Overview

This article explores seven types of unsecured loans specifically designed for small and medium enterprises (SMEs) to foster business growth. It emphasizes the significant advantages these loans offer, including rapid access to capital, customized financing solutions, and flexible repayment options. Such features are crucial for SMEs as they navigate financial challenges and seize growth opportunities.

Are you aware of how unsecured loans can transform your business? These financial tools provide immediate funding, allowing you to respond swiftly to market demands. Furthermore, tailored financing solutions mean you can find options that align perfectly with your business model, enhancing your operational efficiency.

Additionally, the flexibility in repayment terms ensures that you can manage your cash flow effectively, adapting to the unique rhythms of your business. This adaptability is essential for SMEs aiming to thrive in a competitive landscape. By leveraging these loans, you position your business to capitalize on emerging opportunities and drive sustainable growth.

In conclusion, understanding the various types of unsecured loans available can empower you to make informed financial decisions. Explore these options and consider how they can support your journey toward success.

Introduction

In the dynamic landscape of small and medium enterprises (SMEs), securing the right financing can be a game-changer for growth and innovation. With a plethora of options available—from tailored unsecured loans to rapid approval processes—businesses are increasingly turning to specialized lenders to meet their unique financial needs.

This article delves into the diverse range of unsecured loan solutions designed specifically for SMEs, highlighting key players in the market such as:

- Finance Story

- Bizcap

- Tyro

- Westpac

By exploring the benefits and considerations of these financing options, SMEs can better navigate the complexities of borrowing, ensuring they have the necessary capital to thrive in a competitive environment.

Whether it's managing cash flow, investing in new projects, or overcoming financial hurdles, understanding the landscape of unsecured loans is crucial for any SME aiming for sustainable growth.

Finance Story: Tailored Unsecured Loan Solutions for SMEs

Finance Story excels in providing personalized SME unsecured loans that are specifically tailored for small and medium businesses. By prioritizing a thorough comprehension of each client's unique financial situation, Finance Story offers SME unsecured loans with adaptable terms and attractive rates, empowering enterprises to secure the necessary capital without the constraints of collateral. In 2025, the average interest rates for SME unsecured loans in Australia are anticipated to be approximately 9.5%, indicating a competitive market that makes these financing options increasingly accessible for SMEs aiming to grow or innovate.

Shane, the Founder and Funding Specialist Director at Finance Story, brings a wealth of experience in enterprise growth and financing solutions. With a background in senior consultancy roles and a proven track record of saving companies millions, he understands the complexities of repayment criteria and the positive impact that well-structured financial solutions can have on a company's long-term success. His unique insights into automation, robotics, and technology solutions further enhance the value of the financing options he provides, ensuring that SMEs can leverage these tools for growth.

The benefits of SME unsecured loans for small enterprises are significant; they provide rapid access to capital, enabling prompt investment in growth opportunities such as renovations or equipment acquisitions. Notably, the average loan amount for renovations is $55,250, illustrating the potential for substantial improvements that can drive business success.

Case studies reveal the resilience of small and medium enterprises in Australia, particularly in navigating challenges like high interest rates and inflation. The Australian Small Business & Family Enterprise Report underscores the vital role of SMEs in the economy, highlighting the need for tailored financing solutions to support their growth. For instance, customized SME unsecured loans have proven effective in helping enterprises overcome financial hurdles, showcasing successful examples where companies have utilized these funds to accelerate growth.

Expert opinions further emphasize the importance of tailored financial solutions. Phil Collard, a financing specialist, states that "the appropriate funding option can be a very powerful tool to accelerate growth," underscoring the necessity for small to medium enterprises to have clear plans mapped out, including anticipated returns on investment (ROI).

As the landscape for SME unsecured loans evolves, Finance Story, under Shane's guidance, remains committed to offering innovative and flexible financing options to ensure that small and medium enterprises can thrive in a competitive environment. To discover how customized financing can benefit your enterprise, consider reaching out to Finance Story for a consultation.

Prospa: Fast and Flexible Unsecured Business Loans

Finance Story delivers customized financing proposals tailored to the unique requirements of small and medium enterprises (SMEs) seeking SME unsecured loans for commercial property investments and refinances. Our expertise is in crafting refined and highly tailored proposals that meet the elevated expectations of lenders, ensuring you secure the right funding for your next development.

Are you looking to purchase a warehouse, retail premise, factory, or hospitality venture? We provide access to a comprehensive range of lenders, including high street banks and innovative private lending panels. Understanding loan repayment requirements is crucial for efficient financing, and our team is here to guide you through this process.

Schedule your free personalized consultation with Shane Duffy, our Head of Funding Solutions, to discuss your needs and goals. Let us help you craft your next chapter in financing.

In today's competitive lending environment, the demand for SME unsecured loans and strategic financial planning is critical, and we are dedicated to supporting your growth with tailored financial strategies.

