Overview

This article serves as a comprehensive guide for identifying the best commercial loan companies, tailored to meet various borrower needs. It spotlights leading lenders such as NAB, BOQ Specialist, Liberty Financial, ING Broker, and CommBank, detailing their distinctive offerings and customer service strategies. By examining the suitability of these lenders for different borrower profiles, this overview equips potential clients with the insights necessary to make informed financing decisions.

Are you looking for a commercial loan that fits your specific requirements? Understanding the unique features of each lender can significantly impact your financing choices. This article not only highlights prominent lenders but also emphasizes how their services can align with your financial goals.

Furthermore, by focusing on the customer service approaches of these institutions, we provide a clearer picture of how they can support you throughout the borrowing process. Each lender's strengths are examined, allowing you to assess which one might be the best fit for your financial situation.

In addition, the information presented here is designed to empower you as a borrower. With a solid understanding of your options, you can approach the lending process with confidence. This knowledge is essential in navigating the complexities of commercial loans, ensuring you make decisions that are in your best interest.

Introduction

In the dynamic realm of commercial lending, businesses encounter a multitude of options, each presenting unique features tailored to diverse financial needs. As the demand for customized financing solutions escalates, grasping the strengths of leading commercial loan providers becomes crucial.

From the extensive offerings of NAB to the specialized services of BOQ Specialist and the innovative strategies of Liberty Financial, each lender boasts distinct advantages that can significantly influence a borrower’s journey.

This article explores the key players within the commercial lending landscape, comparing their loan products, interest rates, customer service, and overall compatibility with various borrower profiles. By doing so, we aim to equip businesses with the insights necessary to make informed financial decisions.

