Overview

This article delineates the crucial steps to ascertain eligibility for a loan on commercial property. It underscores the significance of meeting credit score requirements, submitting comprehensive documentation, and grasping the nuances of various loan types. Furthermore, it elaborates on the criteria that lenders assess, including:

- Creditworthiness

- Income stability

- The necessity of a deposit

By doing so, it effectively navigates potential borrowers through the intricate landscape of securing financing.

Introduction

Navigating the world of commercial property loans can be a daunting task, particularly for those unfamiliar with the intricate requirements and processes involved. To secure financing for assets such as office spaces, retail storefronts, or industrial facilities, a thorough evaluation of eligibility criteria, documentation, and financial health is essential.

This article outlines seven essential steps to determine the feasibility of obtaining a loan on commercial property, addressing common challenges and questions that potential borrowers face.

Are you prepared with the necessary insights to confidently approach lenders and enhance your chances of approval?

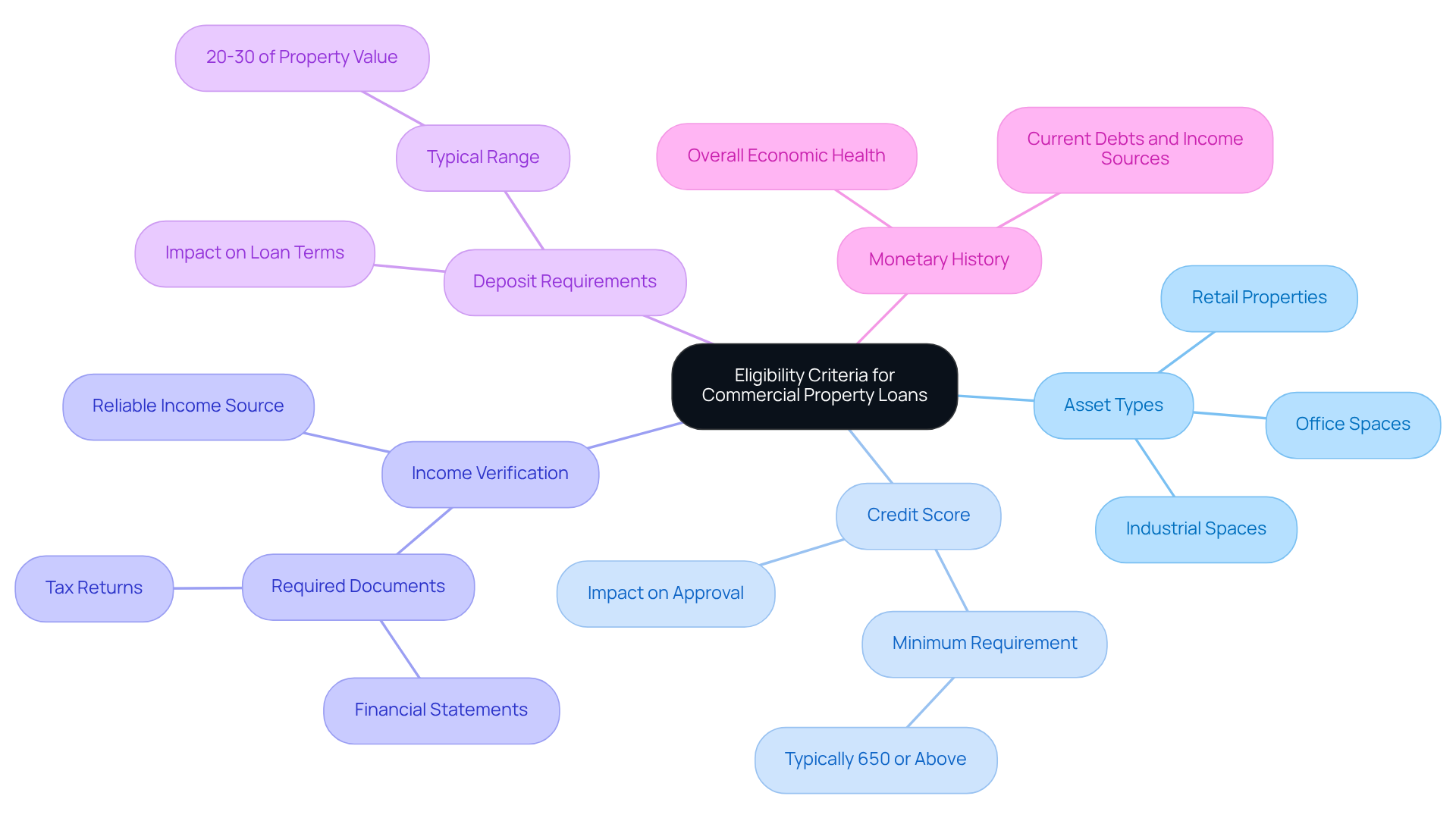

Identify Eligibility Criteria for Commercial Property Loans

Verify that your asset type qualifies for financing because you may be asking, can I get a loan on commercial property, which includes categories such as office, retail, and industrial spaces. At Finance Story, we specialize in crafting refined and highly customized business cases to present to banks, ensuring your asset meets the necessary criteria for funding.

Do you meet the minimum credit score requirement? Typically set at 650 or above, a solid credit score is essential for determining if I can get a loan on commercial property. Our expertise in understanding repayment criteria can assist you in navigating this requirement effectively.

It is crucial to possess a reliable income source to comfortably manage your repayment obligations, which financial institutions will evaluate during the application process. Lenders frequently request detailed monetary statements and tax returns for income verification, and we are here to help you prepare these documents.

When considering if I can get a loan on commercial property, be prepared to offer a deposit, usually ranging between 20-30% of the property's worth, as most financial institutions demand this as a standard. Finance Story can guide you through the specific deposit requirements tailored to your situation.

Evaluate your company's monetary history and stability. Creditors will scrutinize your overall economic health, including current debts and income sources, to assess eligibility. With our thorough comprehension of the borrowing environment, we can assist you in making a compelling case to prospective financiers.

