Overview

Choosing a business loan broker in Australia is a strategic move that can significantly enhance a small business's access to tailored financing solutions. This choice not only streamlines the loan application process but also improves negotiation outcomes for better loan terms. Brokers, such as Finance Story, leverage their expertise and extensive lender networks to provide personalized support. This ensures that businesses can secure appropriate funding while saving time and alleviating the stress associated with financial management. By partnering with a broker, you position your business for success in navigating the complexities of financing.

Introduction

In the dynamic world of small business financing, navigating the complexities of securing the right loans can be daunting. As enterprises strive to thrive amidst competition, tailored financial solutions have become paramount. Finance Story emerges as a beacon of support, offering customized business loan options designed specifically for the unique needs of small businesses. With a commitment to understanding each client's financial landscape, this brokerage simplifies the loan application process and enhances the likelihood of securing favorable terms.

As small business owners grapple with cash flow management and evolving operational needs, the expertise of brokers like Finance Story proves invaluable in unlocking the funding necessary for growth and success.

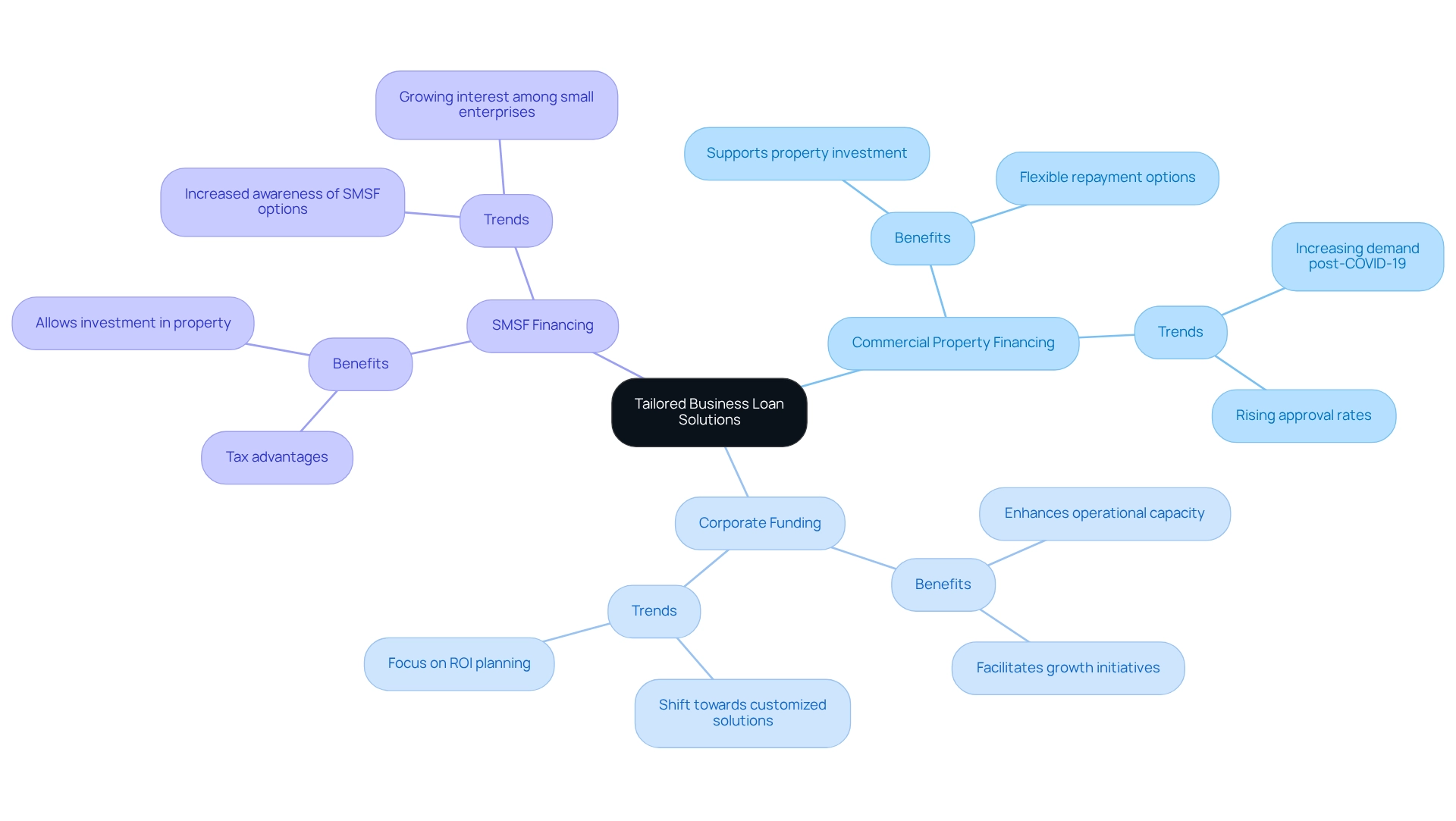

Finance Story: Tailored Business Loan Solutions for Small Enterprises

Finance Story excels in delivering personalized funding solutions tailored to the unique needs of small enterprises. By emphasizing a comprehensive understanding of each client's financial landscape, the brokerage offers a diverse array of services, including:

- Commercial property financing

- Corporate funding

- SMSF financing

This tailored approach not only increases the likelihood of securing the most suitable funding options but also empowers emerging enterprises to thrive in a competitive market.

As we look ahead to 2025, the average credit amount for small enterprises in Australia reveals a growing trend towards customized financial solutions. Many companies recognize the necessity of personalized offerings to address their specific operational needs. Financial experts highlight that selecting the right credit option can significantly enhance growth, underscoring the importance of a well-structured plan that includes anticipated returns on investment. As Phil Collard, Money.com.au's financing lending specialist, aptly states, "The appropriate funding option can be a very powerful tool to accelerate growth, so be sure to have your plans clearly outlined, including anticipated ROI."