Overview of Leading Commercial Loan Companies

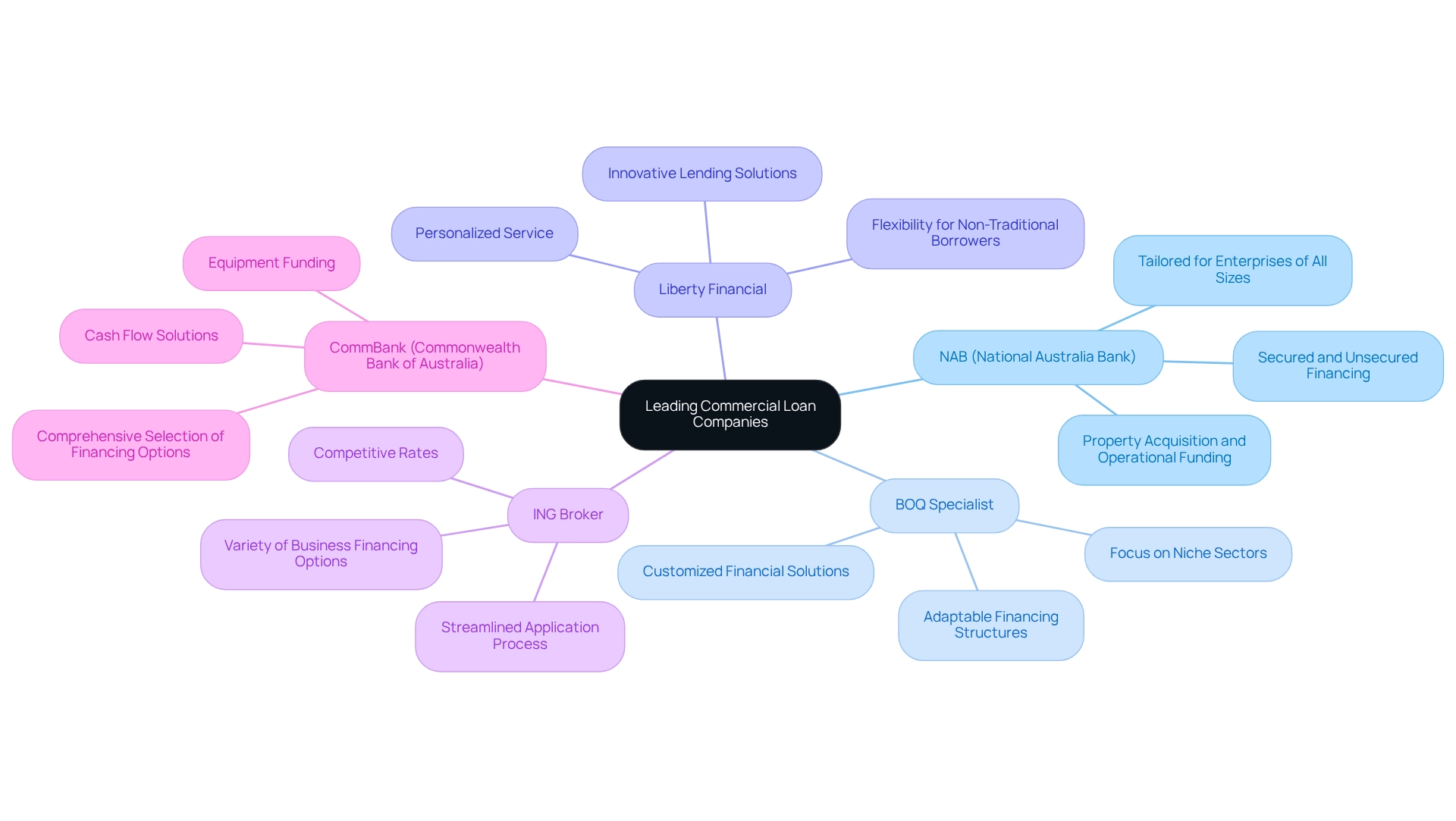

In the competitive landscape of business lending, the best commercial loan companies distinguish themselves through unique offerings and a significant market presence. Key players include:

- NAB (National Australia Bank): Renowned for a broad array of secured and unsecured financing options, NAB serves enterprises of all sizes, from startups to large corporations. Their commercial financing is tailored to meet diverse enterprise needs, including property acquisition and operational funding.

- BOQ Specialist: This lender focuses on customized financial solutions, particularly for professionals and businesses in niche sectors. BOQ Specialist offers adaptable financing structures, including SMSF options, making it a preferred choice for specific markets.

- Liberty Financial: Liberty is recognized for its innovative lending solutions, catering to borrowers who may not meet traditional lending criteria. Their approach emphasizes flexibility and personalized service, appealing to a broad range of clients.

- ING Broker: ING provides a variety of business financing options designed for professional investors and owner-occupiers, featuring competitive rates and a streamlined application process that enhances accessibility.

- CommBank (Commonwealth Bank of Australia): As one of Australia's largest banks, CommBank offers a comprehensive selection of business financing options, including cash flow solutions and equipment funding, making it a versatile choice for many enterprises.

These firms represent a cross-section of the business financing market, with some being the best commercial loan companies, each having unique strengths and target audiences. In December 2024, the average loan size for owner-occupier dwellings in the Australian Capital Territory reached $632,000, reflecting the growing demand for commercial financing solutions. Furthermore, successful lending strategies employed by NAB and BOQ Specialist have established benchmarks in the industry, showcasing their commitment to supporting clients through tailored financial products.

At Finance Story, we recognize the importance of developing refined and highly personalized proposals to present to lenders, ensuring our clients secure financing options from the best commercial loan companies. We collaborate with a comprehensive panel of lenders, including mainstream banks, private lenders, and angel investors, to provide a wide range of options tailored to your specific needs. Whether you aim to acquire a warehouse, retail space, factory, or hospitality project, we possess the expertise to assist you in refinancing and obtaining customized loans for your commercial property investments. As Shaun McGowan, Founder of Money.com.au, emphasizes, "He's committed to helping individuals and companies pay the least amount possible for financial products, through education and developing top-notch technology." This perspective underscores the significance of cost-effective solutions in today's financial landscape.