Bizcap: Quick Approval Unsecured Business Loans

Bizcap specializes in providing SME unsecured loans, emphasizing quick approvals that are often finalized within just a few hours. This rapid response is crucial for SMEs—defined as enterprises with an annual turnover of less than $10 million—facing cash flow challenges or looking to seize new opportunities. With loan amounts reaching up to $5 million, Bizcap offers flexible terms and minimal documentation requirements, making it an ideal choice for businesses in need of SME unsecured loans and swift financial solutions.

The significance of prompt funding, especially through SME unsecured loans, cannot be overstated; it empowers small enterprises to navigate financial hurdles effectively. For example, Bizcap's comprehensive credit assessment approach prioritizes current cash flow over historical financial difficulties, as illustrated in the case study titled "Holistic Credit Assessment by Bizcap." This strategy enables them to assist businesses that may have previously struggled to secure funding, promoting resilience and encouraging entrepreneurs to rebuild and thrive.

In 2025, Bizcap remains committed to providing SME unsecured loans, with statistics indicating a high approval rate for loan applications—over 80% of requests are accepted, demonstrating their understanding of the unique needs of small businesses. Testimonials from satisfied clients underscore the convenience and efficiency of Bizcap's services, with small business owner Michael M. stating, 'Bizcap is quick and convenient. They understand what I need.' This reinforces their reputation as a trusted partner in the financial landscape, particularly in a year marked by significant advancements in their service offerings.

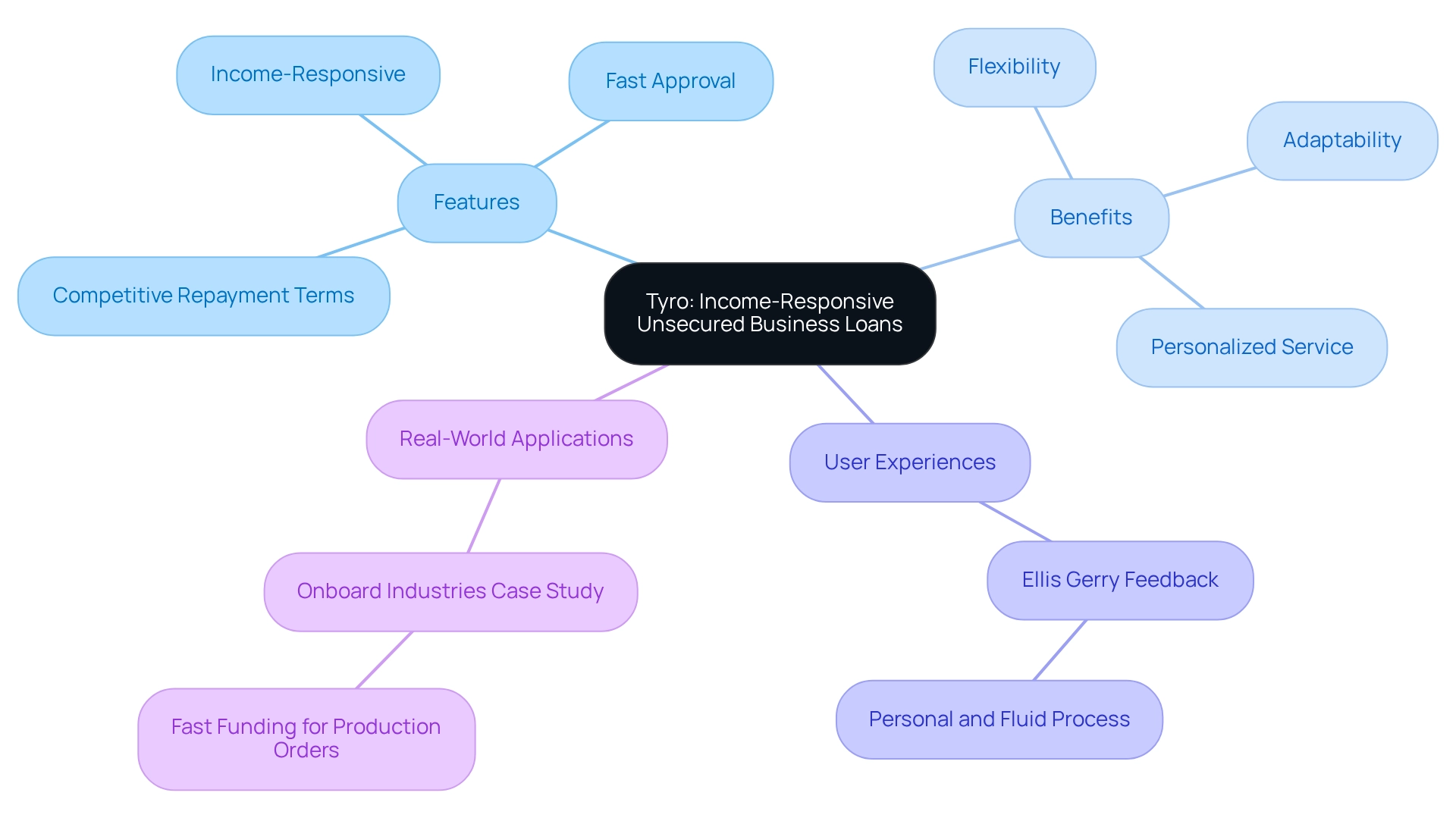

Tyro: Income-Responsive Unsecured Business Loans

Tyro offers sme unsecured loans that are income-responsive and tailored to the cash flow needs of small and medium enterprises. This innovative approach enables businesses to secure financing that aligns with their revenue fluctuations, ensuring manageable repayments even in challenging times. With an average approval time significantly faster than traditional banks, Tyro's sme unsecured loans are particularly advantageous for small and medium enterprises navigating dynamic markets.