Recent statistics show that small enterprise loan approval rates are on the rise, further supporting the case for utilizing a business loan broker in Australia like Finance Story. The brokerage guarantees a finance proposal or pays $1,000 if they cannot secure one for qualified enterprises, showcasing their confidence in delivering results. Additionally, the surge in commercial credit card usage post-COVID-19, with monthly transaction values reaching record highs, indicates an increasing reliance on credit for operational needs. This trend highlights the critical role of effective cash flow management in sustaining growth and reinforces the significance of customized financing options, which can be facilitated by a business loan broker in Australia. By leveraging their extensive expertise and access to a variety of lenders, Finance Story ensures that businesses receive the personalized financing solutions essential for success. Their commitment to understanding and addressing the unique challenges faced by small enterprises positions them as a trusted partner in navigating the complexities of financing, particularly in refinancing and securing tailored financial solutions for commercial property investments.

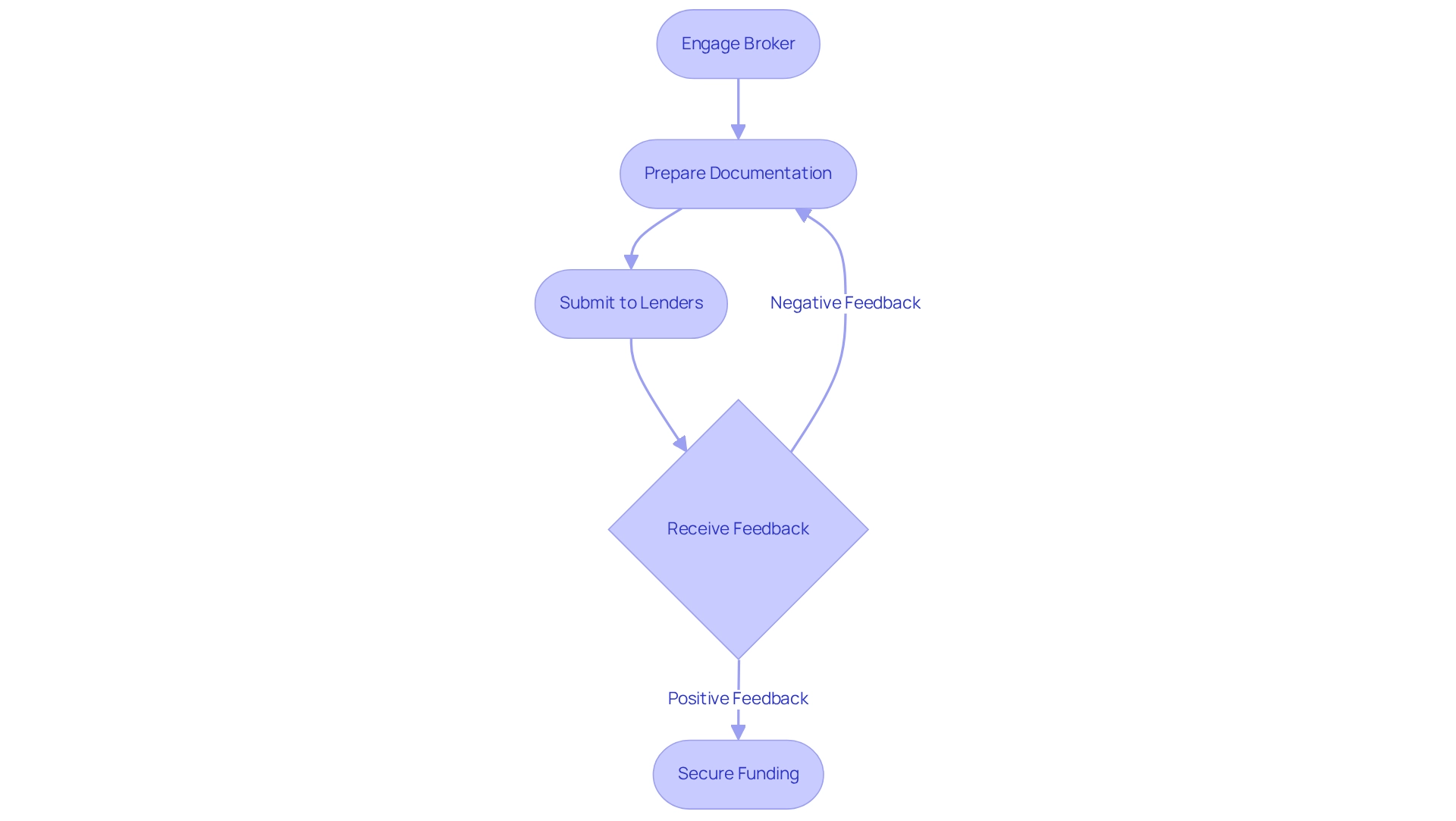

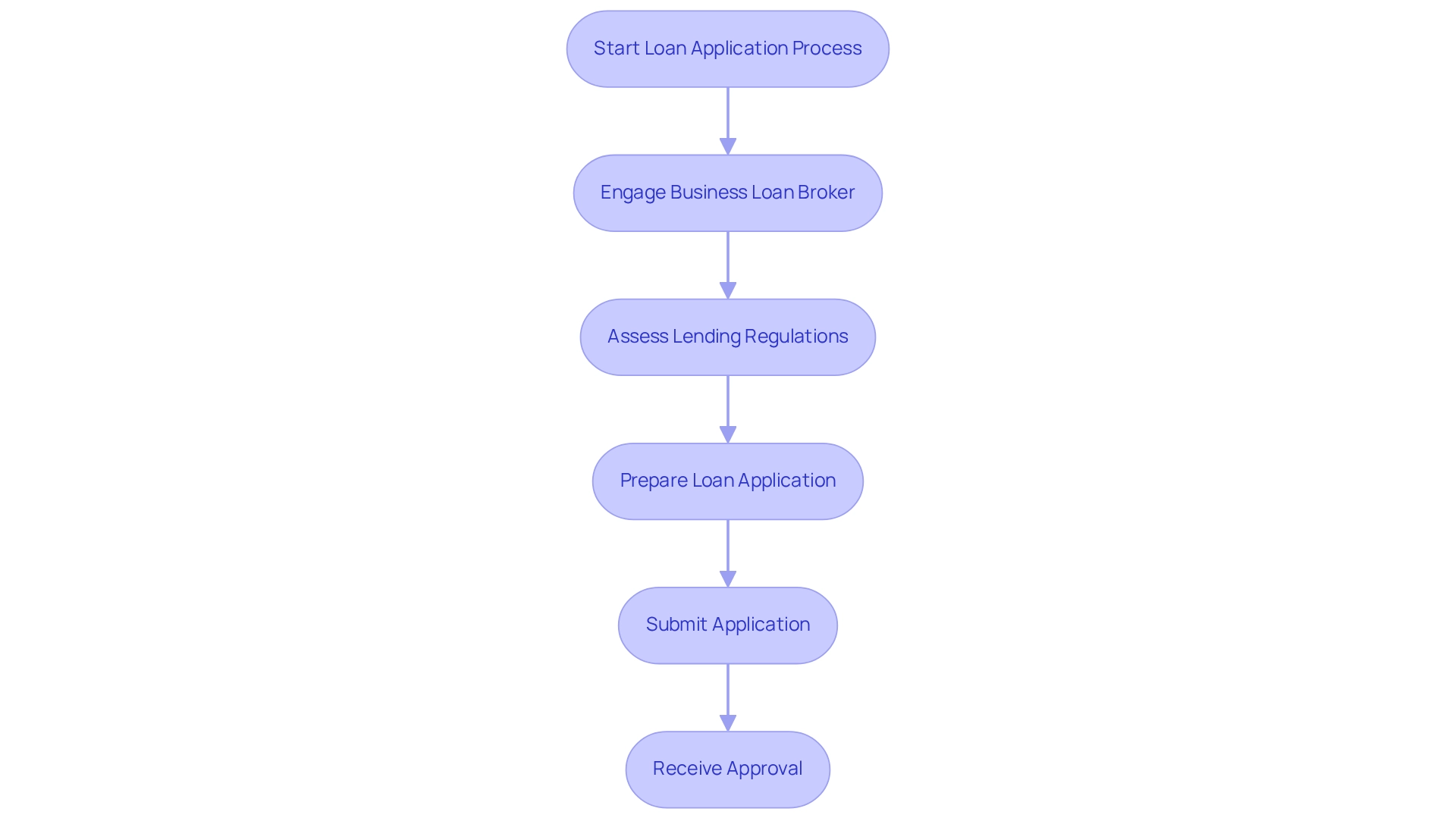

Streamline Your Application Process with Expert Brokers

Financial intermediaries, such as a business loan broker Australia like Finance Story, are essential in streamlining the application process for small businesses by managing documentation and communicating with lenders on behalf of their clients. This approach not only saves valuable time but also alleviates the stress often associated with navigating complex financial requirements.

