Overview

This article outlines seven essential steps to secure the lowest commercial property loan rates. These steps include:

- Enhancing your credit profile

- Comparing lenders

- Effectively negotiating loan terms

Each step is supported by specific strategies and factors that influence loan rates. Furthermore, it demonstrates how careful preparation and informed decision-making can lead to more favorable financing outcomes. Are you ready to take control of your financial future? Let's explore these strategies together.

Introduction

Navigating the landscape of commercial property loans can indeed be a daunting task, particularly when aiming for the most competitive interest rates. With a variety of loan types available—each accompanied by its own unique terms and conditions—grasping the intricacies of financing is essential for any business owner aspiring to invest in real estate.

This guide will explore the critical steps necessary to secure the lowest commercial property loan rates, equipping readers with strategies to:

- Enhance their credit profiles

- Effectively compare lenders

- Negotiate favorable terms

However, what hidden challenges might derail even the most prepared borrower, and how can these obstacles be overcome?

Understand Commercial Property Loans

To purchase, refinance, or develop commercial real estate, it is essential to consider commercial property financing options that offer the lowest commercial property loan rates. Unlike home financing, these agreements feature unique conditions, interest charges, and eligibility criteria. The primary types include:

- Owner-Occupied Loans: Designed for businesses acquiring property to operate from, these loans typically offer lower interest rates and more favorable terms due to the reduced risk associated with owner occupancy.

- Investment Financing: Intended for obtaining properties meant for rental earnings, these funds usually feature elevated interest levels and more stringent terms, reflecting the perceived risks of rental income fluctuations and potential vacancies.

- Development Financing: These funds support new construction or major renovations, providing essential capital for enterprises seeking to grow or enhance their operational capabilities.

In 2025, average interest rates for owner-occupied commercial property financing are projected to be around 5.54% p.a., while investment financing may see rates exceeding 6% due to their higher risk profile. Understanding these differences is crucial for selecting the suitable financing option that aligns with your enterprise goals and financial strategy, including obtaining the lowest commercial property loan rates. At Finance Story, we specialize in crafting polished and highly individualized business cases to present to banks, ensuring you secure the best financing solutions tailored to your needs. Furthermore, prospective borrowers should be aware of the Loan to Value Ratio (LVR) requirements, which significantly influence borrowing eligibility and terms. As highlighted by financial specialists, the variations in borrowing conditions and interest terms between owner-occupied and investment financing are considerable, making it essential for borrowers to evaluate their particular requirements meticulously.

Identify Factors Affecting Loan Rates

Several key factors significantly influence the interest rates on commercial property loans:

- Credit Score: A higher credit score is crucial, as it often results in lower interest rates. Lenders regard borrowers with robust financial histories as less risky, which can result in more favorable terms. Significantly, a credit score above 750 frequently qualifies for more favorable terms.

- Loan-to-Value Ratio (LVR): Maintaining a lower LVR is advantageous, as it indicates reduced risk for lenders. Generally, borrowers with an LVR below 80% can obtain more favorable terms, making it a crucial factor when seeking financing. A lower LVR also reduces repayment pressure, which is beneficial for long-term financial planning.

- Economic Conditions: Interest levels are also influenced by wider economic factors, including inflation figures and central bank strategies. These factors can cause variations in lending conditions, affecting total borrowing expenses.

- Property Type: The category of property being financed influences the determination of interest levels. Properties in high-demand areas or those with strong economic activity may attract lower rates compared to those in less desirable locations.

Additionally, borrowers should be aware that processing fees for commercial property loans are usually around 3.54% of the loan amount, which adds to the overall cost of securing financing.

At Finance Story, we specialize in creating refined and highly personalized proposals to present to lenders, ensuring that you can navigate these factors effectively. We offer access to a full range of lenders, including high street banks and innovative private lending panels, which can provide tailored refinancing options to meet your evolving business needs. By comprehending these dynamics, borrowers can create effective tactics to obtain the lowest commercial property loan rates available. The case study titled "Understanding Commercial Property Loan Interest Rates" provides further insights into these dynamics, emphasizing the importance of these factors in negotiating favorable terms.

