Overview

This article delves into the essential criteria for assessing the best commercial mortgage brokers, drawing insights from client experiences. It underscores the significance of factors such as:

- Experience

- Lender relationships

- Customer service

- Transparency

- Reputation

These elements are not merely theoretical; testimonials powerfully illustrate how they contribute to successful financing outcomes. By understanding these key aspects, readers can make informed decisions that align with their financial goals.

Introduction

Navigating the realm of commercial mortgage brokers can indeed feel overwhelming, particularly given the multitude of options and the intricacies of financing. As businesses pursue tailored solutions to address their unique financial needs, it becomes essential to understand the key criteria for evaluating brokers.

Assessing experience and lender relationships, alongside prioritizing client service and transparency, are pivotal factors; the right broker can significantly influence the ability to secure favorable financing.

This article explores the critical factors clients should consider, highlights the distinct services provided by leading brokers, and offers a comparative analysis of the pros and cons of various options. By examining client testimonials and current market trends, readers will gain invaluable insights into selecting the ideal commercial mortgage broker to support their financial journey.

Key Criteria for Evaluating Commercial Mortgage Brokers

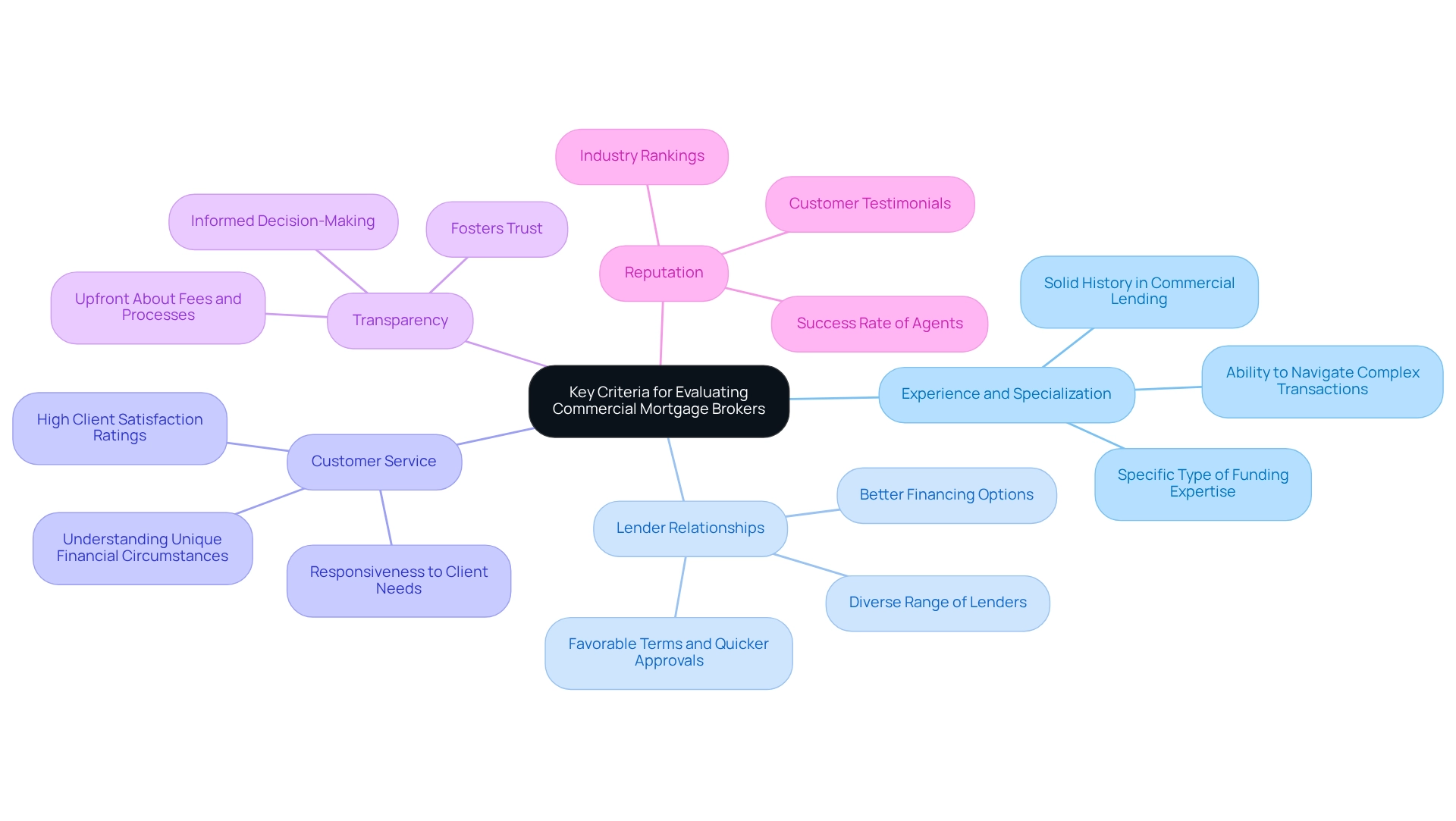

When evaluating commercial mortgage brokers, clients should consider several key criteria to ensure they select the right partner for their financing needs:

-

Experience and Specialization: Look for agents with a solid history in commercial lending, particularly in the specific type of funding required, such as retail, industrial, or office space. This specialization can significantly influence the agent's ability to navigate complex transactions—a strength exemplified by Finance Story through their polished and individualized business cases presented to banks.

-

