Overview

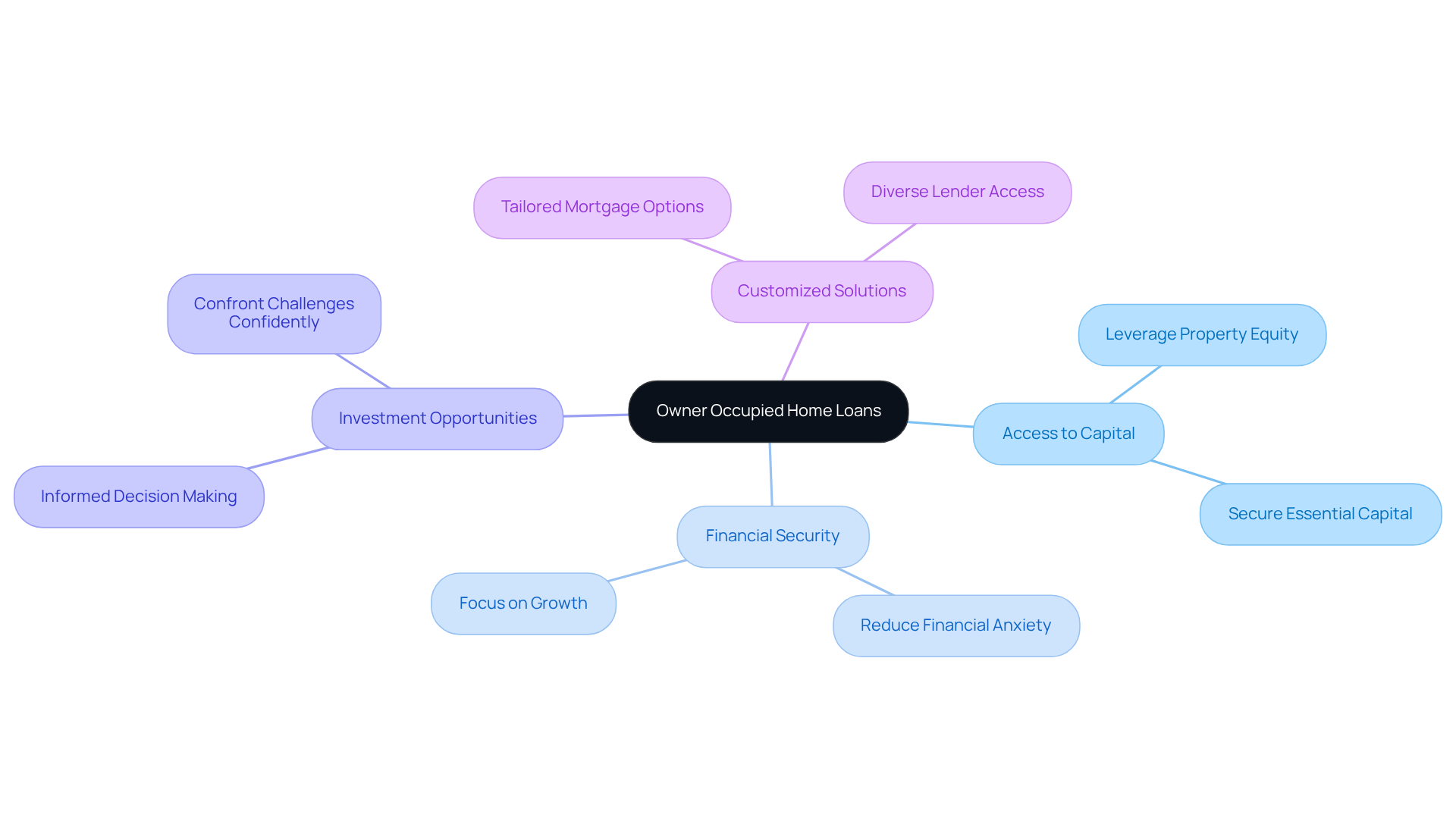

Owner-occupied home loans present significant advantages for small business owners, including:

- Enhanced financial stability

- Tax benefits

- Improved cash flow management

These loans empower entrepreneurs to leverage their primary residence as a source of capital, thereby reducing their tax burden through valuable deductions. Furthermore, they allow for the maintenance of liquidity essential for operational expenses, ultimately fostering business growth and financial security.

Are you maximizing the potential of your primary residence? By understanding how these loans work, you can make informed decisions that positively impact your financial landscape. The ability to access funds from your home can be a game changer, providing the necessary resources to support your business ambitions.

In addition, the tax advantages associated with owner-occupied home loans can significantly alleviate financial pressure. By utilizing deductions effectively, you can keep more of your hard-earned income, allowing for reinvestment into your business. This strategy not only enhances your financial stability but also positions your business for long-term success.

Ultimately, owner-occupied home loans are not just a financial tool; they are a pathway to achieving your business goals. Consider exploring this option further to unlock the potential that lies within your primary residence.

Introduction

Owner-occupied home loans serve as a pivotal financial tool for small business owners, offering a unique blend of personal and professional benefits. By leveraging their primary residence, entrepreneurs can access crucial capital that not only supports their business ventures but also enhances their financial stability.