In 2025, the popularity of Tyro's sme unsecured loans has surged, with statistics indicating a growing number of small and medium enterprises embracing this flexible financial option. For instance, Onboard Industries, a leading surfboard product expert, leverages sme unsecured loans through Tyro financing to efficiently manage production orders, exemplifying the practical application of these financial solutions in real-world scenarios. The benefits of Tyro's income-responsive financing extend beyond mere flexibility; they also offer competitive average repayment terms and adjustable schedules that adapt to the business's income. This adaptability is essential for small and medium enterprises, allowing them to focus on growth without the constraints of rigid repayment structures often found in sme unsecured loans. Additionally, the Tyro App empowers customers to evaluate their borrowing capacity and customize their options, further emphasizing the personalized nature of Tyro's services.

Feedback from users, such as Ellis Gerry from Onboard Industries, underscores the personal and adaptable experience Tyro delivers compared to traditional banks. This aspect is crucial, highlighting Tyro's unique selling proposition. The streamlined application process, which can result in funds being deposited in under 60 seconds for those using a Tyro Bank Account, enhances the borrowing experience, making it a preferred choice for many small and medium-sized enterprises eager to accelerate their growth.

Westpac: Comprehensive Unsecured Loan Options for SMEs

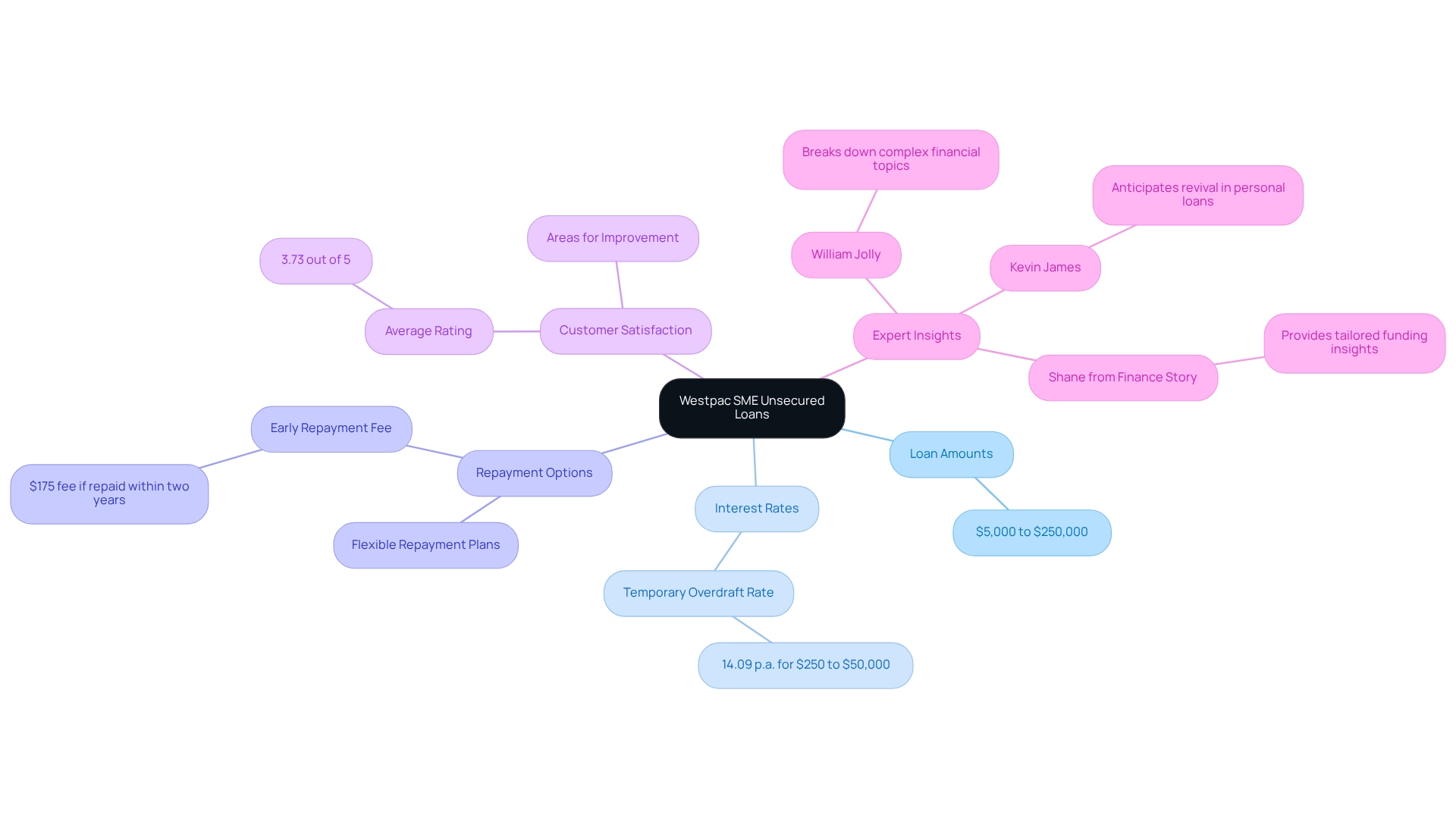

Westpac provides a diverse array of SME unsecured loans specifically designed for small and medium-sized enterprises. With loan amounts ranging from $5,000 to $250,000, businesses can select the funding that aligns best with their needs. Competitive interest rates and flexible repayment options cater to various financial requirements, including business expansion, equipment purchases, and operational capital demands.

The bank's commitment to small and medium enterprises is evident in its comprehensive strategy, ensuring that businesses can secure funding tailored to their unique circumstances. For example, Temporary Overdraft rates are currently set at 14.09% p.a. for amounts between $250 and $50,000, providing additional flexibility for short-term financial needs. It is also important to note that a $175 fee applies if a personal credit is repaid within two years of a term exceeding two years, a consideration that prospective borrowers should keep in mind when evaluating their options.

Westpac's established reputation in the banking sector instills confidence among small to medium enterprises seeking financial support. Recent insights from industry experts, including Kevin James from Equifax, indicate a potential resurgence in personal financing as government stimulus measures wind down, presenting a favorable environment for small and medium enterprises to explore funding opportunities. Additionally, customer satisfaction ratings for Westpac's personal financing average 3.73 out of 5, highlighting areas for improvement in customer service. This information is crucial for small business owners as it may influence their financing decisions, underscoring the importance of choosing a lender that not only offers robust SME unsecured loans but also prioritizes client experience.

In 2025, Westpac continues to adapt its SME unsecured loans to meet the evolving needs of SMEs, ensuring that businesses have access to essential resources for growth and development. As economic journalist William Jolly points out, grasping complex financial concepts is vital for small business owners. Furthermore, collaborating with experts such as Shane from Finance Story can provide tailored insights into securing the right funding options, enhancing the overall proposal process. Westpac's flexibility, combined with a focus on customer satisfaction, positions it as a reliable partner for small and medium enterprises navigating their financial journeys.