Lender Relationships: A facilitator's connections with a diverse range of lenders can offer customers more financing options and potentially better rates. Strong relationships often lead to more favorable terms and quicker approvals. Finance Story provides access to a comprehensive suite of lenders, including high street banks and innovative private lending panels, catering to various commercial property needs.

-

Customer Service: Assess the intermediary's responsiveness and commitment to understanding the individual's unique financial circumstances. High client satisfaction ratings reflect a financial advisor's dedication to personalized service, which is essential in the commercial lending process. Finance Story has garnered favorable reviews, demonstrating their efficiency in alleviating the persistent concerns associated with funding.

-

Transparency: Ensure that the broker is upfront about fees, processes, and any potential challenges in securing funding. Transparency fosters trust and assists customers in making informed decisions. Brokers like Finance Story emphasize transparent communication throughout the financing process, which is crucial for establishing strong relationships with clients.

-

Reputation: Examine testimonials from customers and industry rankings to evaluate the agent's reliability and success rate. With mortgage advisors finalizing a record 76.8% of all new residential home loans in the March 2025 quarter, the growing impact of these professionals underscores the importance of selecting a trustworthy partner. Finance Story's ability to provide valuable insights into market trends and lending practices further solidifies their role as trusted advisors.

By focusing on these criteria, clients can navigate the complexities of commercial financing more effectively and choose from the best commercial mortgage brokers who align with their financial goals. As Keely Pate, Director of Training and Development at Alternative Capital Solutions, states, "If you want to reach your goals and fulfill your potential, become intentional about your personal growth. It will change your life." This perspective is particularly relevant when making informed decisions about financial partnerships.

