Overview

The primary objective of this article is to pinpoint the top commercial mortgage brokers in the UK that offer tailored financing solutions for businesses. It prominently features Finance Story as a leading broker, showcasing their personalized approach and extensive experience in navigating complex financial landscapes to secure optimal funding options for clients.

Are you seeking a financing partner who understands your unique business needs? Finance Story stands out with its commitment to delivering customized solutions, ensuring that your financial goals are met with precision and care.

Introduction

In the competitive landscape of commercial financing, businesses often find themselves navigating a complex web of options and requirements. The right mortgage broker can make all the difference, providing tailored solutions that align with specific business needs and financial goals. This article explores the seven best commercial mortgage brokers in the UK, highlighting their unique offerings and the critical role they play in securing optimal funding solutions.

As enterprises strive for growth in an ever-evolving market, the question remains: how can businesses leverage these expert services to ensure they not only meet their financing needs but also position themselves for long-term success?

Finance Story: Tailored Commercial Mortgage Solutions for Your Business

Finance Story distinguishes itself in the UK mortgage market by delivering bespoke solutions tailored to the unique needs of each enterprise. By prioritizing a deep understanding of client requirements, Finance Story offers a broad array of funding options, including commercial property loans and enterprise finance. With over 25 years of experience in optimizing operations and implementing technology, the firm skillfully navigates complex financial landscapes, ensuring clients secure the most appropriate funding solutions for their individual circumstances. This personalized approach not only enhances client satisfaction but also reinforces Finance Story's reputation as a trusted partner in achieving financial objectives.

Key Features:

- Bespoke Solutions: Tailored financing options designed to meet individual business needs.

- Expert Guidance: Extensive experience in the finance sector, providing valuable insights and support.

- Diverse Offerings: Access to a wide range of lenders and financial products, ensuring optimal funding solutions.

For instance, Finance Story successfully developed a funding strategy for Mr. N and Mr. C, who sought a conventional Buy-to-Let loan for four properties, resulting in a competitive interest rate that aligned with their long-term financial goals. Additionally, the firm demonstrated its expertise by assisting a pension trustee client from the Isle of Man in securing a £500,000 loan on a property within their pension scheme. Such examples underscore the effectiveness of customized funding solutions in addressing the diverse needs of enterprises today. As Mr. A, a senior South African executive, remarked, "Our bespoke approach, where we really get to know our clients, allows us to offer solutions that other wealth planners and private banks aren’t able to.

Bionic.co.uk: Compare Commercial Mortgages for Optimal Financing

Finance Story is recognized as one of the best commercial mortgage brokers UK, empowering companies to secure tailored commercial mortgage options from a diverse range of lenders. By harnessing Finance Story's expertise in developing refined and highly customized proposals, businesses can effectively present their cases to banks, ensuring they identify the best commercial mortgage brokers UK to find suitable funding solutions for their needs. This service is particularly advantageous for small to medium-sized enterprises (SMEs) that may lack the resources for comprehensive market research on their own.

Why Choose Finance Story?

- Expertise in Tailored Proposals: Gain access to specialized knowledge in crafting loan proposals that meet the elevated expectations of lenders, significantly enhancing the likelihood of securing favorable terms.

- Comprehensive Lender Access: Explore a wide array of lenders, including the best commercial mortgage brokers UK, as well as innovative private lending groups, ensuring enterprises can find the right funding for their unique circumstances.

- Insights on Loan Repayment Criteria: Obtain valuable information on current market trends and lender requirements, empowering users to make informed decisions regarding their funding options.

In an environment where retail loan rates for small enterprises in the UK fluctuate dramatically, leveraging Finance Story's expertise can lead to substantial savings. For example, borrowers who received at least four rate quotes could save over $1,200 annually, underscoring the critical nature of thorough research in obtaining favorable terms. Furthermore, it is vital for SMEs to recognize that interest continues to accrue during capital repayment holidays, which can influence long-term financial planning. As the business loan market evolves, Finance Story plays a pivotal role in assisting SMEs in navigating their funding journeys with efficiency.