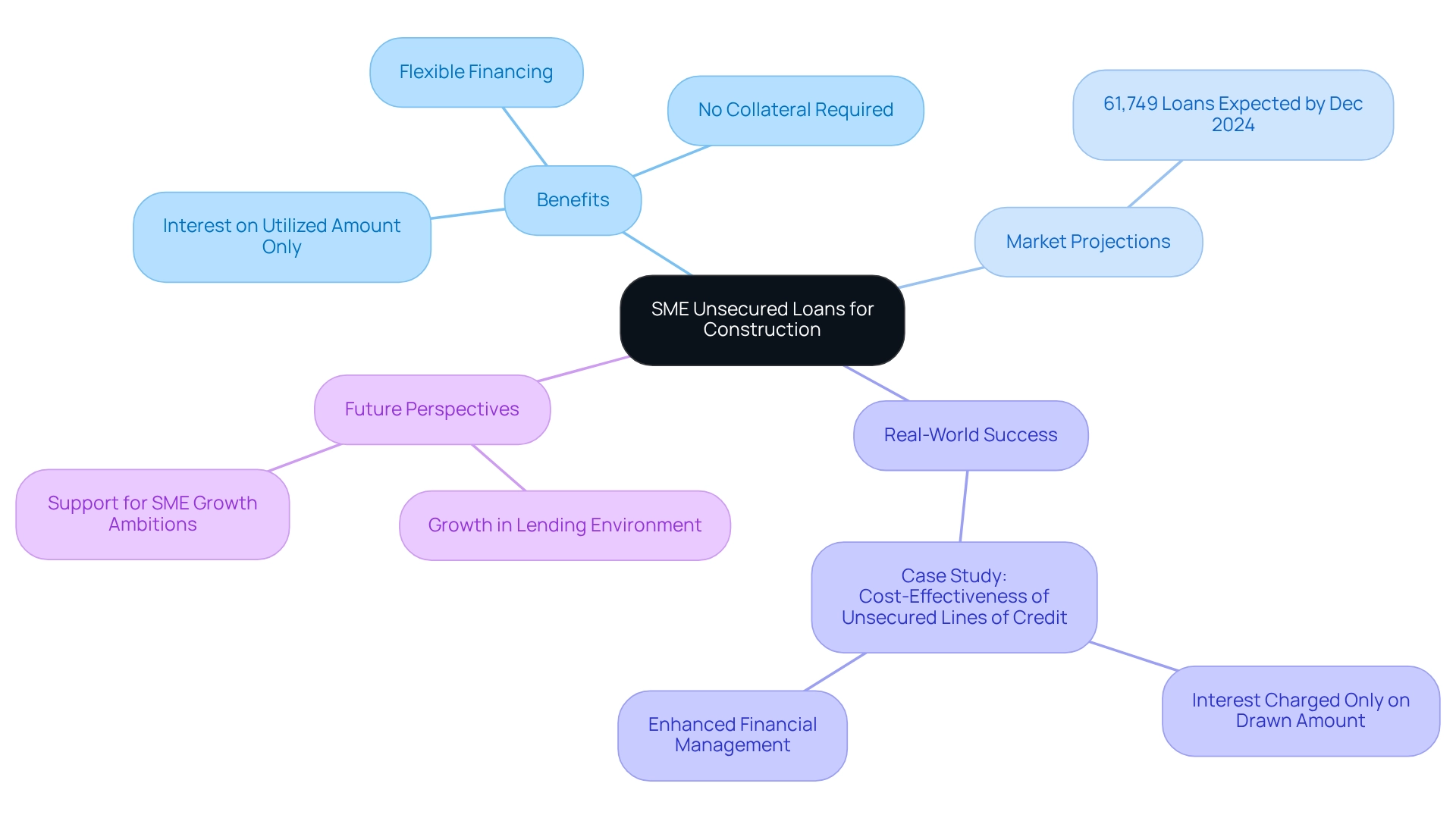

Capital Boost: Unsecured Loans for Construction SMEs

Capital Boost is dedicated to providing SME unsecured loans specifically tailored for small and medium-sized enterprises in the construction sector. This approach addresses the unique challenges these firms encounter, such as fluctuations in cash flow and the urgent need for funding to maintain project timelines. By offering SME unsecured loans as flexible financing solutions that do not require collateral, Capital Boost empowers construction firms to obtain vital funds for projects, equipment, and operational expenses without risking their assets. This strategy not only facilitates immediate access to capital but also supports sustained growth in a competitive marketplace.

Looking ahead to 2025, the anticipated average borrowing amounts for construction enterprises utilizing Capital Boost's services are expected to be significant, reflecting the increasing demand for accessible financing options. The lending landscape is experiencing positive growth, with overall lending indicators from May 2024 suggesting a favorable environment for SMEs. This is particularly relevant as SME unsecured loans are projected to reach 61,749 by December 2024, underscoring the expanding availability of financing solutions for construction companies. The effectiveness of SME unsecured loans is particularly noteworthy; interest is charged only on the amount utilized, allowing construction firms to manage their finances more efficiently. For example, a construction company that accessed an unsecured financial advance from Capital Boost successfully completed a major project ahead of schedule, illustrating how timely access to capital can enhance operational efficiency and competitiveness. This feature has proven advantageous, enabling contractors to focus on immediate needs while minimizing interest costs.

As the lending environment continues to evolve, Capital Boost remains a vital resource for small and medium-sized enterprises in the construction industry striving to thrive in this dynamic sector. Small business owners should consider exploring SME unsecured loans as a viable option to meet their financial needs and support their growth ambitions.