Additionally, the case study of Joseph Camberato and National Business Capital illustrates the impact of innovative financial solutions, as Joe has built a reputation for providing educational and financial resources that empower enterprises to thrive. The market share of business credit providers continues to evolve in 2025, with industry leaders highlighting the importance of adaptability and innovation in addressing borrower needs. Notably, discussions led by Anna Bligh regarding how banks can assist customers in financial difficulty underscore the critical role lenders play in supporting clients during challenging times.

Comparison of Loan Products and Services

When evaluating loan products and services, the diversity and adaptability provided by the best commercial loan companies are crucial factors to consider.

- NAB: This lender presents a comprehensive suite of secured and unsecured loans, including commercial property loans, business overdrafts, and equipment financing. NAB's offerings are defined by competitive interest rates and flexible repayment terms, positioning them as a strong contender in the lending sector.

- BOQ Specialist: Recognized for its customized method, BOQ Specialist provides property financing with both fixed and variable interest rate choices. Furthermore, they offer SMSF financing, allowing clients to utilize their superannuation funds for property investments, which introduces an additional level of flexibility for investors.

- Liberty Financial: Liberty distinguishes itself with its wide array of financing options, including enterprise financing, mortgages for businesses, and lines of credit. Their ability to customize solutions for borrowers with unique financial circumstances positions them as a versatile option in the market.

- ING Broker: Aiming at seasoned investors, ING Broker focuses on business financing that encompasses refinancing alternatives and property acquisition financing. Their streamlined application process enhances accessibility for borrowers, reflecting a commitment to efficiency.

- CommBank: With a broad spectrum of business financing options, CommBank provides cash flow solutions, equipment finance, and commercial mortgages tailored to various business needs. Their diverse product range ensures that they can cater to different borrower profiles effectively.

This comparison underscores the importance of understanding the specific credit products available, as the best commercial loan companies can offer unique offerings that better align with the diverse needs of borrowers. As the Australian mortgage lending sector is anticipated to expand considerably, reaching an estimated AUD 912.64 billion by 2034, the demand for adaptable and creative financing solutions will only rise, making it crucial for borrowers to select wisely among these options. Furthermore, as Patrick Allaway, CEO, noted, "this digital shift aims to resolve legacy issues and improve online banking capabilities," highlighting the industry's evolution towards more adaptable solutions. Additionally, with refinancing data highlighting an essential element of the mortgage market dynamics, small enterprise owners should stay updated on these trends, particularly considering the recent -4.5% shift in investor financing commitments from September to December 2024.

Distinctive Features and Benefits of Each Lender

Each of the best commercial loan companies offers distinctive features tailored to meet various borrower needs, and understanding these can significantly enhance your financing journey.

- NAB: Renowned for its robust online platform, NAB streamlines loan applications and management, offering dedicated support for businesses facing complex financing challenges. This commitment to service is underscored by the recent regulatory examination, emphasizing the importance of transparency and accountability in borrowing practices. Furthermore, NAB provides foreign exchange services, trade finance, and international money transfers, making it a compelling option for enterprises involved in import/export activities.

- BOQ Specialist: BOQ Specialist excels in personalized service, delivering tailored financial advice and solutions, particularly for professionals in specialized sectors. Their approach fosters strong relationships, ensuring clients receive the guidance necessary to navigate their unique financial landscapes. However, some clients may find the offerings of the best commercial loan companies to be limited compared to larger institutions.

- Liberty Financial: Liberty stands out by considering non-traditional income sources, broadening access for a diverse range of borrowers. This flexibility is especially advantageous for individuals whose financial circumstances may not meet traditional borrowing standards, enabling them to obtain funding from the best commercial loan companies that aligns with their requirements. Nonetheless, borrowers should be aware of potentially higher interest rates associated with this flexibility.

- ING Broker: Known for competitive rates and a straightforward application process, ING Broker appeals to borrowers seeking efficiency and transparency. Their streamlined method simplifies the lending experience, making it easier for companies to access the capital they require from the best commercial loan companies. However, their offerings may not be as comprehensive as those of larger banks.