Enhance Your Credit Profile

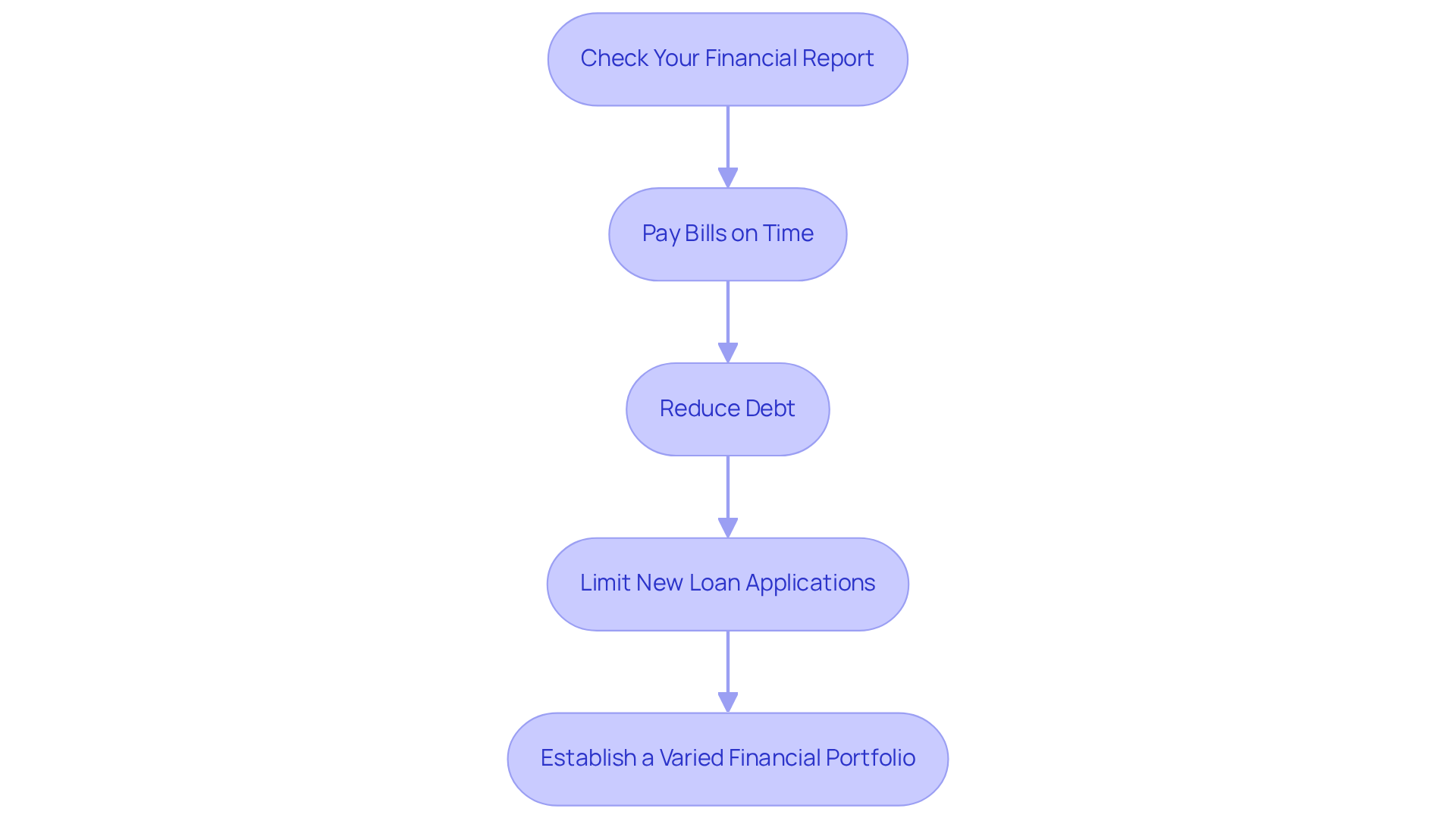

To enhance your credit profile and improve your chances of securing favorable commercial loan rates, consider the following steps:

-

Check Your Financial Report: Regularly review your financial report for errors. You are entitled to one free report from each major bureau every year. Disputing inaccuracies can lead to significant improvements in your score, as even minor mistakes can negatively impact your creditworthiness.

-

Pay Bills on Time: Consistently paying bills on time is crucial. Payment history is the most significant element in scoring, and timely payments can assist in preserving a strong score. As Mahum Zaidi states, 'Making timely payments is the first crucial step to a good rating.'

-

Reduce Debt: Aim to lower your card balances and avoid maxing out your limits. Maintaining your borrowing utilization below 30% is recommended, but for improved scores, strive to keep it even lower. This illustrates responsible financial management.

-

Limit New Loan Applications: Each new loan application can temporarily lower your score. Stagger applications to reduce adverse effects on your financial profile.

-

Establish a Varied Financial Portfolio: Having a mix of financing types, such as charge cards, installment agreements, and retail accounts, can positively influence your score. This diversity shows lenders that you can manage various financial responsibilities.

By applying these strategies, you can greatly improve your financial profile, making you a more appealing borrower for the lowest commercial property loan rates. For example, a recent study named 'Enhancing Credit Ratings for Gen Z Professionals' emphasized that individuals who actively oversee their scores through timely payments and debt reduction experienced enhancements in their eligibility for financing within just a few months. Taking control of your credit score can set a positive financial future.