British Business Bank: Expert Guidance on Financing Commercial Properties

The British Business Bank is pivotal in aiding companies seeking property funding, offering tailored support and resources specifically designed for small enterprises. Their initiatives focus on enhancing access to finance, allowing businesses to navigate the complexities of securing commercial mortgages with the help of the best commercial mortgage brokers UK.

- Funding Programs: The bank provides a diverse array of funding options tailored to the unique needs of SMEs, ensuring businesses can find suitable financial solutions.

- Expert Resources: Extensive guides and tools are available to assist companies in comprehending their funding choices, empowering them to make informed decisions.

- Support Network: The British Business Bank connects businesses with a network of advisors and financial institutions, streamlining the loan process and facilitating access to critical funding.

Through these initiatives, the British Business Bank profoundly impacts SME funding, fostering an environment where small enterprises can thrive and secure the capital necessary for growth and development.

Unbiased.co.uk: Comprehensive Insights on Business Mortgages

Finance Story is recognized as one of the best commercial mortgage brokers UK, providing reliable insights for companies seeking comprehensive information on commercial mortgages. We specialize in crafting polished and highly individualized loan proposals that align with the increasingly heightened expectations of lenders. Our expertise empowers small enterprise owners to make informed funding choices by providing access to a complete array of lenders, including the best commercial mortgage brokers UK, as well as high street banks and innovative private lending panels.

-

Tailored Loan Proposals: We develop personalized business cases to assist you in securing the ideal financing for your commercial property investments, be it a warehouse, retail premise, factory, or hospitality venture.

-

Lender Comparisons: Our extensive network enables you to compare various lenders and their offerings, ensuring you discover the best fit for your specific needs.

-

Expert Guidance: Our team delivers insights into loan repayment criteria and funding alternatives, aiding you in navigating the complexities of commercial loans.

Current trends in commercial loan products highlight the importance of the best commercial mortgage brokers UK in providing flexibility and customized solutions, reflecting the diverse needs of companies today. As businesses increasingly seek tailored funding options, Finance Story plays a pivotal role in connecting them with the right resources and expertise. Contact us today to initiate your tailored loan proposal.

NicheAdvice.co.uk: Personalized Support for Commercial Mortgage Needs

Finance Story is dedicated to providing tailored assistance for enterprises seeking financing options. Their team of experts collaborates closely with clients to comprehend their unique needs and financial situations, ensuring they receive customized advice and solutions. This personalized approach aids companies in navigating the complexities of the loan process and securing the optimal funding choices available.

Recent trends indicate a growing demand for commercial loans, as the best commercial mortgage brokers UK report a 23.3% increase in commercial property financing compared to the same period last year. This underscores the significance of customized advice in achieving successful financing outcomes.

Key Services:

- Tailored Advice: Finance Story delivers personalized mortgage solutions tailored to the specific needs of each business, recognizing that no two situations are identical. Their expertise in crafting polished and highly individualized business cases enables clients to present compelling proposals to the best commercial mortgage brokers UK.

- Expert Consultation: Access to knowledgeable advisors, such as the best commercial mortgage brokers UK, who understand the commercial lending landscape empowers informed decision-making. With a comprehensive panel of lenders, including mainstream banks, private lenders, and angel investors, Finance Story provides clients with a diverse array of funding options.

- Comprehensive Support: Assistance throughout the entire mortgage application process guarantees a seamless experience from beginning to end. The best commercial mortgage brokers UK at Finance Story help facilitate navigation of lender flexibility, which is essential for securing favorable terms.

Companies that have engaged with Finance Story report smoother application processes and enhanced funding results, highlighting the value of tailored support. As one satisfied client remarked, "Working with Finance Story has alleviated our constant worry about securing funding. Their tailored solutions have been instrumental in our journey." This sentiment reflects the broader industry acknowledgment of the importance of customized solutions in achieving successful funding outcomes. Additionally, case studies such as 'Streamlined Mortgage Processes with Finance Story' exemplify the tangible benefits of personalized support, showcasing how tailored advice can lead to efficient and effective financing solutions.