Small Business Loans Australia: Diverse Unsecured Loan Types

In Australia, SMEs can access a wide array of SME unsecured loans, which include short-term financing, lines of credit, and merchant cash advances. Each type of credit addresses specific monetary requirements, whether tackling urgent cash flow issues or financing larger projects. The adaptability inherent in unsecured financing enables companies to select alternatives that align with their financial strategies and growth goals. This flexibility is essential, particularly as the unsecured financing market continues to expand, driven by the rising demand for accessible capital among SMEs and startups.

Current trends indicate that enterprises are increasingly opting for unsecured financing due to simplified application procedures and quicker access to capital, which can significantly enhance operational efficiency. For instance, HSBC Fusion achieved an 80% error reduction and 76% cost savings, underscoring the operational benefits that can be realized through effective management of financing.

As Malcolm Roberts, Productivity Commissioner, observes, 'Finding the right product may be challenging, but the benefits can be significant.' This statement echoes the growing awareness among SMEs of the advantages that diverse unsecured financing options can provide in fostering growth.

To explore the optimal funding choices tailored to your objectives, consider scheduling a complimentary personalized consultation with Finance Story's Head of Funding Solutions, Shane Duffy. His expert guidance can help you navigate the funding landscape and develop a customized financial strategy that meets your unique needs.

Furthermore, examining global examples, such as China's leading position in the unsecured financial credit market, can provide valuable insights into how these financial products can be leveraged for expansion and innovation.