However, the complexities of navigating these loans can leave many wondering: how can tailored financing solutions truly transform their business landscape?

This article delves into the myriad advantages of owner-occupied home loans, revealing how they can empower entrepreneurs to achieve both personal and professional financial goals.

Finance Story: Tailored Owner Occupied Home Loans for Small Business Owners

Finance Story specializes in offering tailored owner occupied home loans specifically created for small enterprise proprietors. By acknowledging the unique financial situations that entrepreneurs encounter, the brokerage provides customized financing alternatives that meet both professional and personal requirements. This tailored approach streamlines the loan process, significantly enhancing the client experience. Consequently, owners find it simpler to secure owner occupied home loans for their residences while concurrently aiding their entrepreneurial endeavors.

Our dedication to crafting robust proposals guarantees that we collaborate closely with clients to create tailored solutions that not only address immediate monetary needs but also nurture enduring partnerships founded on trust and comprehension. With expert guidance throughout your monetary journey, Finance Story is well-equipped to navigate the complexities of the economic landscape.

This trend emphasizes the increasing demand for customized funding that assists small enterprise leaders in reaching their monetary objectives. Are you ready to explore how tailored financing can empower your business and personal aspirations? Let us help you achieve your financial goals with confidence.

Financial Stability: Secure Your Business with Owner Occupied Home Loans

Owner occupied home loans serve as a vital resource for small enterprise owners, allowing them to leverage their primary residence as collateral to secure essential capital. This approach not only facilitates access to funds but also fosters a sense of financial security, empowering entrepreneurs to concentrate on growth without the anxiety of unpredictable financial fluctuations.

Have you considered how a home mortgage could benefit your business? Engaging with Finance Story about your next home mortgage is straightforward and effective. By tapping into their property equity, entrepreneurs can make informed decisions, invest in new opportunities, and confront challenges with greater confidence.

With a comprehensive array of lenders and mortgage options available, the stability provided by owner occupied home loans is crucial for fostering long-term success. It allows business owners to focus on strategic planning and operational efficiency, ultimately enhancing their enterprise's resilience in a competitive landscape.

Connect with us to explore customized refinancing solutions that can help you access equity and capitalize on lower rates.