Distinct Services Offered by Leading Commercial Mortgage Brokers

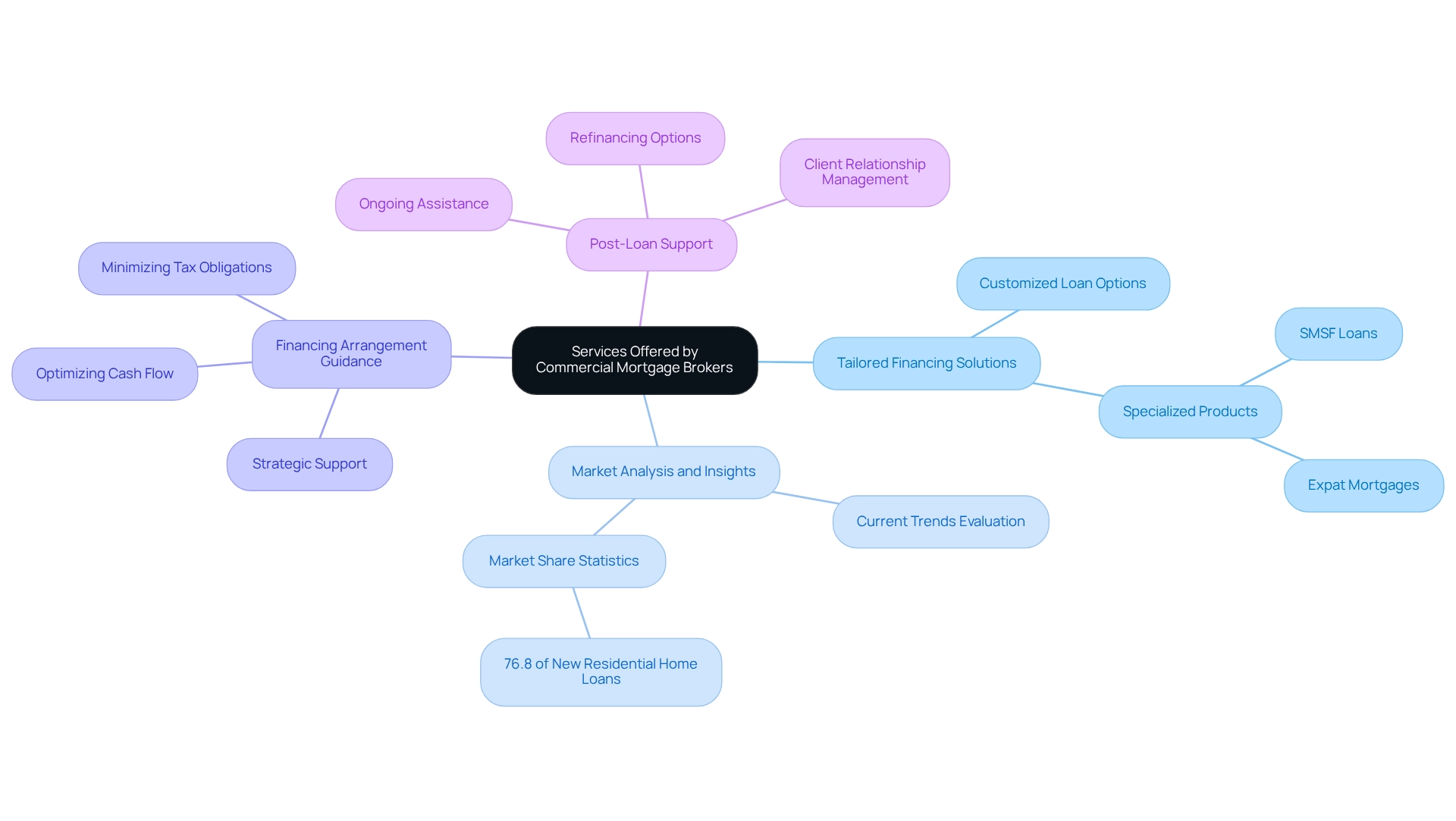

Leading commercial mortgage brokers provide a comprehensive array of services tailored to meet the diverse needs of their clients:

-

Tailored Financing Solutions: Brokers like Finance Story excel in delivering customized loan options that address individual circumstances, including specialized products such as SMSF loans and expat mortgages. This personalized approach ensures that clients secure the most suitable funding for their unique situations. With an extensive panel of lenders, Finance Story is dedicated to understanding business needs and offering tailored solutions that adapt to evolving requirements.

-

Market Analysis and Insights: Numerous agents conduct thorough market evaluations, equipping clients with essential information about current trends. This insight empowers clients to make informed decisions, particularly in a competitive landscape where the mortgage intermediary market share reached 76.8% of all new residential home financing in early 2025. As Anja Pannek, CEO of MFAA, asserts, "This report provides clear evidence of a thriving industry that delivers real value to consumers and increasingly so for business owners."

-

Financing Arrangement Guidance: Experienced advisors offer strategic support on financing structuring, assisting clients in optimizing cash flow and minimizing tax obligations. This expertise is vital for small business owners aiming to enhance their financial efficiency. Finance Story specializes in developing refined and highly tailored business cases to present to lenders, ensuring clients find the best commercial mortgage brokers to access the best financing options available.

-

Post-Loan Support: Several brokers extend their services beyond loan acquisition, providing ongoing assistance to help clients manage repayments and explore refinancing options. This commitment to client success fosters enduring relationships and enhances overall satisfaction. Finance Story's access to a full suite of lenders allows them to offer customized refinancing solutions that enable clients to access equity and lower rates with expert mortgage guidance.

Moreover, a satisfied customer remarked, "I will certainly be suggesting your business to anyone. We are finished with the constant worry. Once again, thank you so much for being a part of our journey." This testimonial highlights Finance Story's unwavering dedication to client success.

These distinctive services not only illustrate the adaptability of commercial mortgage professionals but also underscore their commitment to delivering genuine value to both consumers and business owners.

