge for business owners, particularly as the landscape evolves. With a range of funding options available—from traditional bank loans to innovative crowdfunding—grasping the nuances of each can greatly influence an enterprise's growth potential.

However, with lending criteria tightening and market volatility on the rise, how can small business owners secure optimal financing solutions tailored to their unique needs?

This article explores diverse financing avenues, weighing their pros and cons while addressing the obstacles small enterprises face in today's competitive environment.

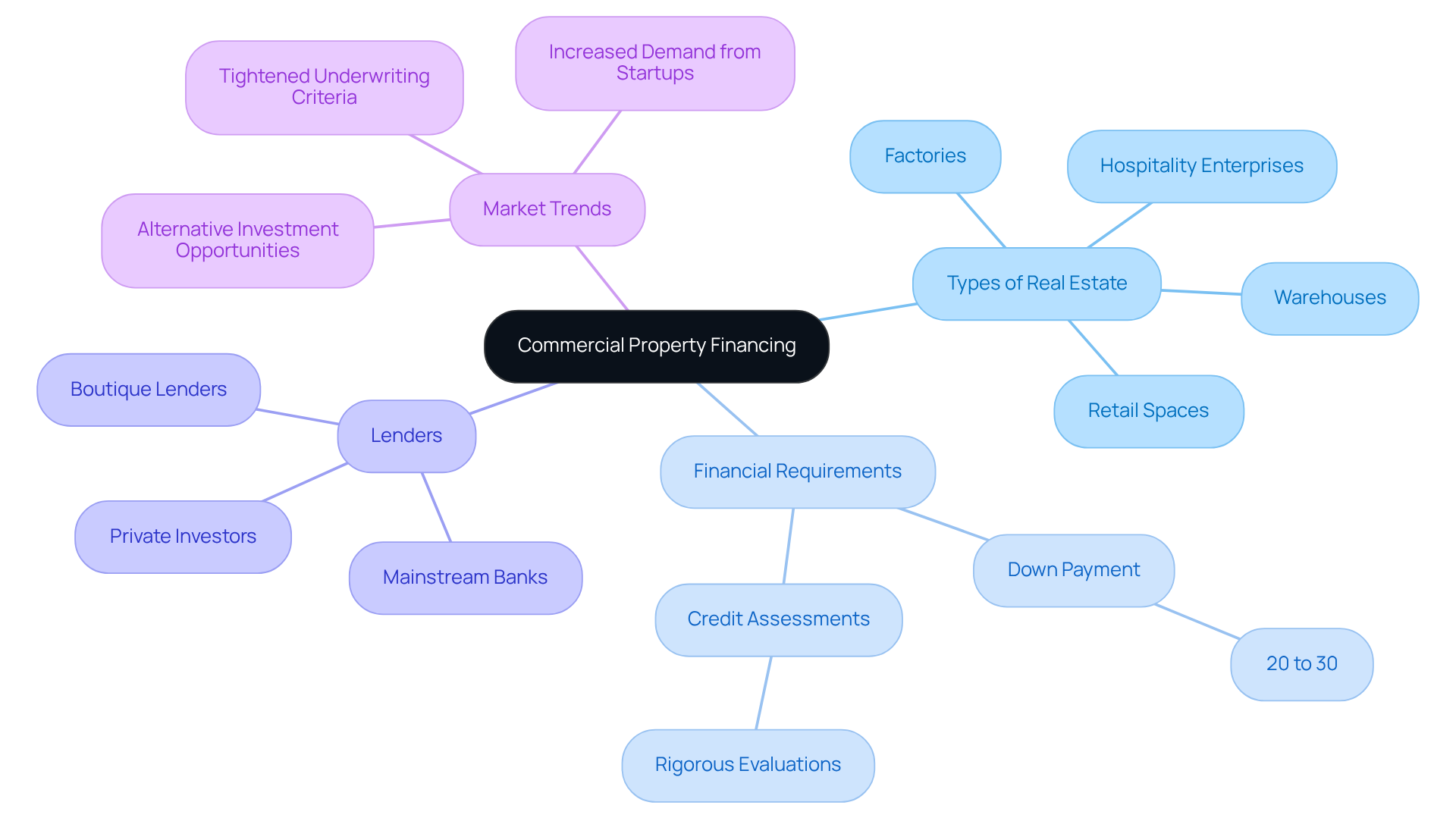

Understanding Commercial Property Financing

The best way to finance a commercial property is through the process of acquiring capital for the purchase, development, or refinancing of assets intended for commercial use, such as warehouses, retail spaces, factories, and hospitality enterprises. Unlike residential loans, which tend to be more straightforward, commercial funding encompasses various elements, including:

