Overview

This article identifies the best small business loan providers, outlining essential criteria to consider. It highlights the importance of evaluating factors such as interest rates, repayment terms, and customer service—elements that can significantly impact a small business's ability to secure favorable financing tailored to its operational needs. By understanding these key aspects, business owners can make informed decisions that align with their financial goals.

Introduction

In the dynamic world of entrepreneurship, securing the right financing is not just important—it's essential for success. Small business loans act as vital lifelines, empowering owners to cover startup costs, manage operational expenses, and seize growth opportunities.

As we navigate the evolving financial landscape of 2025, a variety of loan options, from traditional term loans to innovative lines of credit, present diverse pathways to capital. However, navigating this complex terrain demands a keen understanding of the available options and the criteria for selecting the most suitable loan provider.

By delving into the nuances of different loan types and evaluating key factors such as:

- Interest rates

- Repayment terms

- Customer service

small business owners can make informed decisions that align with their financial goals and operational needs.

Understanding Small Business Loans

The best small business loan providers offer minor enterprise financing options that serve as essential financial tools, empowering entrepreneurs and proprietors to secure capital for various needs, including startup costs, operational expenses, and growth initiatives. As we look ahead to 2025, the small business financing landscape is evolving, offering several key types of loans:

- Term Loans: These traditional loans involve borrowing a fixed amount, repaid over a specified period, typically at a fixed interest rate. They are ideal for enterprises seeking predictable repayment schedules.

- Lines of Credit: This flexible option allows companies to borrow up to a predetermined limit, paying interest only on the amount used. It is particularly advantageous for managing cash flow fluctuations.

- SBA Financing: Backed by the Small Business Administration, these funds often feature reduced interest rates and extended repayment terms, making them an attractive choice for small enterprises in search of economical funding.

- Equipment Financing: This loan type is designed for acquiring equipment, using the equipment as collateral, enabling companies to obtain essential tools without significant upfront costs.

- Invoice Financing: This option allows companies to borrow against outstanding invoices, providing quick access to cash and helping to bridge cash flow gaps.

Recent statistics reveal that 83% of lenders in the consumer sector now offer embedded services, compared to only 45% of SMB lenders. This trend suggests that minor enterprise proprietors may soon benefit from more integrated financial solutions, enhancing their access to capital. However, a substantial funding shortfall persists for minor enterprises globally, underscoring the ongoing challenges they face in securing essential capital. Many minor and medium-sized enterprises (SMEs) grapple with cash flow issues, highlighting the critical need for improved access to financial assistance.

Expert insights underscore the importance of understanding these financing types, as the best small business loan providers can significantly influence a company's operational efficiency and growth potential. For instance, while term financing remains popular, a growing number of small enterprises are turning to lines of credit for greater financial flexibility. As Jim Pendergast notes, "Factoring occurs when companies sell their outstanding accounts receivable to a third-party factoring firm in exchange for an immediate cash advance," presenting an alternative financing option that can alleviate cash flow challenges.

At Finance Story, we specialize in crafting refined and highly personalized case studies for banks, ensuring that your funding proposals align with the increasingly high expectations of lenders. Our expertise encompasses not only traditional financing but also refinancing options tailored for commercial property investments. With access to a comprehensive range of lenders—from high street banks to innovative private lending groups—we empower small enterprise owners to secure funding from the best small business loan providers to meet their needs. Case studies demonstrate that effective working capital management is vital for SMBs, with many relying on credit to cover startup costs and operational expenses. The case study titled 'The Importance of Working Capital for SMBs' emphasizes that enterprises with adequate working capital are better positioned to navigate financial challenges and seize growth opportunities. Successful credit applications often hinge on a clear understanding of these financing options and the specific needs of the enterprise, enabling entrepreneurs to make informed decisions that align with their financial goals.