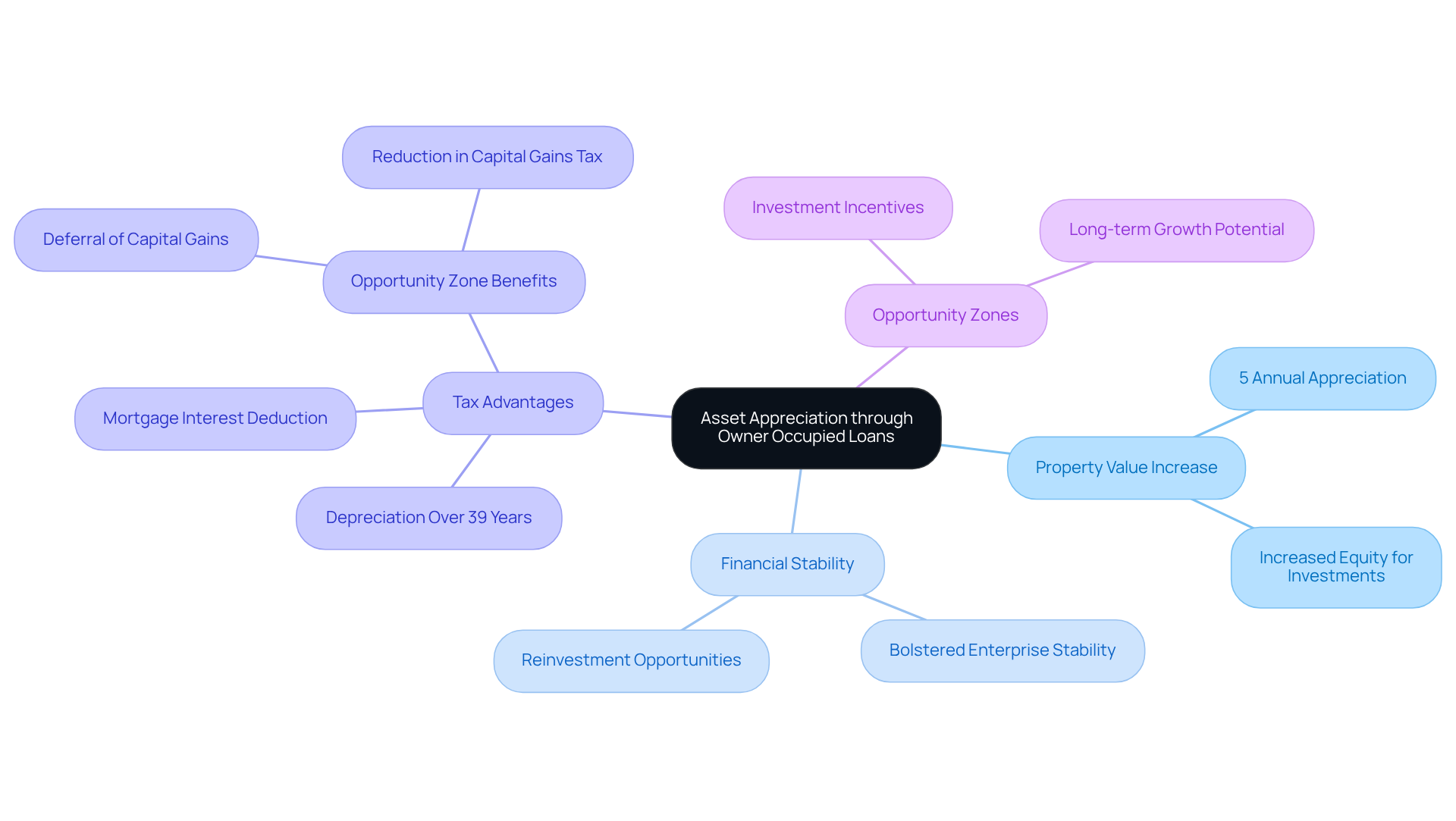

Asset Appreciation: Increase Your Business Value with Owner Occupied Loans

Investing in owner occupied home loans can lead to significant asset growth over time, greatly benefiting small enterprise proprietors. As property values rise, individuals not only enhance their personal wealth but also bolster their enterprise's economic stability. For example, properties can appreciate by an average of 5% annually, resulting in increased equity that can be leveraged for future investments or expansions. This cycle of growth fosters a robust financial foundation, empowering entrepreneurs to reinvest in their operations or pursue new opportunities.

Moreover, the tax advantages associated with commercial properties, such as depreciation over 39 years, enhance cash flow and lower taxable income. Finance Story is dedicated to developing refined and highly customized cases for lenders, ensuring that small entrepreneurs have access to a comprehensive array of funding options tailored to their specific situations. As one satisfied client expressed, 'We are done with the constant worry,' which underscores our commitment to supporting enterprises facing challenging financing scenarios.

By strategically leveraging the value of their properties and considering the benefits of Opportunity Zones—where qualifying capital gains can be deferred until December 2026—small entrepreneurs can create a sustainable framework for growth that aligns with their personal and professional aspirations.

