Overview

The article "6 Steps to Navigate Australian Business Lending Successfully" provides a structured approach for businesses aiming to secure financing in Australia effectively. It begins by addressing the lending landscape, emphasizing the importance of understanding it thoroughly. Next, it guides readers to assess their financial needs accurately, ensuring they are well-prepared. A robust loan application is crucial, and the article details how to prepare one that stands out. Furthermore, comparing lenders is highlighted as a vital step to enhance the chances of obtaining favorable loan terms. This process is supported by insights into current market conditions and expert recommendations, empowering businesses to navigate the lending process with confidence.

Introduction

In the dynamic landscape of business financing, grasping the intricacies of business lending in Australia is essential for entrepreneurs aiming for growth and stability. With a diverse array of lenders—from traditional banks to innovative fintech companies—business owners must adeptly navigate various loan products, eligibility criteria, and repayment terms to secure the necessary funding.

As the economic environment evolves, characterized by rising finance levels and favorable lending conditions, equipping oneself with comprehensive knowledge about available options can significantly impact success. This article explores the essentials of business lending, examining:

- Types of loans

- Assessing financial needs

- Preparing effective applications

- Comparing lenders

to empower businesses in making informed financial decisions.

Understand the Basics of Business Lending in Australia

Australian business lending includes a variety of financial products designed to help businesses secure the necessary funds for growth and operational needs. Comprehending the landscape is essential for making informed choices.

- Types of Financial Institutions: The borrowing environment includes conventional banks, credit unions, and alternative sources, each providing unique products and requirements. Traditional banks generally offer a variety of secured and unsecured financing options, while credit unions might provide more personalized service and competitive rates. Alternative financing sources, including fintech firms, often emphasize speed and adaptability, serving businesses that may not satisfy the strict standards of conventional institutions. At Finance Story, we offer access to a comprehensive range of financial institutions, including mainstream banks and creative private financing groups, ensuring you discover the perfect match for your needs.

- Financing Terms: Understanding common financing terms is essential. Key aspects include interest rates, which can vary significantly based on the financial institution and the borrower's profile; repayment periods, which can range from short-term (a few months) to long-term (several years); and associated fees, which may include establishment fees, ongoing fees, and early repayment penalties.

- Eligibility Criteria: Financial providers typically assess several factors when evaluating credit applications. These consist of credit history, which indicates the borrower's previous borrowing patterns; operational performance, encompassing revenue and profit margins; and overall financial stability, which includes cash flow and current debts. At Finance Story, we focus on developing refined and highly tailored proposals that satisfy the growing demands of creditors, making sure that your application distinguishes itself.

- Purpose of Funding: Companies pursue financing for different purposes, such as entering new markets, acquiring equipment, or handling cash flow. Comprehending these objectives can assist in customizing the application to meet financial institution expectations. Our knowledge in restructuring commercial financing enables us to support enterprises in adjusting their funding strategies to address changing requirements, whether for warehouses, retail locations, factories, or hospitality projects, through Australian business lending. As of early 2025, corporate lending in Australia remains strong, with outstanding finance to enterprises having increased by nearly 9% compared to the prior year. This growth reflects a robust economic environment, bolstered by stabilizing inflation and steady wage growth, which positively influences lending conditions. Moreover, the EY Item Club predicts that write-off rates on credit to enterprises will stay low at 0.17% in 2025, suggesting a favorable lending environment.

In conclusion, navigating the lending landscape for enterprises necessitates a solid understanding of the types of creditors available, the terms and conditions of credit, and the criteria that affect eligibility. By equipping themselves with this foundational knowledge and leveraging the expertise of Finance Story, entrepreneurs can better position themselves to secure the financing necessary for their ventures.

Explore Different Types of Business Loans

In Australia, businesses have access to a diverse array of loan options, each designed to meet specific financial needs:

- Term Loans: These traditional loans feature fixed repayment schedules and are ideal for substantial investments, allowing businesses to plan their finances effectively. Terms and conditions, fees, charges, and credit approval criteria apply to these products, which is essential for organizations to consider.

- Lines of Credit: Providing flexibility, lines of credit allow companies to withdraw funds as required, making them appropriate for handling cash flow variations.

- Equipment Financing: Designed for acquiring equipment, these funds are frequently backed by the equipment itself, guaranteeing that companies can obtain essential tools without putting pressure on their cash flow.

- Invoice Financing: This option enables companies to borrow against outstanding invoices, offering prompt cash flow to cover operational expenses while awaiting customer payments.

- Government Grants and Loans: Various government programs are available to support small enterprises, offering grants and loans that can greatly alleviate economic burdens. For example, the Small Enterprise Loan Guarantee Scheme offers crucial support for small enterprises in Queensland, improving their capacity to obtain funding.

