Overview

This article delineates the essential requirements for securing owner-occupied commercial real estate loans. It emphasizes the critical components of:

- Documentation

- Financial stability

- Creditworthiness

- Down payment

- The necessity of a well-structured business plan

By meeting these requirements and fostering strong relationships with lenders, borrowers can significantly enhance their chances of loan approval and secure favorable terms. This reflects the increasing trend of owner-occupier borrowing within the commercial property market, underscoring the importance of strategic planning and preparation.

Introduction

The landscape of commercial real estate financing is evolving rapidly, with owner-occupied properties emerging as a focal point for investors. As the demand for tailored loan solutions continues to grow, it becomes crucial for business owners to understand the specific requirements for securing these loans.

What essential elements can make or break a loan application in this competitive market? This article delves into the key requirements for owner-occupied commercial real estate loans, offering insights that empower borrowers to navigate the complexities of financing with confidence.

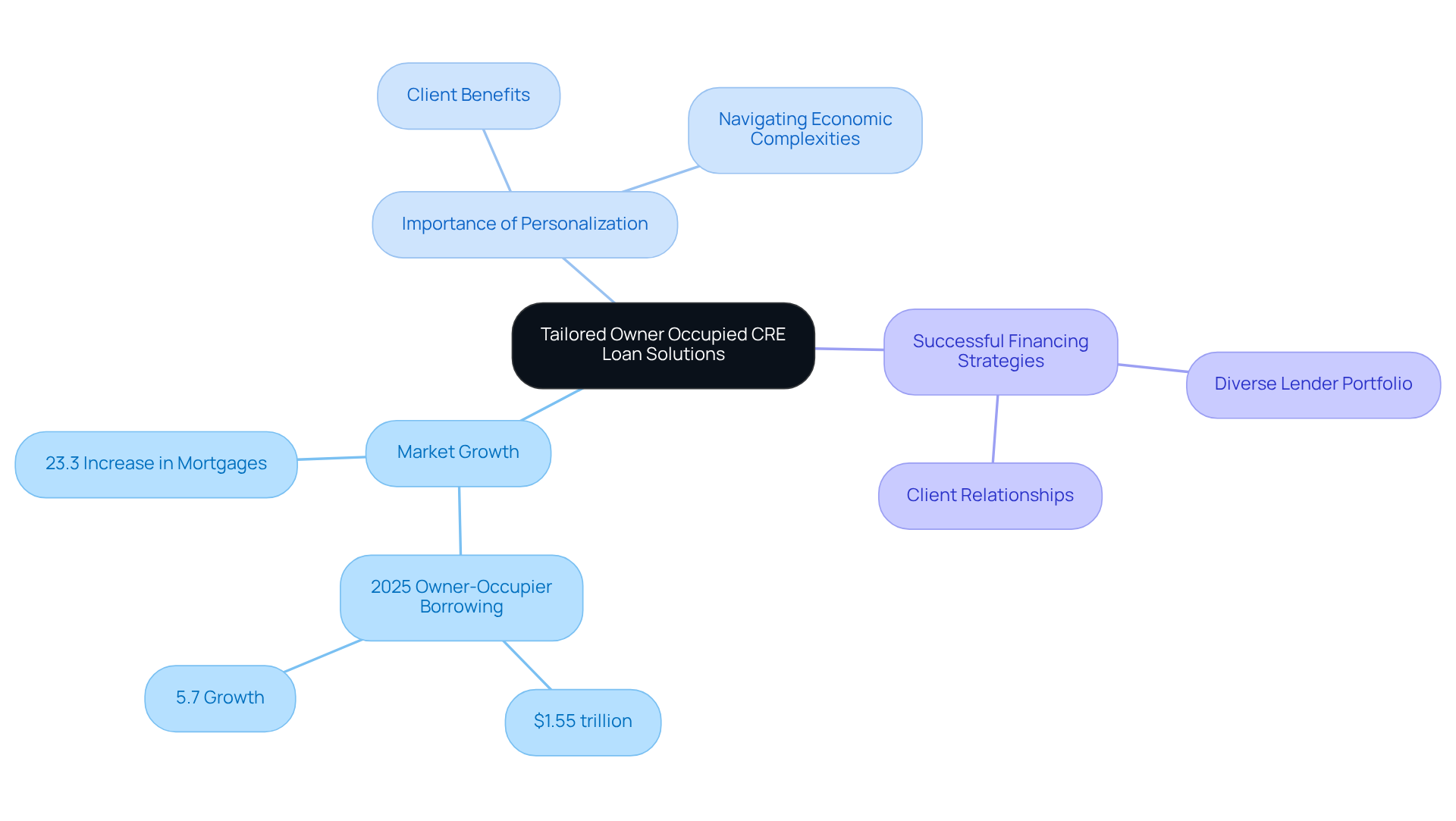

Finance Story: Tailored Owner Occupied Commercial Real Estate Loan Solutions

Finance Story excels in delivering tailored financing solutions, ensuring that the owner occupied commercial real estate loan requirements are met, recognizing that each client's financial situation is unique. This customized approach guarantees that the financial products offered not only satisfy urgent funding needs but also align with long-term business growth strategies. In 2025, the commercial property landscape is characterized by a notable increase in owner-occupier borrowing portfolios, which soared to $1.55 trillion, reflecting a 5.7% annual growth. This trend highlights the increasing commitment of buyers to invest in commercial properties despite prevailing economic pressures.

The significance of personalized service in securing commercial real estate loans cannot be overstated. Clients benefit from tailored funding options that address their specific circumstances, enhancing their ability to navigate the complexities of the economic landscape. As the market evolves, the demand for customized mortgage solutions continues to rise, evidenced by a substantial 23.3% increase in commercial property mortgages reported over the past year.

Successful financing examples demonstrate how Finance Story's personalized approach yields effective outcomes. By leveraging a diverse portfolio of private lenders and conventional institutions, the brokerage can provide clients with a range of choices tailored to their specific needs. This flexibility is crucial in a market where trends indicate a shift towards larger monetary obligations, as illustrated by the average new credit amount for owner occupied commercial real estate loan requirements, which has reached a record high of $640,998.