Brokers utilize their industry expertise to ensure that all necessary documentation is meticulously prepared, resulting in significantly faster approval times. In fact, companies that engage intermediaries can save an average of 30% in processing time compared to those who apply independently. Moreover, a swift discovery initiative for a prominent regional bank uncovered potential savings of $25.7 million, underscoring the financial benefits of leveraging a business loan broker Australia for efficient financing processing.

A business loan broker Australia excels at presenting robust financing applications, whether for secured or unsecured funding, thereby increasing the likelihood of approval. Their ability to articulate financing options in straightforward terms empowers business owners to make informed decisions. As highlighted by industry experts, a proficient business loan broker Australia should clearly delineate funding alternatives in an easily understandable manner, transforming the often daunting loan application process into a more manageable and efficient experience.

Finance Story specializes in crafting tailored and highly refined cases for presentation to banks, ensuring that small business owners can secure the appropriate funding for their commercial property investments. We provide a comprehensive array of lenders, including high street banks and innovative private lending panels, to accommodate diverse circumstances.

Whether you seek financing for a warehouse, retail space, factory, or hospitality venture, our expertise can guide you through the available options. Case studies indicate that businesses working with brokers experience reduced stress and benefit from a streamlined application process, leading to quicker access to funds. This efficiency is particularly vital in today’s fast-paced corporate environment, where timely funding can significantly influence operational success.

To explore your funding options and initiate your application, contact Finance Story today.