Comprehending these choices is essential for aligning your strategy with your objectives. As of 2025, the landscape of australian business lending in Australia continues to evolve, with term financing and lines of credit being particularly favored among small enterprise owners. Financial consultants stress the significance of being proactive in obtaining funding through australian business lending, as seeking credit when in a strong financial position can lead to more advantageous terms. "It is always best to be pre-emptive," as noted by experts, highlighting the risks of waiting until urgent capital is needed. For example, Queensland small enterprise owners can investigate various financing choices, such as term financing, lines of credit, and government-supported options like the Small Enterprise Loan Guarantee Scheme, which together improve their capacity to succeed in a competitive market. Furthermore, collaborating with specialists such as Finance Story can offer customized insights and assistance in crafting refined funding proposals, ensuring that companies meet the elevated expectations of lenders. A case study titled 'Preemptive Financing Strategies for Enterprises' illustrates that many firms hesitate to secure funding until they are in urgent need of capital, which can lead to unfavorable credit terms. Consequently, seeking financial assistance when in good health is a strategic decision.

Assess Your Financial Needs and Loan Requirements

To effectively evaluate your monetary requirements for a business credit, follow these essential steps:

- Review Financial Statements: Begin by analyzing your income statement, balance sheet, and cash flow statement. This analysis will provide a comprehensive understanding of your current financial position and highlight areas that may require improvement.

- Identify Funding Purpose: Clearly define the purpose of the loan. Whether it’s for expansion, purchasing equipment, or covering operational costs, having a specific goal will guide your funding strategy. Notably, 9% of small enterprises pursue financing for reasons beyond conventional growth strategies, emphasizing the necessity to comprehend various funding objectives.

- Calculate Loan Amount: Determine the total funding required by considering both immediate and future expenses. This assessment should reflect your business's growth plans and operational needs.

- Consider Repayment Capacity: Assess your capability to repay the amount by examining anticipated cash flow in relation to current financial commitments. This step is crucial, as financial institutions often evaluate repayment capacity to mitigate risk. For instance, payroll considerations can be significant, with Lendio noting that 6% of financing may be allocated for payroll expenses. Furthermore, collaborating with specialists such as Finance Story can assist you in crafting refined and customized loan proposals that meet financial institution expectations, thus boosting your likelihood of approval.

- Consult Financial Experts: Engage with economic consultants or accountants who can provide insights into your economic landscape. Their expertise can assist you in navigating intricate financial statements and preparing for creditor inquiries. It's important to recognize that financial institutions are increasingly asking accountants to provide assurances regarding clients' capacity to repay debts, which raises ethical considerations for accountants acting as guarantors.

- Explore Financing Options: Consider the full range of lenders available through Finance Story, including high street banks and innovative private lending panels. This variety can cater to different circumstances, whether you are looking to finance a warehouse, retail premise, factory, or hospitality venture. Additionally, if refinancing is part of your strategy, Finance Story can assist in meeting the evolving needs of your business through Australian business lending. This thorough assessment will not only prepare you for Australian business lending but also enhance your chances of securing the necessary funding. In 2025, small enterprises in Australia are anticipated to request an average funding amount that corresponds to their distinct economic requirements, with 9% of them seeking Australian business lending for various objectives beyond conventional growth strategies. Comprehending these dynamics is crucial for making informed monetary decisions.