- CommBank: Beyond loans, CommBank provides a comprehensive range of financial products, including cash flow management tools and advisory services for enterprises. This holistic approach enhances their value proposition, equipping organizations with the resources necessary for sustainable growth. On the downside, their larger size may lead to less personalized service compared to boutique lenders.

Alongside these financiers, collaborating with Finance Story can grant you access to a complete range of lenders, including high street banks and creative private finance panels. Our expertise in developing refined and personalized cases ensures that you can secure the right financing customized to your evolving needs. As minor enterprises increasingly utilize credit for expansion—demonstrated by an average request of $94,845—grasping these subtleties becomes crucial for choosing the best commercial loan companies as their financial partner. Furthermore, with broker-originated lending increasing to 40%, small enterprises are increasingly seeking the best commercial loan companies, making it essential to consider the unique characteristics of commercial loan providers in Australia in 2025.

"I will definitely be recommending your company to anyone. We are finished with the constant worry. Once again, thank you so much for being a part of our journey." - Natasha B, VIC

Best Fit for Different Borrower Profiles

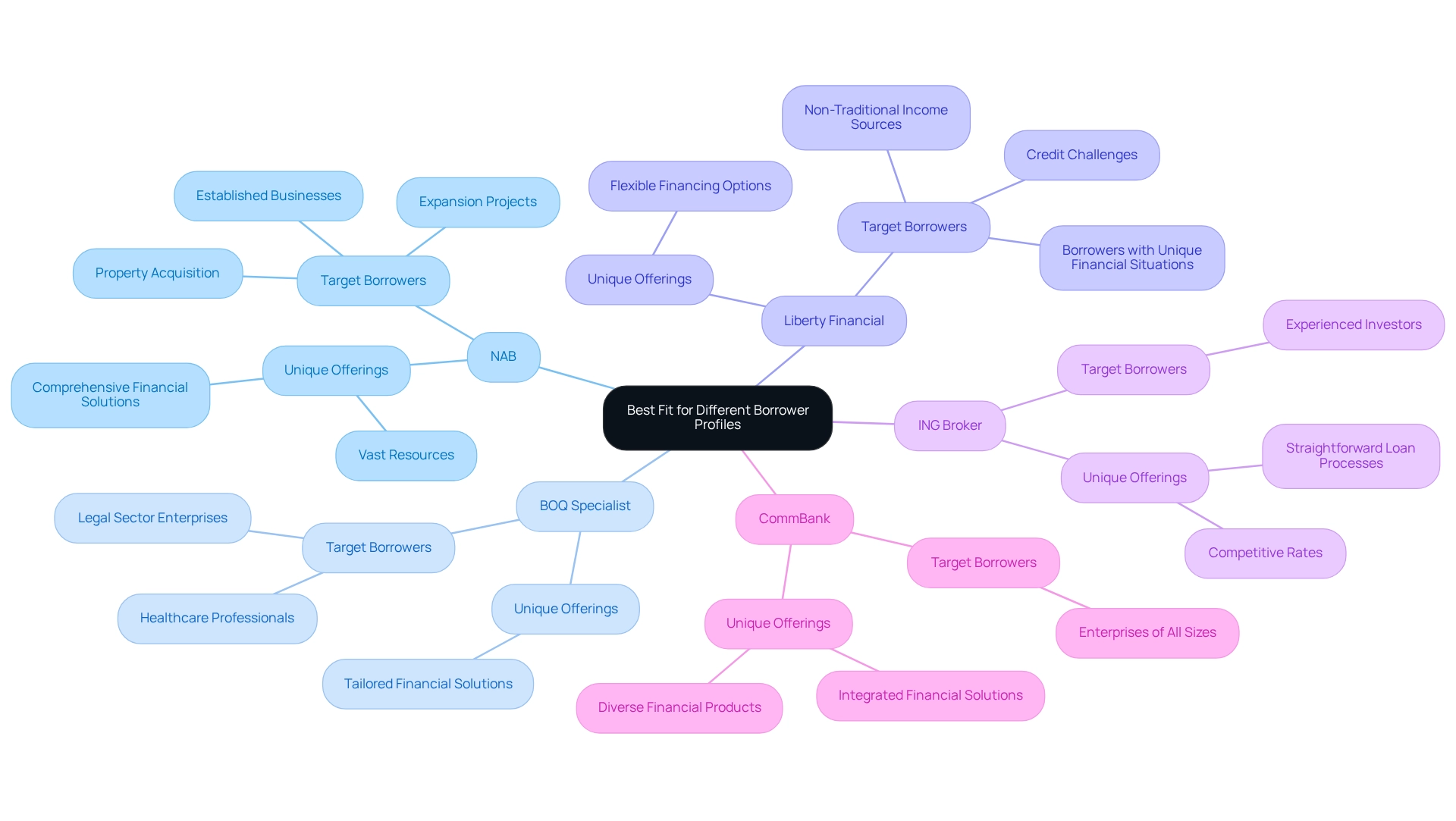

Different lenders, such as the best commercial loan companies, cater to various borrower profiles, making it essential to align the right lender with the right client. NAB is best suited for established businesses seeking comprehensive financial solutions, particularly those requiring significant funding for expansion or property acquisition. NAB's vast resources and expertise render it a reliable option for larger projects.

-

BOQ Specialist: Ideal for professionals and enterprises in specialized markets, such as healthcare and legal sectors, needing tailored financial solutions. Their focused approach ensures that unique industry needs are met effectively.

-

Liberty Financial: A suitable choice for borrowers with unique financial situations, including those with non-traditional income sources or credit challenges. Liberty's flexibility accommodates a diverse range of financial profiles.

-

ING Broker: Best for experienced investors looking for competitive rates and straightforward loan processes, particularly in commercial property investments. Their efficient method appeals to individuals familiar with the financing landscape.

-