Financial advisors emphasize that tailored financial services are essential for fostering strong client relationships and ensuring successful financing results. By prioritizing individual client needs, Finance Story positions itself as a trusted partner in the commercial real estate sector, empowering clients to achieve their financial objectives efficiently.

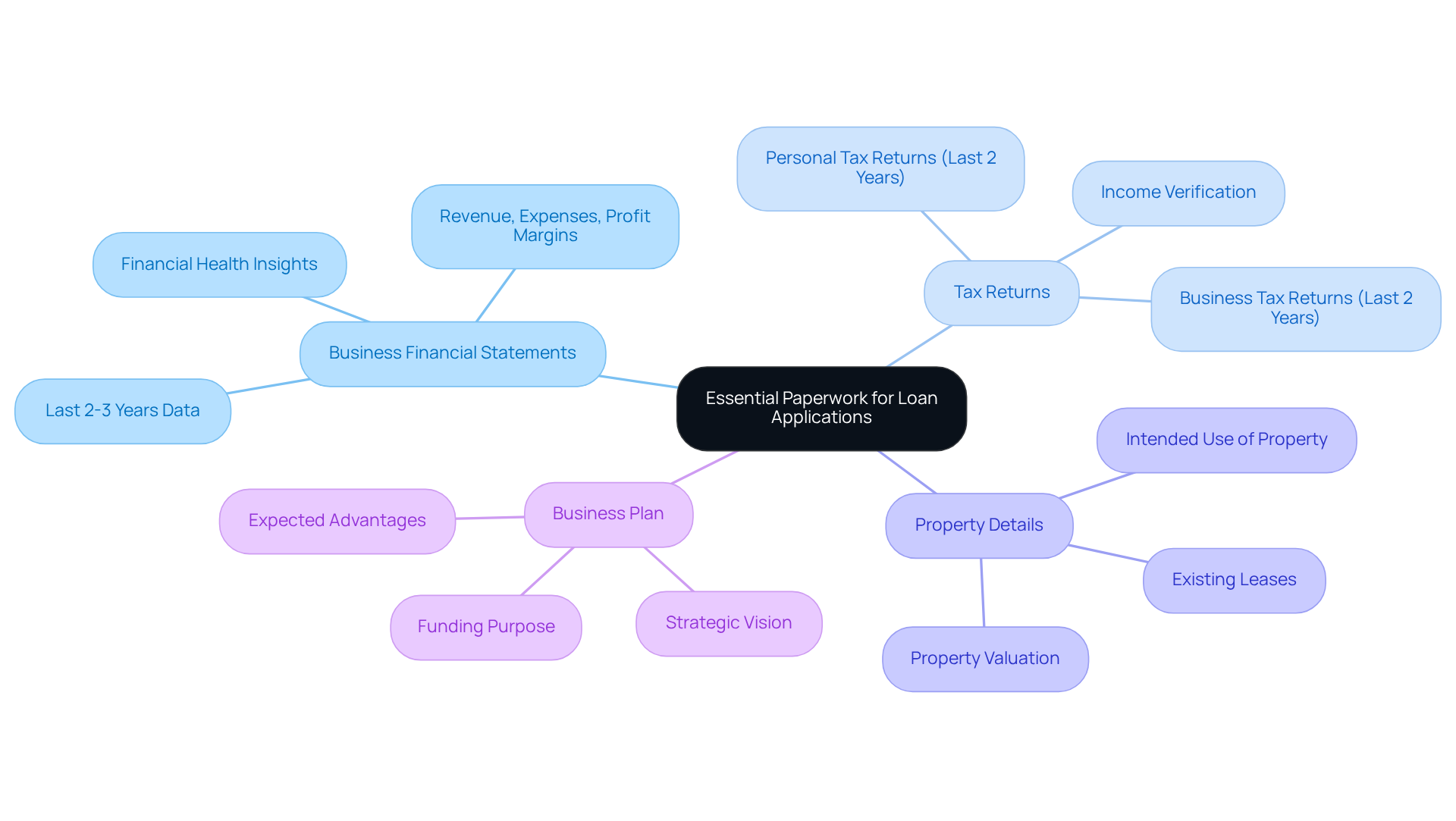

Comprehensive Documentation: Essential Paperwork for Loan Applications

To effectively secure an owner occupied commercial real estate loan requirements, clients must gather several crucial documents that illustrate their economic stability and the feasibility of their enterprise. Key paperwork includes:

- Business Financial Statements: These should encompass the last two to three years, detailing revenue, expenses, and profit margins. This information is vital as it offers lenders insights into the company's financial health.

- Tax Returns: Both personal and business tax returns for the previous two years are typically required to verify income. This documentation assists in creating a steady income source, which is essential for approval.

- Property Details: Comprehensive information about the property being financed is essential. This includes its valuation, any existing leases, and the intended use of the property, which helps lenders assess the investment's potential.

- Business Plan: A well-organized business plan detailing the aim of the funding and its expected advantages to the business is essential. This document not only clarifies the purpose of the financing but also demonstrates the borrower's strategic vision.

Statistics suggest that fulfilling owner occupied commercial real estate loan requirements, which include comprehensive documentation, greatly improves the chances of credit approval, as numerous lenders demand detailed monetary statements and tax returns to evaluate risk precisely. For example, successful candidates frequently provide a comprehensive set of documentation, which can simplify the approval procedure and result in advantageous financing conditions. A case study involving Rameshwara Prabhu illustrates this point; by providing comprehensive economic insights and a targeted strategy, he secured an 80% loan-to-value ratio for his commercial property, showcasing the effectiveness of meticulous preparation in navigating complex lending criteria.

Financial Stability: Demonstrating Your Business's Economic Health

Lenders assess a business's financial stability through several key metrics, which are vital for securing owner-occupied commercial real estate loans:

-

Cash Flow Analysis: A positive cash flow is essential, indicating that the business generates sufficient revenue to cover expenses and loan repayments. This metric reflects the company's operational efficiency and financial health. At Finance Story, we specialize in developing refined and highly customized cases that effectively demonstrate your cash flow to financiers, significantly boosting your likelihood of approval.