Pros and Cons of Each Commercial Mortgage Broker

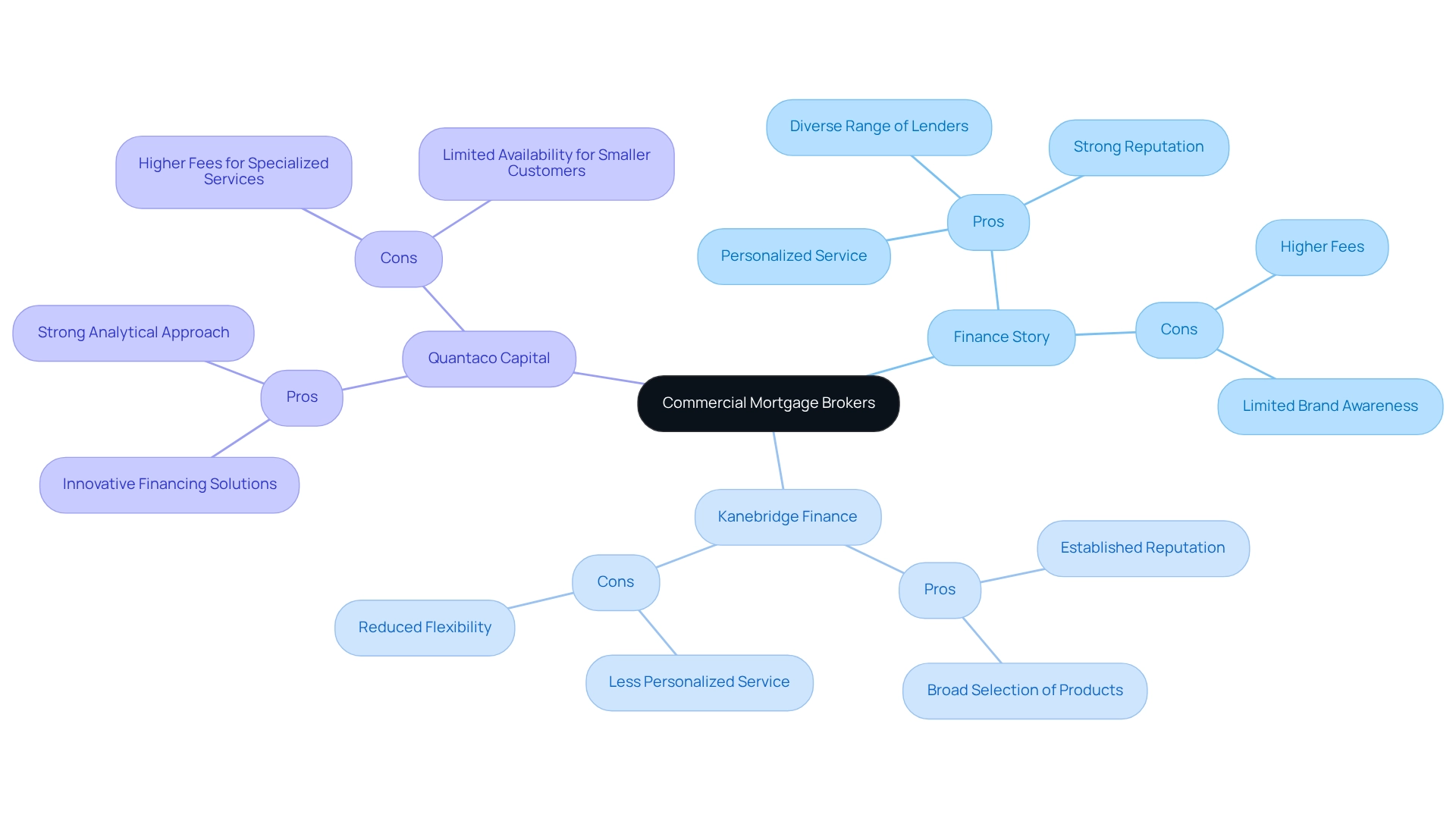

A comparative analysis of the pros and cons of various commercial mortgage brokers reveals distinct advantages and challenges for each option:

-

Finance Story

- Pros:

- Offers personalized service tailored to individual client needs, ensuring a bespoke approach to financing.

- Provides access to a diverse range of lenders, enhancing the variety of funding options available.

- Holds a strong reputation for effectively navigating complex financial situations, making it a dependable option for individuals facing challenges.

- Cons:

- Fees may be higher compared to some larger brokers, which could impact overall financing costs.

- Limited brand awareness compared to national companies, potentially impacting customer trust for some.

- Pros:

-

Kanebridge Finance

- Pros:

- Established reputation with a strong client base, indicating reliability and trustworthiness.

- Provides a broad selection of commercial financing products, addressing diverse funding requirements.

- Cons:

- May lack personalized service due to a larger client volume, which can lead to a more transactional experience.