CommBank: Appropriate for enterprises of all sizes that require a diverse array of financial products and services, including integrated financial solutions. CommBank's extensive offerings make it one of the best commercial loan companies, providing a versatile choice for various commercial needs while understanding the optimal fit for different borrower profiles is crucial for navigating the financing landscape effectively. As the demand for tailored financing solutions continues to rise, Finance Story specializes in crafting polished and highly individualized business cases to present to lenders. This ensures that clients secure the right funding for their business investments, whether it be a warehouse, retail premise, factory, or hospitality venture. By leveraging insights from case studies and our extensive network of lenders, including high street banks and innovative private lending panels, clients can make informed decisions that align with their financial goals.

Interest Rates and Fees Comparison

When evaluating commercial loans, understanding interest rates and associated fees is essential for making informed financial decisions:

- NAB: Offers competitive interest rates starting at approximately 5.5% for secured loans, accompanied by various fees, including establishment and ongoing service fees.

- BOQ Specialist: Interest rates generally vary from 5.0% to 6.0%, based on the financing structure, with minimal fees for SMSF financing, making it a desirable choice for investors.

- Liberty Financial: Known for its flexible rates, Liberty's interest rates begin around 6.0%, with potential fees that may include application and valuation charges, catering to diverse borrowing needs.

- ING Broker: Provides competitive rates starting at 5.25%, featuring a transparent fee structure that ensures no hidden costs, appealing to borrowers seeking clarity.

- CommBank: Interest rates typically vary from 5.5% to 7.0%, with different charges depending on the type of credit, including setup and monthly service fees, which can affect total borrowing expenses.

This comparison underscores the significance of understanding the total cost of borrowing from the best commercial loan companies, as it can vary considerably between different lenders. For instance, the framework of an enterprise—whether a sole proprietorship or a limited company—can affect credit eligibility and personal financial responsibility. This emphasizes the necessity for thorough evaluation of organizational structure when pursuing funding. As robust commercial activity can enhance financing opportunities, potential borrowers should evaluate their options thoroughly to secure the best commercial loan companies and obtain the most favorable terms.