Compare Lenders and Loan Options

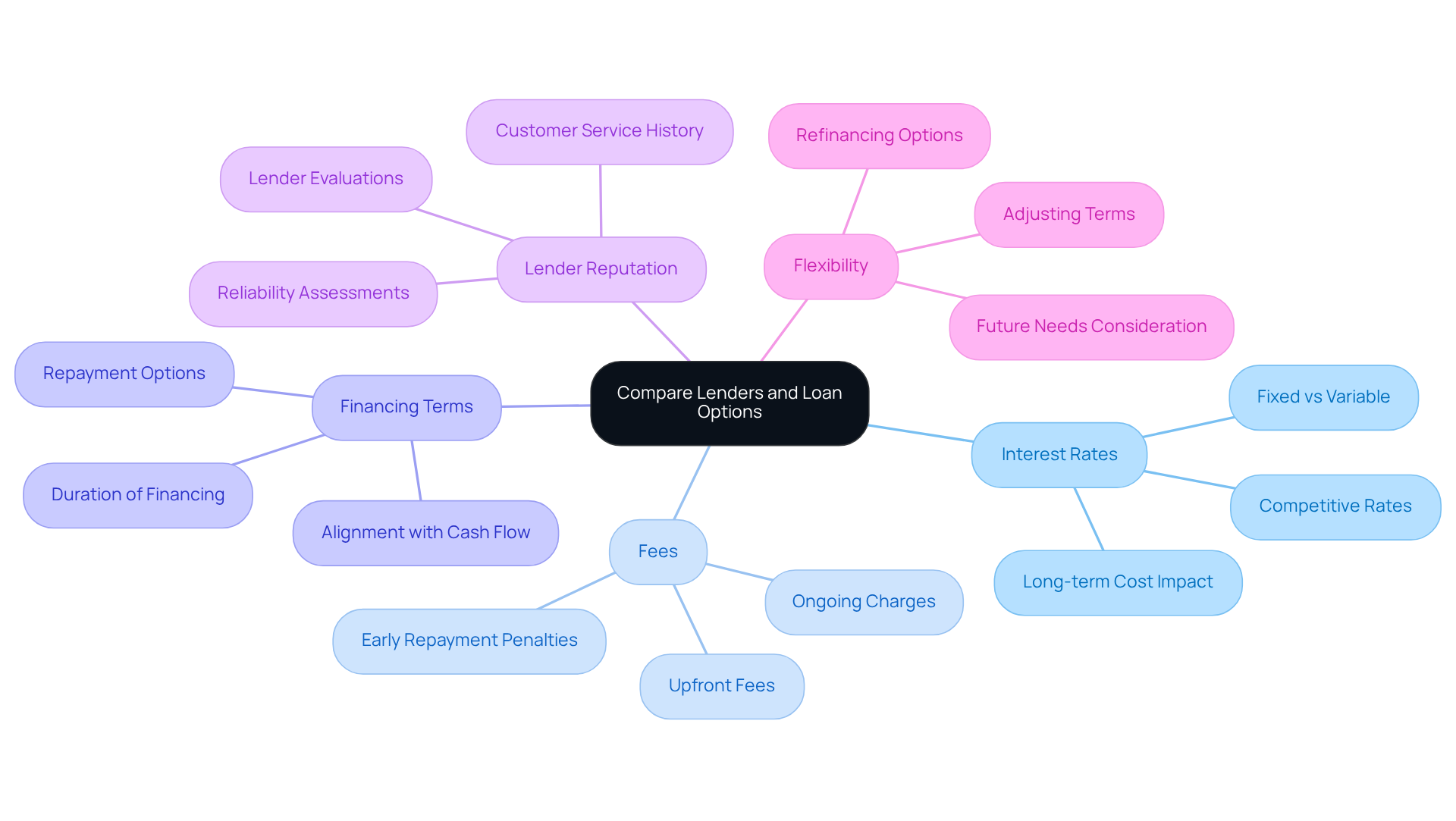

When evaluating lenders and loan options for commercial property financing, it is crucial to consider several key factors that can significantly influence your financial decisions:

- Interest Rates: Look for competitive rates, but also determine if they are fixed or variable, as this choice can greatly affect your long-term costs.

- Fees: Be attentive to upfront fees, ongoing charges, and any penalties for early repayment, since these can accumulate and impact your overall financial commitment.

- Financing Terms: Reflect on the duration of the financing and the repayment options available, ensuring they align with your business’s cash flow and growth strategies.

- Lender Reputation: Investigate lender evaluations and their customer service history to gauge reliability and support throughout the financing process.

- Flexibility: Consider whether the lender provides options for refinancing or adjusting terms in the future, which can be critical as your business evolves.

Utilizing online comparison tools can streamline this process, enabling you to effectively identify the most suitable financial option for your specific needs. By following these guidelines, you can enhance your chances of securing favorable financing terms that align with your objectives.