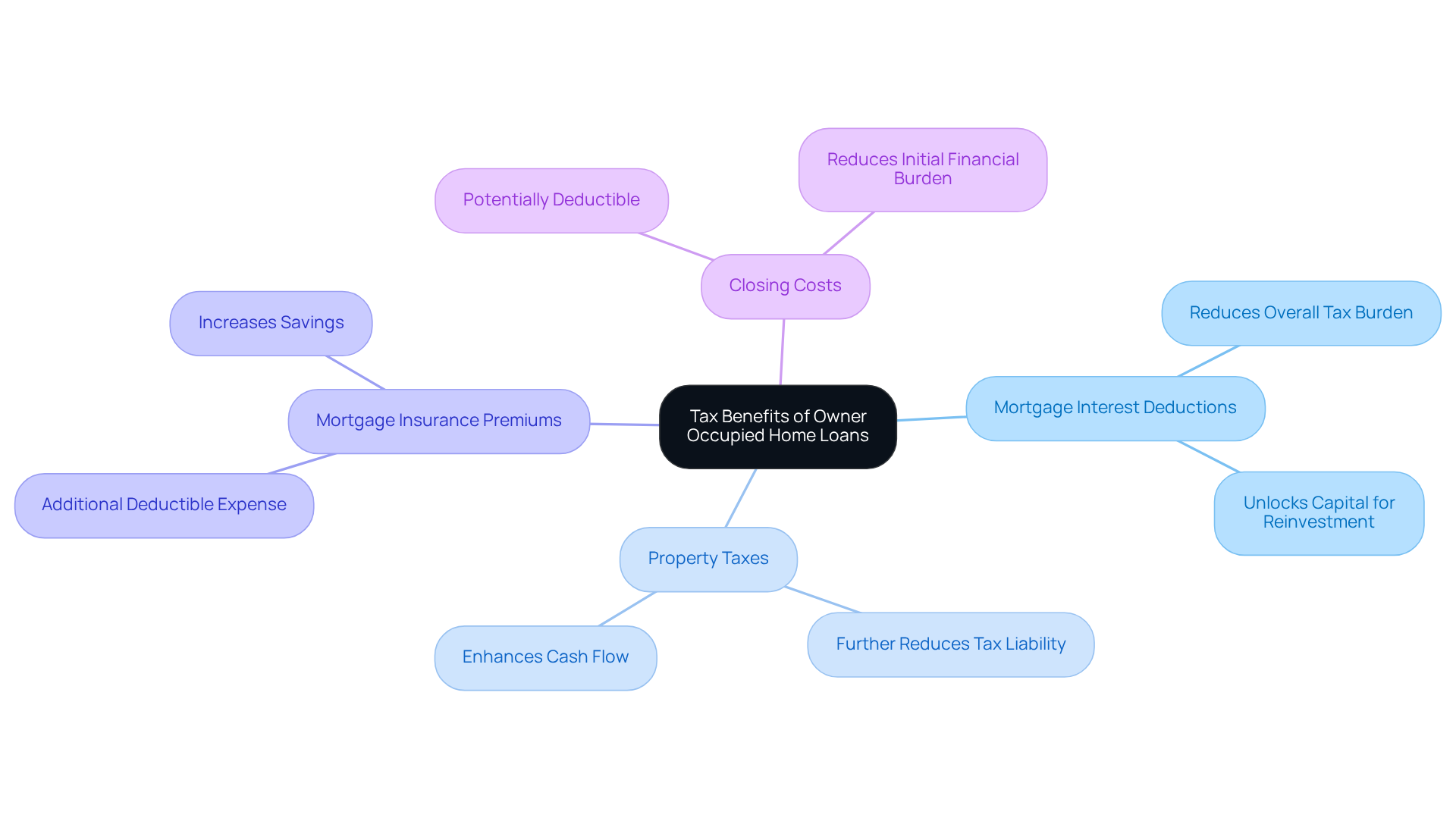

Tax Benefits: Leverage Deductions with Owner Occupied Home Loans

Residences that qualify for owner occupied home loans and are occupied by their inhabitants offer significant tax advantages for small business operators, making them a strategic financial choice. According to the Congressional Research Service (CRS), one of the key benefits is the ability to deduct mortgage interest and property taxes, which can greatly reduce the overall tax burden. By utilizing these deductions, business owners can unlock capital for reinvestment into their operations, promoting growth and improving cash flow. Additionally, deductible expenses related to owner occupied home loans may include mortgage insurance premiums and certain closing costs, further enhancing savings.

With Finance Story, securing your home loan is as straightforward as 1, 2, 3, thanks to our personalized support and access to top-tier products in the market. This financial strategy not only addresses immediate operational needs but also fosters long-term economic stability. To fully leverage these benefits, small business owners should consult with a tax professional to ensure they maximize all available deductions. Are you ready to take control of your financial future?

Flexible Loan Terms: Customize Your Financing with Owner Occupied Home Loans

Homes that are owner occupied allow small enterprise proprietors to tailor their funding choices through owner occupied home loans, ensuring that the conditions align with their unique monetary requirements. This flexibility allows borrowers to select repayment schedules, interest rates, and amounts that support their cash flow management and overall financial strategy. With Finance Story's expertise in crafting refined and highly personalized cases, small enterprise owners gain access to a comprehensive array of lenders tailored to their specific situations, whether for acquiring commercial property or refinancing existing debts.