Furthermore, small enterprise owners can simplify their financing application procedure by using online forms accessible for evaluating funding requirements. Finance Story focuses on developing refined and highly tailored business cases to present to banks, ensuring that clients are well-prepared to manage the intricacies of business financing. As noted by Dr. Zafar Abbas Zaidi Syed, "I think Nishani and Tanmay did a great job when you help me to take a first step for the mortgage for my first home, it showed that you had professional skills to take your customers ahead." This highlights the significance of expert advice in managing the intricacies of business financing. Moreover, the average interest rates and charges for business financing in Australia for 2025 should be taken into account to ensure borrowers are well-informed.

Customer Service and Support

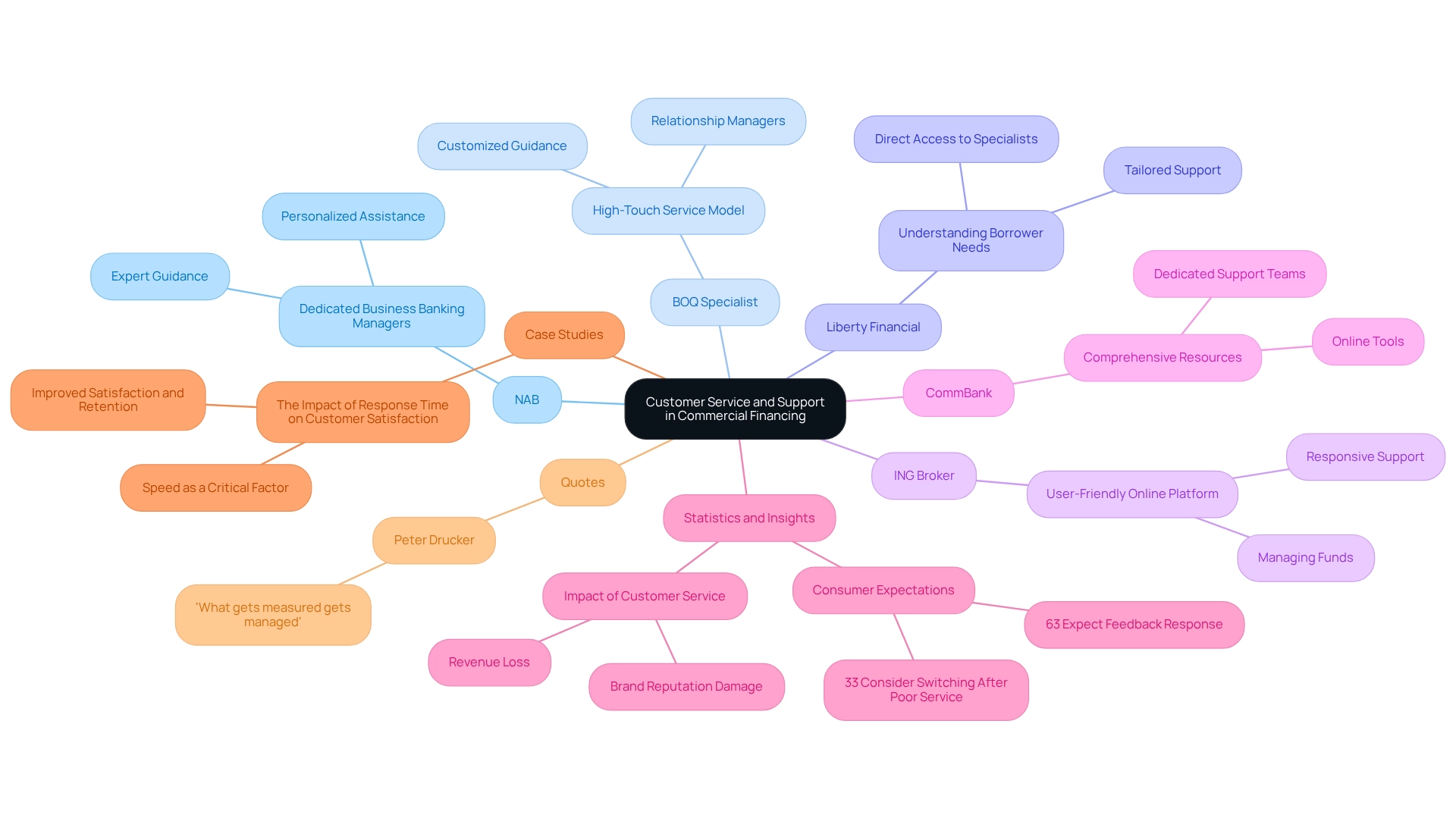

Customer service and support play a pivotal role in shaping the lending experience, particularly in commercial financing. As we approach 2025, lenders increasingly recognize that exceptional customer service can significantly influence borrower satisfaction and retention.

- NAB sets itself apart through its dedicated business banking managers, who provide personalized assistance throughout the financing process. This ensures clients receive expert guidance tailored to their unique requirements.

- BOQ Specialist exemplifies a high-touch service model by assigning relationship managers to clients. This approach not only provides customized guidance but also fosters strong relationships.

- Liberty Financial prioritizes customer service by focusing on understanding individual borrower needs. Clients benefit from direct access to financing specialists for tailored support.

- ING Broker enhances the customer experience with a user-friendly online platform for managing funds, complemented by responsive support to address client inquiries promptly.

- CommBank offers a wealth of resources, including online tools and dedicated support teams, ensuring clients receive comprehensive assistance throughout their financing journey.

At Finance Story, we understand that crafting a polished and individualized business case is essential for securing the right financing. Our expertise in developing tailored loan proposals empowers clients to effectively present their needs to lenders, enhancing their chances of approval. The importance of customer service in business financing cannot be overstated. Statistics indicate that 63% of consumers expect businesses to listen and respond to their feedback, a vital aspect in the finance sector where understanding borrower requirements can lead to customized solutions. Furthermore, 33% of consumers would consider switching providers immediately after a poor customer service experience, underscoring the potential revenue loss and damage to brand reputation that lenders face in a competitive market. This highlights the necessity for lenders to cultivate responsive and knowledgeable teams that can effectively support borrowers.