Bionic.co.uk: Essential FAQs for Commercial Mortgages

Finance Story offers a comprehensive FAQ section dedicated to loans for enterprises, addressing common inquiries and challenges that businesses may face. This resource is vital for companies aiming to understand the financing process, eligibility criteria, and potential obstacles. By providing clear and concise answers, Finance Story empowers enterprises to navigate the complexities of securing a commercial loan, utilizing the best commercial mortgage brokers UK for tailored loan proposals and funding options.

Common FAQs Include:

- What is a commercial mortgage? A commercial mortgage is a financial product specifically designed for businesses to acquire properties for operational needs, including offices, retail spaces, or industrial units.

- What are the eligibility criteria? Eligibility generally encompasses factors such as the business's creditworthiness, the loan-to-value (LTV) ratio, and the overall financial health of the business. Typically, business LTV ratios range from 50% to 75%, with a cash deposit of at least 30% of the property's purchase price required.

- How do I apply for a business loan? The application process necessitates the preparation of essential documentation, including financial statements, tax returns, and a proposal summary detailing tenant performance and property security. Some lenders may require a Decision in Principle (DIP) before accepting offers. Additionally, presenting a robust financial plan can mitigate lender risk and improve rates.

- What documents are required? Key documents include company details, property information, tenant lease terms, and financial statements. Collecting these documents is crucial for a seamless application process.

Understanding these common inquiries can enable companies to make informed decisions and streamline their journey toward securing the services of the best commercial mortgage brokers UK. With the expert guidance of Finance Story, even enterprises encountering obstacles in the application process can adeptly manage their financing needs.

