Overview

This article highlights the essential criteria for selecting the best business loan brokers while offering comparative insights into various brokers available in the market. It underscores the significance of factors such as lender network, customer service, fees, and reputation. Notably, brokers like Finance Story excel in these areas, providing tailored financing solutions specifically designed for small business owners.

Are you aware of how these factors can impact your financing options? Understanding these elements can help you make informed decisions that align with your business needs.

Introduction

In the intricate realm of business financing, the choice of a loan broker can profoundly influence a small business's capacity to secure funding. With a plethora of options at their disposal, entrepreneurs must grasp the essential criteria for selecting a broker to successfully navigate this complex landscape.

- Evaluating lender networks and expertise

- Assessing customer service and fee transparency

These are critical factors that significantly impact finding the ideal match for specific financial needs. As the demand for customized solutions continues to escalate, this analysis explores the strengths and weaknesses of leading brokers, illustrating how they address diverse client requirements and adapt to the shifting trends of the market.

Key Criteria for Selecting a Business Loan Broker

When choosing a financial intermediary, small enterprise owners must evaluate several important factors:

- Lender Network: A broker's access to a diverse range of lenders is crucial, as it directly influences the variety of loan options available. Brokers like Finance Story, considered among the best business loan brokers, have an extensive array of lenders including major banks, private financiers, and boutique investors, allowing them to offer customized solutions that match specific organizational needs and improve the chances of obtaining advantageous terms. Their proficiency in developing refined and highly personalized business cases guarantees that customers maneuver through the complexities of different financing options, enabling informed choices that address their distinct situations.

- Customer Service: The quality of support and communication from an intermediary is vital. Those who prioritize customer relationships, like Finance Story, tend to deliver personalized service, which can simplify the loan process and improve overall satisfaction. As one pleased customer observed, the assistance provided eased their ongoing concerns, emphasizing the significance of an agent's dedication to their customers' experiences.

- Fees and Transparency: Understanding the fee structure is essential for avoiding unexpected costs. The best business loan brokers should clearly communicate their fees and compensation methods, ensuring transparency throughout the engagement. For instance, if you choose to pay upfront fees, expect to pay around 2% of the total amount borrowed.

- Reputation and Reviews: Examining a firm's reputation through customer testimonials and industry evaluations can offer essential insights into their trustworthiness and efficiency. Positive feedback, such as that from clients of Finance Story, often reflects the dedication of the best business loan brokers to client success and satisfaction. In 2023, it was observed that 24% of commercial lending was aimed at ethnic minority-led enterprises and 41% at women-led enterprises, highlighting the role of the best business loan brokers in facilitating access to funding for diverse entrepreneurs. As Anja Pannek, CEO of the Mortgage & Finance Association of Australia, remarked, 'The ongoing underrepresentation of women in mortgage and finance broking is a concern we are persistently addressing with the industry and offering resources to assist enterprises in making positive strides towards diversity and inclusion.' Moreover, the best business loan brokers can save time and provide access to various lenders, ultimately resulting in improved financing choices for small enterprises. A case study titled 'The Role of Loan Intermediaries in Financing' emphasizes that intermediaries play a crucial role in aiding small enterprises to navigate the financing landscape and obtain essential funding, showcasing how Finance Story supports customers in achieving their financial objectives.

Comparative Analysis of Leading Business Loan Brokers

This comparative analysis evaluates several prominent business loan brokers based on essential criteria:

- Broker Name: Finance Story

- Lender Network: Extensive

- Specialization: Commercial & Residential

- Customer Service: High

- Fees Structure: Transparent

- Reputation: Excellent

- Broker Name: OnDeck

- Lender Network: Moderate

- Specialization: Small Business Loans

- Customer Service: Good

- Fees Structure: Competitive

- Reputation: Very Good

- Broker Name: Bizcap

- Lender Network: Broad

- Specialization: Flexible Funding

- Customer Service: Excellent

- Fees Structure: Low Fees

- Reputation: Excellent

- Broker Name: VOXFIN

- Lender Network: Limited

- Specialization: Small Business Loans

- Customer Service: Average

- Fees Structure: Moderate

- Reputation: Good

- Broker Name: Inovayt

- Lender Network: Extensive

- Specialization: Business Growth

- Customer Service: High

- Fees Structure: Transparent

- Reputation: Very Good

This table highlights the distinctions in lender networks, areas of specialization, customer service quality, fee structures, and overall reputations of each broker. For instance, Finance Story is considered one of the best business loan brokers because of its extensive lender network and high customer service ratings, making it a strong contender for both commercial and residential financing needs. Their proficiency in developing refined and customized proposals guarantees that customers can obtain the appropriate financial support tailored to their unique situations, including assets such as warehouses, retail spaces, factories, and hospitality projects.