-

Debt-to-Income Ratio: This ratio provides insight into how much of the entity's income is allocated to debt repayment. A lower ratio suggests that the company maintains a manageable level of debt compared to its income, which is favorable in the eyes of creditors. Additionally, understanding the debt-to-equity ratio is critical, as it measures the proportion of debt to equity financing in the company’s capital structure. Presenting these ratios can help you make a compelling case to potential lenders.

-

Profitability Metrics: Consistent profitability over time serves as a strong indicator of an enterprise's ability to sustain operations and meet financial obligations. Metrics such as net profit margin and return on assets (ROA) illustrate how effectively a business converts revenue into profit. A profit margin below 5% is considered low, while a margin above 10% is typically regarded as healthy. Highlighting your profitability metrics can enhance your funding proposal.

-

Liquidity Ratios: Evaluating liquidity ratios, such as the current ratio and quick ratio, is crucial for understanding a company's capacity to meet short-term obligations. A current ratio exceeding 1 signifies adequate short-term liquidity, which is a positive sign for creditors. At Finance Story, we assist you in presenting these ratios effectively to strengthen your credit application.

Understanding these financial indicators is essential for small business owners, as they reflect the company's current economic condition and influence creditors' decisions about owner occupied commercial real estate loan requirements during the loan application process. By effectively managing cash flow and maintaining a strong debt-to-income ratio, businesses can enhance their appeal to creditors and increase their chances of securing funding. Moreover, leveraging the full range of financial institutions available through Finance Story can provide you with tailored financing options that address your specific needs. For actionable insights, consider benchmarking your financial metrics against industry standards to identify areas for improvement.

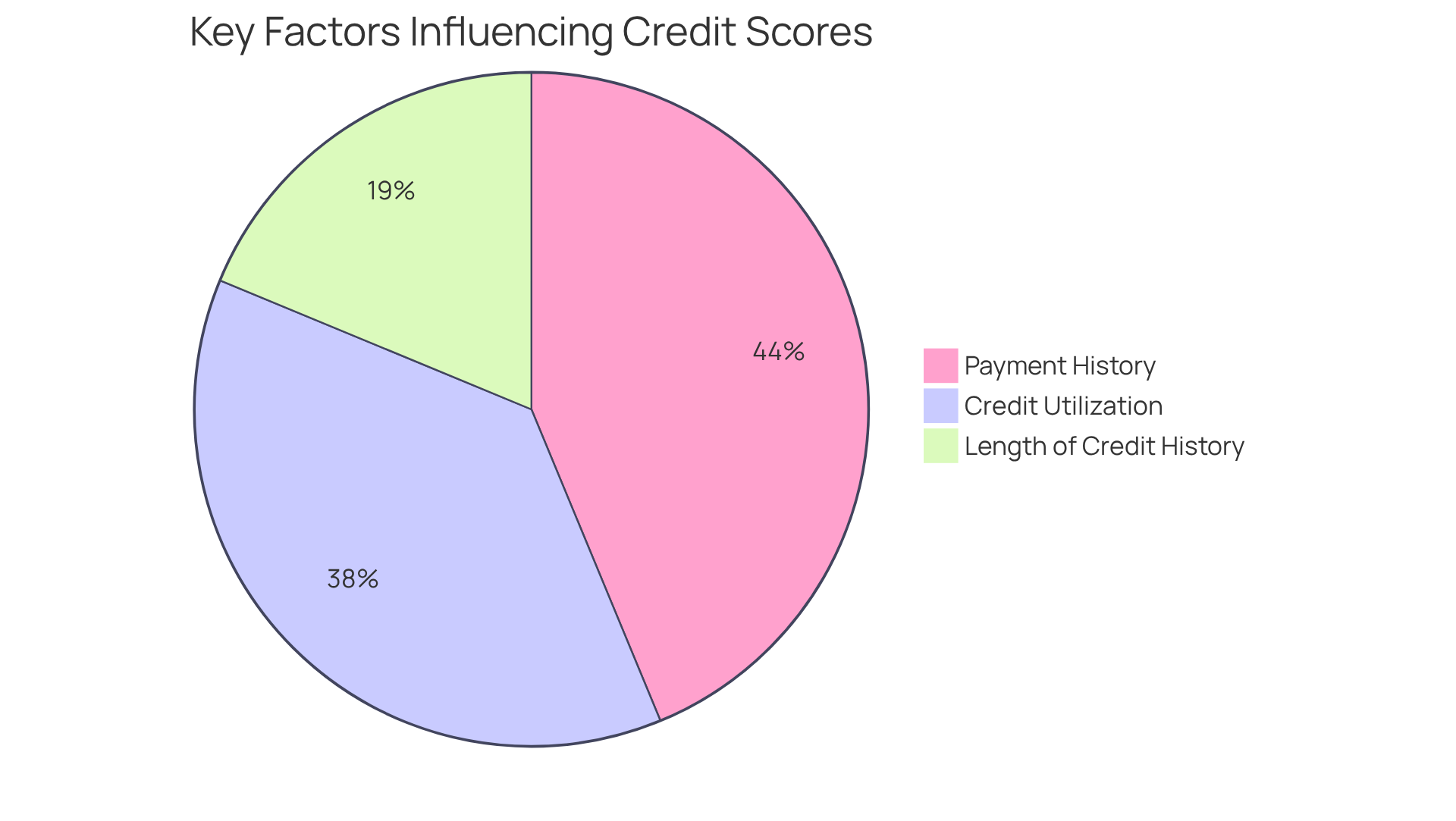

Creditworthiness: Understanding Your Credit Score's Impact

Creditworthiness is fundamentally shaped by your credit score, which reflects your debt management history. The key factors influencing this score include:

- Payment History: Consistently making timely payments on existing debts is crucial, as this aspect accounts for 35% of your credit score. A strong track record in this area can significantly enhance your creditworthiness. For instance, maintaining a good payment history can help improve your score, especially for those with below-average credit.