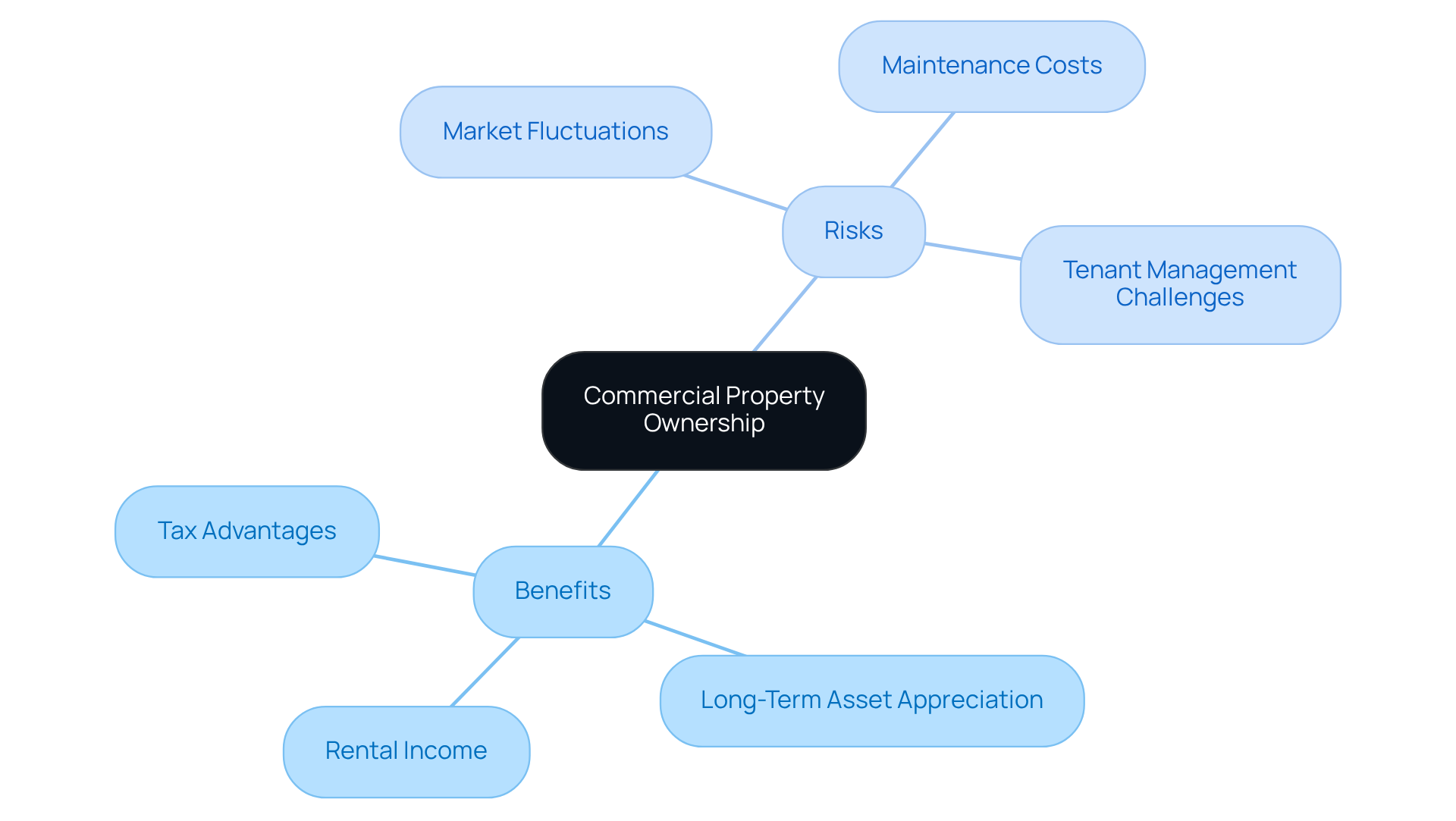

British Business Bank: Understanding Risks and Benefits of Commercial Property Ownership

The British Business Bank offers essential insights into the risks and advantages associated with property ownership, critical for enterprises contemplating real estate investments. By understanding these factors, businesses can evaluate potential returns while remaining cognizant of the inherent risks involved.

Benefits: Investing in commercial property can yield significant advantages, including:

- Rental Income: A consistent cash flow from tenants provides a reliable income stream.

- Long-Term Asset Appreciation: Properties typically appreciate over time, enhancing overall investment value.

- Tax Advantages: Various tax benefits may be available, including deductions for loan interest and depreciation.

Risks: However, potential investors must also weigh several risks:

- Market Fluctuations: Economic conditions can affect property values, leading to potential losses.

- Maintenance Costs: Ongoing expenses for property upkeep can impact profitability.

- Tenant Management Challenges: Managing tenants and ensuring timely rent payments can be complex and time-consuming.

By carefully weighing these advantages and risks, companies can make informed decisions regarding their real estate investments, aligning their strategies with their financial objectives and risk tolerance.