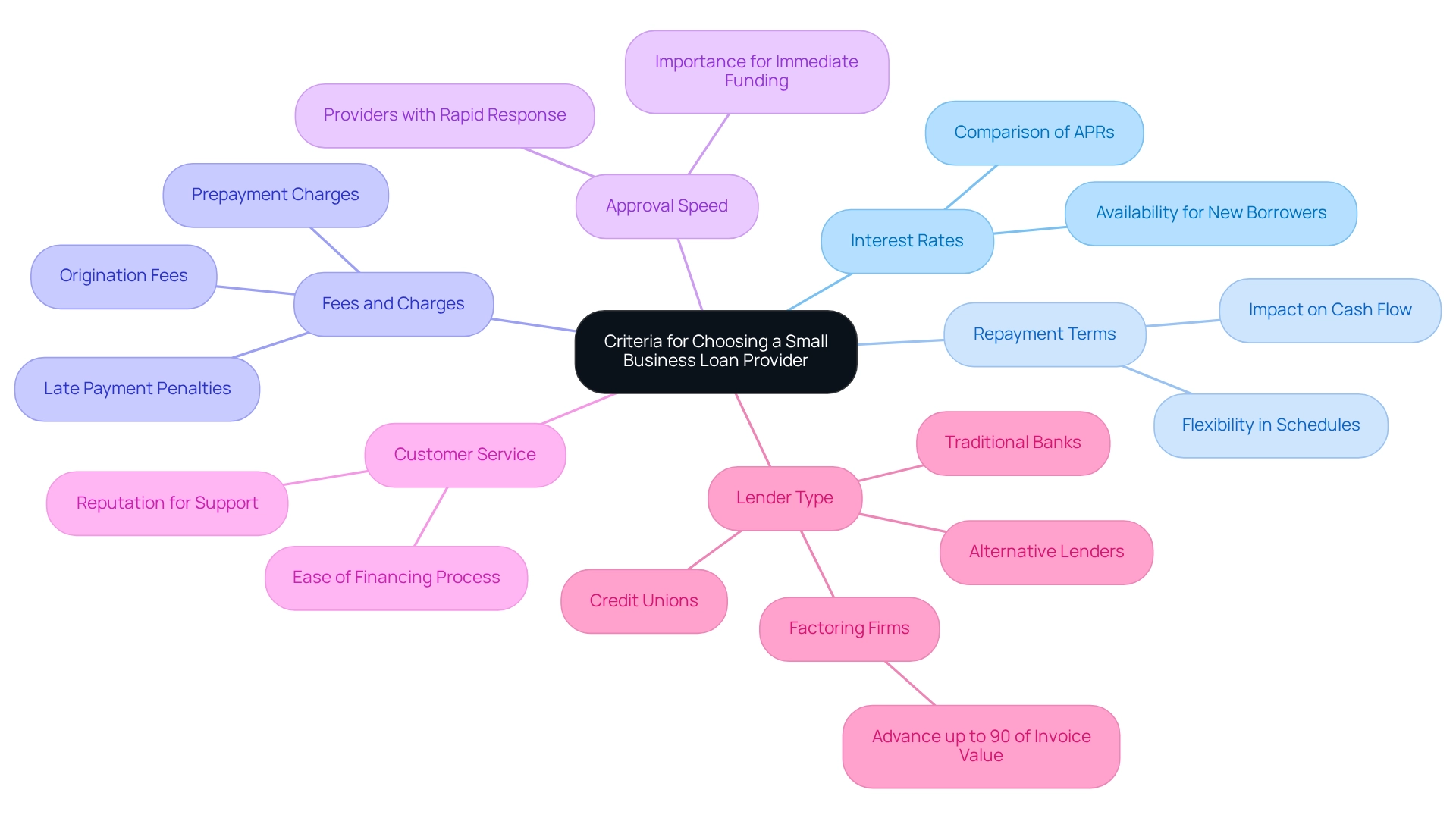

Criteria for Choosing a Small Business Loan Provider

When selecting among the best small business loan providers, it is crucial to assess several essential factors to ensure the best match for your financial requirements.

Interest Rates: Comparing annual percentage rates (APRs) from various lenders is vital, as these rates significantly influence the total cost of borrowing. In 2025, average interest rates for small enterprise financing in Australia are anticipated to fluctuate, making this comparison essential. Be aware that the interest rates mentioned may not be available to new borrowers, which could limit options for startups.