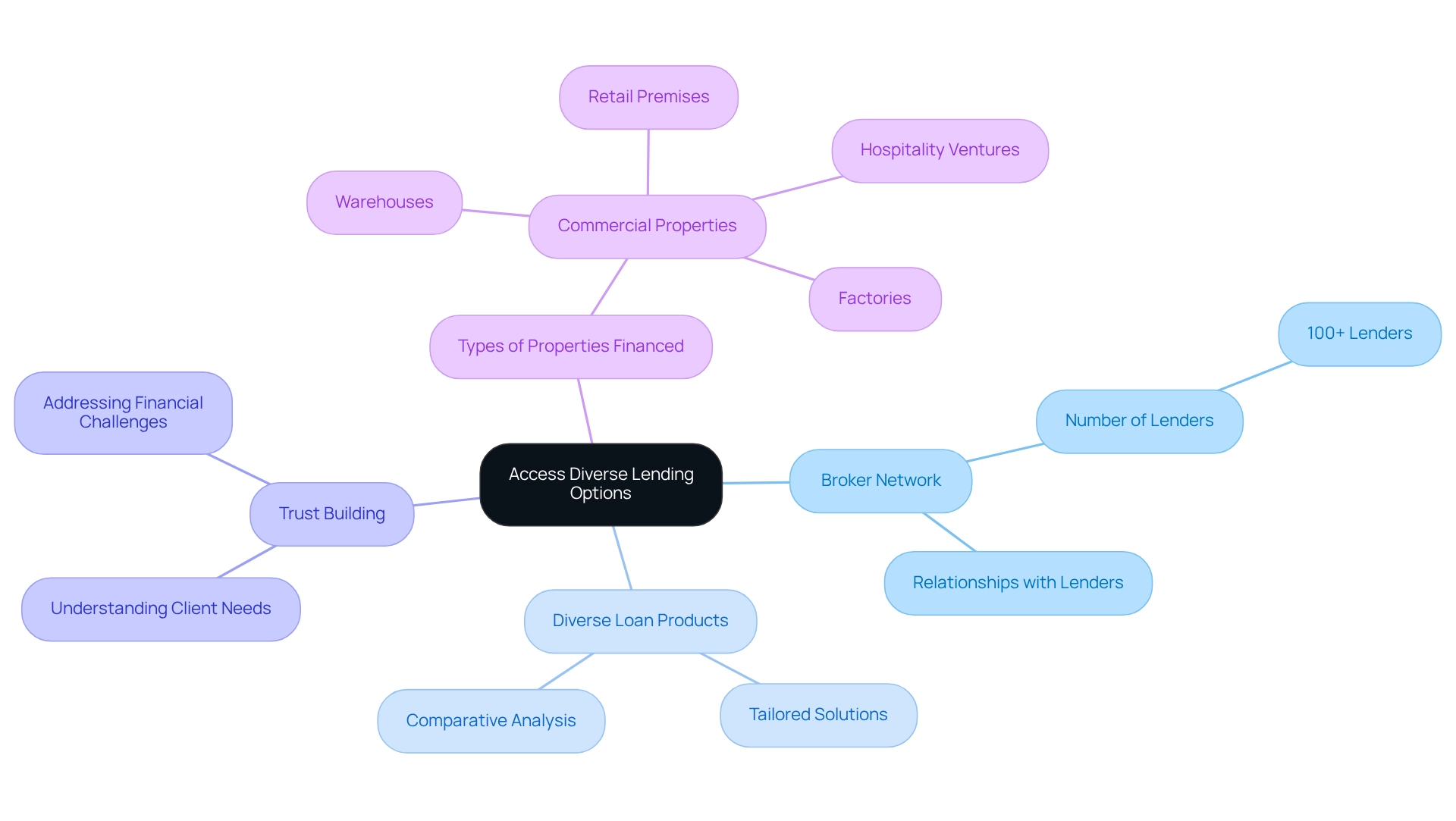

Access Diverse Lending Options Through a Business Loan Broker

Collaborating with a financing broker like Finance Story offers a significant advantage: access to an extensive array of lending options. Brokers establish relationships with numerous lenders, including both traditional banks and innovative private financiers, enabling them to present clients with diverse loan products tailored to their specific needs. This vast network ensures that small enterprises can secure the most favorable rates and terms available in the market.

Consider this: agents can identify small business owners in need of funding by analyzing their client databases and understanding the unique challenges within their industries. This targeted approach not only addresses common financial obstacles but also fosters trust among clients, enhancing the value proposition of the financial advisor. Finance Story, recognized for its bespoke mortgage services, boasts access to a comprehensive portfolio of over 100 lenders, offering terms and rates that may not be accessible elsewhere.

In Australia, a business loan broker provides agents with a multitude of options for small enterprises seeking financing, which is crucial in a landscape where the September quarter recorded the highest quarterly settlement amount to date at $93.42 billion. Financial analysts emphasize that these broker connections with lenders can lead to more advantageous financing terms that may not be available through direct channels. This is particularly vital for small enterprises striving to achieve their goals and secure a successful future.

Moreover, the ability to compare loan products from various lenders empowers enterprises to make informed decisions, ensuring they select the financing solution that aligns best with their objectives. By leveraging the expertise of a business loan broker like Finance Story, companies can navigate the complexities of the lending environment and secure the financing essential for growth and success. Furthermore, by addressing common financial challenges faced by small enterprises, brokers can build trust and expand their service offerings, thereby increasing their value to clients.

"I will certainly be recommending your company to anyone. We are finished with the constant worry. Once again, thank you so much for being a part of our journey." - Natasha B, VIC

Finance Story specializes in financing a variety of commercial properties, including warehouses, retail premises, factories, and hospitality ventures, ensuring tailored solutions for diverse business needs.