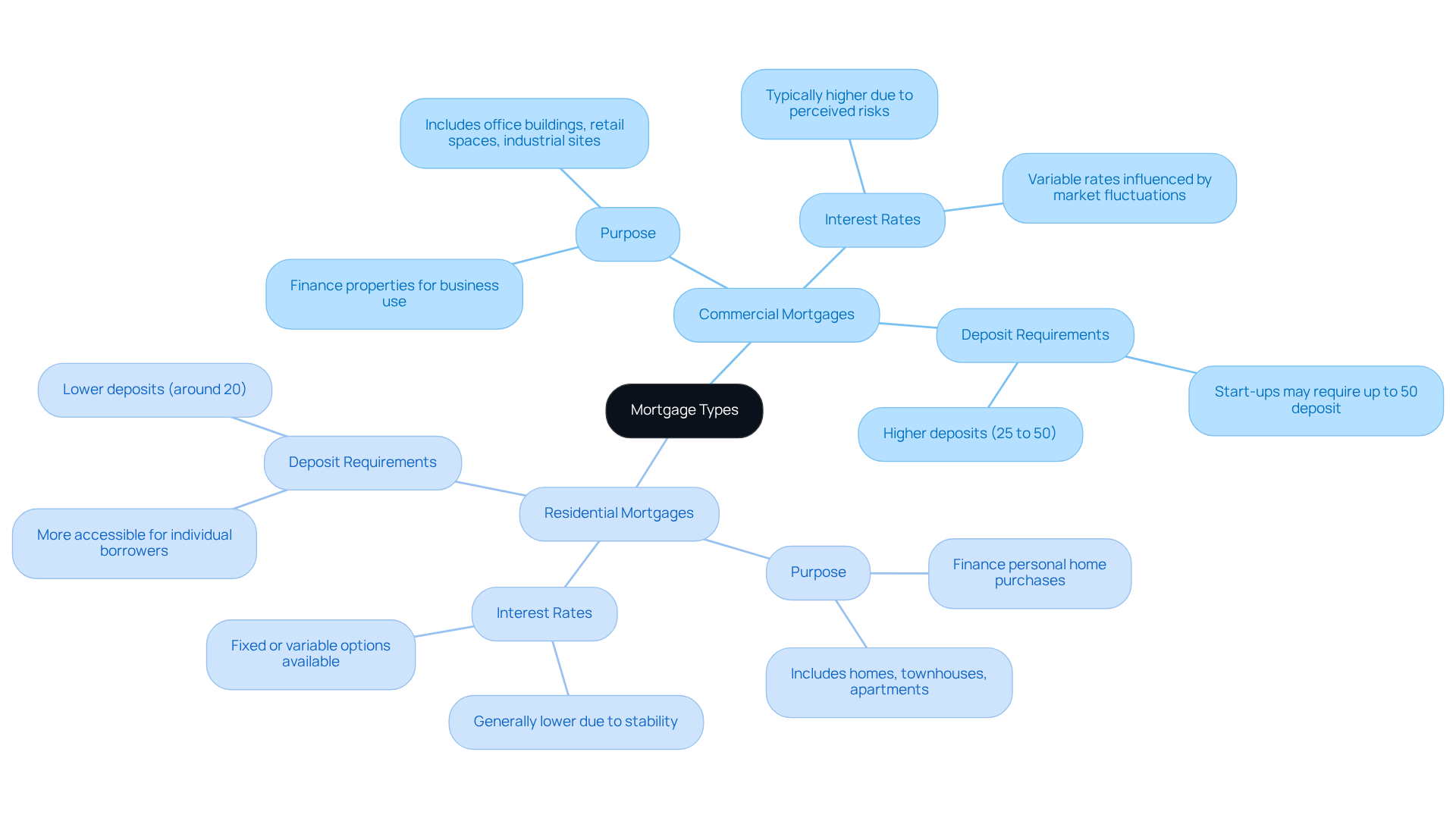

Unbiased.co.uk: Key Differences Between Commercial and Residential Mortgages

Understanding the key differences between commercial and residential loans is essential for businesses seeking the best commercial mortgage brokers UK to find the right funding option. Commercial loans are designed specifically for properties used in commercial activities, whereas residential loans cater to personal home purchases. Here are the primary distinctions:

- Purpose: Commercial mortgages finance properties such as office buildings, retail spaces, and industrial sites. In contrast, residential mortgages are intended for individual homes.

- Interest Rates: Typically, commercial loans carry higher interest rates due to the perceived risks associated with business investments. Residential loans generally offer lower rates, reflecting their stability and predictability.

- Deposit Requirements: Businesses often face higher deposit requirements for commercial loans, with many lenders expecting deposits between 25% and 50%. Conversely, residential loans usually require smaller deposits, often around 20%.

Current trends indicate that interest rates for commercial mortgages are influenced by market fluctuations and cash flow, making them more volatile than residential rates. As of mid-2025, many lenders anticipate further rate reductions, which could impact both commercial and residential funding options.

For businesses evaluating their financing choices, understanding the role of the best commercial mortgage brokers UK is crucial. For instance, a startup might struggle to secure a commercial loan without a robust trading history, often necessitating substantial deposits. In contrast, established enterprises can leverage commercial loans to expand operations or invest in new properties, benefiting from the potential for higher returns despite the inherent risks. Additionally, property loans can help businesses build equity and reduce rental costs, contributing to long-term financial stability.