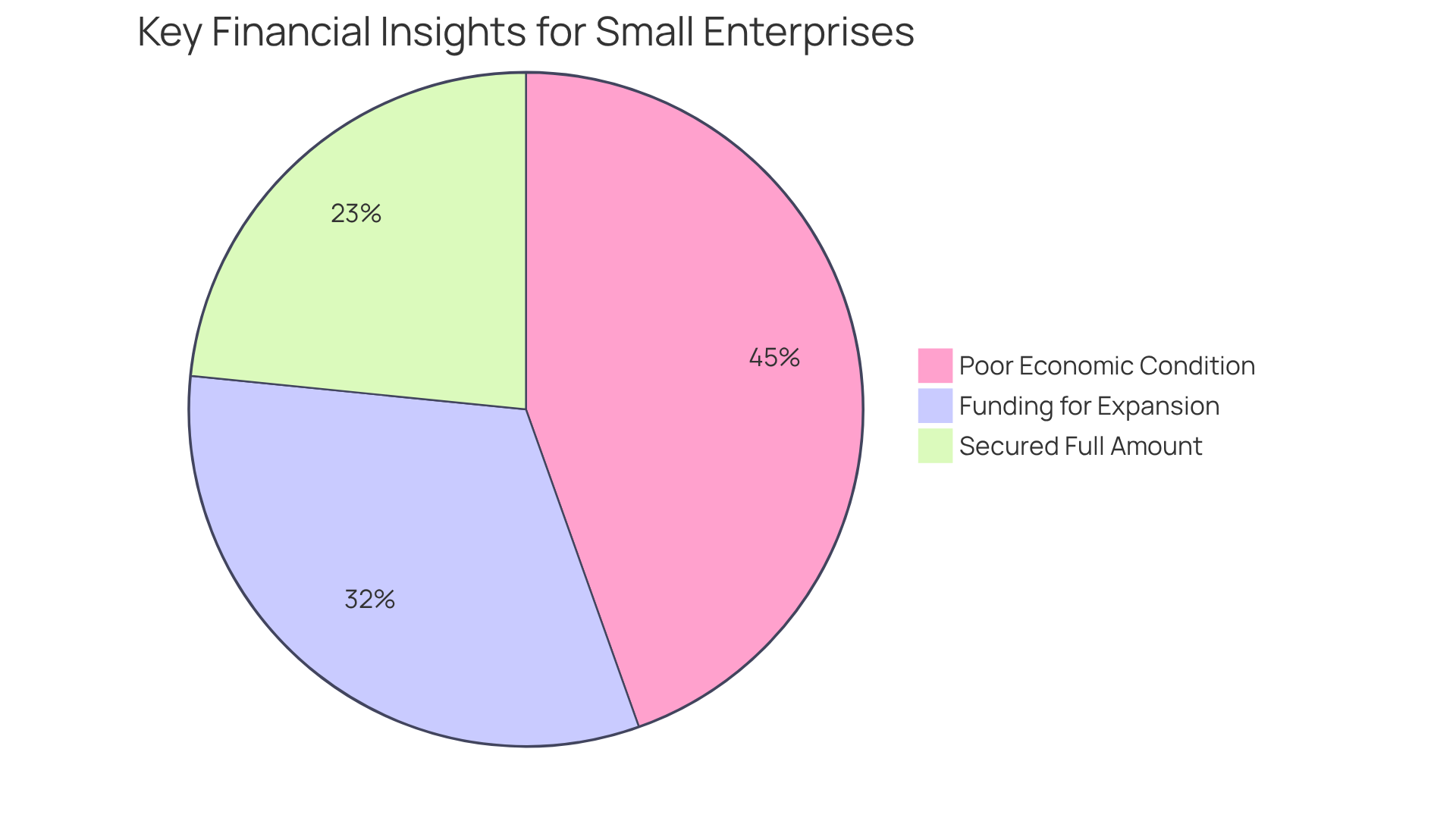

The typical small enterprise financing amount hovers around $663,000, accompanied by an average interest rate of 5.93%. The ability to customize financing options significantly influences a company's financial health. Moreover, 42.4% of entrepreneurs utilize funding for expansion, underscoring the importance of having capital that adapts to growth opportunities. However, it is crucial to recognize that only 31% of applicants secured the full amount they sought in 2021, a decline from 51% in 2019, which highlights the hurdles small enterprise proprietors face in obtaining financing.

Furthermore, with 59% of small enterprises reporting they are in fair or poor economic condition, customizable funding becomes essential for effectively managing monetary challenges and ensuring that borrowing aligns with long-term objectives.

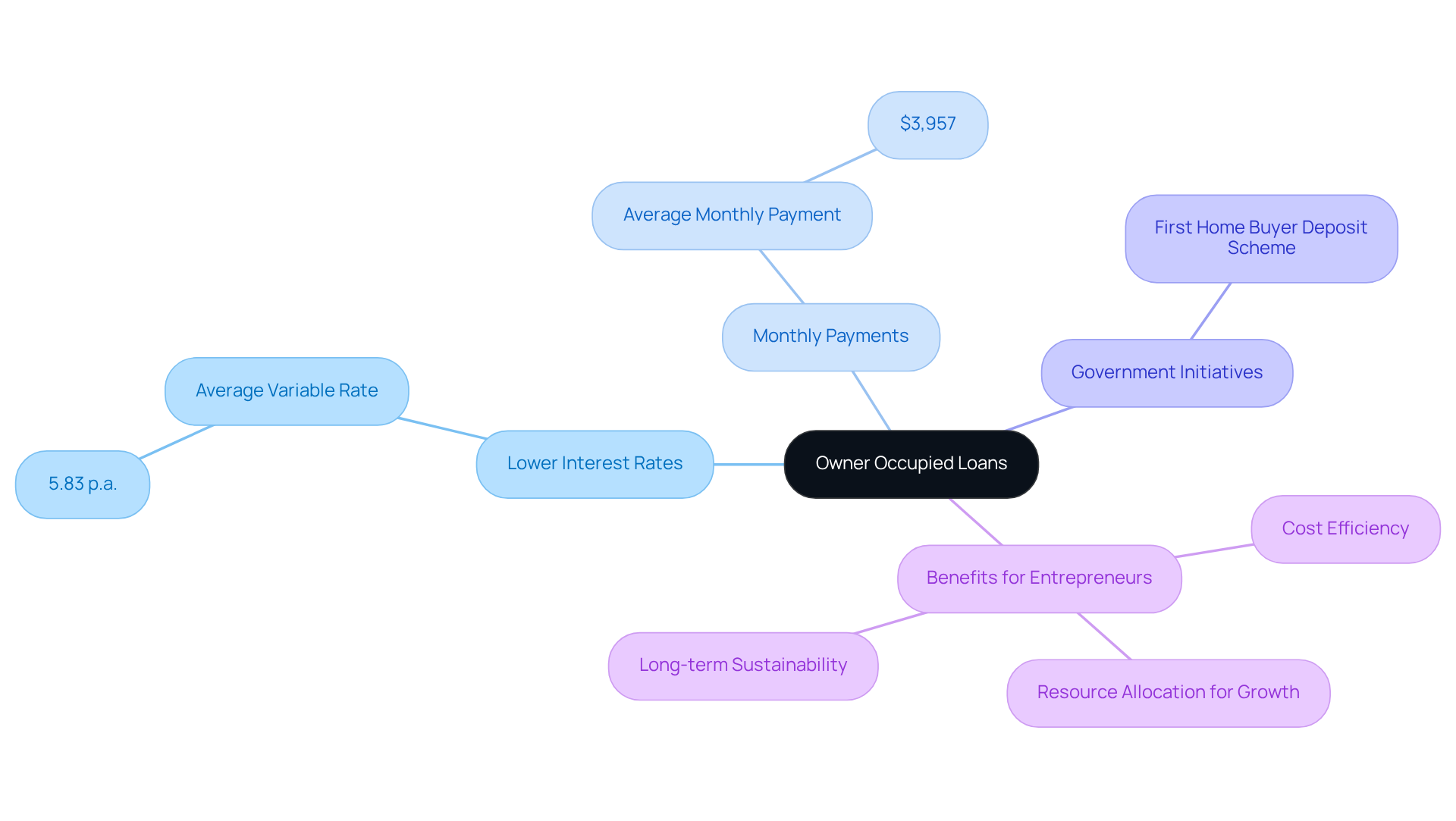

Lower Interest Rates: Save on Financing Costs with Owner Occupied Loans

Residential home loans typically offer reduced interest rates compared to alternative financing options, presenting a significant opportunity for small business owners to save considerably throughout the loan's term. This cost efficiency allows entrepreneurs to redirect resources toward growth initiatives or essential operational expenses, ultimately enhancing profitability and economic stability.