- Credit Utilization: Maintaining low credit card balances relative to your credit limits is essential. Ideally, your credit utilization ratio should remain below 30%, as high balances can negatively impact your score, which constitutes 30% of the overall assessment. In Victoria, the average credit score is 881, highlighting the importance of managing credit effectively.

- Length of Credit History: A longer credit history can positively influence your score by providing lenders with more data on your repayment patterns. This factor accounts for 15% of your credit score, making it beneficial to keep older credit accounts active. Women, for example, have an average credit score of 858, compared to 836 for men, indicating trends that may affect creditworthiness.

By comprehending and proactively overseeing these elements, companies can enhance their creditworthiness, thus boosting their likelihood of obtaining favorable financing conditions when seeking funding. Furthermore, practical measures described in case studies, such as settling old debts and reducing credit applications, can further improve credit profiles.

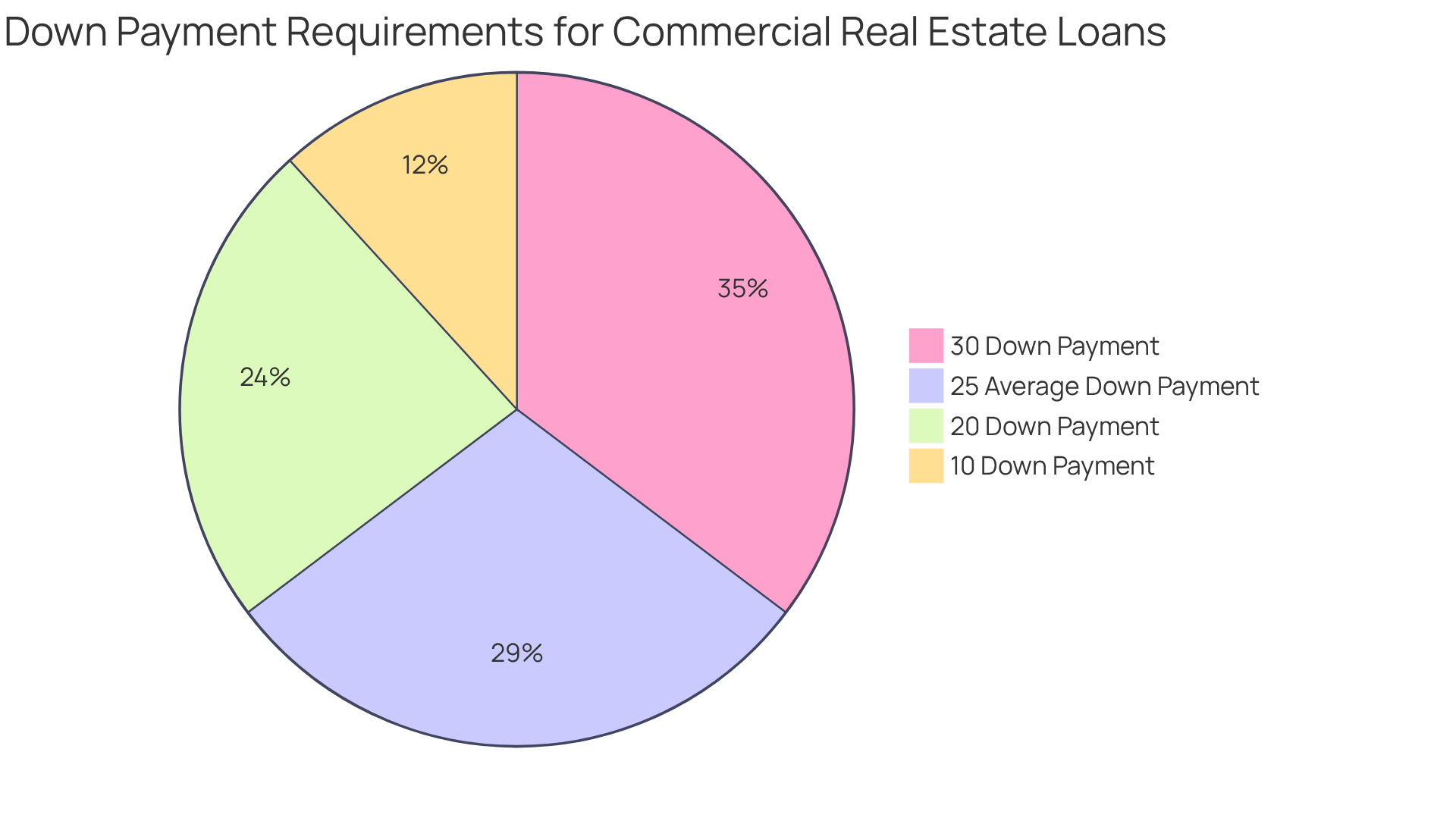

Down Payment Requirements: What You Need to Prepare

For owner occupied commercial real estate loan requirements, down payment typically ranges from 10% to 30% of the property's purchase price, averaging around 25%. Several factors influence the required down payment:

- Property Type: Different types of commercial properties—such as office buildings, retail spaces, and industrial warehouses—often come with varying down payment requirements. Larger or more specialized properties frequently necessitate higher down payments due to perceived risk.

- Creditor Policies: Each creditor has its own criteria, which can significantly affect the percentage required. Some lenders may offer more favorable conditions for established companies with a strong economic history.

- Borrower Profile: A robust economic profile, characterized by good credit scores and healthy cash flow, may enable borrowers to negotiate lower down payment options. For instance, companies in a strong economic position could qualify for SBA funding, which can demand as little as 10% down.

Understanding the owner occupied commercial real estate loan requirements is crucial for potential borrowers. For example, a commercial property priced at $550,000 would typically require a down payment of at least $137,000 using conventional term financing. Additionally, borrowers should be prepared to demonstrate their financial capability through detailed documentation, including financial statements and tax returns, to effectively meet these requirements.