Prepare Required Documentation

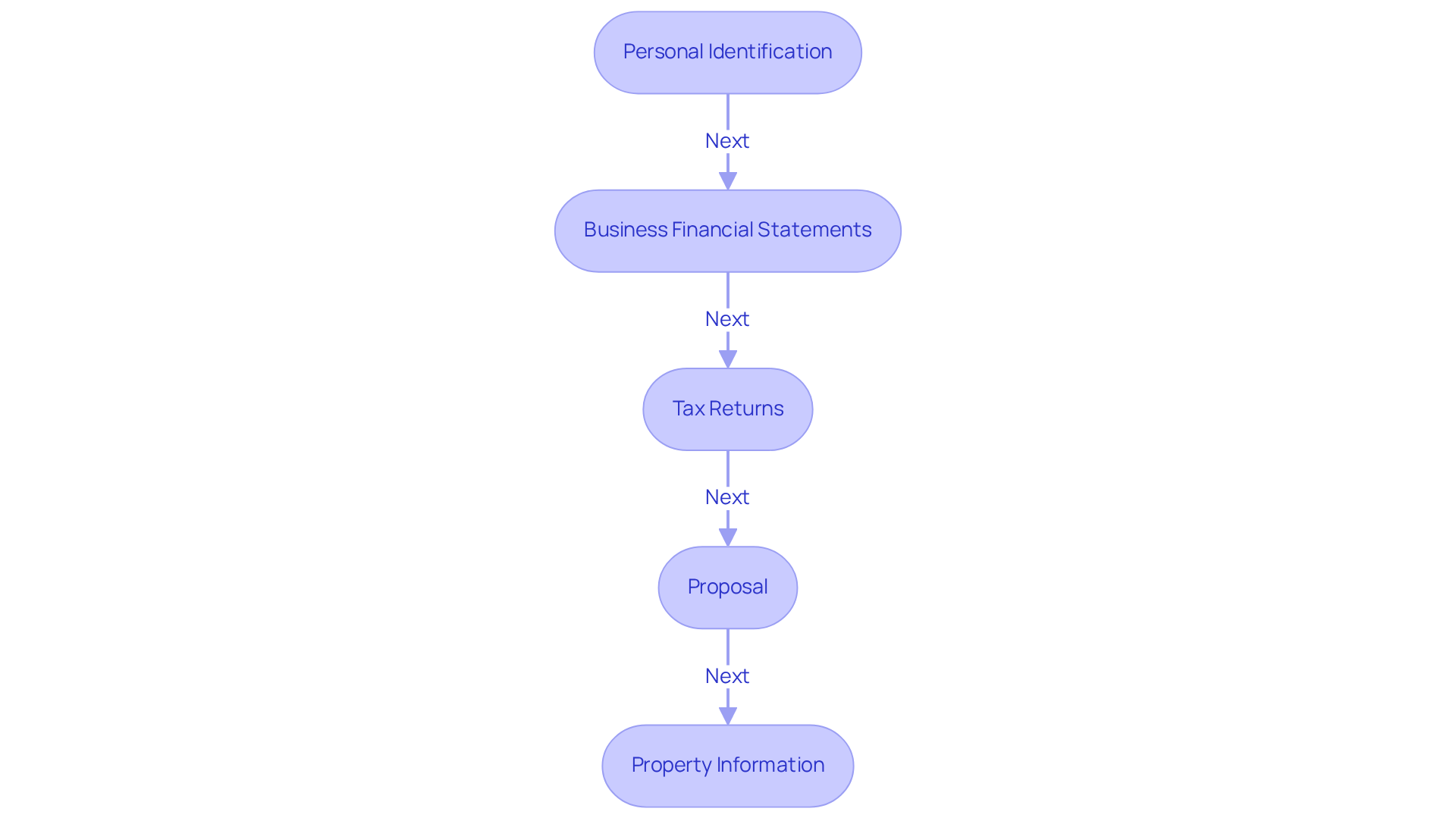

To successfully prepare for your commercial property loan application, it is essential to gather the following documentation:

- Personal Identification: Valid forms include a driver's license or passport.

- Business Financial Statements: Compile profit and loss statements, balance sheets, and cash flow statements for the past two years. Precise financial records are essential, as lenders frequently evaluate the condition of your enterprise through these documents. At Finance Story, we specialize in creating polished and highly personalized case studies that highlight your financial stability, enhancing your appeal to lenders.

- Tax Returns: Provide personal and commercial tax returns for the previous two years, along with Notices of Assessment from the Australian Tax Office (ATO). This documentation helps establish your financial history and credibility.

- Proposal: A thorough proposal outlining your goals and how the funding will be utilized is essential. This not only demonstrates your preparedness but also helps lenders understand your vision. Our expertise in customizing financing proposals ensures that your business plan aligns with lender expectations.

- Property Information: Include specifics about the property you wish to purchase, such as valuation reports and lease agreements if applicable. This information is critical for lenders to assess the investment's potential.