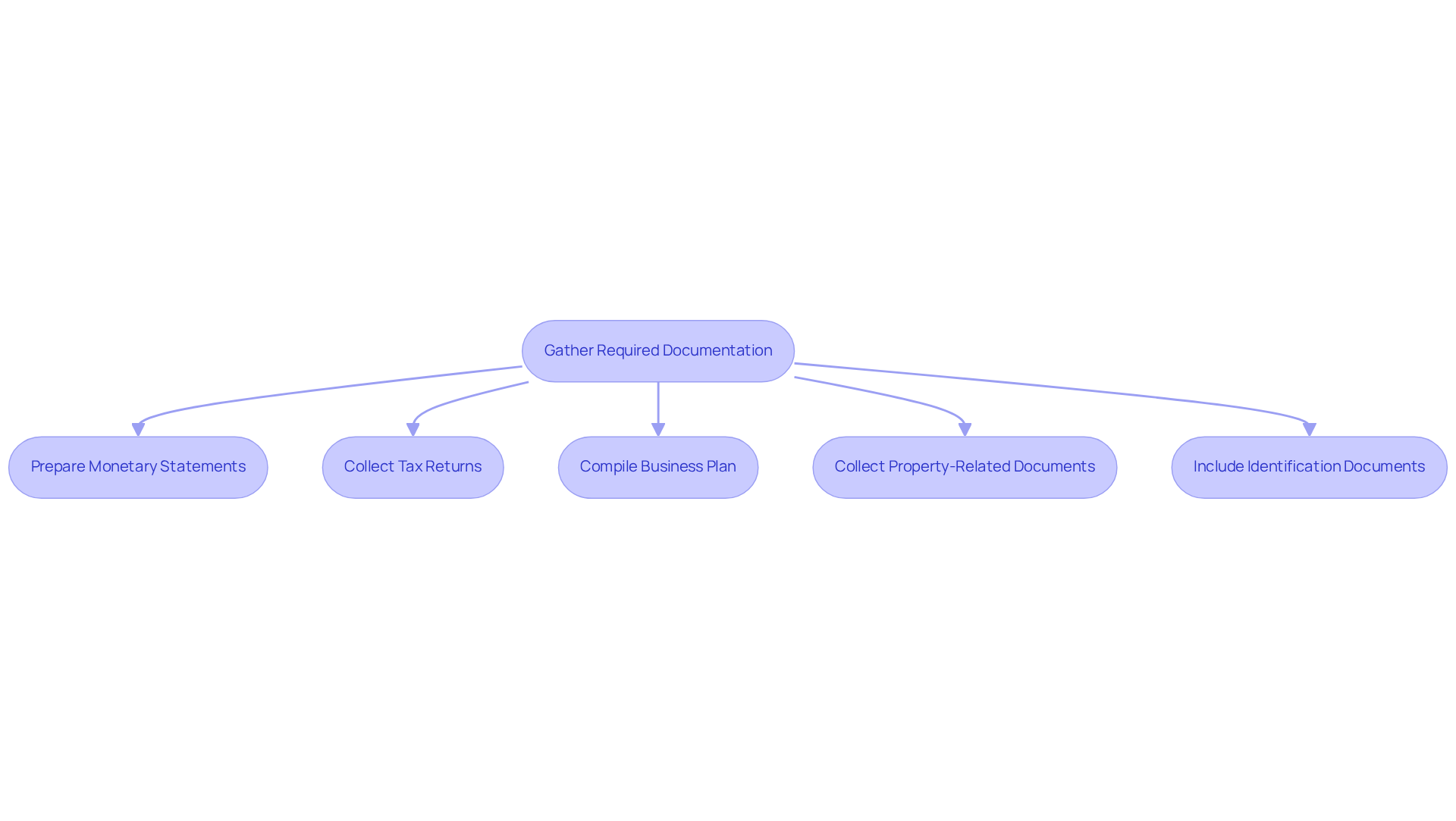

Gather Required Documentation for Loan Application

Prepare detailed monetary statements, including profit and loss statements and balance sheets, to demonstrate the economic health and income stability of your business. This is essential, as creditors anticipate a clear picture of your financial situation, which Finance Story can assist you in expressing through refined business cases.

Collect tax returns from the past two years, including both personal and business, as these offer financial institutions a clear view of your income consistency and tax adherence. Understanding these documents is essential for meeting lender expectations.

Compile a detailed business plan that outlines the purpose of the loan, projected cash flows, and how the financing will contribute to your business growth. Tailored proposals can significantly enhance your chances of securing the necessary funds.

Collect property-related documents such as the title deed and a recent valuation report to establish the property's worth and ownership. This documentation is essential for financiers to evaluate the worth of your investment.

Include identification documents, such as a driver’s license or passport, to verify your identity and ensure adherence to requirements. This step is often overlooked but is essential for a smooth application process.

Keep in mind that when considering whether I can get a loan on commercial property, most financial institutions usually ask for a deposit of 20-30% of the purchase price, and there might be an establishment fee varying from $2,500 to $5,000 based on the assessment criteria. As Romy Dhungana, a mortgage broker, emphasizes, 'Working with an experienced finance broker will mean you have all the facts before you submit an application, including preliminary discussions with the lender on potential requirements.' Additionally, property-related expenses and interest payments for commercial mortgages are tax-deductible, which can provide significant financial benefits. Leveraging the expertise of Finance Story can help you navigate these requirements effectively.

Explore Different Types of Commercial Property Loans

When considering funding for commercial properties, it is essential to ask, can I get a loan on commercial property by exploring the various types of financial options available? Fixed-rate financing offers predictable payments, simplifying budgeting for long-term investments. These credits maintain the same interest rate throughout their duration, ensuring stability against market variations. In 2025, fixed rates for commercial security financing range from 5.59% to 7.56%, making them an appealing choice for individuals seeking cash flow predictability.

On the other hand, variable-rate financing can provide lower initial rates, potentially advantageous for short-term projects or repositioning strategies. These credits fluctuate with market indices, starting at a lower level but possibly increasing over time. For instance, current variable interest rates for commercial financing range from 5.89% to 10.74%, depending on the lender and borrower profile.