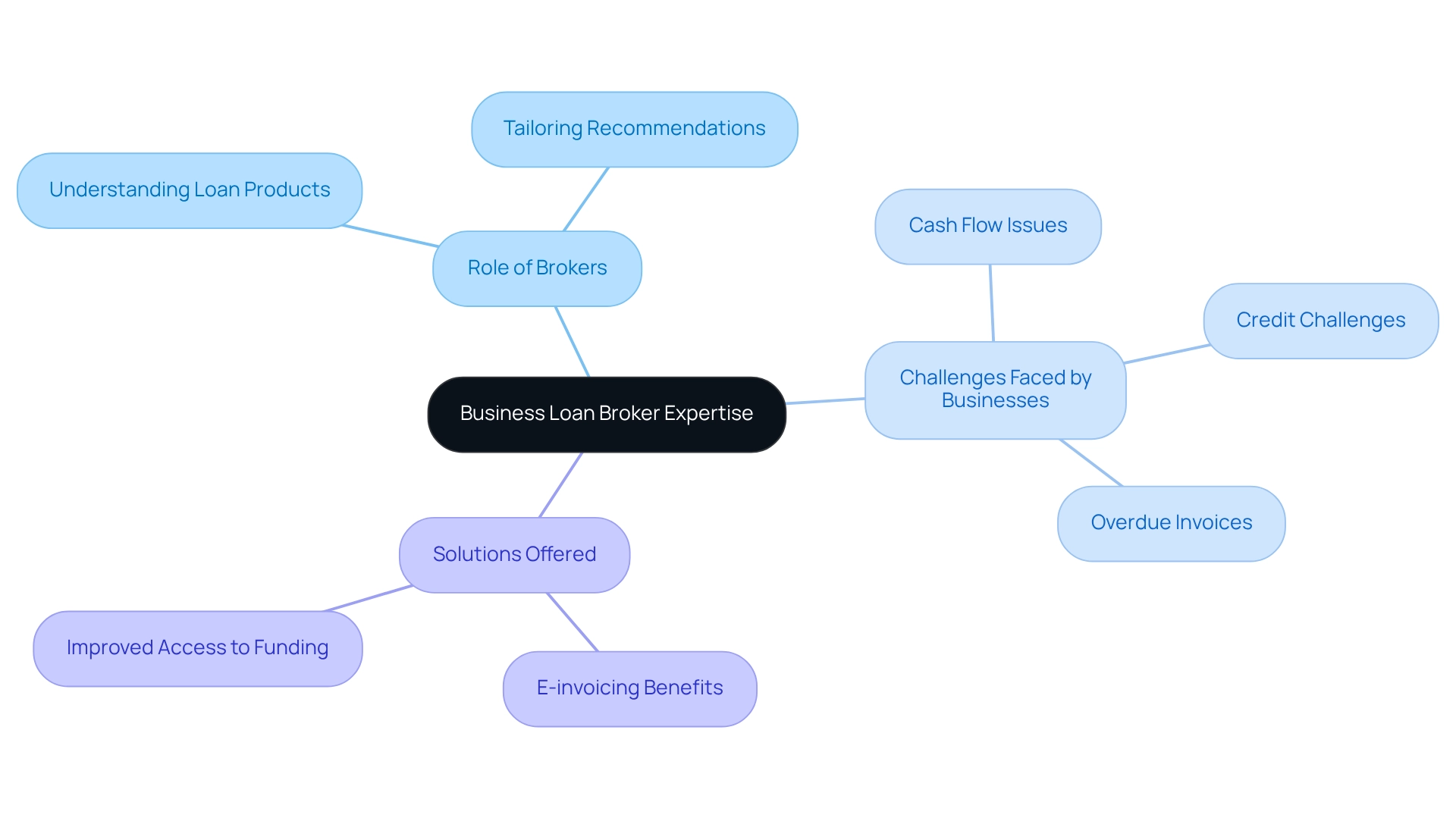

Navigate Complex Financial Situations with Broker Expertise

A business loan broker in Australia is pivotal in helping companies navigate complex financial landscapes, particularly when it comes to securing appropriate funding for commercial property investments and refinances—encompassing warehouses, retail locations, factories, and hospitality ventures. For small enterprises grappling with cash flow challenges, an imperfect credit history, or the need for customized financing, a business loan broker Australia can offer invaluable expertise. As a business loan broker Australia, they possess a deep understanding of various loan products and can tailor recommendations that align with the specific financial health and goals of the business, including developing refined and personalized cases to present to banks.

Statistics reveal that a significant number of small businesses in Australia face credit challenges, with many striving to maintain steady cash flow. In fact, more than half of Australian B2B companies have reported overdue invoices since the onset of the pandemic, resulting in heightened stress around invoice management. This underscores the importance of having a knowledgeable business loan broker Australia who can assist companies in navigating these turbulent waters. Furthermore, 78% of entrepreneurs recognize the benefits of implementing e-invoicing, which can significantly improve cash flow management and reduce the anxiety associated with late payments.

Case studies illustrate how intermediaries have successfully aided small businesses in overcoming cash flow obstacles. For instance, companies that engaged intermediaries reported improved access to funding options and more effective cash flow management strategies. By leveraging their expertise, a business loan broker Australia not only helps businesses secure the right funding but also provides ongoing support to ensure financial stability. As Paul Allen aptly states, "Haven’t kept up with the latest numbers? Don’t worry! We’ve done the hard work for you." This comprehensive approach empowers small business owners to make informed decisions and navigate the complexities of the financial landscape with confidence.

Negotiate Better Loan Terms with Professional Brokers

Professional brokers, including a business loan broker Australia, possess the negotiation skills and industry expertise essential for securing beneficial financing terms for their clients. By advocating for minor enterprises, they act as a business loan broker Australia, leveraging established connections with a comprehensive array of lenders, including high street banks and creative private lending groups, to negotiate lower interest rates, reduced fees, and more favorable repayment terms. This tactical approach can lead to considerable savings throughout the duration of the financing, ultimately enhancing a small enterprise's financial plan.

For instance, businesses that proactively seek financing when financially healthy often secure better terms. A case study on proactive financing strategies emphasizes that seeking funding during financially stable times can result in more advantageous conditions. This highlights the significance of involving intermediaries early in the financing process. Statistics indicate that a business loan broker in Australia has effectively secured average interest rate cuts of up to 1.5% for modest enterprise financing, resulting in significant cost savings.

Furthermore, small enterprises have reported considerable financial assistance through discussions facilitated by a business loan broker Australia, with many attaining fee reductions that enhance their cash flow. Finance Story specializes in creating refined and highly personalized cases to present to banks, ensuring that clients can secure the appropriate loan for their needs, whether they are acquiring a warehouse, retail space, factory, or hospitality venture. As one expert aptly stated, "It is always best to be pre-emptive." By leveraging the knowledge of skilled agents, organizations not only maneuver through the intricacies of the lending environment but also set themselves up for lasting financial achievement. For tailored financing solutions, contact Finance Story today.

Receive Personalized Support Tailored to Your Business Needs

Business loan brokers in Australia provide personalized support specifically designed to meet the unique needs of each business. By dedicating time to comprehend the unique challenges and goals of their clients, financial advisors can suggest the most appropriate funding options. This tailored approach not only facilitates access to the right financing through a business loan broker Australia but also fosters a trusting relationship between the business loan broker Australia and the client, which is essential for long-term success.