Business Plan: Crafting a Viable Strategy for Loan Approval

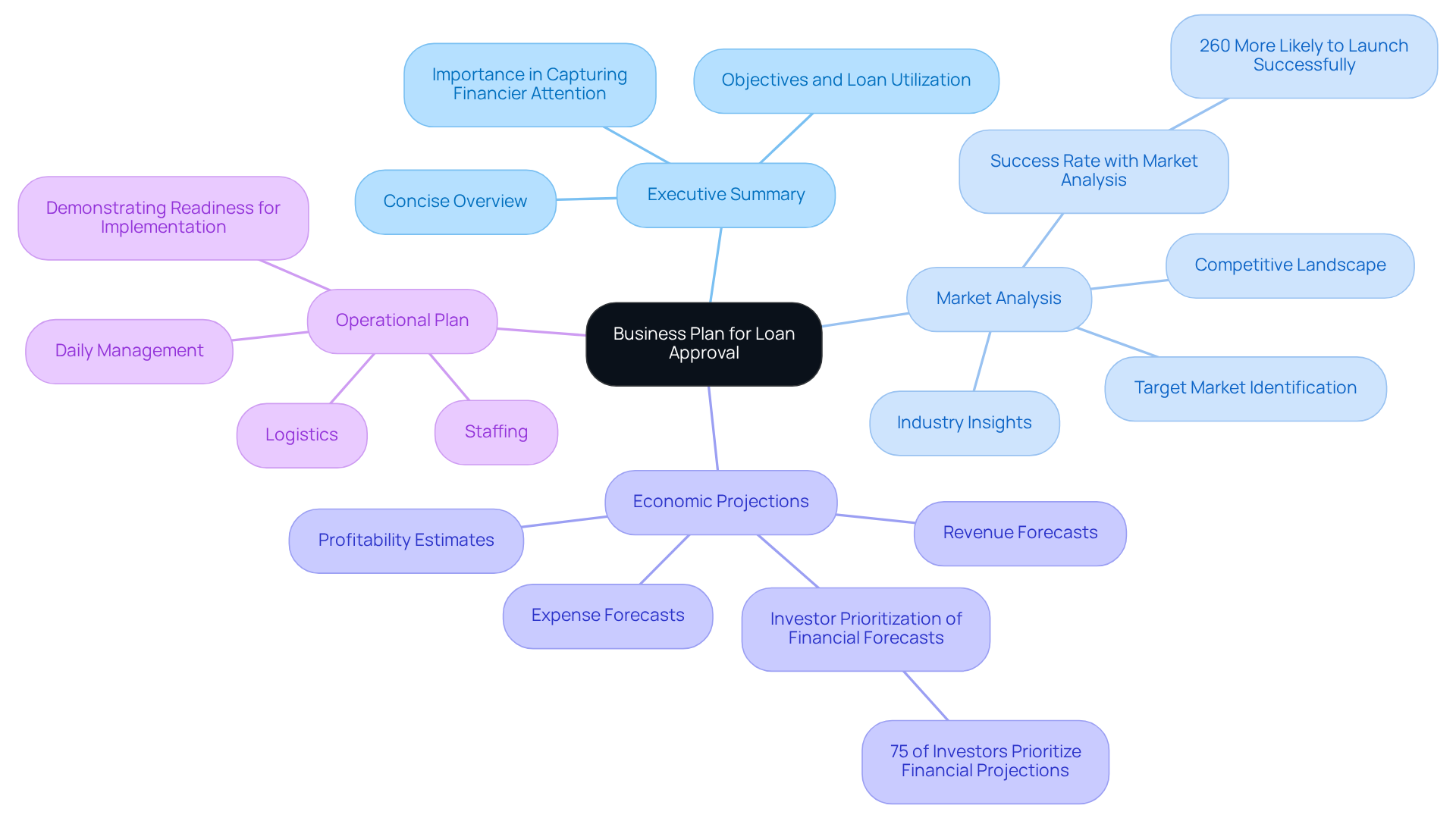

A well-crafted business plan is essential for securing owner-occupied commercial real estate loans and should encompass the following key components:

-

Executive Summary: This section provides a concise overview of the business, outlining its objectives and detailing how the loan will be utilized. A strong executive summary can capture the attention of the financier and set the tone for the entire plan.

-

Market Analysis: A thorough market analysis is crucial, offering insights into the industry, target market, and competitive landscape. Financial specialists stress that grasping market dynamics can greatly improve a company's credibility with lenders. In fact, companies with thorough market analyses are 260% more likely to launch successfully. Furthermore, companies with strategic plans are 2.5 times more likely to obtain loans, emphasizing the significance of this element.

-

Economic Projections: Detailed economic forecasts of revenue, expenses, and profitability over the next few years are vital. These forecasts not only illustrate the organization's potential for expansion but also reassure lenders of its economic viability. Statistics indicate that 75% of investors prioritize financial forecasts in plans, emphasizing their significance in obtaining funding. Furthermore, possessing a strategic plan enhances funding results by more than 25%, rendering this section essential.

-

Operational Plan: This section describes how the organization will function, including staffing, logistics, and daily management. A clearly outlined operational plan demonstrates to financiers that the enterprise is ready for implementation and possesses a distinct strategy for achievement.

By incorporating these elements, companies can present a compelling case to lenders, demonstrating their preparedness for owner-occupied commercial real estate loan requirements and their strategic vision. The funding environment progressively supports those with organized strategies, as shown by the fact that 28% of enterprises with plans obtain investment capital compared to only 12% lacking them. Therefore, dedicating time to developing a solid business strategy is not only advantageous; it is crucial for successful funding acquisition. Additionally, collaborating with Finance Story guarantees that your funding proposal is refined and customized to fulfill the particular requirements of financiers, improving your likelihood of obtaining the essential capital for your commercial property investment. Finance Story offers access to a full range of lenders, including high street banks and innovative private lending panels, suitable for various commercial properties such as warehouses, retail premises, factories, and hospitality ventures.