For borrowers with limited documentation, low-doc financing is a viable option. These financial products typically feature more lenient income verification standards, enabling access to funding without extensive documentation.

Interest-only financing can also be beneficial for managing cash flow, particularly for investors aiming to optimize their initial capital. This structure allows borrowers to pay only the interest for a specified period, which can be advantageous during the initial phases of real estate investment.

It is crucial to distinguish between owner-occupied and investment real estate, as this distinction significantly influences financing terms and interest rates. Generally, financing for owner-occupied residences may offer reduced rates and more favorable conditions compared to investment assets, which are often viewed as higher risk.

In conclusion, understanding the nuances of fixed-rate versus variable-rate financing, along with the specific requirements of your commercial investment, is vital for making informed financial choices. Furthermore, collaborating with specialists such as Finance Story to compare customized quotes from various providers and to develop refined, personalized business cases can greatly enhance your chances of securing the best financing alternatives available.

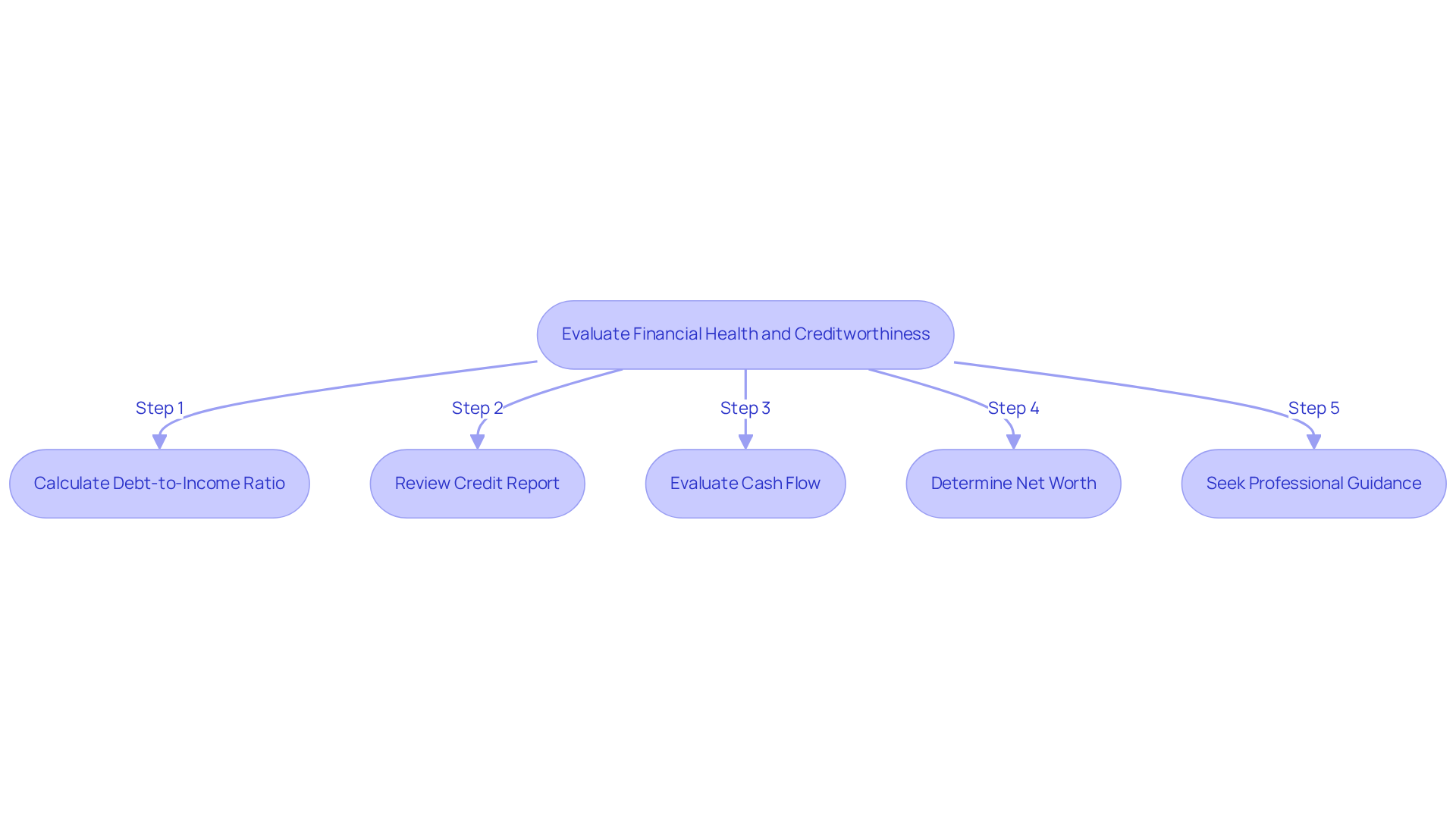

Evaluate Financial Health and Creditworthiness

To effectively assess your financial health and creditworthiness when pursuing a commercial property loan, begin by calculating your debt-to-income ratio (DTI). This crucial metric aids financial institutions in evaluating your ability to manage monthly payments relative to your earnings. A DTI of 30% or lower is typically seen as favorable, whereas ratios exceeding 40% may raise concerns for lenders. For example, if your monthly debt obligations total $2,000 and your gross monthly income is $6,000, your DTI would be approximately 33%, indicating a manageable level of debt.

Furthermore, scrutinize your credit report for any inaccuracies that could negatively impact your approval chances. Common errors include:

- Incorrect personal information

- Closed accounts being marked as open

- Duplicate entries

Such discrepancies can result in higher interest rates or even credit denials. It is advisable to review your credit report regularly, as studies show that one in five individuals may have a credit mistake that could affect their financial standing.