- Possibly reduced flexibility in financing arrangements, restricting choices for individuals with specific needs.

- Pros:

-

Quantaco Capital

- Pros:

- Provides innovative financing solutions tailored for unique projects, appealing to clients with specific needs.

- Employs a strong analytical approach to loan structuring, ensuring well-informed financial decisions.

- Cons:

- Higher fees for specialized services may deter cost-sensitive clients.

- Limited availability for smaller customers, which could exclude a significant market segment.

- Pros:

Client testimonials for Finance Story highlight the brokerage's exceptional service, with remarks emphasizing that the best commercial mortgage brokers make securing loans easy and provide personalized support throughout the process. This focus on building strong, long-term relationships ensures clients feel understood and supported in their financial decisions, setting Finance Story apart in a competitive landscape.

Client Experiences: Testimonials and Success Stories

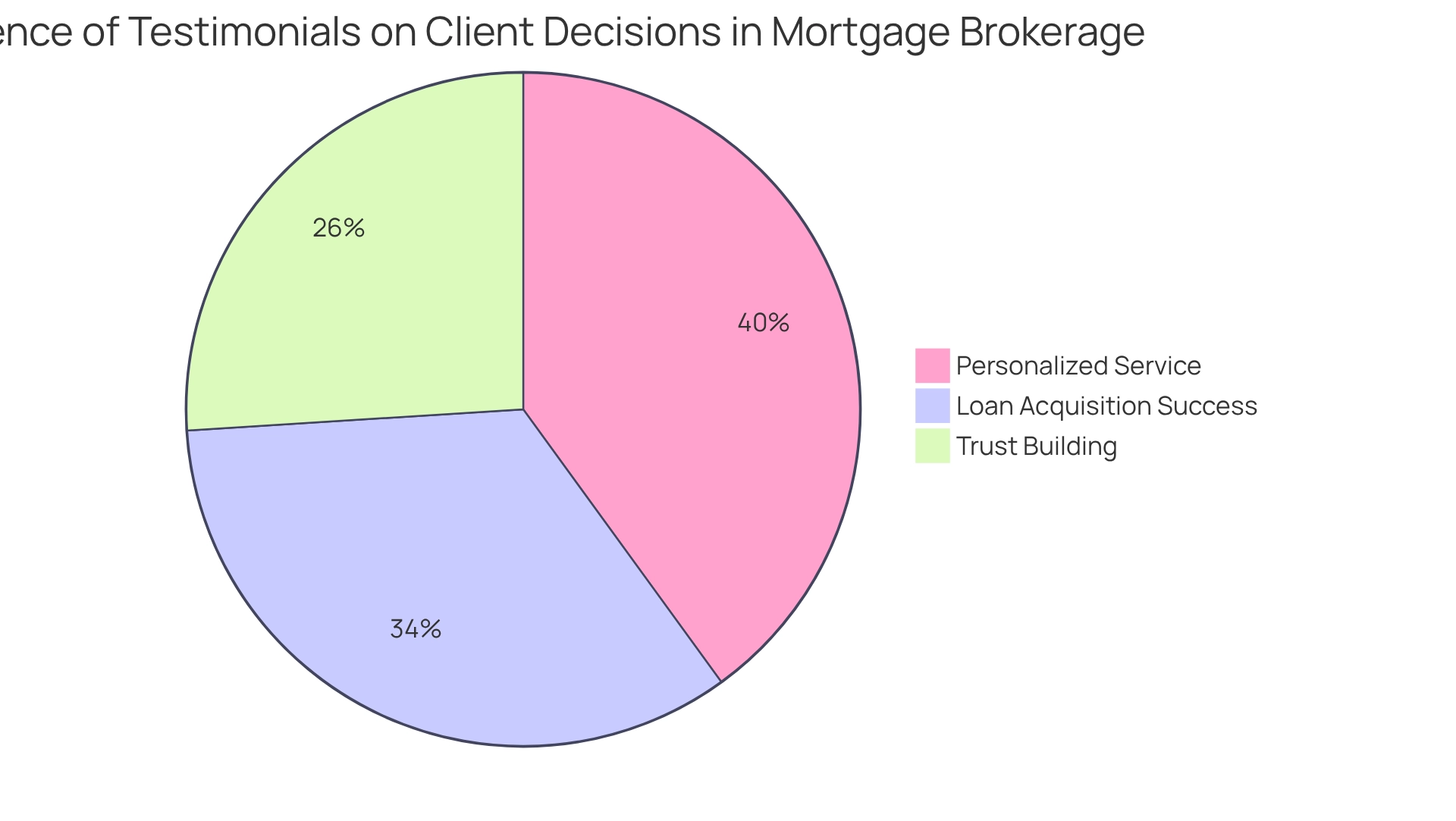