Finance Story, one of Australia’s most innovative business loan broker Australia specializing in commercial and personal funding, exemplifies this commitment to personalized service. Their expertise in creating polished and highly individualized loan proposals ensures that clients can secure funding even in challenging circumstances. For instance, Natasha B. from VIC stated, "I will certainly be recommending your company to anyone. We are finished with the constant worry. Once again, thank you so much for being a part of our journey."

Research shows that companies collaborating with agents have greater satisfaction levels, with 85% of clients noting favorable results because of tailored service. As financial specialists highlight, a business loan broker Australia can provide customized funding suggestions that are essential for aligning financial solutions with company objectives, ensuring that each client feels appreciated and comprehended throughout the process.

As Gabriel aptly puts it, "Opportunity doesn’t knock, you knock until opportunity answers," highlighting the proactive role brokers play in seeking the best financing options for their clients. A case study from TWSS demonstrates how Finance Story's tailored assistance aided a modest enterprise in obtaining financing that aligned perfectly with its growth goals, ultimately resulting in a successful expansion into new markets.

Ensure Compliance with Lending Regulations Through a Broker

Navigating the regulatory environment can be daunting for small enterprise owners. A business loan broker in Australia possesses in-depth knowledge of the lending regulations that govern the industry, ensuring their clients remain compliant throughout the loan application process. This proactive strategy not only reduces the risk of legal issues but also boosts the entity's credibility with lenders, facilitating easier access to financing.

At Finance Story, we specialize in creating polished and highly customized cases tailored to meet the heightened expectations of lenders. Our expertise in obtaining the appropriate financial resources for various commercial property investments—be it a warehouse, retail space, factory, or hospitality project—ensures that emerging enterprises can effectively navigate these complexities. We offer a full range of lenders, including high street banks and innovative private lending panels, to suit any circumstances.

Statistics show that compliance problems are a considerable obstacle for minor enterprises in Australia, with many encountering difficulties during credit applications. For instance, early payout charges for commercial financing can vary from $0 to $450, emphasizing the financial factors that entrepreneurs must manage. By utilizing the knowledge of a business loan broker in Australia, companies can effectively navigate these complexities. Recent case studies demonstrate how modest enterprises have successfully upheld compliance with intermediary assistance, resulting in easier loan approvals, particularly as alternative lending options have arisen for SMEs.

Specialists in financial compliance stress that a business loan broker in Australia plays an essential role in regulatory adherence, offering customized advice that aligns with current lending regulations impacting minor enterprises. As Samuel Ricketts, Sales Director in Europe, noted, "Our customer immediately recognized the value that their ActiveDocs system delivered," underscoring the importance of having the right support in place. As the landscape evolves, intermediaries remain crucial allies in ensuring that companies not only meet compliance standards but also enhance their overall financial credibility through improved visibility and transparency of controls, which can increase board-level confidence.

Save Time and Focus on Your Business While Brokers Handle Loans

Engaging a commercial financing intermediary allows small enterprise proprietors to reclaim valuable time that can be redirected towards enhancing their operations. Business loan broker Australia perform critical functions such as researching financing options, preparing applications, and liaising with lenders. This delegation alleviates the burden of financial management, empowering entrepreneurs to concentrate on their core activities, thereby fostering growth and innovation.

Statistics indicate that small enterprise owners who utilize intermediaries can save significant time—up to 40%—in the loan acquisition process. This efficiency becomes increasingly vital as the demand for refinancing in Australia is anticipated to surge, particularly with many fixed-rate mortgages nearing their conclusion, where a business loan broker Australia can play a crucial role. Brokers, like those at Finance Story, are instrumental in navigating this landscape, ensuring that owners secure favorable refinancing options tailored to their specific needs.

A case study entitled 'Streamlining the Loan Acquisition Process' exemplifies how intermediaries facilitate the journey for business owners by managing documentation and lender communications. The findings reveal that this efficient method not only reduces stress but also allows entrepreneurs to focus on their operations while successfully securing necessary financing through expertly crafted funding proposals.

Expert insights reinforce the benefits of this approach. Financial consultants emphasize that delegating debt management to agents can yield improved negotiation outcomes, including lower interest rates. As Angus Clarebrough notes, "Business financing intermediaries can assist in securing lower interest rates by exploring financing options and negotiating with creditors on the borrower's behalf." By leveraging their industry expertise and relationships, intermediaries, such as a business loan broker Australia, broaden access to a diverse array of financing choices, encompassing a complete spectrum of lenders from mainstream banks to innovative private lending groups, ultimately contributing to enhanced operational efficiency for small enterprises across Australia. This includes financing options for various commercial properties such as warehouses, retail premises, factories, and hospitality ventures.