- Real estate type

- Intended use

- Financial stability of the enterprise

Typically, this type of financing necessitates a larger down payment, generally between 20% and 30%, reflecting the increased risk associated with commercial investments. Additionally, lenders often impose more rigorous credit assessments to evaluate the borrower's financial health.

For small business owners, understanding these components is essential for effectively navigating the best way to finance a commercial property in the real estate market. Recent trends indicate that banks have tightened their underwriting criteria, with the maximum Loan-to-Value Ratio (LVR) for residential development now averaging around 65%. This shift underscores the importance of presenting a strong financial profile as the best way to finance a commercial property when pursuing commercial funding.

Furthermore, the landscape of commercial real estate funding is evolving, and identifying the best way to finance a commercial property is essential to meet the increasing demand from various sectors, including startups and self-employed individuals. Creative lenders are now offering choices for off-the-plan acquisitions and self-managed super fund (SMSF) loans, enhancing accessibility for small enterprise owners.

Successful instances of commercial real estate funding for startups often highlight the importance of customized solutions that align with specific organizational needs. By leveraging a diverse array of lenders, such as:

- Boutique lenders

- Private investors

- Mainstream banks

Enterprises can secure funding that not only addresses their immediate needs but also supports long-term growth objectives. As the market continues to evolve, staying informed about the latest funding options and requirements will empower small business owners to make strategic decisions in their real estate investments.