Research shows that thorough documentation can boost approval rates, with a suggested deposit of 20-30% to improve financing terms. Furthermore, examining different documentation choices, as mentioned in the case study 'Utilizing Alternate Documentation Options for Approval,' can accelerate the approval process. By following these steps and having these documents organized and readily available, you position yourself for a smoother experience in obtaining the lowest commercial property loan rates needed for your financing.

Negotiate Loan Terms Effectively

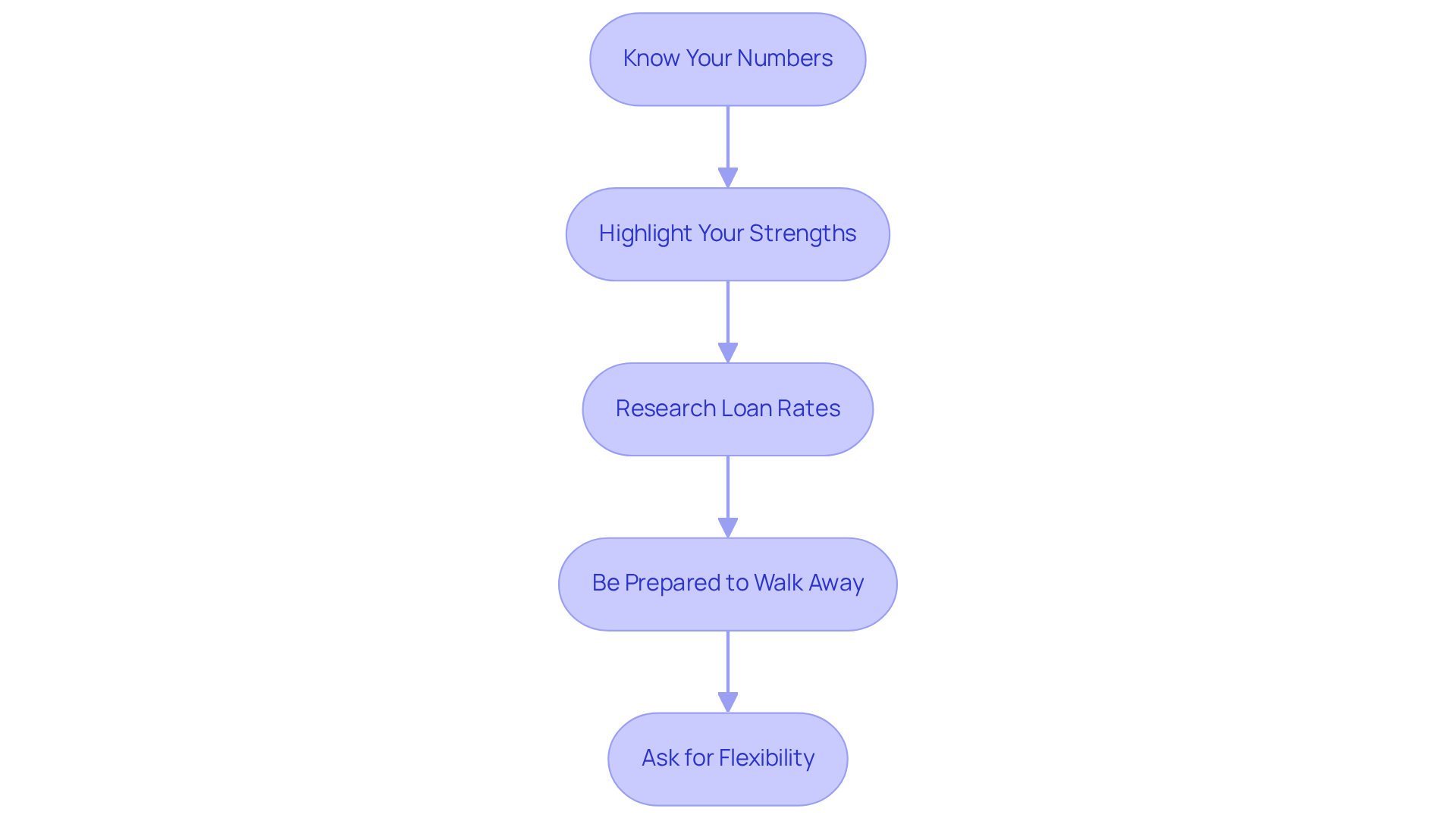

To negotiate loan terms effectively, consider these strategies:

-

Know Your Numbers: Being well-versed in your financial situation and understanding what you can afford is crucial. Finance Story specializes in helping you navigate your financial landscape, enabling you to make informed decisions.

-

Highlight Your Strengths: Emphasizing your creditworthiness, entrepreneurial achievements, and any collateral you can offer is essential. Our expertise in crafting polished and individualized business cases empowers you to present your strengths convincingly.

-

Researching the lowest commercial property loan rates allows you to leverage this knowledge during negotiations. With access to a comprehensive range of lenders, Finance Story provides insights into the lowest commercial property loan rates that are tailored to your situation.

-

Be Prepared to Walk Away: Demonstrating to lenders that you have options and are willing to consider other offers if necessary can strengthen your position. Our team assists you in exploring various financing solutions, ensuring you have viable alternatives.

-

Ask for Flexibility: Inquire about options for adjusting terms, such as repayment schedules or interest rates. Understanding repayment criteria is vital, and Finance Story can support you in negotiating favorable terms.

Successful negotiation can lead to significant savings and improved terms, especially when you leverage the expertise of Finance Story.