Mortgage specialists stress the importance of assessing financial obligations and long-term implications when deciding between these two loan types. As Bobby Turner, a Marketing, SEO & Stats Lead Content Expert, noted, "The choice between commercial and residential funding requires careful planning and a clear understanding of your business's financial landscape." This insight underscores the necessity for businesses to evaluate their unique circumstances and seek guidance from the best commercial mortgage brokers UK to navigate the complexities of commercial funding. Furthermore, businesses should be prepared to provide comprehensive documentation, including proof of income, trading accounts, and details about assets and liabilities, to secure a commercial loan. By collaborating with Finance Story, you will gain access to a wide range of lenders, from high street banks to innovative private lending panels, ensuring you find the optimal financing solution for your needs.

Bionic.co.uk: Eligibility Criteria for Securing Commercial Mortgages

Understanding the eligibility requirements for securing commercial loans is crucial for businesses aiming to boost their chances of approval. Lenders assess various key factors when evaluating mortgage applications, and being well-prepared can significantly influence the outcome.

- Credit History: A robust credit score is often a prerequisite, as it reflects the entity's financial reliability.

- Financials of the Company: Lenders scrutinize the financial health of the company, including revenue, profit margins, and cash flow, to gauge its ability to repay the loan.

- Property Valuation: The valuation of the property being financed is pivotal, as it determines the loan-to-value ratio and impacts the lender's risk assessment.

Recent statistics indicate that a substantial proportion of businesses meet typical eligibility criteria for financial loans, underscoring the importance of thorough preparation. Factors such as the company's operational history, industry stability, and existing debt levels are also vital in the evaluation process.

In the UK, the latest criteria for obtaining commercial loans have evolved, with lenders increasingly focusing on the overall financial situation of the applicant. For example, lenders may now consider alternative income streams and the potential for future growth when reviewing applications.

Companies that have successfully navigated loan applications often highlight the importance of providing comprehensive financial records and presenting a clear repayment plan. Engaging with financial advisors can yield valuable insights into customizing applications to align with lender expectations, ultimately facilitating a more efficient approval process.