Types of Financing Options for Commercial Properties

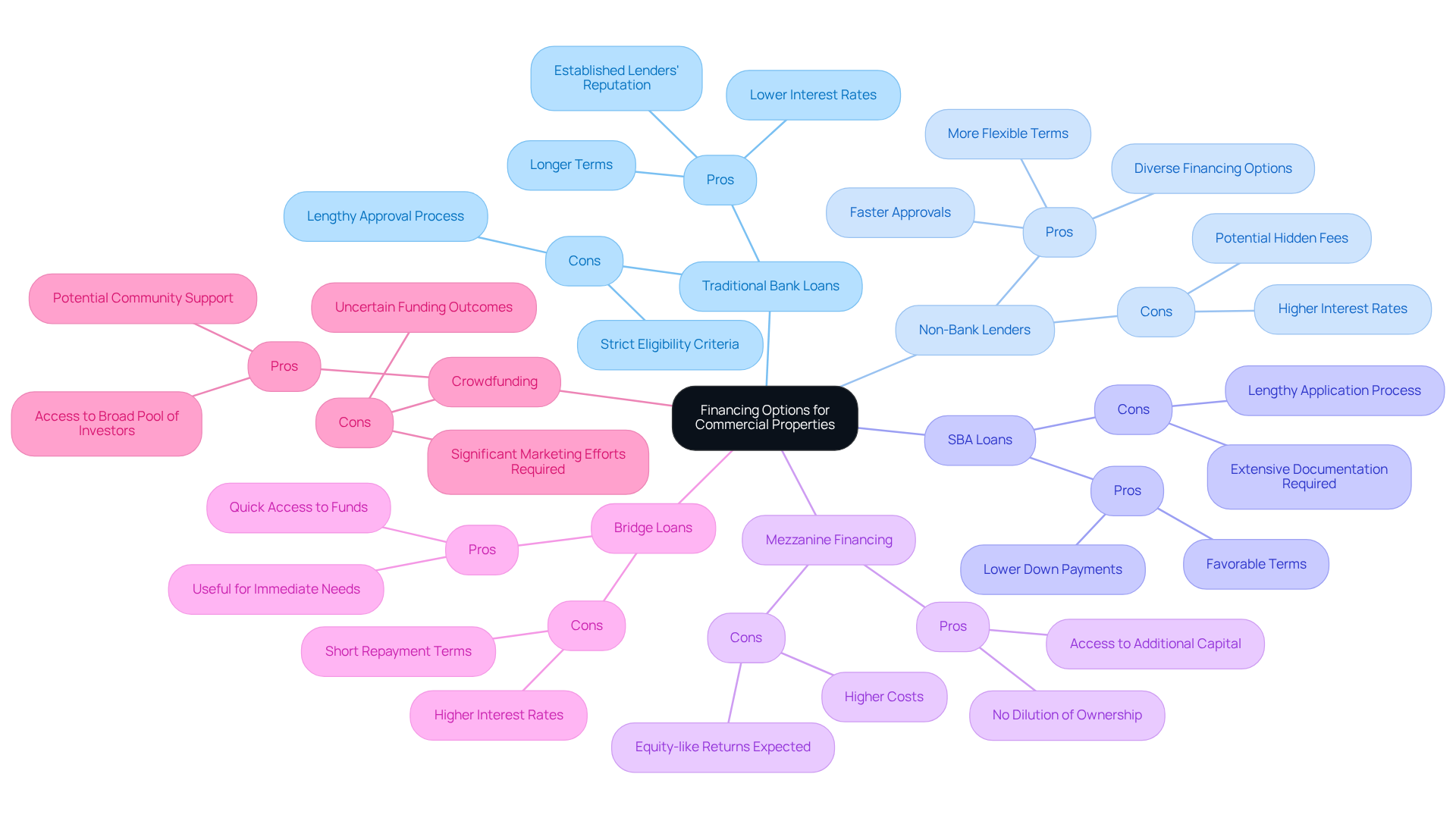

For any business owner, exploring the best way to finance a commercial property is crucial. Here are several avenues to consider:

- Traditional Bank Loans: These loans typically offer competitive interest rates and longer repayment terms, but they may require extensive documentation and a strong credit history. Finance Story specializes in crafting refined and highly personalized proposals to present to banks, ensuring you meet their elevated expectations.

- Non-Bank Lenders: Alternative lenders can provide more adaptable terms and faster approvals, making them suitable for enterprises with distinct funding requirements. With access to a full suite of lenders, including innovative private lending panels, Finance Story can help you navigate these options effectively.

- SBA Loans: The Small Business Administration offers loan programs that assist small enterprises in obtaining capital with reduced down payments and advantageous conditions. This can be vital for those aiming to invest in commercial properties such as warehouses or retail establishments.

- Mezzanine Funding: This blend of debt and equity support enables companies to secure additional capital without relinquishing ownership. It is frequently utilized for larger projects, such as factories or hospitality enterprises. Understanding the structure of such loans is essential for maximizing your investment potential.

- Bridge Loans: These short-term loans provide immediate funding while waiting for more permanent financing solutions. They can be especially beneficial for companies seeking to refinance their commercial loans to accommodate changing requirements.

- Crowdfunding: An emerging option where multiple investors contribute to fund a project, this approach is suitable for innovative or community-focused ventures. It can be an excellent means to utilize asset equity and cash savings for company acquisitions.

Understanding the requirements, benefits, and drawbacks of each financing option is essential to determine the best way to finance a commercial property. Therefore, it is crucial for business owners to evaluate which aligns best with their financial strategy. By collaborating with Finance Story, you can ensure that your loan proposal is tailored to meet the specific criteria of lenders, significantly enhancing your chances of securing the necessary funding.

Evaluating Pros and Cons of Each Financing Option

When considering the best way to finance a commercial property, it is crucial to evaluate the pros and cons.

Traditional Bank Loans offer several advantages: lower interest rates, longer terms, and the reputation of established lenders. However, they also come with drawbacks, such as a lengthy approval process and strict eligibility criteria.

Non-Bank Lenders present an alternative, providing faster approvals and more flexible terms. They grant access to a diverse range of financing options through specialists like Finance Story. On the downside, these loans often carry higher interest rates and potential hidden fees.

