Overview

The article identifies the premier commercial mortgage lenders for small business financing, emphasizing tailored solutions and a diverse array of offerings that cater to various enterprise needs. Highlighting lenders such as Finance Story, RBC Royal Bank, and BDC, it illustrates how these institutions deliver personalized service, flexible terms, and expert guidance. This ensures that small businesses can secure optimal funding to support their growth and development.

Furthermore, these lenders understand the unique challenges faced by small enterprises, providing customized financing options that align with specific business goals. By fostering relationships with their clients, they not only facilitate access to capital but also offer strategic advice that can enhance overall financial health.

In addition, the article showcases the importance of selecting a lender that resonates with the business's vision and operational needs. With a focus on building long-term partnerships, these institutions empower small businesses to thrive in competitive markets.

Ultimately, the insights presented guide small business owners toward making informed decisions about their financing options, ensuring they are equipped to navigate their growth journey effectively.

Introduction

Navigating the world of commercial mortgage financing presents a significant challenge for small business owners, particularly with the vast array of options available in 2025. As the demand for tailored financial solutions continues to rise, it becomes essential to discern which lenders can provide the most effective support.

This article explores the leading commercial mortgage lenders that not only deliver competitive rates and flexible terms but also emphasize personalized service tailored to the unique needs of businesses.

How can entrepreneurs utilize these customized solutions to secure the funding necessary for growth and expansion in an ever-evolving market?

Finance Story: Tailored Commercial Mortgage Solutions for Your Business

Finance Story distinguishes itself in the mortgage market by delivering tailored solutions that cater to the unique needs of each client. By prioritizing a comprehensive understanding of enterprise requirements, Finance Story offers a broad range of funding options, including property loans and corporate finance. Their expert knowledge in navigating complex financial situations ensures that clients secure the most suitable funding alternatives, solidifying their reputation as a trusted partner for businesses aiming to grow and expand.

- Personalized Service: Every client benefits from a bespoke approach that aligns with their specific financial circumstances, guaranteeing optimal loan solutions. Finance Story collaborates with you in an ongoing relationship to achieve the best outcomes for your plans.

- Diverse Offerings: Finance Story presents a wide array of financing solutions, from property loans to SMSF loans, addressing various business needs. With access to a comprehensive panel of lenders—including boutique lenders, private investors, and mainstream banks—they provide all the options necessary for discussion.

- Expert Guidance: With over 25 years of experience, the Finance Story team excels at assisting clients in securing the most advantageous loan solutions, enhancing their financial journeys.

In 2025, a significant number of small enterprises are expected to adopt customized loan solutions, reflecting the growing demand for personalized financial services. This trend underscores the importance of having a dedicated mortgage broker who can navigate the complexities of business lending and connect clients with the best commercial mortgage lenders, ensuring they receive the support needed to thrive.

Schedule Your Free Personalized Consultation: Reserve your complimentary tailored 30-minute session with Head of Funding Solutions, Shane Duffy, to discuss your needs and objectives—from personal to home—and let Finance Story begin collaborating with you to craft your next chapter.

RBC Royal Bank: Long-Term Financing for Commercial Properties

RBC Royal Bank is recognized as one of the best commercial mortgage lenders by offering customized long-term funding options for commercial properties, making it a top choice for entrepreneurs looking to invest in real estate. Their offerings include:

- Flexible Terms: Clients can select from both fixed and variable rate options, enabling them to align their financing strategy with their business goals.

- Competitive Rates: RBC's interest rates are crafted to be attractive for long-term investments, ensuring companies can effectively manage their financial obligations.

- Expert Support: Clients benefit from the guidance of knowledgeable advisors who assist throughout the mortgage process, ensuring a seamless experience.

In addition to RBC's offerings, Finance Story is dedicated to developing refined and highly tailored cases to present to the best commercial mortgage lenders, assisting clients in securing the appropriate loans for their commercial investments. With access to a comprehensive range of the best commercial mortgage lenders, including mainstream banks and innovative private lending panels, Finance Story guarantees that small business owners can discover customized funding solutions that meet their evolving requirements.

As Natasha B. from VIC notes, "I will certainly be recommending your services to anyone. We are finished with the constant worry. Once again, thank you so much for being a part of our journey." This testimonial underscores the satisfaction of clients who have benefited from Finance Story's expertise.

Statistics indicate that small business owners increasingly prefer adaptable loan conditions, valuing the ability to adjust their financing to changing market circumstances. RBC Royal Bank's commitment to providing these alternatives positions them among the best commercial mortgage lenders, addressing the diverse needs of enterprises across various sectors. Understanding the factors behind rate pricing is more crucial than ever, particularly with nearly $1 trillion in commercial real estate debt maturing in 2025. Investors who comprehend rate dynamics, loan options, and market trends will be best equipped to adapt and thrive in the coming years.