Client experiences play a pivotal role in selecting the best commercial mortgage brokers. Understanding this, clients consistently commend the personalized service offered by brokers, particularly their ability to secure loans even in challenging circumstances. Testimonials highlight the firm’s dedication to comprehending personal financial requirements, leading to customized solutions that align with each individual’s distinct circumstances. This commitment not only fosters trust but also enhances the likelihood of successful loan acquisition, with statistics indicating that testimonials can boost conversions by up to 34%.

Overall, the favorable responses from customers underscore the significance of tailored service and innovative solutions provided by the best commercial mortgage brokers in the industry, especially as increasing interest rates continue to influence market dynamics in 2025.

Market Trends Impacting Commercial Mortgage Brokers

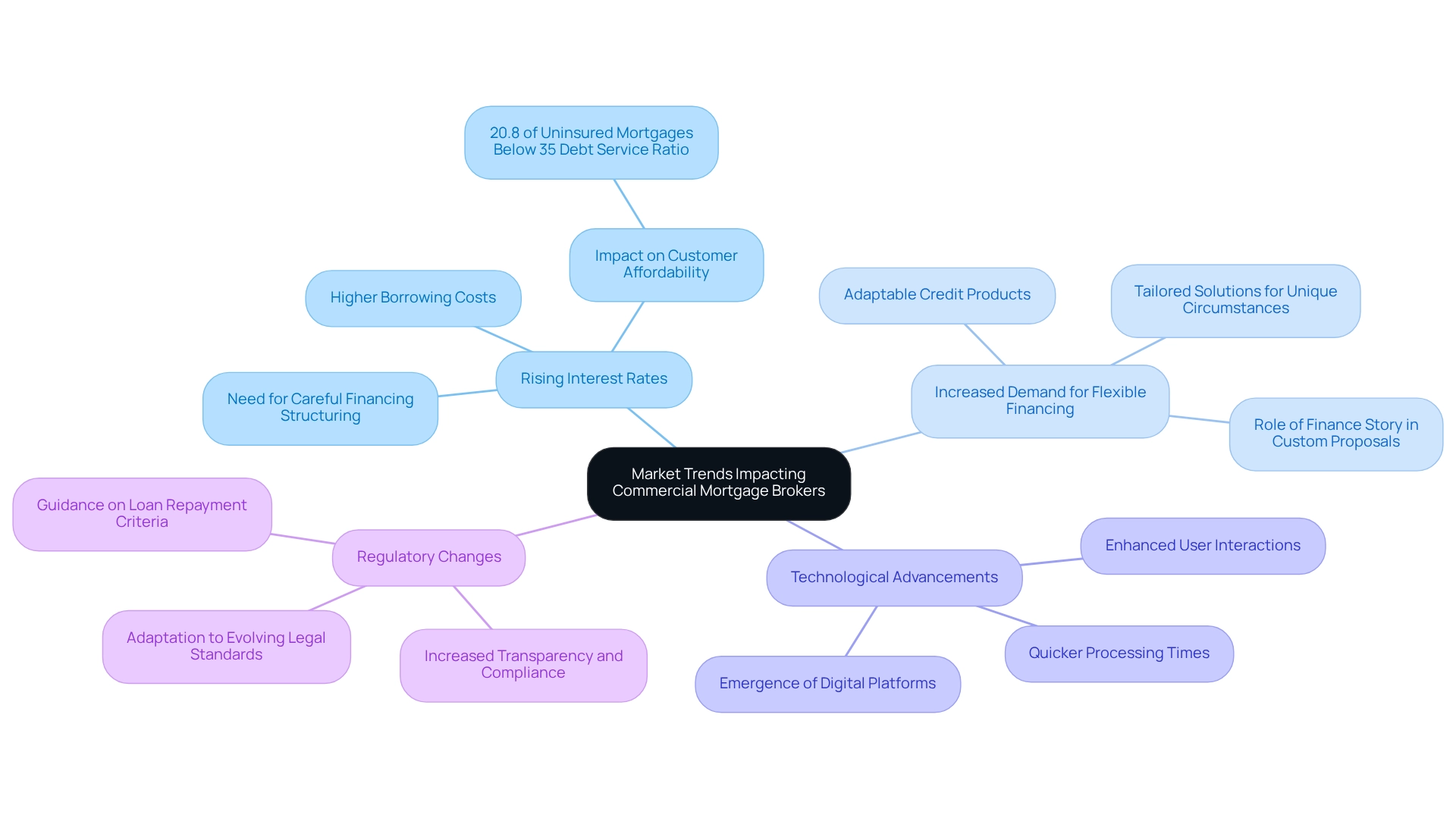

The commercial mortgage brokerage landscape is currently shaped by several key market trends:

-

Rising Interest Rates: As central banks raise interest rates to combat inflation, brokers encounter the challenge of higher borrowing costs. This shift significantly impacts customer affordability, necessitating careful financing structuring to ensure that customers can manage increased repayments. In 2022, for instance, 20.8% of uninsured mortgages had a total debt service ratio below 35%, highlighting a growing concern for borrowers as rates climb.

-

Increased Demand for Flexible Financing: Businesses are increasingly pursuing adaptable credit products that can respond to fluctuating cash flows and evolving market conditions. This demand for flexibility is crucial, particularly for companies with less-than-perfect financial backgrounds, as they require solutions tailored to their unique circumstances. Finance Story excels in crafting customized loan proposals with the assistance of the best commercial mortgage brokers, ensuring that these changing needs are addressed and customers have access to suitable financing options.

-

Technological Advancements: The emergence of digital platforms is revolutionizing the practices of commercial mortgage professionals. These advancements facilitate quicker processing times and enhance user interactions, enabling agents to deliver more effective services tailored to individual needs. Finance Story harnesses technology to present polished and personalized business cases to lenders, streamlining the financing process for clients.

-

Regulatory Changes: New regulations aimed at consumer protection are reshaping the operational environment for intermediaries. These changes necessitate increased transparency and compliance, compelling intermediaries to adapt their practices to align with evolving legal standards. To effectively guide customers through the complexities of loan repayment criteria and financing options, the best commercial mortgage brokers must remain informed about these developments.

In light of these trends, understanding commission fees and their structures has become increasingly important. Financial consultants emphasize the necessity for customers to evaluate commission charges meticulously, as these can vary significantly throughout the market. As the demand for flexible financing options rises, the best commercial mortgage brokers must showcase their ability to meet diverse customer needs while navigating the complexities introduced by rising interest rates and regulatory changes. With access to a comprehensive suite of lenders, Finance Story is well-positioned to tackle these challenges and provide tailored solutions for commercial property investments.