For instance, the average variable rate for owner occupied home loans is 5.83% p.a. as of May 2025. Entrepreneurs can benefit from lower monthly payments, averaging around $3,957. This reduction in financing costs not only alleviates immediate financial pressure but also fosters long-term sustainability.

Furthermore, initiatives from the Albanese Federal Government, such as the first home buyer deposit scheme, enhance access to owner occupied home loans, thereby simplifying the process for small entrepreneurs to secure favorable financing conditions. By leveraging the savings from reduced interest rates, entrepreneurs can invest in their ventures more effectively, fostering growth and resilience in a competitive market.

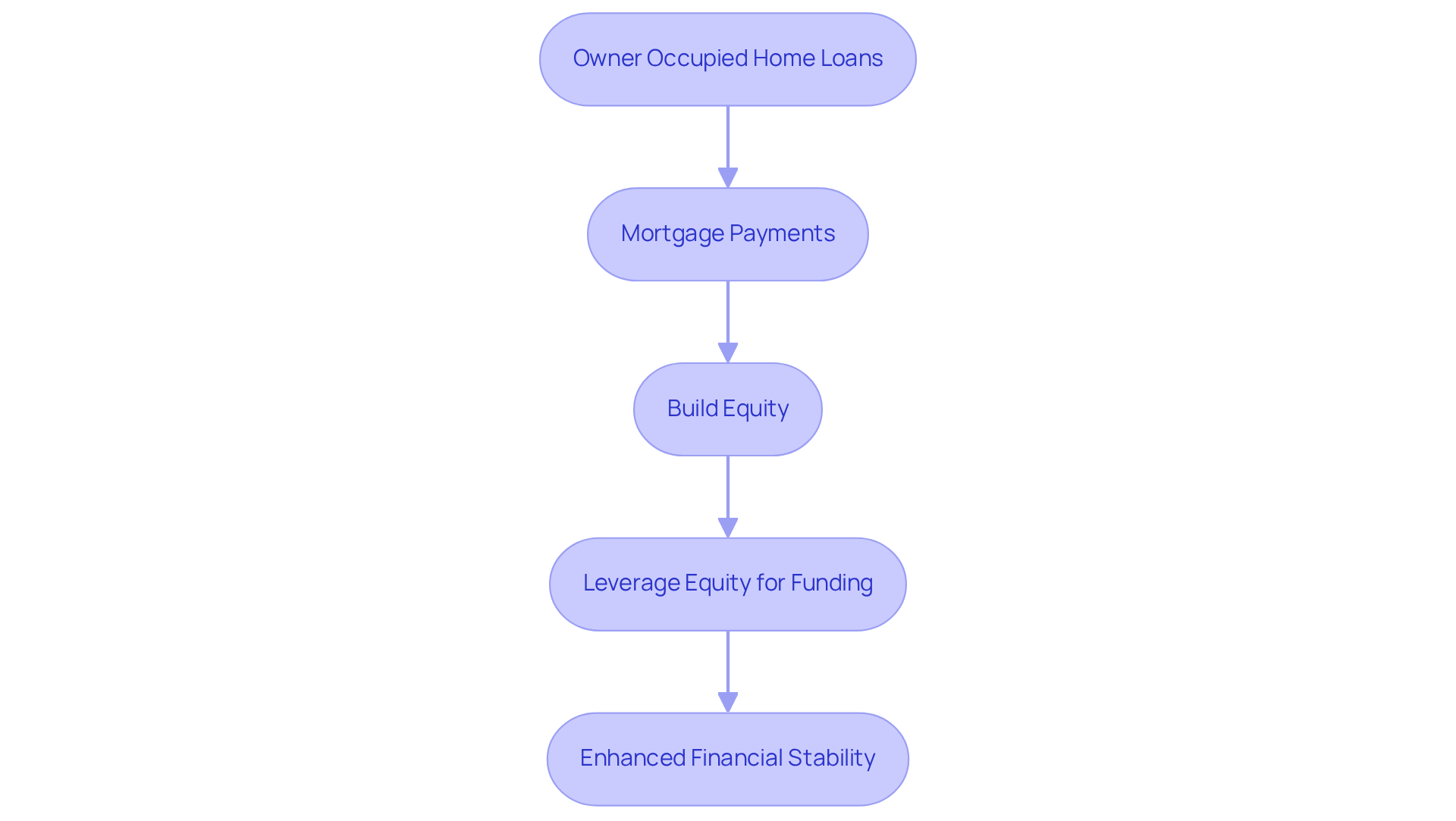

Equity Building: Strengthen Your Financial Position with Owner Occupied Loans

Occupant-occupied residential financing serves as a vital resource for small enterprise proprietors, enabling them to accumulate equity in their properties over time. Each mortgage payment increases their ownership stake, transforming the property into a valuable asset that can be leveraged for future financing needs. This accumulated equity is essential for various commercial endeavors, such as growth, renovations, or other investments, ultimately providing a monetary cushion that enhances overall stability.