On the other hand, providers such as OnDeck concentrate mainly on small business loans, presenting competitive fees yet with a more restricted lender network, while the best business loan brokers are increasingly focusing on meeting the growing demand for specialized services in the current financial landscape, as indicated by recent insights from the July 2024 Pulse: Commercial Lending survey that gathered feedback from 123 providers. This aligns with Finance Story's commitment to providing customized solutions through the best business loan brokers that meet various customer needs.

Furthermore, case studies demonstrate practical results, such as an individual who saved over £1,500 over five years by remortgaging through an intermediary, highlighting the potential financial advantages of utilizing these services.

A pertinent case study titled 'Let to Buy Mortgage for Deposit Funding' illustrates how Finance Story enabled a regulated bridging finance solution for a person needing to raise funds for a deposit on a new residential property while undergoing a complex remortgage. This example showcases the brokerage's capability to navigate challenging financial situations effectively, reinforcing their reputation as a leader in tailored financing solutions.

Testimonials from pleased customers further highlight Finance Story's commitment to customer success and satisfaction, and Andrew Beckett, Head of Broker and Third-Party Distribution at Lend, stresses the significance of the best business loan brokers preparing for heightened demand by simplifying application procedures and consistently reconnecting with customers to comprehend their requirements. This insight corresponds with the necessity for agents to adapt to the evolving market, further emphasizing the significance of choosing an agent that not only comprehends the nuances of the market but also provides customized solutions to meet diverse client needs.

Tailored Solutions for Small Business Owners: Broker Suitability

For small business owners in search of effective funding options, working with the best business loan brokers to obtain tailored financing solutions is essential. Here’s how various brokers cater to these specific needs:

- Finance Story: Renowned for its personalized approach, Finance Story excels in delivering bespoke solutions for both commercial and residential customers. Established by Shane, a seasoned expert in enterprise growth and funding, the brokerage boasts over 30 years of experience navigating complex financial situations. Shane's extensive background in high-level consultancy and multi-million dollar projects ensures that individuals receive the most suitable funding options tailored to their unique circumstances. Finance Story focuses on developing refined cases for funding proposals, significantly improving the likelihood of obtaining financial support. This dedication to understanding customer requirements has resulted in high success rates for personalized financing options, particularly in refinancing and securing customized commercial property funding. With access to a comprehensive portfolio of lenders, Finance Story can offer a wide range of financing options to meet diverse client needs.

- OnDeck: Focusing on small enterprise financing, OnDeck provides rapid funding solutions with adaptable repayment choices. This positions it as a perfect option for startups and expanding enterprises that require prompt funds to capitalize on opportunities or manage cash flow effectively.

- Bizcap: Centered on flexible funding, Bizcap offers a variety of loan products that can be customized to meet the unique cash flow needs of small businesses. This flexibility ensures that customers can respond effectively to shifting market circumstances, thereby enhancing their financial resilience. Brokers that integrate Bizcap's innovations can position themselves as the best business loan brokers by improving their capacity to meet customer needs, diversifying their offerings, and establishing themselves as strategic partners.

- VOXFIN: Although VOXFIN operates with a more restricted lender network, it emphasizes personalized service, assisting clients in securing the best possible terms for their small enterprise loans. This tailored approach fosters strong relationships and trust between the broker and clients.

- Inovayt: Concentrating on growth, Inovayt provides financing solutions that align with the long-term objectives of small enterprise owners. This focus on strategic expansion makes them an attractive option for entrepreneurs aiming to broaden their operations. Statistics reveal that small enterprise financing (under $1 million) constitutes 12.6% of small community banks’ assets, underscoring the importance of customized funding in the small enterprise sector. Furthermore, Goldman Sachs indicates that 70% of small enterprise funding is supplied by banks with under $250 billion in assets, emphasizing the competitive landscape for small enterprise financing. Additionally, variations in typical loan approval amounts, such as the decrease from $704,581 in 2021 to $538,903 in 2022, highlight the necessity for enterprises to remain vigilant regarding financial trends when making funding choices. Brokers like Finance Story, recognized as some of the best business loan brokers, with their innovative and adaptable solutions, are well-positioned to assist small business owners in navigating these challenges effectively.