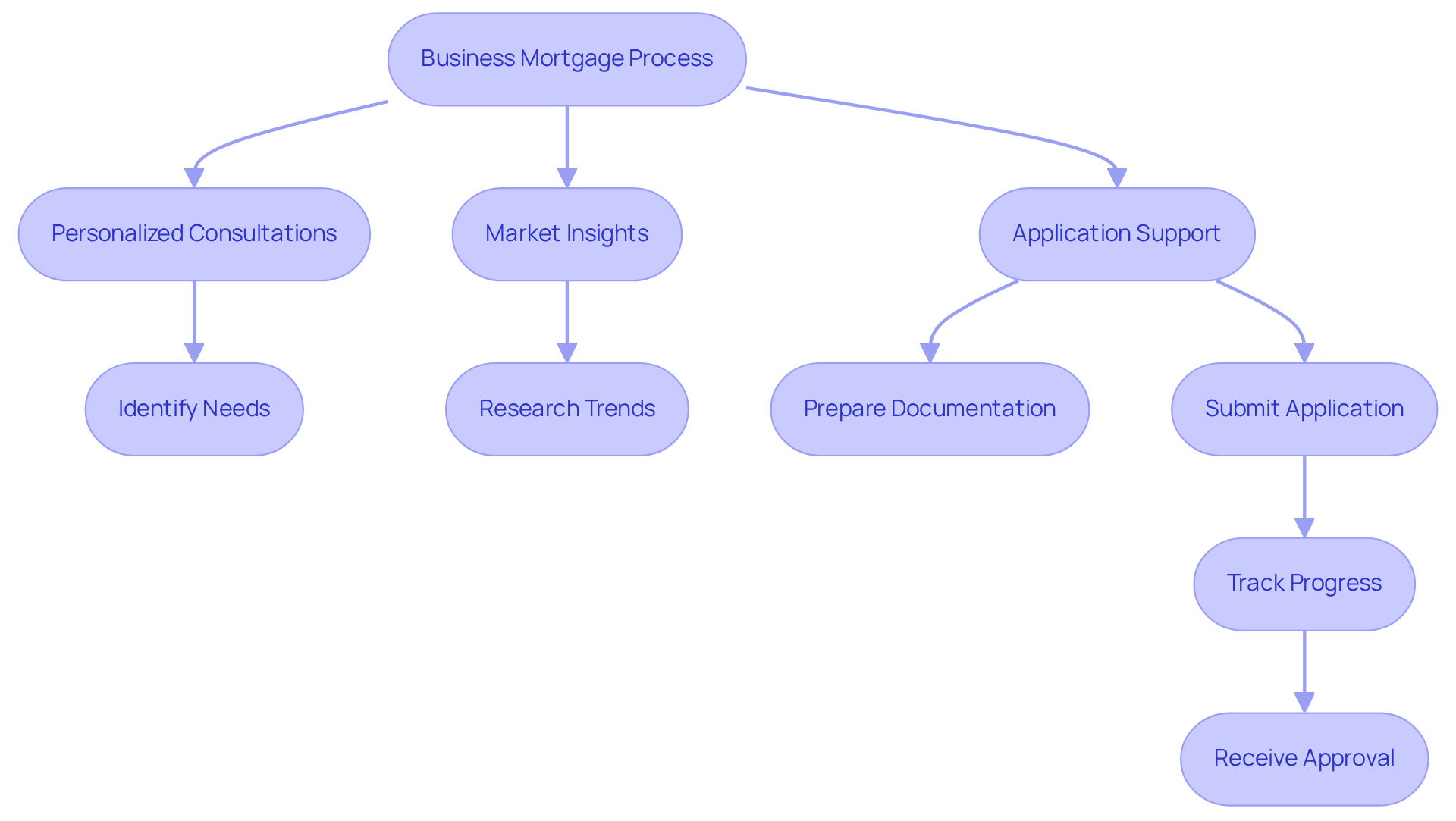

NicheAdvice.co.uk: Expert Financial Advice for Business Mortgages

Finance Story specializes in delivering expert financial guidance tailored for companies seeking loans. Their seasoned consultants offer personalized support throughout the loan application process, equipping companies to comprehend their options and make informed decisions. This expert assistance is crucial for securing optimal funding solutions, particularly when considering that 80% of Australians rely on mortgage brokers for home loans, underscoring the significance of professional help in navigating complex financial landscapes.

Finance Story fully understands organizational needs, fostering a continuous partnership to achieve the best outcomes for your objectives. They present a comprehensive panel of lenders, including mainstream banks, private lenders, and angel investors, ensuring that all facets of your financing are addressed.

Key Services Offered:

- Personalized Consultations: Tailored one-on-one meetings to address specific business needs.

- Market Insights: Current information on the latest trends and lender offerings.

- Application Support: Extensive assistance in preparing and submitting loan applications, ensuring accuracy and timeliness.

As one expert noted, "Navigating the home loan process is complex, and if you attempt everything alone without expert guidance, you risk losing the mortgage." This highlights the necessity of having a knowledgeable broker like Finance Story, recognized as one of the best commercial mortgage brokers UK, at your side, specializing in crafting polished and highly individualized business cases to present to lenders.

Furthermore, case studies such as "The Application Facilitator" demonstrate how brokers aid clients throughout the entire loan application process, ensuring all necessary documentation is collected and submitted accurately. This level of support not only streamlines the application process but also increases the likelihood of securing favorable loan terms.

Conclusion

Finance Story and its esteemed peers exemplify the critical role of personalized commercial mortgage solutions in the UK market. By prioritizing tailored financing options, businesses can secure the most suitable funding to meet their unique needs. The focus on bespoke solutions not only enhances client satisfaction but also fortifies the overall financial landscape for enterprises aiming to grow and thrive.

Key insights throughout the article highlight the advantages of collaborating with the leading commercial mortgage brokers in the UK. From expert guidance and comprehensive lender access to tailored loan proposals, these brokers empower businesses to navigate complex financial environments. Real-life examples illustrate how customized strategies lead to successful funding outcomes, reinforcing the value of personalized support in achieving financial objectives.

In a rapidly evolving market, understanding the intricacies of commercial mortgages is essential for businesses. Engaging with expert brokers like Finance Story can significantly impact securing favorable terms and navigating the application process with confidence. As companies evaluate their financing options, leveraging tailored solutions and expert insights will be vital in fostering growth and ensuring long-term success.