Overview

This article delves into seven SMSF (Self-Managed Super Fund) property lenders that provide tailored investment solutions for individuals aiming to invest in real estate through their superannuation. It underscores the significance of personalized lending options and expert guidance in navigating the complexities of SMSF loans. Furthermore, it emphasizes how these customized solutions can improve financial outcomes and ensure compliance with regulations within the property investment landscape.

Introduction

Navigating the realm of Self-Managed Super Funds (SMSFs) and property investment can indeed be a daunting endeavor for many investors. With over 625,000 SMSFs currently operational in Australia, the demand for tailored financial solutions has surged, signaling a significant shift in how individuals approach retirement savings.

This article explores the specialized SMSF lending options available, highlighting how various financial institutions, including Finance Story, Liberty, and Bluerock, are reshaping the property investment landscape through personalized loan products and expert guidance.

Furthermore, readers will gain insights into compliance requirements and innovative borrowing arrangements, equipping them with the essential knowledge needed to make informed decisions in this evolving sector.

Whether considering commercial properties or leveraging superannuation for investment, possessing the right knowledge can empower investors to maximize their financial potential while adeptly navigating the complexities of SMSF regulations.

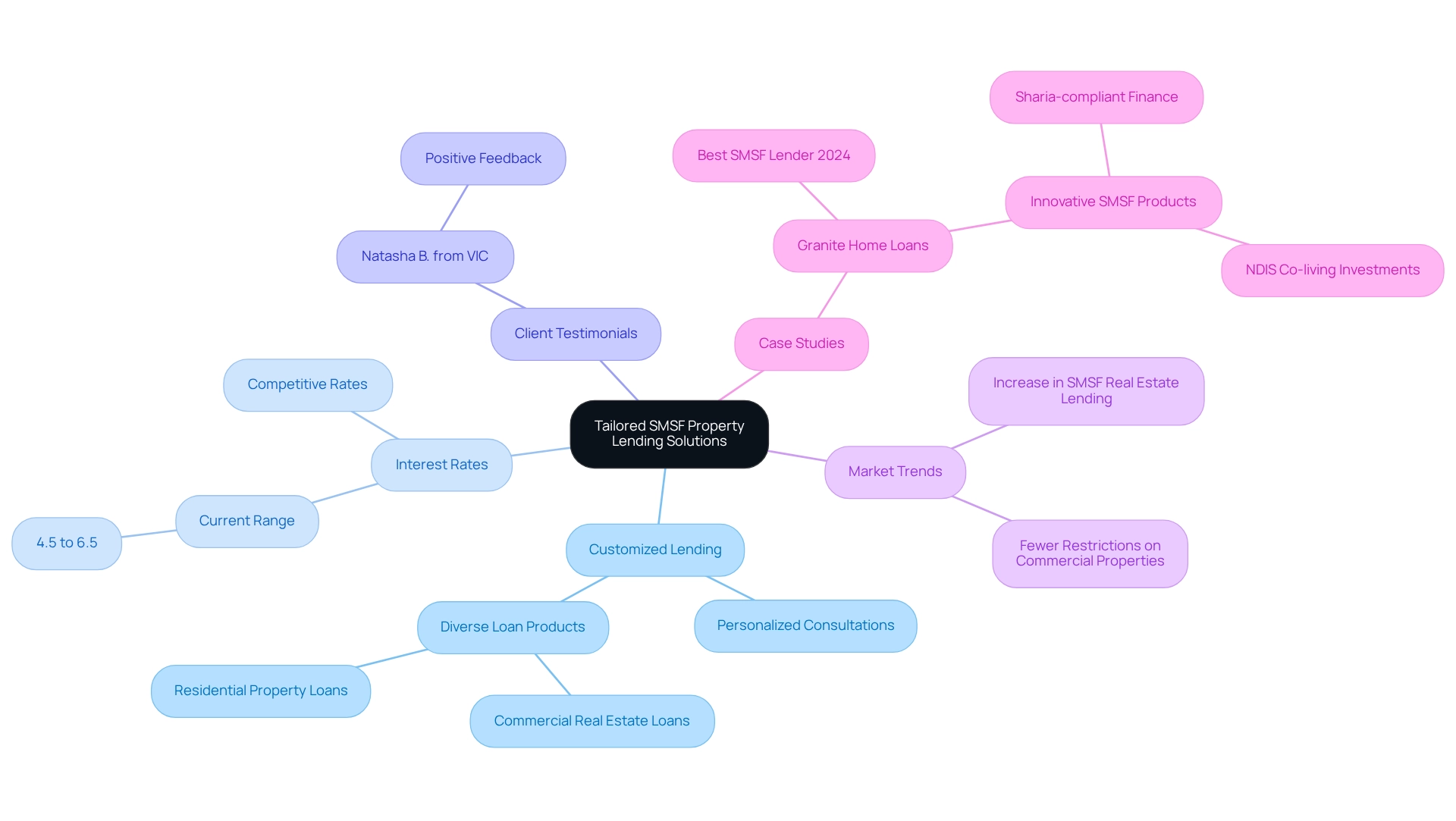

Finance Story: Tailored SMSF Property Lending Solutions

Finance Story excels in delivering customized lending solutions tailored for smsf property lenders, addressing the distinct financial situations of each individual. By prioritizing a comprehensive understanding of personal requirements, the brokerage collaborates with smsf property lenders to offer a diverse range of self-managed super fund loan products specifically designed to facilitate property investment in commercial real estate, including office buildings and warehouses. Their approach features personalized consultations, ensuring clients receive the most suitable financing options available. This commitment to personalization positions Finance Story as a trustworthy ally in the self-managed superannuation fund lending landscape.

In 2025, average interest rates for self-managed superannuation fund loans remain competitive, currently ranging from 4.5% to 6.5%, contingent on the lender and specific loan conditions. Recent statistics indicate a significant increase in self-managed superannuation fund real estate lending across Australia, particularly through smsf property lenders, highlighting the growing interest among investors eager to leverage their superannuation for real estate acquisitions. Notably, commercial real estate holdings present fewer restrictions compared to residential properties, which makes them an attractive option for smsf property lenders and self-managed super fund investors.