SBA Loans are particularly beneficial for small businesses, featuring lower down payments and favorable terms. Yet, they require a lengthy application process and extensive documentation.

Mezzanine Financing allows businesses to access additional capital without diluting ownership, making it a valuable option for those looking to expand. The trade-off is higher costs due to the equity-like returns expected by investors.

Bridge Loans provide quick access to funds, which is useful for immediate needs, especially when collaborating with a broker like Finance Story who can expedite the process. However, these loans typically come with higher interest rates and short repayment terms.

Crowdfunding opens the door to a broad pool of investors and potential community support. Nonetheless, it presents uncertain funding outcomes and may necessitate significant marketing efforts.

Understanding these elements, alongside the customized solutions offered by Finance Story—including support for various real estate types such as warehouses, retail spaces, and hospitality enterprises—can empower owners to identify the best way to finance a commercial property that suits their needs. Testimonials from satisfied clients further underscore Finance Story's effectiveness in navigating complex funding situations.

Challenges for Small Business Owners in Securing Financing

For small business owners, understanding the best way to finance a commercial property presents several challenges.

-

Creditworthiness: Building a strong credit history is essential; however, many minor enterprises face challenges in this domain. A single late payment can significantly impact their creditworthiness, making it difficult to secure loans. Finance Story focuses on developing refined and highly tailored cases to present to banks, assisting entrepreneurs in enhancing their likelihood of obtaining loans despite credit difficulties.

-

Documentation Requirements: The extensive paperwork required by lenders can be overwhelming, particularly for entrepreneurs who may not have dedicated financial personnel. Average documentation requirements for commercial real estate loans in 2025 are anticipated to remain strict, further complicating the process. Finance Story's expertise in crafting tailored loan proposals can streamline this process, ensuring that all necessary documentation is effectively presented.

-

High Down Payments: The requirement for significant down payments can discourage many minor enterprises from pursuing commercial property investments, restricting their growth potential. This financial strain is exacerbated by increasing costs, with nearly 80% of lesser enterprises mentioning this as a main issue in 2024. By collaborating with Finance Story, owners of enterprises can explore a comprehensive variety of lenders, including creative private lending alternatives that might provide the best way to finance a commercial property with more adaptable down payment conditions.

-

Market Volatility: Economic fluctuations can affect property values and lender confidence, creating an unpredictable environment that complicates financing efforts. This volatility can lead to stricter lending criteria, making it more challenging for minor enterprises to obtain advantageous conditions. Understanding these dynamics is crucial, and Finance Story provides insights into the best way to finance a commercial property while navigating these challenges effectively.

-

Limited Options: Traditional banks are increasingly reluctant to lend to minor enterprises, often necessitating higher credit scores and stronger financials. This trend encourages owners to explore alternative funding sources, which may come with less favorable terms. Finance Story provides access to a comprehensive range of lenders, including high street banks and entrepreneurial private lending groups, allowing enterprises to discover funding solutions that match their particular situations.

By recognizing and understanding these challenges, small business owners can better navigate the financing landscape and explore alternative solutions that may be more accessible and beneficial for their specific needs.

Conclusion

Navigating the complexities of commercial property financing is essential for small business owners seeking to secure the best funding options for their ventures. By understanding the various financing avenues available—such as traditional bank loans, non-bank lenders, and SBA loans—entrepreneurs can tailor their approach to meet their unique financial needs. The emphasis on building a strong credit profile and preparing thorough documentation cannot be overstated, as these factors play a crucial role in obtaining favorable financing terms.

Key insights discussed throughout the article highlight the importance of:

- Evaluating the pros and cons of each financing option

- Recognizing the challenges posed by market volatility

- Understanding high down payments

- Acknowledging stringent lender requirements

Furthermore, leveraging the expertise of specialized services like Finance Story can significantly enhance the likelihood of securing the necessary funding, allowing small businesses to thrive in a competitive landscape.

Ultimately, understanding the landscape of commercial property financing empowers business owners to make informed decisions that align with their growth objectives. As the financing environment continues to evolve, staying abreast of current trends and exploring innovative funding solutions will be vital for overcoming obstacles and achieving long-term success in commercial real estate investments.