Driva: Guidance on Unsecured Loan Applications for SMEs

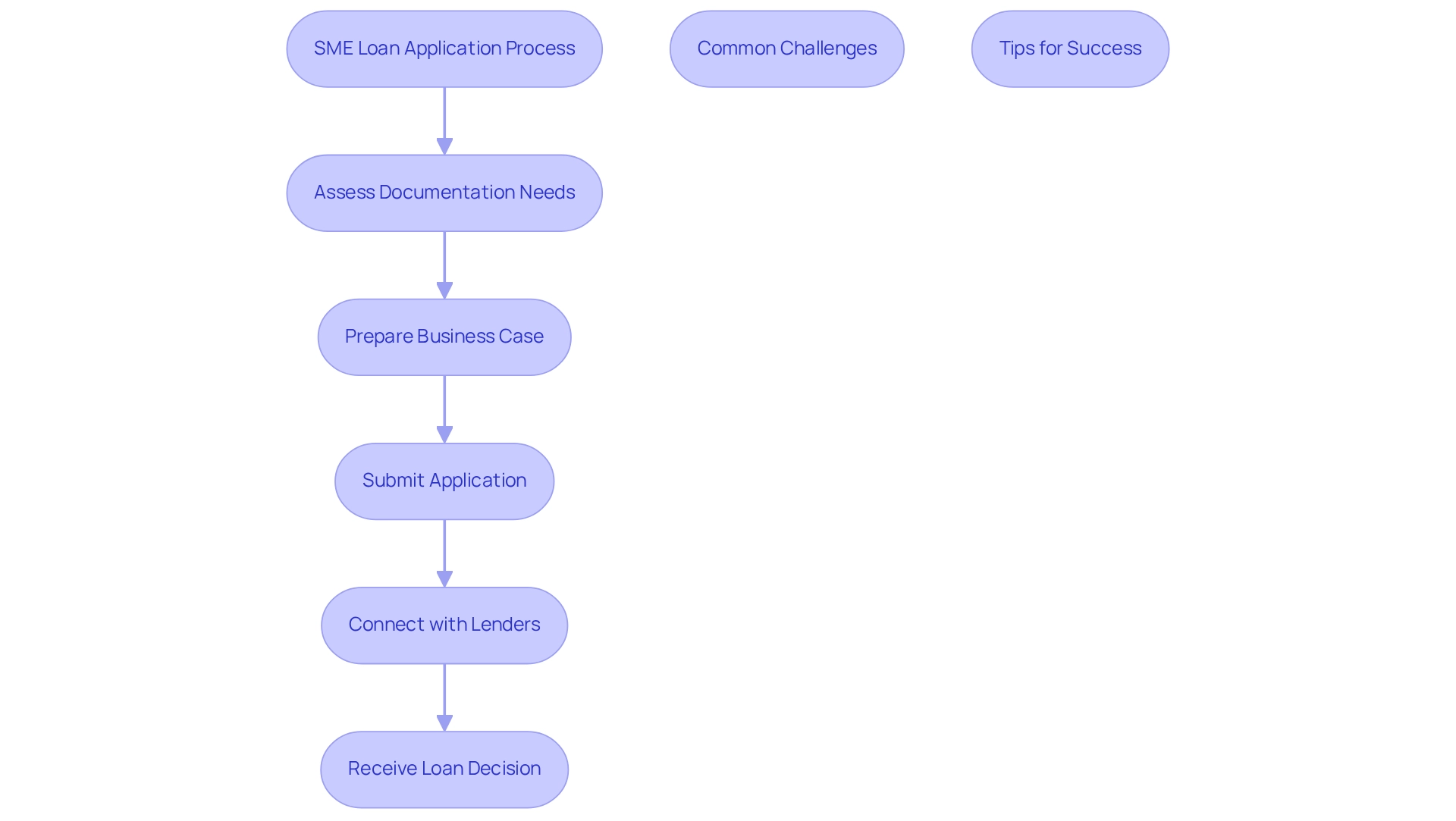

Finance Story provides essential support for small and medium enterprises navigating the financing application process, particularly in securing SME unsecured loans for their commercial property investments and refinances. Our expertise lies in crafting polished and highly individualized business cases that effectively present to lenders, empowering businesses to approach financing with confidence. By offering crucial advice on documentation and eligibility requirements, we enable small and medium-sized enterprises to showcase their cases effectively, addressing common challenges such as inadequate documentation or unclear financial histories.

As consumer trust continues to grow, the importance of thorough documentation cannot be overstated; it significantly impacts the success rates of financing applications. Statistics reveal that a well-prepared application can enhance approval chances for SME unsecured loans, which is vital for small and medium enterprises seeking funding. Notably, 81% of substantial term credits of $1 million or $3 million were allocated for owner-occupied commercial real estate, underscoring the types of financing that small and medium enterprises might consider, including warehouses, retail spaces, factories, hospitality initiatives, and SME unsecured loans.

Real-world examples illustrate how companies have successfully navigated the credit application landscape with Finance Story's support, showcasing the value of tailored guidance. Our customized assistance has helped numerous small enterprises connect with a diverse range of lenders, including high street banks and innovative private lending panels, ensuring they are well-equipped to tackle the complexities of SME unsecured loans. Finance Story's insights into the loan application process highlight the necessity of meticulous preparation for SME unsecured loans, ensuring that small and medium-sized enterprises are equipped to meet the evolving demands of lenders. As the lending landscape transforms, we remain committed to streamlining the process, making it easier for small enterprises to achieve their growth objectives.