Successful case studies illustrate the effectiveness of Finance Story's customized self-managed superannuation fund loans. Clients have reported enhanced financial outcomes through tailored financing solutions that align with their specific strategies. For example, Natasha B. from VIC remarked, "I will definitely be recommending your business to anyone. We are finished with the constant worry. Once again, thank you so much for being a part of our journey." Financial consultants emphasize the importance of tailored loan offerings from smsf property lenders, noting that these can significantly improve portfolio performance and customer satisfaction. As the self-managed super fund lending market evolves, Finance Story remains at the forefront, adapting to emerging trends and innovations relevant to smsf property lenders. Their ability to navigate complex financial landscapes and provide tailored lending alternatives ensures that clients are well-equipped to achieve their real estate aspirations.

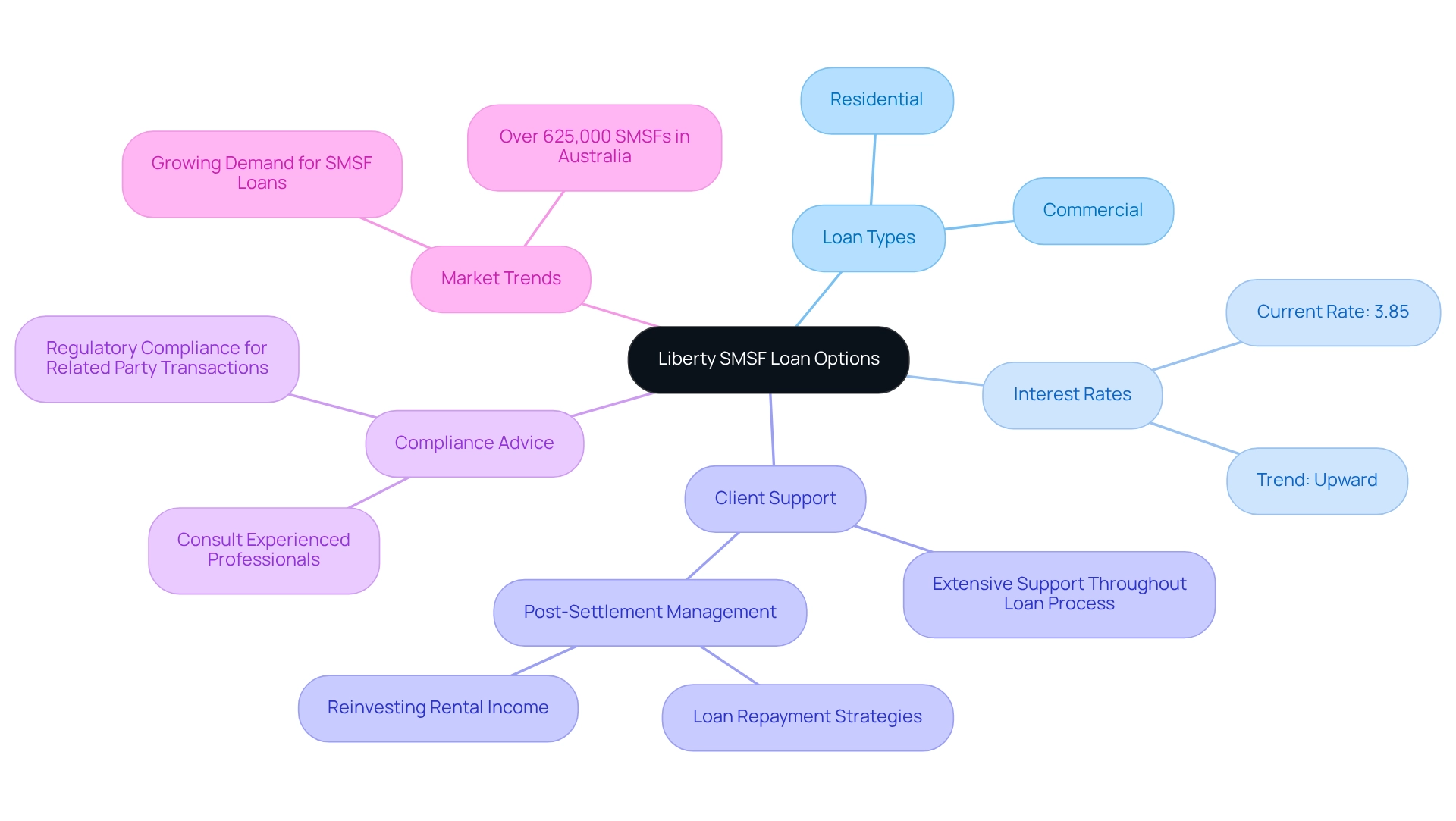

Liberty: Comprehensive SMSF Loan Options for Property Investment

Liberty presents a comprehensive array of loan options specifically designed for real estate, encompassing both residential and commercial properties. As we look towards 2025, the average loan amounts provided by SMSF property lenders for self-managed superannuation fund property investments reveal a notable upward trend. Many borrowers are seizing the opportunity for wealth accumulation through strategic property acquisitions. Liberty's loans stand out due to their competitive interest rates, currently shaped by the Reserve Bank of Australia's recent cash rate reduction to 3.85%, along with flexible terms that enable clients to optimize their superannuation funds effectively.

The company is unwavering in its commitment to providing extensive support throughout the loan process, which is crucial given the complexities associated with SMSF property lenders and self-managed superannuation fund lending. Trustees are strongly encouraged to seek advice from knowledgeable experts, such as those at Finance Story, to ensure compliance with regulations, particularly regarding the purchase of assets from related parties. Successful real estate ventures utilizing Liberty self-managed super fund loans illustrate the potential for substantial returns, provided that appropriate post-settlement oversight is maintained. This includes efficient loan repayment strategies and reinvesting rental income back into the self-managed super fund. As one expert aptly noted, "But with diligence, the rewards can be substantial."

With over 625,000 self-managed super funds currently operating in Australia, the demand for tailored loan options from SMSF property lenders continues to rise. Liberty's dedication to understanding the unique needs of each individual positions them as a trusted partner in navigating the lending landscape, ensuring that individuals can confidently pursue their real estate ambitions. Moreover, Finance Story offers personalized financial solutions for self-managed superannuation fund loans, providing expert guidance on compliance and lender selection, thereby enhancing the competitive landscape for borrowers.