Property Appraisal: Assessing the Value of Your Investment

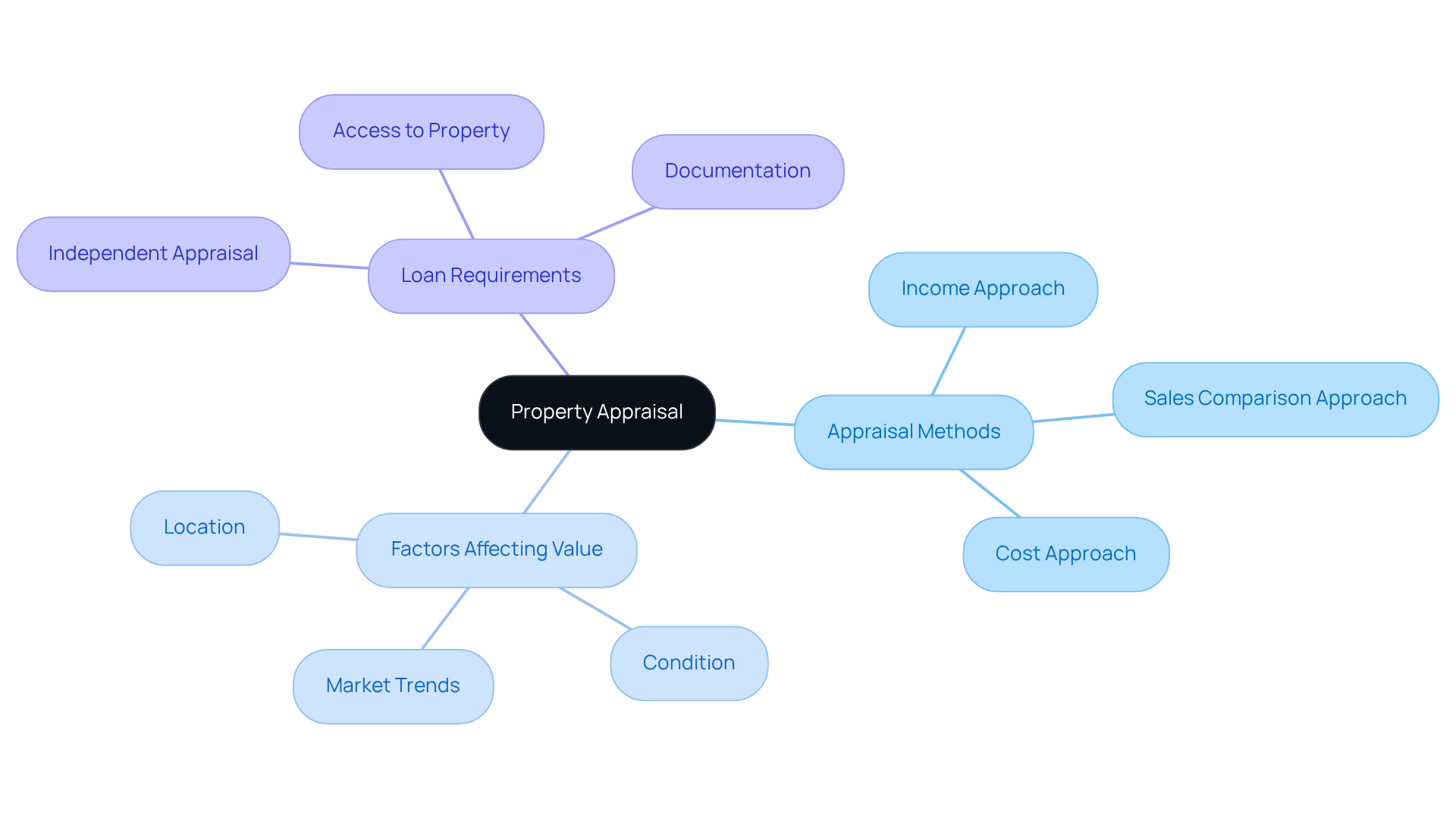

A property appraisal is a critical component of the financing process, determining the market value of the property being funded. This assessment not only impacts credit approval but also shapes the terms and conditions of the financing. Key aspects include:

-

Appraisal Methods: Common methods in commercial lending encompass the income approach, assessing the property's income-generating potential; the sales comparison approach, evaluating the property against similar recently sold properties; and the cost approach, estimating value based on the cost to reproduce improvements, minus depreciation.

-

Factors Affecting Value: Various elements can significantly influence the appraisal outcome. These include the property's location, overall condition, and prevailing market trends. For example, properties in high-demand areas or those with unique features may command higher valuations.

-

Owner Occupied Commercial Real Estate Loan Requirements: Lenders generally require an independent appraisal to ensure that the property's value aligns with the amount borrowed. Clients should be ready to grant access to the property and provide pertinent documentation, such as maintenance records or recent renovations, to facilitate a thorough appraisal process. Accurate evaluations are essential, as they aid in establishing the value-to-equity ratio, which can directly influence interest rates and financing conditions.

Loan Terms and Conditions: Navigating Your Financing Agreement

Understanding the terms and conditions of your credit is essential for effective financing. Key components include:

-

Interest Rates: Choosing between fixed and variable rates significantly impacts overall loan costs. Fixed rates provide stability by securing a specific interest rate for the entire term, while variable rates may fluctuate based on market conditions, potentially leading to lower initial payments but higher expenses over time. At Finance Story, we collaborate with a comprehensive range of lenders to ensure you obtain the best possible interest rates for your commercial investments.

-

Repayment Terms: The duration of the credit and repayment schedule are crucial factors. Typical repayment terms for owner occupied commercial real estate loan requirements range from 15 to 30 years, with various schedules that may include monthly or quarterly payments. Borrowers should also be aware of any penalties for early repayment, which can affect long-term financial planning. Our expertise at Finance Story guarantees that you fully understand these repayment criteria, facilitating better economic planning.

-

Fees and Charges: Additional borrowing costs can accumulate quickly. Common fees include origination fees, appraisal fees, and closing costs. It is vital for clients to meticulously review all terms before signing to ensure they align with their financial capabilities and goals. Grasping the total cost of borrowing, inclusive of these fees, aids in making informed decisions. At Finance Story, we guide you through these complexities, ensuring you are aware of all potential fees and charges.