Consider the example of small enterprise proprietors utilizing owner occupied home loans; they often find themselves in a more advantageous position to secure additional funding. As they build equity, they can tap into this resource to finance new projects or manage unexpected expenses. This strategic use of property equity not only aids in growth but also fortifies the owner’s economic foundation.

Moreover, the significance of equity in small enterprise financing cannot be overstated. It is a critical factor in determining borrowing capacity and significantly influences lenders' decisions. By establishing a solid equity base through owner occupied home loans, entrepreneurs enhance their position in the eyes of financial institutions, thereby increasing their chances of obtaining necessary funding.

At Finance Story, we understand the distinct challenges faced by small enterprise leaders. Our streamlined process ensures personalized support and access to a comprehensive portfolio of financing options tailored to your needs. As one satisfied customer, Natasha B. from VIC, shared, "I will definitely be recommending your service to anyone." We have alleviated the constant worry, and we are grateful for your support on this journey.

In summary, owner occupied home loans not only help small enterprise proprietors build equity but also empower them to utilize this equity for future financial opportunities, ultimately enhancing their overall financial standing. Contact Finance Story today to discover how we can help you secure the best home funding options for your requirements.

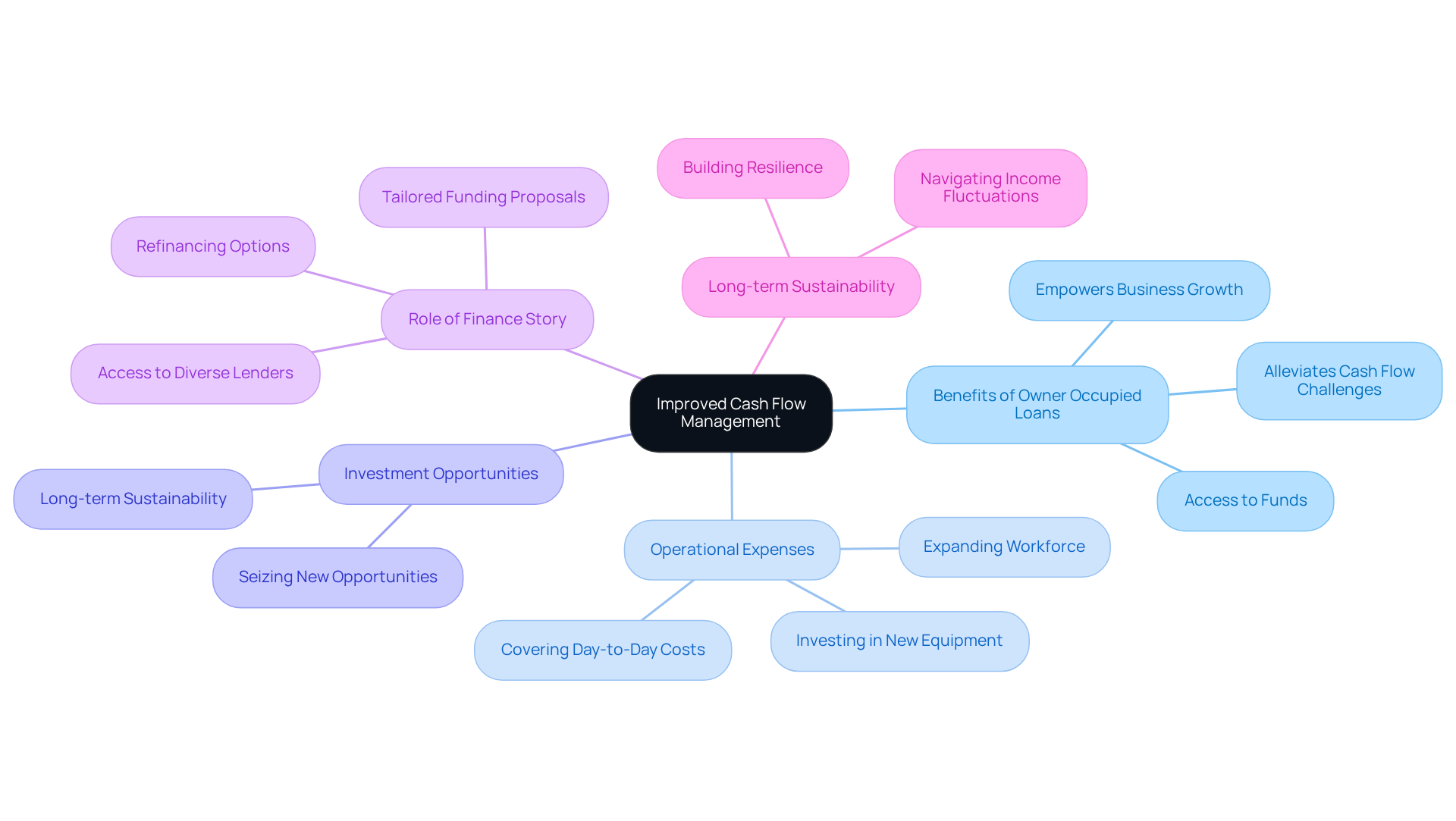

Improved Cash Flow Management: Optimize Your Finances with Owner Occupied Loans

Residency-occupied home financing serves as a powerful resource for small enterprise proprietors, significantly enhancing cash flow management. By leveraging these loans, individuals can access funds that can be allocated to various operational costs, thereby preserving liquidity while simultaneously investing in growth opportunities. This strategic financing approach is crucial for navigating the inevitable fluctuations in income and expenses that many businesses face.

For instance, small enterprise leaders can utilize these funds to cover operational expenses, invest in new equipment, or expand their workforce—all of which contribute to long-term sustainability and growth. Furthermore, with Finance Story's expertise in crafting tailored funding proposals, small enterprise operators can secure the financing options that best suit their unique circumstances. Finance Story provides access to a comprehensive array of lenders, including high street banks and innovative private lending panels, ensuring entrepreneurs can identify the optimal solutions for their needs.

The ability to enhance finances through owner occupied home loans not only alleviates short-term cash flow challenges but also empowers businesses to seize new opportunities as they arise, ultimately fostering resilience in a competitive market. Additionally, refinancing options are available to help enterprises adapt to their evolving requirements. As Vala notes, 'With such dramatic change over the past two years, now is the ideal time for brokers to conduct a financial health check with their clients.' This insight is particularly relevant, considering that 82% of businesses that failed cited cash flow issues as a contributing factor, underscoring the critical importance of effective cash flow management.

Enhanced Business Credit: Boost Your Financing Options with Owner Occupied Loans

Securing owner occupied home loans through Finance Story can significantly enhance a small enterprise's credit profile. By demonstrating responsible borrowing habits and guaranteeing prompt repayments, entrepreneurs can improve their credit scores, thereby broadening their financing alternatives for future projects. Finance Story, recognized for its customized mortgage brokerage solutions, understands the unique challenges faced by small enterprises and provides individualized assistance to navigate these complexities. A strong credit profile is essential for obtaining favorable financing terms, ultimately fostering growth.