Aussie: Expert Guidance on SMSF Property Investment Loans

Professional advice from smsf property lenders on self-managed superannuation fund real estate financing is essential for individuals aiming to leverage their super for property acquisitions. With over 625,000 SMSFs in Australia, involving approximately 1.1 million individuals, the demand for tailored advice has surged, reflecting a remarkable 31% increase in SMSFs over the past five years. Informed brokers play a pivotal role in assisting individuals as they navigate the complexities of lending from smsf property lenders, ensuring they are well-informed about their options and the associated risks.

Finance Story focuses on supporting individuals with commercial real estate ventures, including office buildings, warehouses, and retail spaces. Notably, there are fewer restrictions on commercial real estate ventures compared to residential assets. Finance Story assists individuals in building a solid compliance case and locating the appropriate smsf property lenders, which enables informed decision-making regarding real estate ventures.

Seeking guidance from knowledgeable financial advisors and brokers can significantly enhance adherence to regulations, empowering clients to make informed decisions regarding their real estate ventures. A compelling case study highlights how effective post-settlement management, including proper loan repayment arrangements and directing rental income to the superannuation fund, maximizes financial benefits while ensuring compliance. Remarkably, the loan balance was reduced to $120k by the time the couple sold the asset, showcasing the financial advantages of effective fund management.

As of 2025, the legal structure for SMSF property lenders continues to support limited recourse borrowing arrangements (LRBAs) under strict conditions, thereby protecting retirement assets. This evolving landscape underscores the importance of professional guidance from smsf property lenders, as it helps prevent minor concerns from escalating into significant financial difficulties and ensures successful fund real estate acquisitions. Brokers emphasize that the purpose of these assets extends beyond mere retirement advantages; as Miranda Brownlee, Deputy Editor of Adviser, notes, "the sole purpose is never just about retirement benefits because someone else is always gaining something from the asset regardless of the circumstances." This perspective highlights the critical need for professional advice from Finance Story in managing investment properties.

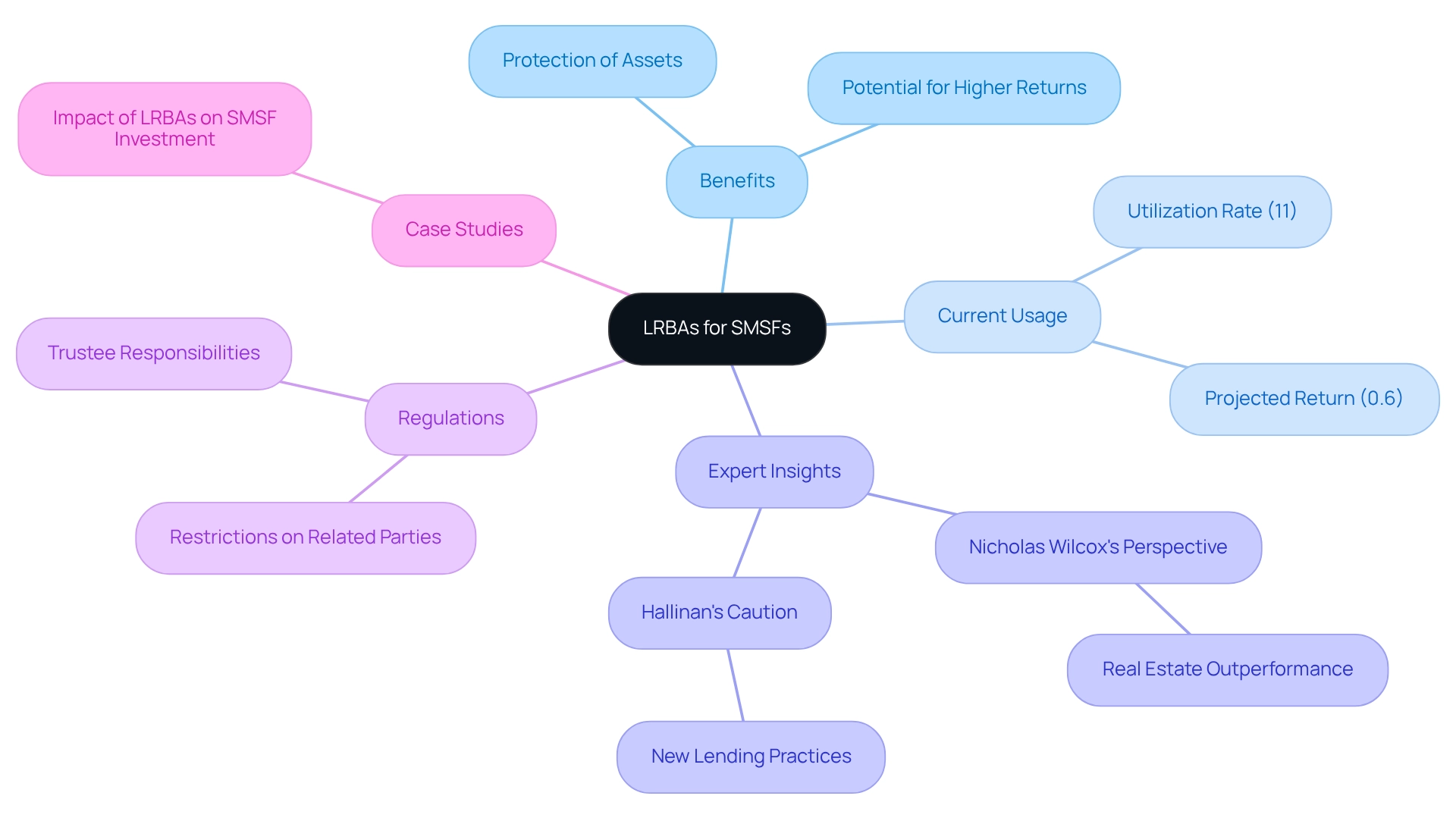

Bluerock: SMSF Loans via Limited Recourse Borrowing Arrangements

Bluerock excels in offering self-managed superannuation fund loans through Limited Recourse Borrowing Arrangements (LRBAs), a strategic method that enables smsf property lenders to secure financing for real estate acquisitions while safeguarding the fund's other assets. This structure restricts the lender's recourse solely to the property acquired, providing a significant layer of protection for investors. Notably, participants of a self-managed super fund often serve as trustees or directors, which adds a layer of responsibility and authority over financial decisions.