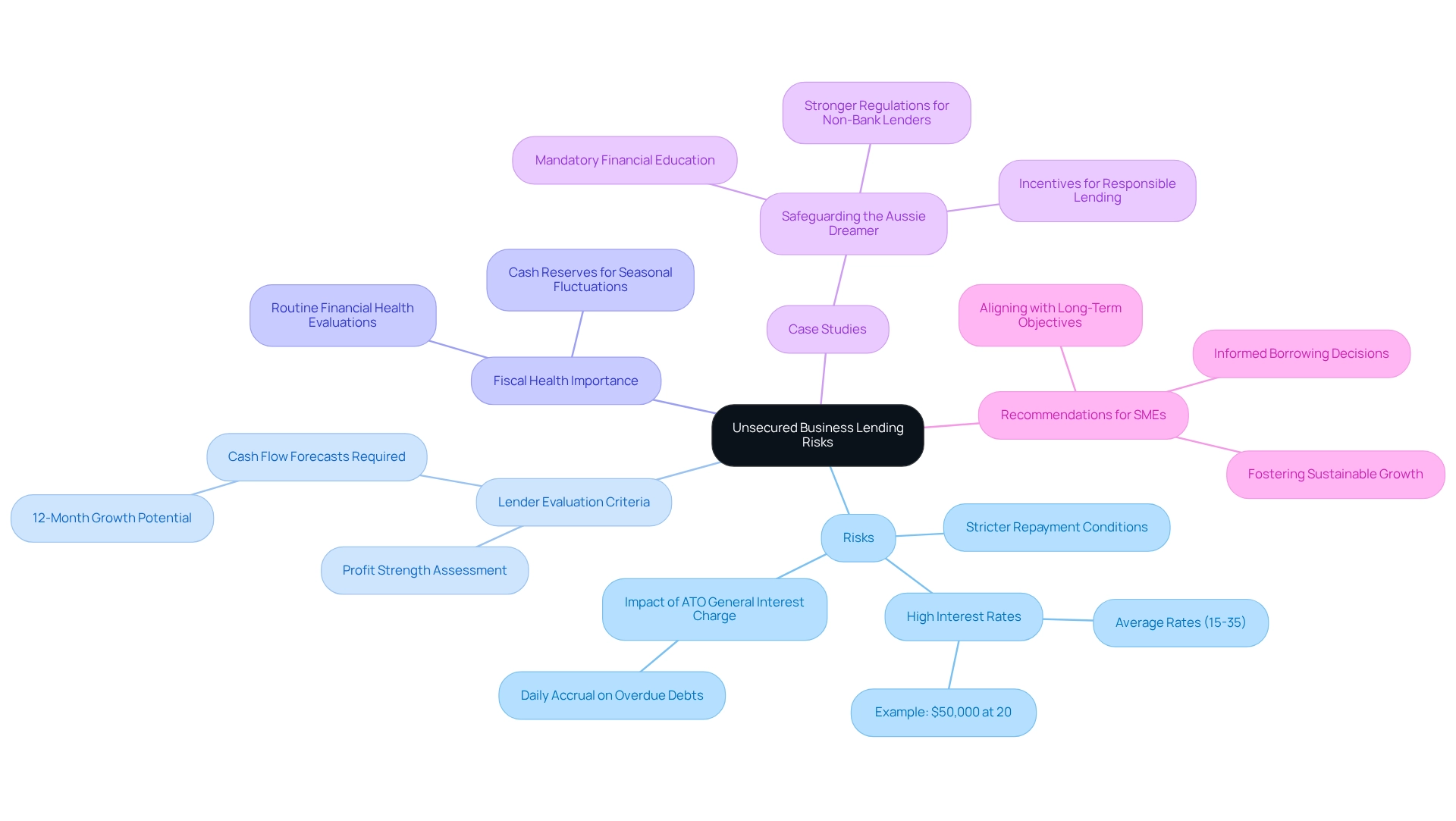

Odin Biz: Understanding Risks in Unsecured Business Lending

Odin Biz underscores the critical importance for SMEs to grasp the risks associated with unsecured lending. These financial instruments, while providing rapid access to funds without collateral requirements, typically carry higher interest rates—averaging between 15% and 35%—and impose stricter repayment conditions. For instance, a café in Melbourne secured a $50,000 unsecured credit line at a staggering 20% interest in 2024, exemplifying the potential economic strain on small enterprises.

Recognizing these risks is vital for SMEs aiming to navigate their financial landscape effectively. Shane Duffy, the creator of Finance Story, emphasizes that lenders assess the strength of a company's profits when evaluating repayment capabilities. They prefer businesses that can comfortably meet all repayment obligations, including those tied to existing loans. This is particularly crucial for enterprises experiencing seasonal fluctuations in revenue, as they must ensure sufficient cash reserves to cover repayments during slower periods. Moreover, lenders typically require a comprehensive plan and cash flow forecasts for at least the next 12 months to evaluate the venture's growth potential and cash flow management.