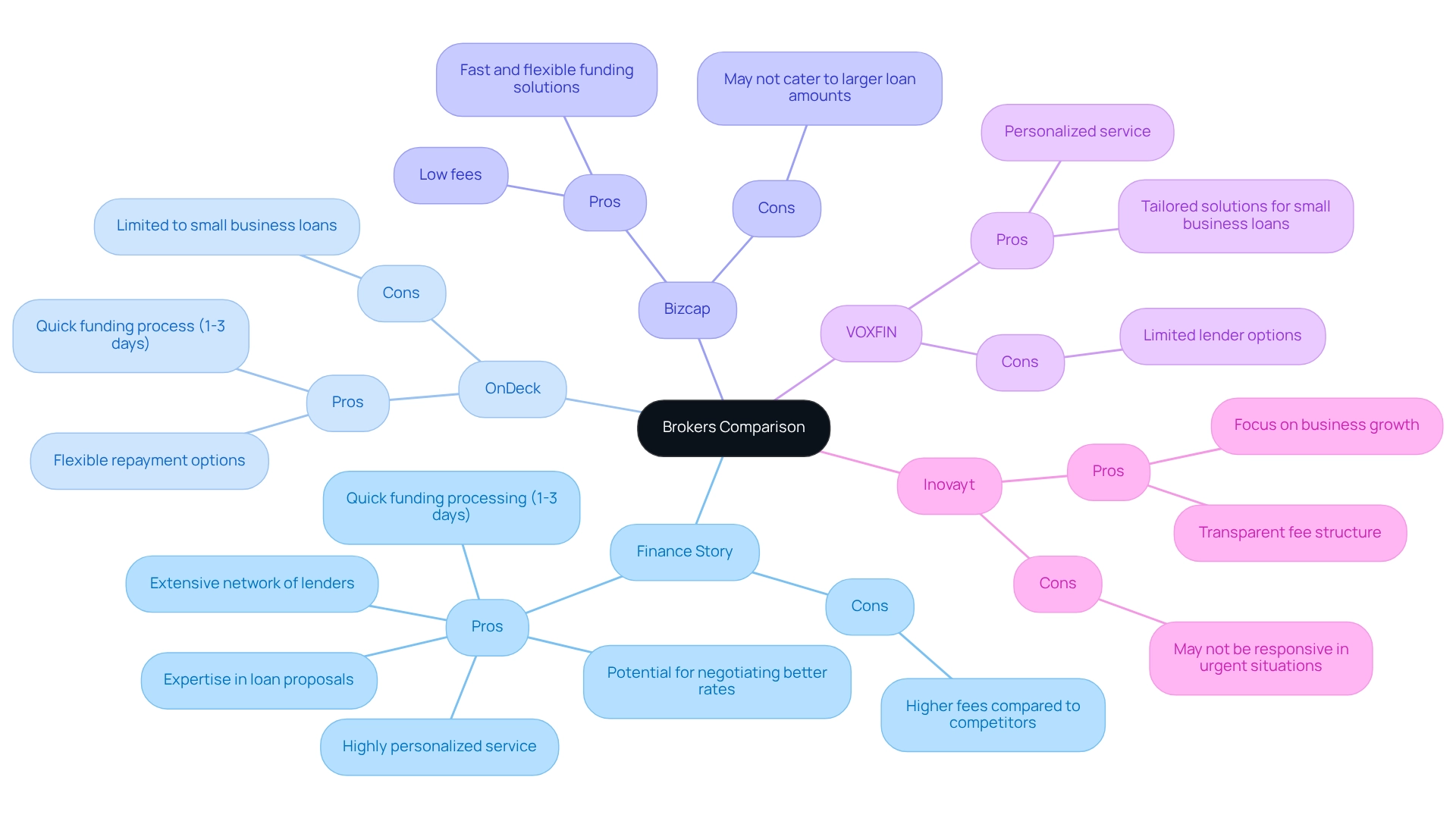

Pros and Cons of Each Broker

Here’s a breakdown of the pros and cons for each broker:

-

Finance Story

- Pros:

- An extensive network of lenders offers a wide range of options tailored to meet diverse financing needs.

- The service is highly personalized, backed by a strong reputation for customer satisfaction, as many clients report a seamless loan process.

- Expertise in creating polished and individualized loan proposals ensures that clients can secure funding even in challenging circumstances.