Currently, only 11% of self-managed superannuation funds are utilizing LRBAs, as reported by the association. This underexplored option holds considerable potential benefits. With the projected return for SMSFs at a mere 0.6% for the 2021-22 year, LRBAs present a compelling alternative for capital allocation. However, Hallinan cautioned that the lending practices of smsf property lenders may be unfamiliar to many trustees, urging careful consideration to ensure it benefits all fund members. Furthermore, it is essential to recognize that residential real estate cannot be rented to or acquired from associated parties, which are critical regulations impacting SMSF real estate activities.

Finance Story is prepared to assist you in building a solid case and ensuring adherence to regulations, while locating the suitable lender for your commercial real estate needs. Bluerock's specialized expertise in establishing and managing LRBAs, particularly with smsf property lenders, empowers clients to effectively navigate this complex borrowing strategy, optimizing their financial opportunities while minimizing risk. As the landscape of self-managed superannuation fund real estate investment evolves, expert insights suggest that limited recourse borrowing arrangements may outperform conventional investment yields, offering a persuasive option for astute investors aiming to enhance their portfolios. Nicholas Wilcox, Director and finance broker at Blue Crane Capital, remarked, 'I think real estate may be able to outperform that.'

Moreover, the case study titled 'Impact of LRBAs on Self-Managed Superannuation Fund Investment' indicates that while LRBAs have gained traction, their overall impact on the self-managed superannuation fund sector and the broader financial system remains limited.

Granite Home Loans: Simplifying SMSF Lending for Property Buyers

Finance Story is dedicated to simplifying the self-managed super fund lending process through SMSF property lenders for property purchasers, enabling clients to explore their choices with ease. Their application processes are designed to be straightforward, bolstered by clear communication that elucidates the complexities often associated with self-managed superannuation fund loans. In 2025, average approval rates for these loans have exhibited promising trends, underscoring the effectiveness of Finance Story's approach. Notably, Wave Money requires a Net Servicing Ratio of 1.1 or higher for investors with a dollar surplus, highlighting the importance of understanding servicing criteria in the lending process.

With competitive interest rates and flexible terms, Finance Story empowers trustees of self-managed super funds to make informed financial decisions with confidence. In contrast to residential real estate ventures, commercial assets present fewer restrictions, allowing for greater flexibility in financial options. Finance Story assists individuals in constructing a compelling case and ensuring compliance with superannuation regulations, which is vital for successful financial endeavors. This commitment to streamlining the lending process not only enhances the user experience but also positions Finance Story as a leader in facilitating successful property ventures through SMSF property lenders and superannuation fund structures. Recent case analyses showcase how their tailored solutions have enabled clients to achieve their financial goals, bolstering the brokerage's reputation for excellence in SMSF property lenders. For example, as homeowners consider refinancing trends and strategies amidst rising interest rates, Finance Story's expertise in navigating these challenges proves invaluable, offering individuals effective strategies to reduce their rates or adjust their loan terms.