BDC: Financing Solutions for Small and Medium-Sized Enterprises

The Business Development Bank of Canada (BDC) is dedicated to providing tailored funding solutions for small and medium-sized enterprises (SMEs), reflecting its commitment to fostering business growth. BDC's diverse loan offerings are crafted to address the unique needs of SMEs, ensuring they have the necessary capital to thrive.

-

Specialized Programs: BDC's Business Accelerator Loan Program exemplifies its focus on SMEs, offering up to $500,000 in financing to eligible enterprises. This program is particularly advantageous for companies generating less than $10 million in revenue that have been operational for over 12 months, enabling them to secure essential funding for expansion.

-

Flexible Repayment Options: Acknowledging the cash flow challenges faced by small businesses, BDC provides customized repayment plans that align with their financial circumstances. This flexibility aids companies in managing their finances more effectively while focusing on growth.

-

Advisory Services: Beyond funding, BDC offers advisory services that assist companies in navigating various challenges. This comprehensive approach ensures that entrepreneurs not only receive funding but also the guidance necessary to make informed decisions and propel their ventures forward.

BDC's commitment to supporting SMEs is further emphasized by its recognition as one of Canada’s Top 100 Employers and its innovative financing solutions. By empowering entrepreneurs with the resources and support they need, BDC plays a crucial role in enhancing the resilience and success of small enterprises across the nation.

Equitable Bank: Flexible Commercial Mortgage Options

Equitable Bank is recognized as one of the best commercial mortgage lenders in the sector by offering a variety of adaptable options tailored to the unique needs of businesses. Their commitment to flexible terms allows borrowers to select from diverse repayment arrangements and timeframes, ensuring that each financing solution aligns with specific objectives.

Key features of Equitable Bank's offerings include:

- Customizable Terms: Businesses can tailor their mortgage terms to suit their operational needs, enhancing cash flow management. The Commercial Equity Line of Credit (CELOC), for instance, provides a credit limit of up to $250,000 with minimum withdrawals of $5,000, granting small business owners flexible access to funds.

- Competitive Rates: With attractive interest rates, Equitable Bank helps businesses reduce funding costs, making it an appealing option for small business owners.

- Supportive Service: The dedicated team at Equitable Bank is focused on assisting clients throughout the loan process, ensuring they find the most suitable solution for their financial needs. Their team provides personalized support, guiding clients through the complexities of securing funding.

In 2025, companies increasingly favor adjustable loan conditions, with data indicating that over 70% of small business owners value flexibility in their funding options. This trend is exemplified by numerous enterprises utilizing the best commercial mortgage lenders, such as Equitable Bank's mortgage solutions, to adapt to changing market conditions and growth strategies. For instance, a small business owner in Toronto successfully leveraged a Commercial Equity Line of Credit (CELOC) to finance the launch of a second restaurant, showcasing how adaptable funding can facilitate growth initiatives.

Furthermore, partnering with Finance Story enhances the funding experience, as they specialize in developing refined and customized cases to present to lenders. Their expertise in refinancing and securing tailored loans ensures that small business owners can effectively navigate the complexities of property investments. Finance Story's access to a comprehensive portfolio of lenders, including high street banks and innovative private lending panels, empowers clients to identify the best funding solutions for their evolving needs.

Equitable Bank's innovative approach to corporate loans, combined with Finance Story's customized brokerage options, makes them some of the best commercial mortgage lenders for businesses seeking flexible funding solutions that meet their changing requirements.

Canadalend.com: Navigating Commercial Mortgage Financing

Finance Story stands as a leading platform dedicated to assisting companies in navigating the complexities of property loan solutions. Our deep expertise empowers clients to make informed decisions that are uniquely tailored to their specific needs.

-

Tailored Loan Proposals: We excel in crafting polished and highly individualized business cases to present to banks, ensuring you secure the optimal financing for your commercial property investment.

-

Expert Consultation: Gain access to seasoned loan specialists who grasp the intricacies of repayment criteria, offering personalized advice tailored to your enterprise's circumstances.

-

Comprehensive Lender Access: With an extensive array of the best commercial mortgage lenders, including high street banks and innovative private lending panels, we provide options that cater to various business property types, from warehouses to hospitality ventures.