In addition, evaluate your cash flow statements to confirm you possess adequate liquidity to cover loan repayments and other expenses. A positive cash flow indicates that your income exceeds your expenses, which is a strong indicator of financial stability.

Determining your net worth is also vital. This involves calculating your total assets minus liabilities, providing a clear picture of your financial position. A strong net worth can enhance your appeal to creditors, showcasing your ability to manage and repay debt.

If your financial health seems uncertain, seeking professional guidance can be invaluable. Financial experts can assist you in navigating complex situations, ensuring you present the best possible case to lenders.

By following these steps, you can answer the question of how, 'can I get loan on commercial property' to significantly bolster your chances of securing financing for your investment.

Understand Loan Terms and Conditions

Examine the interest rate structure with a focus on both fixed and variable options. As of March 2025, the average variable rate for owner-occupiers seeking new credit stands at 6.00% per annum. In contrast, investment credits are priced at 6.26% for outstanding amounts and 6.20% for new amounts. Fixed rates offer stability, while variable rates may present lower initial costs, albeit with potential fluctuations over time that can impact overall repayment amounts.

Understand the repayment schedule, including payment frequency and any penalties associated with early repayment. Familiarity with these details is crucial for effective cash flow management. Furthermore, Finance Story specializes in crafting polished, individualized business cases to present to lenders, ensuring you meet the elevated expectations surrounding fund acquisition.

Clarify any charges linked to the credit, such as origination and processing fees, as these can significantly influence the total borrowing cost. In 2025, common fees may encompass application fees, valuation fees, and legal costs, making it essential to request a comprehensive breakdown.

Verify the term duration and explore refinancing alternatives. Many commercial loans feature terms ranging from 5 to 30 years. Understanding your refinancing options can offer flexibility in managing your investment. Finance Story connects you with a broad spectrum of financial institutions, including high street banks and innovative private funding panels, to help you explore how can I get loan on commercial property.

Discuss collateral requirements with the lender. Most business credits necessitate the asset itself to serve as collateral; however, additional resources may be required to secure the financing.