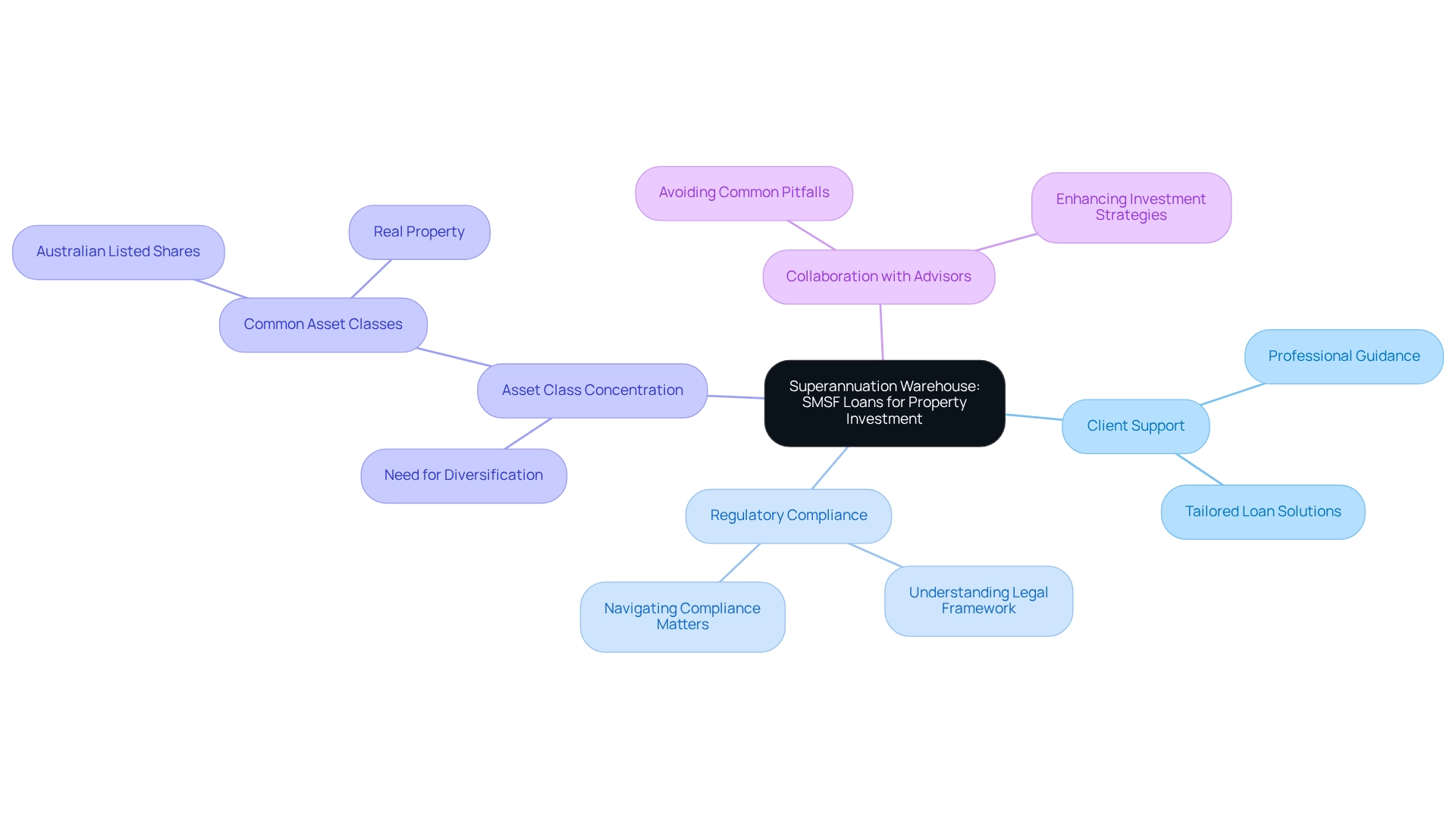

Superannuation Warehouse: Specialized SMSF Loans for Property Investment

Finance Story specializes in providing loans tailored specifically for real estate ventures, ensuring that clients receive professional support throughout the process. Their dedicated team focuses on meeting regulatory obligations, which is essential for successful projects with SMSF property lenders in real estate. Unlike residential real estate, commercial assets come with fewer restrictions, offering greater flexibility. With a strategic financial approach, Finance Story empowers clients to enhance their retirement savings through real estate, particularly in commercial spaces such as office buildings, warehouses, and retail locations.

Current trends indicate that 74% of self-managed superannuation fund assets are concentrated in just five asset classes, underscoring the necessity for diversification strategies to effectively mitigate risks. As trustees navigate the complexities of real estate, it is vital to remain vigilant regarding compliance matters. Collaborating with knowledgeable advisors can significantly increase the likelihood of successful ventures while adhering to the legal framework.

'Collaborating with informed advisors is essential to steering clear of typical traps in self-managed super fund borrowing,' states a spokesperson from Finance Story. The company, as one of the leading smsf property lenders, provides clients with the expertise needed to make informed decisions and achieve their investment goals.

BOOK A CHAT.

Loanscope: Comprehensive SMSF Lending Guidance for Property Investors

Finance Story excels in delivering comprehensive lending advice tailored specifically for real estate investors. Their dedicated team offers personalized consultations, enabling clients to thoroughly evaluate their financial situations and select the most suitable loan options for investing in commercial properties such as office buildings, warehouses, and retail spaces.

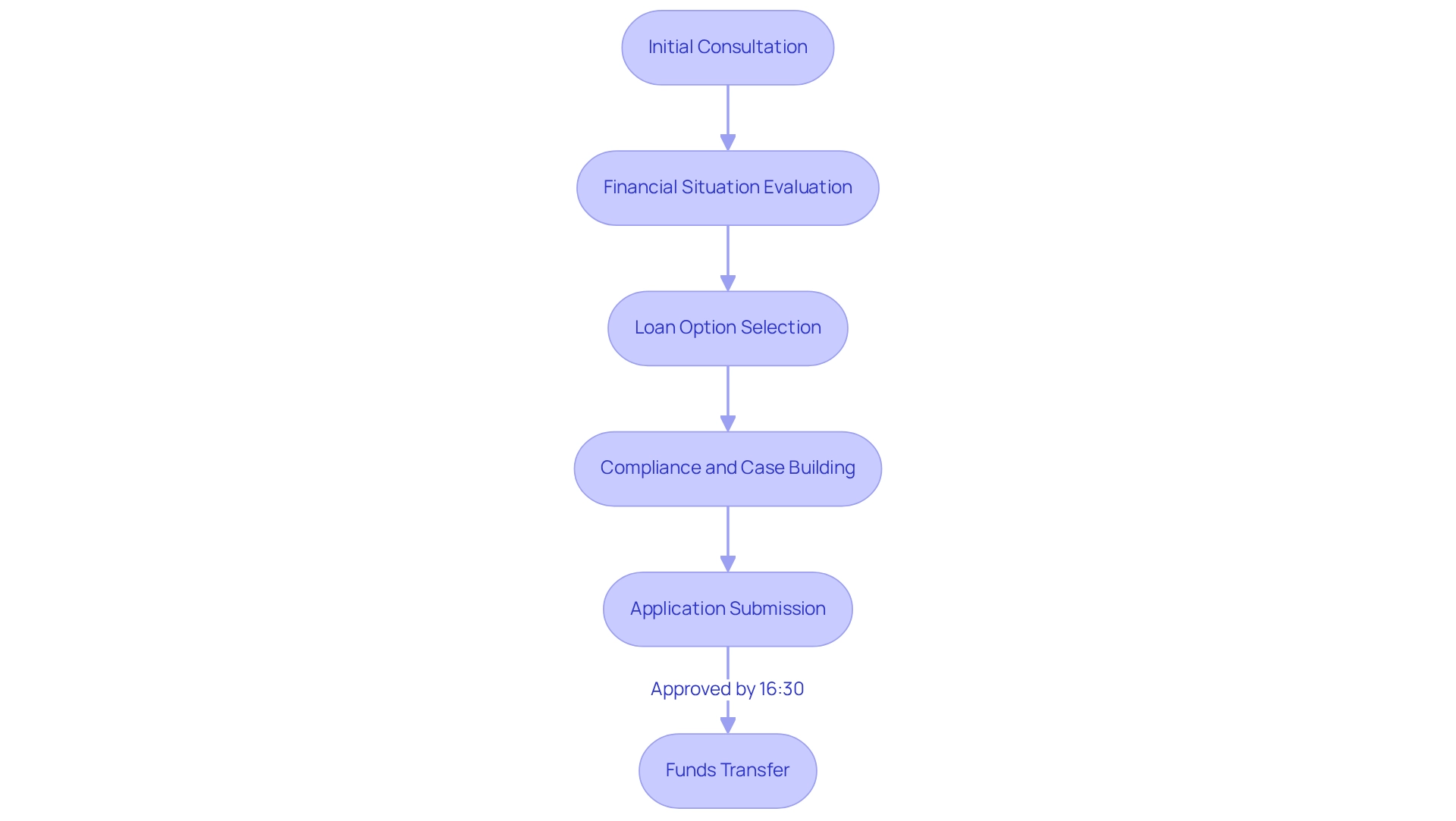

By streamlining the self-managed super fund lending process and establishing a robust case for compliance with regulations, Finance Story empowers investors to make informed and confident decisions about their property investments through SMSF property lenders. Notably, funds will be transferred to customers' accounts on the same day as approval if authorized by 16:30, underscoring the efficiency of their services.