CommLoan: Compare Commercial Mortgage Rates Easily

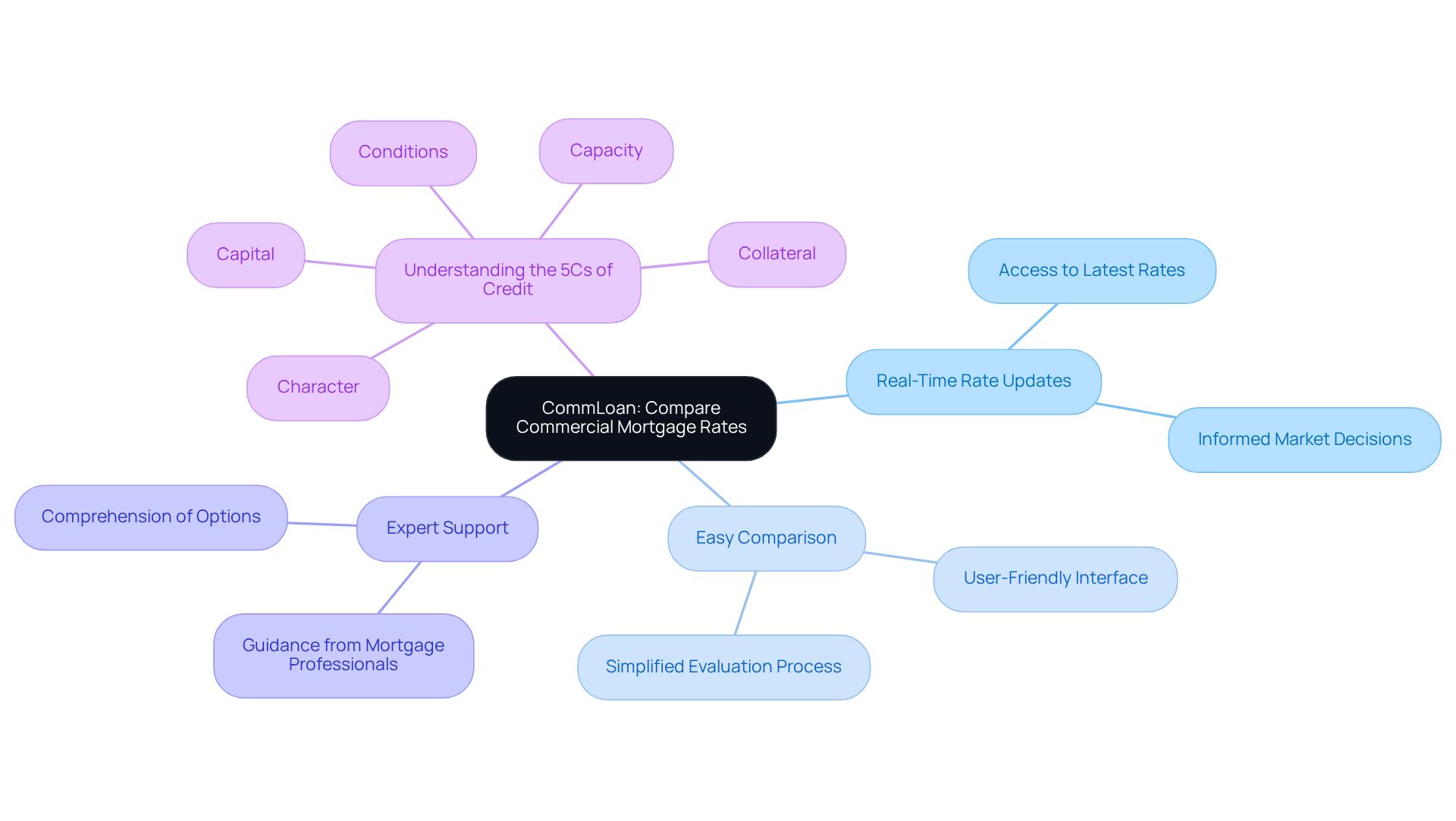

CommLoan presents a robust platform that empowers businesses to compare business loan rates effortlessly from a variety of lenders, including high street banks and private lending groups. This transparency is essential for borrowers, allowing them to make informed financial decisions tailored to their specific needs.

- Real-Time Rate Updates: Users gain access to the latest rates from multiple lenders, ensuring they are always informed about current market conditions.

- Easy Comparison: The platform features a user-friendly interface that simplifies the process of evaluating various financing options, making it accessible even for those unfamiliar with business funding.

- Expert Support: Clients receive guidance from mortgage professionals who assist them throughout the comparison process, ensuring they comprehend their options and can select the best fit for their needs.

- Understanding the 5Cs of Credit: Borrowers are encouraged to familiarize themselves with the 5Cs of credit—character, capacity, capital, collateral, and conditions—crucial for securing commercial loans. This knowledge is vital for small enterprise owners looking to enhance their funding strategies.

Statistics indicate that user interaction with CommLoan's loan comparison platform has significantly increased, highlighting a rising demand for clear and effective funding solutions. As CommLoan representatives note, real-time rate updates not only elevate the user experience but also empower borrowers to secure the most competitive rates available in 2025. This commitment to providing current information positions CommLoan among the best commercial mortgage lenders, serving as a valuable resource for companies navigating the complexities of property loans, particularly in understanding loan repayment standards and obtaining tailored funding options for various property types, including warehouses, retail spaces, and hospitality projects.