Repayment Terms: Flexibility in repayment schedules is critical. Consider the length of the loan and whether payments are structured monthly, quarterly, or based on revenue. Understanding these concepts can assist organizations in managing cash flow efficiently. Lenders, particularly the best small business loan providers, will evaluate the strength of your enterprise's profits and its ability to make repayments, so ensure your financials reflect a capacity to support the loan.

Fees and Charges: Be vigilant about additional costs, such as origination fees, late payment penalties, or prepayment charges. These fees can accumulate and impact the overall expense of the loan.

Approval Speed: The speed of the approval process can be a deciding factor, especially for businesses requiring immediate funding. Certain providers are recognized for their rapid response periods, which can be beneficial in urgent circumstances.

Customer Service: A financial institution's reputation for customer support is paramount. Responsive assistance can significantly ease the financing process, ensuring that business owners feel supported throughout their financial journey.

Lender Type: Evaluate whether to approach traditional banks, credit unions, or alternative lenders. Each category has its distinct benefits and drawbacks, influencing the conditions and availability of credit. Finance Story focuses on developing refined and highly personalized proposals to present to banks, ensuring that your submission meets the increased expectations of lenders, particularly when working with the best small business loan providers. Moreover, it is notable that factoring firms advance up to 90% of the value of each invoice, providing a feasible financing solution for companies requiring immediate cash flow.

These criteria not only assist entrepreneurs in choosing a funding provider that aligns with their specific financial requirements but also aid operational objectives. For instance, a recent study emphasized that enterprises owned by women frequently encounter difficulties in obtaining funding compared to their male counterparts, underscoring the significance of selecting a financier that comprehends varied commercial needs. As Michael McCareins, a Content Marketing Associate at altLINE, emphasizes, understanding the nuances of financing options is crucial for making informed decisions. By carefully considering these factors, entrepreneurs can navigate the lending landscape more effectively and secure favorable financing options.

Comparative Analysis of Top Small Business Loan Providers

This comparative analysis evaluates several leading small business loan providers based on essential criteria, offering insights into their offerings and suitability for entrepreneurs:

-

Provider: Bizcap

- Interest Rates: 5% - 15%

- Repayment Terms: Flexible, up to 5 years

- Approval Speed: Fast (within 24 hours)

- Customer Service: Highly rated

- Lender Type: Alternative lender

-

Provider: OnDeck

- Interest Rates: 10% - 30%

- Repayment Terms: 3 to 24 months

- Approval Speed: Quick (1-3 days)

- Customer Service: Good

- Lender Type: Online lender

-

Provider: Commonwealth Bank

- Interest Rates: 6% - 12%

- Repayment Terms: 1 to 10 years

- Approval Speed: Moderate (1 week)

- Customer Service: Excellent

- Lender Type: Traditional bank

-

Provider: NAB

- Interest Rates: 5% - 10%

- Repayment Terms: 1 to 7 years

- Approval Speed: Moderate (1 week)

- Customer Service: Very good

- Lender Type: Traditional bank

-

Provider: Prospa

- Interest Rates: 7% - 25%

- Repayment Terms: 3 to 36 months

- Approval Speed: Fast (1-2 days)

- Customer Service: Good

- Lender Type: Online lender

This table illustrates the variations in interest rates, repayment terms, approval speeds, and customer service across different lenders. For instance, Bizcap stands out with its competitive rates and rapid approval process, while OnDeck, despite its higher interest rates, offers swift access to funds. Comprehending these differences is crucial for entrepreneurs seeking funding from the best small business loan providers that align with their specific operational needs, as recent statistics show that the Small Business Administration (SBA) completely approved about 34% of business financing applications, emphasizing the competitive nature of the lending environment. This statistic highlights the significance of selecting the appropriate financial institution, as many applications may not receive approval.

Furthermore, minor term financing of $25,000 is mainly used for equipment acquisitions, whereas larger amounts, varying from $1 million to $3 million, are frequently allocated for owner-occupied commercial properties. This trend affects the decisions small business owners encounter when choosing a lender, as comprehending the intention of the funding can direct them toward the best small business loan providers, highlighting the importance of collateral in obtaining financing. Financing supported by physical assets, like equipment financing, has shown greater approval rates, with complete approvals hitting 73%. As noted by finance writer Janet Gershen-Siegel, this highlights the value of having solid collateral when approaching lenders. The case study titled 'The Importance of Collateral in Credit Approval' emphasizes that financing secured with collateral significantly enhances the likelihood of approval, reinforcing the need for entrepreneurs to consider their assets when applying for funding.