This approach not only enhances understanding but also fosters a sense of security in navigating the complexities associated with SMSF property lenders and their lending options. Furthermore, Finance Story is recognized for its professionalism and deep expertise in the finance sector, effectively assisting individuals in achieving their financial goals.

Dark Horse Financial: In-Depth SMSF Loan Insights and Application Guidance

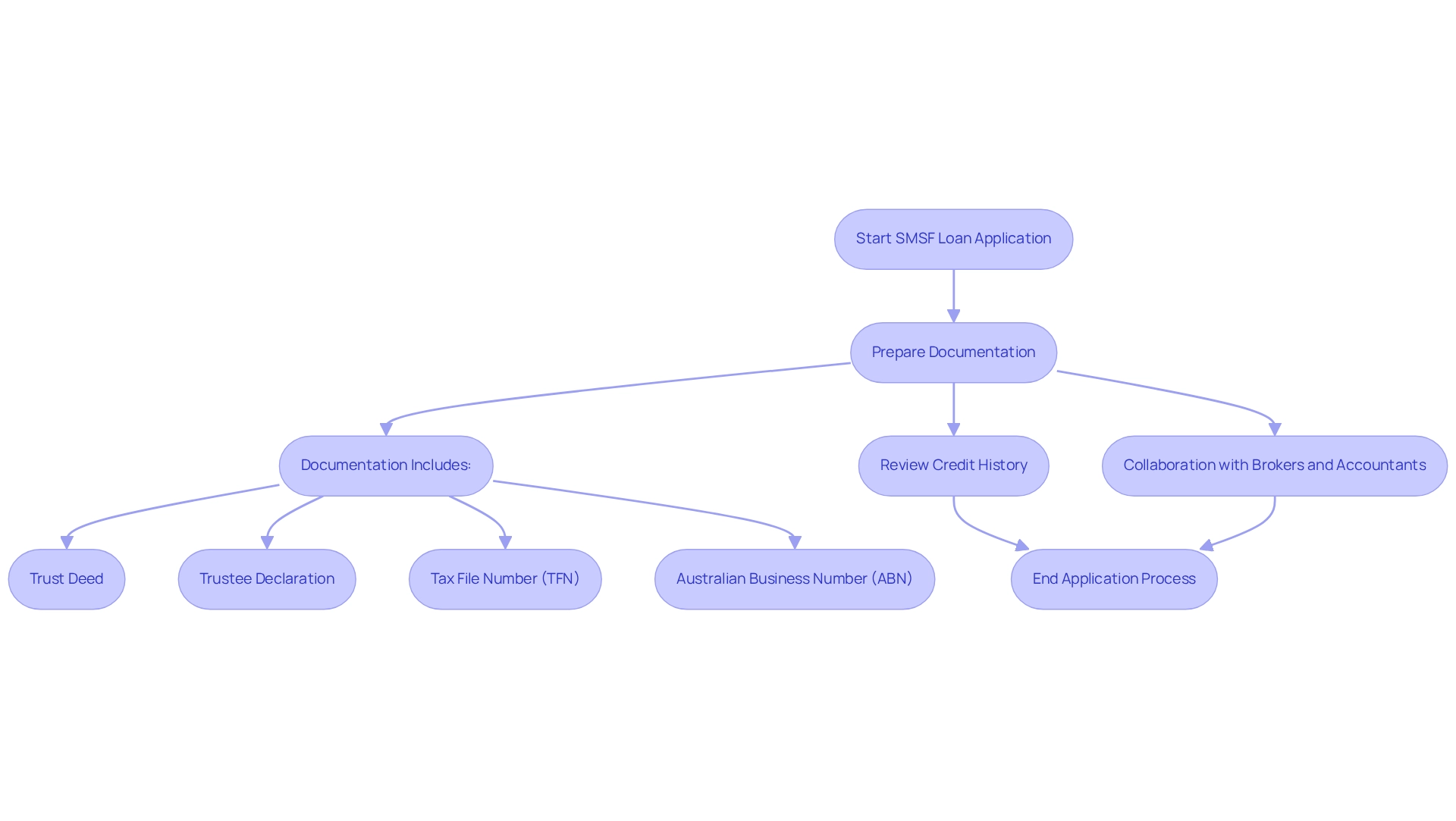

Finance Story delivers comprehensive insights into SMSF property lenders and self-managed superannuation fund loans, equipping individuals with essential guidance throughout the application process. They assist in preparing the necessary documentation, which typically includes:

- Trust Deed

- Trustee Declaration

- Tax File Number (TFN)

- Australian Business Number (ABN)

Understanding these requirements is crucial, as proper preparation can significantly enhance the likelihood of loan approval. Notably, there are fewer limitations on commercial real estate ventures compared to residential buildings, presenting valuable opportunities for investors. Moreover, some lenders offer alternative servicing options that allow for additional member contributions to meet borrowing requirements, providing essential flexibility for investors.

With a commitment to transparency and support, Finance Story empowers individuals to effectively navigate the landscape of SMSF property lenders. Their approach encompasses these alternative service options, which can assist individuals in refining their investment strategies for commercial property.

Case studies illustrate the importance of collaboration between brokers and customers' accountants and financial planners, ensuring that self-managed super fund loans comply with legislative requirements. Such partnerships foster trust and lead to increased referrals, deepening the understanding of individuals' financial situations, ultimately aiding them in their loan applications.

In 2025, Finance Story continues to provide tailored insights into self-managed superannuation fund loans, helping individuals make informed decisions and mitigate risks associated with their investments. As Siobhan Williams, Head of Mortgages at Finance Story, remarked, "We saw a gap in the market. We consulted with some brokers and partners that we knew were writing volume in this space. And we developed a product over time with their feedback." Their expertise in the application process, coupled with a focus on customer education, positions them as a vital ally for individuals seeking to leverage SMSF property lenders for self-managed super fund real estate loans effectively. Furthermore, reviewing credit history and financial statements can enhance the likelihood of loan approval, underscoring the significance of thorough preparation.