Take Action and Secure Your Loan

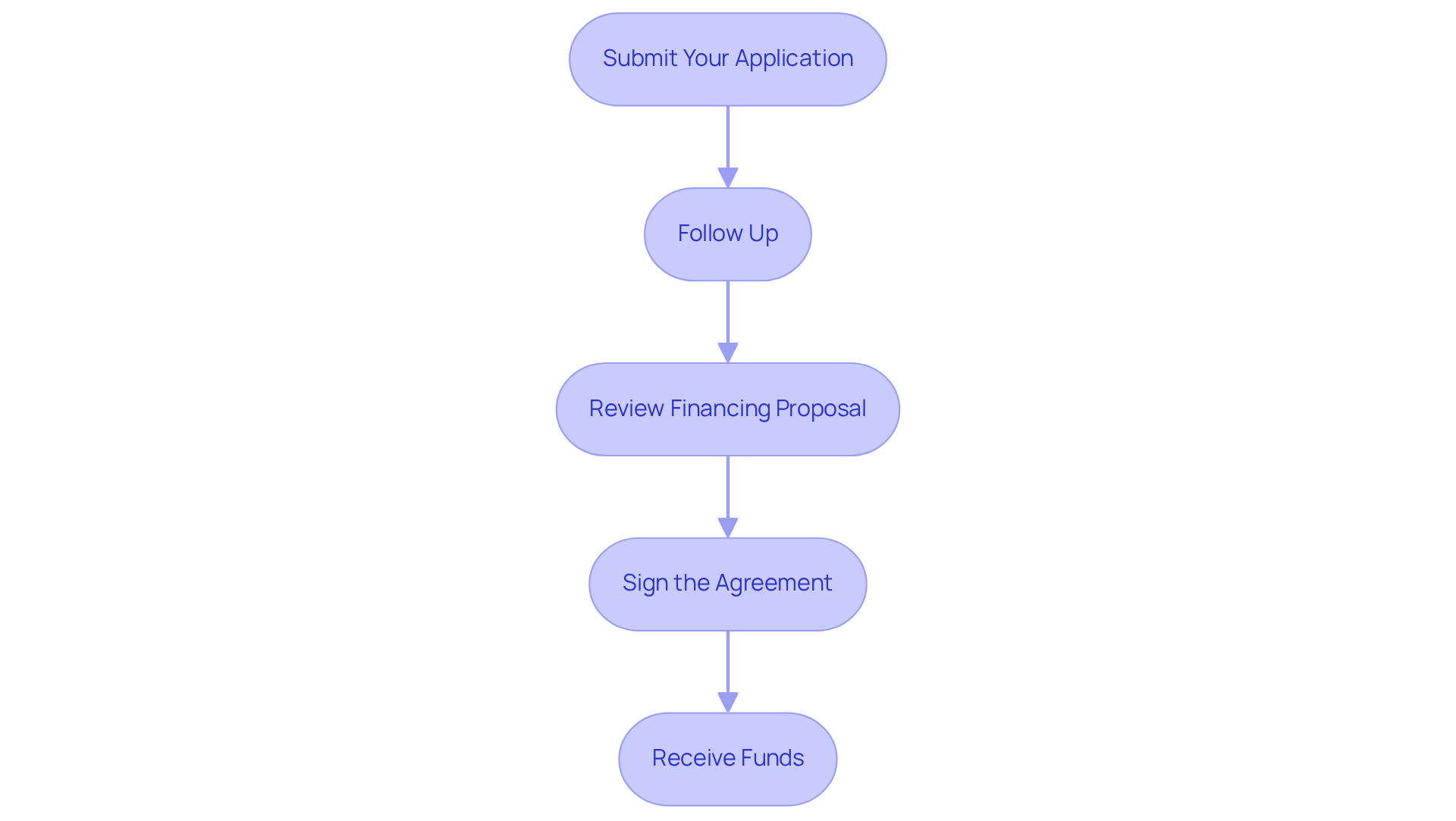

To take action and secure your loan, follow these essential steps:

- Submit Your Application: Ensure that all documentation is complete and accurate before submission. A well-prepared application can significantly improve your chances of approval.

- Follow Up: Maintain regular contact with the lender to check on the status of your application. Statistics indicate that timely follow-ups can increase your chances of a successful outcome, as lenders appreciate proactive communication.

- Review Financing Proposal: Once approved, meticulously examine the financing proposal. Ensure that all terms align with what was negotiated, as discrepancies can lead to complications later.

- Sign the Agreement: After verifying all details, sign the financing agreement and any other necessary documents. This step is crucial for completing your financial agreement.

- Receive Funds: Once the financing is finalized, the funds will be disbursed, enabling you to proceed with your commercial property investment.

By diligently following these steps, you can effectively secure the lowest commercial property loan rates and achieve your financial objectives. Successful borrowers often emphasize the importance of thorough preparation and consistent follow-up, which can make a significant difference in the loan application process.

Conclusion

Understanding how to secure the lowest commercial property loan rates is crucial for any business seeking to invest in real estate. By recognizing the various types of commercial loans, the factors that influence interest rates, and the necessary steps to enhance credit profiles and negotiate favorable terms, borrowers can position themselves for success. This comprehensive approach not only facilitates access to funding but also ensures that businesses can thrive in a competitive market.

Key strategies include:

- Maintaining a strong credit score

- Comparing lenders

- Preparing thorough documentation

- Effectively negotiating loan terms

Each of these elements significantly impacts the overall cost of financing and can lead to substantial savings over time. By taking proactive steps and leveraging available resources, such as expert guidance from organizations like Finance Story, borrowers can navigate the complexities of commercial property financing with confidence.

Ultimately, securing the best loan rates is not merely about obtaining funding; it is about laying a solid foundation for future growth and stability. Businesses are encouraged to take action by applying the insights gained from this guide, ensuring they are well-prepared to make informed financial decisions. The journey toward securing a commercial property loan begins with understanding the landscape and taking deliberate steps to optimize the borrowing experience.