Consult with a Financial Advisor or Broker

Identify a trustworthy advisor or mortgage broker, such as Finance Story, who can assist you in answering the question, 'can I get a loan on commercial property' and navigating the intricacies of obtaining commercial property financing. Look for professionals with a strong track record and positive client testimonials; their expertise can significantly impact your financing journey. Finance Story, known for its bespoke mortgage services, has supported businesses of all sizes and understands the nuances of financing in challenging circumstances. They have access to a comprehensive portfolio of private and boutique commercial investors, providing you with a wide range of options. Ensure to confirm their legal license to provide credit advice by checking ASIC Connect’s Professional Registers.

Prepare a comprehensive list of questions regarding loan options, interest rates, and current market conditions. Ask about the variety of products offered and how they correspond with your monetary objectives. This proactive approach ensures you gather essential information to make informed decisions.

Clearly discuss your financial objectives and property plans with the advisor. Articulating your goals helps the broker tailor their recommendations to your specific needs, ensuring that the solutions provided are relevant and beneficial. Finance Story specializes in crafting refined and highly tailored business cases to present to financiers, boosting your chances of obtaining the right funding.

Request a detailed comparison of different lenders and their products. Understanding the subtleties among various financing alternatives, including interest rates, fees, and terms, is essential for determining if I can get a loan on commercial property for your investment. Additionally, ask for a written quote from the broker that details the loan specifics, enhancing transparency in the process.

Ensure the advisor comprehensively understands your unique monetary situation. This includes your current financial standing, future aspirations, and any challenges you may face in securing financing. A customized approach nurtures a stronger collaboration and improves the chances of successful funding acquisition. Also, clarify the broker's fee structure upfront to avoid any surprises later.

If you find yourself dissatisfied with the broker's service or feel misled, remember that you have the option to file a formal complaint with their business, ensuring your rights as a consumer are protected.