Swoop Funding: Connecting Businesses with Lenders for Commercial Mortgages

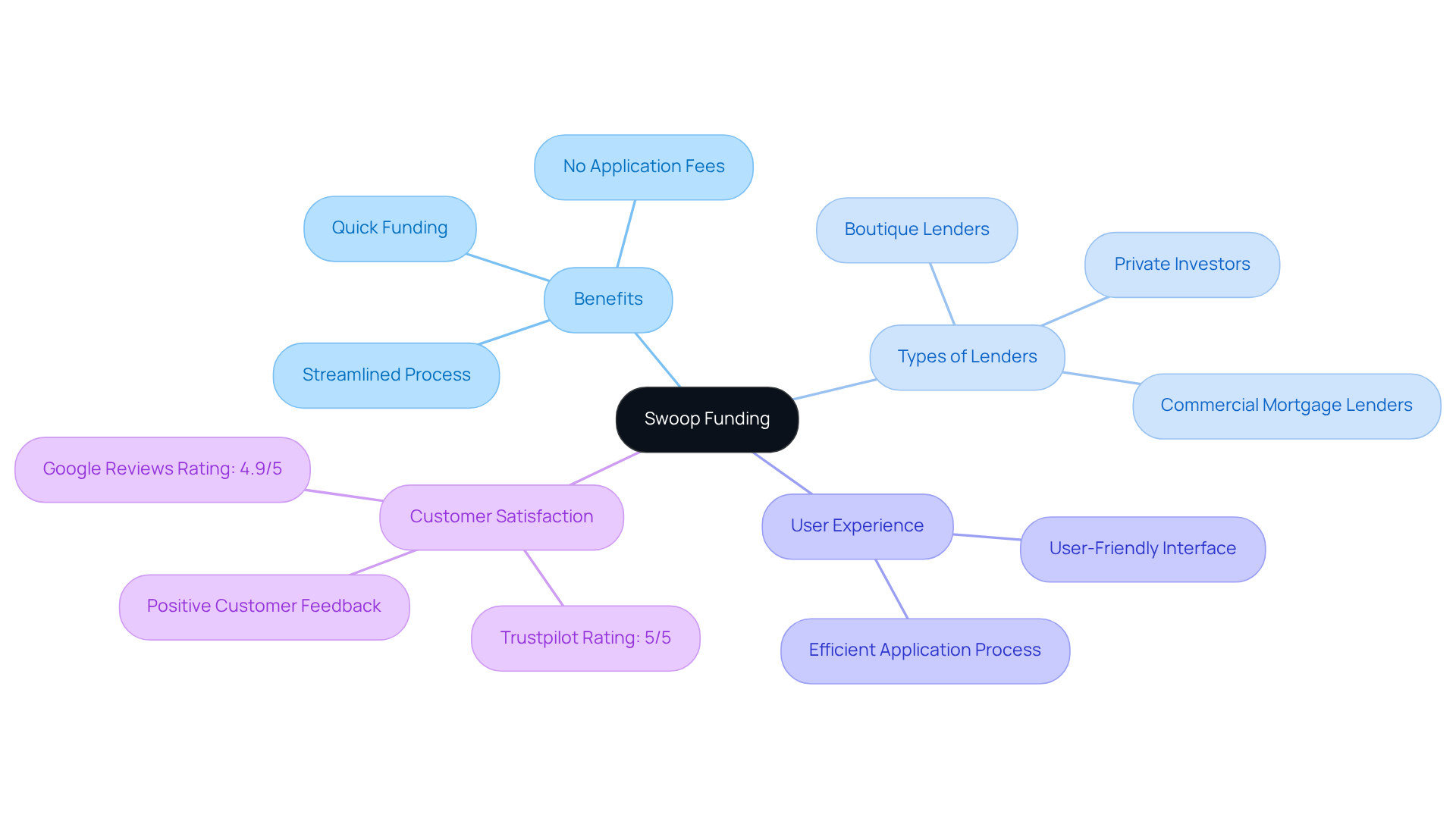

Swoop Funding serves as a dynamic marketplace platform that connects enterprises with the best commercial mortgage lenders, significantly enhancing the borrowing experience for commercial loans. This innovative approach not only streamlines the process but also boosts the chances of securing advantageous financing options.

By providing access to a multitude of lenders, including boutique lenders, private investors, and the best commercial mortgage lenders, Swoop Funding amplifies the likelihood of companies discovering the ideal mortgage tailored to their unique needs. The platform excels in linking enterprises with the best commercial mortgage lenders that match their specific financial situations, ensuring personalized attention for each client. Through collaboration with Finance Story, companies can craft compelling cases that resonate with lenders, thereby enhancing their chances of approval.