BOOK A CHAT

Heritage: Essential SMSF Setup and Loan Information for Property Investors

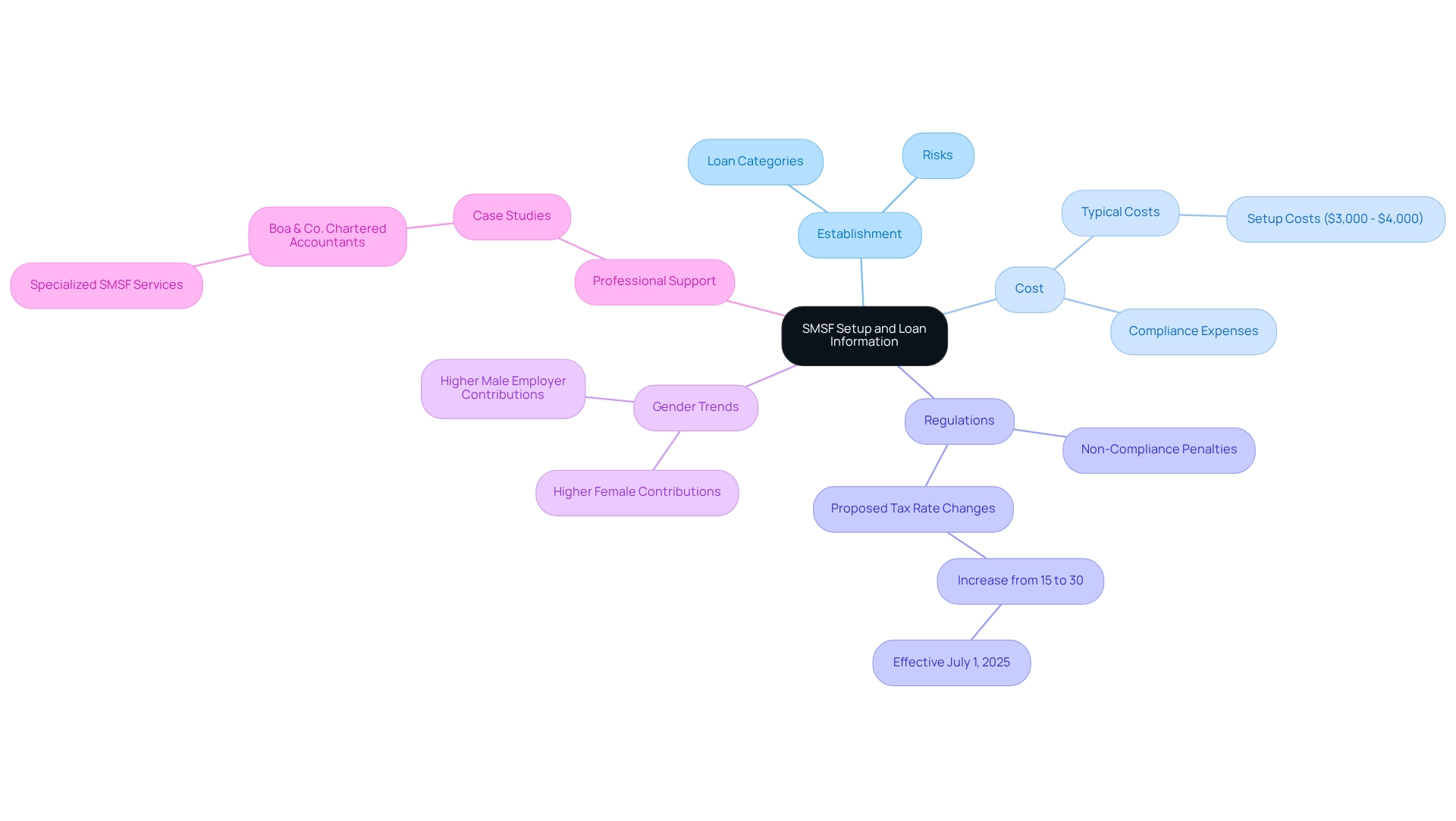

Finance Story offers essential insights into the establishment of Self-Managed Super Funds (SMSFs) and the options available from SMSF property lenders for property investors. Their expert guidance ensures individuals navigate the complexities of self-managed superannuation fund establishment while adhering to regulations. By detailing the various loan categories and associated risks, including contributions to commercial real estate like office buildings, warehouses, and retail spaces, Finance Story empowers clients to make informed decisions regarding their real estate investments through SMSF property lenders, particularly in the commercial sector.

As the self-managed superannuation fund sector experiences significant growth, understanding the average costs associated with setting up SMSF property lenders is vital. Recent statistics reveal that approximately 1.1 million Australians are utilizing SMSF property lenders for real estate, highlighting a trend toward greater financial independence. The typical cost for establishing a self-managed super fund is estimated to be around $3,000 to $4,000, covering both setup and ongoing compliance expenses. Finance Story's commitment to transparency and education helps clients grasp the complexities of SMSF regulations, including the severe penalties for non-compliance, which can impact their financial strategies.

With the evolving landscape, particularly in light of recent government proposals affecting superannuation—such as the proposed increase in the concessional tax rate on super balances exceeding $3 million from 15% to 30%, effective July 1, 2025—Finance Story remains at the forefront, offering tailored solutions that align with the latest guidelines for SMSF establishment in 2025. Their comprehensive approach not only facilitates effective SMSF arrangements but also enhances clients' confidence in their investment decisions.

Furthermore, as noted by Shaun Backhaus, the trend of higher average member contributions among females compared to males underscores the importance of informed decision-making for real estate investors. Additionally, case studies, such as that of Boa & Co. Chartered Accountants, illustrate the critical role of professional support in managing the complexities of self-managed superannuation funds, emphasizing the value of Finance Story's services.

BOOK A CHAT.