As entrepreneurs explore their funding choices, they should take into account the average interest rates for minor enterprise bank credits, which ranged from 6.42% to 12.41% in the second quarter of 2024. Comparing these average rates with those listed in the table for each provider allows readers to see how the providers stack up against the average, enhancing the comparative analysis. Moreover, for leasehold enterprises, utilizing property equity and cash savings can be essential for acquisitions, and collaborating with specialists in customized financing proposals can greatly enhance the likelihood of obtaining the required funding.

Key Takeaways for Selecting the Right Loan Provider

When selecting from the best small business loan providers, consider these key takeaways:

-

Assess Your Needs: Clearly define the purpose of the financial assistance and the amount required. Understanding your specific financial needs is crucial, especially since 70% of small businesses carry some form of debt, contributing to a total debt burden of $18 trillion. The average SBA funding reached $458,584 in 2024, reflecting the ongoing reliance on debt for financing.

-

Compare Offers: Don’t settle for the first proposal; research various institutions to find the most favorable rates and terms. Statistics show that only 8% of small business loan applications seek more than a million, indicating a preference for manageable loan amounts. Finance Story offers access to the best small business loan providers, ensuring you can discover the right financial institution for your situation, whether you are acquiring a warehouse, retail space, or hospitality project.

-

Read Reviews: Investigate customer feedback and testimonials to assess the provider's reputation and service quality. Positive feedback can provide insights into the lender's reliability and support.

-

Understand the Fine Print: Scrutinize the loan agreement to grasp all terms, conditions, and fees involved. This diligence can prevent unexpected costs and ensure transparency in the lending process. Collaborating with specialists such as Finance Story can assist you in developing refined and highly personalized proposals to present to the best small business loan providers, thereby improving your likelihood of approval.

-

Seek Expert Guidance: Consulting with a financial advisor or finance consultant can help navigate complex options and make informed decisions. As pointed out by industry specialists, 'Comprehending the lending environment for minor enterprises is vital for their development and achievement,' which highlights the importance of knowledgeable decision-making when choosing among the best small business loan providers. Finance Story focuses on customizing funding proposals to accommodate the changing requirements of your enterprise, guaranteeing you obtain the appropriate financing for your commercial property investments.

By following these insights, owners of modest enterprises can greatly enhance their opportunities to obtain funding that not only meets their urgent financial requirements but also corresponds with their long-term goals. Additionally, with the average small business comparing multiple loan offers from the best small business loan providers before making a decision, taking the time to evaluate options can lead to more favorable outcomes.

Conclusion

Understanding the diverse landscape of small business loans is crucial for entrepreneurs aiming to secure the right financing for their ventures. This article highlights various loan types—term loans, lines of credit, SBA loans, equipment financing, and invoice financing—each serving distinct purposes to meet the unique needs of small businesses. As the financial landscape evolves, selecting the appropriate loan provider requires careful consideration of the following factors:

- Interest rates

- Repayment terms

- Fees

- Approval speed

- Customer service

- Lender type

By evaluating these critical factors, business owners can make informed decisions that align with their operational goals. The comparative analysis of top small business loan providers underscores the importance of understanding the differences in offerings; this knowledge can significantly impact the success of securing favorable financing. Additionally, the emphasis on collateral and the need for a solid business case when applying for loans cannot be overlooked, as these elements play a vital role in enhancing approval rates.

Ultimately, the path to successful financing lies in thorough research and a strategic approach to selecting a lender. By assessing individual needs, comparing offers, reading reviews, understanding the fine print, and seeking expert advice, small business owners can navigate the complexities of the lending landscape more effectively. This proactive approach not only addresses immediate financial requirements but also supports long-term business growth and stability. As the journey of entrepreneurship unfolds, securing the right financing remains a cornerstone of achieving sustained success.