- Streamlined Process: Swoop Funding's user-friendly interface simplifies the application process, enabling enterprises to navigate the complexities of securing a loan effortlessly.

The success rates of companies leveraging Swoop Funding to identify suitable lenders are impressive, with numerous clients commending the service's efficiency and responsiveness. This marketplace not only connects users to various types of loans, including business mortgages, but also provides a centralized platform for exploring diverse funding options from the best commercial mortgage lenders. As a result, companies can secure funding swiftly, often within 24 hours, making Swoop Funding an indispensable asset in the competitive lending landscape.

Moreover, Swoop Funding boasts a Trustpilot rating of 5/5 stars based on over 380 reviews, showcasing high customer satisfaction. The platform is especially advantageous for startups and SMEs in search of varied funding options, as it imposes no application fees on borrowers. However, potential clients should remain cognizant that some loan options may carry higher interest rates, a crucial consideration when evaluating funding solutions.

MortgageWeb: Insights and Tools for Commercial Mortgages

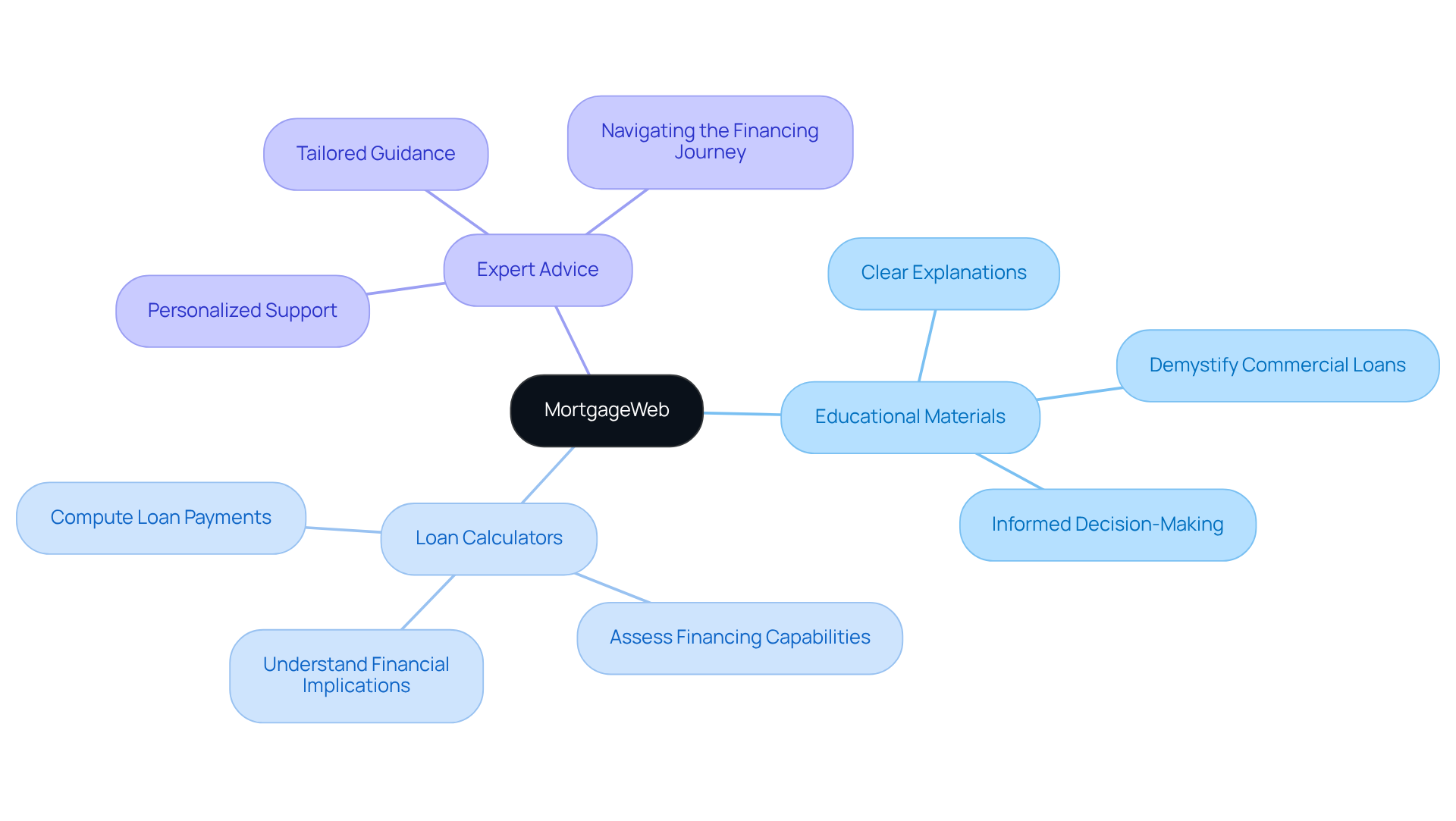

MortgageWeb provides a comprehensive array of insights and resources tailored to assist organizations in navigating the complexities of business loans. Their educational materials, including articles and guides, delve into various aspects of business funding, ensuring that borrowers are thoroughly informed about their options.