- There is potential for negotiating better rates despite higher fees, as indicated in the cost comparison between brokers and direct lenders.

- Funding can be processed quickly, often within 1 to 3 working days, allowing businesses to access capital when they need it most.

- Cons:

- Fees may be higher compared to some competitors, which could impact overall loan costs, with interest rates from competitors like Zip Business Loans ranging from 0.50% to 2.50% per month.

- Pros:

-

OnDeck

- Pros:

- The funding process is quick, with funds often available within 1 to 3 working days.

- Flexible repayment options can accommodate varying business cash flows.

- Cons:

- Services are limited to small business loans, which may not suit all financing needs.

- Pros:

-

Bizcap

- Pros:

- Offers fast and flexible funding solutions that cater to urgent financial needs.

- Low fees make it an economical choice for many businesses.

- Cons:

- May not cater to larger loan amounts, limiting options for growing businesses.

- Pros:

-

VOXFIN

- Pros:

- Focuses on personalized service, ensuring clients feel supported throughout the process.

- Good for small business loans, with tailored solutions available.

- Cons:

- Limited lender options may restrict competitive rates.

- Pros:

-

Inovayt

- Pros:

- Strong focus on business growth, providing strategic financial advice.

- Features a transparent fee structure, allowing clients to understand costs upfront.

- Cons:

- May not be as responsive as others in urgent situations, potentially delaying funding decisions.

- Pros:

Future Trends in Business Loan Brokerage

The business financing brokerage landscape is undergoing a significant transformation, with the best business loan brokers driving this change by harnessing advanced technology, such as AI-driven platforms and automated underwriting systems, to enhance the application process. This results in faster approvals and improved efficiency for clients. Notably, customers utilizing flexible servicing experience a 30% increase in loan repayment rates on average.

Focus on Niche Markets: An increasing number of agents are specializing in niche markets, such as startups or specific industries. This specialization enables the best business loan brokers to provide tailored financing solutions that address the unique needs of these segments. For instance, Finance Story exemplifies this by creating polished and highly individualized business cases tailored to the specific requirements of commercial property investments, including warehouses, retail premises, factories, and hospitality ventures.

Greater Transparency: The demand for openness in fees and loan conditions is on the rise, prompting intermediaries to adopt clearer communication practices. For example, some agents now offer comprehensive analyses of all related expenses in advance, fostering trust and enabling customers to make informed choices.

Sustainability Considerations: With a growing focus on environmental accountability, intermediaries are beginning to provide financing alternatives that promote sustainable business practices, aligning with the principles of contemporary enterprises.

Improved Customer Experience: The emphasis on customer service continues to grow, with agents actively pursuing customer feedback to enhance their offerings and ensure high levels of satisfaction. The incorporation of customer relationship management (CRM) tools enables brokers to tailor interactions and respond more effectively to customer needs. This dedication to service excellence is crucial as companies navigate the complexities of securing financing. Finance Story's expertise in refinancing and securing tailored business loans for commercial properties ensures that clients receive support from the best business loan brokers in meeting their evolving business needs. As the asset finance market demonstrates an 11% increase in new business, reaching £22.5 billion, it is evident that businesses are increasingly turning to asset-based lending as a viable funding option. This trend underscores the importance of adaptability and strategic planning in the brokerage sector, as highlighted by industry experts who assert that those who embrace new opportunities will be well-positioned for success.

Conclusion

Selecting the right business loan broker is a pivotal decision for small business owners seeking funding. A thorough evaluation of key criteria—such as lender networks, expertise, customer service, fee transparency, and reputation—can significantly impact the financing process. Brokers like Finance Story exemplify the benefits of an extensive lender network and personalized service, ensuring that clients receive tailored solutions that meet their unique financial needs.

The comparative analysis of leading brokers reveals distinct strengths and weaknesses, emphasizing the importance of aligning a broker's offerings with specific business goals. Whether opting for quick funding through OnDeck or flexible solutions from Bizcap, understanding these variations is essential for making informed choices.

As the landscape of business financing evolves, trends such as technology integration, niche market specialization, and a focus on transparency highlight the need for brokers to adapt to changing client demands. This evolution not only enhances the client experience but also ensures that small businesses can effectively navigate the complexities of securing necessary funding.

Ultimately, the decision to engage a business loan broker should be guided by a clear understanding of individual financial circumstances and objectives. By prioritizing brokers that offer tailored, transparent, and responsive services, small business owners can position themselves for success in an increasingly competitive marketplace.