Case studies demonstrate that businesses prioritizing fast response times can significantly enhance customer satisfaction and retention rates. For instance, the case study titled "The Impact of Response Time on Customer Satisfaction" illustrates that companies responding quickly to inquiries not only improve satisfaction but also foster loyalty among clients. As Peter Drucker aptly stated, 'What gets measured gets managed,' emphasizing the significance of monitoring customer service effectiveness in finance.

As the lending landscape evolves, the emphasis on customer support will remain a key differentiator among the best commercial loan companies, shaping the future of borrower relationships.

Conclusion

In the dynamic realm of commercial lending, businesses encounter a multitude of options designed to cater to their specific financial needs. This article has underscored the unique features and advantages of top commercial loan providers, including:

- NAB

- BOQ Specialist

- Liberty Financial

- ING Broker

- CommBank

Each lender presents distinct strengths—NAB's extensive offerings, BOQ Specialist's customized services, and Liberty Financial's innovative solutions—ensuring borrowers can identify a fitting match for their requirements.

The comparative analysis of loan products, interest rates, and customer service highlights the critical importance of selecting the appropriate lender. Grasping the nuances of each provider—from competitive rates to personalized support—empowers businesses with the essential knowledge to make informed decisions. As the demand for adaptable financing solutions continues to escalate, the insights provided in this article serve as an invaluable resource for navigating the complexities of commercial loans.

Ultimately, the quest for securing the right financing transcends mere numbers; it is equally dependent on the caliber of customer service and support that lenders provide. By prioritizing the establishment of strong relationships and delivering tailored solutions, commercial loan providers can significantly enhance the borrowing experience. As businesses strive to flourish in a competitive landscape, leveraging these insights will be pivotal in making strategic financial decisions that align with their growth objectives.