- Educational Materials: These resources demystify the intricacies of commercial loans, offering clear explanations that empower enterprises to make informed decisions.

- Loan Calculators: Essential tools that enable companies to compute loan payments and assess their financing capabilities, aiding them in understanding the financial implications of their choices.

- Expert Advice: Access to seasoned loan specialists who deliver personalized support, guaranteeing that businesses receive tailored guidance throughout the financing journey.

In 2025, the demand for educational materials on commercial loans is projected to rise, as organizations increasingly recognize the significance of informed decision-making. Data indicates that a substantial number of borrowers utilize these resources to enhance their understanding of loan options, leading to more strategic funding decisions. For instance, companies that engaged with educational tools reported increased confidence in their loan choices, highlighting the tangible benefits of leveraging such resources.

MortgageWeb's commitment to providing these insights not only clarifies the property loan landscape but also fosters a culture of informed borrowing, which is vital for small enterprises seeking favorable funding.

Commercial Mortgages Canada: Comprehensive Financing Options

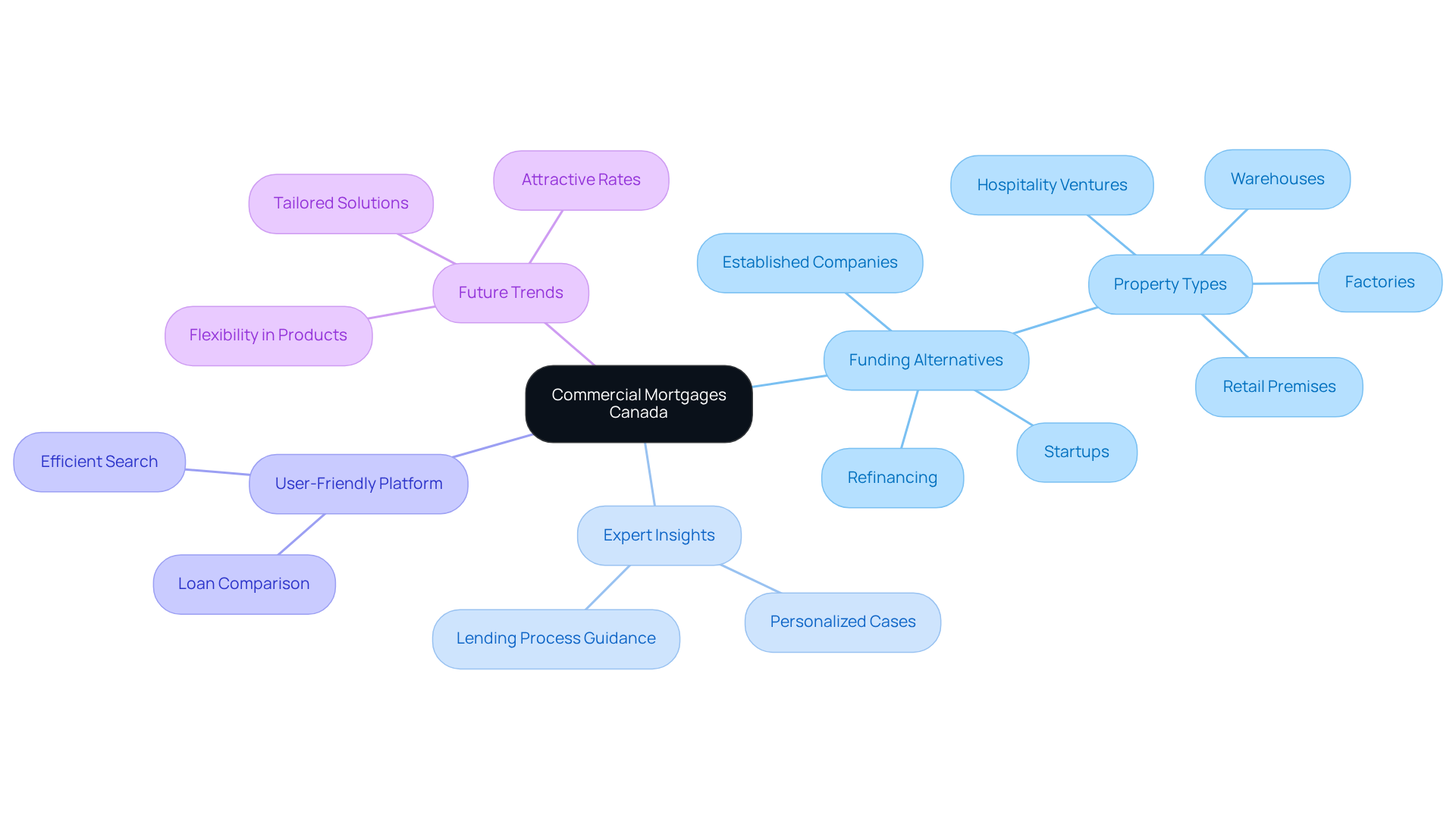

Finance Story provides a comprehensive summary of funding alternatives tailored for enterprises nationwide. Their platform is expertly designed to assist borrowers in navigating the diverse range of products available, ensuring they discover the best fit for their specific needs.