Effectively navigating these components can lead to a more favorable financing experience, empowering borrowers to secure the best possible terms for their commercial real estate investments. Seeking professional advice from Finance Story can also provide invaluable insights into the complexities of loan agreements.

Lender Relationships: Building Connections for Better Loan Options

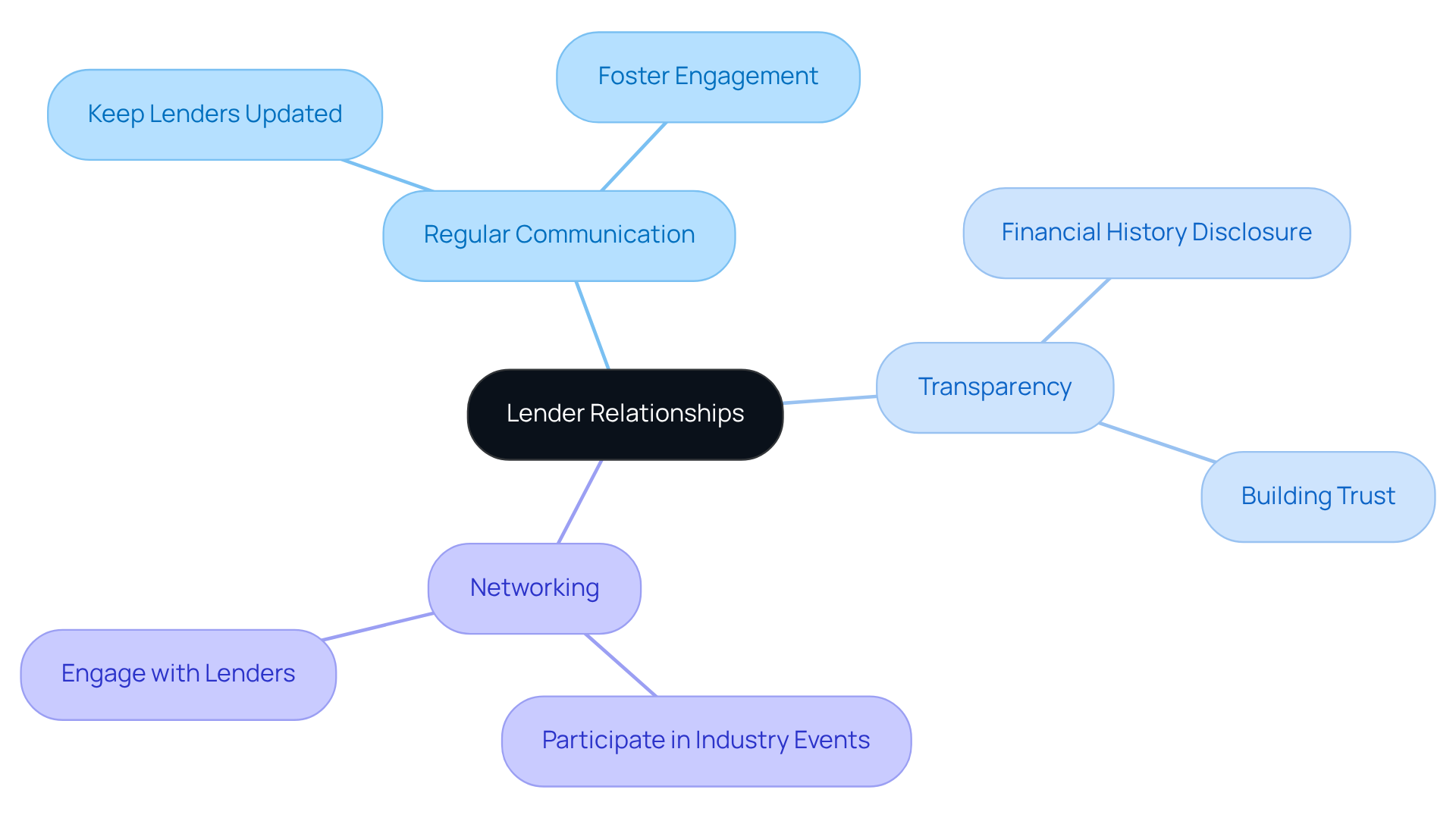

Building strong connections with financial institutions is essential for enhancing your funding experience. At Finance Story, we recognize the owner occupied commercial real estate loan requirements and work closely with you to ensure access to a comprehensive panel of financiers, including mainstream banks, boutique financiers, and private investors. Effective strategies to consider include:

- Regular Communication: Are you keeping lenders updated on your business's progress and any changes in your financial circumstances? This proactive approach fosters engagement and can lead to better financing options.

- Transparency: How forthright are you about your financial history and current needs? Building trust is essential for a successful lending relationship. Our expertise in creating polished and individualized business cases can help you present your needs effectively.

- Networking: Are you actively participating in industry events and engaging with lenders? Building rapport can keep you informed about available financing options. A solid connection can result in more advantageous financing conditions and quicker access to resources.

As Porter Gale aptly states, "Your network is your net worth." By prioritizing these strategies and collaborating with Finance Story, small business owners can navigate the complexities of owner occupied commercial real estate loan requirements more effectively, ultimately securing improved funding options.