The Australian Taxation Office (ATO) General Interest Charge (GIC) applies to overdue tax debts, accruing interest daily. This can exacerbate the financial pressure on businesses already managing unsecured debts, making it essential for SMEs to assess their fiscal health and confirm their ability to meet these obligations. The GIC can significantly influence overall financial commitments, underscoring the necessity for meticulous fiscal planning. In contrast, secured loans usually present lower interest rates, potentially alleviating some financial burdens.

Recent discussions at the 2024 SME summit highlighted the significance of equitable and sustainable financing options for small businesses. Prime Minister Anthony Albanese remarked, "Small businesses are the backbone of our economy. We must ensure they have access to fair and sustainable financing options." This sentiment reinforces the need for SMEs to be well-informed about the implications of unsecured lending.

Additionally, case studies such as 'Safeguarding the Aussie Dreamer' advocate for measures to enhance the integrity of unsecured lending. These include stronger regulations for non-bank lenders, mandatory financial education for borrowers, and incentives for responsible lending. Such initiatives aim to prevent exploitation and ensure that unsecured credit remains fair and manageable for small enterprises.

By acknowledging the risks tied to unsecured lending, small and medium enterprises can make informed borrowing decisions that align with their long-term objectives. To further support this, SMEs should routinely evaluate their financial health, taking into account factors such as cash flow and existing debt, before pursuing unsecured credit, ultimately fostering sustainable growth.

ScotPac: Tailored Unsecured Loans for Business Growth

Finance Story specializes in crafting refined and highly customized proposals for SME unsecured loans tailored to meet the unique needs of small enterprise owners. By concentrating on the specific requirements of each client, Finance Story provides flexible financing solutions that accommodate a range of commercial property investments, whether it be a warehouse, retail space, factory, or hospitality venture.

This personalized approach is vital; businesses with stronger asset bases and solid credit histories often enjoy lower interest rates, making financing through SME unsecured loans more attainable. Recent trends suggest a promising outlook for SMEs, with 60% planning to invest in their businesses over the next six months, despite the challenges posed by rising interest rates and inflation. This surge in investment is bolstered by initial capital expenditure plans for 2023-24, which are 11% higher than the previous financial year.

However, it is crucial to acknowledge that the number of new credit approvals for property investors has declined for the first time in nearly two years, indicating a shifting lending environment. Finance Story's expertise in refinancing and securing SME unsecured loans is instrumental in this landscape, empowering small and medium enterprises to expand operations, invest in new projects, or effectively manage cash flow.

Furthermore, Finance Story provides predictable sources of working capital through SME unsecured loans for companies grappling with cash flow challenges, solidifying their role as a dependable partner for small and medium enterprises, especially in difficult economic conditions. With access to a comprehensive suite of lenders, including high street banks and innovative private lending panels, Finance Story ensures clients have a diverse range of financing options.

Customer satisfaction ratings for Finance Story's services reflect their commitment to reliability and exceptional service, establishing them as a preferred choice for numerous enterprises. Real-world examples demonstrate how SMEs have effectively harnessed Finance Story's expertise to drive their growth by utilizing SME unsecured loans for various purposes such as acquiring equipment, expanding facilities, hiring staff, or managing cash flow. This underscores the significance of personalized service in SME financing.

As companies navigate the complexities of securing funding, Finance Story emerges as a trustworthy partner, ready to assist in achieving their financial objectives. For small business owners seeking financing, connecting with Finance Story can be the pivotal first step toward realizing their investment aspirations.

Conclusion

The landscape of unsecured loans offers a multitude of opportunities for small and medium enterprises (SMEs) seeking the financing essential for growth and innovation. By exploring tailored solutions from key players such as Finance Story, Bizcap, Tyro, Westpac, and Capital Boost, businesses can identify options that align with their specific financial needs and operational goals. Each lender presents unique advantages—from the rapid approval processes at Bizcap to the income-responsive loan structures from Tyro—ensuring that SMEs can navigate their financial journeys with greater ease and flexibility.

As SMEs confront challenges like cash flow management and the necessity for timely investments, grasping the nuances of unsecured loans becomes crucial. The insights shared in this article underscore the importance of tailored financial strategies, expert guidance, and thorough preparation when engaging with lenders. By leveraging the expertise of specialized lenders, SMEs can craft robust loan proposals, thereby enhancing their chances of securing favorable financing terms.

Ultimately, the right unsecured loan can serve as a powerful tool for SMEs, enabling them to surmount obstacles and unlock new avenues for growth. By staying informed about the diverse range of options available and the associated risks, small business owners can make informed borrowing decisions that align with their long-term objectives. In a competitive environment, taking proactive steps to secure the right financing is essential for sustainable success and innovation within the SME sector.