Finance Story showcases an extensive array of options from the best commercial mortgage lenders, effectively addressing various organizational requirements. This encompasses solutions for startups, established companies, and those seeking to refinance existing loans, including warehouses, retail premises, factories, and hospitality ventures. With access to the best commercial mortgage lenders, including mainstream banks and innovative private lending groups, they ensure that every enterprise can secure an appropriate funding solution.

- Expert Insights: Users benefit from Finance Story's expertise in crafting refined and highly personalized cases for presentation to banks. Their insights illuminate the lending process, enabling informed decisions regarding financing options. Satisfied customers have commended Finance Story for their support, with one stating, "I will definitely be recommending your business to anyone. We are finished with the constant worry. Once again, thank you so much for being a part of our journey." - Natasha B, VIC.

- User-Friendly Platform: The website is designed for simplicity, allowing borrowers to efficiently search for and compare loan options. This streamlined approach enhances the overall user experience, making it easier to identify suitable financing solutions.

As we look to 2025, the landscape of commercial mortgage products continues to evolve, with the best commercial mortgage lenders increasingly prioritizing flexibility and tailored solutions. Numerous lenders, particularly the best commercial mortgage lenders, are now offering attractive rates and conditions that align with the distinct financial profiles of enterprises. This adaptability is crucial, especially in a dynamic economic environment where companies must remain agile to thrive.

In summary, Finance Story sets itself apart through its commitment to providing extensive funding solutions, expert guidance, and an accessible experience, establishing itself as a valuable asset for enterprises seeking loans.