Comparative Analysis of Fees and Costs

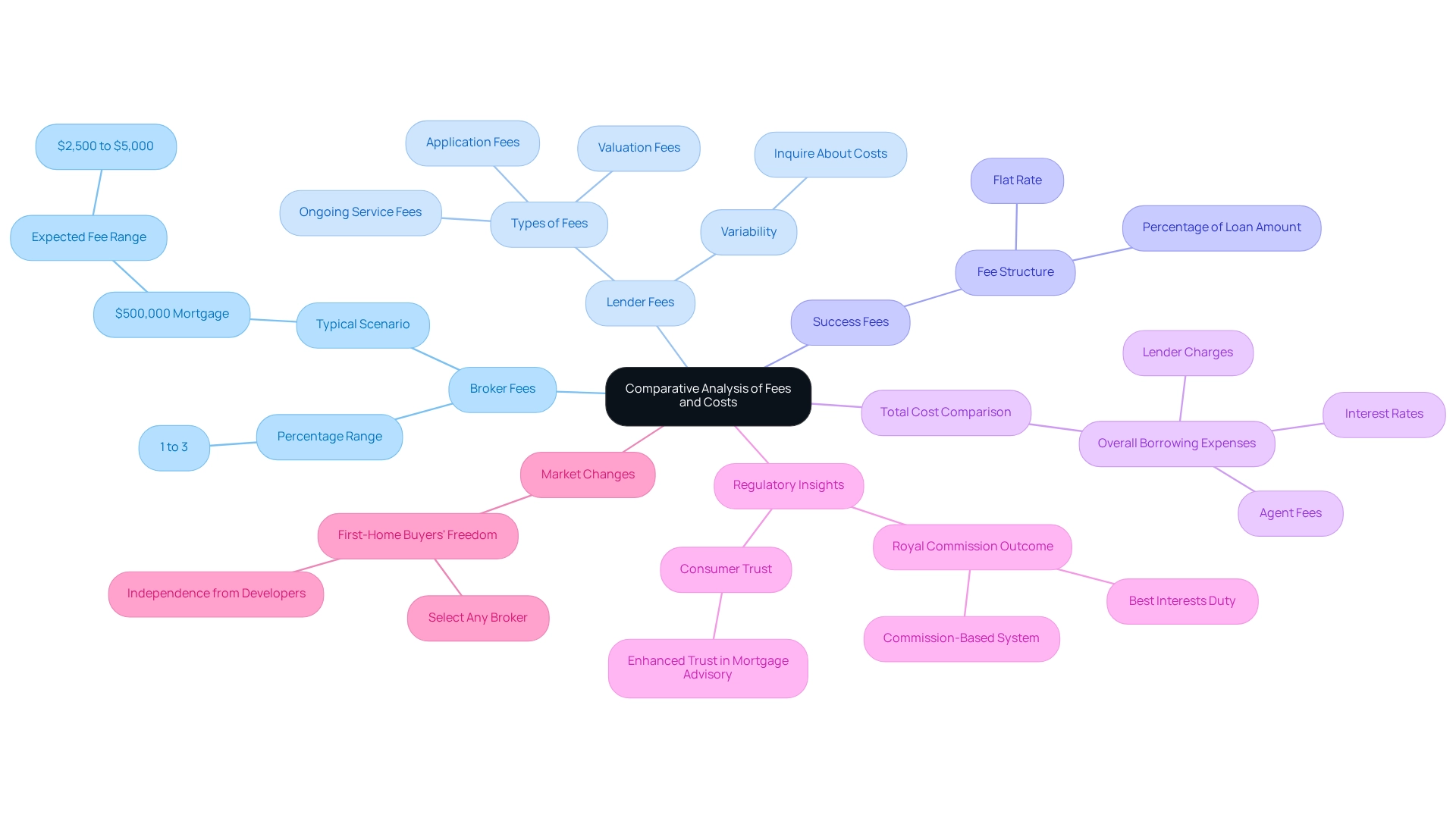

When evaluating commercial mortgage brokers, clients should consider several key fee structures:

- Broker Fees: Brokers typically impose a charge ranging from 1% to 3% of the amount borrowed. It is essential to clarify whether this fee is due upfront or at the time of loan settlement.

- Lender Fees: Brokers may pass on various lender fees to customers, including application, valuation, and ongoing service fees. Statistics indicate that these fees can vary significantly, so clients should proactively inquire about these costs to avoid surprises.

- Success Fees: Some agents apply a success fee, which depends on securing financing. This fee can either be a percentage of the loan amount or a flat rate.

- Total Cost Comparison: To determine the most economical choice, clients should compute the overall borrowing expenses, considering agent fees, lender charges, and interest rates.

Understanding these fee structures is crucial for making informed financial decisions with the best commercial mortgage brokers. For instance, in a typical scenario involving a $500,000 mortgage, intermediary fees can range from $2,500 to $5,000, underscoring the importance of transparency in fee disclosures. Furthermore, the 2018 Royal Commission into Banking highlighted the necessity for intermediaries to act in the best interests of consumers, thereby enhancing trust in the mortgage advisory system. As indicated by the Royal Commission, "Instead, they implemented the Best Interests Duty and chose not to revisit financial advisor remuneration until a review." Client testimonials further underscore the significance of these experiences, with many expressing satisfaction with the clarity and support provided by their agents throughout the financing process. Additionally, first-home buyers now enjoy the freedom to select any broker, regardless of ties to property developers or real estate agents, reflecting the evolving landscape of mortgage brokerage.

Conclusion

Understanding the intricacies of selecting the right commercial mortgage broker is essential for businesses aiming to secure favorable financing. Key criteria such as experience, lender relationships, client service, transparency, and reputation play a vital role in this decision-making process. By focusing on these elements, clients can navigate the complexities of commercial financing with confidence and clarity.

The distinct services offered by leading brokers further enhance their value, providing tailored solutions that cater to individual needs and market insights that empower informed decisions. The right broker can not only simplify the loan acquisition process but also offer ongoing support that fosters long-term success.

Ultimately, the comparative analysis of various brokers highlights the importance of weighing the pros and cons of each option. Client testimonials serve as a testament to the effectiveness of personalized service and innovative financing solutions. As market trends evolve, including rising interest rates and demands for flexible financing, the role of a knowledgeable and dedicated broker becomes even more critical in guiding clients through their financial journeys. By making informed choices, businesses can position themselves for growth and stability in an ever-changing economic landscape.