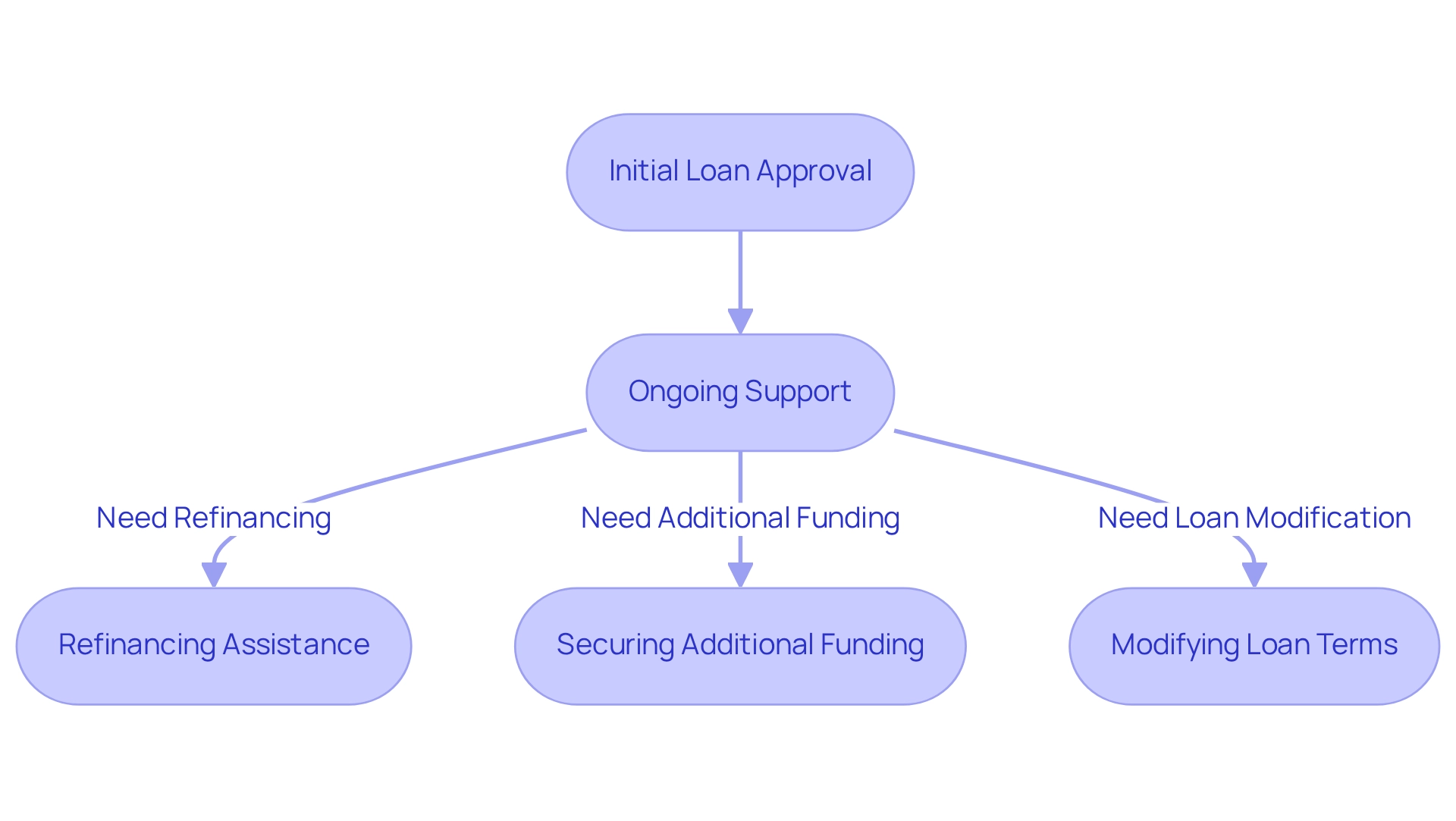

Benefit from Ongoing Support After Securing Your Loan

The connection with a financial lending intermediary extends well beyond the initial funding approval. A business loan broker in Australia plays a crucial role in providing ongoing support, guiding clients through future financial needs and challenges. This encompasses assistance with refinancing, securing additional funding, or modifying loan terms to align with evolving strategies. Recent statistics reveal a notable increase in minor enterprise refinancing trends across Australia, highlighting the role of a business loan broker Australia in facilitating smoother transitions during these processes. Brokers offer valuable insights into market conditions and funding alternatives, ensuring enterprises are well-informed.

Finance Story is dedicated to developing refined and highly customized cases for presentation to banks, a necessity for emerging enterprises seeking refinancing or new funding. We provide a comprehensive range of lenders, including high street banks and innovative private lending panels, tailored to various circumstances. A significant case study illustrates how a small enterprise, after securing its initial financing through Finance Story, accessed further funding for growth. The agent's continuous assistance enabled the company to adjust its financial strategy effectively, emphasizing the value of having a committed ally in the financial landscape. As Finance Story states, "With the right mortgage advisor by your side, obtaining commercial financing becomes a more manageable and less stressful experience."

Financial experts assert that maintaining a connection with a business loan broker Australia can lead to improved loan terms and conditions, as these professionals frequently negotiate favorable rates and reduced fees on behalf of their clients. This ongoing support is vital for enterprises striving to thrive in a competitive environment, ensuring they have the resources and guidance necessary to achieve their financial objectives. As the landscape of commercial financing continues to evolve, the role of brokers in providing continuous support remains indispensable.