Consider this:

- 76% of small enterprise owners prioritize paying bills on time to enhance their credit, a practice that holds particular significance when managing properties occupied by their occupants.

- Furthermore, 88% of small business proprietors express a desire to improve their personal or business credit, highlighting the importance of owner occupied home loans in achieving this goal.

- The typical new borrowing amount for homeowners has reached an unprecedented level of $640,998, reflecting a strong commitment to responsible money management.

This trend highlights the critical role of owner occupied home loans, not only in securing immediate funding but also in laying a solid foundation for long-term financial success. With Finance Story providing access to the best market products and expert guidance throughout the process, small business owners can confidently pursue their financial objectives.

Expert Guidance: Navigate Owner Occupied Home Loans with Finance Story's Support

Navigating the intricacies of owner occupied home loans can be especially challenging for small entrepreneurs. Are you aware of the financing options available to you? Finance Story offers expert advice throughout the financing process, ensuring clients fully comprehend their choices and can make informed decisions. With over 25 years of experience in organizational enhancement and technology deployment, the team at Finance Story is dedicated to assisting entrepreneurs in obtaining customized funding options, including:

- Commercial property financing

- SMSF financing

This personalized assistance streamlines the funding procedure, enabling entrepreneurs to achieve their monetary objectives with confidence.

Client testimonials consistently highlight the brokerage's exceptional service. How have small business owners successfully navigated the loan process with Finance Story's assistance? The answer lies in the brokerage's commitment to fostering ongoing relationships and leveraging a comprehensive panel of lenders. This approach ultimately leads to easier loan approvals and better financial outcomes. By standing out as a trusted partner in securing the right financing solutions, Finance Story empowers entrepreneurs to take control of their financial futures.

Conclusion

Owner occupied home loans serve as a strategic financial tool for small business owners, effectively merging personal and professional financial needs into a cohesive funding solution. These loans empower entrepreneurs to leverage their primary residences, granting access to capital that is essential for both personal stability and business growth.

Throughout this discussion, the numerous benefits of owner occupied home loans have been underscored. From financial stability and asset appreciation to tax advantages and flexible loan terms, these loans are tailored to meet the unique challenges faced by small business proprietors. Furthermore, the capacity to build equity and enhance cash flow management significantly strengthens the financial position of entrepreneurs, enabling them to concentrate on growth and resilience in a competitive market.

Ultimately, the significance of owner occupied home loans is profound. They not only provide immediate financial relief but also establish a foundation for long-term success. Small business owners are strongly encouraged to explore these tailored financing options and consult with experts like Finance Story to maximize their potential. By taking proactive steps to secure the right funding, entrepreneurs can adeptly navigate the complexities of their financial landscape with confidence, ensuring their ventures not only survive but thrive.