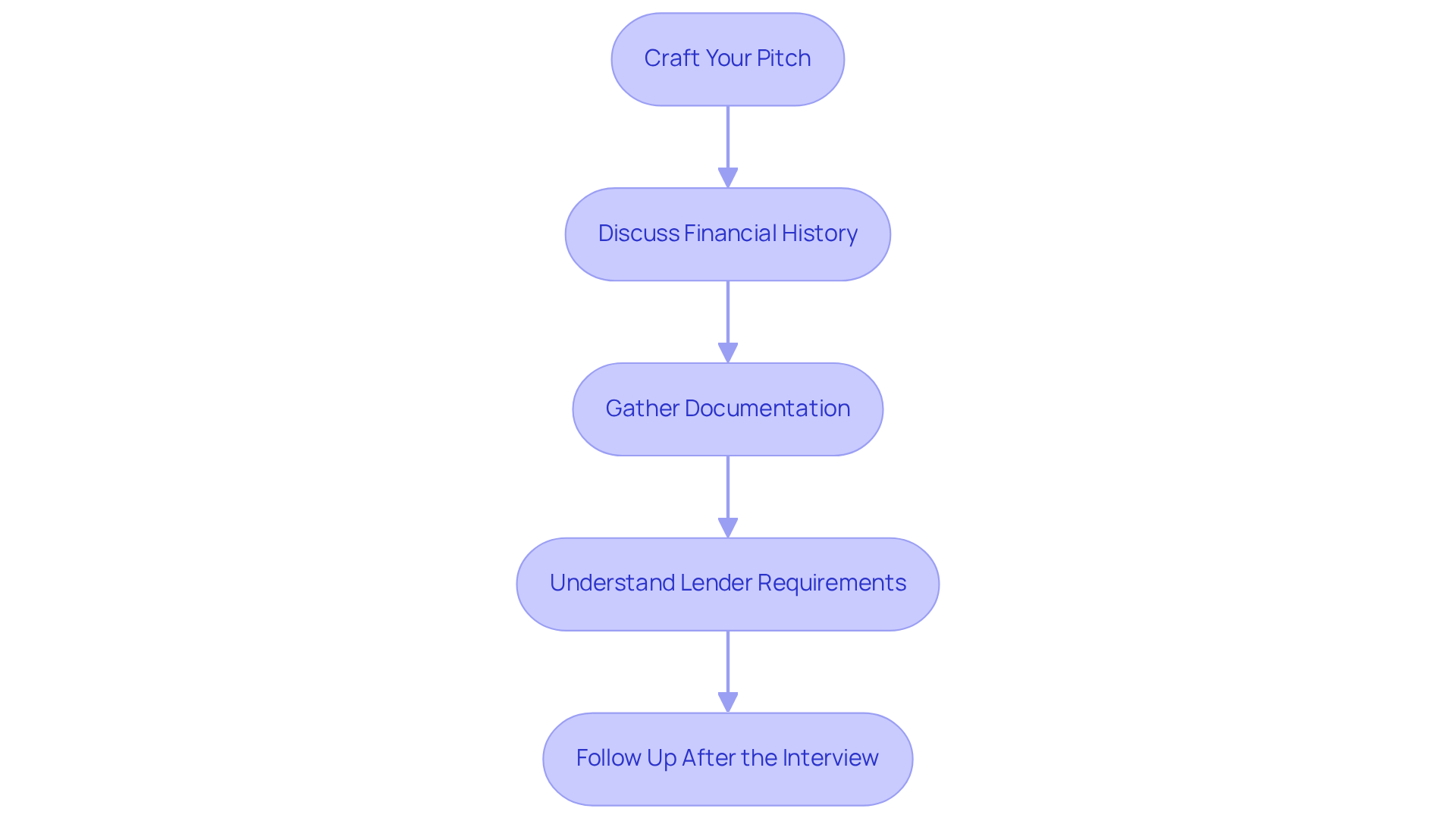

Prepare for the Loan Interview

Craft a compelling pitch that clearly outlines your business and the purpose of the loan. Emphasize how the funding will propel your growth and success, drawing on the expertise of Finance Story to create polished, individualized business cases that resonate with lenders. Be prepared to discuss your financial history, including past performance and future projections, showcasing your understanding of your business's economic health. Anticipate inquiries regarding your business model and market positioning; familiarize yourself with industry trends and how your business aligns with them. Gather all necessary documentation, such as account statements, tax returns, and business plans, to provide a comprehensive overview of your economic situation.

Remember, when considering whether you can get a loan on commercial property, it's important to note that acquiring a commercial property mortgage typically requires a deposit of 20-30%, unlike the 10% needed for residential properties; thus, be ready for this financial commitment. After the interview, follow up with the lender to express your continued interest and reinforce your commitment to the financing process, which can help keep your application top of mind. Research the lending institution's history and loan products to tailor your approach during the interview; understanding their offerings can provide you with a competitive advantage.

As highlighted by financial advisors, an effective pitch not only articulates the need for funding but also illustrates how it aligns with market opportunities and growth potential. Additionally, consider the growing trend of small-business owners acquiring commercial assets through