Refinancing Options: Planning for Future Financial Flexibility

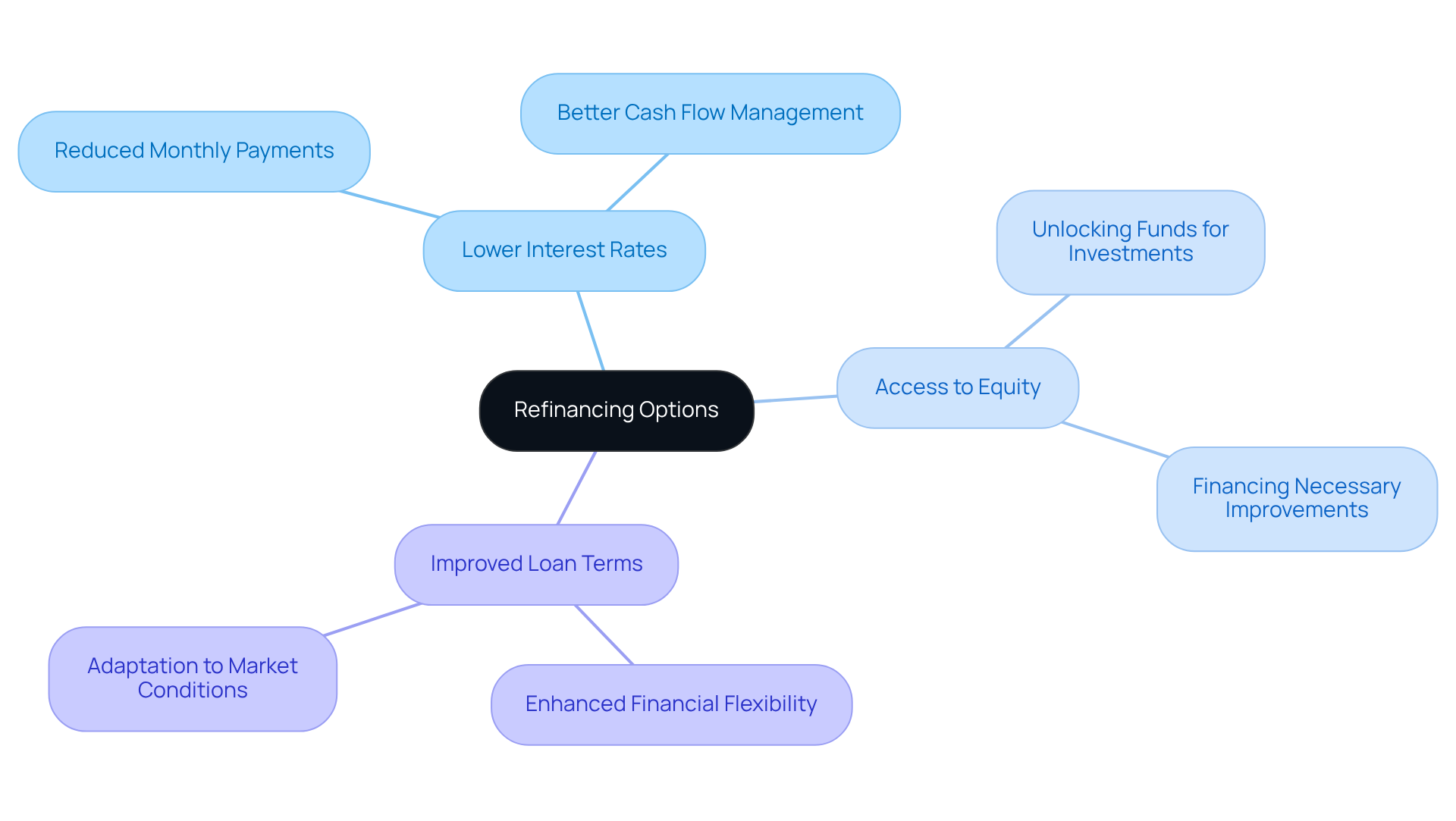

Refinancing your commercial property mortgage presents numerous benefits that can significantly enhance your economic strategy, particularly when working with experts like Finance Story. Key benefits include:

- Lower Interest Rates: When market rates decline, refinancing can lead to reduced monthly payments, facilitating better cash flow management.

- Access to Equity: This process allows you to unlock the equity accumulated in your property, providing essential funds for further investments or necessary improvements.

- Improved Loan Terms: By adjusting the terms of your loan, you can enhance your financial flexibility, making it easier to navigate shifting market conditions.

At Finance Story, we specialize in developing polished and highly individualized business cases for presentation to banks, ensuring you secure the best refinancing options available. We offer a comprehensive range of lenders, including high street banks and innovative private lending panels, tailored to your specific circumstances—whether you are refinancing a warehouse, retail premise, factory, or hospitality venture.

Regularly evaluating your financing terms alongside market trends is crucial. For example, with the recent surge in refinancing activity—over 65,000 home loans were refinanced in the first quarter of 2025, reflecting a 12.5% rise in refinance volumes year-over-year—business owners are actively pursuing improved loan conditions. This trend underscores the importance of remaining informed about potential savings and opportunities within the lending landscape.

Furthermore, small businesses can benefit from refinancing by freeing up cash flow and accessing built-up equity for growth initiatives, which is vital in today's competitive environment. As interest rates fluctuate, understanding when to refinance can be transformative for your financial health. Phil Ringuet, Director of Lending Solutions at Finance Story, emphasizes, "That’s why it’s wise to reach out to us and evaluate your home financing choices early."

Regular reviews of your loan conditions, coupled with consultations with a mortgage broker, can ensure you are making the most informed financial decisions.

Conclusion

Tailored financing solutions for owner-occupied commercial real estate are essential for navigating today's dynamic market. By understanding specific requirements and preparing accordingly, businesses can secure the funding necessary for growth and stability. The emphasis on customized approaches and the importance of thorough documentation cannot be overstated, as they significantly enhance the likelihood of approval and favorable terms.

Key insights from this discussion highlight the critical components of securing these loans, including the necessity of:

- A solid business plan

- Demonstrating financial stability

- Fostering strong lender relationships

The evolving landscape of commercial real estate financing underscores the importance of being informed about market trends and the specific requirements that lenders prioritize, such as creditworthiness and down payment expectations.

Ultimately, the journey toward obtaining financing for owner-occupied commercial properties is not solely about meeting requirements; it is about strategically positioning oneself for success. Engaging with knowledgeable partners like Finance Story can provide invaluable support, ensuring that businesses not only meet their immediate funding needs but also lay a strong foundation for future growth. Embrace the opportunity to refine your approach to commercial real estate financing, as the right strategies and partnerships can lead to significant long-term benefits.