Moneysmart: Trusted Insights on SMSF Property Rules and Borrowing

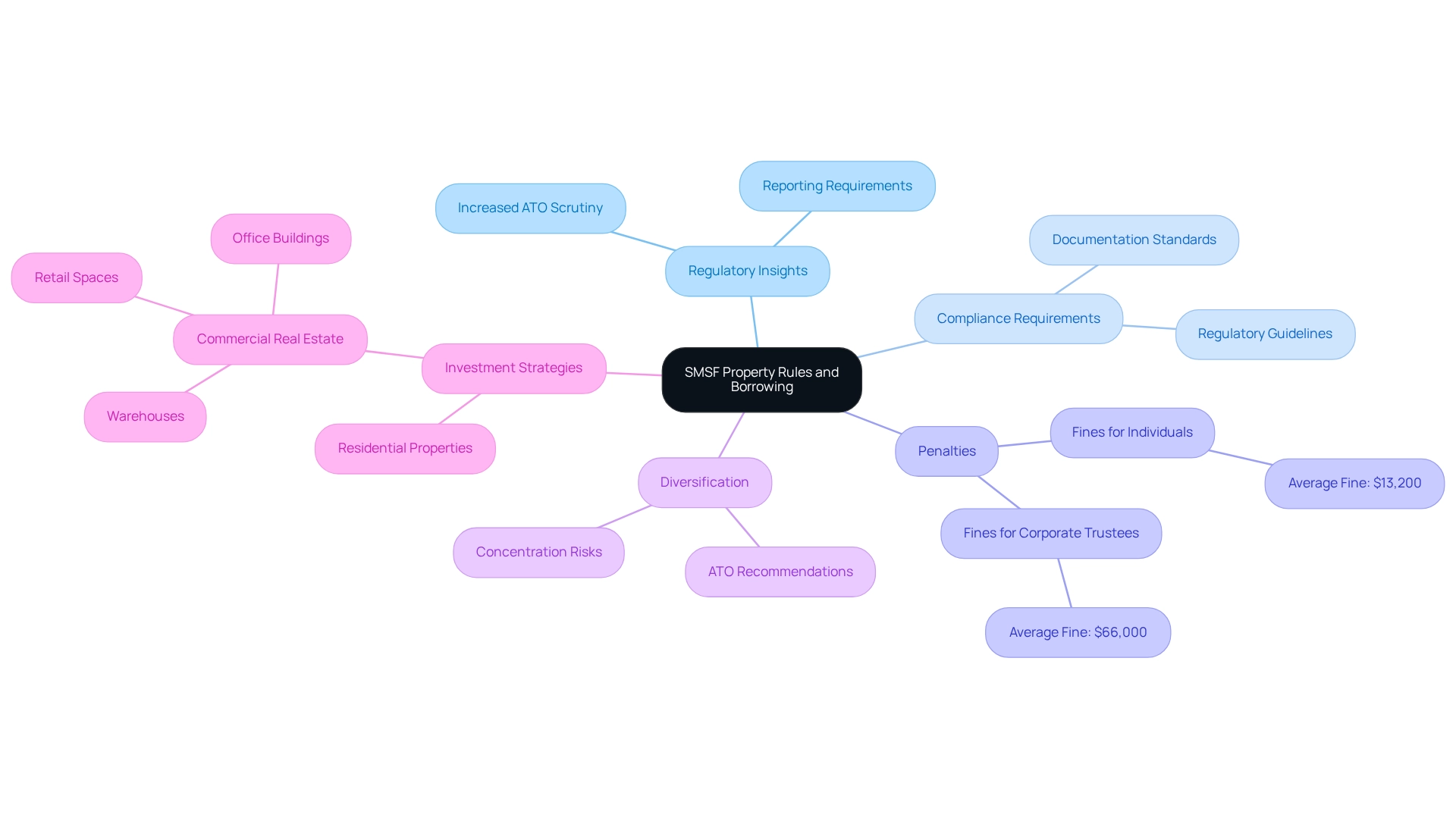

Moneysmart delivers essential insights into the regulations and borrowing associated with SMSF property lenders, empowering investors with the expertise required to navigate the complexities of this lending landscape. Their comprehensive resources address critical areas such as compliance requirements, funding strategies, and the implications of borrowing within an SMSF framework.

In 2025, SMSFs will face heightened reporting requirements and increased scrutiny from the ATO, underscoring the importance of meticulous documentation and strict adherence to regulatory guidelines. Non-compliance can result in substantial penalties, with average fines soaring to $13,200 for individuals and $66,000 for corporate trustees. This reality makes it imperative for trustees to engage with seasoned advisors to ensure compliance and sidestep potential pitfalls.

Statistics reveal that many SMSFs are heavily concentrated in single assets, prompting the ATO to recommend that funds holding over 90% in one asset category diversify their portfolios. This emphasizes the critical role of diversification in robust financial strategies.

Finance Story provides expert guidance on leveraging SMSFs for commercial real estate investments, including office buildings, warehouses, and retail spaces, which come with fewer restrictions compared to residential properties. By offering tailored support for compliance and the selection of SMSF property lenders, Finance Story ensures that clients are fully equipped to navigate the complexities of SMSF lending.

As one expert aptly stated, "If you ever find yourself unsure or in a sticky situation with your SMSF loan or property, don’t hesitate to seek a second opinion from an SMSF professional.

Conclusion

Navigating the complexities of Self-Managed Super Funds (SMSFs) and property investment is an intricate journey that demands careful consideration and expert guidance. This article highlights how various financial institutions, including Finance Story, Liberty, and Bluerock, are innovating within the SMSF lending landscape to provide tailored solutions that cater to the unique needs of investors. With over 625,000 SMSFs in Australia, the demand for specialized lending options is on the rise, particularly in the realm of commercial property investments, which present fewer restrictions compared to residential properties.

The importance of personalized consultations and compliance with regulatory requirements cannot be overstated. Financial institutions are stepping up to offer comprehensive support throughout the loan process, ensuring that clients are equipped with the necessary knowledge to make informed decisions. Through the use of Limited Recourse Borrowing Arrangements (LRBAs) and other innovative lending strategies, investors can effectively safeguard their assets while pursuing lucrative property opportunities.

Ultimately, successful property investment through SMSFs hinges on a combination of expert advice, strategic planning, and a thorough understanding of compliance requirements. Engaging with knowledgeable brokers and financial advisors not only enhances investment performance but also mitigates risks associated with SMSF borrowing. As the landscape continues to evolve, leveraging the insights and tailored solutions provided by industry leaders will be crucial for investors looking to maximize their financial potential and secure their retirement through strategic property investments.