Prepare Your Loan Application and Documentation

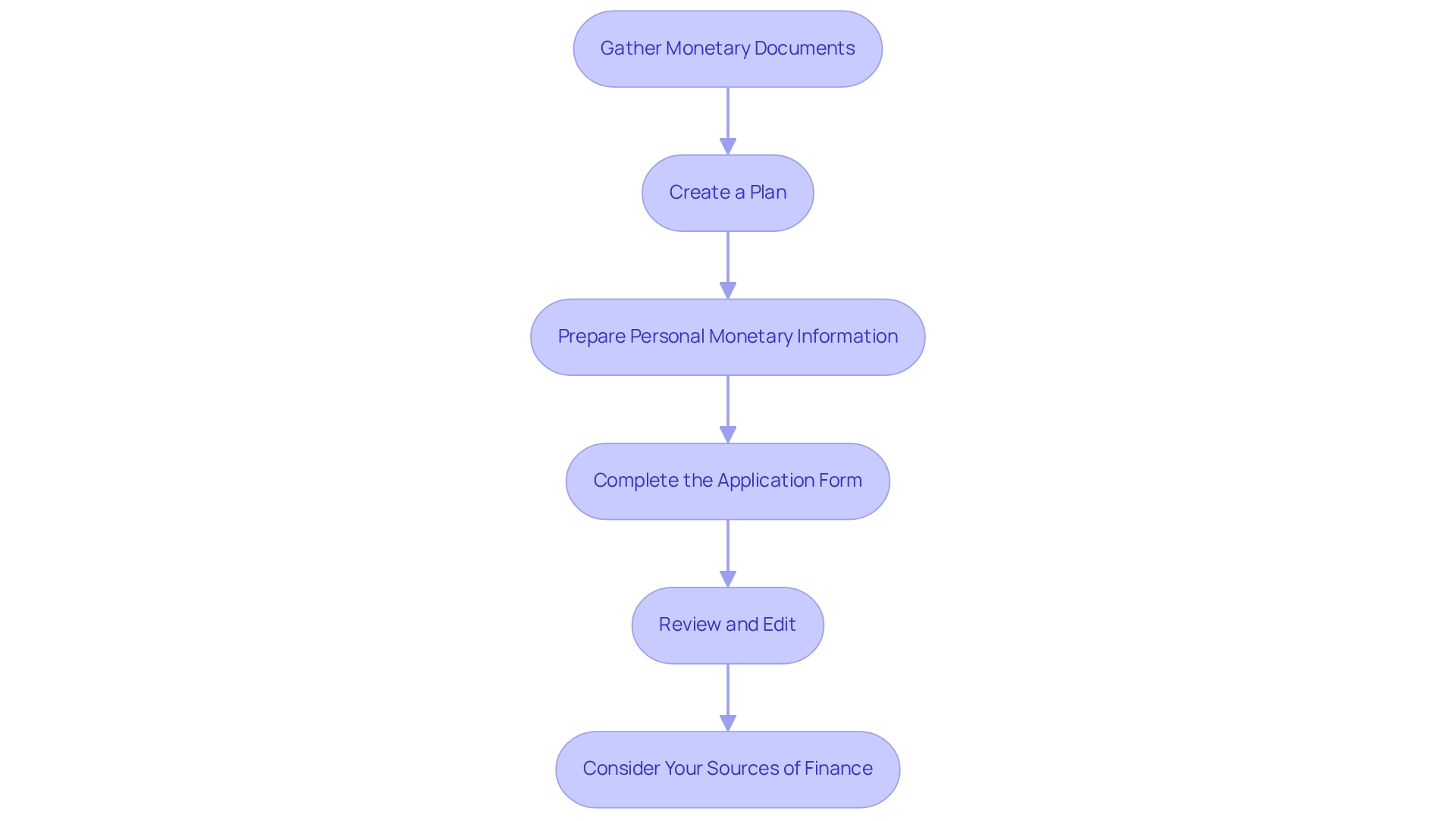

Preparing your loan application involves several essential steps that can significantly impact your chances of approval.

-

Gather Monetary Documents: Start by collecting crucial documents such as tax returns, bank statements, and fiscal projections. These documents provide lenders with a clear view of your economic condition and are vital for developing a refined case that meets the heightened expectations of lenders.

-

Create a Plan: Develop a comprehensive plan detailing your model, market analysis, and financial forecasts. A well-organized enterprise strategy is essential; companies with formal plans are 16% more likely to obtain funding. This is especially critical when presenting your case to banks for refinancing or obtaining a customized loan.

-

Prepare Personal Monetary Information: If applicable, include personal monetary statements, particularly for small businesses or startups. This information assists creditors in evaluating your overall financial stability and is essential when collaborating with various financial institutions, from high street banks to private lending panels.

-

Complete the Application Form: Accurately fill out the financial institution's application form, ensuring that all information aligns with your documentation. Inconsistencies can raise red flags for financial institutions, especially when seeking to refinance or secure funding for commercial property investments.

-

Review and Edit: Before submission, double-check all documents for accuracy and completeness. It may be beneficial to have a trusted advisor review your application to catch any potential errors or omissions. This step is vital in ensuring that your application stands out in the competitive australian business lending environment.

-

Consider Your Sources of Finance: Remember that you have access to a full range of financial institutions, including high street banks and innovative private lending panels. This variety can offer you choices customized to your unique requirements, whether you are funding a warehouse, retail space, factory, or hospitality project. By adhering to these steps, you will enhance your standing in the eyes of potential financiers, boosting your likelihood of obtaining australian business lending that you require. For instance, prompt and thoroughly prepared submissions can lead to quick approvals for pressing monetary needs, which is essential for companies aiming to seize immediate opportunities.

Compare Lenders and Choose the Right Financing Option

When assessing lenders for Australian business lending, it is crucial to consider several key aspects to guarantee you make a knowledgeable choice:

- Interest Rates: Look for competitive rates that suit your financial capability and the particular category of financing you need. In 2025, average interest rates for small enterprise financing in Australia differ, so comprehending the current environment is essential. For context, monthly repayments for the average mortgage in Australia total $4,096 over a 30-year period, which can help you assess what to anticipate for business financing. Additionally, working with Finance Story can provide you access to a full suite of lenders, including high street banks and innovative private lending panels, ensuring you find the best rates available.