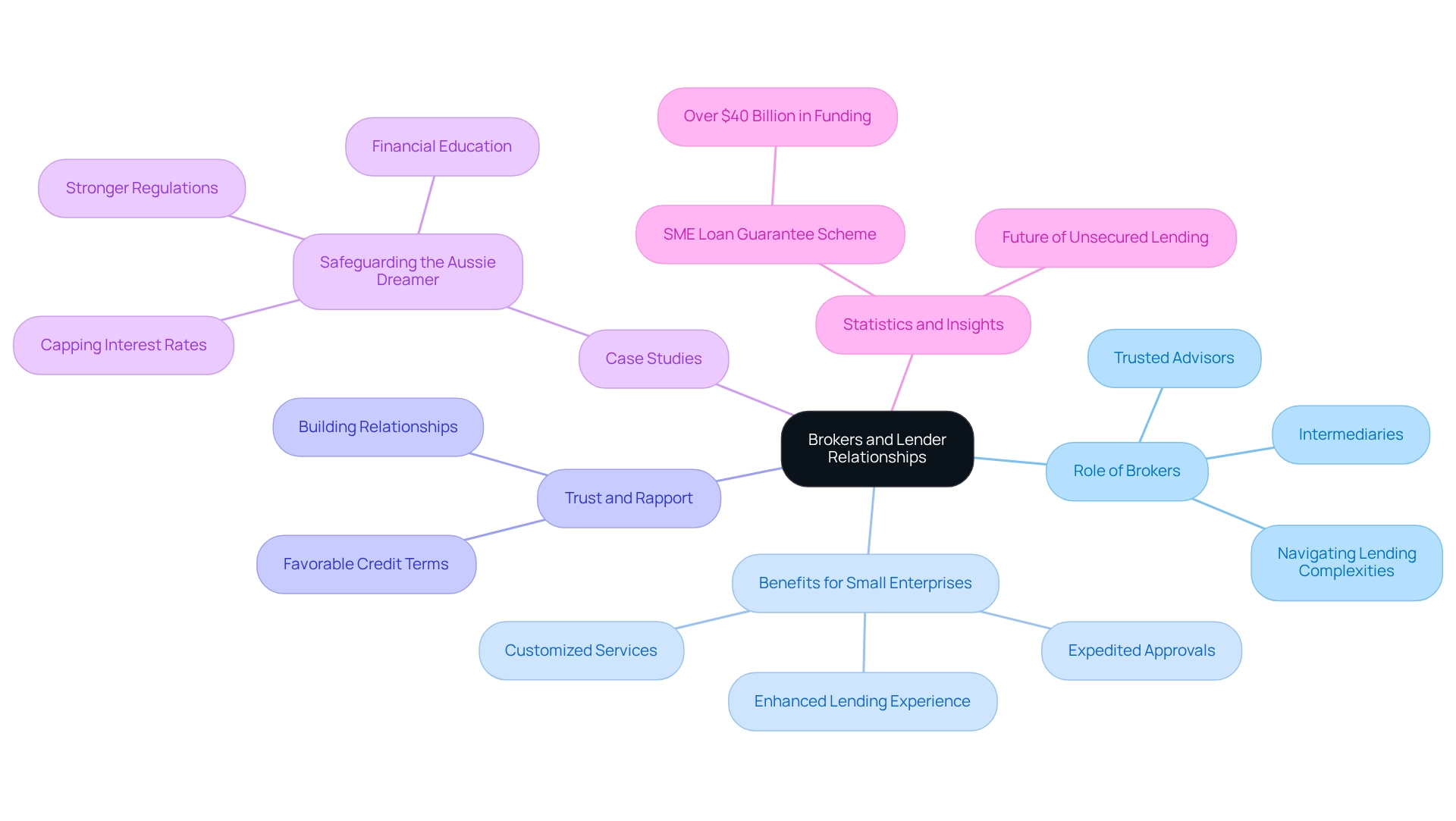

Build Strong Lender Relationships with the Help of a Broker

Brokers, particularly business loan broker Australia, serve as vital intermediaries, forging robust connections between small enterprises and lenders. Their expertise empowers businesses to navigate the complexities of the lending environment, especially when working with a business loan broker Australia, establishing trust and rapport with financial institutions. This trust can lead to more favorable credit terms, expedited approvals, and an enhanced lending experience overall. As small enterprises grow, these connections become increasingly essential for securing future funding.

Finance Story exemplifies this role by offering customized mortgage brokerage services tailored to both commercial and residential financing needs, even in challenging circumstances. Their highly professional and personalized mortgage services assist companies in crafting refined financing proposals, ensuring clients can present compelling cases to lenders. This expertise is crucial for small enterprises seeking funding for various projects, from retail spaces to large-scale developments, and a business loan broker Australia can help facilitate this process.

Jason Back, host of Broker Daily’s Business Accelerator podcast, underscores the importance of intermediaries in securing funding. He asserts that if organizations do not view intermediaries as integral to their wealth generation, they risk falling behind competitors. This highlights the necessity for intermediaries to position themselves as trusted advisors throughout their clients' financial journeys, especially when working with a business loan broker Australia, as statistics reveal that strong lender connections significantly impact loan approval rates for enterprises in Australia. The Morrison Government’s SME Loan Guarantee Scheme has facilitated over $40 billion in funding, emphasizing the critical role effective broker-client relationships play in accessing substantial financial resources.

The case study titled 'Safeguarding the Aussie Dreamer' illustrates the need for stronger regulations and financial education to shield SMEs from the dangers of unsecured lending. By fostering informed connections through intermediaries like Finance Story, small enterprises can navigate these challenges more effectively and secure the assistance of a business loan broker Australia to obtain the funding they need without encountering financial distress. Ultimately, a business loan broker Australia bolsters trust between small enterprises and lenders, ensuring that clients are well-prepared to achieve their financial objectives efficiently and effectively. Small business owners should leverage the expertise of brokers to enhance their financing outcomes and cultivate lasting relationships with lenders.

Conclusion

Navigating the landscape of small business financing is no small feat, particularly in an era where tailored solutions are paramount for success. Finance Story emerges as a dedicated ally, presenting personalized business loan options crafted to meet the unique financial needs of small enterprises. By deeply understanding each client’s specific circumstances, brokers significantly enhance the likelihood of securing favorable loan terms, ultimately empowering businesses to thrive amidst fierce competition.

The advantages of partnering with a broker extend well beyond mere access to funds. With their expertise in simplifying the application process, negotiating better terms, and ensuring compliance with lending regulations, brokers like Finance Story are invaluable in alleviating the stress associated with loan management. Their extensive network of lenders allows small businesses to explore diverse financing options, ensuring they can select the most competitive rates available. Statistics underscore that engaging a broker can lead to substantial time savings and improved loan outcomes, making this a strategic move for any small business owner.

Moreover, the relationship with a broker does not conclude once the loan is secured. Continuous support and guidance in refinancing and adapting financial strategies are crucial for long-term success. By fostering strong relationships with lenders, brokers enhance the overall lending experience, paving the way for future financing opportunities. As the financial landscape continues to evolve, the role of brokers remains indispensable, providing the expertise and personalized support that small businesses require to navigate complexities and achieve their growth objectives. Embracing the services of a knowledgeable broker like Finance Story can truly be a game-changer for small enterprises aiming for sustainable success.