SMSF limited recourse borrowing arrangements, offering unique financing alternatives tailored to your investment strategy. Explore the full spectrum of lenders available, including high street banks and private lending panels, to identify the best fit for your financing needs.

When considering financing, you may wonder, can I get a loan on commercial property like warehouses, retail spaces, factories, and hospitality ventures, so ensure your proposal captures the potential of your selected property.

Conclusion

Navigating the landscape of commercial property loans demands a strategic approach to determine eligibility and secure financing effectively. By understanding the essential steps outlined in this article, potential borrowers can confidently assess their readiness and significantly enhance their chances of securing the necessary funds for their investments.

Key insights include:

- Identifying eligibility criteria such as credit score requirements

- Income verification

- The importance of a solid business plan

- Gathering the required documentation

- Exploring different loan types

- Evaluating financial health

Consulting with a financial advisor or broker can provide tailored guidance, ensuring that all aspects of the loan application are meticulously addressed.

Ultimately, the journey to obtaining a commercial property loan transcends merely meeting criteria; it involves presenting a compelling case to lenders. By leveraging the insights and strategies discussed, individuals can take proactive steps toward achieving their investment goals. Engaging with professionals and thoroughly preparing for the loan interview can significantly impact the outcome, making it essential to approach this process with diligence and confidence.