CMHC: Mortgage Insurance for Commercial Properties

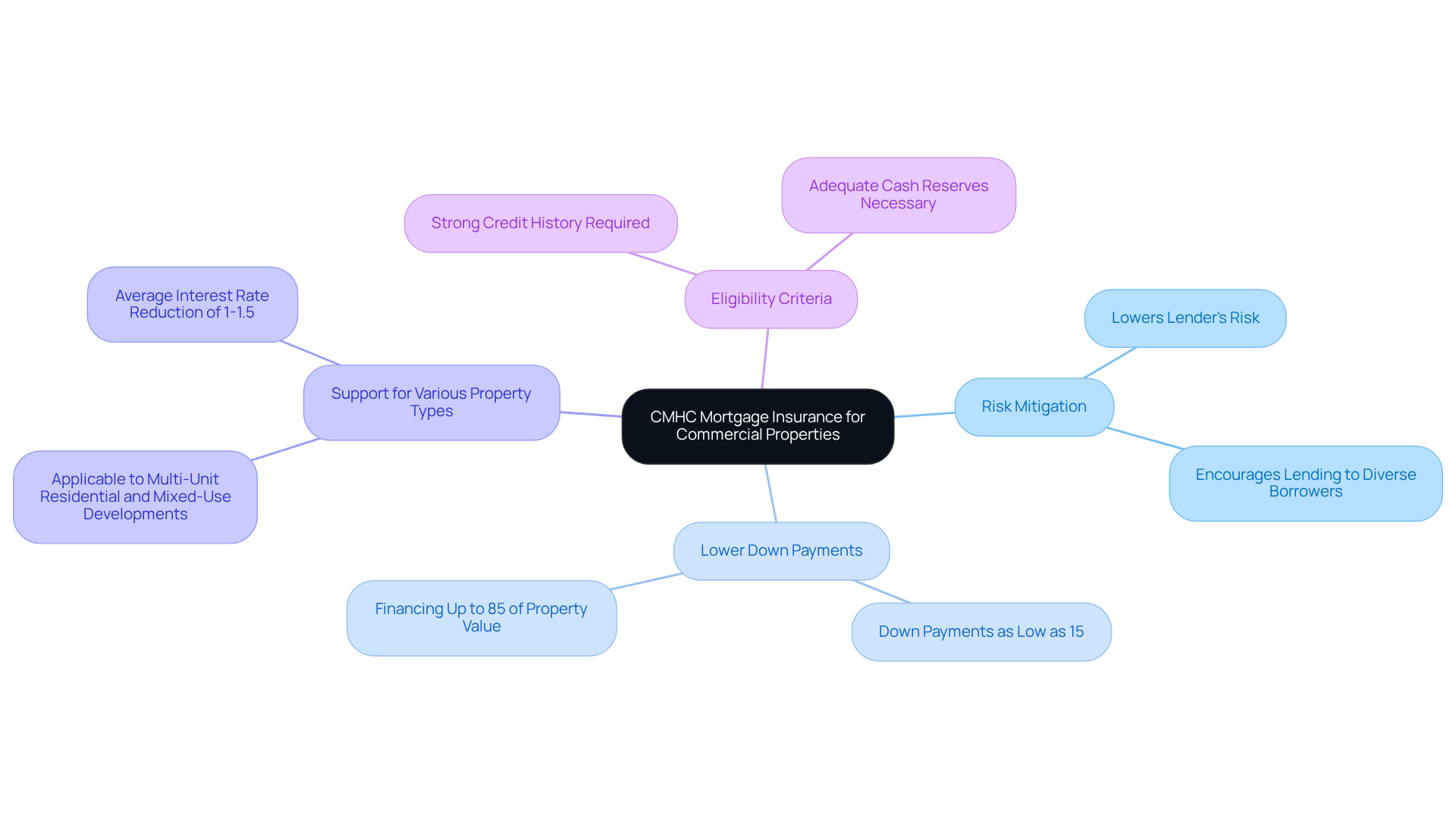

The Canada Mortgage and Housing Corporation (CMHC) plays a pivotal role in business funding by providing mortgage insurance that serves as an essential safety net for borrowers. This insurance not only facilitates access to funding but also significantly reduces the barriers to entry for enterprises seeking to invest in commercial properties.

- Risk Mitigation: CMHC insurance notably lowers the lender's risk, streamlining the funding process for companies. This assurance encourages the best commercial mortgage lenders to extend credit to a wider array of borrowers, including those who may have previously faced challenges in securing loans.

- Lower Down Payments: A standout feature of CMHC insurance is the ability for borrowers to secure funds with down payments as low as 15%. This flexibility allows companies to allocate their capital more efficiently, enabling them to invest in growth opportunities instead of tying up funds in substantial down payments. Notably, CMHC business loans permit funding up to 85% of the property's value, in contrast to the 65%-75% typically offered by traditional loans, making it an appealing choice for small business owners.

- Support for Various Property Types: CMHC insurance is applicable to a wide range of business properties, including multi-unit residential buildings and mixed-use developments. This versatility makes it an attractive option for investors looking to diversify their portfolios. Moreover, borrowers can benefit from an average interest rate reduction of 1-1.5% for CMHC-insured loans compared to standard mortgage rates, which highlights the financial advantages provided by the best commercial mortgage lenders.

- Eligibility Criteria: It is crucial for small business owners to recognize that qualifying for CMHC-insured loans necessitates meeting specific eligibility criteria, including a strong credit history and adequate cash reserves.

In 2025, the impact of CMHC insurance on corporate funding remains substantial, as it continues to provide essential support for enterprises navigating the complexities of the real estate market. By reducing risks and offering favorable funding conditions, the best commercial mortgage lenders empower enterprises to pursue their real estate objectives with confidence. Furthermore, collaborating with Finance Story enables small business owners to leverage customized loan proposals and access a comprehensive range of lenders, ensuring they secure optimal funding solutions tailored to their specific needs. Contact Finance Story today to discover how we can assist you in achieving your commercial financing goals.

Conclusion

In the realm of commercial mortgage financing, the significance of tailored solutions for small businesses is paramount. As demonstrated throughout this article, the leading commercial mortgage lenders not only provide a variety of financing options but also prioritize personalized service that aligns with the unique needs of each enterprise. This bespoke approach is essential for small businesses seeking the funding necessary for growth and expansion.

Key insights emphasized include the diverse offerings from top lenders such as:

- Finance Story

- RBC Royal Bank

- BDC

- Equitable Bank

Each lender presents specialized programs, flexible terms, and expert guidance. These lenders are increasingly acknowledging the demand for customized financing solutions, enabling businesses to navigate the complexities of property investments with greater ease. Furthermore, platforms like CommLoan and Swoop Funding enhance the borrowing experience by facilitating comparisons and connections with suitable lenders, further empowering small business owners in their financing journeys.

Ultimately, as the landscape of commercial mortgages continues to evolve, small business owners are encouraged to seek out lenders that not only provide competitive rates but also offer the personalized support necessary to thrive in a dynamic market. Embracing tailored commercial mortgage solutions will not only assist in securing the best financing options but will also position businesses to adapt and grow in the face of future challenges. Engaging with expert brokers and leveraging available resources can significantly enhance the chances of obtaining favorable funding, ensuring that businesses are well-equipped to achieve their financial goals.