- Fees and Charges: Be vigilant about hidden fees that can affect your total borrowing cost. Statistics indicate that many borrowers overlook application fees, early repayment penalties, and ongoing service fees, which can significantly affect the total repayment amount. Finance Story specializes in creating polished and highly individualized business cases, helping you navigate these costs effectively.

- Loan Terms: Assess the repayment terms, including the duration of the loan and the flexibility of payment schedules. This can help you manage cash flow effectively and avoid financial strain. Comprehending the particular conditions presented by various financial institutions is vital, particularly as your business develops.

- Borrower Reputation: Examine reviews and ratings of financial institutions to assess customer satisfaction and service quality. A creditor's reputation can offer insights into their dependability and the experiences of other borrowers. Finance Story's expertise in the industry can direct you toward trustworthy financing sources that meet your needs.

- Support and Guidance: Consider lenders that provide extra assistance, such as financial advice or resources for enterprises. This can be especially advantageous for small enterprise owners who may require additional support maneuvering through the intricacies of financing. Finance Story takes pride in offering extensive assistance during the financing process, making sure you feel assured in your choices.

- Case Study on Unsecured Financing: Unsecured commercial financing does not necessitate assets as collateral, but they may involve personal guarantees from company directors. This renders them attractive for companies that do not wish to link their assets to credit. However, unsecured loans can lead to higher interest rates due to the lack of collateral, and directors may be held personally responsible for repayments if the borrowing company defaults.

- Expert Insight: According to economic expert Peter Boehm, some specialists believe that recent reductions in interest rates were premature, particularly considering ongoing inflationary pressures caused by global uncertainties. This emphasizes the significance of assessing interest rates thoroughly in the present lending environment.

By meticulously examining these factors, including the refinancing choices accessible for different commercial properties like warehouses, retail spaces, factories, and hospitality projects, you can choose a lender that matches your operational requirements and financial objectives. Remember, the right financing option can significantly influence your business's success and growth potential, and with Finance Story's expertise, you can navigate this process with confidence.

Navigate the Loan Approval Process

Navigating the financing approval process involves several key steps that can significantly affect your chances of securing funds.

- Submit Your Application: Complete your application thoroughly and send it to your selected financial institution, ensuring all required documentation is included. Do you understand what you may need to provide to your financier?

- Loan Provider Evaluation: The loan provider will evaluate your application, emphasizing your financial condition and the intended purpose of the loan. This stage is vital, as lenders assess risk according to your creditworthiness and project plan. Finance Story's specialized expertise in crafting refined and tailored cases can assist you in preparing for this review, ensuring you present your enterprise in the best light.

- Provide Additional Information: Be ready to respond to any follow-up questions or requests for further documentation. This may involve clarifying your financial statements or providing further details about your operations. Having a knowledgeable partner like Finance Story can be invaluable during this stage, especially when navigating the complexities of refinancing and securing customized financial solutions for commercial property investments, whether it be a warehouse, retail space, factory, or hospitality venture.

- Receive Approval or Denial: After the review, the lender will either approve or deny your application. If approved, you will receive an offer detailing the terms and conditions, which is generally based on current average approval rates for Australian businesses, expected to be around 70% in 2025.

- Accept the Offer: Carefully review the financing proposal. If the terms satisfy your requirements, sign the agreement to complete the financing. Understanding the implications of the terms is essential to avoid future complications.

- Funding: Once the agreement is signed, the financial institution will disburse the funds as per the agreed terms. The time taken for loan approval in Australian business lending can vary, but statistics indicate that most approvals are completed within 2 to 4 weeks in 2025. By understanding these steps in Australian business lending, you can navigate the loan approval process more effectively, increasing your chances of obtaining the financing necessary for your business goals. Specialized expertise, such as that offered by Finance Story, can also provide valuable insights into overcoming common challenges during this process, with access to a full suite of lenders from high street banks to innovative private lending panels.

Conclusion

Understanding the complexities of business lending in Australia is essential for entrepreneurs aiming to secure funding for growth and operational needs. This article outlines various types of loans available, including term loans, lines of credit, and government grants, underscoring the importance of aligning these options with specific business goals. Assessing financial needs and preparing effective applications are crucial steps in the lending process, ensuring that businesses present a compelling case to potential lenders.

Furthermore, comparing lenders based on interest rates, fees, and support services is vital for making informed financing decisions. The insights provided about the loan approval process equip business owners with the necessary knowledge to navigate challenges effectively.

Ultimately, by leveraging the expertise of organizations like Finance Story, entrepreneurs can significantly enhance their chances of securing favorable financing terms. As the lending landscape continues to evolve, staying informed and proactive will empower businesses to not only meet their immediate financial needs but also position themselves for long-term success.